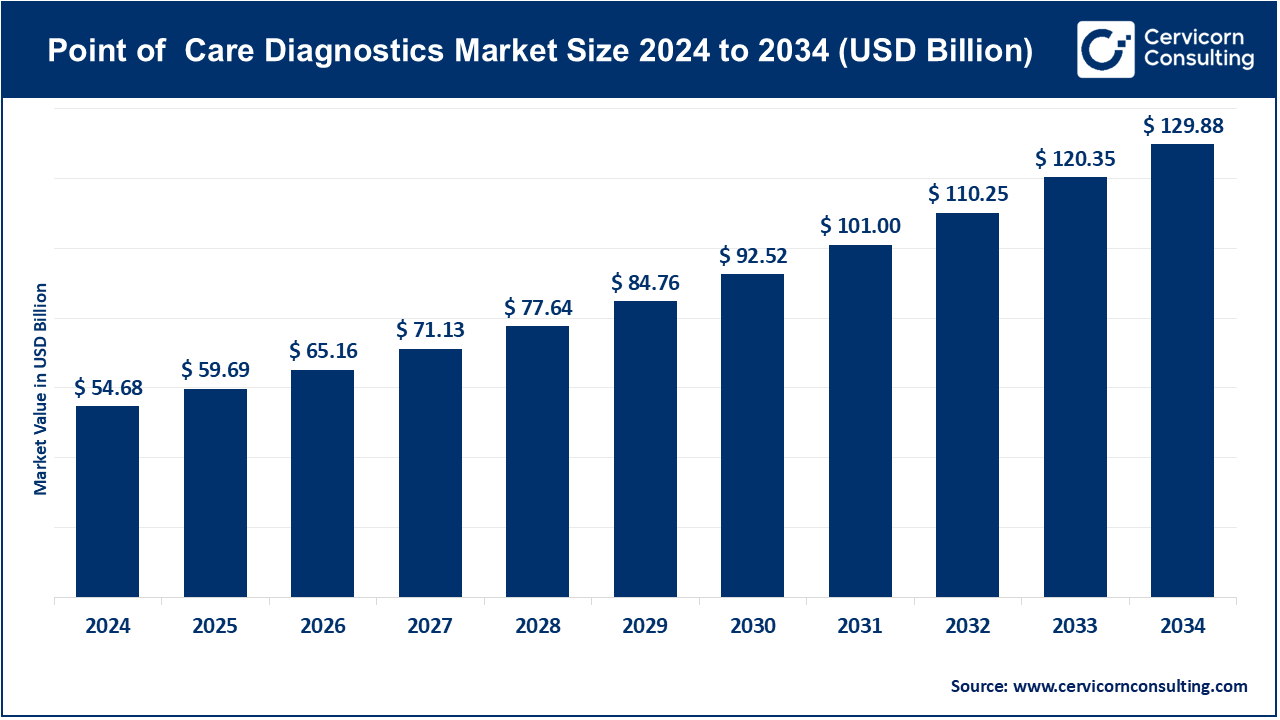

The global point of care diagnostics market size was accounted for USD 54.68 billion in 2024 and is expected to hit around USD 129.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.04% from 2025 to 2034.

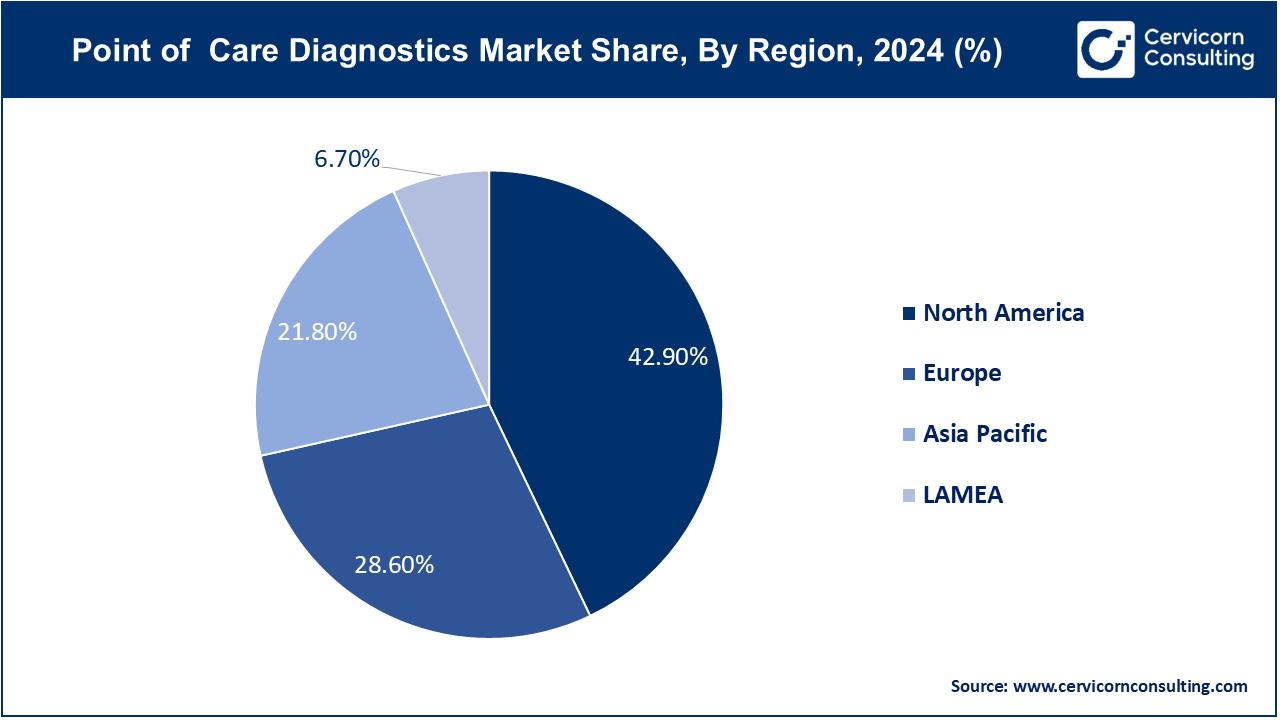

The point-of-care diagnostics market has seen significant expansion in recent years, fueled by the increasing demand for rapid and accurate testing solutions in both developed and developing regions. The surge in chronic diseases like diabetes, cardiovascular conditions, and infectious diseases has created a strong need for accessible diagnostic tools. Additionally, the COVID-19 pandemic highlighted the importance of POC testing, boosting adoption across healthcare systems globally. North America dominates the market due to its advanced healthcare infrastructure and high adoption of innovative technologies. However, regions like Asia-Pacific are emerging as strong players, driven by increasing healthcare investments, growing awareness of early disease detection, and expanding rural healthcare access. The market is further supported by advancements in portable testing devices, miniaturized sensors, and the integration of AI and cloud-based solutions for seamless data management.

Point-of-care (POC) diagnostics refers to medical testing performed at or near the site of patient care, providing immediate results without the need to send samples to a laboratory. These tests are designed to be simple, quick, and portable, allowing healthcare professionals to diagnose and monitor patients in real time. POC diagnostics can be used in a variety of settings, such as clinics, hospitals, homes, and even remote areas, making them accessible to a wider population. Examples of POC tests include glucose meters for diabetes management, pregnancy tests, and rapid tests for infectious diseases like COVID-19 or influenza. These tools help healthcare providers make faster decisions, improve patient outcomes, and reduce the burden on centralized labs.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 59.69 Billion |

| Projected Market Size (2034) | USD 129.88 Billion |

| Growth Rate (2025 to 2034) | 9.04% |

| Dominating Region | North America |

| Rapidly Growing Region | Asia-Pacific |

| Segments Covered | Product Type, Technology,Mode of Delivery, Sample, End User, Region Region |

| Key Companies | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Becton, Dickinson and Company (BD), Thermo Fisher Scientific, Johnson & Johnson, Danaher Corporation, Quidel Corporation, Bio-Rad Laboratories, Cepheid (a Danaher Company), Molecular Devices, Ortho Clinical Diagnostics, HemoCue (part of Radiometer), Medtronic, Nova Biomedical |

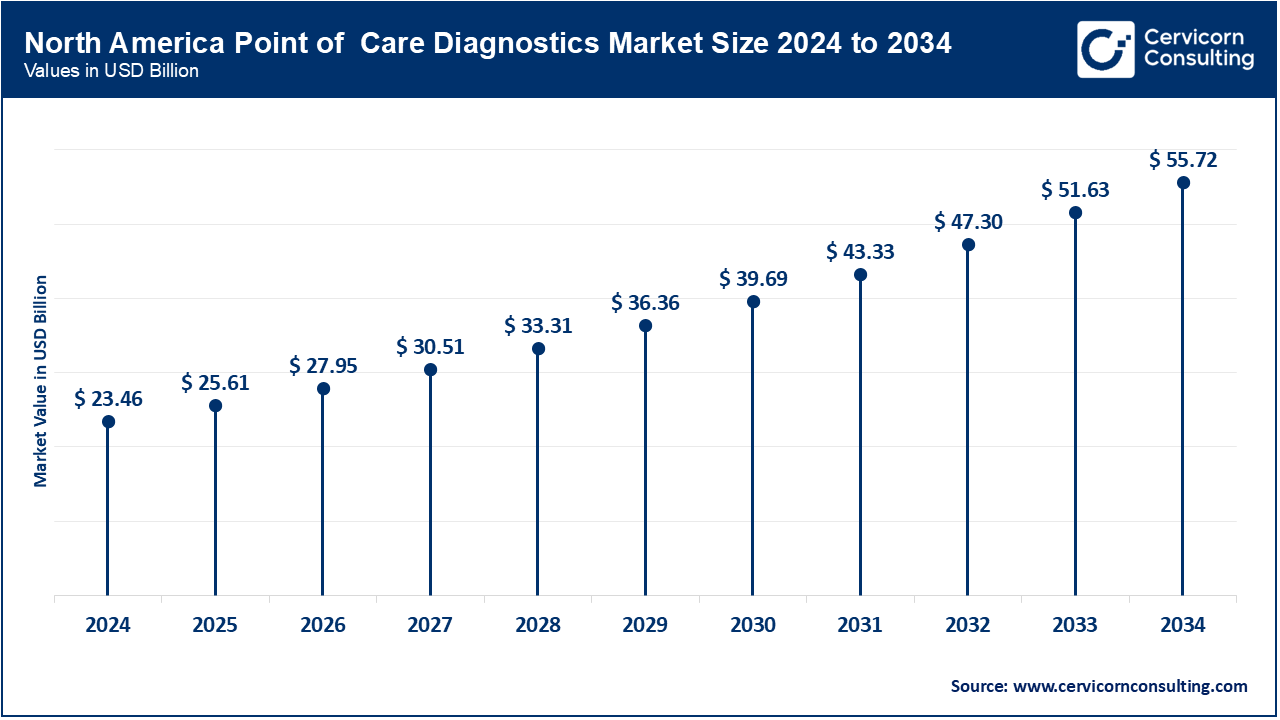

The North America point of care diagnostics market size was valued at USD 23.46 billion in 2024 and is expected to reach around USD 55.72 billion by 2034. The POC diagnostics industry in North America is well-established, driven by significant demand across healthcare settings such as hospitals and clinics. The United States leads with its advanced healthcare infrastructure and high adoption of cutting-edge diagnostics technologies. Canada contributes with a focus on innovations in home care diagnostics and improved patient management. The region benefits from robust healthcare policies, continuous technological advancements, and a strong regulatory framework that supports the efficient integration and use of POC diagnostic solutions.

The Europe point of care diagnostics market size was estimated at USD 15.64 billion in 2024 and is projected to surpass around USD 37.15 billion by 2034. Europe plays a significant role in the POC diagnostics market, with demand driven by its advanced healthcare systems and emphasis on patient-centered care. Countries like Germany, France, and the UK are at the forefront, supported by strong regulatory standards and a commitment to innovation in medical technology. The European market is characterized by its focus on high-quality, sustainable diagnostics solutions and regulatory compliance, which align with the region’s goals of enhancing healthcare efficiency and accessibility.

The Asia-Pacific point of care diagnostics market was worth at USD 11.92 billion in 2024 and is predicted to reach around USD 28.31 billion by 2034. The Asia-Pacific market is spurred by increasing healthcare needs and expanding medical infrastructure. China and India are major contributors due to their growing healthcare sectors and rising demand for affordable diagnostic solutions. Japan and South Korea also play key roles with advanced POC technologies and high-quality standards. The region's growth is supported by significant investments in healthcare infrastructure, technological advancements, and a rising emphasis on efficient and accessible diagnostics.

The LAMEA point of care diagnostics market was valued at USD 3.66 billion in 2024 and is expanding to USD 8.7 billion by 2034. The LAMEA region is expanding, driven by improving healthcare access and rising demand for diagnostic services. Brazil and South Africa are notable markets, benefiting from increased healthcare investments and growing consumer needs. The Middle East’s expanding healthcare and diagnostic sectors also contribute to market growth. Despite challenges such as economic fluctuations and infrastructural constraints, the region’s potential for market development is substantial, supported by increasing healthcare investments and advancements in diagnostic technologies.

The point of care diagnostics market is segmented into product type, technology, mode of delivery, sample, end-user, and region. Based on product type, the market is classified into glucose monitoring, cardiac markers, infectious disease testing, pregnancy and fertility testing, cholesterol testing, tumor/cancer markers, Hb1Ac testing, coagulation testing, thyroid stimulating hormone, hematology, primary care systems, decentralized clinical chemistry, feces, lipid testing, blood gas/electrolytes, ambulatory chemistry, Drug of Abuse (DOA) testing, autoimmune diseases, urinalysis/nephrology, and others. Based on technology, the market is classified into Lateral Flow Assays (LFA), biosensors, microfluidics, molecular diagnostics, and immunoassays. Based on mode of delivery, the market is classified into prescription-based testing, over-the-counter testing. Based on sample, the market is classified into blood, urine, and others. Based on end-user, the market is classified into hospitals, clinics, home care, ambulatory care settings, and laboratories.

Glucose Monitoring: Glucose monitoring devices are essential for individuals with diabetes, allowing them to track their blood glucose levels in real-time. These devices include fingerstick glucose meters, continuous glucose monitors (CGMs), and insulin delivery systems. They provide patients with immediate feedback on their glucose levels, helping them manage their condition effectively. Continuous glucose monitors, for instance, offer data trends and alerts for high or low blood sugar levels, enabling better glycaemic control and reducing the risk of complications associated with diabetes.

Cardiac Markers: Tests for cardiac markers are critical in diagnosing and managing heart conditions, particularly in emergency situations. These tests measure specific proteins or enzymes released into the blood during a heart attack, such as troponin, creatine kinase (CK), and myoglobin. Rapid point-of-care tests for cardiac markers allow healthcare providers to quickly assess a patient's heart health and determine the need for immediate intervention. The speed and accuracy of these tests can significantly impact patient outcomes, as timely treatment is crucial in minimizing heart damage.

Infectious Disease Testing: Kits for infectious disease testing enable rapid diagnosis of various illnesses, including influenza, HIV, COVID-19, and strep throat. These point-of-care tests are designed to deliver results in minutes, allowing healthcare providers to initiate treatment promptly. The ease of use and quick turnaround time are especially beneficial in emergency rooms and urgent care settings. With the increasing prevalence of infectious diseases, especially in the wake of the COVID-19 pandemic, the demand for these testing kits has surged, highlighting their importance in public health and disease management.

Pregnancy and Fertility Testing: Point-of-care tests for pregnancy and fertility are widely used for quick and convenient detection of pregnancy or ovulation. Home pregnancy tests typically utilize urine samples to detect the presence of human chorionic gonadotropin (hCG), while ovulation predictor kits measure luteinizing hormone (LH) levels. These tests empower individuals to monitor their reproductive health and make informed decisions regarding family planning. The accessibility and ease of use of these tests have contributed to their popularity among consumers.

Cholesterol Testing: Cholesterol testing devices allow for the measurement of blood lipid levels, including high-density lipoprotein (HDL), low-density lipoprotein (LDL), and triglycerides. Point-of-care cholesterol tests enable healthcare providers to assess cardiovascular risk factors quickly. Regular monitoring of cholesterol levels is crucial for managing heart disease and promoting heart health. The convenience of point-of-care testing encourages more patients to undergo routine screenings and make lifestyle changes based on their results.

Tumor/Cancer Markers: Tests for tumor or cancer markers are designed to detect specific proteins or substances in the blood that may indicate the presence of cancer. These point-of-care tests can be used for screening, diagnosis, and monitoring treatment effectiveness. Rapid detection of cancer markers can lead to earlier interventions and better patient outcomes. As cancer rates continue to rise globally, the demand for effective and accessible diagnostic tools remains high, making these tests increasingly important in oncology.

Others: The "Others" category includes a variety of point-of-care tests, such as those for drug abuse detection, metabolic panels, Coagulation and respiratory function tests. These tests are designed to provide immediate results and aid in the diagnosis or monitoring of various health conditions. For instance, drug testing kits can quickly detect the presence of substances in urine or saliva, assisting healthcare providers in managing substance use disorders. The diversity of these tests highlights the versatility of point-of-care diagnostics in meeting various healthcare needs.

Lateral Flow Assays (LFA): Lateral flow assays are simple, rapid diagnostic tests commonly used in point-of-care settings. They work by using capillary action to draw a liquid sample (such as blood or urine) through a porous membrane, where it interacts with specific reagents that produce a visible result, such as a colored line. LFAs are widely used for home pregnancy tests and rapid tests for infectious diseases like COVID-19. Their ease of use, quick results, and low cost make them an attractive option for both healthcare providers and patients.

Biosensors: Biosensors are analytical devices that combine a biological component with a physicochemical detector to measure specific substances in a sample. In point-of-care diagnostics, biosensors can be used for various applications, including glucose monitoring, infectious disease testing, and drug testing. These devices offer high sensitivity and specificity, allowing for accurate and reliable results. The integration of biosensors into point-of-care settings enhances the ability to monitor patient health and make timely clinical decisions.

Microfluidics: Microfluidic technology involves the manipulation of small volumes of fluids on a chip, allowing for rapid and efficient analysis of samples at the point of care. Lab-on-a-chip devices can perform multiple tests simultaneously, providing comprehensive diagnostic information from a single sample. This technology is particularly valuable for its ability to deliver quick results in a compact format, making it ideal for use in emergency settings and remote locations. Microfluidics continues to advance, with ongoing research aimed at expanding its applications in point-of-care diagnostics.

Molecular Diagnostics: Molecular diagnostics encompass a range of techniques used to detect and analyze genetic material, such as DNA and RNA, for diagnosing diseases. Techniques like polymerase chain reaction (PCR) and nucleic acid amplification tests (NAAT) are commonly used in point-of-care settings to identify infections, including viral and bacterial pathogens. The ability to detect diseases at a molecular level enhances the accuracy of diagnoses and allows for personalized treatment options. As molecular diagnostics technology advances, its integration into point-of-care testing is expected to grow, improving patient outcomes.

Immunoassays: Immunoassays are diagnostic tests that utilize the binding of antibodies to specific antigens to detect the presence of proteins or pathogens in a sample. These tests are widely used in point-of-care diagnostics for various applications, including hormone level testing, infectious disease detection, and allergy testing. The sensitivity and specificity of immunoassays make them valuable tools in clinical settings, enabling rapid diagnosis and monitoring of health conditions. With the continuous development of new antibodies and assay formats, the role of immunoassays in point-of-care diagnostics is expected to expand.

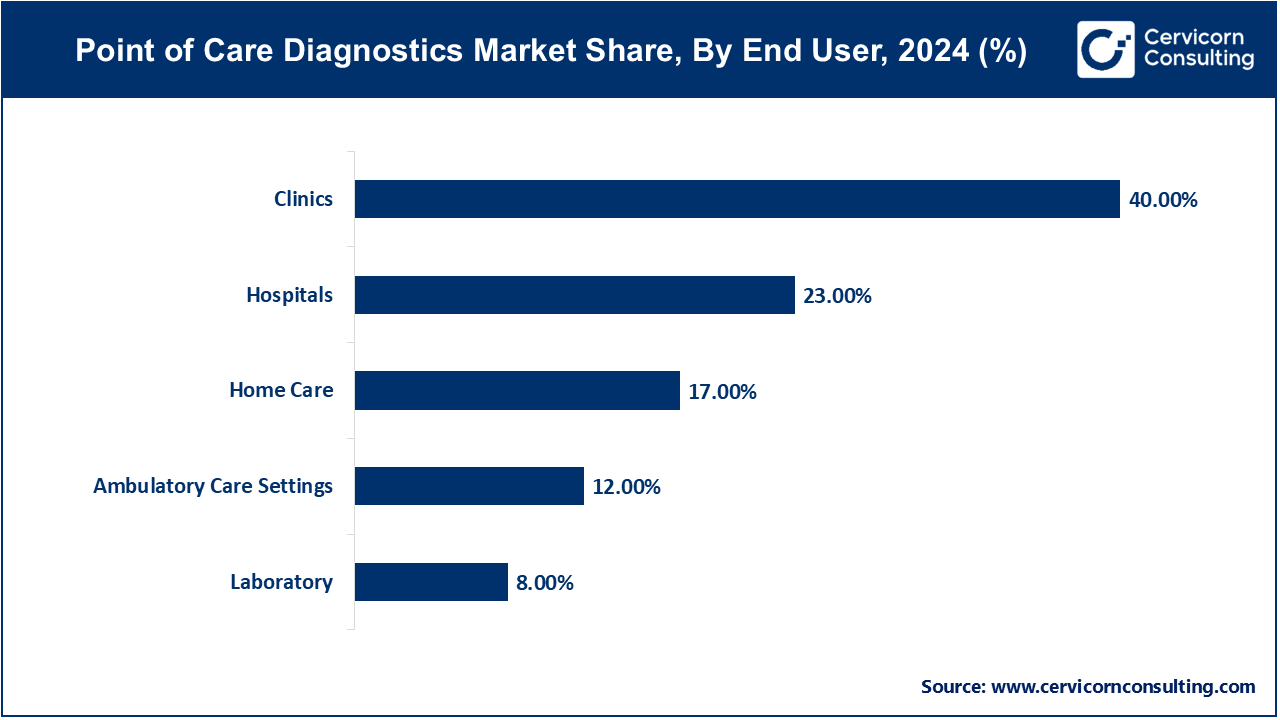

Hospitals: The hospital segment has accounted for 23% of revenue share in 2024. Hospitals play a crucial role in providing immediate test results that inform patient care decisions. These tests enable healthcare providers to quickly assess patient conditions, initiate treatment, and monitor progress without the delays associated with traditional laboratory testing. In emergency departments, point-of-care tests for cardiac markers, glucose levels, and infectious diseases are particularly valuable for rapid diagnosis and intervention. The integration of point-of-care diagnostics into hospital workflows enhances patient care efficiency and improves clinical outcomes.

Clinics: The clinical segment has captured the highest revenue share (40%) in 2024. Outpatient and specialist clinics increasingly utilize point-of-care diagnostics to provide quick and convenient test results for patients. These tests allow healthcare providers to make timely clinical decisions during patient visits, improving the overall patient experience. For instance, clinics often use point-of-care tests for glucose monitoring, pregnancy testing, and infectious disease screening. By offering immediate results, clinics can enhance patient satisfaction and ensure that follow-up care is appropriately tailored to individual needs.

Home Care: The home care segment has accounted revenue share of 17% in 2024. Home care point-of-care diagnostics empower patients to monitor their health conditions from the comfort of their homes. Devices designed for home use, such as glucose meters, blood pressure monitors, and rapid test kits, enable individuals to take charge of their health management. This shift toward home care diagnostics has been particularly beneficial for chronic disease management, allowing patients to track their conditions and share data with healthcare providers remotely. The convenience and accessibility of home care diagnostics promote proactive health management and reduce the burden on healthcare facilities.

Ambulatory Care Settings: The ambulatory care settings segment has garnered a revenue share of 12% in 2024. Point-of-care tests are increasingly utilized in ambulatory care settings, including urgent care centers and emergency rooms. These tests provide rapid diagnostic results for patients seeking immediate medical attention, facilitating timely treatment and reducing wait times. In situations where every minute counts, such as trauma or acute illness, point-of-care diagnostics enable healthcare providers to quickly identify life-threatening conditions and take appropriate action. The integration of point-of-care testing in ambulatory settings enhances patient care and supports effective triage processes.

Laboratories: The laboratories segment has reported 8% revenue share in 2024. While point-of-care diagnostics are often associated with immediate testing in clinical settings, they also play a role in laboratory environments. Laboratories can utilize point-of-care tests for quick screening and preliminary assessments before sending samples for more comprehensive analysis. This hybrid approach allows for efficient workflow management and faster turnaround times for critical tests. Additionally, laboratories may adapt point-of-care testing technologies for specialized applications, enhancing their diagnostic capabilities and responsiveness to clinical needs.

Prescription-based Testing: The prescription-based testing segment generated approximately 54% of the revenue share in 2024. Prescription-based testing refers to point-of-care diagnostic tests that require a healthcare provider's authorization before use. These tests are typically used in clinical settings, where providers assess patient needs and determine the appropriate tests to order. Prescription-based tests offer a higher level of oversight and can be tailored to individual patient conditions, ensuring that the right diagnostic tools are employed. This approach helps maintain clinical standards and can lead to more accurate diagnoses and effective treatment plans.

Over-the-Counter Testing: The OTC testing segment generated approximately 46% of the revenue share in 2024. Over-the-counter (OTC) testing allows consumers to access point-of-care diagnostic tests without a prescription, empowering individuals to take control of their health. These tests are designed for home use and include pregnancy tests, glucose monitoring devices, and rapid tests for infectious diseases. The convenience and accessibility of OTC testing have contributed to its popularity, as consumers can perform tests at their convenience and obtain results quickly. OTC tests promote proactive health management and enable early detection of potential health issues.

The point of care (POC) diagnostics industry features a mix of established companies and innovative startups, all striving to capture a share of this rapidly growing sector. Key players include Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, and Cepheid, known for their advanced POC testing technologies and extensive product portfolios. These companies are focusing on innovation, investing in research and development to enhance the accuracy, speed, and usability of their testing devices.

Additionally, Trends in the POC diagnostics market include the increasing adoption of telemedicine and remote patient monitoring, driven by the COVID-19 pandemic, as well as a growing emphasis on personalized medicine and point-of-care testing for chronic disease management. As healthcare continues to evolve, the demand for convenient, rapid, and reliable diagnostic solutions will likely propel the market forward.

CEO Statements

Robert Ford, CEO of Abbott Laboratories: “Our continued investment in point of care diagnostics is aimed at enhancing our capabilities to deliver timely and accurate results that can significantly impact patient care and outcomes."

Severin Schwan, CEO of Roche: “Roche is committed to advancing point of care diagnostics through innovative technologies that enable more personalized and effective patient management.”

Bernd Montag, CEO of Siemens Healthineers: " Our focus on point of care diagnostics reflects our dedication to making healthcare more accessible and efficient, with solutions that bring testing closer to the patient”

These developments underscore significant strides in advancing diagnosis and technology, reflecting growing collaborations and strategic investments aimed at expanding the global healthcare economy.

Strategic partnerships and Launches highlight the rapid advancements and collaborative efforts in the Point of Care market. Industry players are involved in various aspects of Point of Care, including production, storage technologies, and fuel cells, and play a significant role in advancing the market. Some notable examples of key developments in the point of care (POC) diagnostics market include:

These developments underscore significant strides in advancing hydrogen infrastructure and technology, reflecting growing collaborations and strategic investments aimed at expanding the global point of care (POC) diagnostics industry.

Market Segmentation

By Product Type

By Technology

By Mode of Delivery

By Sample

By End-User

By Region