Hybrid Train Market Size and Growth 2025 to 2034

The global hybrid train market size was valued at USD 21.89 billion in 2024 and is expected to be worth around USD 51.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.90% from 2025 to 2034.

The global hybrid train market is growing rapidly due to increasing government investments in green transportation and stricter emission norms. Countries like Germany, the UK, and Japan are leading in hybrid rail adoption, with projects focused on hydrogen and battery-electric trains. The rising demand for sustainable transport solutions is encouraging rail operators to replace traditional diesel trains with hybrid alternatives. Additionally, technological advancements in battery efficiency and hydrogen fuel cells are driving innovation in this sector. Leading manufacturers are collaborating with governments to introduce eco-friendly rail networks, boosting market expansion. Asia-Pacific and Europe dominate hybrid train adoption, while North America is catching up with investments in sustainable railway systems. With smart rail technologies and urban transit expansion, the hybrid train market is expected to witness strong growth in the coming years.

What is a Hybrid Train?

A hybrid train is a railway vehicle that uses two or more energy sources, typically combining diesel engines with electric batteries or hydrogen fuel cells. This dual-power system enhances efficiency by reducing fuel consumption and emissions while allowing trains to operate in non-electrified areas. Hybrid trains capture and store energy through regenerative braking, which converts kinetic energy into electricity, further improving performance. These trains are designed for environmental sustainability, lower operational costs, and better fuel efficiency than traditional diesel trains. Many countries are adopting hybrid trains to meet strict emission regulations and reduce their dependence on fossil fuels. Manufacturers like Alstom, Hitachi, and Siemens are actively developing hybrid train technologies, focusing on hydrogen-powered and battery-electric models.

Key insights beneficial to the hybrid train market:

- According to study, 40% fuel savings compared to traditional diesel trains.

- 30% reduction in carbon emissions, aligning with global climate goals.

- Government subsidies and policies in Europe and Asia promoting hybrid train adoption.

- Over 500 hybrid trains deployed worldwide as of 2023, with a growing pipeline for future projects.

- 15-20% increase in battery efficiency in the past five years, improving hybrid train performance.

- Major players like Alstom and Siemens investing heavily in hydrogen-based rail solutions.

Hybrid Train Market Report Highlights

- The Europe region has accounted highest revenue share of 52.70% in 2024.

- The Asia-Pacific region has generated revenue share of 21.40% in 2024.

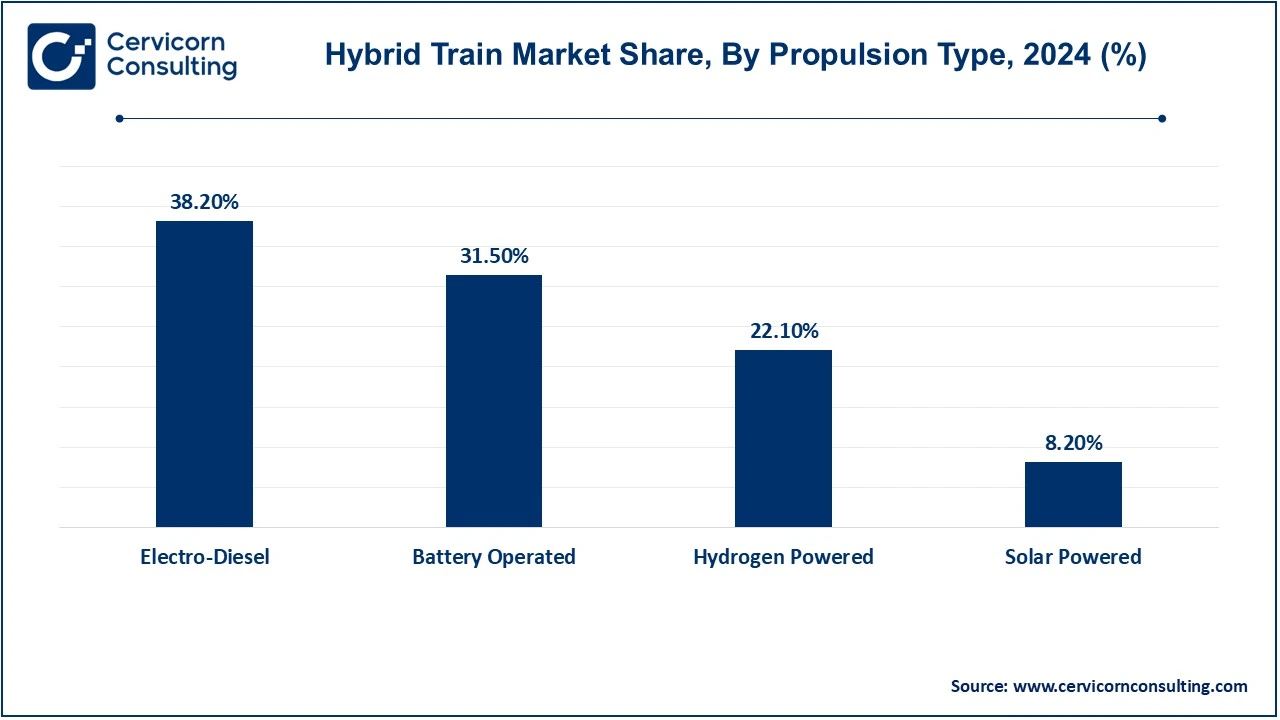

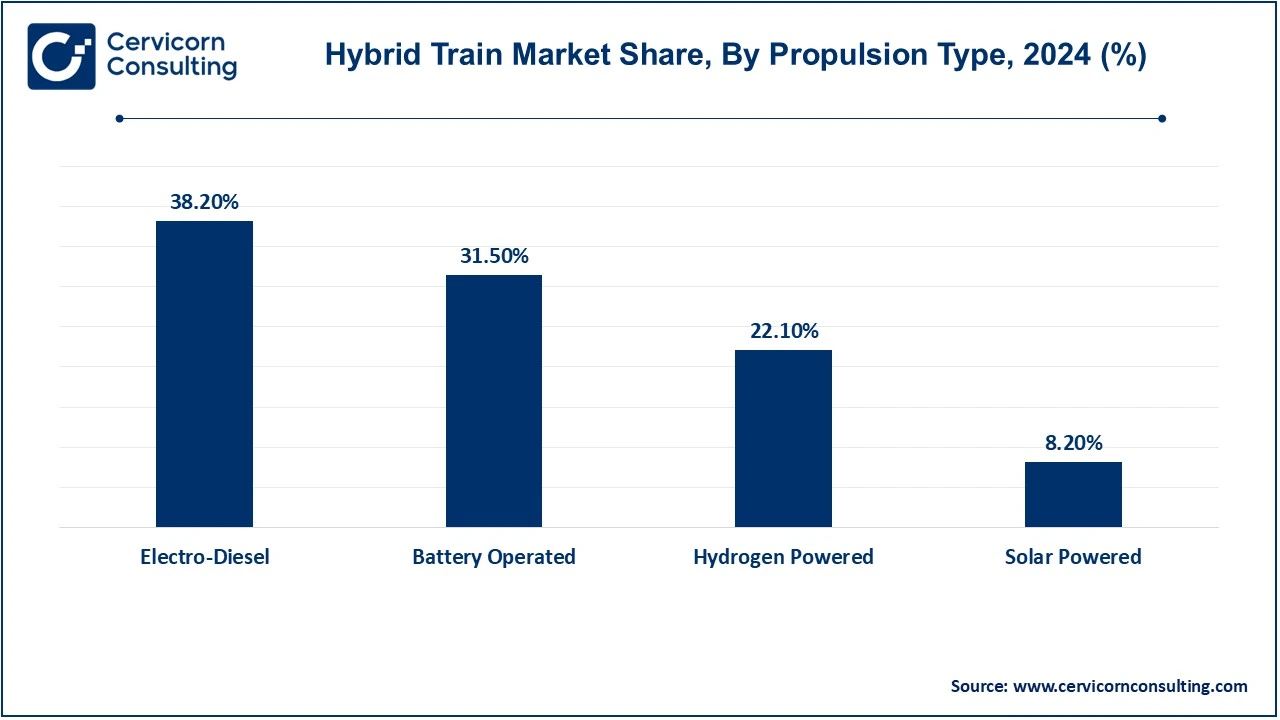

- By propulsion type, the electro-diesel segment has accounted revenue share of 38.20% in 2024.

- By application, the passenger segment has captured revenue share of 58% in 2024.

- By operating speed, the less than 100 km/h segment has garnered revenue share of 46% in 2024.

Hybrid Train Market Growth Factors

- Use of Hybrid Trains is Growing: High-speed rail and freight services are two other uses for hybrid trains in addition to transportation services. Hybrid locomotives are being used by freight firms more and more to satisfy carbon reduction goals and improve fuel economy. Such trains are now being created to facilitate long-distance travel that is quicker, cleaner, and more efficient. As more and more businesses see the advantages of reduced costs, lower consumption, and better outcomes, hybrid train sales are rising. Hybrid trains are even more popular since they may provide a variety of rail services.

- Depletion of Natural Resources and Fossil Fuels: The depletion of natural resources and fossil fuels that power the global economy, coupled with rising fuel prices, is driving the increasing demand for low-cost, environmentally friendly fuel alternatives. This is the main concern of governments of major countries in promoting technologies that can solve these persistent problems without affecting the current global economy. The growing popularity of hybrid train technology is due to its advantages such as use of clean energy as a power source and energy efficiency during operation. Rising fuel prices due to the scarcity of fossil fuels are expected to promote the growth of hybrid fuels as a better alternative to traditional traction fuels.

- Demand for Effective Locomotives: One of the main factors driving the need for cutting-edge hybrid fuel-based train technology is the growing demand for effective, emission-free locomotives. The market is anticipated to expand as a result of the growing demand for cutting-edge hybrid-fueled vehicles and the continuous collaborations between rail mobility companies and hybrid fuel developers to create these locomotives. For example, For instance, ZTR, a pioneer in locomotive control systems, and Union Pacific Railroad (UP) announced an agreement in October 2022. Development of hybrid electric locomotives for the UP plant in North Little Rock, Arkansas, is the goal of the agreement.

Hybrid Train Market Trends

- Growing Trend towards Sustainability: The hybrid train market is driven by environmental sustainability. Governments and regulators worldwide are setting strict emission limits to curb climate change and reduce air pollution. Since hybrid trains dramatically reduce carbon emissions compared to traditional diesel trains, they are seen as a key component of this approach. These trains use battery power in cities to reduce pollution and can run on non-electrified routes, which make up a significant portion of the world's rail networks. As manufacturers focus on developing more effective and environmentally friendly models, the hybrid train market is driven by the movement towards greener transportation options.

- Integration with Connected and Smart Technologies: Smart and connected technologies revolutionize the hybrid train market. Data analytics and sophisticated monitoring systems are being used in order to optimize transportation systems, increase energy efficiency, and improve the user experience. For example, predictive maintenance systems allow operators to keep an eye on the condition of hybrid trains in real time, prevent malfunctions and minimize downtime. In addition, smart energy technologies are enabling more effective use of gasoline and battery power. Due to these technological advancements, hybrid trains are becoming increasingly popular as they are more reliable, economical and user-friendly.

- Increased Market Investment: Regions are planning to invest more in energy generation to increase the performance and efficiency of their transport networks. As the transition progresses, these trains will become increasingly important. As hybrid trains are capable of running on both electrified and non-electrified lines, rail operators currently have reliable options for optimizing their routes without electrifying them entirely. Such versatility is especially useful in circumstances in which electrification is still in progress whereas some rail lines continue to function on diesel.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 23.84 Billion |

| Predicted Market Size in 2034 |

USD 51.36 Billion |

| CAGR 2025 to 2034 |

8.90% |

| Supreme Region |

Europe |

| Hot Growth Region |

Asia-Pacific |

| Key Segments |

Propulsion Type, Operating Speed, Application, Region |

| Key Companies |

Hitachi Rail, Hyundai Rotem, Mitsubishi Electric, Kawasaki Heavy Industries, Siemens Mobility, CRRC Corporation, Thales Group, Wabtec Corporation, Bombardier Transportation, Stadler Rail, Alstom Transport, Skoda Transportation, Vossloh, HybridTrain Innovations, GreenRail Technologies, AnsaldoBreda, Toshiba Infrastructure Systems, Ingeteam, EcoRail Innovations, Advanced Rail Systems, GreenTrack Solutions, Voith Turbo |

Hybrid Train Market Dynamics

Drivers

Government Incentive Programs and Initiatives

- The use of hybrid trains is being encouraged by foreign governments around the world by introducing incentives and funding initiatives. These programs offer tax exemptions, grants and subsidies to companies and rail operators that invest in hybrid technology. For example, the European Green Deal offers significant support for the development and deployment of hybrid trains with the aim of making rail transport more environmentally friendly. Government officials in Asia and the North American continent have also emphasized rail infrastructure enhancements based on hybrid technology. These incentives are making hybrid trains more attractive and advantageous option for operators, which is accelerating market development.

Expanding Public-Private Partnerships

- Governments are working with the business community to openly address the financial constraints and issues related to the manufacturing of hybrid trains. These partnerships make it easier to implement state-of-the-art train technologies and infrastructure. For example, in February 2023, Utah State University and the ASPIRE Engineering Research Centre announced a collaboration with Swiss rolling stock manufacturer Stadler Rail to develop and test a battery-powered passenger train called FLIRT. Additionally, public and private investment is increasingly being allocated to the development and modernization of railroads to support hybrid trains. This means installing recharge stations, electrified railroads, and other necessary infrastructure.

Restraints

Maintenance and Implementation Concerns

- Hybrid trains feature more complex and diversified propulsion systems than traditional trains, demanding more regular and specialist maintenance and evaluation. Hybrid trains require trustworthy and lasting propulsion components, as well as modern evaluation, vetting, management, and control methods that can detect and avoid any problems and breakdowns. Hybrid train software, when integrated with sensors, may be able to alert management or personnel to irregularities or engine concerns.

High Cost for Developing Hybrid Trains

- The high cost of research and development of hybrid train technologies as compared to conventional counterparts is expected to hamper the market growth. Hybrid trains are classified based on propulsion types such as hydrogen-powered, battery-powered, electro-diesel, gas-powered and others. Each fuel source requires a different infrastructure for its storage and hence incurs additional costs for building the infrastructure.

Opportunities

Technological Advances in Battery and Energy Storage Systems

- Innovations in lithium-ion batteries, solid-state batteries and other energy storage solutions are improving the performance, range and efficiency of hybrid trains. These advances enable longer periods of all-electric operation, reducing reliance on diesel engines. In addition, regenerative braking systems—which capture and store energy during braking—are proliferating. By using less fuel and requiring less maintenance, these strategies also increase the environmental efficiency of hybrid trains but also reduce operational costs.

Growing Research & Development

- Continuous R&D spending spurs innovation and pushes the boundaries of this technology. Research and development efforts are focused on improving battery performance, improving regenerative braking systems and developing new hybrid propulsion systems to meet evolving market demands for efficiency and sustainability.

Challenges

Infrastructure Challenges

- One of the main obstacles to the adoption of hybrid and hydrogen trains is the need to develop the necessary infrastructure. Strategic installation of hybrid train charging stations and hydrogen refuelling stations along the rail network is required to ensure smooth operations. This requires significant investment and collaboration between rail operators, governments and private stakeholders.

Adaptation to Climatic Changes

- A challenge for hybrid trains is adapting to different climatic conditions such as temperature, humidity, precipitation and altitude. These factors can affect the efficiency and durability of the propulsion components such as the diesel engine, electric motor and battery. To cope with these variations, hybrid trains must have climate-specific features such as cooling and heating systems, insulation and ventilation. For example, in cold climates, hybrid trains may need to have anti-freeze systems to prevent the diesel fuel from gelling or pre-heating systems to warm up the battery before operation.

Hybrid Train Market Segmental Analysis

The hybrid train market is segmented into propulsion type, operating speed, application and region. Based on propulsion type, the market is classified into electro-diesel, battery operated, hydrogen powered and solar powered. Based on operating speed, the market is classified into less than 100 km/h, 100 - 200 km/h and more than 200 km/h. Based on application, the market is classified into passenger and freight.

Propulsion Type Analysis

Electro-Diesel: The electro-diesel segment has dominated the market in 2024. A rise in the demand for diesel-electric locomotives owing to their advantages such as lower maintenance, high efficiency, ease of use, sustainability, reliability, and lower fuel consumption as compared to conventional locomotives is expected to drive the growth of the hybrid train market during the forecast period. Moreover, the diesel-electric locomotive is reliable for electrified and non-electrified trains. Hence, it is most commonly used in the railway industry for passenger and freight transportation.

Battery Operated: The rise in the demand for battery-powered hybrid trains from passenger and freight transportation is expected to boost the growth of the market during the forecast period. The growth of the global market is also largely due to a shift in user expectations towards electrified trains in support of dependable, effective, and advantageous rail transportation. Improved battery technologies like lithium-ion and nickel-cadmium can address the primary problems of hybrid locomotives, which are their power density and durability.

Hydrogen Powered: Hydrogen-powered hybrid trains use hydrogen fuel cells to generate electricity and emit water vapor as a byproduct. These trains are an attractive option for long-distance travel or areas with limited access to electricity.

Solar Powered: Solar-powered hybrid trains use photovoltaic (PV) panels installed on roofs or along the tracks to generate electricity for propulsion. This technology is still in the development stage and is mainly used in experimental projects or as a supplemental power source for existing train systems.

Operating Speed Analysis

Less than 100 km/h: This segment has held revenue share of 46% in 2024. The construction of hybrid trains for low-speed cargo transport at speeds below 100 km/h is common in cities as well as suburbs. Since these locomotives can reduce energy usage, noise pollution, as well as chemical emissions along with offering efficient transit options in congested areas, they are recommended.

101-200 km/h: The demand for the 101–200 km/h segment has grown as a result of the main market trend toward the use of these train locomotives for freight transportation. Alstom, for instance, has created an environmentally friendly, 120 km/h battery-operated shunting locomotive for freight transportation. This hybrid locomotive is powered by two batteries, Prima H3 and Prima H4, for a lightweight and zero-emission hybrid train.

Hybrid Train Market Revenue Share, By Operating Speed, 2024 (%)

| Operating Speed |

Revenue Share, 2024 (%) |

| Less than 100 km/h |

46% |

| 100 - 200 km/h |

29% |

| More than 200 km/h |

25% |

More than 201 km/h: The more than 201 km/h segment is growing due to the steady introduction of high-speed trains (HSR). Moreover, hybrid trains with existing diesel engines can reach speeds of over 200 km/h, which is a significant growth factor. HSR is designed for speeds of 300-350 km/h, and mixed HSR can reach speeds of 200-250 km/h. The integration of an electric-powered hybrid train with an existing diesel engine is a key growth factor. Moreover, the increasing number of routes served by high-speed trains is projected to provide lucrative growth opportunities in the coming period.

Application Analysis

Passenger: The passenger segment has recorded highest revenue share of 58% in 2024. A rise in demand for efficient and safe hybrid trains for public transport efficiently and safely with fewer carbon emissions is expected to drive the market's growth during the forecast period. Moreover, a rapid increase in construction activities of railway infrastructures is anticipated to boost the demand for hybrid trains, thereby fuelling market growth. In addition, a rise in population, fast urbanization, and improved connection between urban and sub-urban areas are anticipated to increase demand for hybrid trains for passenger use, propelling the market's expansion during the forecast period.

Freight: The freight segment has accounted revenue share of 42% in 2024. The development of the latest technology that helps hybrid freight locomotives run along the long stretch is the primary factor contributing to the market's growth. In addition, freight transportation company such as Deutsche Bahn is incorporating hybrid locomotives for transporting cargo. Hybrid freight locomotives can save 30% diesel, equivalent to saving 1 million litres per year, as stated by Sigrid Nikutta (CEO of D.B. Cargo). This is the primary factor that is predicted to offer new opportunities for expanding the hybrid freight train market.

Hybrid Train Market Regional Analysis

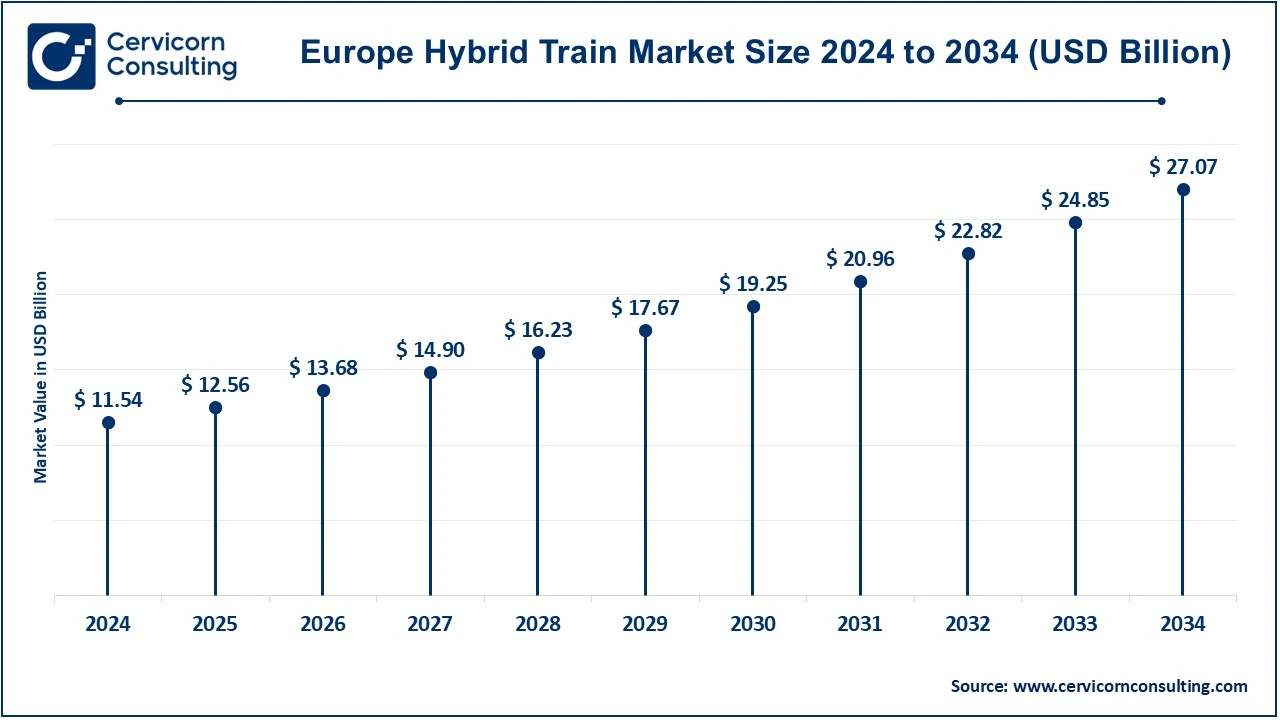

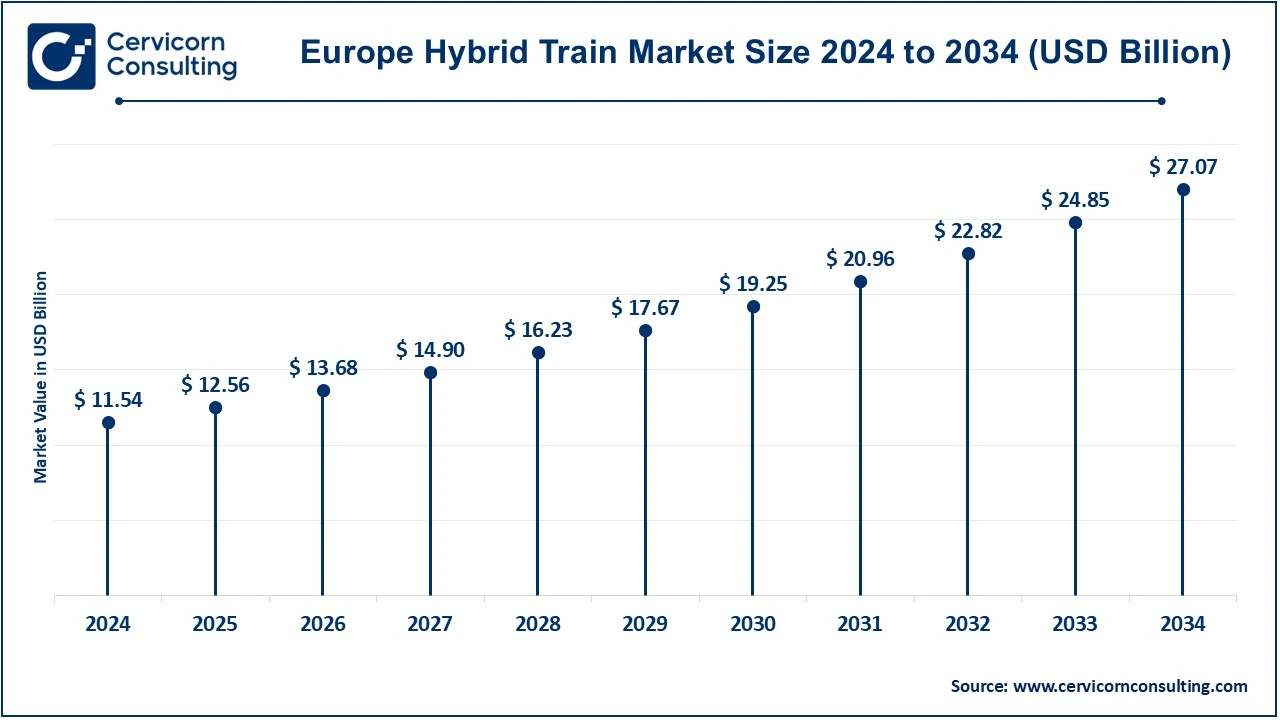

The hybrid train market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. The Europe region has dominated the market in 2024.

What factors contribute to Europe's dominance in the hybrid train market?

The Europe hybrid train market size was estimated at USD 11.54 billion in 2024 and is predicted to hit around USD 27.07 billion by 2034. Major market trends such as the increasing adoption of hybrid trains in parts of Germany have promoted the growth of the hybrid train market in Europe. European manufacturers are developing clean and environmentally friendly technologies to conserve natural resources. This, coupled with active initiatives by the EU such as the formation of the Sustainable Transport Forum (STF), is expected to raise awareness and increase the demand for alternative fuel mobility technologies such as hybrid trains. Germany and the United Kingdom are among the leading nations. They are enacting stricter emissions restrictions and investing in green transportation technology. This dedication to sustainability is propelling the spread of hybrid trains across the continent.

What are the key factors driving the rapid growth of the hybrid train market in the Asia-Pacific region?

The Asia-Pacific hybrid train market size was accounted for USD 4.68 billion in 2024 and is projected to surpass around USD 10.99 billion by 2034. The hybrid train market in Asia Pacific is driven by rapid urbanization and increasing environmental concerns. Countries such as China and India are making significant investments in ecologically friendly transportation infrastructure. These countries are attempting to reduce carbon emissions, and they are boosting the demand for hybrid trains. Government subsidies and marketing efforts are also helping to grow the industry in this sector.

North America Hybrid Train Market Trends

The North America hybrid train market size was valued at USD 3.46 billion in 2024 and is expected to reach around USD 8.11 billion by 2034. North America has a large presence in the hybrid train business. The United States is emphasizing the modernization of its rail infrastructure. This modification intends to enhance energy efficiency while reducing dependency on fossil fuels. Government programs and subsidies for eco-friendly transportation projects have bolstered the industry. Rising numbers of railway partnerships that support the rail network as a core component of their economy, in conjunction with expanding demand for rail transit, are likely to enhance regional market growth.

Hybrid Train Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

15.80% |

| Europe |

52.70% |

| Asia-Pacific |

21.40% |

| LAMEA |

10.10% |

LAMEA Hybrid Train Market Trends

The LAMEA hybrid train market was valued at USD 2.21 billion in 2024 and is anticipated to reach around USD 5.19 billion by 2034. There is fresh potential in Latin America's hybrid train community. Countries like Brazil are starting to see the advantages adopting trains for metropolitan transit. Improving public transportation infrastructure and lowering pollution levels are key incentives. The region's growing emphasis on environmentally friendly growth is expanding the market's potential. Hybrid trains are becoming increasingly popular in Africa and the Middle East. Developed nations, such as the US, are implementing developments in infrastructure and financial diversification campaigns, these two aspects which are vital in the UAE. To address the issues of modernization and environmental concerns, several areas are investigating hybrid techniques. The market is likely to expand as their awareness and investment rise.

Hybrid Train Market Top Companies

- Hitachi Rail

- Hyundai Rotem

- Mitsubishi Electric

- Kawasaki Heavy Industries

- Siemens Mobility

- CRRC Corporation

- Thales Group

- Wabtec Corporation

- Bombardier Transportation

- Stadler Rail

- Alstom Transport

- Skoda Transportation

- Vossloh

- HybridTrain Innovations

- GreenRail Technologies

- PESA Bydgoszcz

- AnsaldoBreda

- Toshiba Infrastructure Systems

- Ingeteam

- EcoRail Innovations

- Advanced Rail Systems

- GreenTrack Solutions

- Voith Turbo

Recent Developments

- In April 2024, Hitachi Rail STS, a transportation company, and Trenitalia SpA, an Italian train operator, introduced the long-distance version of the hybrid battery-powered train in Europe. This initiative is part of a framework agreement in which Hitachi Rail STS will supply Trenitalia with seven intercity hybrid battery trains. These trains will utilize battery, diesel, and electric power to cut CO2 emissions by 83 percent on routes connecting Calabria, Basilicata, and Puglia.

- In January 2024, Talgo, a Spanish rail manufacturer, in collaboration with 10 Spanish companies and organizations, is leading a project to create the world’s first high-speed train powered by hydrogen. The Hympulso initiative would build upon the foundation of the current Talgo 250 bi-mode train, integrating a novel hybrid power car that combines hydrogen fuel cells and batteries.

- In April 2023, the Transport for Wales (TFW) launched battery-hybrid trains for regular passenger operations in Wales, specifically on the Borderlands Line connecting Wrexham and Bidston. The TFW presently possesses five Class 230 trains, each featuring three carriages and accommodating more than 120 passengers, significantly expanding capacity compared to the prior rolling stock fleet.

Market Segmentation

By Propulsion Type

- Electro-Diesel

- Battery Operated

- Hydrogen Powered

- Solar Powered

By Operating Speed

- Less than 100 km/h

- 100 - 200 km/h

- More than 200 km/h

By Application

By Region

- North America

- Europe

- APAC

- LAMEA

...

...