Electric Compressor Market Size and Growth 2025 to 2034

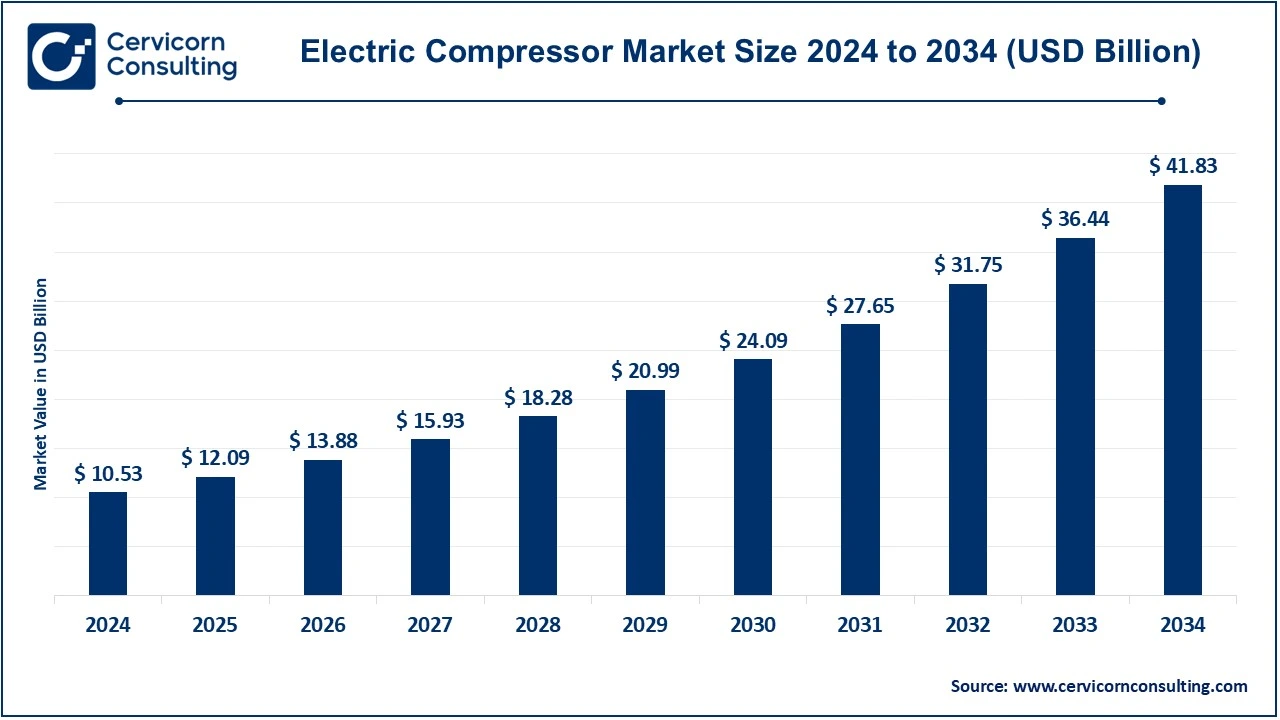

The global electric compressor market size was valued at USD 10.53 billion in 2024 and is expected to be worth around USD 41.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.79% over the forecast period 2025 to 2034.

The electric compressor market is experiencing significant growth driven by the increasing demand for energy-efficient and environmentally friendly solutions across various industries. The shift towards sustainability, along with advancements in electric vehicle (EV) technologies, is pushing the adoption of electric compressors, particularly in sectors such as automotive, industrial manufacturing, construction, and renewable energy. Additionally, innovations like variable-speed drive technology, which helps reduce energy consumption, are enhancing the market's expansion. As industries focus on reducing operational costs and carbon footprints, the demand for electric compressors is projected to continue growing, with substantial investments in energy-efficient technologies and the increasing use of electric systems across global markets.

What is an electric compressor?

An electric compressor is a device that uses electric power to compress air or gases. It works by drawing in air or gas through an intake valve, compressing it using mechanical components like pistons, screws, or rotors, and then storing the compressed air in a tank or delivering it to a system for various applications. Electric compressors are typically more energy-efficient and environmentally friendly compared to their traditional fuel-powered counterparts, as they do not produce exhaust emissions. They are commonly used in industries such as automotive, manufacturing, construction, mining, healthcare, and energy, and are popular in applications such as air conditioning systems, pneumatic tools, industrial processes, and more.

Key Statistics

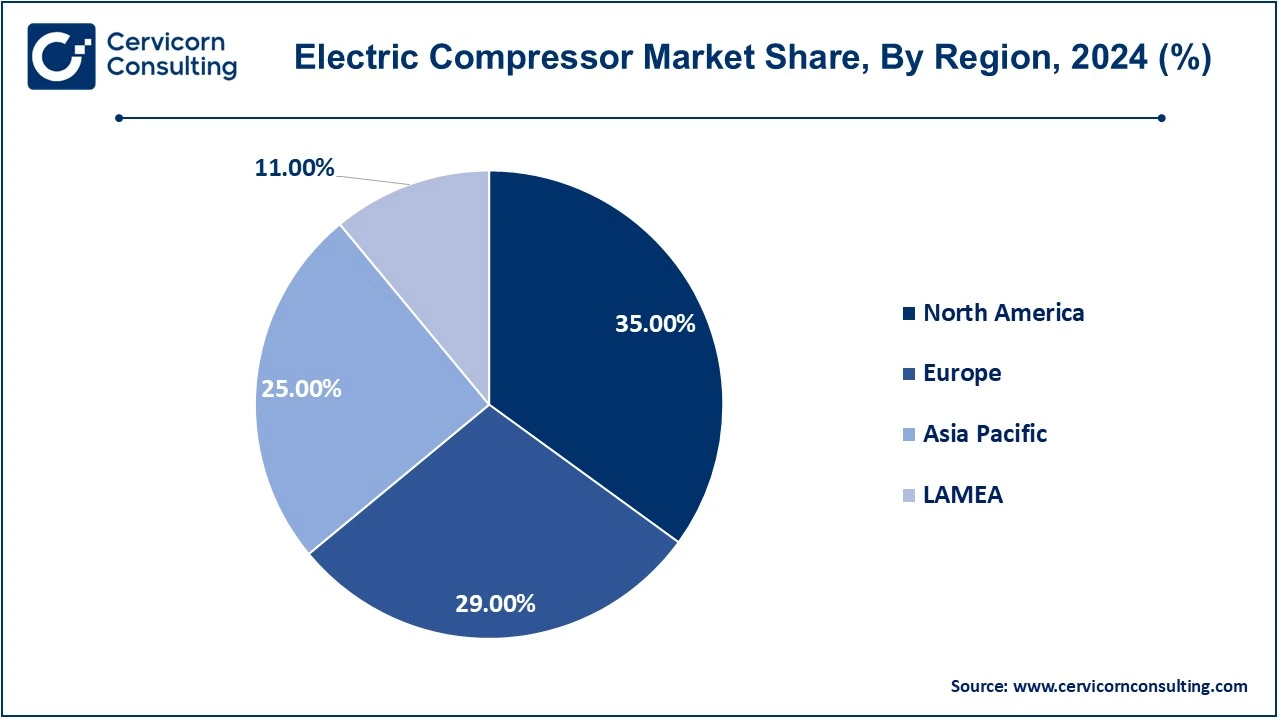

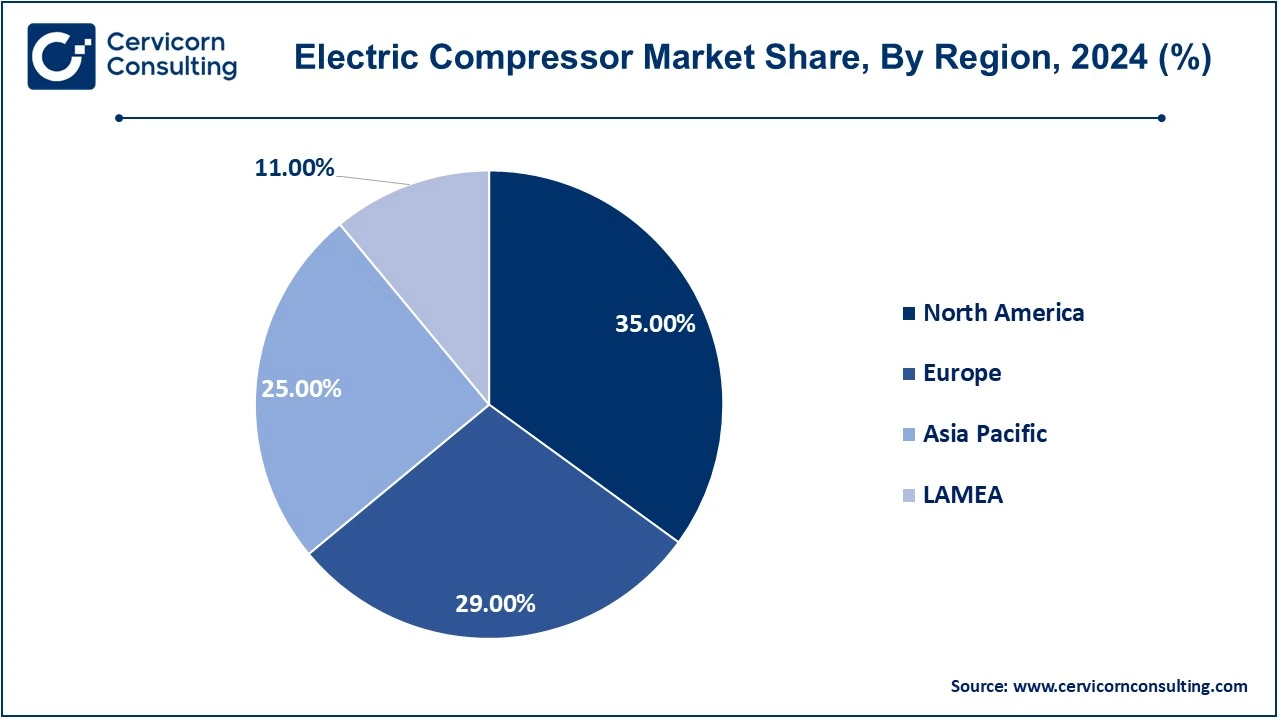

- North America is the largest market for electric compressors, accounting for approximately 35% of the global share in 2024, due to increasing demand in the manufacturing and energy sectors.

- The Asia-Pacific region is projected to grow the fastest, with China leading the way in electric vehicle applications and industrial compressor demand.

- The IEA forecasts that by 2025, energy-efficient compressors (including electric compressors) will reduce global energy consumption in manufacturing by over 15%.

- The adoption of electric compressors in the industrial sector is projected to increase by 18% annually over the next decade.

- By 2025, the market for low-power electric compressors (below 20 kW) is expected to grow by 20% annually.

- By type, screw compressors segment has held revenue share of 40% in 2024.

- By power range, the medium power compressors (20–100 kW) segment has captured revenue share of 45% in 2024.

- By application, the manufacturing segment has generated revenue share of 35% in 2024.

Electric Compressor Market Growth Factors

- Rising Demand for Energy Efficiency: As industries and businesses increasingly prioritize reducing energy consumption and lowering operational costs, the demand for energy-efficient solutions has surged. Electric compressors, especially those featuring variable speed drive technology, offer a significant advantage in energy savings by adjusting motor speed according to air demand. This feature not only improves operational efficiency but also reduces electricity costs, making electric compressors a preferred choice in energy-conscious sectors.

- Growing Adoption of Electric Vehicles (EVs): The rise in electric vehicle production has driven the demand for electric compressors, particularly in the automotive industry. Electric compressors are used in EVs for air conditioning systems and to cool the cabin efficiently. As the global automotive industry continues to shift toward electric mobility, the need for advanced electric compressors is expected to grow, boosting market growth in this sector.

- Government Regulations and Sustainability Goals: Increasing government regulations aimed at reducing greenhouse gas emissions and promoting sustainability are pushing industries to adopt cleaner technologies. Electric compressors, which do not rely on fossil fuels and produce no direct emissions, are aligned with these regulations. Industries are motivated to replace traditional fuel-driven compressors with electric versions to comply with environmental standards, further driving the adoption of electric compressors.

- Expansion of Industrial Automation and Smart Manufacturing: As industrial automation and smart manufacturing systems grow, the demand for reliable, efficient, and intelligent equipment rises. Electric compressors play a crucial role in these settings by providing the necessary compressed air for automated machinery and robots. With advancements in IoT and smart technologies, electric compressors are increasingly integrated into connected systems for real-time monitoring and predictive maintenance, contributing to their rapid adoption in industries such as manufacturing and logistics.

Electric Compressor Market Trends

- Adoption of Variable Speed Drive (VSD) Technology: One of the most significant trends in the electric compressor market is the widespread adoption of Variable Speed Drive (VSD) technology. VSD-equipped compressors adjust their motor speed based on the air demand, leading to energy savings and better operational efficiency. This technology is becoming a standard feature in many industrial applications, as it reduces energy consumption and extends the lifespan of compressors, aligning with the growing demand for sustainability and cost-saving solutions.

- Shift Towards Oil-Free Compressors: There is an increasing preference for oil-free electric compressors across industries that require high-quality, contaminant-free compressed air, such as in the pharmaceutical, food and beverage, and electronics sectors. These compressors eliminate the need for oil lubrication, ensuring that the compressed air remains clean and free from contaminants. As industries place greater emphasis on product quality and hygiene, the demand for oil-free compressors is expected to continue growing.

- Integration with IoT and Smart Technologies: The integration of electric compressors with Internet of Things (IoT) and smart technologies is a notable trend. Smart electric compressors can be remotely monitored and controlled, allowing for real-time performance tracking, predictive maintenance, and improved energy management. This trend is particularly popular in industries embracing Industry 4.0 and smart manufacturing, where automation and connectivity are key to enhancing efficiency and reducing downtime.

- Focus on Sustainability and Eco-Friendly Solutions: With increasing global awareness about environmental issues, industries are prioritizing sustainability, and electric compressors are playing a key role in this shift. Electric compressors are seen as a more eco-friendly alternative to traditional fuel-powered compressors since they produce no direct emissions and are more energy-efficient. The growing emphasis on reducing carbon footprints and adhering to environmental regulations is driving the demand for electric compressors in various sectors.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 12.09 Billion |

| Expected Market Size in 2034 |

USD 41.83 Billion |

| Projected CAGR |

14.79% |

| Dominant Area |

North America |

| Leading Growth Region |

Asia-Pacific |

| Key Segments |

Type, Power Range, Application, Region |

| Key Companies |

Atlas Copco, Ingersoll Rand, Kaeser Compressors, Siemens, Gardner Denver, Boge Compressors, Sullair (A subsidiary of Hitachi), Elgi Compressors, Mitsubishi Electric, Schneider Electric, Hyundai Heavy Industries, Howden |

Electric Compressor Market Dynamics

Drivers

Increasing Industrial Automation

- As industries continue to adopt automation and smart manufacturing technologies, the demand for reliable, energy-efficient air compression solutions has risen. Electric compressors are integral to industrial automation systems, providing the necessary compressed air for machines, robots, and control systems. Their ability to provide consistent, high-quality compressed air in automated environments is driving their adoption across sectors such as manufacturing, logistics, and automotive. With the growing trend of industry 4.0, electric compressors are playing an essential role in ensuring the smooth operation of automated factories and production lines.

Growing Demand for Clean and Oil-Free Air

- The increasing demand for oil-free compressed air is another key driver of the market. Industries such as pharmaceuticals, food and beverage, electronics, and medical equipment manufacturing require high-quality compressed air that is free from contaminants, including oil and other impurities. Electric compressors are often oil-free, ensuring clean air without the risk of contamination. As industries place higher demands on air quality and cleanliness, electric compressors are becoming the preferred choice, driving growth in specialized sectors.

Restraints

High Initial Investment Costs

- Despite their energy efficiency and long-term cost savings, electric compressors often have a higher initial purchase cost compared to conventional compressors. The integration of advanced technologies, such as VSD systems and IoT-enabled monitoring, contributes to this price disparity. For small and medium-sized enterprises (SMEs) or businesses operating in cost-sensitive regions, this upfront expense can act as a significant barrier to adoption, slowing the market’s growth potential.

Limited Availability in Emerging Markets

- In developing and emerging markets, the availability and accessibility of advanced electric compressors remain limited due to insufficient infrastructure and distribution networks. Many industries in these regions continue to rely on traditional fuel-based or low-cost compressors, driven by limited awareness and budget constraints. This uneven market penetration restricts the global adoption rate of electric compressors, creating a gap between developed and developing economies in adopting this technology.

Opportunities

Increasing Adoption of IoT-Enabled Compressors

- The integration of IoT technology into electric compressors presents a significant growth opportunity. IoT-enabled compressors offer real-time monitoring, predictive maintenance, and enhanced control, allowing businesses to improve operational efficiency and reduce downtime. These features are particularly appealing to industries embracing smart manufacturing and Industry 4.0 principles. As the adoption of IoT and automation technologies grows, manufacturers have a lucrative opportunity to develop and offer intelligent, connected electric compressors tailored to the evolving needs of modern industries.

Expansion of Renewable Energy Infrastructure

- The ongoing global shift toward renewable energy sources, such as solar and wind power, creates a promising opportunity for the electric compressor market. Electric compressors are increasingly being utilized in renewable energy systems for applications such as energy storage, cooling, and pressure maintenance. The growing investments in renewable energy projects worldwide, coupled with government incentives to support green technologies, present a substantial market for electric compressors optimized for clean energy applications.

Challenges

Technical Complexity and Maintenance

- While electric compressors offer numerous benefits, their advanced systems can present challenges in terms of technical complexity. Features like VSD and IoT integration require skilled personnel for operation and maintenance, which can be a limiting factor in regions with a shortage of trained professionals. The need for specialized training and technical expertise can increase operational costs and create hurdles for businesses, particularly smaller enterprises.

Intense Market Competition

- The electric compressor market is becoming increasingly competitive, with numerous global and regional players vying for market share. Established companies invest heavily in research and development, creating pressure for smaller players to keep up with innovation. Additionally, the entry of low-cost manufacturers from regions like Asia-Pacific has intensified price competition, forcing companies to strike a balance between affordability and quality. This fierce competition poses challenges for companies aiming to differentiate their offerings while maintaining profitability.

Electric Compressor Market Segmental Analysis

The electric compressor market is segmented into type, power range, application and region. Based on type, the market is classified into scroll compressors, screw compressors, rotary compressors, centrifugal compressors and reciprocating compressors. Based on power range, the market is classified into low power compressors (Below 20 kW), medium power compressors (20–100 kW) and high power compressors (Above 100 kW). Based on application, the market is classified into automotive, construction, manufacturing, mining, healthcare, energy and power.

Type Analysis

Screw compressors hold the largest market share, accounting for approximately 40%. Their dominance can be attributed to their widespread use in industrial applications due to their ability to deliver continuous airflow with high efficiency. Screw compressors are highly reliable, have a long operational life, and require minimal maintenance, making them a preferred choice in manufacturing, construction, and mining sectors.

Scroll compressors are experiencing rapid growth due to their compact size, low noise levels, and energy-efficient operation. They are widely used in industries such as healthcare and electronics, where clean and contaminant-free air is crucial. The increasing adoption of scroll compressors in HVAC systems and their suitability for small-scale industrial applications contribute to their accelerated growth.

Power Range Analysis

Medium power compressors hold the largest market share, contributing approximately 45%. These compressors strike a balance between power output and energy efficiency, making them suitable for a wide range of applications, including manufacturing, construction, and automotive. Their versatility and efficiency drive their extensive usage in industries with moderate air demand.

High power compressors are the fastest growing segment, driven by increasing demand in energy-intensive industries such as mining, energy, and large-scale manufacturing. These compressors provide high-capacity air supply, making them essential for heavy-duty applications. The expansion of renewable energy projects and large industrial facilities is boosting the demand for this segment.

Application Analysis

The manufacturing sector dominates the market, holding a share of approximately 35%. This is due to the extensive use of electric compressors in assembly lines, pneumatic tools, and process automation. The demand for reliable compressed air in production processes and the shift toward smart manufacturing systems are key drivers of growth in this segment.

The automotive sector is the fastest growing segment, primarily fueled by the rising production of electric vehicles (EVs). Electric compressors are essential for EV air conditioning systems and thermal management. The global shift toward sustainable mobility and the growing demand for EVs drive the rapid growth of this application segment.

Electric Compressor Market Regional Analysis

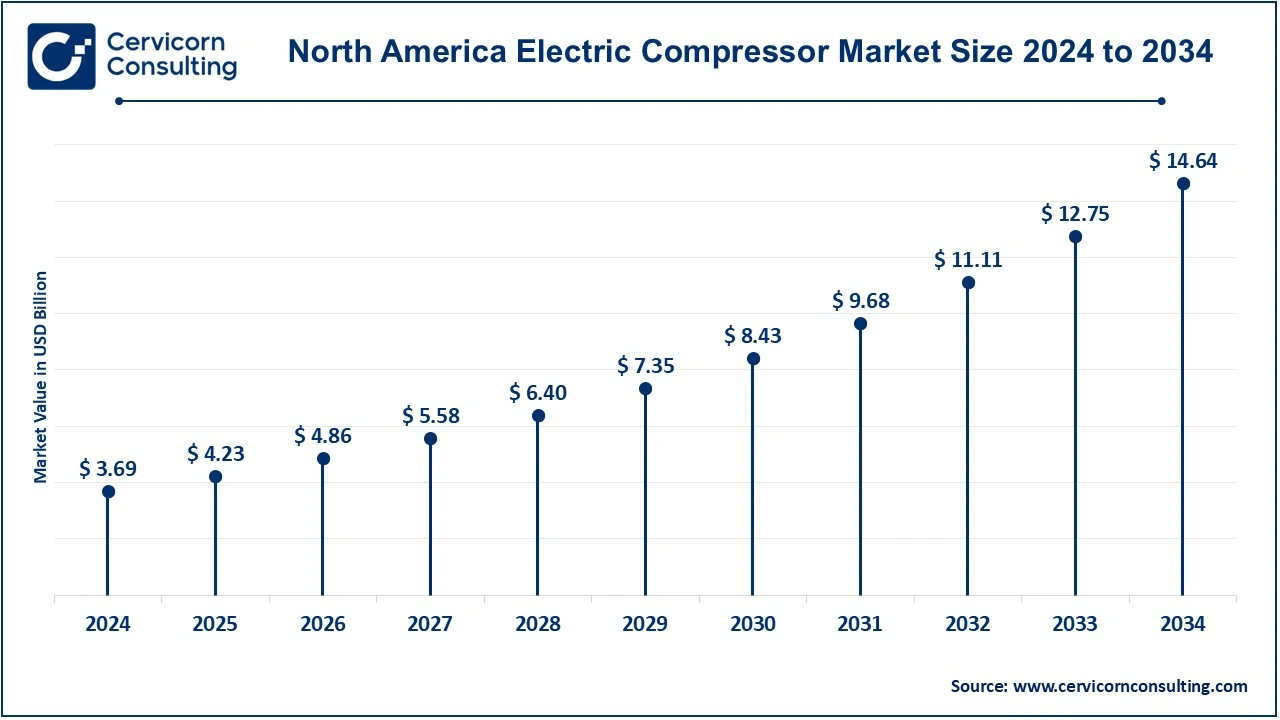

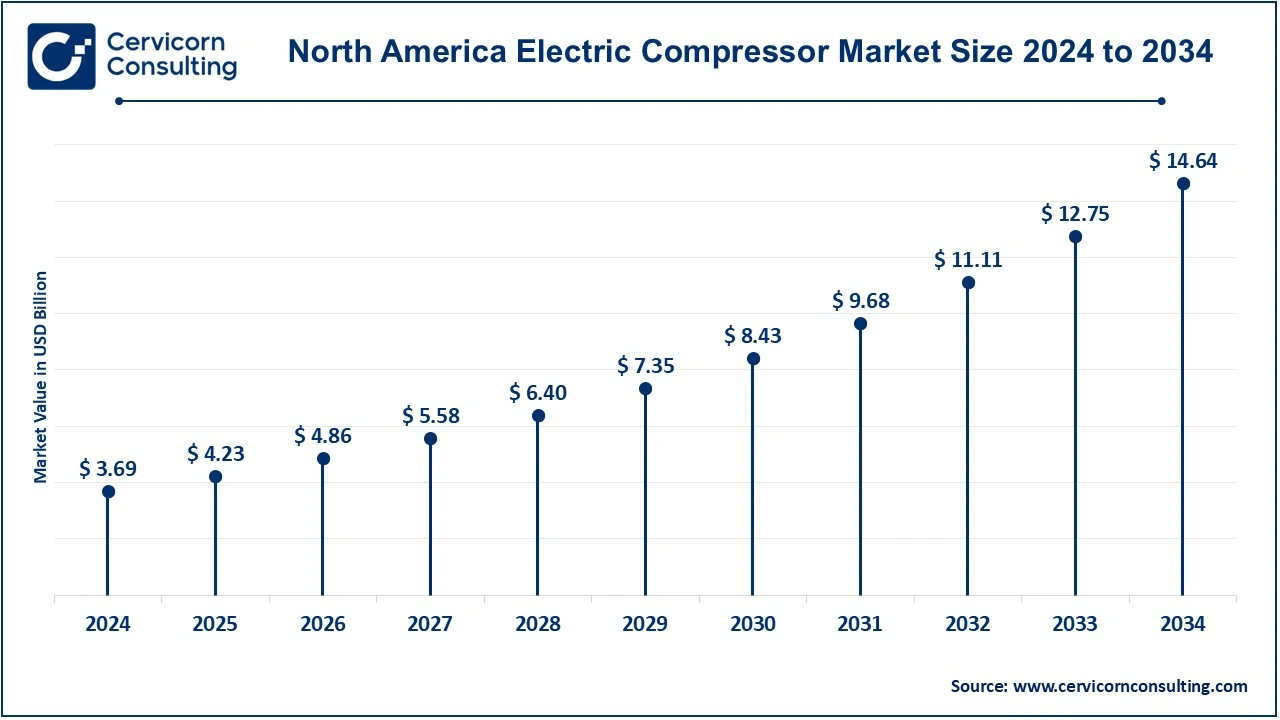

- The North America electric compressor market size was estimated at USD 3.69 billion in 2024 and is expected to reach around USD 14.64 billion by 2034.

- The Europe electric compressor market size was valued at USD 3.05 billion in 2024 and is projected to hit around USD 12.13 billion by 2034.

- The Asia-Pacific electric compressor market size was accounted for USD 2.63 billion in 2024 and is predicted to surpass around USD 10.46 billion by 2034.

- The LAEMA electric compressor market was valued at USD 1.16 billion in 2024 and is anticipated to reach around USD 4.60 billion by 2034.

North America holds the largest market share, contributing approximately 35%. The global electric compressor market size was valued at USD 10.53 billion in 2024 and is expected to be worth around USD 41.83 billion by 2034. This dominance can be attributed to the region's advanced industrial infrastructure and high adoption of energy-efficient technologies. The United States and Canada are leading markets, driven by significant investments in the automotive, manufacturing, and construction sectors. Additionally, strict environmental regulations promoting sustainable and energy-saving solutions further propel the adoption of electric compressors in this region.

The APAC region is the fastest-growing market. The rapid industrialization in countries like China, India, Japan, and South Korea is fueling the demand for electric compressors. The expansion of the manufacturing and automotive industries, coupled with government initiatives to promote green energy and infrastructure development, is driving substantial growth. Additionally, the increasing adoption of electric vehicles in this region further boosts demand for electric compressors.

Europe is driven by its focus on sustainability and energy efficiency. The region is witnessing high demand for electric compressors in sectors like automotive, healthcare, and energy. Countries like Germany, France, and the UK lead the market due to their well-established automotive and manufacturing industries. Additionally, stringent EU regulations to reduce carbon emissions and promote eco-friendly technologies have accelerated the adoption of advanced electric compressors.

The LAMEA region is still developing compared to other regions, but growing industrial activities in Latin America and the Middle East are driving demand. The mining and energy sectors in countries like Brazil, South Africa, and Saudi Arabia are increasingly utilizing electric compressors for efficient and sustainable operations. However, limited infrastructure and lower adoption of advanced technologies in some parts of this region pose challenges to growth.

Electric Compressor Market Top Companies

The electric compressors industry is highly competitive and comprises key players that are driving innovation and technological advancements to meet the growing demand for energy-efficient and sustainable solutions. These companies cater to a wide range of industries, including automotive, construction, manufacturing, and healthcare, while maintaining a strong focus on R&D to stay ahead in the market.

These companies are expanding their global footprint through strategic collaborations, partnerships, and acquisitions. They are also focusing on emerging markets in Asia-Pacific and LAMEA to capitalize on rapid industrialization and infrastructure development in these regions. This competitive landscape reflects a robust market, with companies striving to address evolving customer needs, enhance energy efficiency, and support industries transitioning toward greener solutions.

Recent Developments

- Atlas Copco continues to lead with investments in energy-efficient electric compressors, recently expanding production capacity by €100 million and launching new oil-free screw compressors with Variable Speed Drive (VSD+).

- Ingersoll Rand has strengthened its market presence with a $200 million investment in Asia-Pacific and the launch of the Nirvana series, focusing on energy savings and eco-friendly solutions.

- Hitachi has made strategic investments of ¥10 billion ($75 million) to expand electric compressor production in Japan and Southeast Asia, while launching high-efficiency, low-noise compressors for electric vehicles.

- Siemens has committed €300 million to enhance its energy-efficient compressor solutions across Europe and North America, unveiling AI-powered compressors to optimize performance and reduce energy consumption.

- Mitsubishi Heavy Industries invested ¥5 billion ($38 million) in R&D for electric compressors, launching centrifugal models aimed at energy savings for the oil and gas industry.

- Kaeser Kompressoren SE has expanded its manufacturing in Germany with a $40 million investment, introducing a new rotary screw compressor designed for improved energy efficiency in industrial applications.

Market Segmentation

By Type

- Scroll Compressors

- Screw Compressors

- Rotary Compressors

- Centrifugal Compressors

- Reciprocating Compressors

By Power Range

- Low Power Compressors (Below 20 kW)

- Medium Power Compressors (20–100 kW)

- High Power Compressors (Above 100 kW)

By Application

- Automotive

- Construction

- Manufacturing

- Mining

- Healthcare

- Energy and Power

By Region

- North America

- APAC

- Europe

- LAMEA

...

...