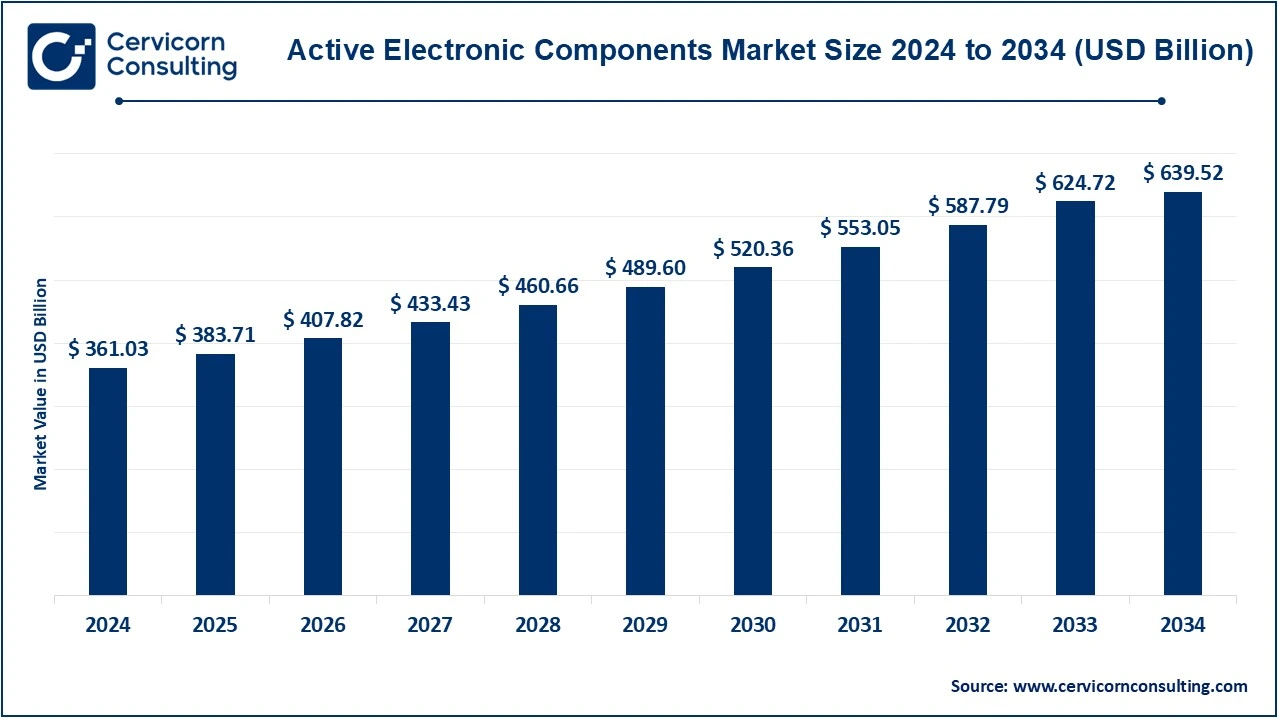

The global active electronic components market size was reached at USD 361.03 billion in 2024 and is expected to be worth around USD 639.52 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 6.28% over the forecast period 2025 to 2034.

Active electronic components market is in the increase trend and also the demand for advanced electronics is further driving the penetration of automation in various industries. These active electronic components include transistors, diodes, integrated circuits (ICs), and thyristors, and would broadly serve as the major controls for controlling and enhancing electrical signals in applications such as consumer electronics, automotive systems, and industrial machinery. The rising penetration of the electric vehicles along with renewable energy systems is expected to fuel the demand for such efficient active devices for optimize power conversion and management.

Technology advancement and miniaturization, along with increasingly energy-efficient components, are some of the market drivers enabling these compact, high-performance devices. In addition, the growing globus of IoT and smart devices has thrown open new platinum opportunities for these properties toward data communication and processing. Supply chain disruptions and material shortages are such challenges that are most likely to affect market dynamics. But in another light, the action electric components market is looking to have good growth in the future.

Report Scope

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 383.71 Billion |

| Expected Market Size in 2034 | USD 639.52 Billion |

| Projected CAGR 2025 to 2034 | 6.28% |

| Leading Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product Type, End Use, Region |

| Key Companies | Advanced Micro Devices Inc., Analog Devices, Inc., Broadcom Inc., Infineon Technologies AG, Intel Corporation, Microchip Technology, Inc., Monolithic Power Systems, Inc., NXP Semiconductors N.V., Qualcomm Inc., Renesas Electronics Corporation, Semiconductor Components Industries, LLC, STMicroelectronics N.V., Texas Instruments Incorporated, Toshiba Corporation |

Defense and Aerospace Needs

Digital Transformation

Supply Chain Disruptions

High Initial Costs

Advancements in IoT & 5G

Data Center Expansion

Disruptive Technology Obsolescence

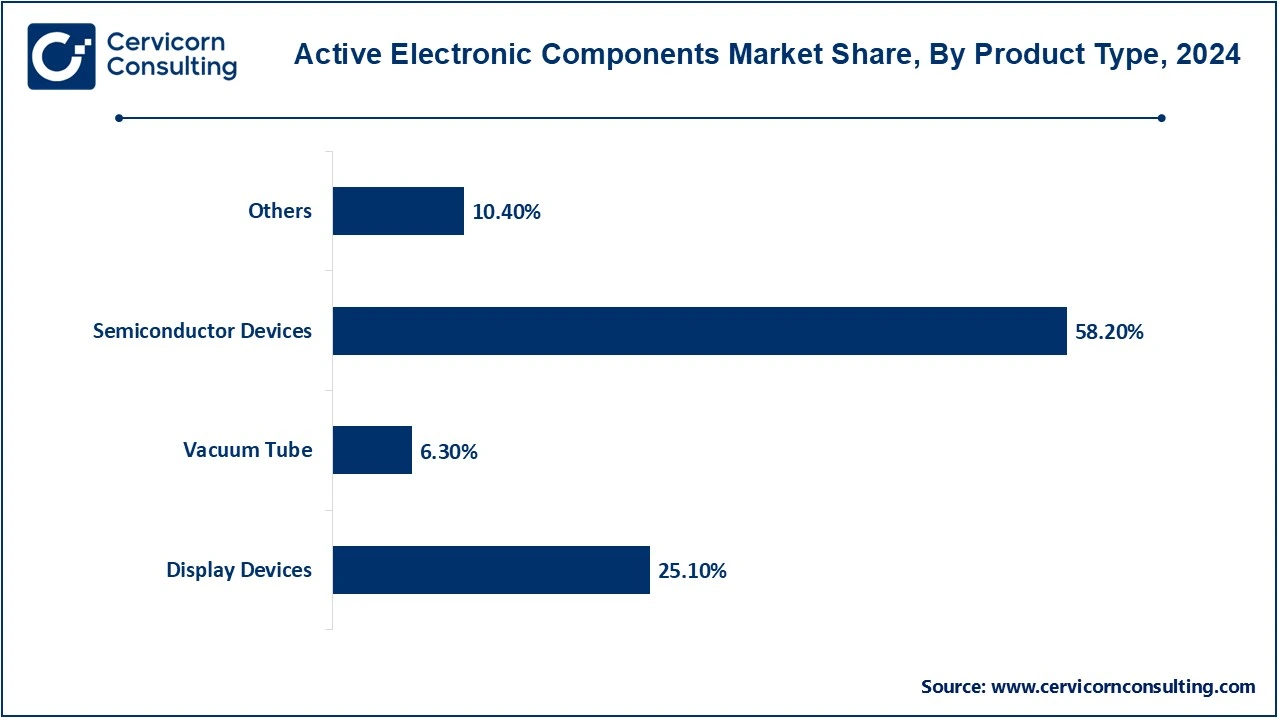

Component Complexity Increase

The active electronic components market is segmented into product type, end user and region. Based on product type, the market is classified into display devices, vacuum tube, semiconductor devices and others. Based on end-use, the market is classified into healthcare, aerospace & defense, manufacturing, automotive, networking & telecommunication, consumer electronics, and others.

Semiconductor Devices: Semiconductor devices dominate the market due to their versatility and widespread application. These components, including transistors, diodes, and integrated circuits (ICs), are integral to consumer electronics, automotive systems, and telecommunications. Their ability to control and amplify electrical signals makes them essential for modern technology. The rise of IoT, 5G networks, and electric vehicles further boosts the demand for semiconductor devices. Advancements in manufacturing processes, such as the development of smaller and more energy-efficient chips, are driving innovation.

Vacuum Tubes: Vacuum tubes were predominant in applications across communication devices up until a day that went when diodes or transistors came into view. There are however specific areas where vacuum tubes are unique, for example, high-frequency amplification in audio and broadcasting systems. Their specialty is that even with having to accommodate very high-power conditions, they have a great reliability for applications which have that kind of stress. Vacuum tubes are still, mainly in the defense and aerospace industries, used for critical radar and microwave applications. Of course, this is a tiny market, but they are still able to survive through a constant development of materials and designs that keep them relevant for very narrow areas.

Display Devices: Display devices like LCDs, LEDs, and OLEDs constitute an essential aspect of the active electronic components segment with applications that run from consumer electronics to automotive to health care. Visual interfaces are created by these devices on an individual's smartphone, television, medical monitor, and vehicle dashboard. These changing requirements hence create a push on innovations within this segment for higher resolution and lower energy power consumption and flexible displays. Developing solutions such as new display technologies such as mini-LED and quantum dot displays will meet the consumer's demand for better viewing experiences.

Others: The "Others" sub-segment product portfolio comprises sensors and actuators as well as microcontrollers. Sensors form the foundation of modern technologies like Internet of Things by their capabilities to do real-time data collection and analysis, safety in automobiles, and automation in industries. An actuator is a device that converts one signal into action or movement. It usually translates an electrical signal into a mechanical motion response, which can then be used within robotic systems and smart appliances to operate or shift devices. A microcontroller, embedded within systems, is the brain behind the functioning of smart devices in a range of applications-from smart thermostats up to certain medical devices.

Consumer Electronics: Active components are mainly deployed extensively in practically all areas of an increased end use such as those enlisted here under the amazing top-end use of consumer electronics. Some products in this category are laptops and mobiles as well as specific-use smart devices such as smart TVs and wearables. All of these devices have smart components that take the form of integrated circuits, diodes, and transistors to be functional and perform. The growing need for miniaturization, energy efficiency, and high-performance devices ensures continual innovation in this area. This part of the market is bolstered by increased disposable incomes, especially among the emerging economies, and the uptake of high-end devices for smart home applications. Developing technological trends such as the advent of IoT application areas and coverage through 5G technologies widen the scope of active components application in consumer electronics thereby providing continuous market growth in this segment.

Networking and telecommunication: Networking and telecommunication will be the vital end-use industries, driven by the worldwide launch of 5G technology. The increases in data traffic further magnify this requirement. For example, active components include RF amplifiers, semiconductors, microprocessors, etc., which show the advantages of high speed in transmission along with the features of connectivity as well as reliable performance in network operation. Active components occupy a significant part of the infrastructure, like base stations, routers, satellite communication systems, etc. The additional boom of IoT devices and cloud computing creates a much greater demand for advanced telecommunication systems, thus creating demand for active components.

Automotive: The automotive industry is rapidly marching towards an active electrical future with a growing number of systems requiring electric powertrains, battery management, and autonomous driving technologies. Electric vehicles (EVs) in particular place additional load requirements on power transistors, inverters, and microcontrollers. Additional powers electronics encompass those deployed in modern passenger vehicles but include even advanced driver-assistance systems (ADAS), infotainment, and connectivity-all demanding high-performing electronic components as well.

Active Electronic Components Market Revenue Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Healthcare | 3% |

| Aerospace & Defense | 5.20% |

| Manufacturing | 21.30% |

| Automotive | 13.40% |

| Networking & Telecommunication | 16.20% |

| Consumer Electronics | 30.80% |

| Others | 10.10% |

Manufacturing: The industrial applications of a manufacturing industry overwrite the AEC for industrial automation, robotics, and process control systems. Such components or devices include thyristors, sensors, and ICs that help improve operational efficiency, precision, and productivity in smart factories. Furthermore, even though Industry 4.0 propels such active components requirements with IoT-enabled machines and predictive maintenance, real-time monitoring over such advances or efficiency can be achieved only on an industrial process.

Aerospace & Defense: Mission-critical applications such as navigation, communication, radar, and surveillance systems depend largely on the activity of electric components in the aerospace and defense industry. The critical electric components include very high-frequency transistors, semiconductors, etc. in such an environment for reliable and high-performance operations. The demand for remote-controlled aircraft, UAVs, and advanced satellite technologies drives innovations in this sector. All nations are spending on modernization of their ageing defense infrastructures, creating permanent demand for sophisticated active components tailored to meet the needs of aerospace and defense.

Healthcare: Healthcare is one of the most prominent end-use markets since they find application in powering medical devices, such as imaging systems as well as diagnostic and wearable health monitoring devices. Rising usage of telemedicine coupled with remote patient monitoring will necessitate the use of a wide variety of sensors, microcontrollers, and other related components in buildings. New device developments, such as minimally invasive surgical devices and those for artificial intelligence-optimized diagnostics, widen the top potential for this segment. They increasingly help in the inclusion of increasing digital health and precision medicine within Active Electronic Components toward future advancements in healthcare technology and bettering patient wellness.

Others: This "Others," segments includes all sorts of different uses like energy management, transportation infrastructure, and retail automation. Active electronic components become indispensable for the use of renewable energy, electric charging stations, and smart grids for ensuring efficient energy utilization. Automated checkout systems and digital signage in retail are in direct need of sensors and ICs. These two give an idea of how active components have their usage across different industries, and with every other day that passes, innovations are unlocking even more within the endless category.

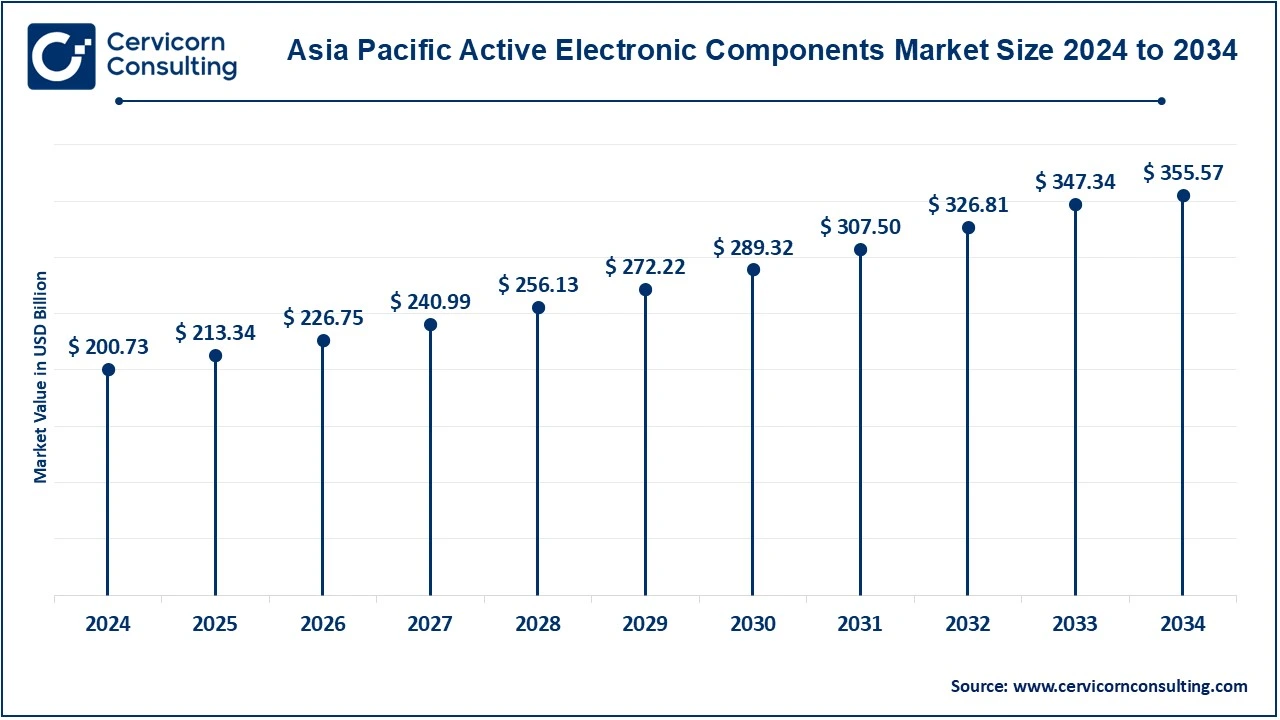

The active electronic components market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The Asia-Pacific active electronic components market size was accounted for USD 200.73 billion in 2024 and is expected to reach around USD 355.57 billion by 2034. Asia Pacific hit fast-paced industrialization and urbanization along with a strong growing electronics manufacturing sector. Again, it is associated with China, Japan, and South Korea, which lead in semiconductor production and innovation in consumer electronics. Asia's brightening future for the market rests on the continuously developing middle class while increasing demand for smartphones, smart devices, and electric vehicles plays very considerable roles in the market. Further, government efforts for renewable energy and smart infrastructure are likely to increase component platforms and more. Finally, India and Southeast Asia are the emerging manufacturing centers for various advanced technologies, where big investments are made.

The North America active electronic components market size was valued at USD 80.51 billion in 2024 and is projected to reach around USD 142.61 billion by 2034. The North America thrives on developments in consumer electronics, car technology, and industrial automation. North America is an innovation hub, which has funded a considerable amount in IoT, electric vehicles, and the development of 5G infrastructure. The presence of leading semiconductor manufacturers and high demand for aerospace and defense technologies further push market growth. The initiative by the governments of the U.S. and Canada is to promote renewable energy, thus increasing the adoption of components suitable for energy systems.

Active Electronic Components Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 22.30% |

| Europe | 17.10% |

| Asia-Pacific | 55.60% |

| LAMEA | 5% |

The Europe active electronic components market size was estimated at USD 61.74 billion in 2024 and is expected to reach around USD 109.36 billion by 2034. Europe benefits from the sustainable, advanced-tech ideology being pursued by the continent. Germany and France are at the forefront of automobile innovation, focusing on the electric and autonomous automobile cases. Both countries will boost demand for advanced components. Further, renewable energy projects, such as wind and solar, are sources of adoption in energy systems. It is a base for industries, further supporting the market, like healthcare, aerospace, and telecommunications. These types of proceedings in terms of European policies concerning energy efficiency and digital transformation will open new opportunities. The increasing amounts that are involved in research and development will make Europe an important region to watch in active electric component development, considering green technologies.

The LAMEA active electronic components market size was worth USD 18.05 billion in 2024 and is anticipated to reach around USD 31.98 billion by 2034. Latin America, the Middle East, and Africa are other emerging regions recording steady growth, owing to increased adoption of renewable energy technologies and the pace of urbanization and digital transformation. Latin America is engaged in several solar and wind energy projects, and demand from there is enough to push power inverters and related products. Capital investments in smart cities and advanced telecommunication infrastructure by Middle Eastern countries will also further the market. Other trends in Africa that will build demand include growth in consumer electronics and having basic infrastructure. There is, however, a dim bulb of hope in most cases with respect to limits in manufacturing capabilities and regional economic instability but modernization will always keep broadening its boundaries.

The new players in the active electric components market have entered the market through innovative niche strategies to stake a claim in the market that will compete with well-established brands. Most of these emerging and start-up companies are into specialized applications such as IoT devices, renewable energy systems, and electric vehicles as they are targeted to meet specific market needs. Their major concern is research and development in producing smaller, more energy-efficient, and higher-performance components that meet the needs of today's technology. They are also incorporating breakthrough manufacturing practices such as employing advanced nanotechnology and 3D packaging. Partnerships and alliances with technology companies, OEMs and government initiatives focusing on smart infrastructure, and sustainability are such strategies to speed up market entry. Some even focus on regional markets-the fast-emerging demand and intensity of competition are very low in Asia-Pacific and Africa. Through well-structured cost-effective and custom solutions, new entrants will reshape the competitive battlefield of the active electric component market.

CEO Statements

Tesla– Elon Musk, CEO

Tesla– Elon Musk, CEO

Recent strategic partnerships and investments in the EV charging infrastructure reflect a strong commitment to advancing sustainable transportation. Key collaborations across Europe and South America are set to enhance charging networks, integrate innovative technologies, and expand the availability of renewable energy-powered charging solutions. Some notable examples of key developments in the market include:

Market Segmentation

By Product Type

By End-Use

By Region