Battery Electric Vehicle Market Size and Growth 2025 to 2034

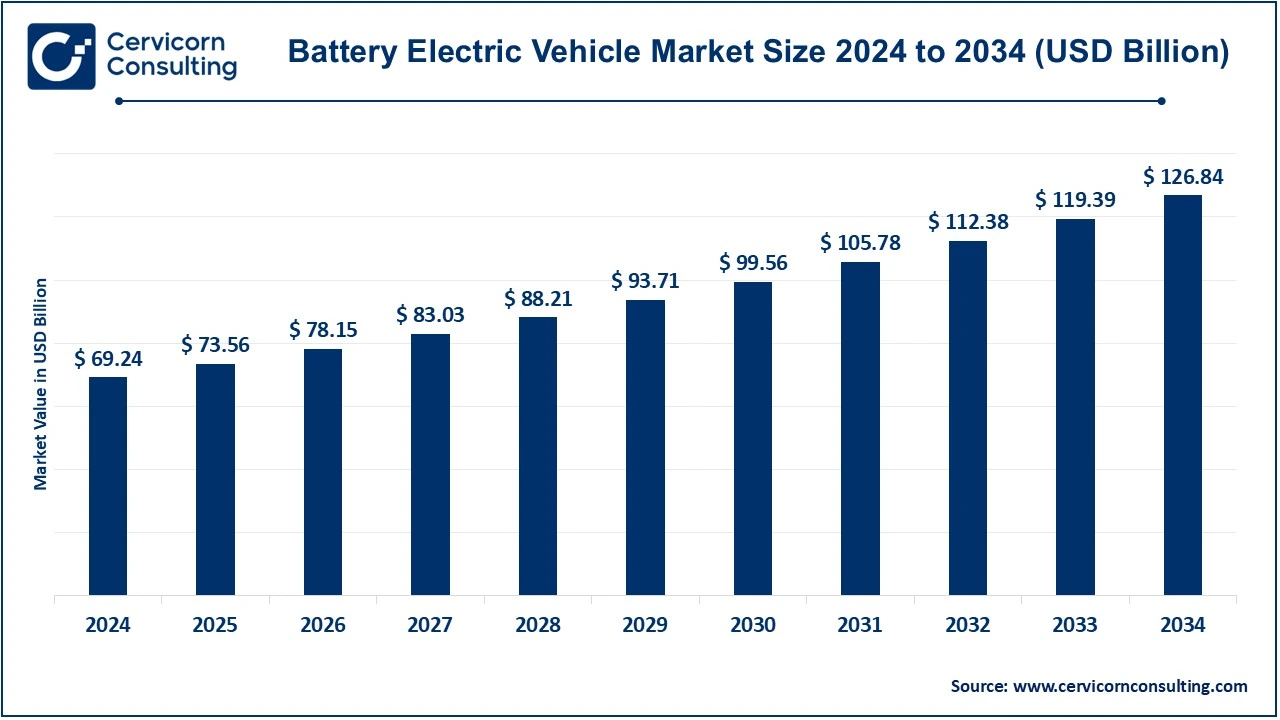

The global battery electric vehicle market size was reached at USD 69.24 billion in 2024 and is expected to be worth around USD 126.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.24% over the forecast period 2025 to 2034. The battery electric vehicles (BEVs) market is growing very fast due to the vast demand for energy-efficient, eco-friendly transportation solutions across various industries, including automotive, logistics, and manufacturing. The BEV market has witnessed significant growth due to increasing environmental concerns, technological advancements, and supportive government policies. Stricter environmental regulations and government incentives promoting zero-emission vehicles have contributed to the growing adoption of BEVs. Many countries are phasing out internal combustion engine (ICE) vehicles, encouraging the adoption of BEVs. Improved battery efficiency, reduced costs, and the expansion of charging infrastructure are driving consumer demand.

Additionally, leading automotive manufacturers are heavily investing in BEV production, accelerating market expansion. Rising fuel prices and global efforts to reduce carbon emissions have further boosted the BEV industry. In regions like Europe, the U.S., and China, stringent emission regulations have pushed automakers to develop sustainable mobility solutions. Companies like Tesla, BYD, and Volkswagen are continuously innovating, making BEVs more affordable and accessible. This growing shift towards electrification is expected to continue in the coming years, transforming the automotive landscape. Ongoing R&D investments are boosting BEV performance, affordability, and consumer appeal. As these innovations align with global sustainability goals, the market is set for robust growth driven by a demand for cleaner, cost-effective, and efficient transportation solutions.

Report Highlights

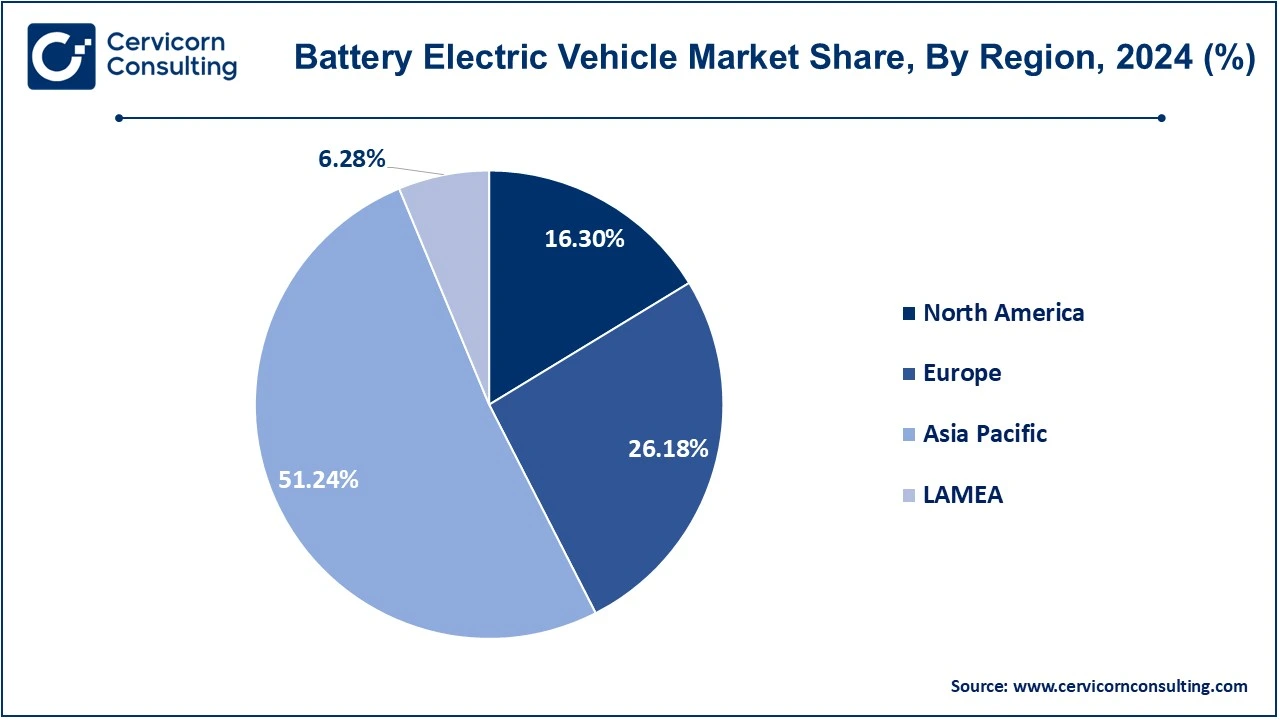

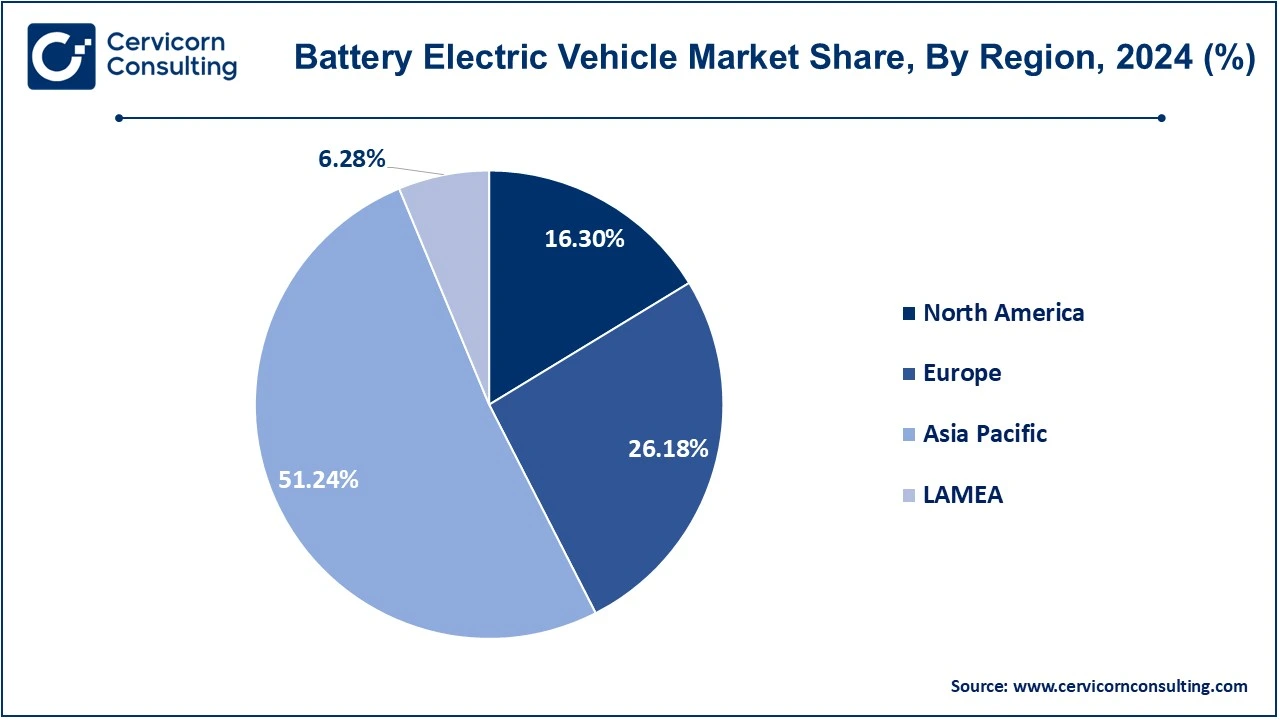

- The Asia-Pacific BEV market accounted for highest revenue share of 51.24% in 2024.

- The Europe BEV market has generated revenue share of 26.18% in 2024.

- By battery type, the lithium-ion battery segment has accounted for 58.40% in 2024.

- By vehicle type, the passenger cars segment has dominated the market in 2024.

What is a Battery Electric Vehicle (BEV)?

A battery electric vehicle (BEV) is a type of electric vehicle (EV) that runs entirely on electricity and does not have a gasoline engine. It uses a rechargeable battery pack to power an electric motor, eliminating the need for fossil fuels. BEVs are charged through external sources like home chargers, public charging stations, or fast chargers. Key features of BEVs include zero emissions, lower maintenance costs due to fewer moving parts, and instant torque for smooth acceleration. Popular BEVs include Tesla Model 3, Nissan Leaf, and Hyundai Kona Electric. The battery, which is the most crucial component, determines the vehicle’s range. Modern advancements in lithium-ion batteries have significantly improved the driving range, making BEVs a viable alternative to traditional fuel-powered cars.

Key Insights Beneficial to the Battery Electric Vehicle (BEV) Market:

- Global EV sales increased by 40% in 2023, with BEVs accounting for a major share.

- Government subsidies and tax incentives have led to a 25% rise in BEV adoption in key markets.

- Battery costs have dropped by 85% since 2010, making BEVs more affordable.

- Charging infrastructure has expanded by 300% over the last five years, supporting BEV growth.

- BEVs contribute to a 50% reduction in carbon emissions compared to gasoline vehicles.

- Leading automakers plan to invest over USD 500 billion in BEV production by 2030.

- Fleet electrification in commercial transport is projected to rise by 60% by 2025.

Battery Electric Vehicle Market Growth Factors

Rising Demand for Zero-Emission Vehicles:

- The increasing focus within the international settlement environment on sustainability and environmental problems is the origin of the demand for zero-emission vehicles, namely BEV. Other such examples include legislation set up by governments around the world that establishes stricter emissions standards and also development programs to encourage such electric mobility, for example in Europe, where therein the European Union established rather ambitious goals with respect to carbon neutrality by means of high BEV adoption by 2035. These are among one of the drivers that companies like Tesla and Rivian sought to capitalize on when producing electric vehicles that are indeed meeting these regulations, furthermore appealing to so-called green consumers.

Battery Cost Decline:

- Advancements in production processes, coupled with economies of scale, meanwhile allowing better materials to embrace; these have led to a major reduction in battery prices. With that reduced cost of the battery comes down in the price of BEVs across the board, hence the availability for consumers to realize in expanding electric vehicle markets. For example, Tesla continuously decreased its battery costs through innovations and creations of the "Gigafactories," as well as studies of lithium-ion technology, which results in more affordable models such as the Model 3. Therefore, BEVs were created for larger penetration into the market.

Technological Improvement Among Battery Systems:

- The technological improvement of battery systems is very important in establishing capacity, range, and some performance for all types of battery electric vehicles. Advances being made in solid-state batteries, fast-charging methods, and increased energy density will overcome limitations traditionally linked to lithium-ion batteries. For example, companies such as QuantumScape are designing solid-state batteries with increased energy density and further faster-charging times because of their technology, substantial improvements fo the BEV's range and practicality. All of these accommodate the further broadening and desirability of BEVs by many a 21st-century consumer.

Battery Electric Vehicle Market Trends

- Increase In Government Initiatives: In most nations across the world, the government has been a great supporter to battery electric vehicle adoption through various forms of incentives, rebates, and even grant programs. The United States government also offers tax credits with purchases of new electric cars while the European Union offers a very ambitious reduction agenda. A few other companies taking advantage of these incentives include Tesla and Rivian, which ease the cost of initial purchase of BEVs and hasten the market growth.

- Expansion of Charging Infrastructure: One of the most crucial factors to proliferate BEVs is worldwide expansion of networks for charging. There's drastic investment in charging stations from private participation in addition to the Governmental support. For example, ChargePoint, the current leading player in electric vehicle charging infrastructure, is surging ahead to build more of its network in order to give more convenient and accessible options for charging, thus helping boost consumer confidence in BEVs.

- Raise in Consumer Awareness: This is another critical reason behind the skyrocketing demand for BEVs due to increased awareness towards the climatic condition of this world and their impacts on the environment. Increasing customer awareness of personal carbon footprint through green automobiles has also been facilitated by producers and will help push other consumers to purchase electric cars in the future. In response, in line with the market trend of shifting to BEVs are companies like Nissan and Hyundai, which are launching environment-friendly cars.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 73.56 Billion |

| Expected Market Size in 2034 |

USD 126.84 Billion |

| Projected CAGR 2025 to 2034 |

6.24% |

| Dominant Region |

Asia-Pacific |

| Fastest Growing Region |

North America |

| Key Segments |

Battery Type, Vehicle Type, Region |

| Key Companies |

Ampere Vehicles, Benling India Energy and Technology Pvt Ltd, BMW AG, BYD Company Limited, Chevrolet Motor Company, Daimler AG, Energica Motor Company S.p.A., Ford Motor Company, General Motors, Hero Electric, Hyundai Motor Company, Karma Automotive, Kia Corporation, Lucid Group, Inc., Mahindra Electric Mobility Limited, Nissan Motors Co., Ltd., Okinawa Autotech Pvt. Ltd., Rivain, Tata Motors, Tesla Inc. |

Battery Electric Vehicle Market Dynamics

Drivers

- Zero Emission Benefits: Being electrically driven, a BEV does not emit any emissions from the tailpipe, thus addressing air pollution and climate change. Such tighter emissions regulations will offer further attractiveness for a BEV on the global landscape. Companies like Tesla lead by example in the market and cash in on the green angle of the zero-emission vehicles, making them much more appealing to the consumer.

- Battery Cost Reduction: The skyrocketing prices of lithium-ion batteries brought the costs of BEVs down to a considerable low. For instance, the prices of electric vehicle batteries are now down by almost 89% in the last decade, which makes electric cars affordable. Companies like BYD and CATL have invested highly in battery building, which has reduced the costs significantly.

- Fuel Efficiency: BEVs use less energy than traditional gasoline-powered vehicles, which reduces costs of operation as well as dependence on fossil fuels. For example, the Chevrolet Bolt EV provides high mileage at a low cost per mile compared to conventional internal combustion engine vehicles, thereby boosting the BEV market.

Restraints

- High Purchase Price at Initial: Arguably the biggest challenge associated with the adoption of widespread use of BEVs relates to their higher upfront price paid at purchase, primarily on the basis of the high costs for batteries. While the costs for batteries are falling, prices of BEVs are still well over those of traditional models. Ford and Volkswagen, of course, are addressing this by introducing more affordable variants.

- Lack of Charging Infrastructure: Several regions, especially rural or relatively sparse localities, are still very new when it comes to the construction of charging infrastructure for BEVs. Companies like Tesla have built a vast number of superchargers throughout North America.

- Issues of Battery Disposal: Although the operation of BEVs contributes to a much lower carbon footprint, their disposal and recycling contribute to environmental issues. Panasonic and Tesla are exploring more environmentally friendly solutions for battery recycling. This is still a problem for the broader market, however, price hurdles remain problematic.

Opportunities

- Advances in Battery Technology: Advances in battery technologies include, for example, solid-state batteries that promise higher energy densities, shorter charging times, and greater safety. Companies like QuantumScape are leading the development of solid-state batteries, which will further reduce costs and enhance BEV performance.

- Electric Commercial Vehicles: Commercial vehicles open the doors to huge possibilities with BEVs as more companies go for electric delivery vans and trucks. One such company is Rivian, which has secured contracts with Amazon, where electric delivery vans are all set to be operated in their transition stage to an electric regime.

- Battery Leasing Models: The company NIO has launched the battery leasing models, according to which customers can change batteries at a charging point instead of buying them. This reduces the initial capital cost for owning a battery-electric vehicle and brings it within reach for more people while creating new possibilities for future business.

Challenges

- Supply Chain Challenges of Battery Production: Growing demand for battery electric vehicles has strained the availability of some of the key raw materials in global supply which include cobalt, nickel, and lithium for battery production. This acquisition of such materials has not been easy for Tesla and General Motors, with cost at times volatile and unreliable for supplies.

- Consumer Perception and Awareness: The current market trend, for most consumers, is viewed with a slightly skeptical eye due to misconceptions about the driving range, charging infrastructure, and long-term reliability of BEVs. Auto majors like Nissan and Volkswagen have taken up the responsibility of conducting educational campaigns about the above issues to ensure that consumers have confidence in BEVs.

- High Charging Infrastructure Cost: The establishment and expansion of fast-charging networks demand high investments accompanied by hurdles, particularly in low-populated areas. Other players in the charging field, like BP and Shell, are scaling the EV infrastructure bit by bit. Nevertheless, several roadblocks need to be addressed to scale the change in infrastructure from proof of concept to being fully functional, namely initiating capital and coordinating different categories of stakeholders.

Battery Electric Vehicle Market Segmental Analysis

The battery electric vehicle market is segmented into battery type, vehicle type and region. Based on battery type, the market is classified into lead acid battery, nickel metal hydride battery, and lithium-ion battery. Based on vehicle type, the market is classified into passenger car, commercial vehicle, and two-wheeler.

Battery Type Analysis

Lithium-ion Battery: Lithium-ion batteries are dominant and prioritized in the BEV market because they have high energy density, very high efficiencies, and long life cycles. Such batteries incorporated longer driving ranges and faster charging. Tesla and BYD lead in large-scale lithium-ion battery applications, bringing BEVs materially forward.

Lead Acid Battery: Lead acid batteries are low-cost and offer a relatively long life cycle, and are mainly used in low-speed electric vehicles and backup power systems. Their low energy density, however, and short life cycle, do not allow them to be used in high-performance BEV applications. Businesses like Exide Industries are engaged in the manufacture of cost-effective lead-acid batteries for basic BEV applications.

Battery Electric Vehicle Market Share, By Battery Type, 2024 (%)

| Battery Type |

Revenue Share, 2024 (%) |

| Lead Acid Battery |

26.90% |

| Nickel Metal Hydride Battery |

14.70% |

| Lithium-ion Battery |

58.40% |

Nickel Metal Hydride Battery: Nickel metal hydride batteries tear down the features of lead-acid batteries with more energy density and longevity, enabling them to be rolled out in hybrid vehicles. However, high cost and sensitivity to heat have prevented their extensive use in such BEVs. They were used in some of the earlier Prius models by Toyota-the very factor that demonstrated their feasibility.

Vehicle Type Analysis

Passenger Cars: Passenger cars being the highest seller among all BEVs owe their massive market by virtue of rising awareness among consumers toward zero emission and incentives from their respective governments. In this segment, major manufacturers like Tesla and Nissan invest their capabilities to the production of models such as Tesla Model 3 and Nissan Leaf.

Commercial Vehicle: BEVs are increasingly finding acceptance in commercial vehicles such as buses, trucks, and delivery vans based on cost savings from running and the stringent emission policies. Companies like Rivian and BYD are developing electric trucks and buses that would help in speeding up its adoption into global markets.

Two-Wheeler: The BEV segment for two-wheelers has picked up momentum in the Asia-Pacific region, where two-wheeler electric scooters and bikes are popular for urban mobility. It is supported by innovators such as Ather Energy and Hero Electric with their efficient and fairly priced models.

Battery Electric Vehicle Market Regional Analysis

The battery electric vehicle market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

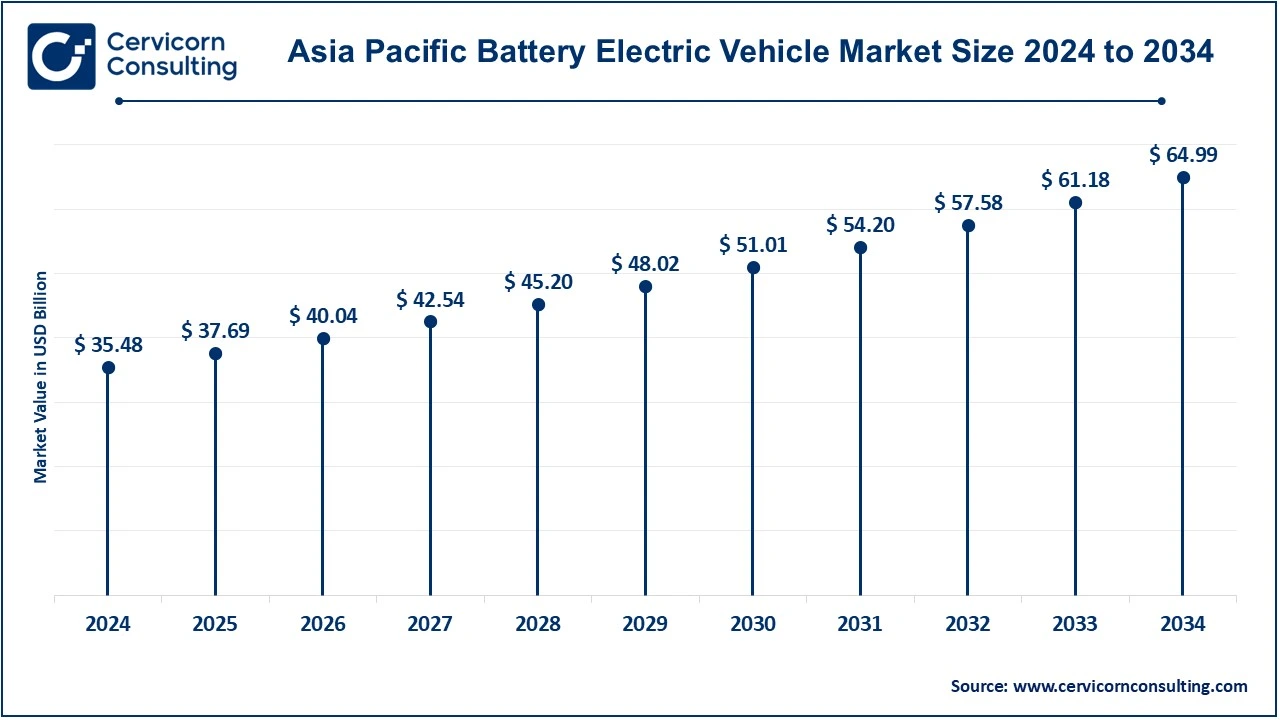

Why is Asia-Pacific largest region for the battery electric vehicle market?

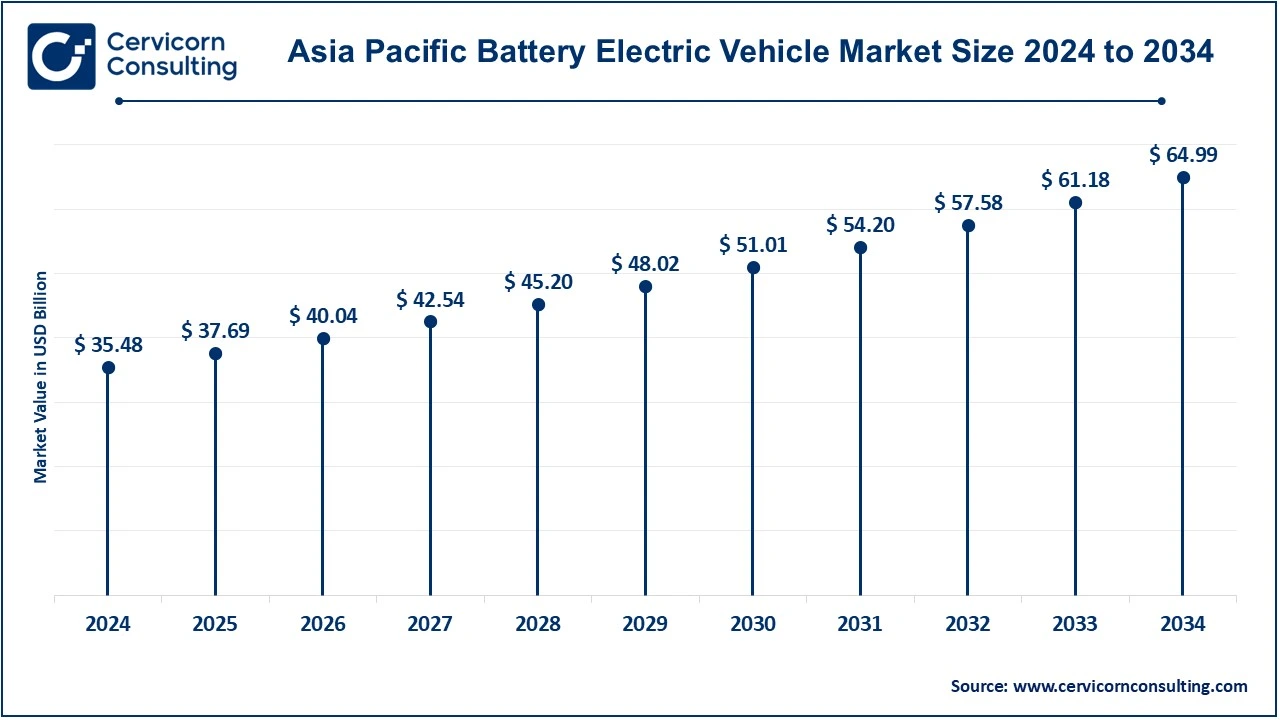

The Asia-Pacific battery electric vehicle market size was accounted for USD 35.48 billion in 2024 and is predicted to surpass around USD 64.99 billion by 2034. Asia-Pacific is the largest market for BEVs, with China as the biggest manufacturer and consumer in actual hardware construction and enjoyed strong government support policies such as subsidies and the establishment of infrastructure for charging. Above average advanced battery technologies were leveraged in Japan and South Korea where companies like BYD, LG Chem, and Panasonic are investing heavily. The fact that it has strong industrial bases, increasing urbanization, and cheaper BEV models has contributed to its spectacular growth, making it the fastest-growing BEV market in the region.

North America Battery Electric Vehicle Market Trends

The North America battery electric vehicle market size was valued at USD 11.29 billion in 2024 and is expected to reach around USD 20.67 billion by 2034. In the North American region, government incentives, stringent emissions regulations, and the establishment of a robust charging infrastructure drive the development of the BEV market. The U.S. continues to maintain its upper hand in the adoption of BEVs with other leading players being Tesla and Rivian. Other key market drivers are consumer awareness of green mobility and advancements in battery technology. There has been steady growth in Canada and Mexico fueled by cross-border trade policies and regional electrification initiatives.

Europe Battery Electric Vehicle Market Trends

The Europe battery electric vehicle market size was estimated at USD 18.13 billion in 2024 and is projected to hit around USD 33.21 billion by 2034. A strengthening BEV market exists in Europe due to a strong regulation framework, as good as the European Green Deal itself, with incentives for adoption. Electric mobility is being pushed forth with prevailing costs in Norway, Germany, and the UK, which have very strict emission standards and extensive charging networks. Volkswagen and BMW are said to be increasing their investments in BEV production and R&D. The European market is also being developed as the battery manufacturing hub, bringing the supply chain close to BEVs.

LAMEA Battery Electric Vehicle Market Trends

The LAMEA battery electric vehicle market size was valued at USD 4.35 billion in 2024 and is anticipated to reach around USD 7.97 billion by 2034. In LAMEA, strong consciousness of environmental concerns and investments in sustainable mobility have led to a slow pace of adoption of BEVs. Governments in the Latin American region like Brazil and Argentina are contemplating initiatives to push the introduction of BEVs in line with government initiatives and multinational partnerships. Whereas in the Middle East, greening is in the form of BEVs in synergie with smart city projects, in Africa this phenomenon is overly embraced by the obstruction of meager infrastructure. Firms including Nissan and BYD venture to be able to push the BEV market into this kind of region by exploiting opportunities from emerging markets.

Battery Electric Vehicle Market Top Companies

- Ampere Vehicles

- Benling India Energy and Technology Pvt Ltd

- BMW AG

- BYD Company Limited

- Chevrolet Motor Company

- Daimler AG

- Energica Motor Company S.p.A.

- Ford Motor Company

- General Motors

- Hero Electric

- Hyundai Motor Company

- Karma Automotive

- Kia Corporation

- Lucid Group, Inc.

- Mahindra Electric Mobility Limited

- Nissan Motors Co., Ltd.

- Okinawa Autotech Pvt. Ltd.

- Rivain

- Tata Motors

- Tesla Inc.

Recent Developments

Recent strategic partnerships and joint ventures in the BEV market reflect a strong commitment to accelerating the transition to sustainable mobility. Collaborations among automakers, battery manufacturers, and technology companies aim to innovate energy storage solutions, expand charging infrastructure, and reduce production costs. These alliances, such as the Hyundai-SK Innovation joint venture and CATL-Sinopec partnership, highlight industry-wide efforts to scale up BEV adoption, meet rising consumer demand, and achieve global decarbonization goals.

- In April 2023, Hyundai Motor Group and SK Innovation Co.’s battery manufacturing division, SK On Co., Ltd., announced plans to establish a joint venture to produce EV battery cells in the U.S. The facility is expected to begin production in late 2025, with an annual capacity of 35 GWh—sufficient to support the production of approximately 300,000 electric vehicles. This strategic collaboration aims to bolster the supply chain and accelerate the transition to sustainable mobility.

- In October 2022, Contemporary Amperex Technology Co., Limited (CATL) partnered with SAIC, a leading Chinese automobile manufacturer, and two major oil companies, Sinopec and China National Petroleum Corporation (CNPC), to form a joint venture. The collaboration focuses on advancing electric vehicles equipped with replaceable batteries, aiming to enhance convenience and efficiency in EV adoption while addressing infrastructure challenges in the industry.

Market Segmentation

By Battery Type

- Lead Acid Battery

- Nickel Metal Hydride Battery

- Lithium-ion Battery

By Vehicle Type

- Passenger Car

- Commercial Vehicle

- Two-Wheeler

By Region

- North America

- APAC

- Europe

- LAMEA

...

...