Healthcare Revenue Cycle Management Market Size and Growth 2025 to 2034

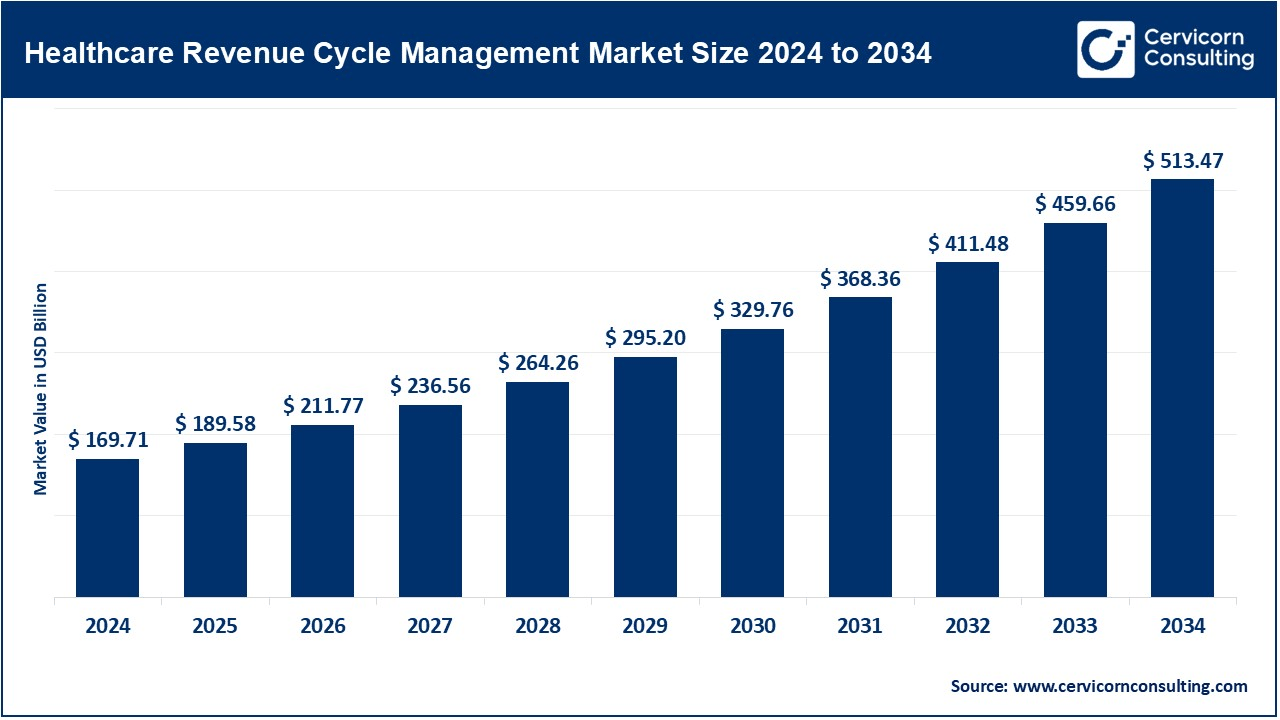

The global healthcare revenue cycle management market size was valued at USD 169.71 billion in 2024 and is growing to approximately USD 513.47 billion by 2034, with a developing compound annual growth rate (CAGR) of 11.70% over the forecast period 2025 to 2034. The need for revenue cycle management solutions in billing and reimbursement processes is very high, and this situation has almost tipped the balance for healthcare revenue cycle management. Healthcare costs, varied billing complexities, and compliance issues are driving providers to take up RCM solutions. The same pressure is also for revenue optimization solutions due to the need for very high performance that has been triggered by the sharp growth in patient data volumes along with the evolution toward value-based care models. Another reason for this increase is the infusion of artificial intelligence and automation into the RCM space, improving administrative efficiencies while easing the error burden for billing and payment processes. Cloud-based RCM solutions have become prominent in their adoption because of their scalability, low cost, and accessibility. RCM is gaining prominence in its adoption across all sectors, including hospitals, clinics, and physician practices, owing to the focus on operational efficiencies as well as financial performance.

RCM actually stands for revenue cycle management within the healthcare context. It is basically managing the revenue or managing the flow of revenues in a healthcare facility-from registration of the patient all the way to the final payment. It covers billing, coding and claims management, verification of insurance, and management of accounts receivable for the right reimbursement of the services provided by the facility. Right now, the RCM industry is witnessing growth due to various factors, such as soaring costs of healthcare, increased mandatory compliance requirements, and the need for efficient collection. Implementation of IT-enabled applications particularly oriented towards cloud computing and artificial intelligence is also facilitating the process and reducing chances of human errors.

- Advanced adoption of RCM tools is fostered by individual growth in per capita spending, greater utilization of health services, and rising healthcare prices charged for a majority of inpatient services. In light of its rising costs and increasing complexities, the efficient payment and management of claims, billing, and reimbursements are critical business drivers behind the adoption and growth of healthcare RCM technologies.

Healthcare Revenue Cycle Management Report Highlights

- The U.S. healthcare RCM market size was estimated at USD 69.11 billion in 2024 and is forecasted to reach around USD 209.11 billion by 2034.

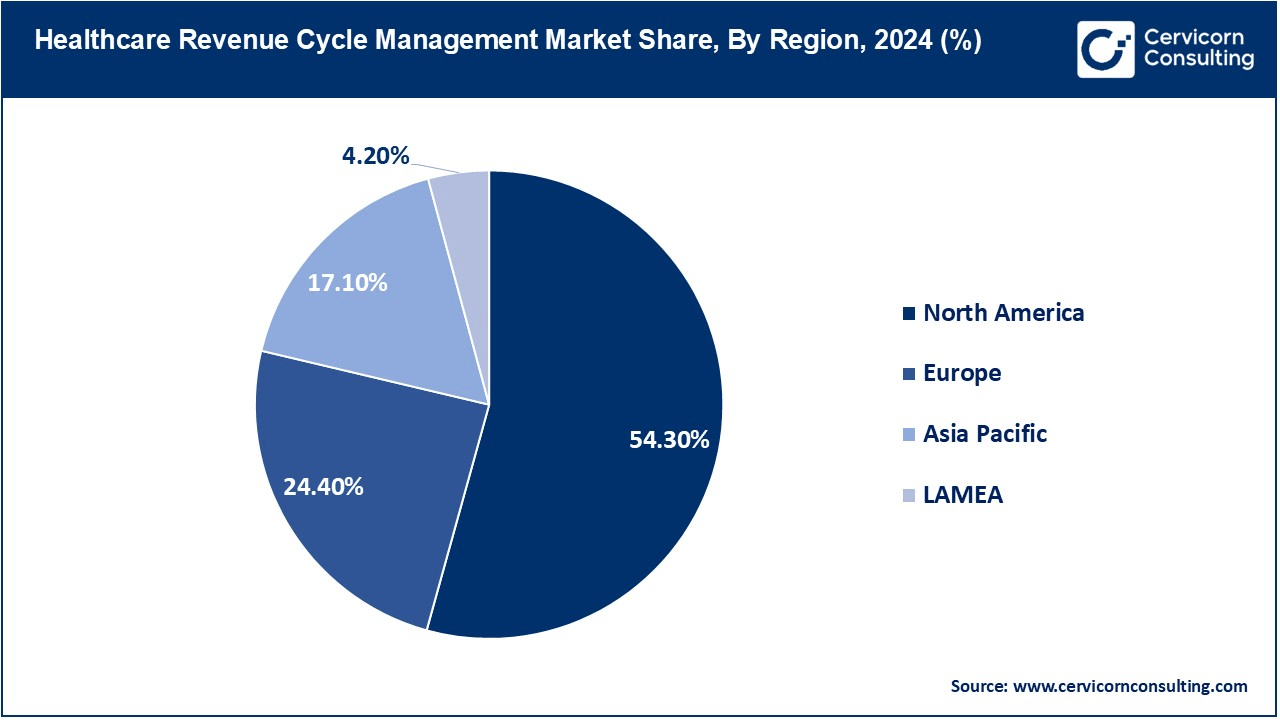

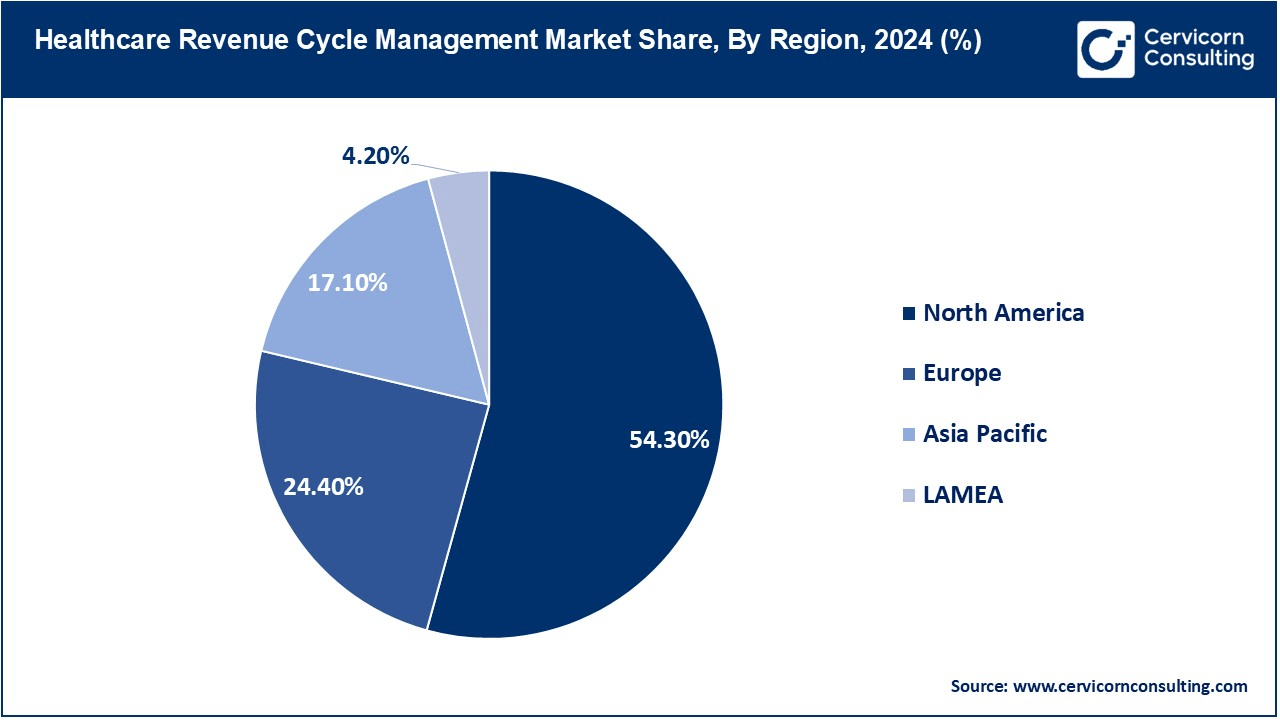

- The North America has accounted highest revenue share of around 54.30% in 2024.

- The Europe has captured revenue share of around 24.40% in 2024.

- By product type, the integrated segment has held revenue share of 71.20% in 2024.

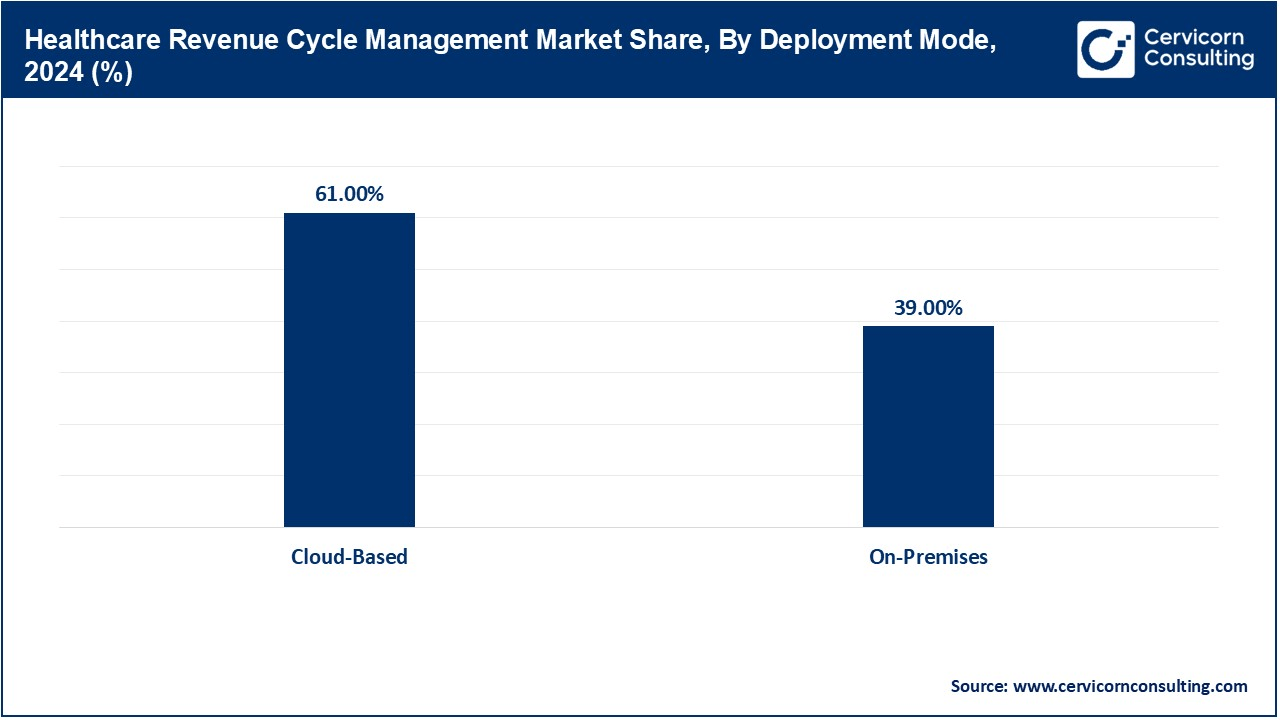

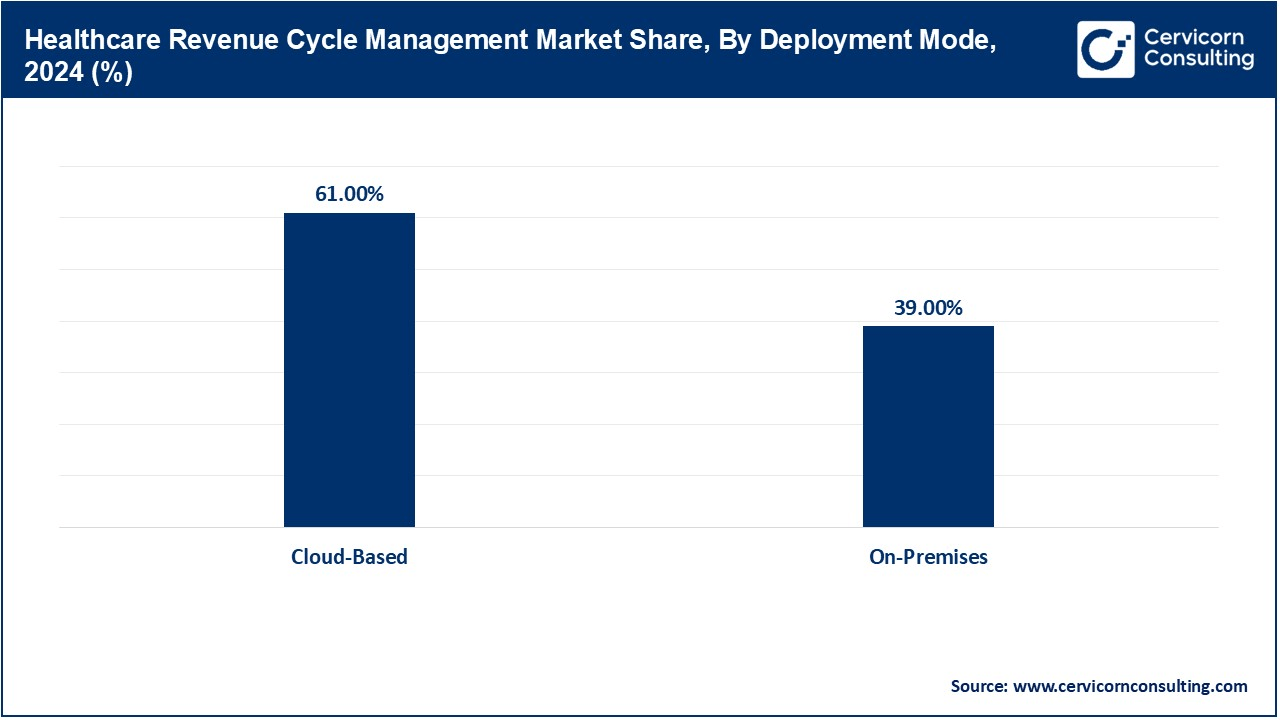

- By deployment mode, the cloud-based segment has accounted revenue share of 61% in 2024.

- By end user, the physician practices & clinics segment has reported revenue share of 41% in 2024.

- By function, the claims & denial management segment was largest revenue holder in 2024.

Healthcare Revenue Cycle Management Market Growth Factors

- The Rise in Healthcare Costs: An increase in healthcare costs in the world has caused hospitals and clinics to focus all the more on their financial management in their survival in a cost-prohibitive environment. Revenue cycle management (RCM) is meant to help healthcare providers have accurate billing and cash flows, and those patients can be assured that they pay on time. The patient visits to hospitals for treatment have increased, and the hospitals have implemented these new and advanced RCM systems due to the high cost of treatment. Both governments and private health establishments are focusing efforts on optimizing financial efficiency toward automated billing and claims processing solutions. Continuous upward trends in cost behavior on health will indeed widen the scope of RCM and render financial management more efficient; in addition, it will continue to reduce the losses incurred by denied or delayed payments.

- Rapid increase in the adoption of digital technology: At present, there is a breakneck transformation into digital technology in the health sector. The support comes in terms of such information technologies as EHRs, artificial intelligence, and cloud platforms. RCM solutions highly digitalized will create efficiencies, automate claims processing, and enhance billing accuracy overall. Payment trend predictions and pre-submission analysis of claim errors could be accomplished along with AI analytics, thus reducing costs further. That element will also allow the optimization of resources through cost savings. It can be noted that, with this trend in healthcare favoring digital transformation, AI-based and cloud-enabled RCM solutions will continue to find greater traction across the healthcare spectrum as financial improvements follow.

- Increasing Demand for Automated Billing and Claims Processing: Conventional processing will always have errors as part of it integrated with systems; these automatic denials of claims and pension losses are common with every processing of such an event. Automation inherent in RCM solutions enables improved accuracy in processing reduced time taken for claims, and thereby ensuring the maximum of how they fall in improving budgets and upholding changing codes in medicine and insurance. Such automation will cause administrative relief that will eventually lift off the shoulders of care providers regarding their administrative costs. Further investigations into AI and machine learning for better billing practices will reveal patterns of claims rejections and solutions to correct those problems. The demand for automated RCM solutions will continue to roar as providers turn to seek efficiency and accuracy in their financial management, which is a plus for revenue collection and a reduction of operational costs.

- Expansion Telehealth Services: On the other hand, the remote services used through telehealth have continued driving demand for more sophisticated RCM systems. Such new billing solutions are required to serve digital transactions and reimbursement from virtual consultations and online prescriptions for remote patient monitoring. Remote clinical consultation billing involves very complex coding and claims processing requirements with the insurance company, increasing the necessity of automation in processing to ensure both accuracy and efficiency. Cloud RCM solutions have been integrated into the payment process of telehealth providers to facilitate the advancement and reduction of claim denials. Long-term perspectives show that as telehealth progresses, the all-in-one RCM solutions will be increasingly used as well to simplify operations for digital health providers and guarantee better encounters in patient payment experience.

Healthcare Revenue Cycle Management Market Trends

- Increased Cloud-based RCM Solutions: The cloud-based RCM solutions are a gaining trend because of the flexibility and cost savings, as well as online access to financial information. Using the RCM systems, healthcare providers would now be able to manage billing and claims at any location far from the provider site. Moreover, such a cloud solution would have automatic software updates to keep ahead with sudden changes in the regulation landscape. As such, advancements in safety in cloud technologies have found more trust in healthcare incorporating the same. Future innovations under the demand for digital healthcare are the enhancement of data analysis and cybersecurity, as well as interoperability with existing systems to streamline financial operations.

- Increasing Demand for Outsourced RCM Services: Outsourcing revenue cycle management by the providers is a significant way they seek to cut costs and build more efficiency in operations by taking up specialized companies to join for-outsourced RCM services for external handling of bill collections and coding. These outsourced RCM services would be well-tailored to address medical billing and coding, processing the claims while allowing hospitals and clinics to concentrate more on patient care. The benefits include reduced errors, faster reimbursements, and increased compliance and consistency with regulations. Outsourcing is also good for small and mid-sized healthcare establishments because they have limited staff and resources. The popularity of the third-party outsourced RCM service keeps on increasing as most providers strive to achieve cost-effective and technology-driven solutions for their practice. Future trends will reflect the availability of AI-powered outsourcing services and the possibility of more cloud-based solutions for remote financial management.

- The growing patient-centric billing- A Transformation in Billing in Healthcare: Bureaucratic entities are now slightly biased towards a more transparent billing system by patients. Quite expected, almost all patients desire very clear and easy-to-understand medical bills in advance, known as upfront cost estimates. Many hospitals and clinics have begun keeping 100% of their payment channels digital, a feature that allows patients to pay all kinds of bills over the Internet or via a mobile payment app. Automated reminders help reduce late payments as well. More commonly, there are personalized financial plans and flexible payment options. These are a few of the trends expected to show better patient satisfaction and decreased financial burden. Future development would essentially regard prediction-enhanced billing about cost estimation well ahead of time and enhance the whole experience of smooth payments now working directly with insurance providers.

- Predictive Analytics Adoption in RCM: Predictive analytics is of help to healthcare providers: they forecast the patient's payment behavior, identify financially risky situations, and improve cash flow. With these new data analysis tools, hospitals can learn to anticipate claim denials and make the best use of their revenue collection strategies. By observing earlier modes of payment patterns, a provider can also better assist patients in financial planning. Also, AI-powered analytical methods have it as part of their agenda to help reduce billing errors and detect fraud. The adoption of predictive analytics in RCM is driven by the booming use of "big data" in healthcare, and future innovations would incorporate real-time data analytics within billing systems for higher-quality decision-making in financial aspects and revenue optimization.

- Surge of RCM impacts Telehealth Services: The development of telehealth services has made the demand for specialized RCM solutions that could cater to virtual consultations, remote diagnosis, and prescription on the Internet all have to have sound billing systems. More and more healthcare providers are incorporating into their systems RCM design to make processes more effective for reimbursement and claims management when it comes to telehealth. The growth of telehealth pushes demand for automated solutions to deal with billing complexities and compliance issues. Cloud-based telehealth RCM architectures are proliferating, accommodating easy integration with electronic medical records. Future improvements will include AI-based coding and reimbursement optimizations for virtual healthcare services to ensure rapid and precise payments.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 189.58 Billion |

| Projected Market Size in 2034 |

USD 513.47 Billion |

| Expected CAGR 2025 to 2034 |

11.70% |

| Most Prominent Region |

North America |

| Quickest Growing Area |

Asia-Pacific |

| Key Segments |

Product Type, Deployment Mode, Function, End-User, Region |

| Key Companies |

AdvantEdge Healthcare, Allscripts Healthcare Solutions, Athenahealth, Change Healthcare, Conifer Health Solutions, eClinicalWorks, Epic Systems Corporation, Experian, GeBBS Healthcare Solutions, McKesson Corporation, Oracle Cerner, Optum, R1 RCM Inc., The SSI Group, Veradigm LLC |

Healthcare Revenue Cycle Management Market Dynamics

Market Drivers

Increased Demand for Operational Efficiency

- Adverse increases in operational costs and administrative issues being faced by healthcare providers mean that RCM solutions offer enhanced automation and efficiency in billing, coding, and claims release by minimizing manual errors. RCM systems thus operate in maximizing provider financial performance using increased revenue collection and shortened reimbursement cycles. In light of all these facts, there is a growing demand for RCM solutions to enhance financial management and streamline operations due to adapting healthcare organizations toward cost containment and service delivery.

Stricter Compliance with Regulations

- Healthcare providers have found themselves bound by complicated tax regulations like HIPAA and ICD-10. This has created an increased need for regulatory-compliant RCM solutions that would automatically capture changes in standards and thus reduce penalties that arise from billing errors. RCM systems are periodically updating their coding and billing rules to enhance the accuracy of claim submission and thus support compliance. The growth of RCM solutions in the healthcare industry is primarily dependent on compliance.

Market Restraints

High Investment Cost

- Perhaps it is one of the greatest hurdles keeping smaller healthcare providers and clinics from adopting RCM solution’s initial costs. The integrated solutions for RCM mean investment in software, hardware, and staff training. This aspect of cost becomes so extreme that small practices often choose manual billing instead of automatic billing practices. Hence, although these costs may save money in the long run, it is the initial investment that proves an obstacle to many healthcare providers in switching to an automated RCM process.

Concerns about sensitive patient information

- In the healthcare domain render the data security of RCM solutions a heavy basis for consideration. On-premises RCMs will provide a larger degree of control over data handling, but they would require extra investment to ensure data security. In contrast, the Cloud RCM is scalable and cost-effective and is considered an easier target for cyber-attacks or data breaches. Data privacy and security fears can act against RCM solutions concerning their adoption, particularly in highly regulated domains.

Market Opportunities

Adoption of Cloud-Based Solutions

- Cloud-based RCM solutions are very quickly increasing in the reputation of being an economic consideration, scalability, and accessibility. They further enhance the providers' ability to remotely access billing information, thus cutting overhead costs with greater operational flexibility. Thus, the cloud solution is very appealing for small-sized healthcare providers and clinics because it offers those clients the same advanced features as the on-premises system but at a much lower price. Cloud technology is on the rise and paves the way for immense market growth for mid-sized healthcare providers in emerging markets.

New telehealth applications

- An evident lock of revenue opportunities for RCM device vendors is created by the new telehealth applications of today. Thus, online consultations, remote patient monitoring, and online prescriptions for patients are creating niches for exclusive billing solutions to manage all digital transactions and reimbursements. Telehealth billing RCM software is capable of handling the exotic coding and insurance claims of remote healthcare. With this growth of telemedicine, RCM service requirements will still see an increased demand and, thereby, market growth.

Market Challenges

Integration with Existing Systems

- Integrating into existing healthcare systems such as electronic health records and practice management software causes complications and eats time. Healthcare organizations involved usually have a tough time ensuring their RCM systems can work with the existing infrastructure. When there is ineffective integration of the provider-RCM with other software, work processes are bound to be interrupted and rendered inefficient, thereby affecting revenue collection and operational outcomes. The seamless integration of RCM into multiple healthcare software remains a challenge for several healthcare providers.

Shortage of Skilled Workforce

- The dawn of automated RCM solutions requires qualified personnel with knowledge about billing and coding stipulations in healthcare, which seems to be lacking in the field cadre to manage or fine-tune these systems of great complexities. A few healthcare providers sometimes might have a shortage of workforce to run the RCM systems efficiently. Such a lack of hiring leads to operational inefficiencies in claims processing. Hence, this lack of skilled manpower obstructs the proliferation and beneficial use cases for RCM solutions.

Healthcare Revenue Cycle Management Market Segmental Analysis

Product Type Analysis

Integrated RCM Solutions: The integrated segment has dominated the market in 2024. In integrated RCM solutions, all revenue cycle functionalities are managed within one system. Large hospitals or healthcare organizations choose this solution as it ensures patient billing, insurance claims, or payment collections. Reduces errors, improves cash flow, and also complies with regulations. Rising efficiency demand drives growth for integrated solutions, and the market gets bigger because of the smooth management of funds and better patient data handling. Currently, providing services with these features is left to big providers with AI-powered features incorporated to automate processes, leaving the health workforce with less input. Now, this section will continue expanding with increasing adaptation of digital healthcare systems.

Healthcare Revenue Cycle Management Market Revenue Share, By Product Type, 2024 (%)

| Product Type |

Revenue Share, 2024 (%) |

| Integrated |

71.20% |

| Standalone |

28.80% |

Standalone RCM Solutions: Standalone RCM solutions cater to specific requirements such as claims processing, billing, or coding. These kinds of solutions are much favored by small clinics and private physician practices because they can have a solution customized according to their need. Standalone solutions, unlike integrated systems, require many software tools to manage the whole revenue cycle, which can be a cause of complexity. However, they give flexibility and lower costs, which are best suited for providers having limitations when it comes to budgets. This market segment is growing because of the adoption of specific solutions by many organizations in the health sector, trying to become efficient. Future innovation is going to be all about automation, interoperability, and stipulation regarding new healthcare rules.

Deployment Mode Analysis

Cloud-Based Solutions: The cloud-based segment has dominated the market in 2024. Cloud-based emerging RCM solutions are being massively adopted, thanks to their affordability alongside other advantages such as scalability and remote access. Removal of infrastructural heavy loads remarkably cuts down costs that may have been drawn from the health care agenda of a provider. The requirement of these useful cloud-based systems has been seen and preferred by small and mid-sized hospitals because they keep themselves up to date without losing the ownership and custodian of the data under security and easy integration with electronic health records (EHRs). The adoption of cloud infrastructure has accelerated under COVID-19 through remote working modalities. Major vendors are emphasizing developing cybersecurity and artificial intelligence in optimizing financial operations. Cloud-based RCM solutions are bound to become market leaders because they offer greater efficiencies in financial outcomes alongside transforming the world of the digital health domain.

On-Premises Solutions: On-premise RCM solutions account for complete control over the management and security of the data. Therefore, large hospitals or health systems are keen on investing in these systems to ensure compliance and the integrity of sensitive patient information. Unlike cloud systems, on-premise RCM necessitates a dedicated IT staff with a budget for maintenance and appropriate upgrades; thus, while it does afford better security, the high setup and operational costs act as barriers for smaller health providers. The market for these on-premise solutions is quite steady; however, the growth is slow since organizations are now shifting to the cloud model. Future advances will focus on hybrid solutions that harmonize benefits into both deployment strategies while vastly upholding security and compliance standards.

End User Analysis

Hospitals: RCM market share is mostly represented by hospitals because it has the highest volume of patients and, subsequently, a complex structure of billing. An appropriate revenue cycle management system is, therefore, the key to preventing revenue losses and ensuring smooth operations in a hospital. Advanced RCM processes implemented in hospitals help reduce denials of claims, improve collections from patients throughput, and allow better cash flow. AI innovations in billing are being implemented by such hospitals to cut down the administrative workload. Compliance with regulations forms the other motivation for such systems to be automated. The entire RCM will gain more and more acceptance due to digitizing financials in hospitals because it will lead to the efficiency of the revenue cycle, thus improving the overall healthcare delivery.

Physician Practices & Clinics: The physician practices & clinics segment has dominated the market in 2024. Physician practices and clinics are also adopting RCM solutions as such solutions aim to manage their finances effectively. Unlike hospitals, these deal with fewer volumes of patients but would like some sort of smoothing for both billing and claims management. Patient Services prefer their cloud-based RCM solutions very much as they cost less and are easy to use. These systems help speed up reimbursement, minimize manual mistakes, and ensure compliance with healthcare regulations. Builds more pressure on physicians to get back to taking care of their patients instead of spending hours at a desk doing paperwork, so automated billing solutions have had demand surging. This segment will see increased RCM penetration in the years to come as practices will be seeking improved financial solutions for less expense.

Ambulatory Surgical Centers (ASCs): Ambulatory Surgical Centers are growing at a very high rate because of the trend toward outpatient procedures. ASCs need RCM solutions that are very efficient in inpatient billing, insurance verification, and compliance management. ASCs generally operate at lower overhead costs than hospitals and still require fairly complex and accurate revenue cycle management so that they can make money. The market is changing towards more automation, which allows more precise work for the reduction of claim rejections. Cloud-based RCM solutions apply to this segment because they are cheaper and more flexible. Because outpatients are the preferred patients for surgical procedures, ASCs will continue to invest in RCM technologies that optimize financial operations.

Healthcare Revenue Cycle Management Market Regional Analysis

The healthcare revenue cycle management market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

What makes North America the leader in the healthcare RCM market?

The North America healthcare revenue cycle management market size was valued at USD 92.15 billion in 2024 and is expected to reach around USD 278.81 billion by 2034. The North American market for RCM solutions in healthcare can, in effect, be touted to be the fulcrum or largest worldwide for its advanced healthcare infrastructure, regulatory requirements, and the embedding of digital solutions. In such a condition, the market in the U.S. seems monopolized, and the impact of the system of insurance claims is very complex, calling for a very efficient billing system. Laws to protect healthcare information, such as HIPAA, have made the enforcement of secure and automated financial systems among healthcare providers mandatory. Cloud RCM adoption is enjoying unprecedented growth, with hospitals and clinics shifting toward cost-effective solutions. Also, the rise of AI and machine learning is counterbalancing the increasing development in the RCM market. Financial optimization and automation are inarguably the most critical requirements to sustain any RCM in the North American space.

Why is Europe hit progressive growth in the healthcare RCM market?

The Europe healthcare revenue cycle management market size was estimated at USD 41.41 billion in 2024 and is projected to hit around USD 125.29 billion by 2034. The Europe is walking along a path of progressive growth, thanks to increasing investments into healthcare IT systems and imposing regulations. Digital healthcare, particularly, has been aggrandized mostly in Germany, the U.K., and France. However, reimbursement challenges make revenue cycle management of utmost importance among healthcare providers in Europe. The government's intervention to further spur their digital transformation gives further impetus to growth. As a result of data security regulations such as GDPR, the spread of cloud RCM solutions is gaining speed. AI-powered automation is expected to attract more and more healthcare providers toward cloud-based financial management systems, thus exponentially spurring the European market. Also, interoperability and seamless integration with existing health systems will be the common trend in the future.

What factors are contributing to the rapid growth of the healthcare RCM market in the Asia-Pacific?

The Asia-Pacific healthcare revenue cycle management market size was reached at USD 29.02 billion in 2024 and is predicted to surpass around USD 87.80 billion by 2034. Asia-Pacific is a region with rapid growth, propelled by increasing healthcare spending, digital transformation, and government initiatives. China, India, and Japan are adopting state-of-the-art billing solutions that provide maximum operating efficiency to healthcare delivery. The demand for cloud RCM is growing, especially among small and mid-sized healthcare service providers. However, some factors deter the market, like fragmentation of the healthcare infrastructure and varied regulations. With rapid urbanization and increasing medical tourism, the need for seamless financial management has gained prominence. Thus, the region has a plethora of opportunities for RCM providers, especially affordable, scalable, AI-supported solutions.

LAMEA Healthcare RCM Market Trends

The LAMEA healthcare revenue cycle management market was valued at USD 7.13 billion in 2024 and is anticipated to reach around USD 21.57 billion by 2034. The Latin America and the Middle East/Africa is getting a new dimension with the modernization of billing systems by healthcare providers. Digitally empowering factors, such as policy frameworks and foreign capital investments, have assumed great importance in spearheading digital transformation. The use of IT in healthcare in Latin America takes the lead with Brazil and Mexico. In the spirit of changing much more by international standards-the private side is catalyzing the whole period of transformation when it comes to the Middle East. Cloud RCM solutions present a value proposition that is just too tempting for cash management by hospitals and clinics. AI and automation have been around for the longest time and are expected to initiate spurts in growth in this area, although the penetration levels are lower compared with North America and Europe.

Healthcare Revenue Cycle Management Market Top Companies

CEO Statements

Kyle Fetter, Chief Operating Officer, XiFin

- "The future of RCM lies in harnessing advanced technologies like AI and machine learning to streamline operations and improve financial outcomes. At XiFin, we are committed to delivering solutions that not only address the complexities of payor policies and regulatory compliance but also enhance patient engagement and operational efficiency. Our focus on API-driven connectivity and automation ensures that our clients can navigate the evolving healthcare landscape with confidence."

Tina Vatanka Murphy, CEO & President, GHX

- "2025 is a pivotal year for healthcare, and the supply chain is at the heart of this transformation. By leveraging AI-powered technologies and enhancing data visibility, we can automate processes, deliver predictive insights, and empower strategic decision-making. At GHX, we are rethinking supply chain strategies to build resilience and efficiency, ensuring that healthcare providers can deliver uninterrupted care even in the face of disruptions."

Ryan Chapin, Executive Director of Strategic Solutions, AGS Health

- "The RCM landscape is becoming increasingly complex, with rising denial rates and cybersecurity threats. At AGS Health, we are embracing AI and automation to mitigate these challenges. By deploying predictive analytics and ambient technologies, we aim to reduce administrative burdens, improve patient satisfaction, and ensure financial sustainability for our clients."

Recent Developments

- In May 2023, Aspirion acquired FIRM Revenue Cycle Management Services Inc. for approximately $650 million to strengthen its position in addressing financial challenges in the U.S. healthcare system. The acquisition aimed to enhance service capabilities, particularly in complex billing and reimbursement processes, enabling better financial management for healthcare organizations.

- In September 2022, AGS Health LLC launched the AGS AI Platform, which integrates automation, AI, and human-in-the-loop services to optimize revenue cycle operations. The platform uses predictive analytics to reduce revenue leakage and improve visibility into financial data, streamlining billing and claims processes for healthcare providers.

- In June 2022, Olive introduced the Autonomous Revenue Cycle (ARC) Management Suite, utilizing AI to automate administrative tasks like billing and claims follow-up. This suite aims to enhance revenue cycle efficiency, reduce errors, and lower operational costs by automating routine processes, leading to better financial outcomes for healthcare organizations.

- In October 2021, Health Prime and AdvantEdge Healthcare Solutions formed a strategic partnership to combine practice management and RCM solutions. This collaboration aimed to provide a comprehensive offering that streamlines operations, improves billing accuracy, and enhances overall financial performance for healthcare providers.

Market Segmentation

By Product Type

By Deployment Mode

By Function

- Claims & Denial Management

- Medical Coding & Billing

- Eligibility Verification

- Payment Remittance

- Others

By End-User

- Hospitals

- Physician Practices & Clinics

- Ambulatory Surgical Centers (ASCs)

By Region

- North America

- Europe

- APAC

- LAMEA

...

...