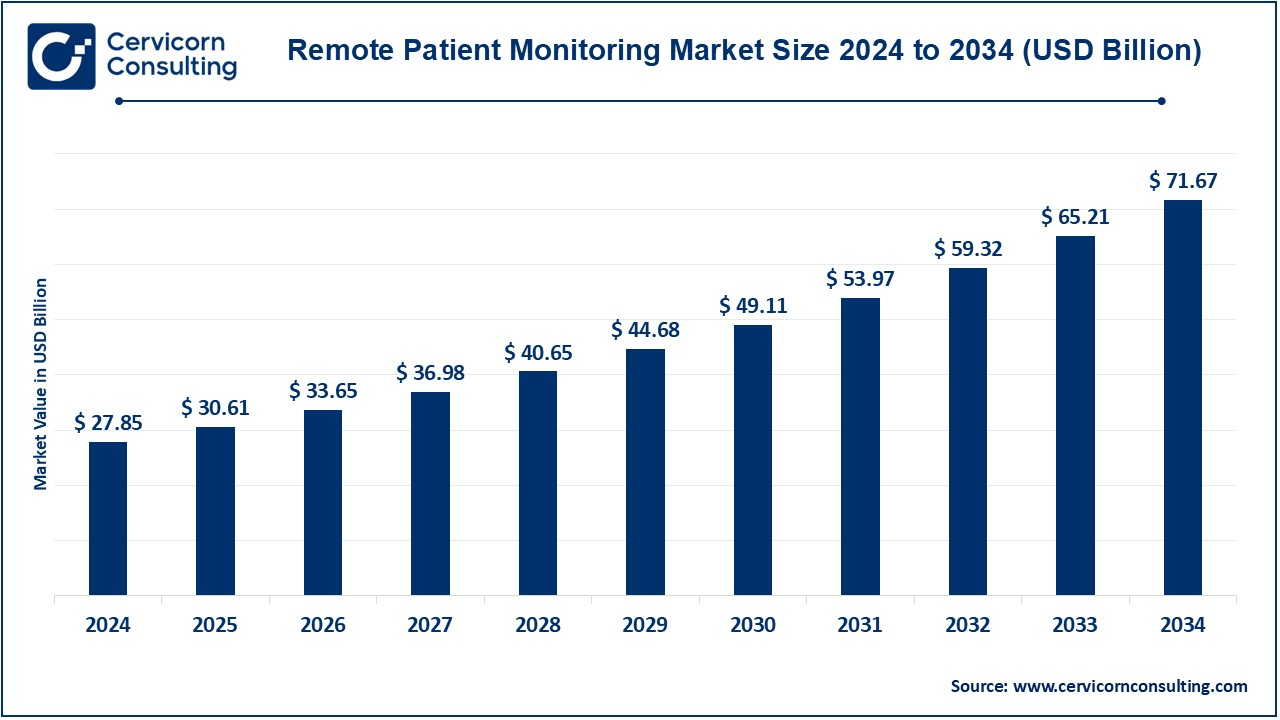

The global remote patient monitoring market size was valued at USD 27.85 billion in 2024 and is estimated to hit around USD 71.67 billion by 2034. It is growing at a compound annual growth rate (CAGR) of 9.91% during the forecast period 2025 to 2034. The remote patient monitoring market is expected to grow as there has been a surge in chronic diseases cases along with shortage of the healthcare professional.

The RPM market is expected to grow during the forecast period owing to the advanced digital health technologies along with rising incidences of the chronic diseases an d the demand for the tele-health solutions. The RPM has enabled the healthcare providers to collect the real-time information on the vital signs and health measures for improving patient results along with the reducing the need for the hospital visits and healthcare costs. Some of the factors that encourage the growth of the RPM market include the adoption of artificial intelligence (AI) in the patient monitoring process, incorporation of the wearable health devices, and growing adoption of IoT in healthcare. Increased aging population along with government initiatives to promote telemedicine is further invigorating the market for RPM solutions.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 30.61 Billion |

| Expected Market Size in 2034 | USD 71.67 Billion |

| Projected CAGR 2025 to 2034 | 9.91% |

| Benchmark Region | North America |

| Leading Growth Region | Asia-Pacific |

| Key Segments | Product, Application, End User |

| Key Companies | Abbott, American Telecare, Biotronik, Boston Scientific Corporation, CareValidate, Dräger Medical, F. Hoffmann-La Roche Ltd, GE Healthcare, Honeywell, Johnson & Johnson, Koninklijke Philips N.V., LifeWatch, Masimo, Medtronic, Nihon Kohden Corporation, Omron Corporation, OSI Systems, Inc., Shenzhen Mindray Bio-Medical Electronics Co., Ltd, Smiths Medical, Vitls, Inc, Welch Allyn |

Increasing Investments and Partnerships in RPM

Impact of the Pandemic-COVID

High Initial Costs & Infrastructure Requirement

Data Privacy & Security Concerns

Emerging Markets & Untapped Regions

Integration with Smart Homes & AI-driven Healthcare

Limited Awareness & Adoption in Developing Regions

Regulatory & Compliance Challenges

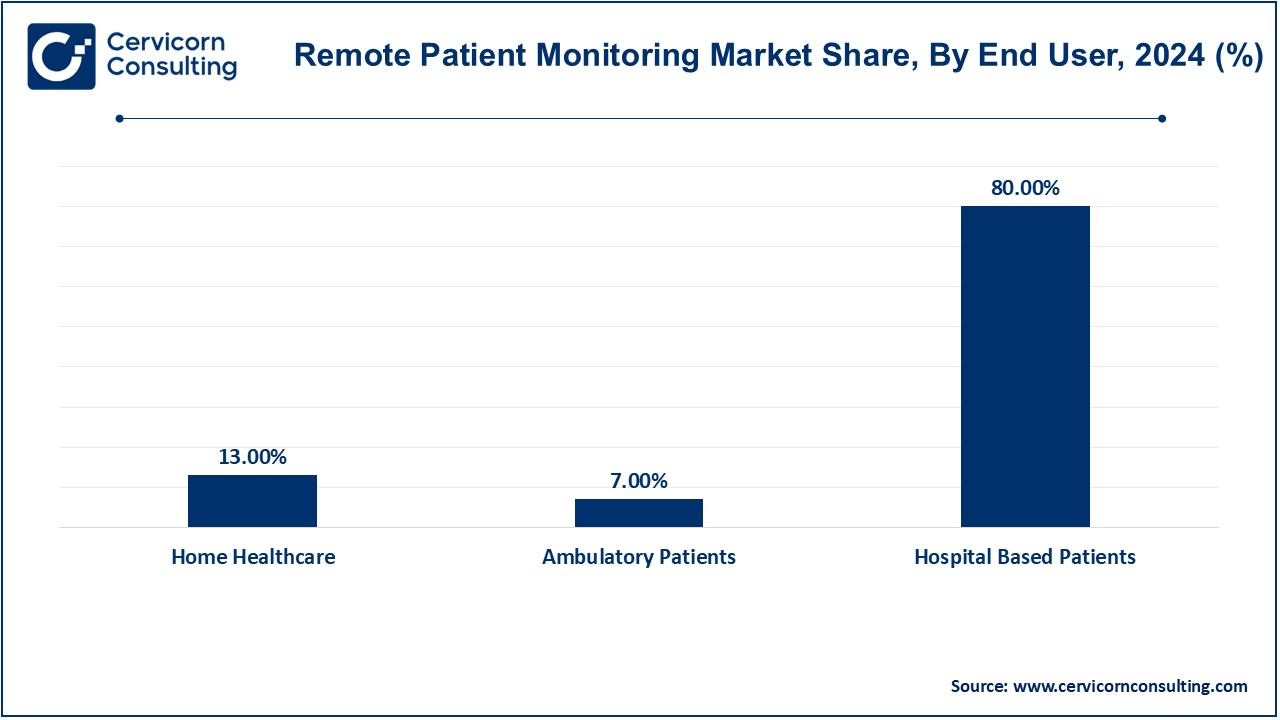

The remote patient monitoring market is segmented into product, application, end user and region. Based on product, the market is classified into vital sign monitors and special monitors. Based on application, the hypertension, dehydration, virus, infections, bronchitis, weight management and fitness monitoring, sleep disorder, diabetes, cardiovascular diseases, cancer and others. Based on end user, the market is classified into home healthcare, ambulatory patients and hospital based patients.

Vital Sign Monitors: These monitors of important signals are the skeleton of the RPM market; continuous check-up of these very important health parameters of heart rate, blood pressure, oxygen saturation (SpO2), respiratory rate, and body temperature. Some pulse oximeter, digital blood pressure monitors, or electronic thermometers continuously collect and transmit data to healthcare providers. It has an important role in the remote assessment, chronic care, postoperative care and elderly monitoring for reducing the hospital visits and allows early intervention.

Remote Patient Monitoring Market Share, By Product, 2024 (%)

| Product | Revenue Share, 2024 (%) |

| Vital Sign Monitors | 18.06% |

| Special Monitors | 81.94% |

Special Monitors: A special monitor is a device designed exclusively for disease-specific monitoring. Such monitor comes with solutions targeted in the RPM market, which includes glucose monitor for diabetes, ECG monitor for cardiac patients, apnea monitors for respiratory conditions, and fetal monitors for pre-natal care. The health data continuously collected by special monitors enable early complications and individual treatment modification. Some of these devices have been advanced with wireless command and AI analytics for better remote diagnostics.

Cancer Monitoring: Remote Patient Monitoring (RPM) plays a very important role in cancer care through the continuous monitoring of patient vitals, psychotropic medication adherence and treatment adverse events. Many RPM devices monitor vital signs, including temperature, oxygen saturation, heart rate as well as being used for the establishment of early warning signs of complications like infection or vomiting due to chemotherapy. Wearable sensors and mobile health applications augment pain and fatigability.

Cardiovascular Disease Monitoring: RPM is one of the key outcomes in the management of cardiovascular disease (CVD) because it records the participant's heart rate, blood pressure and electrocardiography (ECG). Early detection of arrhythmias, hypertension, and heart failure signs based on smart wearable devices and remote ECG monitors to avoid adverse cardiac events. Outpatients following cardiac intervention also need continuous surveillance to minimise readmissions as well as to enable rapid medical care. AI-based RPM solutions monitor real-time information and signal clinicians in such a way as to allow tailored therapeutic interventions.

Diabetes Management: RPM enhances diabetes control by the implementation of continuous glucose monitoring (CGM) and remote insulin titration. Through the combination of smart glucose meter and wearable CGM device, patients can continuously monitor blood glucose and upload this data to the doctor. Prediction of glucose excursions is made by artificial intelligence-based analyses with optimization of glycemic control which in turn minimizes the development of complications such as neuropathy and renal dysfunction.

Sleep Disorder Monitoring: Wearable sleep monitors and home-used polysomnography (PSG) based-RPM therapies for sleep-disorders, including obstructive sleep apnea and insomnia, consist. These monitors are capable of identifying sleep patterns, blood oxygen saturation, respiration rate and heart rate variability to identify sleep problems. Continuous data monitoring enables clinicians to tailor treatment, like continuous positive airway pressure therapy in the treatment of obstructive sleep apnea patients. This POC offers insights into both the fidelity of a person's quality of sleep, and a personalized sleep suggestion.

Weight Management & Fitness Monitoring: RPM applications for body weight control and fitness tracking provide users with the ability to track physical activity, energy intake, and body composition. Wearable devices (e.g., smart watches, fitness trackers) capture step counts, heart rate and metabolic activity which can drive adoption of healthy living behaviours. RPM systems integrate AI-driven coaching and personalized, adaptive recommendations in the areas of weight management, muscle hypertrophy, and general fitness improvement.

Bronchitis Monitoring: RPM is used in the airway management process by the monitoring of data regarding respiratory function (i.e., lung function, pO(2), respiration, etc. Wearable gas volume sensors and spirometers, smart inhalers, and so on, can reconstruct an overall condition, and multilayer flares can be identified and treatment efficacy can be determined. AI-based RPM platforms forecast trends of symptoms and tendency to symptom worsening and can therefore be deployed at an early stage in the process to avoid the escalation of emergency medical care. When chronic bronchitis or recurrent infections are present, patients may require continuous monitoring in order to obtain the best medication adherence and lifestyle changes.

Infection Monitoring: RPM plays a role in the spiral phase, early detection and treatment of infections based on continuous measurement of physiological parameters such as body temperature, heart rate and fractional inspired oxygen levels. Wearable biosensors measure patients with fever escalations, respiratory dysfunction or physiological dysregulation, and enable the timely response of their physicians to intervene. AI-based analytics assesses pattern of symptoms and risk to avoid complications in immunocompromised.

Virus Monitoring: RPM solutions are a major contributor to the viral pathogen detection, including influenza, COVID-19, and other infectious diseases. Wearable devices and smart thermometers take laboratory measurement of fever, oxygen tension, and respiratory rate and their application can be utilized towards early detection and early interventions. Telehealth embedding allows health care providers to monitor patients at a distance which reduces avoidable admissions and the chances of viral transmission. Analytic based on AI can be exploited to predict outbreaks and to estimate disease severity.

Dehydration Monitoring: RPM enables not only dehydration detection and management, but also hydration, heart rate, blood pressure, and temperature monitoring. Sensors for hydration, smart bottles, and bioimpedance analysis devices, all record fluid balance and electrolyte levels. AI driven data assists to provide recommendations of personalised hydration according to the old people, athletes, chronic medical conditions subjects. The early detection of dehydration can prevent the development of complicating conditions including heatstroke, renal failure, and electrolyte unbalance.

Hypertension Management: RPM plays an important role in the treatment of hypertension not only in monitoring the constant blood pressure by means of smart cuffs and wearables. Analytics based on artificial intelligence identify blood pressure variabilities and risk factors and generate patient-specific treatment plan. RPM solutions integrate features of medication adherence monitoring and lifestyle counselling, coaching patients to maintain optimal blood pressure. Telehealth monitoring has the potential to reduce the frequency of routine clinical visits and to provide clinicians with timely feedback with which to intervene in advance.

Hospital-Based Patients: RPM ensures improved patient care through the continuous monitoring of vital signs and other disease-specific parameters. RPM solutions provide for monitoring of post-surgical recovery, chronic condition management, and early complication detection with possible outcome improvements that decrease hospital-acquired infection and readmission risk. Integration of wearable devices and AI-driven analytics would equip hospitals with higher returns in outcomes relative to resource optimization. Seamless departmental sharing of data would make real-time clinical decision making possible for RPM.

Ambulatory Patient: Using RPM, ambulatory patients getting outpatient treatment or rehabilitation may enjoy keeping track of their health outside the clinical setting. For instance, RPM monitoring devices collect information on the most important health indicators, including heart rate, glucose measurements, and respiratory function, to allow physicians to monitor and adjust treatment plans remotely. This serves to streamline post-operative monitoring therapies for patients with chronic diseases or those requiring long-term interventions. By doing this, RPM eliminates a lot of the unnecessary need to conduct patients' travel to health care facilities, which results in convenience but also saves costs incurred from patients and health care providers.

Home Healthcare: Home health care is a major end-use segment of RPM, where patients receive medical attention while still at home. These patients would now have the ability to monitor chronic conditions, post-surgical recoveries, and elderly patients that require continuous monitoring. Wearable sensors and intelligent medical devices allow real-time data transfer to the health providers, thus enabling timely intervention. With this, better patient independence is achieved, and it also reduces hospital readmissions and decreases healthcare costs.

The remote patient monitoring market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

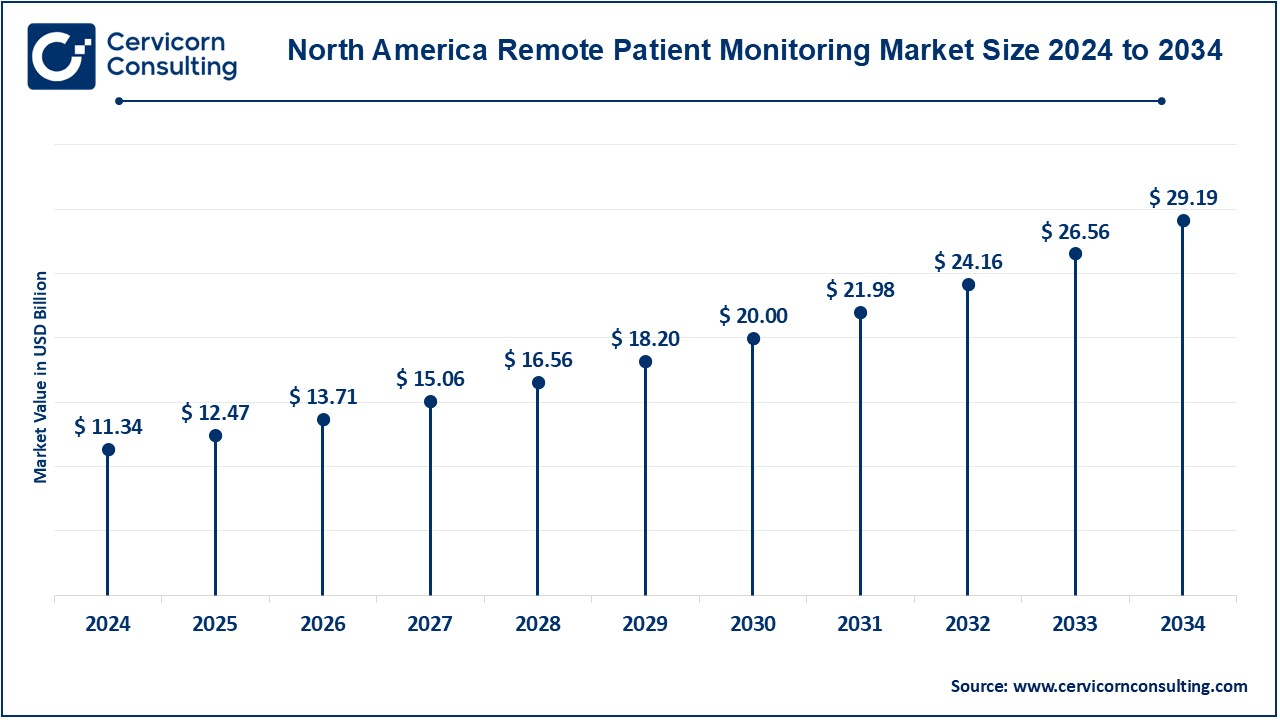

The North America remote patient monitoring market size was estimated at USD 11.34 billion in 2024 and is expected to reach around USD 29.19 billion by 2034. North America is the market leader for RPM market due to health facility expansion, explosion of telehealth adoption, and government push. The US is at the crossroads of highly favourable reimbursement legislation, Medicare billing codes for RPM services, and major funding of digital health technologies. Along with the market impact integration, the increasing number of chronic diseases and the increase of the elderly population create a greater and greater demand. RPM's proliferation is due to the proliferation of 5G networks, AI based medical care, and consumer market for wearable health monitoring devices.

The Europe remote patient monitoring market size was reached at USD 7.91 billion in 2024 and is projected to surpass around USD 20.36 billion by 2034. The European RPM market is expanding along the back of both public programs, trends in health care digitation and steadily rising morbidity of chronic diseases. Countries such as Germany, the UK, and France are making significant provision of telemedicine and remote monitoring solutions to improve patient situation and to decrease the burden of hospital overcrowding. Compelled by data security, interoperability, and the use of eHealth, the European Union has reignited the use of RPM through regulations.

The Asia-Pacific remote patient monitoring market size was accounted for USD 7.07 billion in 2024 and is forecasted to grow around USD 18.19 billion by 2034. The RPM market is expanding rapidly in the Asia-Pacific region, spurred by the adoption of smartphones, government support for digital health, and an expanding burden of chronic conditions. Following countries (China, India, Japan and South Korea) are buying telehealth and wearable health gadgets aimed at improving access to healthcare, especially where access is limited, in rural or underserved regions. The confluence of an expanding middle-class, rising health-care expenditure and advances in the area of AI and IoT are driving adoption. In spite of a high demand for home-based care (HBC) and growing concern about early prevention (EP), the Asia- Pacific RPM market is predicted to develop rapidly in the future.

Remote Patient Monitoring Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 40.73% |

| Europe | 28.41% |

| Asia Pacific | 25.38% |

| LAMEA | 5.48% |

The LAMEA remote patient monitoring market was valued at USD 1.53 billion in 2024 and is anticipated to reach around USD 3.93 billion by 2034. The LAMEA RPM market is a growing market as the market is aware of telehealth, health reform federal programs and internet service is improving. With RPMs, healthcare for remote areas is being introduced in Latin America, such as in Brazil and Mexico to better serve those living in these regions. Middle East led by the UAE and the Saudi Arabia is investing in digital health technologies to modernize health IT infrastructure. In Africa, programs for mobile health and health equity are leading the way to adoption of RPM. However, hurdles such as lack of healthcare facility and government regulation are still there.

Market Segmentation

By Product

By Application

By End User

By Region