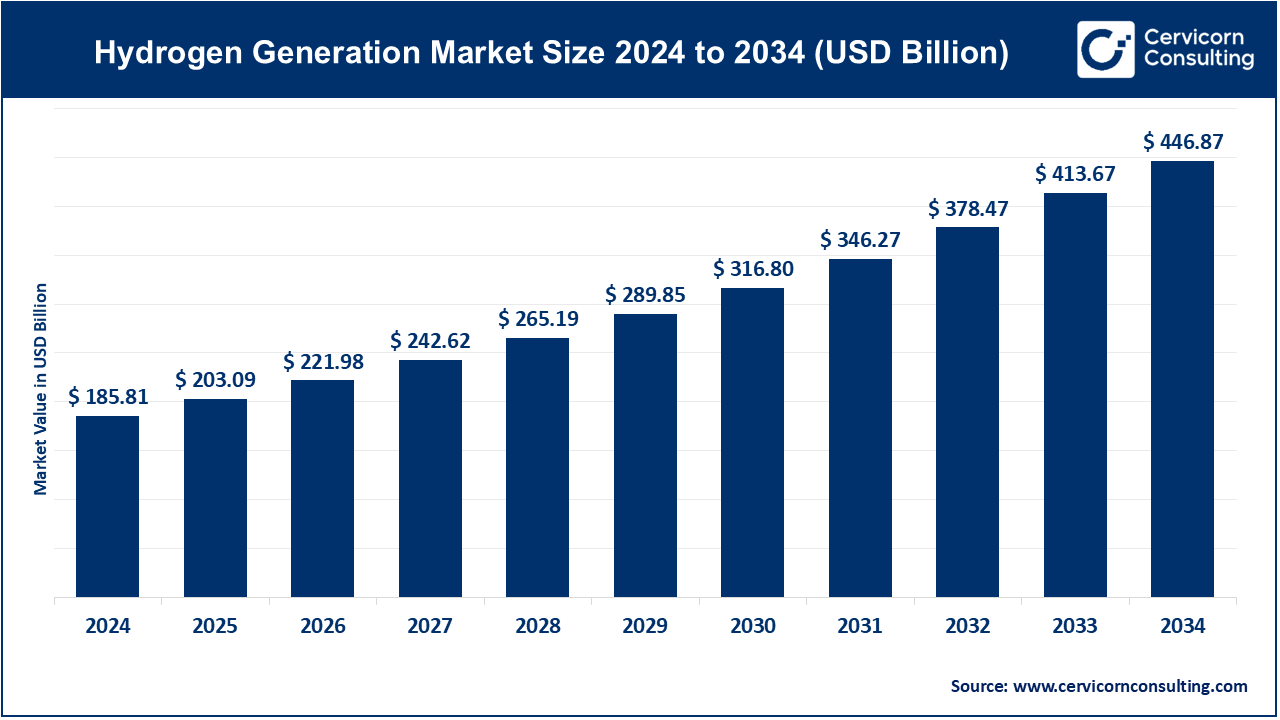

The global hydrogen generation market size was accounted for USD 185.81 billion in 2024 and is projected to reach around USD 446.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.3% from 2025 to 2034.

The hydrogen generation market is undergoing substantial expansion, driven by the growing need for cleaner, renewable energy sources and the transition towards decarbonized economies. The market's rise is particularly supported by increased investments in green hydrogen technologies, which utilize renewable electricity for hydrogen production through electrolysis. This is expected to become a key driver as countries around the world aim to meet climate goals and reduce reliance on fossil fuels. Governments and private players are increasingly focusing on large-scale projects to develop hydrogen infrastructure, particularly in industries such as transportation, power generation, and heavy manufacturing. The demand for hydrogen is accelerating across various sectors, with the industrial use of hydrogen in ammonia production and petroleum refining being the largest applications. Additionally, the growing use of hydrogen fuel cells in electric vehicles (EVs) and the potential for hydrogen to serve as a long-term energy storage solution are propelling market interest.

Hydrogen generation refers to producing hydrogen gas through different methods, each with unique applications and environmental impacts. The main production techniques include Steam Methane Reforming (SMR), which extracts hydrogen from natural gas, though it produces carbon dioxide, classifying it as gray hydrogen. Other methods like Partial Oxidation (POX) and Coal Gasification are less commonly used but still important in specific industrial processes. On the cleaner side, Electrolysis involves splitting water molecules using electricity, generating green hydrogen when powered by renewable sources. These methods cater to various industries like petroleum refining, ammonia production, and transportation, with hydrogen playing a crucial role in fueling vehicles through fuel cells and generating clean electricity.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 203.09 Billion |

| Market Growth Rate | CAGR of 9.3% from 2025 to 2034 |

| Market Size by 2034 | USD 446.87 Billion |

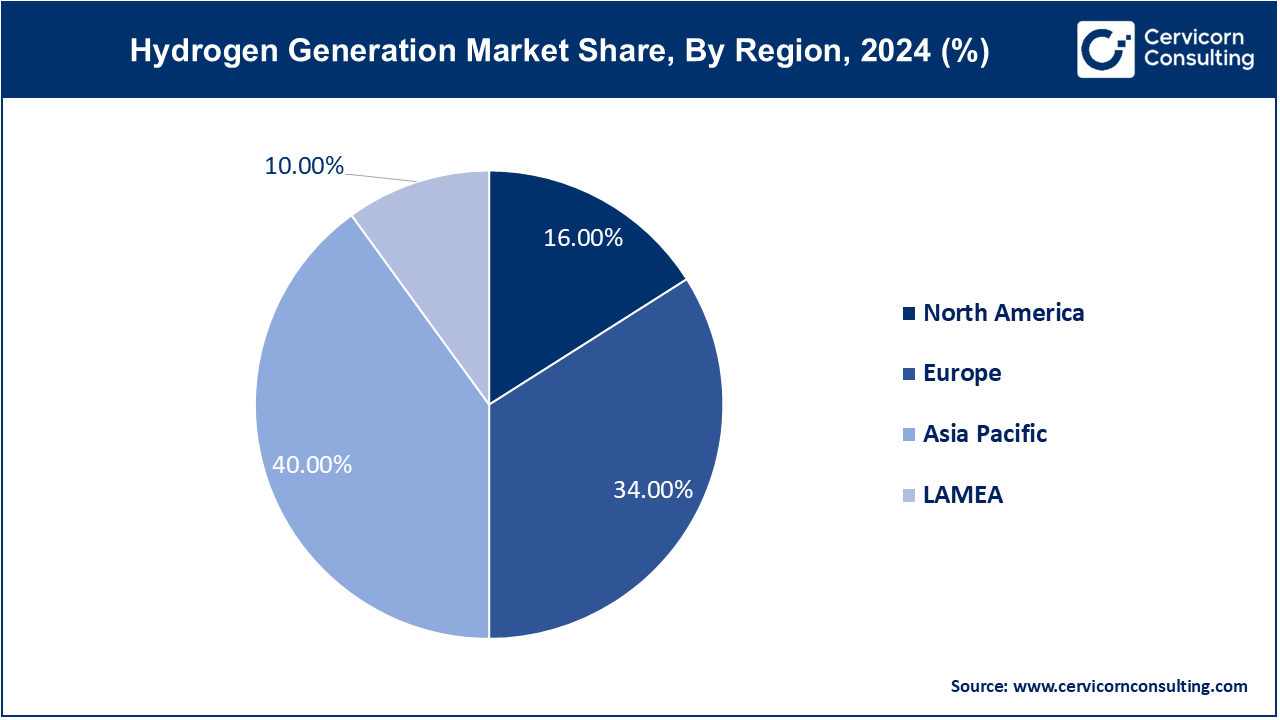

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Segment Coverage | Technology , Application, System, Source, Regions |

Increasing Energy Demand

Government Regulations and Climate Policies

High Production Costs:

Infrastructure Challenges:

Advancements in Electrolysis Technology:

Expansion into Emerging Markets:

Technological Maturity and Standardization:

Public Perception and Acceptance:

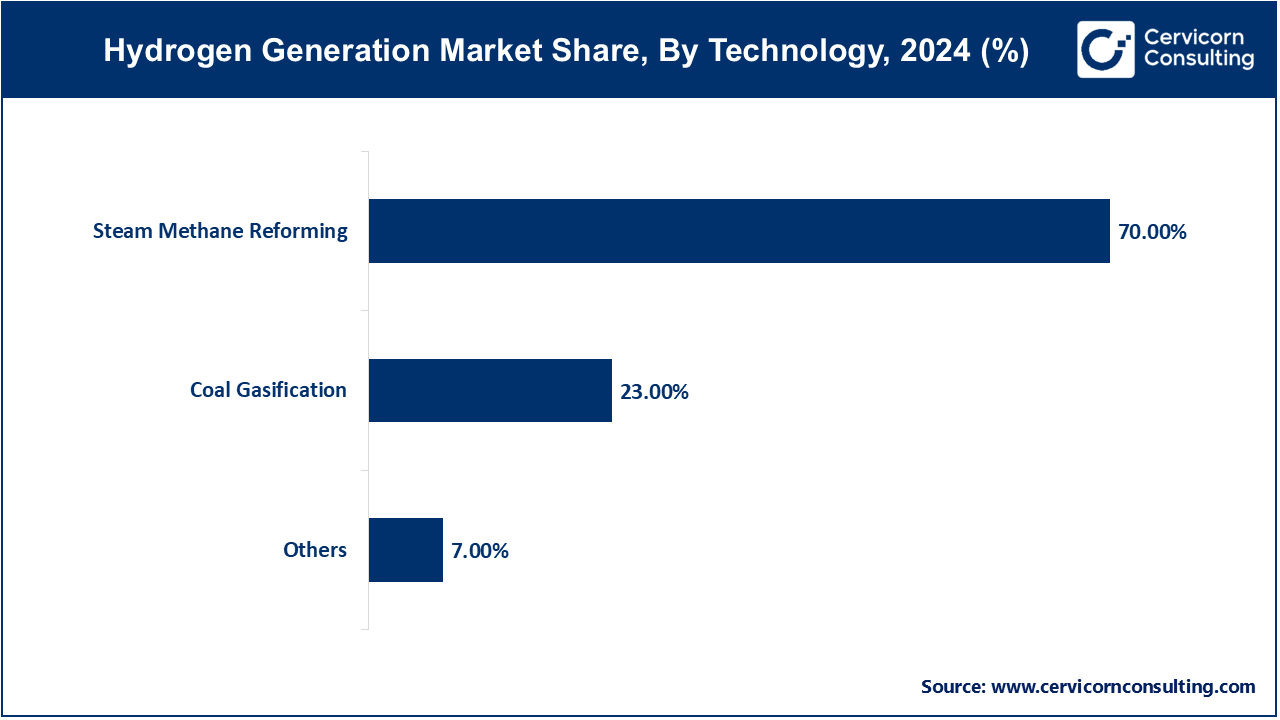

Steam Methane Reforming: In 2024, This segment has registered highest market share of 70%. Steam Methane Reforming (SMR) is the most common method for hydrogen production, leveraging natural gas to generate hydrogen efficiently and cost-effectively. Trends include integrating carbon capture and storage (CCS) technologies to mitigate emissions. The drive towards cleaner hydrogen production and abundant natural gas supplies are key factors propelling SMR's dominance in the market.

Coal Gasification: The coal gasification segment has covered market share of 23% in 2024. Coal Gasification involves converting coal into hydrogen and other byproducts under high temperatures. This technology is prevalent in regions with abundant coal reserves. Market trends focus on incorporating CCS to reduce carbon emissions. Drivers include the need to utilize existing coal resources sustainably and the push for energy independence in coal-rich countries.

Others: Other hydrogen generation technologies encompass electrolysis, biomass gasification, and photoelectrochemical methods. This segment has recorded market share of 7% in 2024. Electrolysis, especially using renewable energy, is gaining traction as it produces green hydrogen with zero emissions. Market trends highlight innovations in electrolyzer efficiency and cost reduction. The growing demand for green hydrogen and advancements in renewable energy integration are key drivers for these emerging technologies.

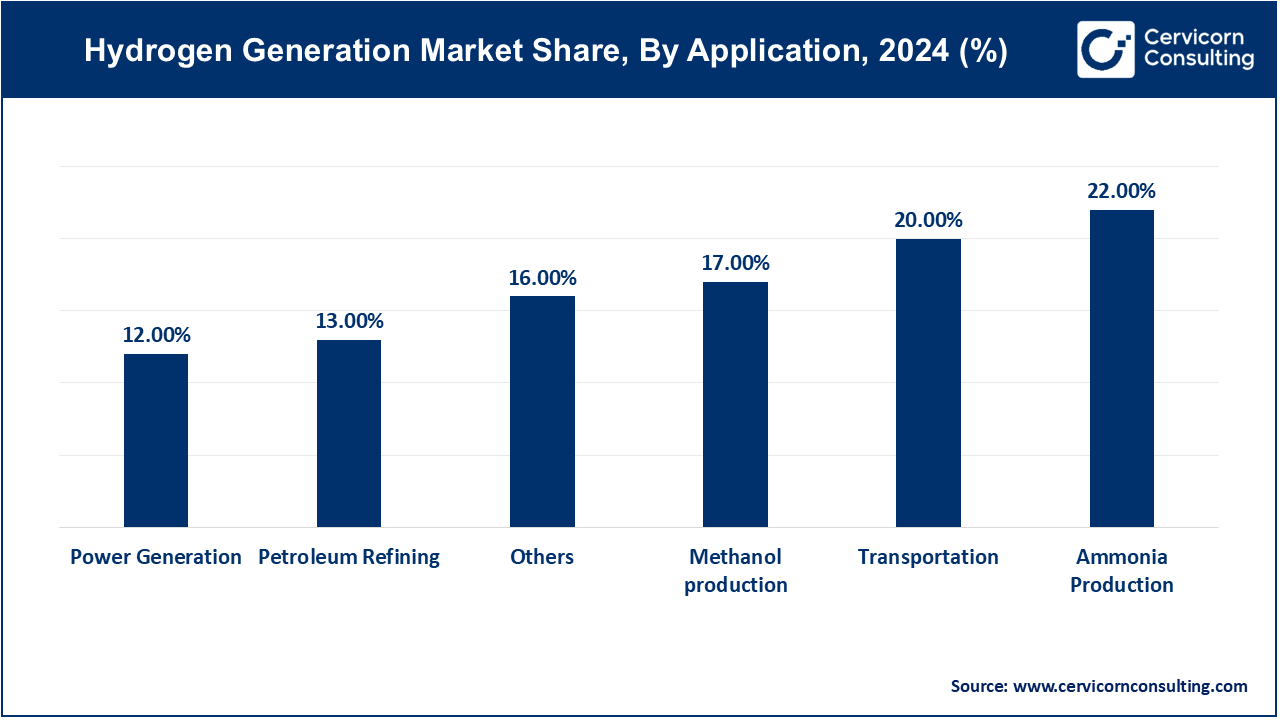

Methanol Production: The methanol production segment has calculated market share of 17% in 2024. Hydrogen is crucial for methanol production, which is used in various industrial applications. The market trend involves increasing demand for cleaner hydrogen to meet sustainability goals. Drivers include the push for reduced carbon emissions and the growing use of methanol as a feedstock in chemical manufacturing, emphasizing the need for greener hydrogen sources.

Ammonia Production: In 2024, ammonia production segment has acquire market share of 22%. Hydrogen is a key component in ammonia production, used primarily as a fertilizer. The trend toward sustainable ammonia production involves integrating green hydrogen to reduce carbon emissions. Drivers include rising global food demand and stringent environmental regulations, which promote the adoption of low-carbon hydrogen technologies in the ammonia sector.

Petroleum Refining: In petroleum refining, hydrogen is used to remove sulfur from fuels and improve fuel quality. The market trend includes increasing investments in hydrogen infrastructure to support cleaner refining processes. This segment has captured market share of 13% in 2024. Drivers include regulatory pressures for reduced sulfur content in fuels and the need for cleaner refining practices to comply with environmental standards.

Transportation: Hydrogen is emerging as a clean fuel for various transportation modes, including fuel cell electric vehicles (FCEVs). This segment has generated market share of 20% in 2024. Trends include advancements in hydrogen refueling infrastructure and increased vehicle adoption. Drivers include the need for zero-emission transportation solutions and government incentives promoting hydrogen-powered vehicles and infrastructure development.

Power Generation: The power generation segment has garnered market share of 12% in 2024. Hydrogen is used in power generation to produce electricity with zero emissions when combined with fuel cells or gas turbines. The trend focuses on integrating hydrogen with renewable energy sources for grid stability and energy storage. Drivers include the transition to renewable energy and the need for flexible, low-emission power generation solutions.

Others: Other applications of hydrogen include its use in metal processing, electronics, and space exploration. Trends highlight the diversification of hydrogen applications beyond traditional sectors. In 2024 others segment has achieved market share of 16%. Drivers include technological advancements and growing interest in hydrogen’s potential for specialized and emerging industries, contributing to a broader market exploration.

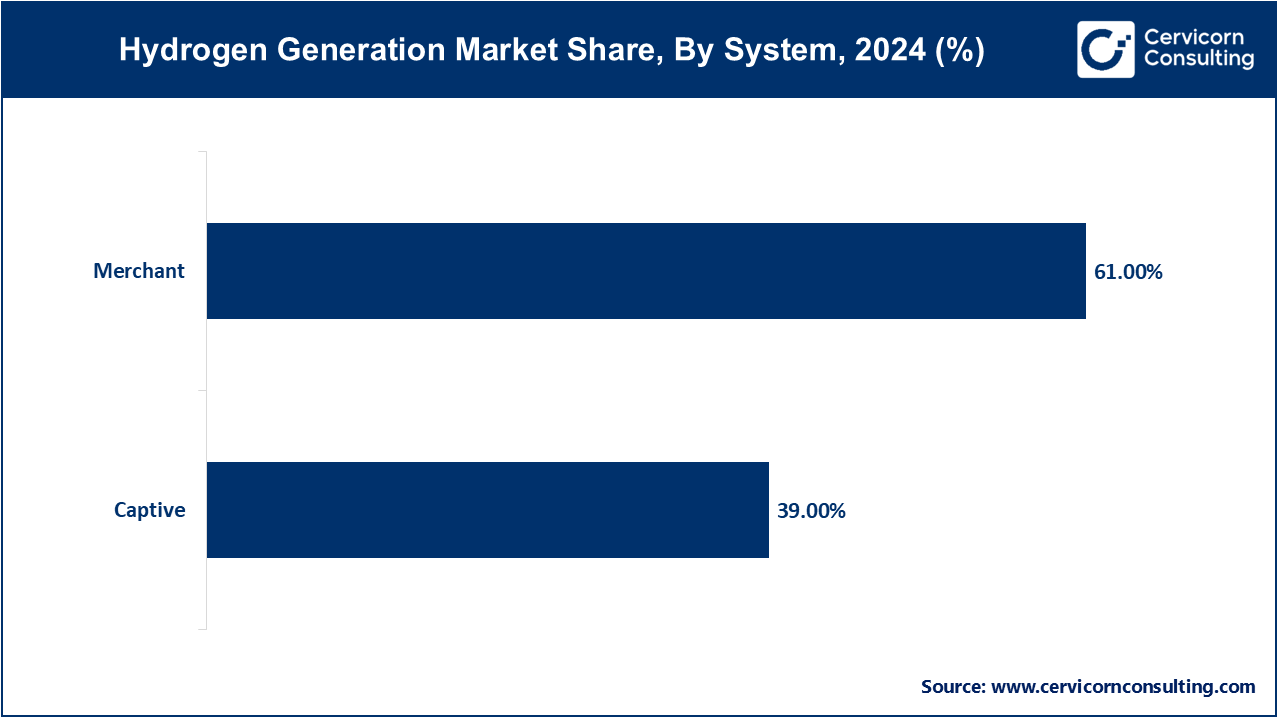

Captive Systems: This segment has measured market share 39% in 2024. Captive hydrogen systems involve on-site production for dedicated use, typically within industrial operations. Trends include increasing investments in on-site production to ensure supply security and reduce logistics costs. Drivers are the growing need for reliable hydrogen supply in industries like refining and chemicals, and the push for cost efficiency and reduced environmental impact through localized production.

Merchant Systems: Merchant hydrogen systems supply hydrogen to multiple customers via distribution networks. Merchant systems segment has recorded dominating market share of 61% in 2024. The market trend is toward expanding hydrogen infrastructure to support broader distribution. Drivers include rising demand for hydrogen across diverse sectors such as transportation and power generation, and the need for economies of scale and efficiency in hydrogen delivery and logistics.

Natural Gas: The natural gas segment has acquire market share of 71% in 2024. Hydrogen production from natural gas, primarily through Steam Methane Reforming (SMR), is the dominant method. Trends include integrating carbon capture and storage (CCS) to reduce emissions. Key drivers are the abundant availability of natural gas, established infrastructure, and the push for cleaner hydrogen production methods to meet environmental regulations.

Coal: Coal gasification is a significant source of hydrogen, especially in coal-rich regions. Trends focus on incorporating CCS to mitigate the high carbon emissions associated with coal. Drivers include leveraging existing coal resources for hydrogen production and enhancing energy security in countries with substantial coal reserves, despite environmental concerns.

Biomass: Hydrogen from biomass involves converting organic material into hydrogen through gasification or biochemical processes. Trends include increased research and development to improve efficiency and cost-effectiveness. Drivers are the push for renewable and sustainable hydrogen sources, the availability of biomass waste, and the growing emphasis on reducing reliance on fossil fuels

Water: Electrolysis of water, using electricity to split water into hydrogen and oxygen, is gaining traction, especially for producing green hydrogen. Trends include advancements in electrolyzer technology and decreasing costs of renewable energy. Drivers are the need for zero-emission hydrogen production methods, government incentives for green hydrogen, and the integration of renewable energy sources like wind and solar power.

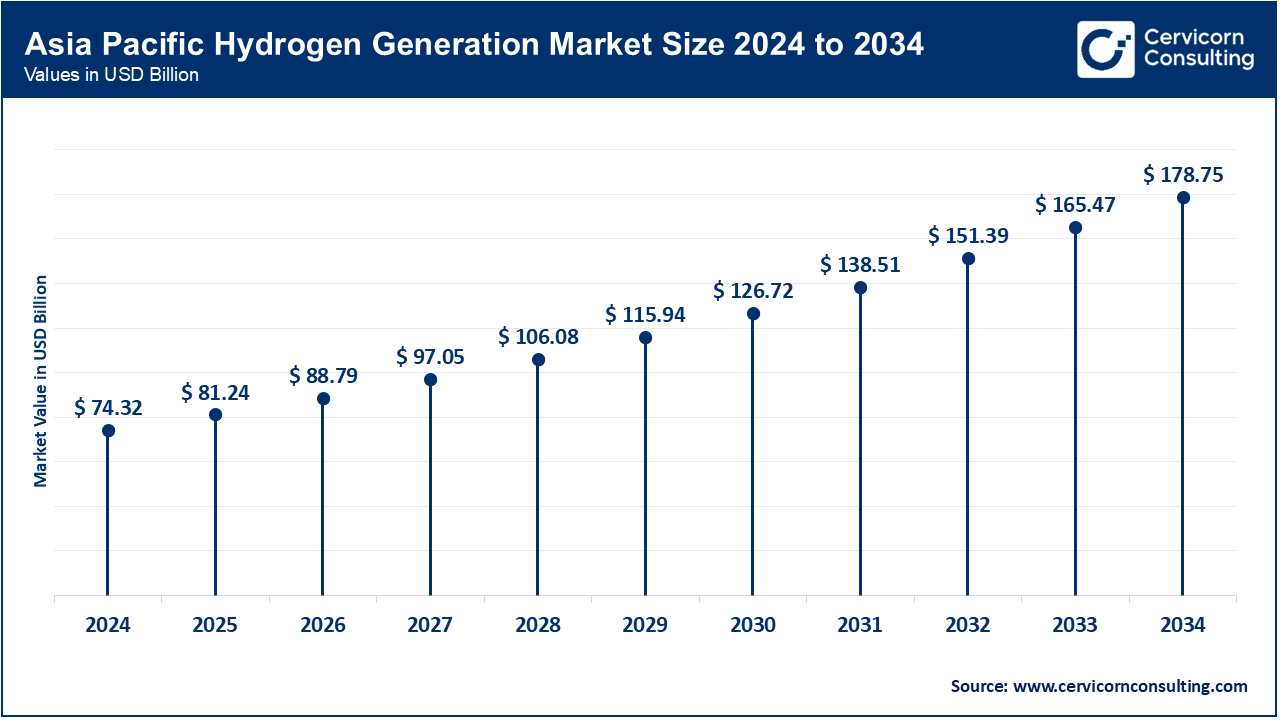

Asia Pacific market size is expected to reach around USD 178.75 billion by 2034 increasing from USD 74.32 billion in 2024. The Asia-Pacific hydrogen generation market is rapidly growing, with significant contributions from Japan, South Korea, China, and Australia. Japan and South Korea lead in hydrogen fuel cell technology and infrastructure development. China focuses on large-scale hydrogen production and the deployment of hydrogen-powered vehicles, supported by its long-term hydrogen plan. Australia's abundant renewable resources drive green hydrogen projects. Key drivers include government policies, technological advancements, and the need to diversify energy sources to enhance energy security and sustainability.

North America market size is calculated at USD 29.73 billion in 2024 and is projected to grow around USD 71.51 billion by 2034. The North American hydrogen generation market is driven by strong government support, technological advancements, and significant investments in hydrogen infrastructure. The U.S. leads with initiatives like the Hydrogen Energy Earthshot and extensive research and development programs. Canada also emphasizes hydrogen as part of its clean energy strategy. Key drivers include the push for decarbonization, the development of hydrogen fuel cell vehicles, and increasing use in industrial applications. The region focuses on both blue and green hydrogen production to meet its energy transition goals.

Europe is at the forefront of the hydrogen generation market, driven by ambitious decarbonization targets and the European Union's Hydrogen Strategy. Europe market size is measured at USD 63.18 billion in 2024 and is expected to grow around USD 151.84 billion by 2034. Countries like Germany, France, and the Netherlands are investing heavily in hydrogen infrastructure, including refueling stations and green hydrogen projects. The region prioritizes green hydrogen produced from renewable energy to reduce carbon emissions. Collaborative projects and public-private partnerships are common, with a strong emphasis on integrating hydrogen into various sectors, such as transportation, industry, and power generation.

The LAMEA region shows increasing interest in hydrogen generation, with countries like Saudi Arabia, South Africa, and Brazil taking the lead. LAMEA market size is forecasted to reach around USD 44.69 billion by 2034 from USD 18.58 billion in 2024. Saudi Arabia invests in large-scale green hydrogen projects as part of its Vision 2030 initiative. South Africa leverages its platinum resources for hydrogen fuel cell development. Brazil explores hydrogen production from renewable sources. The region's market growth is driven by the availability of natural resources, government initiatives to diversify energy portfolios, and the need for sustainable energy solutions to address climate change.

New players like ITM Power and Plug Power are leveraging advanced electrolyzer technologies and strategic partnerships to accelerate green hydrogen production. ITM Power, for example, collaborates with Linde to develop large-scale green hydrogen plants, while Plug Power partners with companies like Renault for hydrogen fuel cell solutions in transportation. Dominating players such as Air Liquide and Linde plc drive market growth through extensive hydrogen infrastructure and innovative projects. Air Liquide's collaboration with Toyota and Hyundai on hydrogen mobility and Linde's development of hydrogen refueling stations highlight their commitment to expanding hydrogen applications and infrastructure globally, pushing the hydrogen economy forward.

Benoît Potier, Chairman and CEO of Air Liquide

"Hydrogen is a cornerstone of the energy transition. Our commitment to developing a robust hydrogen economy is evident in our ongoing investments in production, infrastructure, and partnerships aimed at making hydrogen a key player in the global energy landscape."

Steve Angel, CEO of Linde plc

"Linde is at the forefront of hydrogen innovation, driving the transition to a low-carbon economy. Our focus on developing scalable hydrogen solutions and infrastructure will support industries in reducing emissions and achieving sustainability goals."

Seifi Ghasemi, Chairman, President, and CEO of Air Products and Chemicals, Inc.

"Air Products is dedicated to advancing hydrogen as a clean energy source. Our collaborations and investments in hydrogen production and distribution networks underscore our commitment to providing sustainable energy solutions globally."

Andy Marsh, CEO of Plug Power Inc.

"At Plug Power, we are pioneering the green hydrogen economy with cutting-edge electrolyzer technology and strategic partnerships. Our mission is to build a comprehensive hydrogen ecosystem that addresses the growing demand for clean energy across various sectors."

Graham Cooley, CEO of ITM Power plc

"ITM Power is revolutionizing green hydrogen production with innovative electrolyzer solutions. Our collaborations with industry leaders and focus on large-scale projects are driving the commercialization of green hydrogen, crucial for achieving net-zero emissions."

Randy MacEwen, President and CEO of Ballard Power Systems Inc.

"Ballard is committed to leading the fuel cell market with our advanced hydrogen technology. Our strategic partnerships and continuous innovation in hydrogen fuel cells are essential for enabling zero-emission transportation and contributing to a sustainable future."

These statements reflect the CEOs' focus on innovation, collaboration, and commitment to advancing hydrogen technologies and infrastructure to support the global transition to sustainable energy.

Market Segmentation

By Technology

By Application

By System

By Source

By Regions