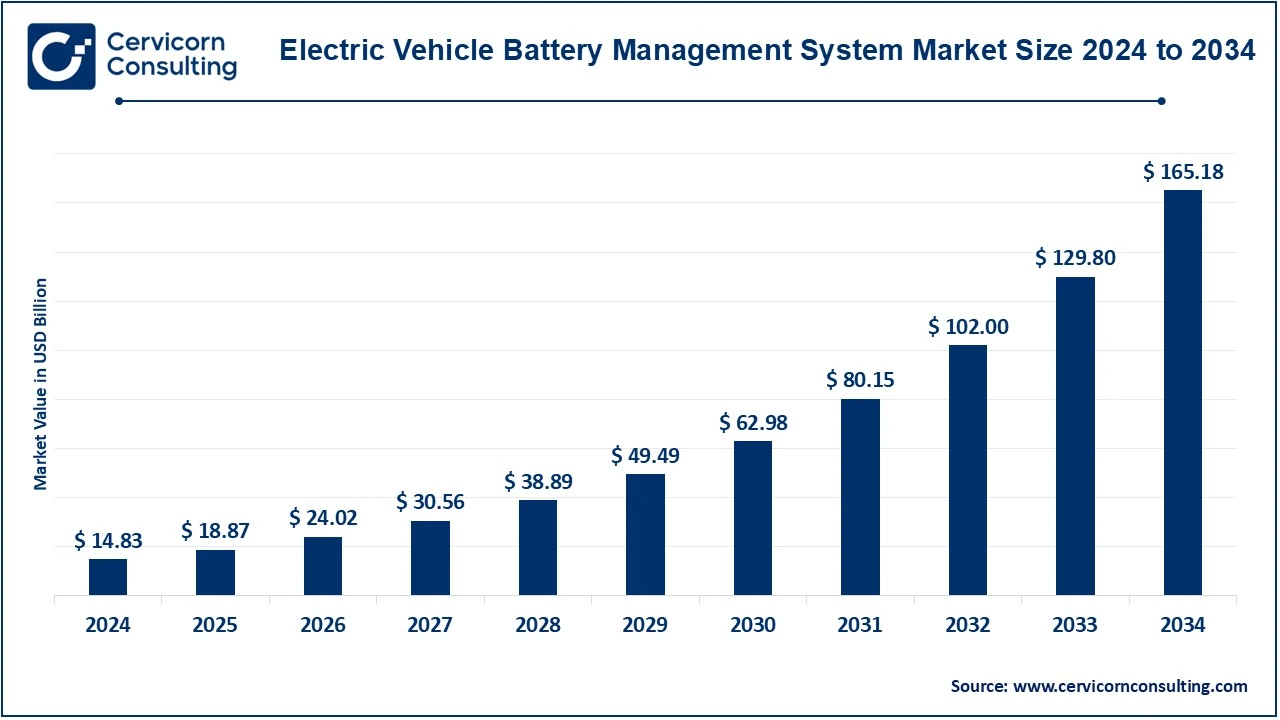

The global electric vehicle battery management system market size was estimated at USD 14.83 billion in 2024 and is expected to reach around USD 165.18 billion by 2034, growing at a compound annual growth rate (CAGR) of 30.12% over the forecast period 2025 to 2034.

The electric vehicle (EV) battery management systems (BMS) market plays an increasingly important role in a rapidly growing EV industry, as it safe-guards battery packs against threats to their efficiency and life. A BMS manages and monitors parameters such as voltage, temperature, and state of charge to ensure maximum safety and performance while preventing overheating or overcharging. Emerging are some of the most innovative and advanced wireless BMS systems, which bring less wiring and high scalability in solution applications. The key players are aggressively investing in R&D to improve their systems for better integration, energy efficiency, and cybersecurity along with highly competitive leadership. However, challenges like cost and the need for a standards-based solution do exist and will eventually be solved. That is why this EVT BMS market will show considerable growth since it will be part of the electric mobility revolution that takes place.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 18.87 Billion |

| Expected Market Size in 2034 | USD 165.18 Billion |

| Projected CAGR 2025 to 2034 | 30.12% |

| Top-performing Region | Asia Pacific |

| Region with the Strongest Growth | Europe |

| Key Segments | Type, Propulsion Type, Vehicle Type, Component, Application, Region |

| Key Companies | DENSO Corporation, Elithion Inc., Exide Corporation Enersys, GS Yuasa Corporation, Johnson Matthey, Marelli Holdings Co., Ltd., Navitas System, LLC, NEC Corporation, Renesas Electronics Corporation, Sensata Technologies, Inc., Storage Battery Systems, LLC, Texas Instruments Incorporated, Toshiba Corporation |

Focus on Sustainable Energy Solutions

Technological Advancements in Semiconductor Elements

High Cost of Advanced BMS

Lack of Standardization

Autonomous Driving and Connectivity

Data Analytics

Complexity of Battery Pack

Thermal Management Challenges

The electric vehicle battery management system market is segmented into type, propulsion type, vehicle type, component, application and region. Based on type, the market is classified into lead-acid, redox-flow, and lithium-Ion. Based on propulsion type, the market is classified into hybrid electric vehicle, and battery electric vehicle. Based on vehicle type, the market is classified into passenger car and commercial vehicles. Based on component, the market is classified into integrated circuits, cutoff FETs and FET Driver, temperature sensor, fuel gauge/current measurement devices, microcontroller and other. Based on application, the market is classified into discharge monitoring, current management, temperature monitoring and voltage monitoring.

Li-Ion Batteries: Lithium-ion batteries segment has dominated the EV BMS market in 2024. Lithium-ion batteries have been at the top of the chain when it comes to electrics and hybrids. Being light, their energy density and high energy cycles make them perfect candidates for BMS that ensure safety and efficiency in as much as they are sensitive to temperature changes and overcharging. BMS is very important in lithium-ion batteries for cell balancing, temperature measurement, and prevention of thermal runaway. Advances in lithium-ion technology have also helped BMS systems, seem more capability-oriented with developing trends in battery performance and vehicle range improvement.

Redox Flow Batteries: Redox flow batteries have emerged as a promising alternative for certain EV applications because of their long operational life and scalability. By storing energy in liquid electrolytes, flow batteries provide flexible designs and convenient maintenance. Their characteristic demands a special BMS management of flow rate electrolytes, temperature, and state of charge. Although evaluating possibilities for their use in heavy-duty and commercial vehicles is underway, redox flow batteries have no widespread use in EVs, the vast majority being lithium-ion batteries.

Lead-Acid Batteries: The usage of lead-acid batteries is not so common in modern vehicles as these are less and are being used owing to affordability and reliability. They are ideal for low-speed electric vehicles and auxiliary power in normal EVs. BMS for lead-acid batteries focuses on the prevention of overcharging and sulfation along with ensuring the optimization of the charge cycles. However, even with their lower energy density and shorter lifespan than lithium-ion batteries, BMS solutions are available and cost-effective, adding value to lead-acid batteries in performance and life.

Battery Electric Vehicles (BEVs): These types of vehicles operate on the electric power only which is stored in the battery packs that can be recharged which makes the role of BMS indispensable. The BMS in BEV critically manages battery functions such as state-of-charge monitoring, thermal management, cell balancing, and so on to ensure safety and performance. With BEVs becoming popular owing to zero-emission driving and improvement in charging infrastructure, the need for advanced BMS solutions kept on increasing. Long-lasting BMS systems improve battery life and enhance energy efficiency to haunt consumer concerns, like range anxiety, reliability, etc. It recognizes the intensifying significance kept by such breakthrough BMS technologies when it comes to BEVs demanding longer ranges and high performance.

Electric Vehicle BMS Market Revenue Share, By Propulsion Type, 2024 (%)

| Propulsion Type | Revenue Share, 2024 (%) |

| Hybrid Electric Vehicle | 24% |

| Battery Electric Vehicle | 76% |

Hybrid Electric Vehicles (HEVs): Hybrid Electric Vehicles (HEVs) combines an internal combustion engine along with the electric propulsion system owing to which it requires BMS for the management of the smaller battery efficiency. The BMS in HEVs ensures optimal utilization of the batteries through charge and discharge cycle balancing, temperature monitoring, and overcharging prevention. While BEVs mainly depend on the seamless integration of the electric and conventional power sources, for HEVs, battery management is thus crucial. The increasing trend towards HEVs, particularly in areas where charging infrastructure is limited, calls for reliable yet flexible BMS solutions. Advanced BMS technologies, therefore, will play a major role in the potential success of future HEVs, which will be more fuel-efficient and environmentally friendly.

Voltage Monitoring: This is one half of BMS applications-the critical volt monitoring aspect-which keeps strict adherence to the zero-voltage cut-off and voltage compensation monitoring of each cell in a battery pack while overcharging as well as over-discharging voltage monitoring so as to prolong the life and performance of the battery. In electric vehicles, this takes a more serious importance because steady voltages released from cells are essential for safety and power delivery. Advanced systems of BMS incorporate precision sensors and algorithms keeping continuous monitoring and balance in voltage levels within respective cells, reducing safety risks like thermal runaway or degradation due to cell aging.

Temperature Monitoring: Temperature monitoring in BMS ensures that a battery pack meets the very basic requirement of thermal stability, which is important for the safety and efficiency of the battery pack under consideration. High or very low temperatures can cause the battery not to work properly, as demonstrated earlier, and can also lead to thermal runaway or reduced capacity. Temperature sensors are employed in most BMS systems placed in well-known cooling/heating mechanisms of power supply sources, which are used to control and monitor the temperature of the battery pack. This is a vital feature of electric vehicles that drive through different ambient environments to enable the battery to operate well and non-dangerously.

Current Management: The current management is the primary application of BMS implemented for the current operation of a battery pack during charging and discharging cycles within the allowable limits. Excess current will lead to overheating and inefficiency and, most importantly, to dangerous condition. Therefore, BMS systems regulate the current flow and protect batteries against damage and optimize energy consumption. This feature becomes even more important while fast charging when currents are involved. Advanced BMS technologies enable precise current control to meet the consumer's growing expectations on rapidity while ensuring improved battery safety and longevity.

Discharge Monitoring: The energy discharge by the battery packs is tracked by BMS to maintain or monitor continuous and consistent power output from battery packs. It prevents battery packs from excessive discharging rates through the BMS systems, which would otherwise affect battery condition or performance with reduced risk of efficiency. This application is the most essential for ensuring continued performance and longevity for batteries used in EV operations, especially with high demands. Even in newest designs of BMS, real-time data utilized improves discharges to optimize energy output while keeping the entire battery intact.

The electric vehicle BMS market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

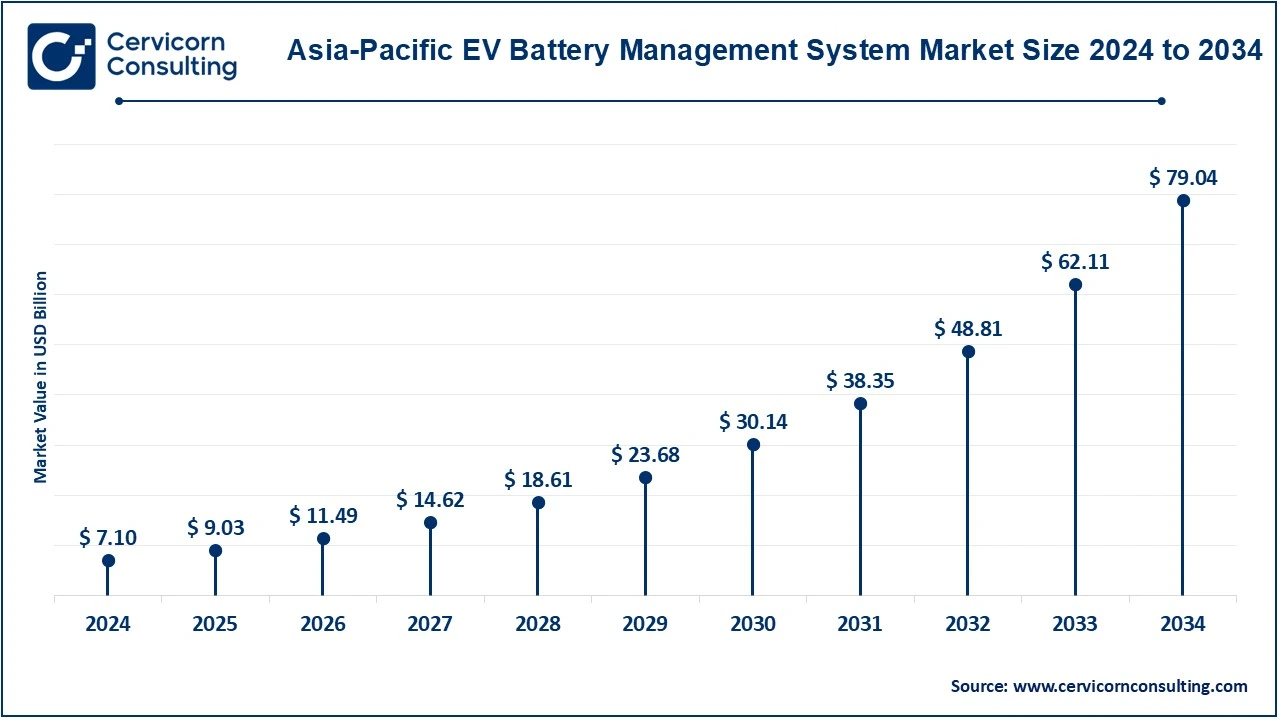

The Asia-Pacific electric vehicle battery management system market size was estimated at USD 7.10 billion in 2024 and is expected to reach around USD 79.04 billion by 2034. Countries like China, Japan, and South Korea make extensive contributions to the record of this growth. This is because China has become the biggest market for EV. With subsidies from the government, low cost of manufacturing, and a robust supply chain for batteries and electronic components, investing in this sector becomes very lucrative. Technologically, the advancements in battery manufacturing as well as top players like BYD and Tesla's Gigafactory in Shanghai derive demand of modern BMS systems. Innovations in batteries coming from Japan and South Korea produce some of the most compact and high-powered technologies for BMS applications.

North America is well positioned as one of the key markets for electric vehicle BMS, it is seeing this growth partly due to increasing consumer interest in EV and partly because of great government-promoted clean energy initiatives. The US and Canada have joined the growing race towards increasing EV sales, with such encouragement made by tight emission regulations, tax incentives, and improvements in the charging infrastructure. This will be further complemented by the presence of major EV manufacturers coupled with strong R&D efforts in battery technologies that would further propel the requirement for advanced BMS in the region. The focus of North America on the reduction of the greenhouse gas emissions and achieving energy independence highlights the importance of the innovative BMS systems for enhancing the EV performance and safety.

Europe is one of the leading region in the electric vehicle revolution with countries such as Germany, Norway, and Netherlands leads in the adoption of electric vehicle. The stringent environment legislations, the European Green Deal aiming at achieving carbon neutrality by 2050, has created strides toward electric mobility. Battery management systems will be highly influential in aiding the electrification objectives of Europe to ensure people remain safe, cost-efficient, and spend their lives with the batteries of electric vehicles. Innovate BMS technologies for such objectives would be achieved given that major automotive manufacturers and battery suppliers already are found in the region, plus governments pour in considerable amounts of money in EV infrastructure.

The region is fast becoming potential markets in the electric vehicle BMS arena as governments create policies to promote it, hence raise awareness on sustainable transport systems. Latin America has started using electric vehicle technology along with incentives which accompanies the construction of the EV charging stations. In the Middle East, green energy projects and electric mobility initiatives are taking shape in the UAE and Saudi Arabia as their plans for economic diversification. Africa's EV market is in the early stages, yet there is great potential because of urbanization along with the increased demand for transport that is affordable and sustainable.

New entrants in the electric vehicle battery management systems industry are trying to develop a competitive edge using innovative technologies and business models. In terms of design, emerging start-ups are both developing and focusing on wireless BMS solutions to simplify architecture and improve efficiency within systems. They are implementing artificial intelligence and machine learning into battery management systems for real-time data analytics and predictive maintenance and battery lifecycle management. Most new ones here are looking for modular and scalable designs for BMS, catering to all types of EV applications-from passenger cars to buses and trucks-and cooperating with OEMs or energy storage companies to enlarge these players' parameters. Responding to the burgeoning demand for being seen as "green", some of the start-ups are also using green materials and processes in production to design BMS. Even as these provide some opportunities, challenges remain in the form of increased R&D costs and competition giants, which new entrants have to deal with.

Market Segmentation

By Type

By Propulsion Type

By Vehicle Type

By Component

By Application

By Region