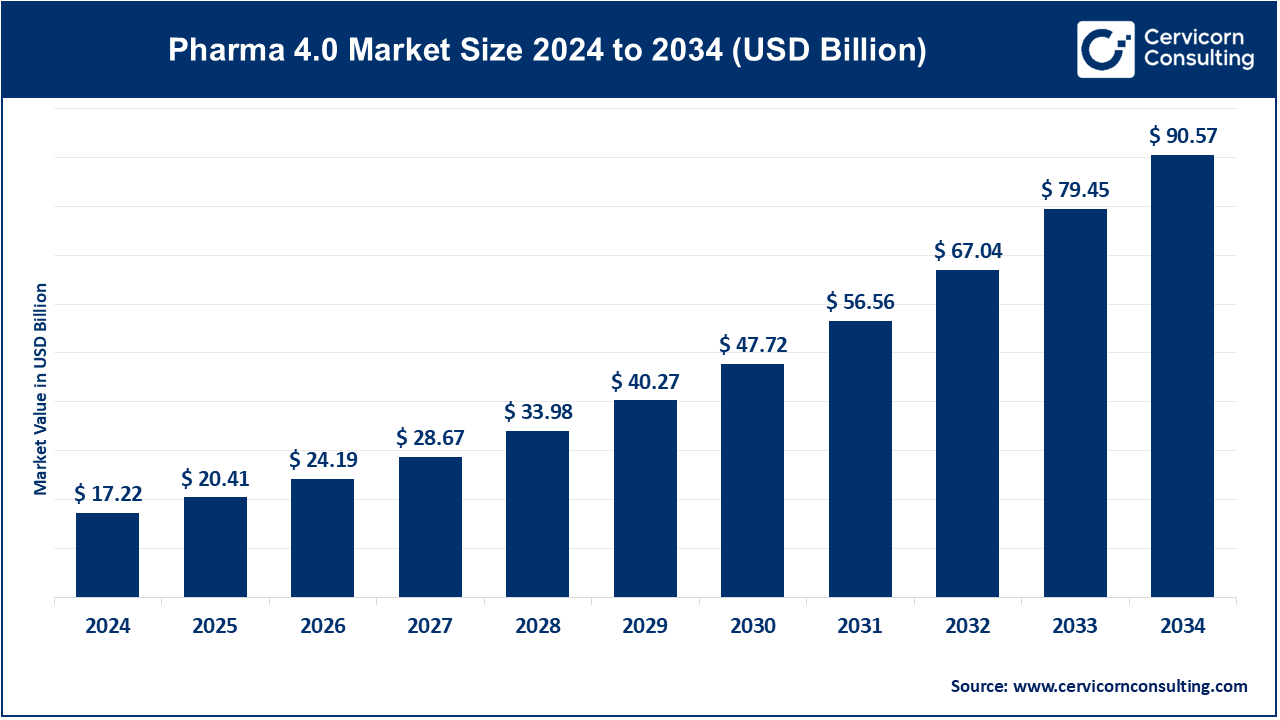

The global pharma 4.0 market size was valued at USD 17.22 billion in 2024 and is expected to be worth around USD 90.57 billion by 2034, growing at a compound annual growth rate (CAGR) of 18.05% over the forecast period 2025 to 2034. The U.S. pharma 4.0 market size was valued at USD 5.67 billion in 2024.

The pharma 4.0 market is experiencing rapid growth due to the increasing demand for automation and digitization in pharmaceutical manufacturing. Companies are investing heavily in AI-driven analytics, IoT-enabled devices, and cloud-based systems to streamline operations. Regulatory bodies are also pushing for digital transformation to ensure compliance with stringent quality standards. The adoption of smart manufacturing techniques, digital twins, and real-time monitoring solutions is further driving market expansion. Additionally, factors such as the rising demand for personalized medicine and the need for efficient vaccine production have accelerated the implementation of Pharma 4.0 technologies.

The pharmaceutical industry is on the cusp of a digital revolution, and pharma 4.0 is leading the way. The pharmaceutical industry is subject to stringent regulations and is therefore rigorously scrutinized when implementing changes that affect production and related aspects, thereby creating the need for a reliable pharmaceutical quality system. Pharmaceutical manufacturers, vendors, and professionals have already started exploring viable applications of industry 4.0 in their organizations, while the International Society for Pharmaceutical Engineering (ISPE) is working to better define the various aspects that characterize Pharma 4.0.

What is a Pharma 4.0?

Pharma 4.0 is the next-generation approach in the pharmaceutical industry that integrates digital technologies like artificial intelligence (AI), the Internet of Things (IoT), cloud computing, and automation to enhance efficiency, quality, and compliance. It builds upon Industry 4.0 principles, focusing on real-time data collection, predictive analytics, and smart manufacturing. This transformation improves drug production, reduces human errors, and ensures faster regulatory compliance. Advanced robotics and machine learning help in precise drug formulation, quality control, and supply chain management. Pharma 4.0 also enhances patient safety by enabling real-time monitoring of drug manufacturing, reducing contamination risks, and ensuring better traceability of medicines.

Key Insights Beneficial to the Pharma 4.0 Market:

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 20.41 Billion |

| Projected Market Size in 2034 | USD 90.57 Billion |

| Growth Rate 2025 to 2034 | 18.05% |

| Dominant Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Type, Technology, Application, End User, Region |

| Key Companies | Microsoft Corporation, Oracle Corporation, ABB, Optum, Inc., Honeywell International Inc., Cisco Systems, Inc., Siemens Healthcare GmbH, GE Healthcare, IBM Corporation, POLARISqb, Optibrium, SAS Health, Microsoft, Amazon Web Services, Inc., Aspen Technology Inc., Google Cloud, Syntekabio, Fujitsu Limited, Lotte Healthcare, Glatt GmbH |

Increasing Need for Data Integration

Increasing Use of Advanced Analytics

Data Security and Privacy Concerns

Need for Significant Investment in Advanced Technologies

Emerging Smart Manufacturing

Ongoing Digital Transformation

Technology Related Concerns

Skills Shortage

Based on technology, the global market is segmented into cloud computing, artificial intelligence, big data analytics, internet of things (IoT) and other. The artificial intelligence (AI) was leading segment in 2024.

Cloud Computing: Cloud computing permits pharmaceutical companies to access and analyze data more effectively by helping them with scalable and flexible resources for data processing, analysis, and storage. Cloud computing also supports remote monitoring and global operations by authorizing data sharing, collaboration, and on-demand computing power. These platforms lead to more effective drug development and discovery by improving data sharing between organizations.

Artificial Intelligence (AI): Artificial Intelligence (AI) helps in the interpretation of complex data, learning from it, and then making predictions or decisions based on it, having the least amount of human intervention. These technologies are used in drug discovery, manufacturing process optimization, quality assurance, and patient diagnostics, significantly reducing time and costs while improving outcomes.

Big Data Analytics: Big data analytics and effective cross-organizational communication can improve the performance of process monitoring and identify and reduce material waste, overproduction, and energy consumption. Pharmaceutical manufacturing is seen to change into a reconfigurable industry with an advanced production line that can easily mass-produce customized drugs to meet different requirements through the integration of big data analytics solutions.

Internet of Things (IoT): IoT, as used in Pharma 4.0, mainly refers to when medical equipment and devices can connect to healthcare systems and exchange data, enhancing patient monitoring and care. Continuous monitoring and feedback loops generated by IoT facilitate improvement in pharmaceutical operations. Pharmaceutical companies can achieve a remarkable amount of waste reduction, improved product quality, and process optimization by recognizing inefficiencies, applying correct actions, and analyzing real-time data. IoT makes data collection possible in real-time from any kind of manufacturing equipment, medical devices, and wearable technology. Better process control, device monitoring, and personalized medical treatments and be achieved as a result of the implementation of IoT.

Based on application, the global market is segmented into drug discovery and development, clinical trials, manufacturing and others. The drug discovery and development segment was leading the market in 2024.

Drug Discovery and Development: The drug manufacturing process which also includes drug development, production, and discovery uses various digital technologies to improve the standard and efficiency. Incorporating pharma 4.0 into drug development and discovery has made specially tailored drug formulations, predictive equipment maintenance, and real-time process monitoring achievable. Furthermore, the incorporation of pharma 4.0 leads to reduced expenses, quicker time to market, and better patient outcomes. Pharma 4.0 is crucial in drug discovery & development because it can transform the process of drug production, guarantee regulatory compliance, and satisfy the ever-growing needs of personalized medicine.

Clinical Trials: The use of Pharma 4.0 in clinical trials has progressed and expanded rapidly in recent years, raising concerns about data integrity, patient safety, and patient privacy while also bringing new requirements from regulators. Pharma 4.0 allows increased patient recruitment and retention owing to the use of modern analytics and remote monitoring. Real-time data analytics and monitoring help in making adaptive strategies and expedited decision-making. Predictive modeling coupled with adaptive study designs can help in optimizing the clinical trial protocol. Further, enhanced safety surveillance via automated adverse event identification and signal control can be achieved with pharma 4.0.

Manufacturing: Pharma 4.0 technologies allow real-time monitoring and control of manufacturing processes, which in turn enhances quality assurance and regulatory compliance. Automated systems can identify deviations from predetermined quality standards and notify operators on time, enabling them to promptly address the problem. Pharma 4.0 aims to integrate data from various sources, including manufacturing sites, quality management systems, and supply chain management systems, into a single digital platform.

Based on end user, the global market is segmented into pharmaceutical companies, biotechnology companies, and CROs & CMOs. The pharmaceutical companies segment has held leading position in the market in 2024.

Pharmaceutical Companies: Pharmaceutical companies around the world are focusing on cutting and expediting the total cost of drug development to satisfy the growing demand for medications and treatments, particularly in nations such as the US, Germany, the UK, China, and India. The growing adoption of cutting-edge technologies for enhancing service and operational efficiency as well as product quality by the pharmaceutical industry is further fueling market expansion.

Biotechnology Companies: Several biotech companies are rapidly adopting cutting-edge digital tools and technologies to transform the process of drug manufacturing. Biotech companies are now rushing to embrace digitalization as they consider it a priority as expectations for faster time to market are higher than ever before. Pushing productivity to all-time highs and producing notable gains in operational effectiveness and financial performance is owing to the adoption of Pharma 4.0 technology.

CROs and CMOs: Pharmaceutical and biotech companies highly depend upon contract laboratories and CMOs/CDMOs for development, manufacturing, and quality work to meet the demands. As pharmaceutical companies consider variables such as expected growth in their product portfolio and evolving manufacturing needs, they increasingly rely on contract manufacturing organizations (CMOs) to maintain and increase productivity. CROs work closely with customers to further develop, evaluate, and commercialize cutting-edge drugs and devices. Contract manufacturing outsourcing (CMOS) solutions, on the other hand, refer to outsourcing arrangements in which one company contracts out parts, materials, or components to another company.

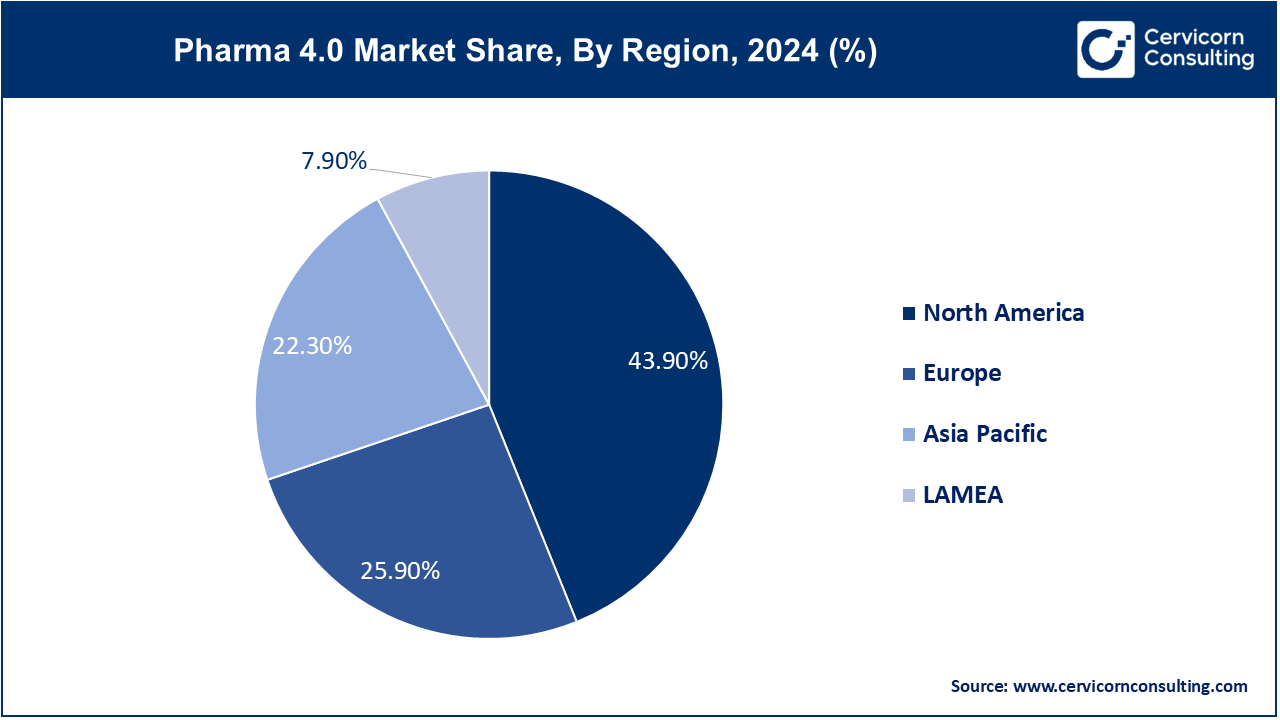

Based on region, the global market is segmented into North America, Europe, Asia-Pacific, latin America and Middle East & Africa. North America has accounted largest revenue share in 2024.

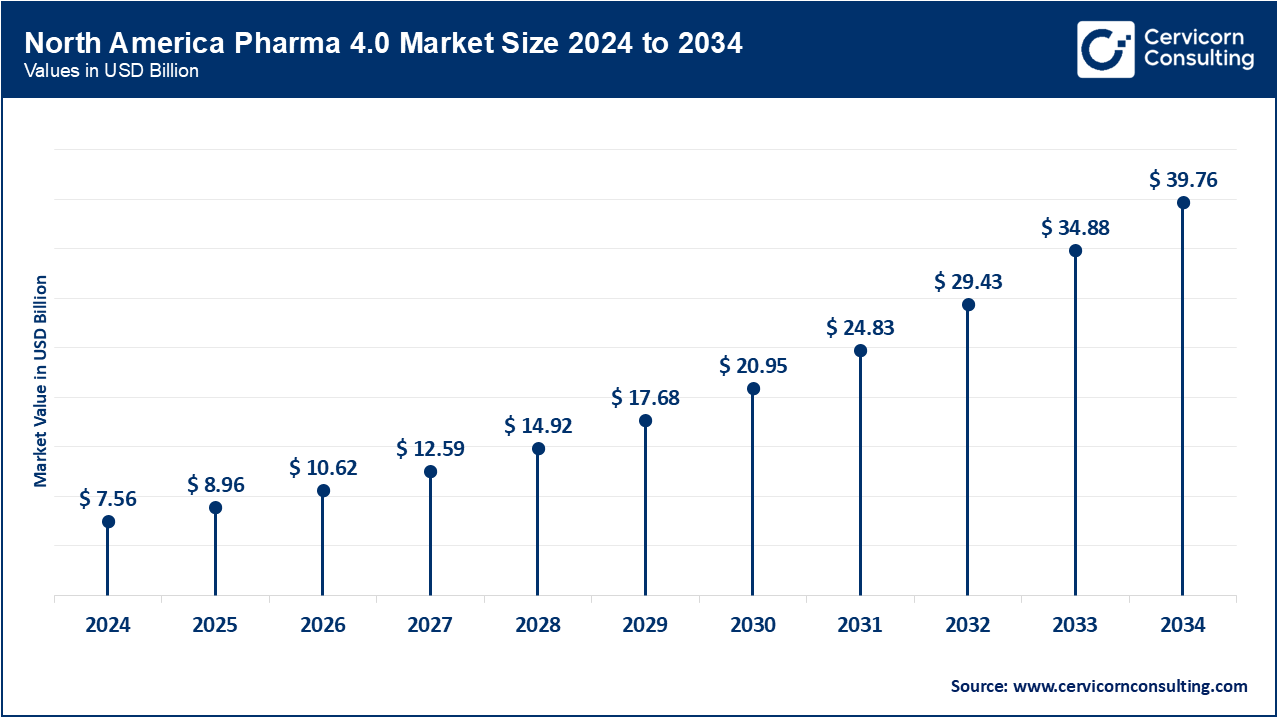

The North America pharma 4.0 market size was valued at USD 7.56 billion in 2024 and is expected to reach around USD 39.76 billion by 2034. The growing emphasis on research and development, growing presence of a reputable pharmaceutical industry and healthcare infrastructure is propelling the North American market. The market expansion was further supported by the growing trend of digitalization in the pharmaceutical industry, rising government initiatives to encourage the adoption of pharma 4.0 technologies, and the growing uptake of digital technologies in the pharmacetical industry.

The huge demand for drug discoveries in the region is driving the adoption of various technologies to improve the overall operational capabilities of the companies. This factor promises a bright future for the market in North America. Moreover, the Food and Drug Administration (FDA) of the United States has already emphasized the well-known importance of advanced technologies for the pharmaceutical and biotechnology industry. This element acts as a growth factor for the market by boosting the adoption rate of such technologies.

The Europe pharma 4.0 market size was estimated at USD 4.46 billion in 2024 and is projected to surpass around USD 23.46 billion by 2034. The pharmaceutical industry in Europe is witnessing a massive transition into a new era. The requirements for manufacturing drugs in Europe are high. On the one hand, pharmaceutical companies have to meet stringent purity requirements. Second, they should document all the processes in detail.

Europe is expected to emerge as a significant during the forecast period due to favorable policy

support, infrastructure developments, and evolving customer preferences. An increasing number of businesses are expected to use Robotic Process Automation (RPA) as pharma 4.0 takes off to remain competitive and meet the demands of the sector that is changing quickly. Thus leading to better patient outcomes, increased innovation, and increased efficiency.

The Asia-Pacific pharma 4.0 market size was accounted for USD 3.84 billion in 2024 and is predicted to hit around USD 20.20 billion by 2034. Asia Pacific is facing potential issues with the traditional operating systems, still it is witnessing higher adoption of modern technologies. The increasing requirements for developing novel drugs and improving the infrastructure of the pharmaceutical industry are expected to drive the growth of the market in the region. Various pharmaceutical companies in emerging economies such as China, India, Japan, and South Korea are focusing on automating tasks to reduce the overall time spent by the companies. This is another factor that is expected to drive the growth of the market in Asia Pacific.

The LAMEA pharma 4.0 market size was valued at USD 1.36 billion in 2024 and is expected to be worth around USD 7.16 billion by 2034. Spending on healthcare in Latin America is rising along with the economies. The region's governments are making greater investments in public health initiatives, insurance coverage, and infrastructure related to healthcare. The growth of the Latin American pharmaceutical market not only offers growth and investment opportunities, but also promises significant financial gains. The landscape is ripe for innovation and expansion. As mentioned above, with a large and increasingly affluent population, supportive regulatory frameworks, growing healthcare infrastructure, and the adoption of digital healthcare solutions, more people are gaining access to healthcare and the need for medicines is growing.

South America's pharmaceutical industry is heavily regulated, with stringent government regulations governing the cost and availability of medications. As a result, there is fierce competition in the market, with numerous businesses fighting for customers' attention. The Middle East and North Africa (MENA) pharmaceutical market has grown significantly in recent years due to several socioeconomic and healthcare-related developments.

Pharma 4.0 offers significant benefits in MENA countries, such as: e.g., improved coordination of patient care and support of local decision-makers in decision-making to keep the health system accessible with the highest quality care. These benefits could significantly improve access to the pharmaceutical market in the region by improving decision-making processes and resource allocation.

Globally, pharmaceutical companies are primarily focused on shortening and reducing the overall cost of drug development to meet the increasing demand for drugs and therapies, especially in countries such as the US, Germany, the UK, China and India. Dominant market players are actively engaging in strategic initiatives such as mergers and acquisitions, facility expansions and partnerships to expand their product portfolio, reach a wider customer base and strengthen their market presence.

In July 2023, privately held Angelini Industries unveiled the "LIFE-GREENAPI" initiative, designed for pharmaceutical manufacturing processes with low environmental impact. In June 2023 "Valspec," a leading provider of lifecycle services and system validation, played a significant role in Genentech's Clinical Supply Center (CSC) project. The CSC project was recently recognized by ISPE with the "Facility of the Year 2023 Pharma 4.0 Category Winner Award." Valspec renewed the test matrix based on user requirements and in collaboration with the automation, equipment C&Q, system owner and quality assurance project teams to obtain approval. Market participants continuously invest in research and development to improve their solutions and stay ahead of the competition.

CEO Statements

John O’Reilly, CEO of Unispace Life Sciences:

Christophe Weber, CEOof Takeda Pharmaceutical:

Market Segmentation

By Type

By Technology

By Application

By End User

By Region