Next Generation Batteries Market Size and Growth 2025 to 2034

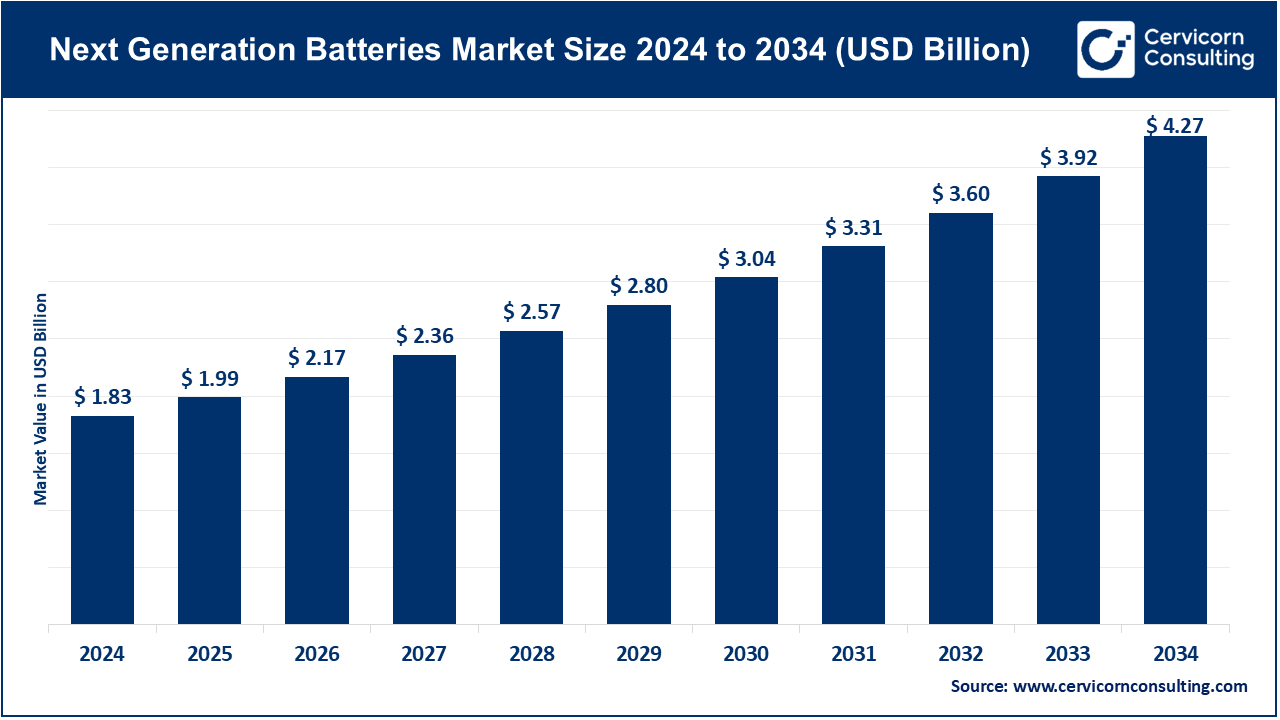

The global next generation batteries market size was valued at USD 1.83 billion in 2024 and is expected to reach around USD 4.27 billion by 2034, growing at a CAGR of 8.84% during the forecast period 2025 to 2034. Factors like an advancement in technology, an upsurge in demand for electric vehicles, and a growing need for energy-efficient storage solutions for renewable power are leading the next generation batteries market at a high pace. A lot of investments in various innovative battery technologies such as lithium-sulfur, sodium-ion, and solid-state batteries have resulted from a rapid shift toward environment-friendly and sustainable sources of energy. High government efforts to reduce the carbon footprint associated with carbon emissions, coupled with increasing consumer demand for longer-duration and faster-recharging batteries.

Next-generation batteries refer to advanced energy storage technologies designed to address the limitations of traditional batteries, such as lithium-ion. These innovative batteries aim to deliver superior performance in terms of energy density, charging speed, lifespan, safety, and environmental sustainability. Examples include solid-state batteries, lithium-sulfur batteries, sodium-ion batteries, and zinc-air batteries. They are being developed for diverse applications, including electric vehicles (EVs), renewable energy storage, portable electronics, and industrial equipment.

Next Generation Batteries Market Report Highlights

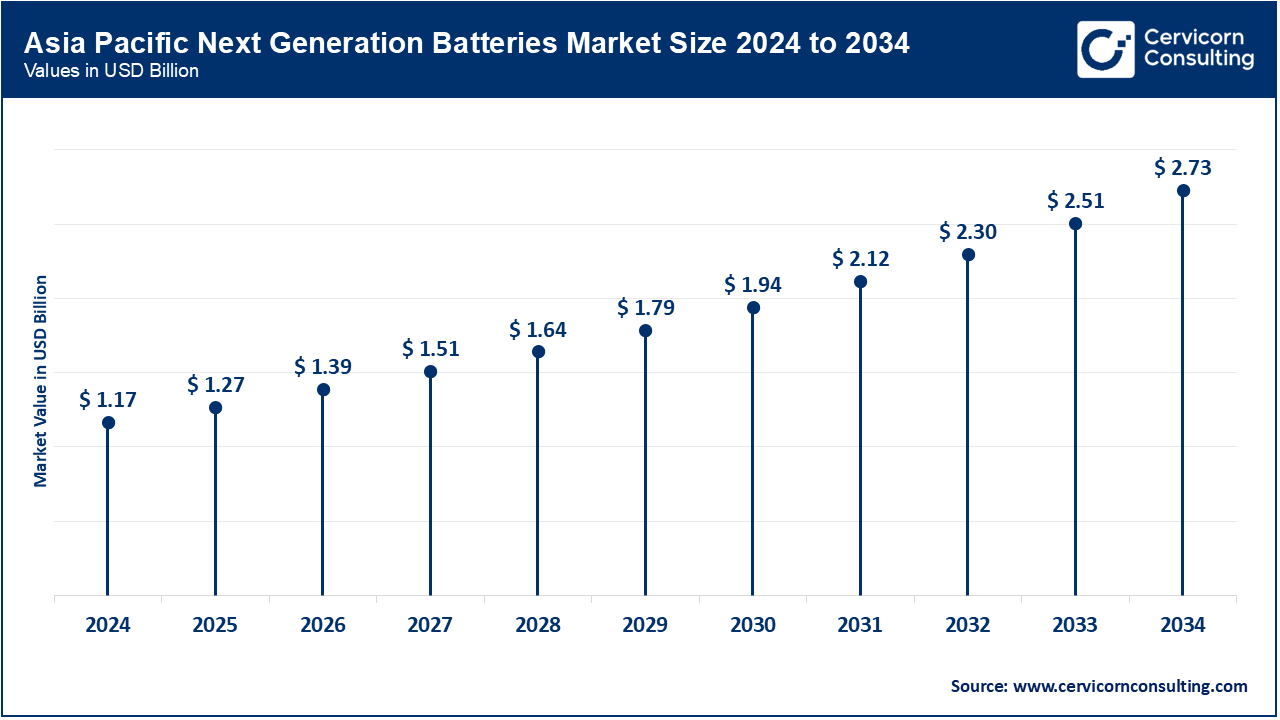

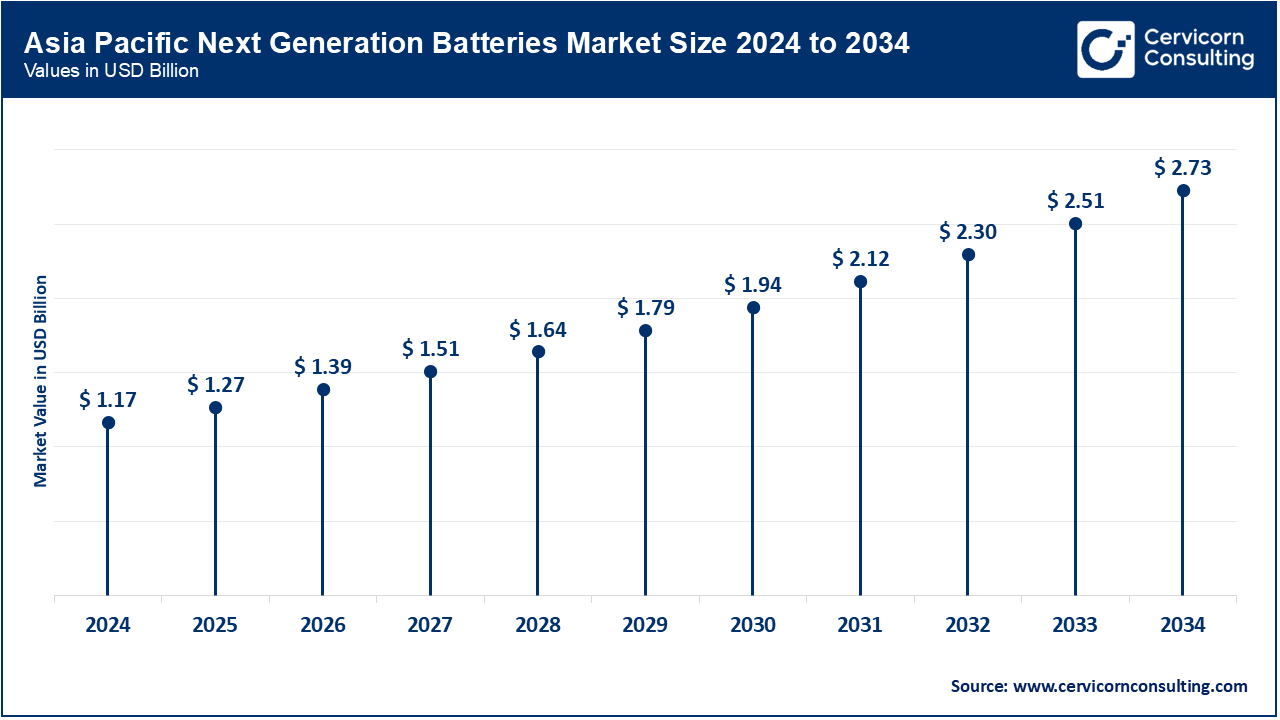

- Asia-Pacific led the market with a revenue share of 63.92% in 2024.

- North America is experiencing significant growth over the forecast period.

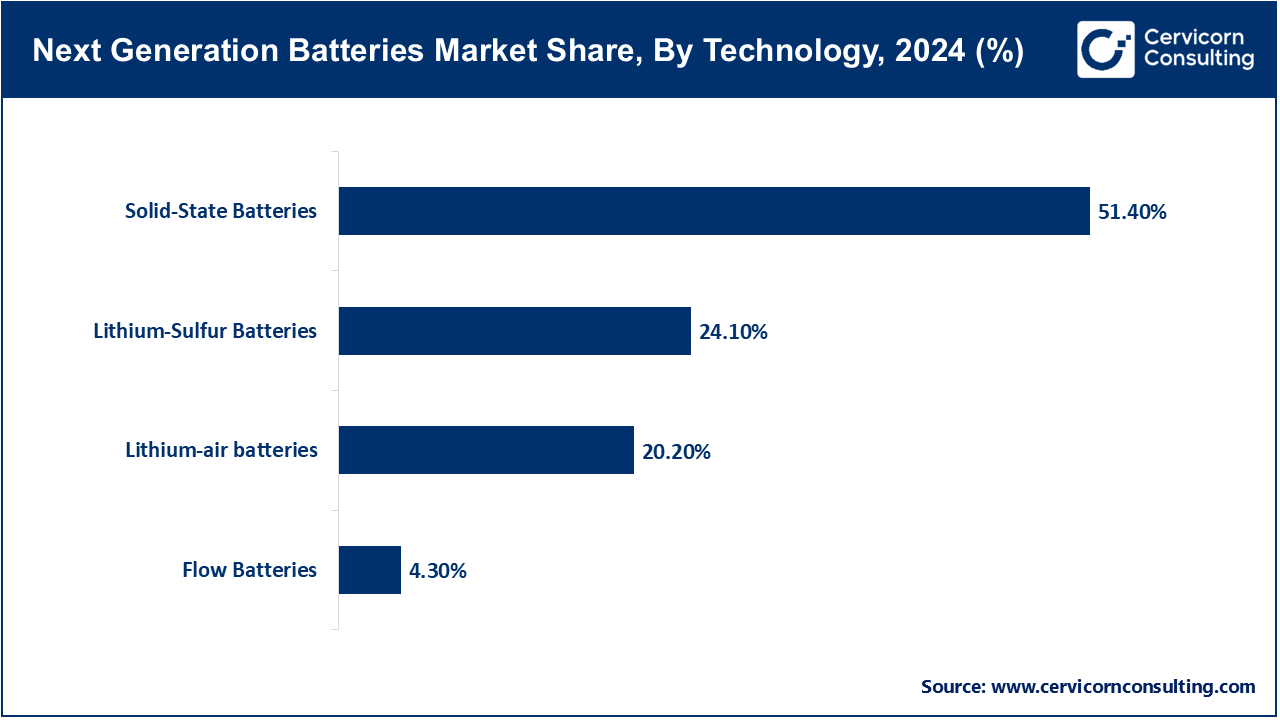

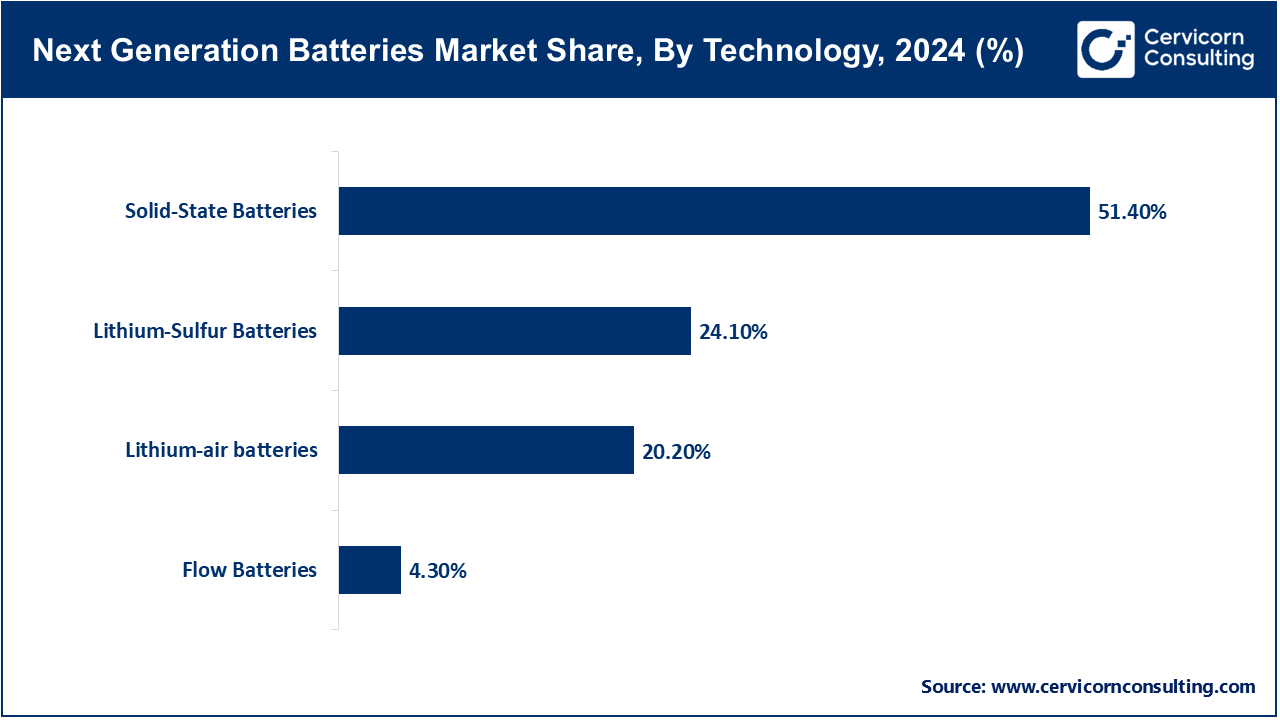

- By technology, the solid-state batteries segment held a revenue share of 51.40% in 2024.

- By application, the electric vehicles (EVs) segment garnered a revenue share of 58.30% in 2024.

- By end use, the transportation segment dominates the market with revenue share of 42% in 2024.

- By end use, the energy storage segment is anticipated to witness fastest-growth over the forecast period.

Next Generation Batteries Market Growth Drivers

- Demand for Electric Vehicles: Environmental worries and government-imposed restrictions regarding carbon emissions have skyrocketed the sale of electric vehicles across the world. Next-generation battery technologies such as solid-state, lithium-sulfur are significantly required to expand the range and speed up recharging time in EVs to ensure long operating periods. They meet the end-users' quest for clean transportation and thus raise the demand pressure on battery companies to innovate with new products as well as quantity. Subsidies and tax rebates have also contributed to the incentives that have led to the growth of the EV market, thus increasing indirectly demand for advanced battery technologies.

- Energy Storage for Renewable Power: While the world turns increasingly to the use of renewable energies such as sun and wind energy, there remains a need for even more efficient and reliable energy storage. Next-generation batteries have higher energy density and longer discharge cycles; therefore, they play a critical role in storing the excess energy produced from renewable sources. These batteries smooth out the power grids for a consistent supply of energy, even when generation levels are low. As governments across the globe force adoption in their quest for achieving climate goals, renewables will become integral and, hence, is growing, thereby becoming a growth driver for the market.

- Deployment of Smart Grids: In the development of smart grids, advanced battery storage systems for efficient energy management and distribution. Reliable energy storage is needed for maintaining balance in variable energy demands to enable effective management of renewable energy inputs. Next-generation batteries with performance and durability capabilities support grid stability as well as minimization of losses in energy flow. There is an expectation that the smart grid projects will increase their development, mainly in cities worldwide, and this may bring in a higher installation of advanced batteries, which would grow the market.

Next Generation Batteries Market Trends

- Solid-State Batteries: Solid-state batteries are revolutionizing the energy storage industry because they outperform traditional lithium-ion batteries. They use a solid electrolyte instead of a liquid one, which means higher energy density, improved safety, and longer lifespans. Automotive and vehicle manufacturers, especially large EV-producing companies, are spending a lot in the R&D of solid-state batteries in support of consumer needs for longer vehicle ranges and faster charging. This trend is affecting business segments like aerospace and consumer electronics that significantly rely on energy storage devices for reliability and low weight.

- Increased demand in Electric Vehicle: There is a very formidable demand seen in the electric vehicle sector as the next generation of batteries promises to be much more efficient and sustainable. Lithium-sulfur and solid-state batteries are truly worth the attention as they provide a lightweight structure, high energy density, and potential for further increment in vehicle mileage. The automobile industry is using these new-age batteries to make their products free from the limitations of traditional lithium-ion batteries. These changes are encouraged by governments through the introduction of incentives on the use of EV, subsidization on the R&D aspect on battery technology, and infrastructures for charging electric vehicles.

- Integration with Renewable Energy Systems: As the consumption of renewable sources around the world is increasing, the necessity for advanced batteries to store more energy efficiently from solar and wind was realized. These batteries allow the smoothing of variation in renewables by storing excess power during in-generations and ensuring energy stability when generation diminishes. Already, flow batteries and solid-state batteries, among others, are deployed at the grid scale and increase energy security and stability. This moves in unison with global goals on the energy transition and decarbonization and builds innovation in energy storage systems.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 1.99 Billion |

| Expected Market Size in 2034 |

USD 4.27 Billion |

| Projected CAGR 2025 to 2034 |

8.84% |

| Dominant Region |

Asia-Pacific |

| Key Segments |

Technology, Chemistry, Application, End Use, Region |

| Key Companies |

Panasonic, Faraday Battery Challenge, EnerVenue, A123 Systems, Sakti3, QuantumScape, LG Energy Solution, Samsung SDI, Northvolt, Solid Power, Hitachi Zosen, Contemporary Amperex Technology Co Limited, StoreDot, BYD, Tesla |

Next Generation Batteries Market Dynamics

Market Drivers

- Need for High-Speed Charging Batteries: Consumers and industries alike are on the lookout for high-speed charging batteries that cut down on transit time, saving precious hours of on-site productive time. This is very true for the EV segment, where long charging times are one of the biggest impediments to higher widespread adoption. Fast-charging without sacrificing safety or efficiency is expected in the next-generation batteries. As investments in research continue to bridge the gap for faster charging technologies, next-generation battery demand continues its boost with the rising momentum needed to cater to consumer preferences as well as meet industry requirements.

- Decarbonization Targets: A demand for reduced emissions of greenhouse gases is leading the world toward a cleaner environment by developing technologies that are less pollutant. With nations and corporations setting highly ambitious decarbonization targets, there has been massive investment in renewable energy storage and electric mobility. The advanced batteries offer efficient energy storage while reducing fossil fuel dependency, pushing the way for a low-carbon economy. With industries set in line with the climate objective, the demand for advanced battery solutions will exponentially be rising.

- Data Center Expansion: The rapid growth of data centers across the globe, driven by increasing digitalization and cloud computing, is creating significant demand for reliable energy storage solutions. Next-generation batteries provide backup power during outages and ensure uninterrupted operations for these energy-intensive facilities. Their high energy density, long life cycle, and minimal environmental impact make them a preferred choice for data center applications. As the number of data centers grows in emerging and developed markets.

Market Opportunities

- Consumer electronics innovation: consumer electronics which includes smartphones, laptops, and wearables may be leveraged for future generations of batteries. Consumers need to have power solutions for their gadgets, and these need to be compact and lightweight and last for a very long time.. Therefore, advanced batteries with high energy density and fast charging times are very ideal for the job. In the sector of consumer electronics, high growth is possible due to increasing disposable income and improvements in technologies. Advanced batteries are bound to witness increased adoption, so this provides an opportunity for manufacturers to grow.

- Smart Cities: Probably the biggest next-generation battery opportunity globally is in smart cities. IoT devices, renewable energy systems, and advanced mobility solutions are integral parts of building smart cities. All these systems need efficient energy storage. Therefore, long-life and high-energy-density batteries become a sine qua non. As governments and the private sector heavily invest in smart city projects, demand for innovative battery solutions would increase and present market opportunities.

- Battery Recycling Market: A fast-growing sustainability concern necessitates the recycling of batteries to extract valuable materials, which reduces environmental impact. Unlocking an emerging market opportunity by developing recycling technologies for future-generation batteries could be realized with efficient recycling processes. The decrease in raw material scarcity and low production costs also resonates with the principles of the circular economy. Governments and companies are now investing heavily in infrastructures for battery recycling. Such has unlocked a lot of exciting avenues for growth in the next-generation batteries market.

Market Restraints

- High Upfront Costs: Next-generation batteries involve highly sophisticated materials as well as production processes and thus are expensive compared to the conventional ones. That is one of the major reasons why such technologies are not adopted as much as they can be, more so in the price-sensitive markets. Innovations try to bring about cost reductions, but cost-affordability is a huge challenge. As consumers and industries evaluate the advantages with the premium price, market penetration is slowed and constitutes a major restraint on the growth of next-generation battery technologies.

- Raw Material Availability: The next generation of batteries is critically hindered by a scarcity of materials, including lithium, cobalt, and nickel. These are also geographically concentrated, meaning the supply chains that carry these elements are prone to geopolitical tensions and export restrictions. Moreover, environmental issues further worsen the case. Since battery demand will grow, a lack of raw material availability can also lead to increasing cost and delay production in the market, which is bound to slow market growth.

- Technological Complexity: The technical challenges are also immense for the next-generation batteries due to innovative designs and new chemistries. It requires huge investments in R&D, manufacturing facilities, and skilled personnel for mass production. Also, consistent performance, safety, and durability standards make it challenging. All these hinder the pace of commercialization and adoption and thus are a major restraint in the market.

Market Challenges

- Lithium and cobalt availability are raw material dependent and quite scarce: Its geographic concentration can cause major hurdles for the production of next-generation batteries. In such cases, supply chain disruptions, political tensions, and rising costs related to the sourcing of these materials pose difficulties for maintaining a constant supply. This is further threatened by the mining activities involving these materials. Overcoming this will require innovations in battery chemistries and strong recycling infrastructures, and thus the challenge in achieving these at scale remains highly critical.

- Cost reduction: Although the new generation of batteries has tremendous benefits, they still have very high production and material costs, making them hard to penetrate markets at large. Cost reductions without compromise in performance, safety, and sustainability are difficult tasks. Optimum manufacturing processes, alternative materials, and increased capacity in the facilities will bring down the costs of next-generation batteries. Until such improvements are seen, the price of next-generation batteries will continue to be unaffordable, mainly for developing countries and cost-sensitive markets.

Next Generation Batteries Market Segmental Analysis

The next generation batteries market is segmented into technology, application, end use, chemistry and region. Based on technology, the market is classified into lithium-sulfur batteries, solid-state batteries, lithium-air batteries and flow batteries. Based on application, the market is classified into electric vehicles, consumer electronics, energy storage systems (ESS), aerospace and Defense. Based on end use, the market is classified into transportation, residential, commercial and utilities. Based on chemistry, the market is classified into lithium-ion, nickel-metal hydride, lead-acid and zinc-air.

Technology Analysis

Lithium-sulfur batteries: Lithium-sulfur batteries are presently gaining so much popularity lately because it has high energy density and their lightweight properties have made it particularly suitable for portable electronic apparatus and electric automobiles. The material used in a cathode is in this case sulfur, it is abundant also much cheaper in comparison to a cathode of a lithium battery. Some of these problems, however, like short cycle life and performance degradation on repeated usage, are under process through continuous R&D. They hold promise for high-performance energy storage.

Solid-State Batteries: The Solid-State Batteries segment dominated the market in 2024. This technology substitutes a solid instead of the liquid inside traditional batteries as an electrolyte. They provide greater safety, have higher energy density, and tend to live much longer than any other conventional batteries. This new generation is popularly taking off for electric cars because it supports faster chargeability and higher driving range. Moreover, their improved safety profile should replace the flammable liquid electrolyte makes them a very promising candidate for consumer electronics and aerospace applications to gain massive interest in the market.

Lithium-air Batteries: Lithium-air batteries are one of the recently developed new technologies used to develop highly energetic power from the use of oxygen in air as a reacting species. So light, they are revolutionizing electric vehicles and aerospace applications. Commercialization is currently limited because of technical barriers like low efficiency, short lifetimes, and moisture and CO2 contamination sensitivities.

Flow Batteries: Scalable flow batteries have the ability to store significant levels of energy. They are, therefore, suitable for grid-scale systems. They use liquid electrolytes that are stored in outside tanks. They last longer and scale more easily. Their usefulness can be witnessed more in the integration of renewable energy sources as they can store the intermittent supply that comes from solar and wind power, thus assisting in making the energy supply steadier and more reliable.

Application Analysis

Electric Vehicles: The next generation of the battery market is already strongly driven by the electric vehicle sector. Demand for longer-range, faster-charging, and more environment-friendly EVs is increasing. So, there is adoption of advanced next-generation batteries, mainly solid-state and lithium-sulfur batteries, which can overcome the limitations of the commercialized lithium-ion battery, offering higher energy efficiency and supporting electrification of transport across the globe.

Consumer Electronics: There is significant demand for more energy density, longer life, lighter weight, and smaller size batteries for most portable consumer electronics products, including smartphones, laptops, and wearable devices. These new technologies such as solid-state and lithium-sulfur variants are well-positioned to answer the calls, with the added benefit of better safety. These new-generation batteries are opening doors for new, imaginative products and longer times that will enable extended usage and therefore improve user experience and drive market penetration in these segments.

Next Generation Batteries Market Revenue Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Electric Vehicles (EVs) |

58.30% |

| Consumer Electronics |

11.60% |

| Energy Storage Systems (ESS) |

26.40% |

| Aerospace and Defense |

3.70% |

ESS: Applications of ESS are highly crucial for grid stabilization, considering the increased focus on renewable sources like solar and wind energy. Flow batteries and solid-state batteries are slowly but surely penetrating this market segment due to the provision of large-scale, long-duration energy storage. These technologies balance energy supply and demand and reduce dependence on fossil fuels; they also enable energy resilience both in residential and commercial settings.

Aerospace and Defense: In the aerospace and defense industries, lightweight and high-performance batteries are required for UAVs, satellites, and military equipment. Lithium-air and solid-state batteries will be very appropriate in these industries due to their improved energy density and reliability in extreme conditions. They power critical systems and reduce payload weights, which is essential for developing aerospace and defense technologies.

Next Generation Batteries Market Regional Analysis

The regional market for next generation batteries comprises North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). More analysis of all of these is shown below.

North America Next-Generation Batteries Market Trends

North America is an important market for next-generation batteries, led by high investments in renewable energy and electric vehicles (EVs). The U.S. leads the region because of government incentives for the adoption of EVs, vast R&D funding, and key battery manufacturers' presence. Solid-state and lithium-sulfur batteries are emerging innovations, and demand for ESS to stabilize the grid is pushing the market forward.

Europe Next-Generation Batteries Market Trends

It is a world leader in sustainability programs and promotes next-generation battery development. The EU Green Deal and phaseout of fossil fuel use are driving EV adoption and renewable energy. Countries that are well ahead of others have sizeable investments in R&D on batteries and gigafactories like Germany and Norway. Solid-state and flow batteries are gaining momentum, mainly in ESS and automotive applications.

Asia-Pacific Next-Generation Batteries Market Trends

The Asia-Pacific next generation batteries market size was estimated at USD 1.17 billion in 2024 and is expected to hit around USD 2.73 billion by 2034. The Asia-Pacific region is far ahead of the rest of the world in next-generation batteries. Demand for EVs, large manufacturing capabilities, and a booming industry in countries like China, Japan, and South Korea have created this scenario. China is the market leader in terms of EV production and innovation of battery technology. Japan and South Korea are following the emergence of solid-state and lithium-air technologies. There is more focus on renewable energy, and the government offers subsidies to further boost the market.

LAMEA Next-Generation Batteries Market Trends

It has growth opportunities with next-generation batteries that are mainly about energy storage with renewable power. Latin America, by focusing on projects involving renewable power, such as solar and wind, will attract flow and solid-state batteries. Demand is being seen in the Middle East, with growing interest in the stability of grid and EV. Africa is tapping into battery technology to improve remote energy access. Thus, an off-grid solution remains a potential future market.

Next Generation Batteries Market Top Companies

Recent Developments

- In February 2022, the U.S. Department of Energy announced an investment of USD 2.91 billion to enhance the production of advanced batteries for stationary energy storage systems and electric vehicles, in alignment with the Bipartisan Infrastructure Law.

- In January 2022, Mercedes-Benz and ProLogium entered into a technology cooperation agreement to jointly develop next-generation battery cells. As part of its commitment to becoming fully electric by 2030, Mercedes-Benz recognizes ProLogium's expertise in solid-state battery R&D and manufacturing as a key asset for accelerating its electrification goals

Market Segmentation

By Technology

- Lithium-Sulfur Batteries

- Solid-State Batteries

- Lithium-air batteries

- Flow Batteries

By Application

- Electric Vehicles (EVs)

- Consumer Electronics

- Energy Storage Systems (ESS)

- Aerospace and Defense

By End Use

- Transportation

- Residential

- Commercial

- Utilities

By Chemistry

- Lithium-Ion

- Nickel-Metal Hydride

- Lead-Acid

- Zinc-Air

By Region

- North America

- APAC

- Europe

- LAMEA

...

...