Healthcare CRM Market Size and Growth 2025 to 2034

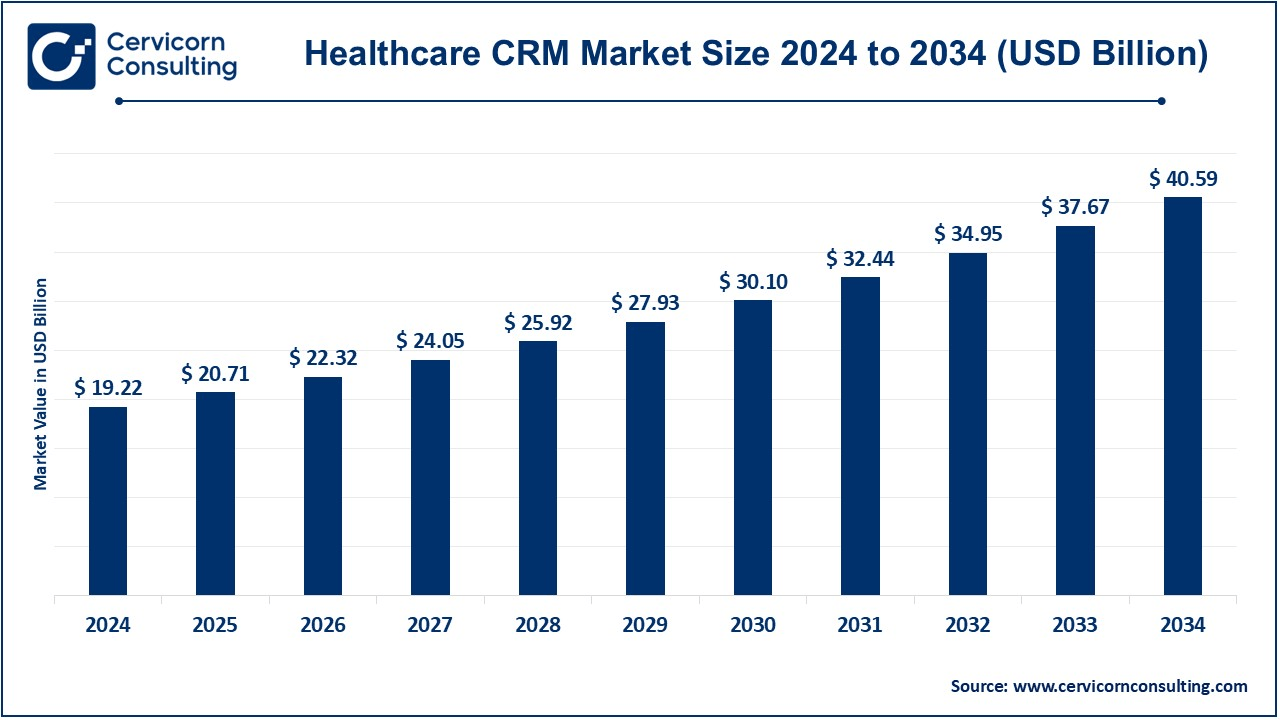

The global healthcare CRM market size was reached at USD 19.22 billion in 2024 and is estimated to surpass around USD 40.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.76% over the forecast period 2025 to 2034. The healthcare CRM market is experiencing robust growth driven by factors such as growing demand for the data that is structured and automation in healthcare organizations.

There has been a surge in the healthcare customer relationship management (CRM) owing to the rising demand for the demand for the patient-centric care along with advancements in the digital technologies and increasing adoption of the data-driven decision making in the healthcare sector. Innovations in digital technologies have been responsible for the growth of CRM software in terms of the utilization of patient data and increasing data-driven decision making in the healthcare sector. By consolidating data from various touch-points, apart from electronic health records (EHRs) as the most common types, these CRM's really simplify communication with patients and at the same time encourage patient engagement, operational efficiency, and data exchange among the healthcare facilities of the involved entities. Demand for personalized healthcare, as mentioned previously, has seen the adoption of CRM further driving healthcare organizations using patient data to understand and improve the delivery quality of health services and continue fostering the relationship. And now with telemedicine and mobile health applications strengthening, management of patient communication by CRM assumes a larger role. They continue with AI and ML in CRM becoming more significant in predicting patient needs and determining resource allocation. Implementation remains costly, but it is thought that better patient outcomes would justify these investments. More so, high-performing AI systems that optimize resource management set the pace for better healthcare CRM delivery.

Healthcare CRM Market Report Highlights

- The U.S. healthcare CRM market size was valued at USD 8.22 billion in 2024 and is expected to hit around USD 17.35 billion by 2034.

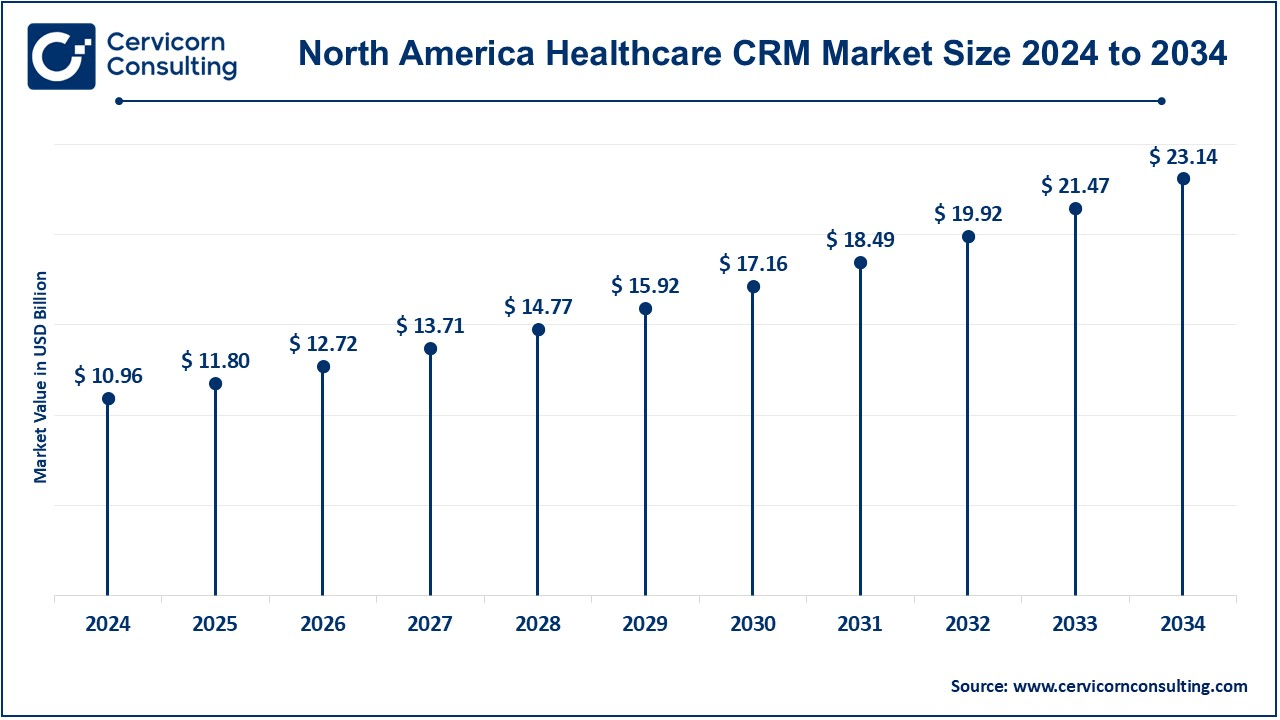

- The North America has captured highest revenue share of 57% in 2024.

- The Europe has held revenue share of 22% in 2024.

- By component, the software segment has leading the market in 2024.

- By deployment, the cloud-based segment has accounted revenue share of 81.50% in 2024.

- By functionality, the sales segment has recoreded revenue share of 31% in 2024.

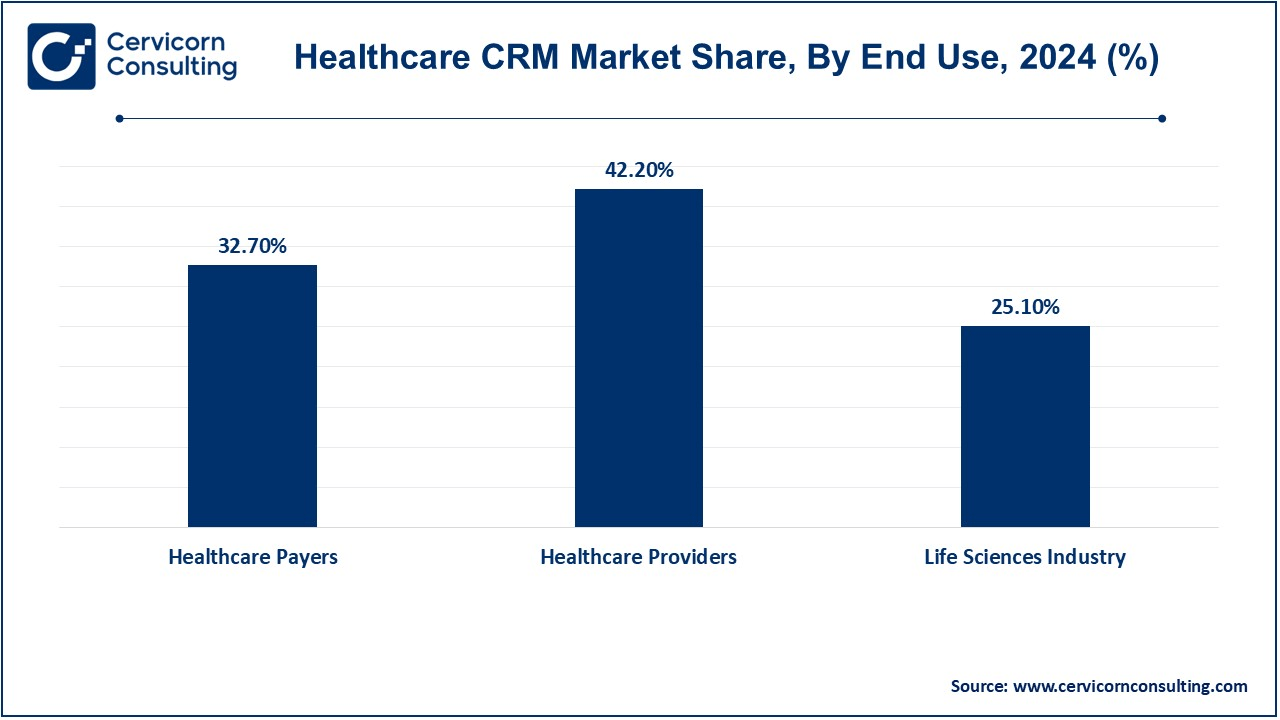

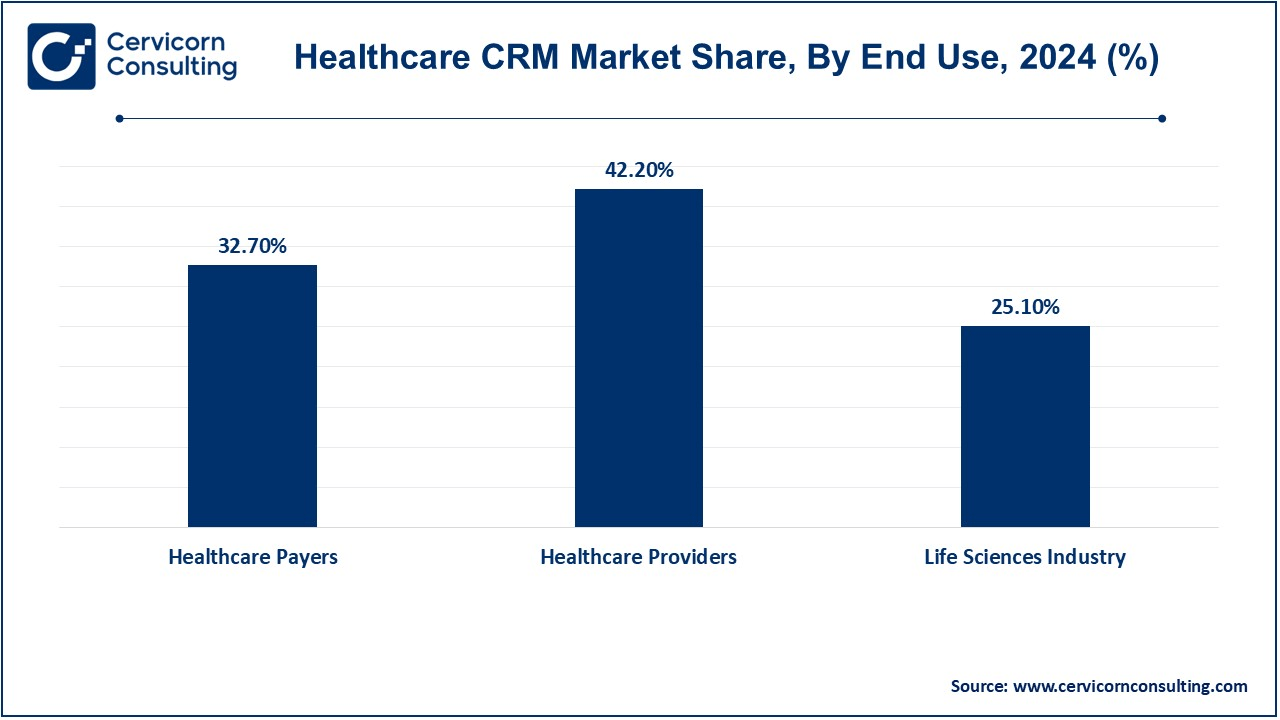

- By end-use, the healthcare providers segment has captured revenue share of around 42.20% in 2024.

Healthcare CRM Market Growth Factors

- Increasing Demand for Patient-Centric Care: Medical care is a personalized patient-focused care, and this is going to require clinicians to deliver individualized services to meet every single patient's needs. This is realized by the CRM through the extraction and processing of information from a variety of sources, whereby each individual is endowed with an identical representation. Improving communication, health trend monitoring, and personal plan of care, CRMs has an effect of improving patient satisfaction and patient outcomes. They allow clinicians to organize patient needs, to handle chronic illness efficiently, and to establish ongoing relationships which can lead patients to feel committed, trusting and reciprocatively linked. With the growth in the demand for value-based care, roll out of CRMs is still in progress across the health system.

- Growing Adoption of Digital Health Solutions: The digitization of health information systems has already begun to translate into improvement of the patient care, and CRMs are at the core of the effort of standardizing a variety of data recorded by systems in health care, including electronic health records (EHRs), appointment schedules, and remote health services. These methods allow us to exploit valuable strategies for the structuring of patient information, the log files of communications and itinerary of communications. With increasing use of digital tools by health care facilities, CRMs make the implementation of interoperability and create a smooth user experience for both patients and providers. Through information flow links, digital health CRMs can enhance decision making, lead to improved operational efficiency which then allows for their adoption on a substantial scale in modern medicine.

- Advancements in AI and Analytics: CRMs with predictive information, patient clustering and resource allocation are transforming CRMs in the era of artificial intelligence (AI) and analytics. AI-powered CRMs enable medical practitioners to forecast, preempt, and prepare the patient needs, to analyze high-risk-population, and to individualize a treatment. Advancements in trend analysis brought about by the use of sophisticated analytics provide opportunities to prevent complications and enhance care delivery. By means of automatic (self-service) creation of administrative tasks, such as appointment reminders and follow-ups, workload decreases and process is optimized. Machine learning algorithms amplify the usefulness of CRMs that are powered by big data for patient interaction and patient outcomes in the data-driven age of medicine.

- Expansion of Telehealth Services: Cytokine receptor monoclonal antibody receptor (CRMs) have been highlighted by the explosion in the adoption of telehealth stemming from the convenience benefit and pandemic need. Telehealth platforms need robust infrastructure to support remote consultation, to maintain a steady dialogue connection, and to provide/perform post visits. CRMs are able to accomplish these functions by providing a single central repository of patient data, logging interaction and providing remote continuity of care. These approaches can be also tailored to better suit the telehealth experience, appointments scheduling, and Feedback collection. As the telehealth trend is incorporated into health care delivery systems, CRMs are critical to the sustainability and expansion of health care telehealth.

- Rising Prevalence of Chronic Diseases: Increasing health care load of chronic diseases, such as diabetes and cardiovascular disease, requires not only continuous, but also sustained patient management. CRMs make available methods for tracking health data, scheduling and delivering personalized plan of care so as to ensure that patients do not forget to attend, and that they are receiving the plan of care tailored to their needs. These systems also improve care coordination among providers, enhance adherence to treatment regimens, and facilitate remote monitoring. The utilization of data-based decision making allows CRMs to take a key position in improving the clinical performance of the patient and the cost derived from chronic diseases that cannot be overlooked in contemporary healthcare management.

Healthcare CRM Market Trends

- Government Initiatives and Investments: On a global scale, introduction of health care digitalization is being pushed by governments to enhance the provision of and efficiency of care services. Efforts to promote the adoption of electronic health record (EHR) systems and digital health technologies are behind EHR and digital health CRM adoption. Regulatory prescripts have fostered the integration and interoperability of data, which has, in turn, driven the development of CRMs. Investments are also in operation to enhance care quality, efficiency and reduction of administrative burden as well as streamline-flow, which in turn brings to greater efficiency and patient-centeredness health systems. Given that health care digitalization today is the primary concern of policymakers, CRMs are the nexus of health care innovation programs.

- Increasing Use of Wearable Devices: Wearable devices (i.e., fitness trackers and medical grade data monitors) produce vast amounts of healthcare data in real time. The capacity of such information to be put into CRMs in order to be monitored continuously by clinicians is that this information can be used by clinicians to monitor patients, identify health trends and take appropriate measures. Wearables also enable patients to understand what they can do to manage themselves in proactive health management, and how they can participate in their care plan. Clinical health facilities can provide personalized intelligence through the use of wearables combined with CRM analytics and clinical data, better manage chronic conditions, and support rehabilitative care. Therefore, the popularity growth of wearables is driving the need for advanced CRM frameworks.

- Focus on Operational Efficiency: Healthcare institutions are facing growing pressure to maximize efficiency of cost and also to minimize process complexity. The use of CRMs can not only improve the administrative processes like booking, follow up of patients and data management, but also it allows the staff to allocate it more of their focus to patient care. CRMs are powered by a suite of different systems and automation of routine activities, bypassing bottlenecks and allowing for interdepartmental cooperation. They also deliver specific suggestions via analytics that can subsequently be used for more effective management of provider resource distribution. Operational efficiency, striving for maximum rate of care quality, has unfortunately been the impetus for the adoption of CRMs in the health care system.

- Growing Healthcare Consumerism: Transparency, ease of access, and patient involvement in healthcare processes are becoming also topics where the patients should have access to more information and to better expectations. CRMs allow the provider to fulfil the following needs, through personalised communication, easy access to medical records and efficient appointment scheduling. By clustering disease data through aggregation, CRMs ensure homogeneity, availability and better patient satisfaction and loyalty. They also allow health organisations to react to consumer-led trends in health care service provision such as digital and on-demand health services, for instance. As healthcare consumers become increasingly popular, CRMs have played a crucial role in managing the changing needs of customers.

- Emergence of Mobile Health Applications: Mobile health (mHealth) applications are transforming what forms the bedrock of patient engagement—access to care, for example. CRMs (combined with mHealth applications) provide means of access to procedures within the appointment scheduling, reminders and secure messaging which, in return, will enhance patient-provider communication. Such applications allow the flow of real-time data, such that providers can monitor health status and deliver, for example, modelized interventions. MHealth apps supported by CRMs facilitate improved care delivery and patient satisfaction bridge the distance between patients and providers. Because of the advent of personal smartphones and health applications, this is promising phenomenon.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 20.71 Billion |

| Expected Market Size in 2034 |

USD 40.59 Billion |

| Projected CAGR 2025 to 2034 |

7.76% |

| Top-performing Region |

North America |

| Rapidly Expanding Region |

Asia-Pacific |

| Key Segments |

Component, Deployment, Functionality, End-Use, Region |

| Key Companies |

Accenture, Alvaria, Creatio, hc1, IBM, LeadSquared, Microsoft, NICE, Oracle (Cerner Corporation), Salesforce, SAP, Talisma, Veeva Systems, Verint Systems Inc., Zoho Corporation |

Healthcare CRM Market Dynamics

Market Drivers

Demand for Real-Time Data Accessibility

- Almost real-time accessibility to report of the patients is compulsory in urgent healthcare situations in order to facilitate and then decide. Collection of data from EHR, wearable devices, and telehealth, by a CRM, guarantees that everything needed is within arm's reach. Real-time data accessibility would mean better care coordination, better emergency responses, and better decision-making among other improvements. CRMs enable a facility or healthcare provider to meet very high demand increase in data processing requirements of up-to-date insights for delivery so that their interventions are very personalized to the individual patients of record, with as little or as much protection as patients may need.

Rising Competition Among Providers

- The health providers are bound to face stiffening competition as services attempt to distinguish themselves from one another. CRM is designed to help health organizations-to interact more fully with the patient, appeal to their experience, and make available better care coordination. This leading edge uses integrated targeting by generation, follow-the-sun efficiency, and scientific insights through source-acquired data to enhance patient loyalty and bring in a new crowd. It is much more closely required in the case when most of the patients give much regard towards seamless and personalized healthcare experiences. This need to lead has encouraged health organizations to invest in robust CRM solutions.

Market Restraints

High Implementation and Maintenance Costs

- In order to use a health care CRM, the organization has to spend more than what a small health care outfit would be able to afford. That is the additional cost of one-time implementation and maintenance. This expense includes purchasing software, customization, linkage with existing IT infrastructure, staff training, and subsequent system updates. The financial obstacle will serve as a problem for the interested entities, especially the resource-crunched entities, when it comes to regarding the CRM solutions to be as much beneficial. Additionally, the ROI will never be seen in the short term that will result in limited adoption. Low cost or flexible affordable CRM solutions could mitigate this hindrance and lead to a much broader process of adoption in health care.

Data Privacy and Security Concerns

- Healthcare CRM stages are taking care of patient-sensitive data hence are vulnerable to breaches and cyber-attacks. It becomes even more complicated for CRM deployment due to requirements of stringent rules or regulations such as the United States' HIPAA or Europe's GDPR on security for certain patient data, resulting in complex and expensive data protection solutions as a criterion for CRM deployment. The biggest problems in this regard are data storage security, access controls, and compliance with prescribed laws. Moreover, this creates trepidation in patient confidence, as thievery may hurt one's reputation. Proper dealing with the issues of data privacy and security has to be included in more comprehensive use of CRMs in healthcare and prompt a never-ending gross investment in brisk cybersecurity measures.

Market Opportunities

Expansion in Emerging Markets

- Emerging markets present vast potential growth in healthcare CRM sectors due to the vast investments in infrastructure for healthcare and very fast adoption of digital health technology: however, on the broader front, states and private sectors in lesser developed countries are more enthusiastic about enhancing access to improved healthcare. Accordingly, healthcare demand generates the necessary environment for new solutions to engaging patients and coordinating with them. Across these markets, chronic diseases are becoming quite predominant. The resulting patient/consumer is equally taking over health or personalized healthcare solutions. The opportunities appear good ones for healthcare CRMs as the relationship-managing systems have possibility for simplifying operational workload since integration of information from different databases all brought these new procedures closer to realization and are excellent potential solutions for providers in developing countries.

Integration with Advanced Technologies

- Integration with advanced technologies such as AI, blockchain, and the Internet of Things (IoT) is going to offer top-notch opportunities for innovations. Sophisticated AI applications on CRM will be enhanced as they can now predict, communicate immediately and result into entirely personal with the patients. Block chain technology on the other hand makes sharing more trustable through secure data protection via permanent record links. With the IoT devices, real-time data produced would be greatly of aid toward facilitating better and crisper analyses applied to the enhanced CRMs thus resulting into yet better detection. These developments will make the CRM even more desirable to the user in that they solve nearly all the complications that exist within healthcare, bring in a more optimized system safeguarding information and focusing on the patient.

Market Challenges

Resistance to Technological Adoption

- Some healthcare providers and staff are apprehensive about adopting new technologies such as CRMs simply because these people have had familiarity with legacy systems, no technical know-how, and fear of a disruption in workflow. Inadequate training and fears of increased workload during the transitional period often exacerbates this reluctance. The convincing of the stakeholders to commit to using the CRMs on an ongoing basis so as to bring in greater efficiency and will also increase patient engagement, continues to be a difficult task. Removing resistance calls for comprehensive training programs, highly comfortable interfaces to be designed, and communication to flow clearly about the various advantages of the adoption of CRM thus only through this could be ensured successful integration into health care practices.

Complex Integration Process

- The integration of healthcare CRMs into existing healthcare information technology (IT) systems like electronic health records (EHRs), lab management systems, and billing systems raises a lot of challenges right from the start. This also emanates from a great number of data formats, missing standardization, and lack of interoperability which mostly leads to delay and rise in costs. If the cost of the installation and annual maintenance exceeds the potential benefits, then it would become so burdensome to adopt CRMs. The "simple" solution then in order to overcome these barriers and to make CRM adoption popular in the healthcare industry is through standardization of API, very high interoperability and quite a lot of vendor support.

Healthcare CRM Market Segmental Analysis

Component Analysis

Software: The software segment has dominated the market in 2024. Applications are the engine of a healthcare CRM which delivers features including, storage, management, and scheduling of patient information, appointment scheduling and management, and the ability to analyze. These methods enable focused consolidation of patient data, smoother information exchange among the members of the healthcare team and better delivery of care. Customizable and scalable software options cater to various organizational needs, from small clinics to large hospital networks. The integration of advanced technologies, through the use of Artificial Intelligence (AI) and Cloud Computing, is rapidly improving software performance, giving access to real-time data and predictive analytics.

Services: In the healthcare CRM market, services are key to software rollout, customization, and continuous support. These are (consultancy, training, system integration, technical support etc) with the potential of smooth assimilation and high performance. Managed services are used and benefit organisations in a variety of ways in order to address problems such as data confidentiality or compliance with legislation as well as training services to enhance the competency of users. Furthermore, the system has a robust support system in the form of systems providing uptime security and continuous operation which reduces the possibility of interruptions in the provision of patient care.

Deployment Analysis

On-Premise Model: On-premise housing of healthcare CRMs is the housing of software and data on the internal servers of an organization and, consequently, enhanced control over patient health data is feasible. This model is for such companies that have good control on data security or such companies that are located in areas with particularly strong regulatory environment. Off-premise solutions have very good customization power, making it possible for the organization to personalize the system according to the unique requirements of the organization. However, it requires a hell of a lot of out of the box infrastructure investment, IT staff and support, etc.

Healthcare CRM Market Revenue Share, By Deployment, 2024 (%)

| Deployment |

Revenue Share, 2024 (%) |

| Cloud/Web-based |

81.50% |

| On-premise |

18.50% |

Cloud/web-based: Cloud/web-based deployment model of healthcare CRMs is scalable and flexible, and economics, which is the most prevalent option for a large majority of organizations. These solutions are served on remote servers and accessed on the internet, so that providers can decrease infrastructure expenses and gain the advantage of automatic updates. Cloud-based CRMs enable real time data access and this allows for better sharing of information amongst stakeholders, as well as better patient engagement (for example). Most significantly, they are very useful, especially, for Small Medium Enterprises, due to their accessibility and easy installation.

Functionality Analysis

Customer Service and Support: Customer service and support features in health care CRMs allow for greater patient engagement by effectively automating communication and handling inquiries. These applications are useful for medical staff working to answer patients' questions, make appointments, and follow up in a timely manner. The availability of features like chatbots, help desk, and ticketing systems 24/7 with multiple modalities and improving the patient safety. With the ability to store rich interaction histories, health organizations are able to provide individualized service, thereby building trust and loyalty. This functionality is critical for patient experience and building strong relationships in the long term, which leads to its penetration in the healthcare CRM market.

Digital Commerce: Digital commerce function within the health care customer relationship management (CRM) allows the vendor to accomplish online billing, payment processing and e-commerce for medical products and services. By combining secure payment gateways and inventory systems, CRMs offer a single solution for streamlining patient and provider interactions. Patients can use the website to pay bills, purchase drugs (pharmacies), or schedule appointments, which either increases the convenience and access. This functionality plays a role in allowing healthcare organizations to broaden their revenue streams and improve operational efficiency, and thereby is a key element in modern healthcare CRMs.

Marketing: Marketing features provided in healthcare CRMs allow a targeted marketing campaign, tracking, and monitoring of patient outreach and quantification of the degree of engagement. These tools make use of data analytics to cluster patients, so that they can be served with tailored marketing campaigns aimed at their specific needs and wants. Automation possibilities simplify operations such as email marketing, reminder for appointment and marketing promotion. Campaign performance analysis can help providers improve their approach and target focus, and hence maximize return on investment. If the marketing function is successful, health care organisations are able to benefit and sustain patients, generate customer loyalty, and increase patient engagement, which in turn makes it one of the power players in the CRM market.

Sales: The Sales segment has dominated the market in 2024. In a healthcare CRMs sales operation, clinicians are empowered to manage relationships with stakeholders including patients, payers and collaborators. These applications provide for lead tracking, contract management, and revenue streams direction all with the goal of productive operations and business growth. Pipelining management and analytics capabilities enable companies to discover opportunities, optimize their use of resources and achieve their revenue targets. By the merging with other functional capabilities CRMs can achieve a integrated representation of organizational performance for strategic decision making. This functionality is particularly relevant to health care organizations, who wish not only to expand market penetration but also to maximize revenue.

Cross-CRM Integration: Cross-CRM functionality provides a tight integration between more than one CRM and other healthcare IT applications, including electronic health records (EHRs) and telehealth services. This capability is also used by the providers to get (comp ill) patient data from different sources, so as to increase care coordination and operational efficiency. Integration of cross-CRM (connection of CRM) licenses better communication and decision making by allowing departmental data sharing across departments and organizations. It also improves the ease of communication for the patient through centralization of channels of communication and duplication reduction. This functionality is becoming increasingly relevant with the expansion of the complexity of health care systems, that is also resulting in demanding integration between CRMs.

End-Use Analysis

Healthcare Providers: The Healthcare Providers segment has dominated the market in 2024. CRM software for healthcare is special software, which is used by organizations that provide services in health facilities to engage patients in the lifetime valuation of their relationship with clients. Individual practitioners, hospitals, and clinics are the direct end users of healthcare CRM systems nowadays. They, too, need to use these systems for making their patient dealings organized, meaningful, and personal. The reason this industry uses CRM software is that controlled data on patients, visits tracked, quick retrieval of medical records, and service personalization go together. Scheduled patient visits can be entered into the system. The patient will be tracked when he or she will need to be scheduled next, in case of a follow-up. By simplifying administrative tasks, health providers can concentrate on improving patient outcomes, reducing operating expense, or assisting in patient satisfaction-the goal is to practice healthcare in the positive.

Healthcare Payers: Insurance companies and administrators of third parties are healthcare payers who introduce CRM solutions to them so that they can better deal with member engagement while they maintain the profiles of all policyholders, complete claims with such a creative service, as policy renewal and reminder, and much more. The insurers can review their risk, come up with open-ended tailor-made insurance packages, and satisfy the members even more through scale-developed member satisfaction improvements. It will help them recognize emerging health trends. They expect to reduce claims fallout time while at the same time reducing the overhead costs, which boosts CRM's worth within the insurance sector.

Life Science Industry: The industry is augmented by life sciences, pharmaceutical corporations, biotechnology, and the companies that produce medical devices. Their use in CRM integrates these providers with healthcare practitioners and provides patient alignment. In Congress, CRM technology is used by life science industries solely to establish options for this efficient communication with sales team and medical personnel in clinical trials. The CRM is an advantage for product selling, makes the marketing easier, and also justifies adherence to regulatory standards. CRM also permits marketing access strategy to get that harder recognition and enhancement of a market with a virtual environment.

Healthcare CRM Market Regional Analysis

The healthcare CRM market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

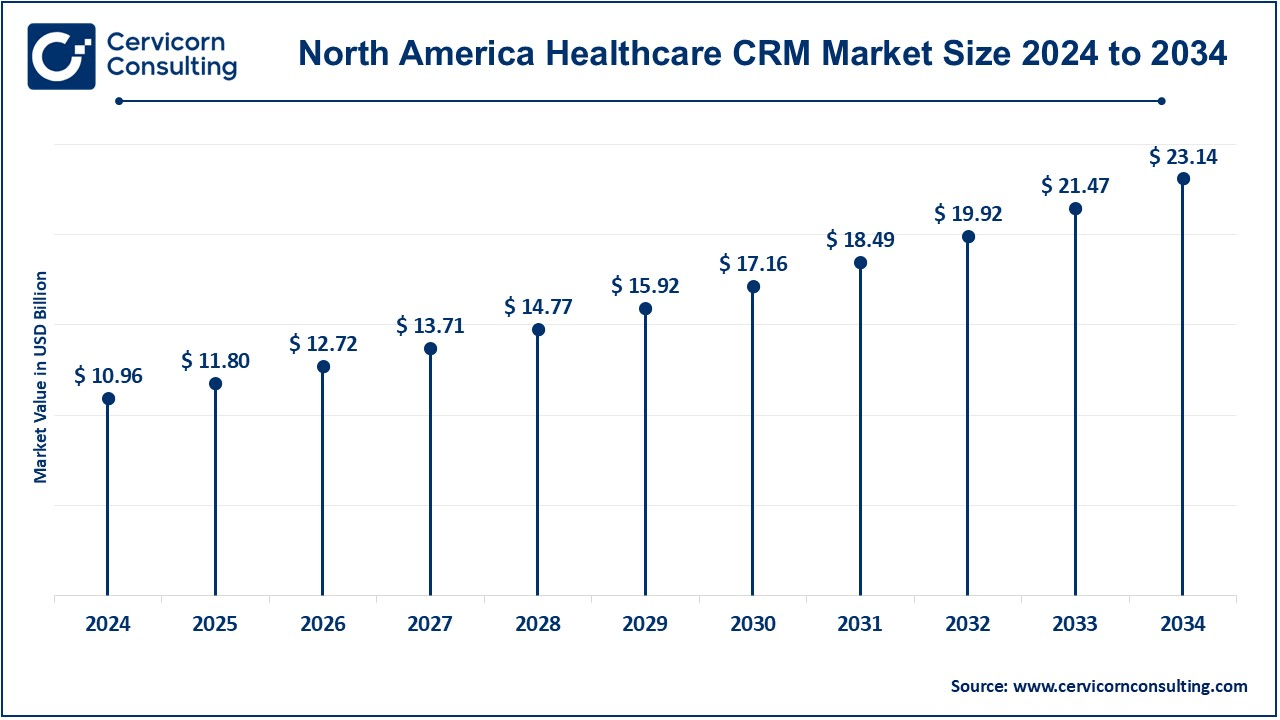

What factors are driving North America's dominance in the healthcare CRM market?

The North America healthcare CRM market size was reached at USD 19.22 billion in 2024 and is estimated to surpass around USD 40.59 billion by 2034. North America is a dominant market because there is a developed healthcare market, widespread adoption of digital health technology and a regulatory environment, which encourages the adoption of such technology. The United States and Canada have been pioneers in applying healthcare CRM systems, all of which are utilized to improve patient care, increase efficiency, and comply with HIPAA standards, etc. In the context of the above trends, the combined issue of declining health care cost and operations efficiency and the raised personalized care need is the reason that the health care CRM market in North America is expanding.

Europe healthcare CRM market is growing

The Europe healthcare CRM market size was reached at USD 19.22 billion in 2024 and is estimated to surpass around USD 40.59 billion by 2034. Europe market is growing as healthcare facilities become, in an increasingly important way, to focus on patient engagement, workflow efficiency, and care delivery. Data privacy legislation in Europe (e.g., GDPR) has become focused on the safe custody of patient information and this leads to a strong integration of CRM applications, which are strong from a security perspective. It is being put into practice in the European territory in order to deal with the geriatric population and prevalence of comorbidities of chronic diseases, for instance, in Germany, the United Kingdom (UK) and France.

Why is Asia-Pacific expanding very rapidly in the healthcare CRM market?

The Asia-Pacific healthcare CRM market size was reached at USD 19.22 billion in 2024 and is estimated to surpass around USD 40.59 billion by 2034. The Asia-pacific market is expanding very rapidly, driven by factors of rising healthcare expenditure, rising expectations of patients, and digitalization in the area. In China, India, and Japan, CRMs are being used to optimize patient care, streamline workflows, and extend service territory. The density and richness of the local population as well as the growing use of telemedicine and mobile apps provide significant opportunities for CRM providers.

LAMEA Healthcare CRM Market Trends

The LAMEA healthcare CRM market size was reached at USD 19.22 billion in 2024 and is estimated to surpass around USD 40.59 billion by 2034. The LAMEA market is modest yet is expanding at a slow, deliberate rate, because healthcare providers and payers in the LAMEA markets are now recognizing the utility of digital change. Across Brazil, Mexico, UAE and South Africa and the adoption of CRM tools continues to rise to enhance the engagement of patients, streamline operations and to provide a proper handling of health information. The area is suffering from shortage of health care infrastructure and legislation, but the sociopolitical pressure exerted by the government in terms of health care access and affordability is the driving force behind the CRM system implementation.

Healthcare CRM Market Top Companies

Recent Developments

- In 2023, Salesforce introduced 'Life Sciences Cloud,' which is a software-as-a-service (SaaS) CRM-arm specifically for medical technology in pharmaceutical sectors. The platform would ensure quick drug and device development while minimizing recruitment and retention costs in human clinical trials. This will also involve leveraging AI to create an unmatched user experience through access to unique product customization services.

- In 2023, Salesforce announced developing cloud space technology for healthcare as part of its closed-for-HIPAA-sort-of Commerce Cloud. You save customer service costs by being able to trade against them and take out point solutions. When coupled with the Data Cloud, Salesforce's consumer data platform really allows for customized experiences across all channels because having an omni-view of each patient and doctor in a centralized, real-time tight snapshot is unparalleled - anytime they interact with an online asset.

Market Segmentation

By Component

By Deployment

- Cloud/Web-based Model

- On-premise Model

By Functionality

- Customer Service and Support

- Digital Commerce

- Cross-CRM

- Sales

- Marketing

By End-Use

- Healthcare Payers

- Healthcare Providers

- Life Sciences Industry

By Region

- North America

- APAC

- Europe

- LAMEA

...

...