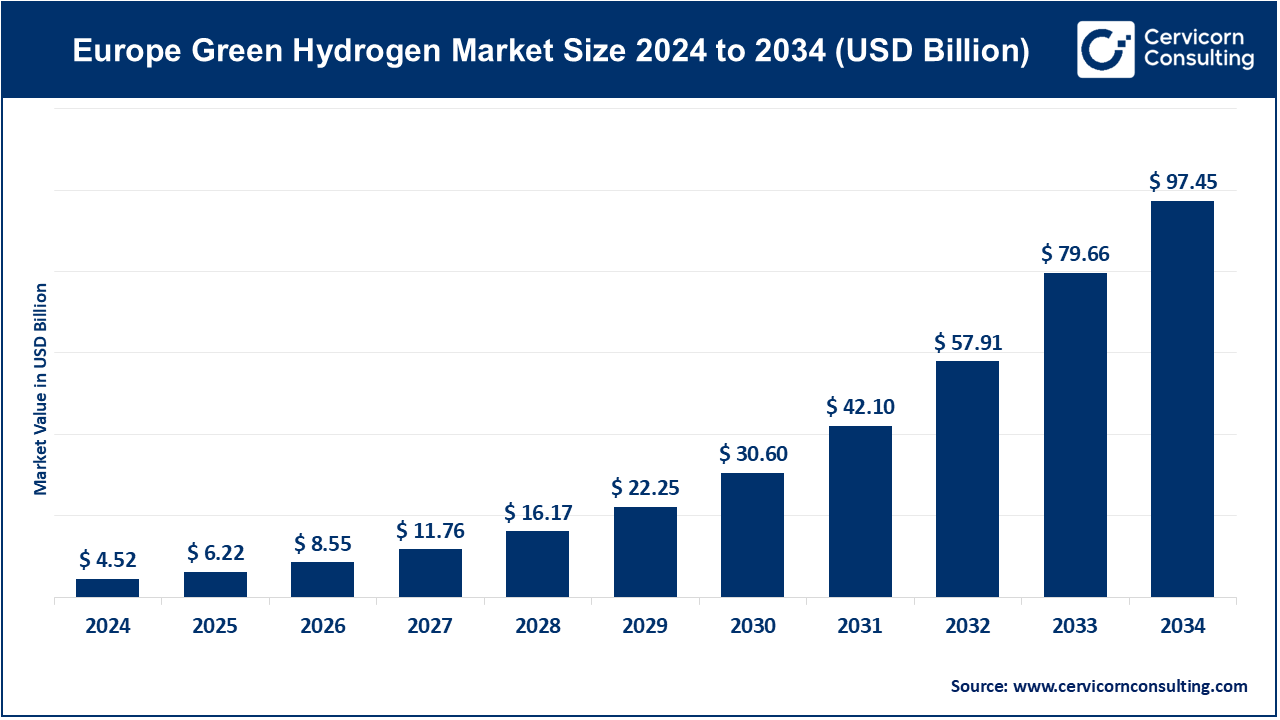

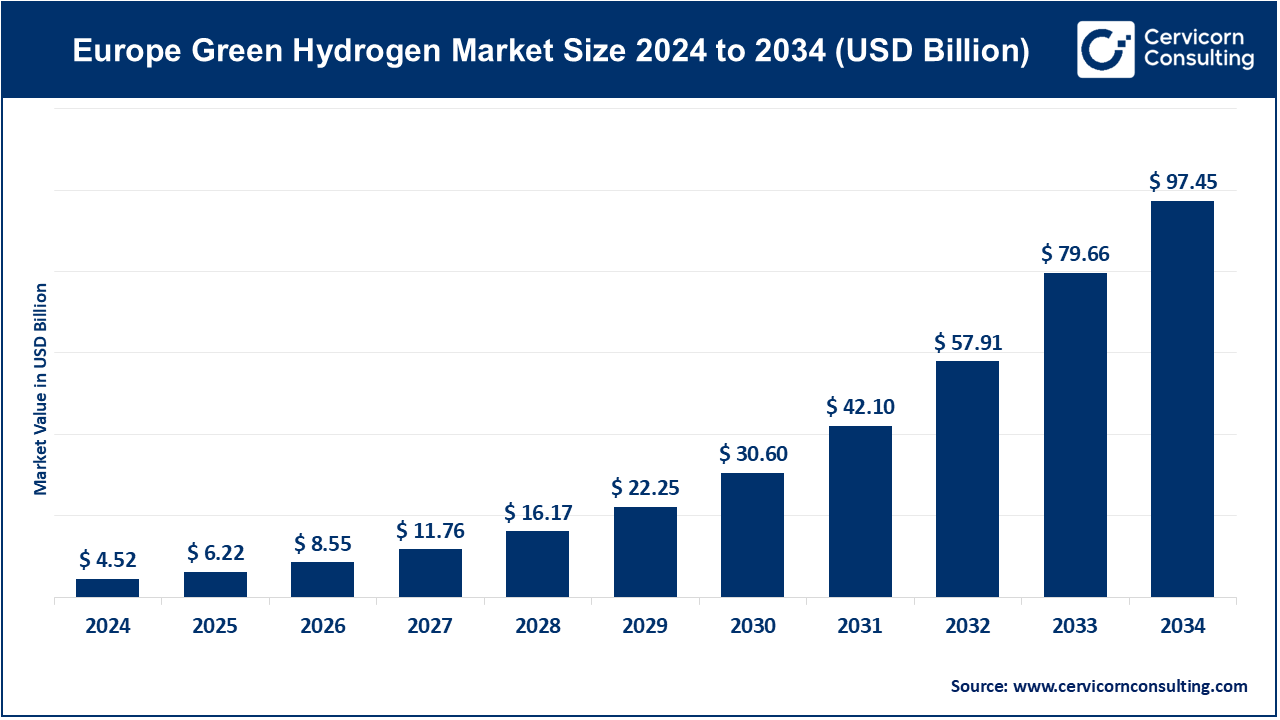

Europe Green Hydrogen Market Size and Growth 2025 to 2034

The Europe green hydrogen market size was valued at USD 4.52 billion in 2024 and is expected to be worth around USD 97.45 billion by 2034, growing at a compound annual growth rate (CAGR) of 40.72% over the forecast period 2025 to 2034. The European green hydrogen market is experiencing rapid growth, driven by substantial investments and supportive policies. Germany, for instance, has committed EUR 9 billion to develop 5 gigawatts of electrolyzer capacity by 2030, aiming to reduce dependence on fossil fuels and enhance energy security. Similarly, companies like Air Liquide and TotalEnergies are investing over EUR 1 billion in large-scale green hydrogen projects in the Netherlands, expected to significantly cut COâ‚‚ emissions in the region. These initiatives reflect Europe's strategic focus on green hydrogen as a cornerstone of its clean energy transition, with the market projected to expand significantly in the coming years.

Green hydrogen is a type of hydrogen fuel produced using renewable energy sources, such as wind, solar, or hydroelectric power. Unlike grey hydrogen, which is made using fossil fuels, green hydrogen is created through a process called electrolysis. This process splits water into hydrogen and oxygen using electricity from renewable sources, making it a clean and sustainable energy carrier. The main advantage of green hydrogen is that it does not emit carbon dioxide (COâ‚‚), reducing greenhouse gas emissions and supporting the global shift toward clean energy. It can be used in industries such as transportation, power generation, and manufacturing, providing an alternative to fossil fuels in sectors that are hard to decarbonize.

Europe Green Hydrogen Market Growth Factors

- Public Sector Investment: The nations across Europe are increasingly supporting green hydrogen projects by granting financial incentives and subsidies to promote this technology. Such financial support lowers the market entry threshold for individual entrepreneurs and guarantees a prospective return on research funds spent on hydrogen technologies. Under the Hydrogen Strategy, for instance, the EU expects further increase in hydrogen production, opening of further infrastructure, and suitability through investment with an upper ceiling of €430 billion by 2030.

- Technological Advances: The technological advancement tendencies in electrolysis and hydrogen production remain innovative daily as they work to lessen the costs and boost their efficiencies. The continuing advances in PEM and SOE methods render hydrogen production increasingly less energy-intensive. The maturing of such technology will render production methods even more marketable and hence encourage market growth in hydrogen technologies thereby delivering affordable solutions to users.

- Investment in Infrastructure: There is going to be a particular commitment to invest in hydrogen production, storage, and distribution. This will include some major strategic initiatives, for example the construction of hydrogen refueling stations, pipelines, and production plants. Collaboration of the public and private sectors for funding infrastructure development is a necessity for a smooth and integrated interplay of green hydrogen and interconnecting energy ecosystem, persuading uptake on a larger scale.

- Growth of the Renewable Energy Base: The increasing capacity for renewable energy sources-such as wind and solar is very important in the green hydrogen production process. Renewable energy systems are becoming staple and cheap sources of energy that will guarantee the function of electrolyzers for hydrogen production. With the synergy between renewable energy and hydrogen production, sustenance and reliability are improved, affording convenience in expansion.

Europe Green Hydrogen Market Trends

- Electrolysis Progress: There is a clear direction towards the improved electrolyzer technologies that are extremely important to produce hydrogen efficiently. Innovations concern higher performance, scalability, durability of electrolyzers, lower costs, and efficient production of hydrogen. Research and development of new materials and designs are essential for the optimization of electrolyters with the latest market outlook.

- Integration with Renewable Energy: Integration of hydrogen production with renewable energy systems is set to become a hot trend. There is a growing number of projects that are devoted to the production of hydrogen from the surplus renewable energy generated at peak production times. This not only enhances the economics of hydrogen production but also helps with the storage of energy as well as stabilizes the renewable energy grids.

- Fuel Cell Development: Increasing adoption and design of fuel cell technologies in other applications such as vehicles and stationary power systems continue to define market dynamics. Investment in R&D results in the development of such fuel cells that are more efficient and economically viable and are likely to usher in hydrogen-powered solutions. This is further significant for heavy-duty trucks.

- Cross-Sector Collaboration: Cooperation between the energy, automotive, and industrial sectors is becoming increasingly common in hydrogen applications. Industry-knowledge-sharing and experience-sharing with resources to exploit benefits from cross-sector collaboration characterize them. Those are keys to accelerating deployment efforts for hydrogen technology and to innovation within sectors.

- Public Awareness and Demand: Increasing environmental awareness of green hydrogen has essentially established a stable increasing demand. As citizens become more aware of climate change and solutions related to sustainable energy, advocacy for cleaner alternatives will grow. This calls for more attention and focus from companies and policymakers toward hydrogen-related programs.

- Market diversification: Major market growth trends includes increasing application of hydrogen in other sectors such as transport, industry and power production among others. Industries are exploring other avenues of using hydrogen apart from the already existing ones such as decarbonizing heavy industry and improving energy storage. The widening of the market scope also presents another opportunity for growth.

Report Scope

| Area of Focus |

Details |

| Market Size in 2024 |

USD 4.52 Billion |

| Expected Market Size in 2034 |

USD 97.45 Billion |

| CAGR (2025 to 2034) |

40.72% |

| Key Segments |

Technology, Energy Source, Distribution Channel, End User |

| Key Companies |

Air Products & Chemicals Inc, Cummins Inc, Engie SA, L’Air Liquide SA, Linde Plc, Nel ASA, Orsted AS, Siemens Energy AG, Toshiba Energy Systems & Solutions Corp, Uniper SE |

Europe Green Hydrogen Market Dynamics

Drivers

- Mitigation of Climate Change: The need to urgently address climate change remains a primary driver of green hydrogen. Hydrogen is increasingly viewed as an indispensable ingredient on the road toward net-zero targets given that nations pledge to cut down on the emissions that cause climate change.Therefore, this has increase in the market need and investment in hydrogen technologies due to the different potential of hydrogen’s decarbonization by each sector.

- Energy Security: The availability of different energy sources, which promotes energy security, would indeed spur the use of green hydrogen. On the other hand, by reducing the use of foreign energy resources in the form of hydrocarbons and using local hydrogen instead, the country achieves higher energy autonomy.This shift protects national security and keeps energy prices from jumping round, in which light hydrogen becomes a seriously viable alternative.

- Industrial Demand: Heavy industry, including steel and cement production processes, advances demand for low-carbon technological solutions, so green hydrogen is much alive and kicking. These industries crave alternatives to the old highly polluting ways to reduce their carbon footprints, and hydrogen is known to work. Cleaner production developments make hydrogen very desirable in the decarbonization strategies for these industries.

Opportunity

- Growing use of renewable sources of energy: The shift toward wind and solar energy has offered a fillip to energy storage systems expected to cushion the grid. Indeed, energy storage systems would be critical for smooth integration of intermittent renewable sources to achieve the EU's ambitious carbon neutrality goal of 2050. Growing need for advanced battery technologies, like lithium-ion and solid-state, can occur because of a strong market demand on grid reliability these storage systems offer.

- Rising Demand for Decentralized Energy Solutions: There is an increasing interest in decentralized energy systems, such as microgrids and community energy projects. Energy independence and resilience for commercial and residential customers depend on some critical energy storage systems. This would open up opportunities for small-scale storage solutions tailored to local needs.

- Technological Advancement in Storage: Innovations are coming up regarding energy storage including flow batteries, hydrogen storage and supercapacitors. It brings huge prospects in the marketplace. All the technologies try to overcome the impediments that the large-capacity generation systems cannot be achieved because they suffer from all the drawbacks from battery degradation or voltage drop.

Restraints

- High Production Costs: The competitive adoption of green hydrogen is being delayed to a great extent due to current high production costs. While cost-excellent, machines have yet to improve the price of electrolysis and inputs from renewable energy for it to be really put into use, because these two technologies remain expensive to operate compared to traditional fossil fuels. To become more competitive and marketable, production costs must be reduced.

- Infrastructure Challenges: Absence of existing infrastructure for hydrogen storage and distribution is an impediment to expanding such a market. The overall hydrogen infrastructure systems, which include facilities such as refueling stations connected with pipelines, demand huge financial investments, thus requiring an incredibly long time to become functional. Resolvement of these infrastructural challenges would play a key role in developing a safe, reliable, and long-time transport solution for hydrogen.

- Market Competition: The green hydrogen market has to contend with competition from other sources of renewable energy and technologies. Energy storage technologies, like batteries and electrification processes, can reduce interest and investment in hydrogen solutions. In order for hydrogen to preserve its competitive position, a clear value proposition must be articulated.

Challenges

- Investment Requirements: The infrastructural and production facilities of hydrogen require huge capital investment. Attractive investments cannot be gathered with most of the money drying up, especially in times of sluggish economic growth or when competing with other energy projects. Funding supply is critical for the advancement of hydrogen and market establishment.

- Public Perception: The public perception of hydrogen safety and usability is still divided. Concerns related to hydrogen handling and supply would stifle public acceptance and use. Education about hydrogen programs would go a long way toward overcoming these misperceptions and transferring responsibility for developing trust in hydrogen programs in the public arena.

- Supply Chain Issues: Creating a steady and healthy hydrogen supply chain remains a huge challenge. The supply chain needs, therefore, coordination with various stakeholders-from producers to distributors to consumers. Setting up sound logistics and supply chains will be a precondition for delivery-on-time and cost-effective-of hydrogen.

Europe Green Hydrogen Market Segmental Analysis

Europe green hydrogen market is segmented into technology, energy source, distribution channel and end user. Based on technology, market is segmented into alkaline electrolysis, PEM electrolyzer, and SOEC electrolyzer. Based on energy source, market is segmented into wind energy and solar energy. Based on distribution channel, market is segmented into pipeline and cargo. Based on end user, market is segmented into chemical, power, food and beverages, medical, petrochemicals, others

By Technology

Alkaline electrolysis: Alkaline electrolysis is an old but still growing technique that encompasses the method of producing hydrogen with an alkaline solution to conduct electricity. This technique is touted to have good efficiencies and lower costs of operation. Because of their scalability, this method enjoys popularity in large-scale hydrogen production. However, they usually require a bigger infrastructure than that of most other applications. Alkaline electrolyzers are much preferred in Europe because it is considered that they provide reliability and robustness and greatly help green hydrogen initiatives in the region.

PEM Electrolysis: PEM Electrolysis is becoming more dominant due to its high efficiency and operational flexibility. In this type of technology, the conduction of protons is via a solid polymer membrane, which makes it suitable in applications requiring a fast response to variable energy applications. These are compact electrolyzers that can be used in any application, from small-scale installations to large plants. The ability to work efficiently with renewable energy sources adds to the attractiveness of PEM water electrolysis for building green hydrogen systems in Europe.

By Energy Source

Wind Energy: Wind energy is a key renewable source for hydrogen production in Europe. Wind farms generate electricity, which can power electrolyzers for green hydrogen production. This method benefits from Europe’s substantial wind resources, particularly in coastal regions and offshore installations. Optimizing excess wind energy during peak generation periods will enhance the efficiency of hydrogen production, thereby closing the loop of energy. The use of wind energy for hydrogen generation is especially relevant in view of the emission reduction targets in the European region.

Solar Energy: Solar energy represents a critical aspect of the European green hydrogen landscape. Solar photovoltaic (PV) systems convert sunlight into electricity for electrolysis to produce hydrogen. Boosting its solar capacity is rather in line with the commitment in the region for sustainable energy solutions. Solar-based hydrogen production benefits from plentiful sunlight, particularly in Southern Europe, allowing for viable and cost-effective hydrogen generation for a number of applications.

By End User

Chemical: The chemical industry uses green hydrogen on a large scale due to its employment in ammonia production and refining processes. Chemically synthesized fertilizers-are produced for agriculture: hydrogen is indispensable. The decarbonization of industrial operations is bringing about greater demand for green hydrogen, driven by growing regulatory pressures and the sustainable vision of companies. The moving of green hydrogen into chemical processes results in not only the significant reduction of the amount of carbon emitted, but also in other respects supports the transition toward sustainable practices.

Power: In the power sector, green hydrogen is fast emerging as an effective energy carrier capable of both storing and distributing renewable energy. Its use in fuel cells offsets electricity generation and blends with natural gas in existing power plants. The ultimate addition of hydrogen means grid stability, energy security. Green hydrogen is expected to become much more important for power generation as Europe seeks to convert its energy mix into cleaner fuel.

Food and Beverages: the Food and Beverage sector has not emphasized hydrogenated oil, it stands out in food processing, which is predominant in hydrogenation. Healthier food with hydrogenated fats and oils therefore enhances their market value. Several such industries are thus being tilted toward using green hydrogen in the automobile sector to leave an environmental footprint and gain credentials for being environmentally conscious.

Medical: Generally, in the medical field, green hydrogen encompasses production in pharmaceuticals and hydrogen gas for different medical purposes, especially the hydrogen inhalation therapy. This drive for sustainability in health care has sparked an interest in green hydrogen due to its being a cleaner alternative. As hospitals and medical facilities embark on keeping carbon footprints low, the acceptance of green hydrogen in medical implementation is expected to rise toward broader environmental aspirations.

Petrochemical: The industry is currently putting efforts in place for exploring the use of green hydrogen feedstock; this route would allow cleaner fuels and chemicals to be produced. Hydrogen is key for processes in refining like hydrocracking and desulfurization. The regulatory framework and market demand for greener products see accelerating transition to sustainable feedstock. Petrochemical companies can lower their carbon emissions and thus enhance their sustainability profile through the integration of this approach in their operations.

Others: The category of "others" comprises a range of different sectors undertaking exploration of green hydrogen usage, such as transport, steelmaking and even energy storage. The transportation, steel, and energy storage sectors are beginning to explore different ways to use hydrogen for decarbonization. With technological advancements and evolving markets, green hydrogen is therefore expected to open up further opportunities across sectors and propel the European market forward as a whole.

Europe Green Hydrogen Market Dynamics Top Companies

- Air Products & Chemicals Inc

- Cummins Inc

- Engie SA

- L’Air Liquide SA

- Linde Plc

- Nel ASA

- Orsted AS

- Siemens Energy AG

- Toshiba Energy Systems & Solutions Corp

- Uniper SE

CEO Statements

Pierre-Etienne Franc, CEO of FiveT Hydrogen

- “It's not greenflation, it's fossil-flation. The current situation with rising natural gas prices creates a competitive advantage for green hydrogen. While capital costs for green hydrogen projects may rise by 10%-15%, it's still significantly less than the skyrocketing prices of natural gas. A robust regulatory framework is essential for the growth of green hydrogen initiatives."

Recent Developments

- In January 2024, Gen2 Energy partnered with Norsk e-Fuel to supply green hydrogen for e-fuel production at a facility in Mosjøen, Norway, aiming to enhance sustainable fuel options in the region.

- In February 2024, Lhyfe announced plans to establish its first green hydrogen plant in the UK, with a targeted capacity of 20 MW, furthering its commitment to renewable energy solutions.

- In March 2023, Conrad Energy secured funding for a new green hydrogen production plant in Lowestoft, which will utilize electrolysis with an initial production capacity of 2 MW, marking a significant step in local renewable energy initiatives.

Market Segmentation

By Technology

- Alkaline electrolysis

- Polymer Electrolyte Membrane (PEM) Electrolyzer

- SOEC Electrolyzer

By Energy Source

By Distribution Channel

By End User

- Chemical

- Power

- Food and beverages

- Medical

- Petrochemicals

- Others

By Geography

- Germany

- United Kingdom

- France

- Italy

- Spain

- Nordic Countries

- Russia

- Turkey

- Rest of Europe

...

...