Nuclear Materials Market Size and Growth 2025 to 2034

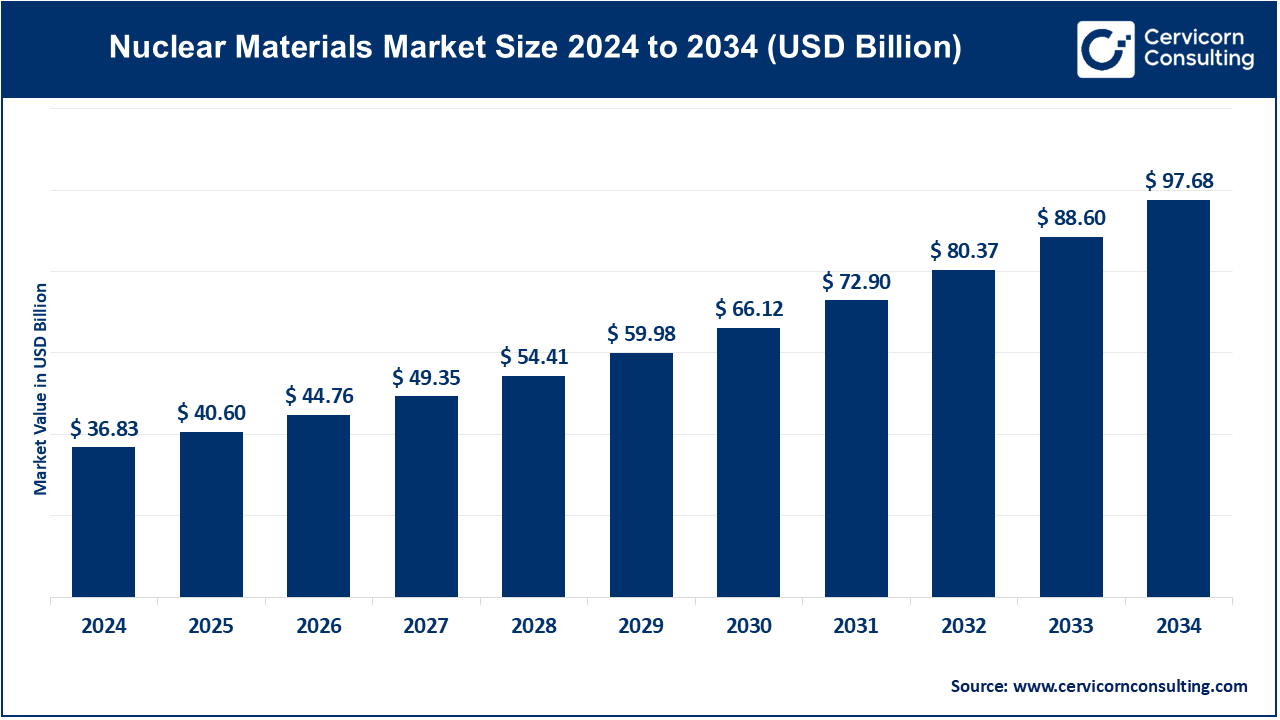

The global nuclear materials market size was valued at USD 36.83 billion in 2024 and is anticipated to reach around USD 97.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.24% over the forecast period from 2025 to 2034. The growth of the nuclear materials market can be attributed to the demand for nuclear energy on the rise globally as more and more governments are looking to reduce carbon emissions. The growing demand for advanced nuclear fuels along with materials for nuclear reactors-in particular zirconium alloys and uranium-is another driver for growth in this sector. Besides, investments in R&D for next-generation nuclear reactors-small modular reactors ( SMRs)-air another aspect lighting market growth. Increased concerns regarding nuclear waste management as well as the needs for advanced high radiation-absorption materials are further fueling the growth of the sector.

A nuclear material is a substance in the production of nuclear energy. Specifically, these would be uranium, thorium, plutonium, or other radioisotopes. Such materials are critical in nuclear reactors in their fission for heating and electrical generation. Nuclear materials also find ubiquitous applications in medicine, industry, and the defense establishment wherein they are used for radiography, cancer treatments, and nuclear weapons. With such, safeguards regarding the safety, security, and handling of nuclear materials would minimize risks related to radiation exposure, environmental contamination, and nuclear proliferation.

Nuclear Materials Market Report Highlights

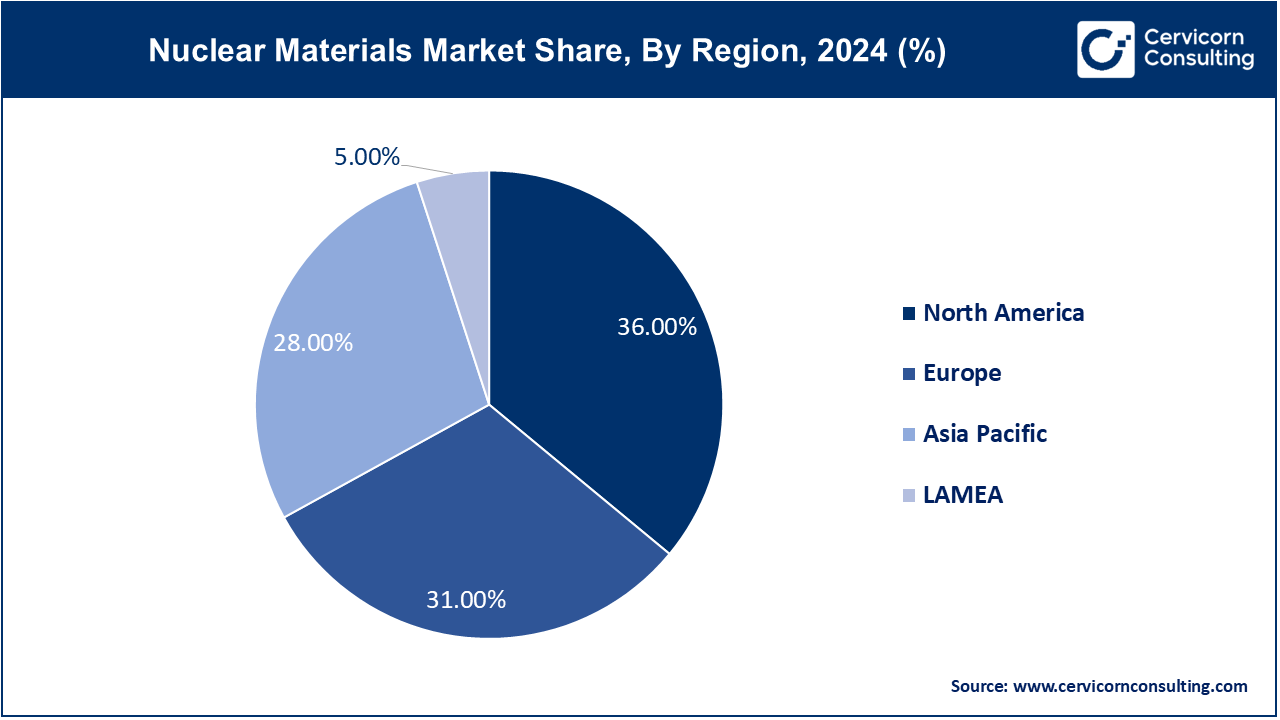

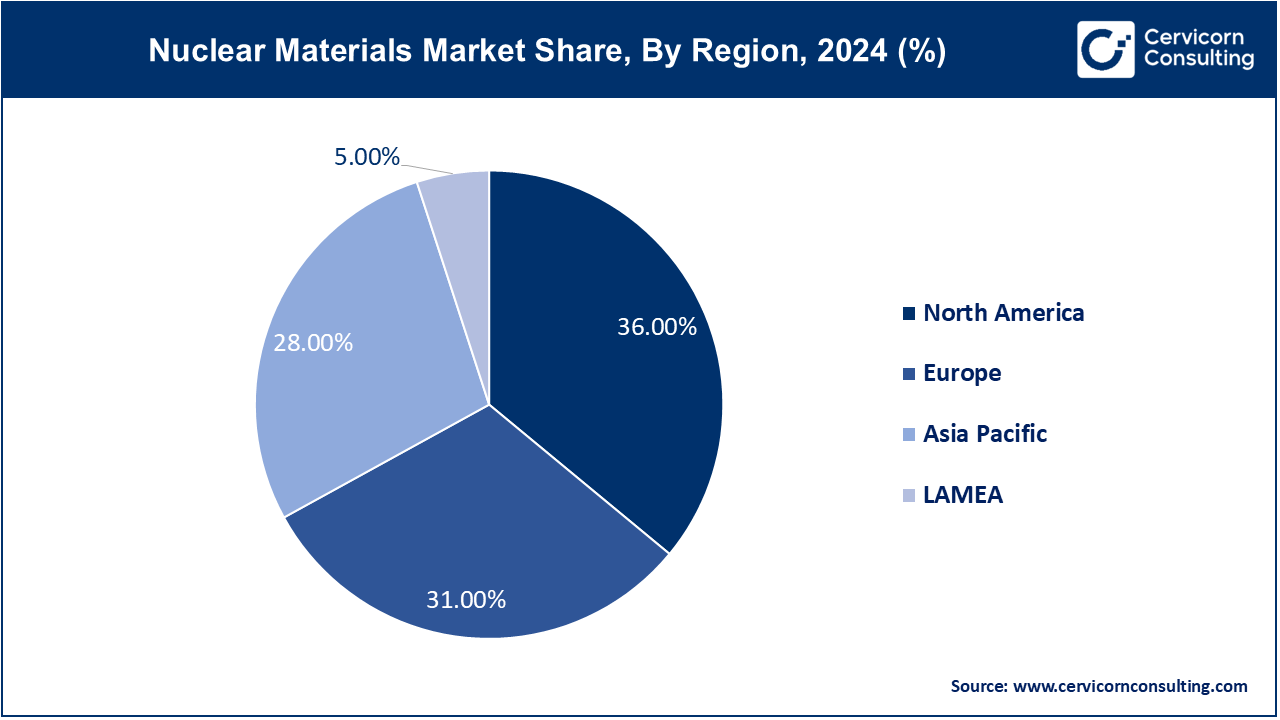

- North America accounted for a highest revenue share of 36% in 2024.

- Europe registered revenue share of 31% in 2024.

- Asia-Pacific is anticipated to hit fastest growth over the forecast period.

- By type, the special nuclear material segment held largest revenue share in 2024.

- By end user, the energy and power segment captured highest revenue share in 2024.

Nuclear Materials Market Growth Factors

- Technological Development: Major contributors to growth in the market include advancements in reactor designs and efficiency of fuels from nuclear technology. These technological changes improve safety, dependability, and performance levels at nuclear plants. As they change over time, problems such as the waste associated with fuel and lifespan of the reactors are gradually erased, increasing nuclear energy as an option and sustainable source of power for many generations.

- Public Awareness of Clean Energy: A greater concern for sustainability and clean energy across the world results in an increase in public consciousness about nuclear energy as a power source that is safe, reliable, and low in carbon. This shift to nuclear energy with increased environmental awareness contributes to this growth. Increasing the public's understanding of nuclear energy's advantages-its low emission and high energy density-encourages growing demand for nuclear materials.

- Nuclear Waste Management Improvements: Developments in nuclear waste management technology are crucial for the growth of the nuclear materials market. Advanced reprocessing, better means of storage systems, and long-term disposal techniques have helped improve the overall sustainability of nuclear power. When improved waste management solutions result in social and environmental acceptability, further growth of nuclear power is assured.

Nuclear Materials Market Trends

- Introduction to Integrated Small Modular Reactors (SMRs): Small Modular Reactors, or SMRs, is one of the biggest trends of this nuclear materials market. This is a much more flexible, cost-effective, and easier-to-deploy product line compared to traditional large-scale reactors; it is expected to change the face of the market by providing safer, scalable, and more accessible nuclear energy for developed countries and developing ones alike.

- Public-Private Partnerships: Increasing partnerships between the government and the private sector are accelerating the growth of nuclear energy. These partnerships involve all the financing, the advancement in technology, and safety in nuclear plants. Public-private partnership allows combining resources, expertise, and research capabilities in further innovation of nuclear technologies that enhance the general viability of these solutions in nuclear energy.

- Investments in Development: This trend also involves investment in the development of effective, cost-efficient decommissioning technologies. Older nuclear plants, nearing the end of their operational cycle, obviously call for more modern technologies for safe and economic decommissioning. All these trends are now mounting a burgeoning market for services and nuclear fuel management.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 40.60 Billion |

| Expected Market Size in 2034 |

USD 97.68 Billion |

| Projected CAGR 2025 to 2034 |

10.24% |

| Dominant Area |

North America |

| Fastest Growing Area |

Asia-Pacific |

| Key Segments |

Special Nuclear Material Type, End User, Region |

| Key Companies |

Kazatompron, Cameco, Orana, Uranium One, ARMZ Uranium Holding, China Nuclear National Corporation, New Brunswick Power Corporation, Uranium Corporation of India, United States Enrichment Corporation, GE Hitachi Nuclear Energy |

Nuclear Materials Market Dynamics

Market Drivers

- Technology Innovation in reactor design: Advances in generation IV reactors are further driving the growth of the nuclear materials market. New designs of the reactor promise heightened efficiency and enhanced safety as well as reduction of waste content. Fast breeder reactors, for instance, produce more fuel than they consume that creates a competitive advantage making nuclear energy an even more attractive and sustainable source of energy to meet the needs of the global community.

- Government Subsidies: In this regard, the government support toward the nuclear energy projects is crucial. This kind of support is realized through financial incentives, tax benefits, and subsidies. The subsidies actually help balance out the very high costs one incurs in constructing a nuclear plant and doing research. This lowers financial barriers to both the private and public sectors, hence encouraging investment in nuclear energy and making it a competitive alternative to other sources of energy.

- Cost Escalation in Fossil Fuels: The time is when, in an age of growing price volatility of fossil fuels, notably oil and natural gas, nuclear power looks more lucrative. Rising fossil fuel prices mean that nuclear energy becomes relatively inexpensive for generating base-load electricity.With steady operation costs and a long life span, nuclear power is ever more competitive in the global energy market, pushing demand for nuclear materials and opening up greater growth in markets.

- Nuclear Fuel Supply Security: The long-term growth of the nuclear materials market depends on the assurance of a stable and diverse supply of nuclear fuel. Nations are shifting their focus towards securing their nuclear fuel supply chains to avoid disruption. Long-term contracts and investments in alternative fuel sources will make the market sustain nuclear power, which will subsequently stimulate demand for nuclear materials for these purposes.

Market Restraints

- High initial capital: High initial capital is the most limiting factor facing the nuclear materials market. This is so because of the capital used in providing such plants. Setting up a nuclear plant is somewhat expensive because it has to include the infrastructural aspect, the technological aspect, and the safety aspect. Many countries or firms cannot afford the initial capital for setting up these nuclear power plants. The rate of expansion in the market and consumption of nuclear energy suffers due to high initial capital.

- It has limited public support. It is true that nuclear power has many environmental advantages; however, several regions still oppose nuclear energy mainly because it creates fear in people's lives due to safety issues and contamination from nuclear accident mishaps. Nuclear accidents, especially the Fukushima tragedy, have further entrenched these anxieties in people's minds, making it arduous for the market expansion process to penetrate these fears and to gain people's confidence in nuclear power.

- Longer Development Timelines: Long development times are another major restraint. Building, licensing, and testing nuclear reactors take decades to complete, thereby delaying the realization of benefits. Such extended timelines create uncertainty for investors and prevent the market from responding quickly to increasing energy demands, thereby affecting the growth rate of the nuclear market.

Market Opportunities

- Extension of SMR Technology: Small Modular Reactors are seen as the largest opportunity for the nuclear materials market. SMRs are less expensive, scalable, and safer compared to large reactors. This is a new attractive option for smaller or emerging markets. The modularity enables quicker deployment and flexibility, opening new opportunities for nuclear energy in urban and remote locations.

- Global Nuclear Power Revival: Interest and investment in nuclear power are on the rise in emerging markets, and this presents an opportunity for the nuclear materials market. Countries in Asia, the Middle East, and Africa are upgrading their nuclear power to meet burgeoning energy demands. New nuclear capacity, which several of these nations are building over the coming few decades, means massive demand for nuclear materials-sufficient growth drivers for the market world-over.

- Production of Nuclear Hydrogen: This now opens an avenue for the market to leverage hydrogen production from nuclear energy. All this encompasses a range of transport, industrial usage, up to energy storage as low-carbon, low-cost hydrogen derived from nuclear power. Increasing demand worldwide for hydrogen, therefore, forms a new window of opportunity for the market on the role nuclear energy can take in its production and puts nuclear materials in position as part of the fabric for future energy strategy.

Market Challenges

- Frequent changes in the Regulation: Regulatory uncertainty is the most significant issue for the nuclear materials market. Changes in policy, shifting political priorities, and different international regulations can cause a delay and added cost to the nuclear energy project. These uncertainties make it impossible for investors to predict long-term returns and deter the growth of the nuclear market.

- Competition from Renewable Energy: Rising renewable energy sources like solar, wind, and hydro add an extra level of challenge to the nuclear materials market. The more renewables cut their prices and deploy fast, the stronger the competition becomes in the race for clean, sustainable, and affordable energy against nuclear. In the near future, this trend in preference towards renewables might limit the growth of nuclear energy ventures.

- Bureaucratic Approval Process Taking a Long Time: Long timelines in acquiring regulatory permits to nuclear plants is considered the most formidable hurdles. Sometimes, years would pass before one gets permission or the safety level is met. Moreover, various environmental reviews create long delays on the deployment of new plants as well as growth of nuclear energy, slowing the reaction of the market to increasing demand for energy as well as minimizing the competitiveness of nuclear energy.

Nuclear Materials Market Segmental Analysis

Type Analysis

Special Nuclear Material

- Plutonium: Plutonium is a fissile material formed by the absorption of uranium-238 in nuclear reactors. Plutonium is an important material in the production of nuclear power and nuclear weapons. An important isotope of plutonium is plutonium-239, which is used in MOX (mixed-oxide) fuel for reactors. However, since it is radioactive and has proliferation potential, plutonium must be handled and stored under very strong safeguards and with appropriate regulatory supervision to ensure safety and security.

- Uranium-233: The uranium isotope is considered fissile that is primarily found by the irradiation process of the compound thorium-232 through a nuclear reactor. Such a compound could actually be employed as a possible basis for constructing so-called 'safer and environmentally friendly' or 'green thorium fuel'. Uranium 233, moreover, may similarly be employed within nuclear weaponry however its employment strictly limited out of fear over such proliferation plus related radioactive decay compounds that do not easily come for handling.

- Uranium-235: It's a naturally occurring isotope; uranium-235 is the fissile material with the most applied use in any form. It can help carry and sustain a nuclear chain reaction with its existence within both weapons developments and power plant production. Mostly, it remains enriched to an even higher content for use in reactor fueling, though applications to this is highly regulated and also controlled in distributing and deploying within the globe efforts of non-proliferation.

Source Material

- Thorium: Thorium is a next-generation nuclear fuel that has attracted much attention due to its advantages over uranium. It is fertile rather than fissile, which means it can be transformed into a fissile material inside a reactor (uranium-233). Thorium reactors are believed to be safer and produce less nuclear waste, which is a promising prospect for sustainable nuclear energy. However, commercial thorium reactors are still in the developmental stage, and their widespread use is not yet achieved.

- Uranium-235: Uranium-235 is also source material since it is mined and enriched to be used as fuel in nuclear reactors. Natural uranium contains only 0.7% uranium-235, while the rest, 99.3%, is uranium-238, which is less reactive. Uranium-235 is enriched to have a higher percentage for use in nuclear reactors, and its use is highly regulated because of the risks of nuclear proliferation.

- Natural Uranium: Natural uranium is the naturally occurring uranium consisting of uranium-238 and uranium-235. Though natural uranium contains only a small amount of uranium-235, its existence enhances the ease of utilization in reactors without enrichment. The isotope uranium-238 can also be fissioned in some reactors to produce energy. Natural uranium is majorly mined and then processed for further use such as enrichment in the production of nuclear power.

- Depleted Uranium: Depleted uranium is a type of uranium that has seen a significant proportion of its isotope uranium-235 removed from it during enrichment. It has been used predominantly in military uses, such as armor-piercing ammunition because of its density and penetrating powers. Depleted uranium is also utilized in radiation shielding and some types of nuclear reactors. However, the environmental and health impacts and toxicity of the substance limit more extensive use of depleted uranium.

Product Material

- Uranium: The major fuel for nuclear reactors all over the world is uranium. It is utilized to produce nuclear power through the fission of uranium in the reactors, where it releases immense amounts of energy while emitting only a few amounts of greenhouse gases. Uranium mining and processing are also vital in the nuclear energy supply chain. Furthermore, uranium is also highly important in defense applications and plays a significant role in the production of nuclear weapons; hence, it is a geopolitically valuable resource.

- Thorium: Thorium is the alternative fuel being studied for nuclear fuel within advanced reactors. Thorium is not fissile, but it can be converted into fissile uranium-233 within a reactor. With regard to advantages, thorium has increased safety factors, less radioactivity at the end of its life cycle, and a much lower production risk of nuclear weapons. However, commercial thorium reactors are yet to be developed by key players in the nuclear technology space.

End User Analysis

Medicine: Nuclear materials have been used very widely in medicine both as diagnostic and for therapeutic purposes. Radioisotopes, like iodine-131 and technetium-99m, are applied in imaging procedures with the intention of detecting cancer or other diseases. In addition, nuclear medicine is highly regarded in the use of cancer treatment through radiation therapy where isotopes such as cobalt-60 are applied to cancerous cells. In this regard, it is the medical sector that remains the demand supplier of nuclear materials due to its use of the improved statuses of nuclear technologies.

Agriculture: In agriculture, nuclear technologies are used on food irradiation, pest control, and soil analysis. Crop yield increases when radioisotopes eradicate pests and diseases, and the irradiation of food to extend shelf life is radiation. Isotopic methods are used for crop breeding. Crop breeding focuses on producing higher strength varieties by using isotopic techniques. The growth of the global population fuels the nuclear agriculture industry, but sustainability in farmlands was a tad more significant compared to previous decades.

Energy and Power: The Energy and Power segment dominated the market in 2024. Nuclear energy is the largest source of low-carbon power in the global energy market. Uranium-235 and plutonium-239 are the fuel used in nuclear reactors that produce electricity by fission reaction under control. Nuclear energy is therefore playing a very crucial role in providing stable and reliable power as the world seeks ways of meeting increasing energy demand while at the same time reducing greenhouse gas emissions, especially in countries committed to clean energy transitions.

Marines: Nuclear materials play a very critical role in the marine sector. They provide a source of power used for propulsion purposes in naval applications, namely compact, long-duration nuclear reactors used by nuclear-powered submarines and aircraft carriers. These types of vessels can stay underwater for extended periods without needing to refuel, making them even more strategically relevant. Many countries depend on nuclear materials as part of their national defense and deterrence.

Aerospace: Nuclear materials can serve as a principal source of energy for space exploration in aerospace. RTGs provided with the power of Plutonium 238 power space craft and rovers to work beyond sun rays, when only solar power is insufficient. These materials warrant rovers working for tens of years on Mars and planetary probes far from Earth working long after their collection of solar or battery power is depleted.

Industrial: There are many industrial applications that require the use of nuclear materials. They are applied in radiography, material testing, and industrial gauging. Radiographic examination, which employs radioactive isotopes such as cobalt-60, enables the detection of welds, pipes, and structural parts of items without causing damage that might have flaws or defects that exist within them. Such applications are of critical importance in industries such as the oil and gas business, construction industry, and manufacturing, where the integrity of materials and structures is crucial to provide safety and better performance. This contributes to widespread industrial demand for nuclear materials.

Nuclear Materials Market Regional Analysis

The nuclear materials market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

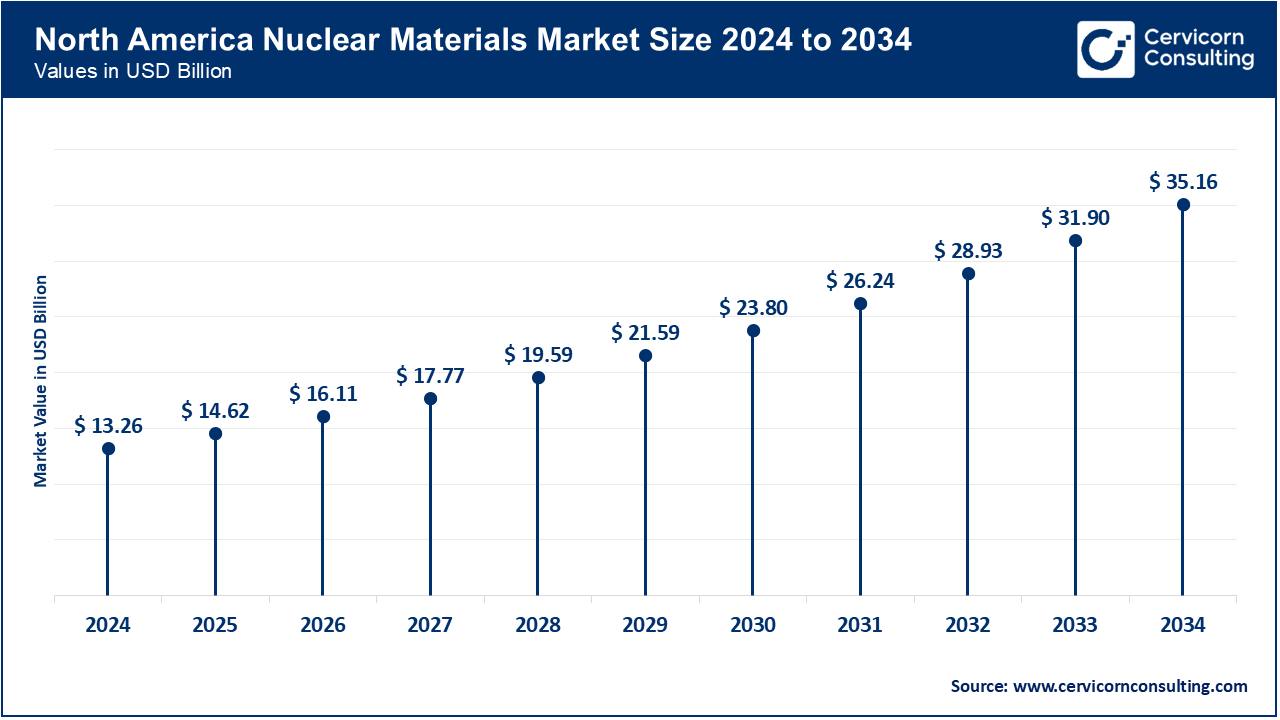

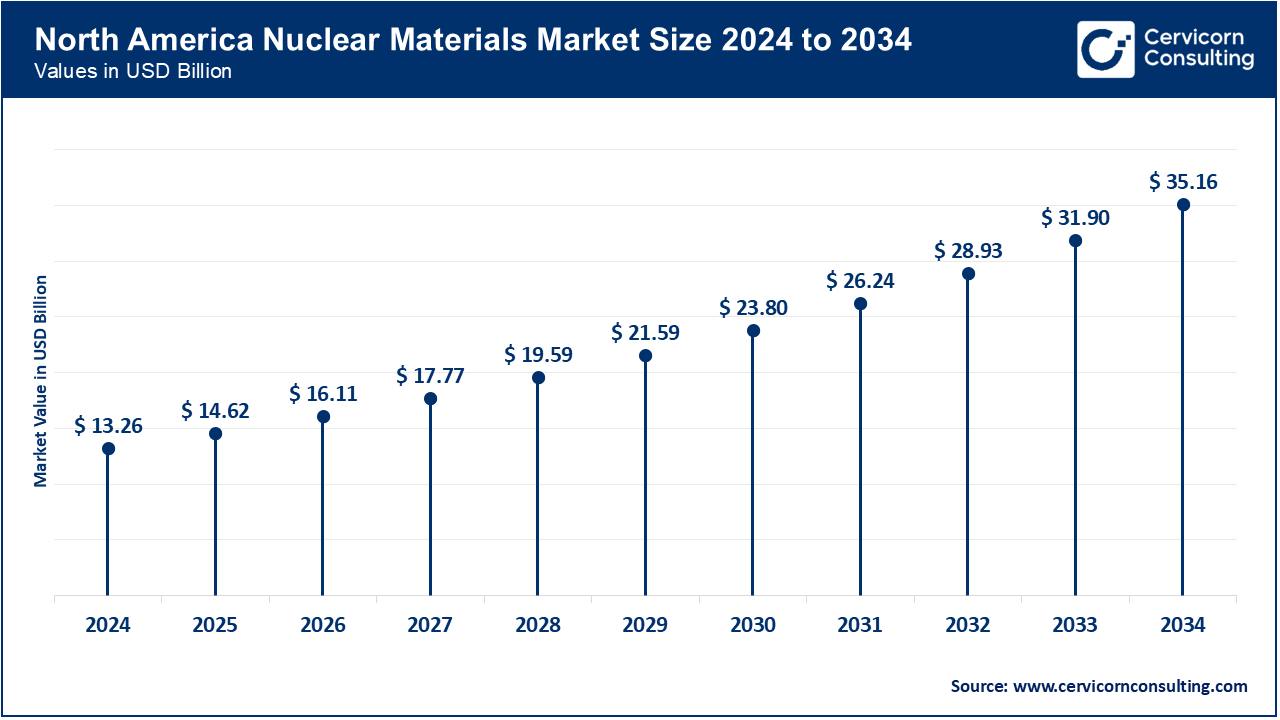

Why North America hit leading position in the nuclear materials market?

The North America nuclear materials market size was reached at USD 13.26 billion in 2024 and is predicted to hit around USD 35.16 billion by 2034. The United States possesses hundreds of operating nuclear reactors; this has established the United States as the largest producer of nuclear electricity globally. For example, from the United States Environmental Protection Agency, it has been known that nuclear reactors account for nearly 20 percent of all the electricity produced in the United States. Uranium is the fuel most widely used in nuclear reactors at power plants. Nuclear energy is produced when uranium atoms are split in a process called fission.

Europe Nuclear Materials Market Trends

The Europe nuclear materials market size was estimated at USD 11.42 billion in 2024 and is expected to reach around USD 30.28 billion by 2034. Europe boasts of the largest share of world-leading market, dominated by France, the UK, and Russia. In the case of France, around 70% of its electricity comes from nuclear energy, and similarly, Russia has also focused efforts on nuclear construction. Countries like Germany, which are now phasing out nuclear, continue to play important roles in nuclear technology and waste management. For example, as of 2022, Germany is decommissioning nuclear power. Only three reactors are currently in operation, with plans to close them at the end of 2022. Of the reactors, 26 are decommissioned while four have been taken offline. The country's energy policy focuses on the transition towards renewable sources; it has plans to increase its renewable energy percentage to 65% by 2030 and be greenhouse gas neutral by 2045, among other sustainable and secure energy supply commitments. It is also one of the bases for nuclear innovation in Europe with several ongoing research projects on advanced reactors.

Why Asia-Pacific witness strong growth in the nuclear materials market?

The Asia-Pacific nuclear materials market size was accounted for USD 10.31 billion in 2024 and is predicted to grow around USD 27.35 billion by 2034. The Asia-Pacific region, which includes China, India, and Japan, is one of the world's fastest-growing markets for nuclear materials. China is rapidly increasing its nuclear capacity to meet its ever-growing energy needs, and India is investigating thorium reactors as a more sustainable future source of power. For example, in January 2023, the Sasakawa Peace Foundation reported that China is exponentially expanding its nuclear arms capabilities and aims to level with the U.S. In Kansu Province, China is constructing two plutonium reprocessing plants that are scheduled to be operational in 2025 and 2030. It is also working on a program involving fast breeder reactors (FBRs), which can possibly produce large amounts of weapons-grade plutonium. Then China's nuclear arsenal may grow to exceed 1,000 warheads by 2030, leaving the rest of the world with serious concerns about proliferation. Japan has committed itself to nuclear power, investing in reactor safety and fuel reprocessing technologies despite setbacks at Fukushima. Clean energy demands drive nuclear power and materials growth in the region.

LAMEA Nuclear Materials Market Trends

The LAMEA nuclear materials market was valued at USD 1.84 billion in 2024 and is anticipated to surpass around USD 4.88 billion by 2034. LAMEA is emerging as a growing market, among others such as Brazil, South Africa, and the United Arab Emirates. Brazil possesses considerable uranium reserves; additionally, it is developing its nuclear energy capacity. South Africa operates the only nuclear power plant in Africa. The United Arab Emirates is building nuclear reactors. One of its nuclear power plants at Barakah is operational. The region's emphasis on energy diversification and sustainability increases demand for nuclear energy and associated materials. For example, according to World Nuclear Association in September 2024, The United Arab Emirates (UAE) has developed a nuclear power program with significant public support, constructing four reactors at Barakah, expected to produce 25% of the country's electricity. The first unit was inaugurated in April 2021 and the subsequent units were commissioned in 2022 and 2023. The UAE Emirate has a strategic plan by 2050 to target half of energy through nuclear power and renewable sources that make it efficient for energy security and sustainability.

Nuclear Materials Market Top Companies

CEO Statements

Meirzhan Yussupov, CEO of Kazatompron

"At Kazatomprom, we are committed to being a global leader in the sustainable production and responsible management of nuclear materials. By leveraging cutting-edge technologies and maintaining the highest safety standards, we are not only meeting the world’s growing energy demands but also contributing to a cleaner, more secure energy future. Our focus is on expanding the use of uranium, improving supply chain resilience, and ensuring the safe, long-term use of nuclear energy."

Tim Gitzel, CEO of Cameco

"At Cameco, we are at the forefront of providing clean, reliable, and sustainable nuclear fuel to meet the world’s growing energy needs. Nuclear energy is a critical part of the global solution to addressing climate change, and as demand for low-carbon energy increases, we are committed to supporting the transition to a cleaner future through responsible uranium production and innovation in the nuclear sector."

Eduards Smirnovs, CEO of Uranium One

"At Uranium One, we are committed to providing the world with the clean energy needed for a sustainable future. As a leading producer of uranium, we understand the vital role nuclear energy plays in reducing carbon emissions and ensuring energy security. Our focus is on responsible resource extraction, innovation, and meeting the growing global demand for uranium to fuel the nuclear power plants of tomorrow."

Recent Developments

- In January 2024, Kazakhstan's national nuclear company, Kazatomprom, is likely to cut output forecast for the year 2024 with constraints such as limited sulphuric acid supplies and delays in building at some new deposits continuing to add pressure. Such problems, due to global disruptions in supply chains, might derail the production uptick and longer-term plans at Kazatomprom for the year 2025. End. The company recently earned itself a long-term uranium supply deal with China, further cementing it as a leading supplier, producing more than 40% of the world's uranium at a time when demand for nuclear energy worldwide is increasing.

- In September 2023, GE advances nuclear technology to develop a novel solution that involves the integration of new sensors and imaging techniques along with an AI-driven Digital Twin for fuel reprocessing facilities. This system has Distributed Ledger/Blockchain technology enabling real-time monitoring of used materials from the spent fuel, with enhanced safeguards as well as secured data. GE Steam Power will provide nuclear steam turbines for new plants in India to construct nuclear power plants while continuing the way of sustainable energy solutions through innovative nuclear technologies.

- In February 2023, Cameco Corporation signed a major supply contract with the state-owned nuclear utility of Ukraine, Energoatom, to supply natural uranium hexafluoride (UF6) for its nuclear fuel until 2035. From 2024 the contract will meet all UF6 requirements for nine reactors at Rivne, Khmelnitsky, and South Ukraine plants, representing about 15.3 million kgU. The contract has an option to supply fuel to the Zaporizhzhia plant in case it is returned under Energoatom control. This partnership aims at increasing the energy independence and supply security of Ukraine in light of current geopolitical challenges and marks a watershed in the history of Cameco.

Market Segmentation

By Special Nuclear Material Type

- Special Nuclear Material

- Plutonium

- Uranium-233

- Uranium-235

- Source Material

- Thorium

- Uranium-235

- Natural Uranium

- Depleted Uranium

- Product Material

By End User

- Medicine

- Agriculture

- Fertilizers

- Breeding

- Other

- Energy and Power

- Electricity Generation

- Heat Generation

- Marines

- Sub-marines

- Nuclear Powered Ships

- Nuclear Naval Fleets

- Civil Vessels

- Others

- Aerospace

- Military Aircrafts

- Space Crafts

- Others

- Industrial

- Metal

- Detergent

- Paper

- Plastic

- Others

By Region

- North America

- APAC

- Europe

- LAMEA

...

...