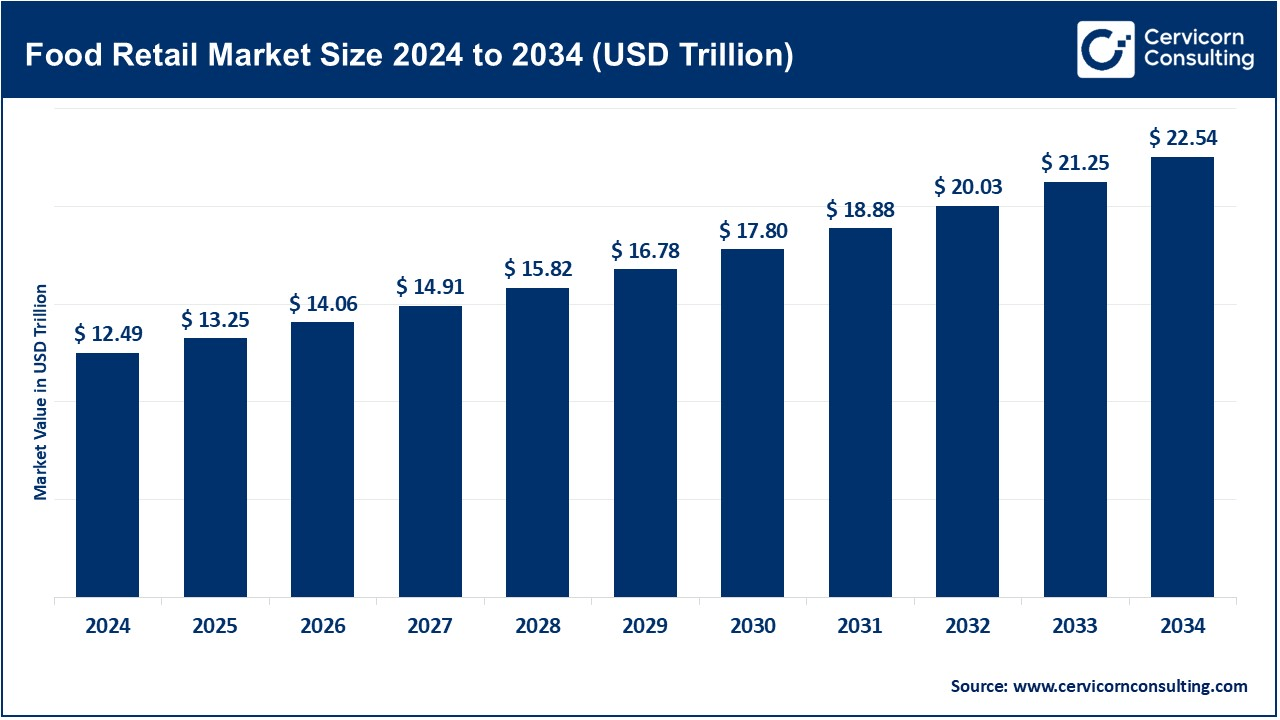

The global food retail market size was reached at USD 12.49 trillion in 2024 and is expected to be worth around USD 22.54 trillion by 2034, exhibiting at a compound annual growth rate (CAGR) of 6.08% over the forecast period 2025 to 2034.

The food retail industry has been experiencing steady growth, driven by changing consumer lifestyles, urbanization, and technological advancements. With increasing demand for convenience, online grocery platforms have expanded rapidly, allowing consumers to shop from home with doorstep delivery. The shift towards healthier food choices, including organic and plant-based products, has also contributed to the industry’s transformation. Additionally, the integration of digital payment solutions, AI-based inventory management, and smart retail technologies has improved efficiency in food retail operations.

Sustainability and eco-friendly practices are also influencing market growth. Retailers are adopting biodegradable packaging, reducing food waste, and supporting local sourcing to meet consumer demand for ethical and environmentally responsible products. The expansion of supermarkets and hypermarkets in developing regions further fuels industry growth, providing consumers with a wider variety of products at competitive prices. The future of food retail is expected to be shaped by automation, data-driven marketing, and personalized shopping experiences.

What is Food Retail?

Food retail refers to the process of selling food and grocery products to consumers through various distribution channels, such as supermarkets, convenience stores, and online platforms. It includes both perishable items like fruits, vegetables, dairy, and meat, as well as non-perishable goods like packaged snacks, beverages, and cooking essentials. Food retailers ensure that consumers have easy access to fresh, processed, and packaged food products for daily consumption.

The food retail industry operates through multiple formats, including hypermarkets, supermarkets, grocery stores, and online marketplaces. Large retail chains like Walmart, Carrefour, and Tesco dominate the market, while local convenience stores and specialty food shops also play a crucial role. In recent years, online grocery shopping has gained popularity due to convenience, digital payment options, and home delivery services. The industry continuously evolves with changing consumer preferences, focusing on organic, healthy, and sustainable food choices.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 13.25 Trillion |

| Expected Market Size in 2034 | USD 22.54 Trillion |

| Projected CAGR 2025 to 2034 | 6.08% |

| Dominant Region | Asia Pacific |

| Key Segments | Product, Category, Distribution Channel, Region |

| Key Companies | Walmart Inc., The Kroger Co., Amazon.com, Inc. (Amazon Fresh, Whole Foods), Tesco PLC, Carrefour S.A., Aldi Group, Costco Wholesale Corporation, Ahold Delhaize, Target Corporation, Metro AG, Seven & i Holdings Co., Ltd. (7-Eleven), Lidl Stiftung & Co. KG |

Consumer Demand for Convenience

Health and Wellness Trends

Supply Chain Disruptions

Low Profit Margins

E-Commerce Integration

Expansion into Emerging Markets

Regulatory Compliance

Intense Competition

The food retail market is segmented into product type, category, distribution channel and region. Based on product, the market is classified into food and grocery. Based on category, the market is classified into packed and unpacked. Based on distribution channel, the market is classified into physical store and online stores.

Food: The food segment remains the backbone of the food retail industry, covering fresh produce, dairy, meat, seafood, and packaged food products. Growing consumer demand for healthier and organic food options is influencing purchasing patterns. The increasing availability of ready-to-eat meals, plant-based products, and gluten-free alternatives has significantly expanded this segment. Supermarkets and online grocery platforms are playing a key role in increasing consumer access to diverse food options, including specialty and international cuisines. The demand for functional foods fortified with vitamins and nutrients is also rising, as consumers prioritize well-being and immunity-boosting products.

Food Retail Market Revenue Share, By Product Type, 2024 (%)

| Product Type | Revenue Share, 2024 (%) |

| Food | 62.70% |

| Grocery | 37.30% |

Grocery: Grocery products, including essential staples such as grains, pulses, cooking oils, dairy products, and beverages, are witnessing steady demand. Changing lifestyle patterns, coupled with increasing urbanization, have driven a shift toward packaged grocery items with extended shelf life. The expansion of private-label grocery brands by major retailers has further fueled market competition. Consumers are increasingly seeking sustainable grocery options, such as organic and non-GMO products, as environmental awareness grows. Digital grocery shopping trends have also enhanced the segment, as subscription-based grocery delivery services become more common.

Packed: Packed food products, including frozen foods, processed meats, dairy products, snacks, and confectionery, have gained significant traction due to convenience and extended shelf life. Consumers prefer pre-packaged and easy-to-cook meals to accommodate their fast-paced lifestyles. Food safety and hygiene concerns have also increased the appeal of packed foods, as they offer controlled packaging and labeling with detailed nutritional information. The rise of sustainable and eco-friendly packaging options, such as biodegradable wraps and reusable containers, is further transforming the segment. Supermarkets and hypermarkets dominate the sales of packed food products, with online grocery platforms emerging as strong competitors.

Unpacked: Unpacked food includes fresh produce, bulk grains, and dairy products sold in open markets or minimal packaging formats. This segment remains essential for consumers who prioritize freshness and affordability. Farmers’ markets, local grocery stores, and specialty organic retailers play a crucial role in providing unpacked food items. Consumers seeking preservative-free and locally sourced food favor this segment. Additionally, rising awareness of plastic waste and food sustainability has encouraged some consumers to opt for bulk purchases and reusable packaging. However, the segment faces challenges related to storage, food wastage, and shorter shelf life compared to packed alternatives.

Physical Stores: The Physical Stores dominated the market in 2024. Supermarkets, hypermarkets, and local grocery stores continue to dominate food retail, as many consumers prefer an in-person shopping experience where they can inspect products before purchasing. Supermarkets offer a wide variety of fresh and packaged food items, competitive pricing, and loyalty programs that keep customers engaged. Hypermarkets, with their large-scale operations, provide discounts and bulk purchase options, making them popular for household grocery shopping. The presence of physical stores also enhances trust and convenience for consumers who prefer immediate purchases without delivery wait times. In addition, physical stores frequently incorporate in-store promotions, tasting counters, and seasonal discounts, which contribute to strong consumer retention.

Food Retail Market Share, By Distribution Channel, 2024 (%)

| Distribution Channel | Revenue Share, 2024 (%) |

| Physical Store | 59.80% |

| Online Stores | 40.20% |

Online Stores: The rapid expansion of digital grocery shopping has reshaped the food retail landscape. Consumers increasingly prefer online grocery platforms for their convenience, variety, and doorstep delivery options. E-commerce platforms allow users to compare prices, access exclusive discounts, and schedule deliveries at their convenience. The emergence of AI-driven recommendations and personalized shopping experiences has enhanced customer engagement. Subscription-based grocery delivery services and meal kits have also gained popularity, providing curated food selections tailored to dietary preferences. Online food retailers are leveraging advanced logistics, warehouse automation, and partnerships with local vendors to ensure fresh and timely deliveries.

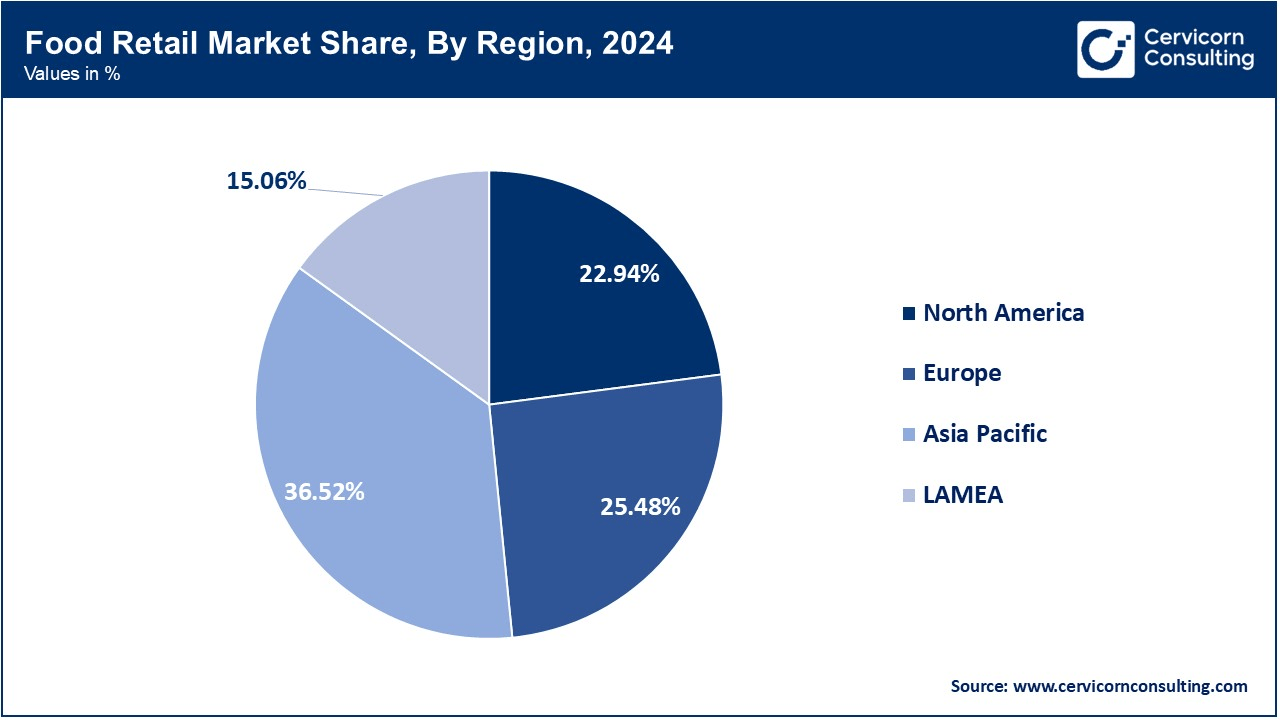

The food retail market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

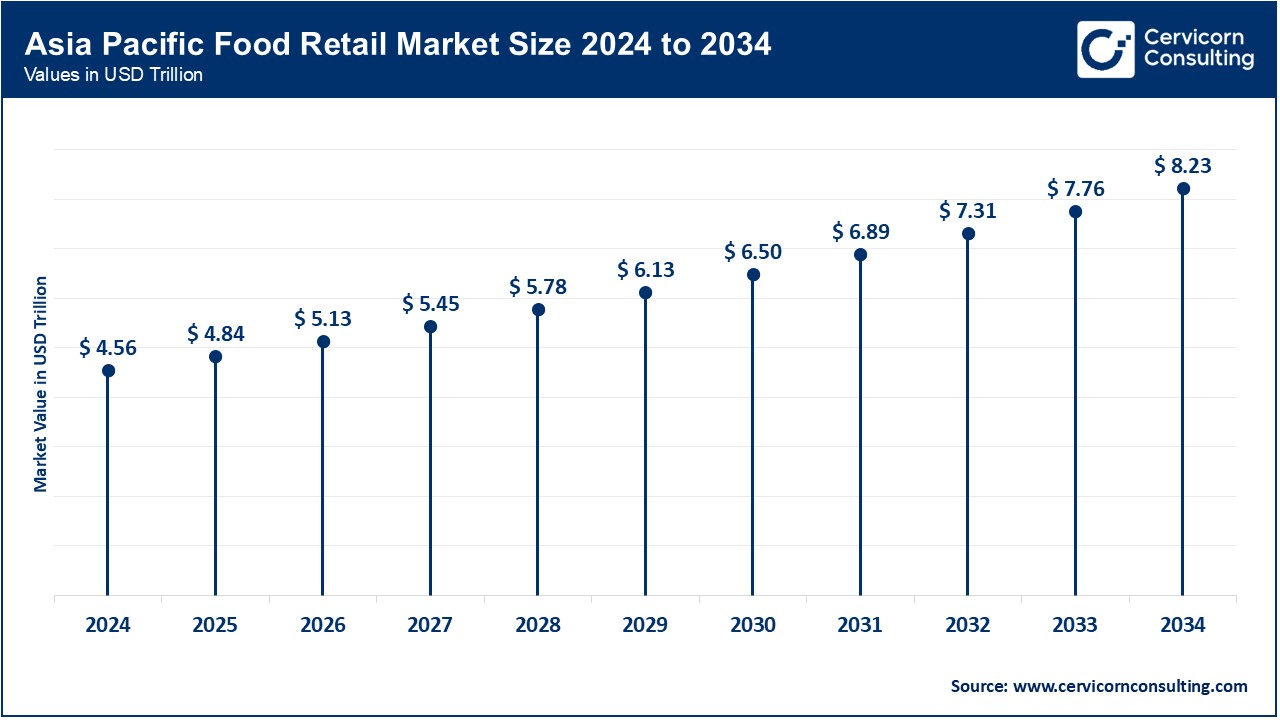

The Asia-Pacific food retail market size was valued at USD 4.56 trillion in 2024 and is expected to reach around USD 8.23 trillion by 2034. Asia-Pacific holding the largest market share in 2024. The region’s dominance is driven by China, India, and Japan, where rising urbanization, increasing disposable incomes, and evolving consumer preferences fuel market expansion. The rapid growth of supermarkets, hypermarkets, and online grocery platforms has further strengthened the food retail sector in APAC. The increasing adoption of digital payment solutions and e-commerce platforms has accelerated online grocery sales, making APAC the most dynamic market for food retail. Additionally, the region’s strong agricultural base and expanding processed food industry contribute to sustained growth. The demand for organic, functional, and convenience foods is also on the rise, driving product innovation and distribution expansion.

The North America food retail market size was estimated at USD 2.87 trillion in 2024 and is forecasted to hit around USD 5.17 trillion by 2034. North America holds a significant market share in the food retail industry, driven by the U.S. and Canada. The region’s market strength is attributed to its well-established supermarket chains, advanced supply chain infrastructure, and high consumer spending on premium and organic food products. The demand for ready-to-eat meals, frozen foods, and plant-based alternatives is rising, fueled by changing lifestyle preferences and increasing health consciousness. E-commerce grocery platforms such as Amazon Fresh and Walmart+ are reshaping the industry, offering personalized shopping experiences and seamless delivery services. Additionally, sustainability initiatives such as zero-waste grocery stores and eco-friendly packaging are gaining traction in North America.

The Europe food retail market size was reached at USD 3.18 trillion in 2024 and is projected to surpass around USD 5.74 trillion by 2034. Europe maintains a strong position in the food retail market, driven by Germany, France, and the U.K. The region’s food retail sector benefits from well-established supermarket chains, stringent food safety regulations, and a growing consumer preference for organic, gluten-free, and plant-based foods. The demand for sustainable and locally sourced products is increasing, leading to a rise in specialty food stores and farm-to-table retail models. Additionally, the presence of discount grocery chains such as Lidl and Aldi has intensified price competition, making food retail highly competitive. The European market is also witnessing significant investment in digital grocery solutions, including AI-driven personalized shopping experiences and rapid delivery services.

The LAMEA food retail market was reached at USD 1.88 trillion in 2024 and is anticipated to reach around USD 3.39 trillion by 2034. LAMEA represents an emerging market in the global food retail industry, with steady growth potential. Countries like Brazil, Mexico, Saudi Arabia, and South Africa are experiencing increased investments in supermarket infrastructure and digital grocery platforms. The rise of modern retail formats such as hypermarkets and convenience stores is transforming the region’s traditional food retail landscape. Additionally, the increasing adoption of mobile-based grocery shopping and digital payments is enhancing accessibility and affordability. Governments across LAMEA are also focusing on improving food security and supply chain efficiency, which is expected to support the long-term expansion of the food retail sector in this region.

The food retail market is highly competitive, dominated by global giants like Walmart, Amazon, and Tesco, alongside regional players catering to specific markets. These companies leverage advanced supply chain management, omnichannel retailing, and private label offerings to strengthen their market presence. E-commerce and digital transformation have reshaped the industry, with online grocery sales growing significantly, driven by consumer demand for convenience. Supermarkets, hypermarkets, and discount retailers continue to hold a major share, while organic and sustainable product lines are gaining traction. Strategic mergers, acquisitions, and partnerships play a crucial role in market expansion, enabling companies to tap into emerging markets and diversify product portfolios.

Market Segmentation

By Product Type

By Category

By Distribution Channel

By Region