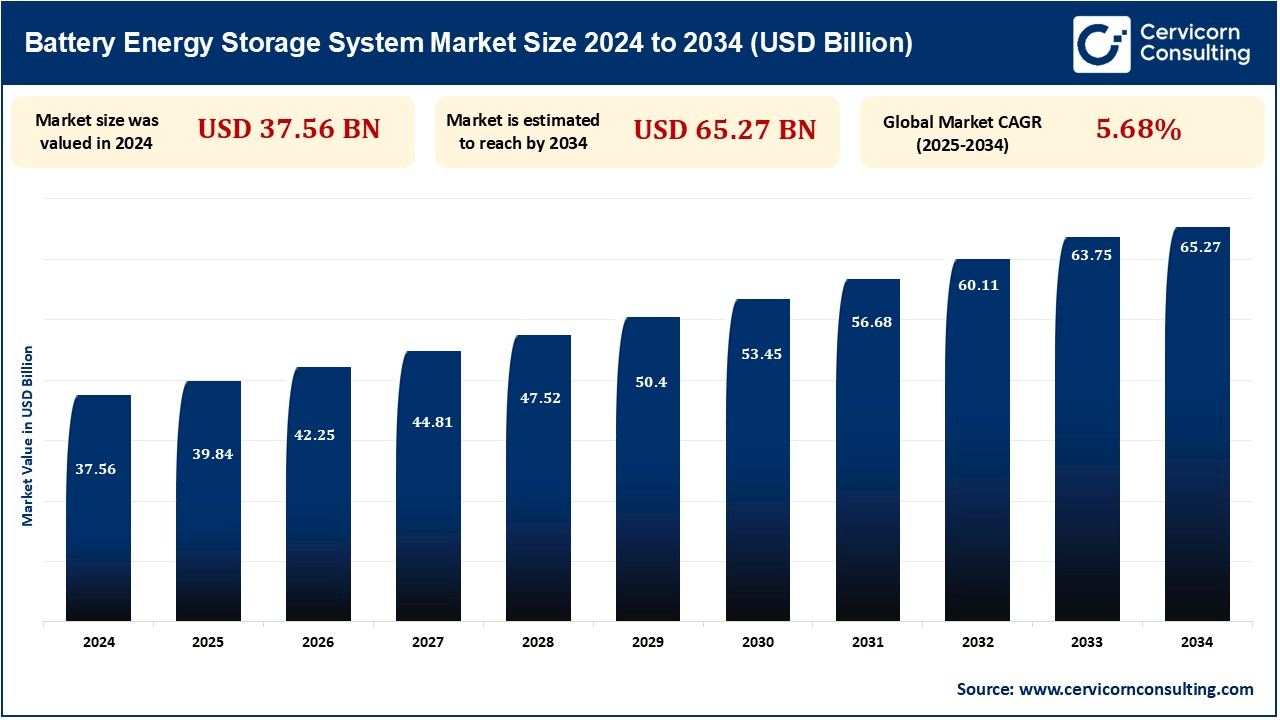

The battery energy storage system market is projected to reach valuation around USD 65.27 billion by 2034 and is reflecting a compound annual growth rate (CAGR) of 5.68%. The battery energy storage system market is on the rise because the need to integrate renewable energy, ensure grid stability, and provide energy efficiency. With growing use of solar and wind energy, BESS has been at the forefront of technology to harvest excess power and offer a steady source of energy supply. Further, government policies, declining battery prices, and improvements in lithium-ion and other battery technologies are fueling market growth. Increased demand for energy security, peak load management, and industrial and transportation electrification further fuel demand. Further, the trend towards decentralized power grids and smart grids raises consumption of battery storage solutions across the world.

The BESS market deals with the market for advanced energy storage solutions that store electricity in rechargeable batteries for later use. These systems are essential for grid stability, renewable energy integration, and energy efficiency, enabling the storage of surplus power from solar, wind, and other renewable sources. BESS has found broad acceptance for residential, commercial, and utility-scale usage and supports peak load management, frequency regulation, and backup power. The industry incorporates numerous battery types, including lithium-ion, lead-acid, and nascent solid-state batteries, under the driving forces of sustainable energy options demand and the trend toward electrification.

The integration of battery energy storage system (BESS) with smart energy systems has improved energy management's efficiency, effectiveness, and automation. Artificial intelligence (AI), the Internet of Things (IoT), and advanced data analytics have enabled BESS to estimate energy use, optimize charge and discharge cycles, and seamlessly connect with renewable energy sources. Smart grids also offer real-time monitoring and control, which reduces wastage of energy and increases grid stability. The technology facilitates dynamic pricing of energy, remote diagnostics, and predictive maintenance, making BESS more cost-effective and efficient and facilitating the transition to a more decentralized and sustainable energy system are further expected to drive the growth of the BESS market during the forecast period.

One of the primary challenges that have been slowing down the growth of the BESS market is its high upfront capital cost. The capital cost entails battery manufacturing, system integration, power conversion hardware, and installation. While the cost of batteries has come down, the cost of the entire system is still high, especially for large-scale installations. In addition, grid interconnection costs, energy management software, and thermal management systems are some of the costs that contribute to the overall cost. These discourage small and medium-sized companies and developing economies from adopting BESS solutions, thereby discouraging widespread deployment even though they have long-term cost-saving and efficiency benefits.

The solid-state battery provides a disruption to the battery energy storage system market. In contrast to lithium-ion batteries, which employ a liquid electrolyte, a solid electrolyte is used with a higher energy density, safety, and lifespan in a solid-state battery. Solid-state batteries are less susceptible to thermal runaway and overheating and reduce the risk of fires much more profoundly. In addition, their performance to operate at high temperatures makes them suitable for grid-scale implementation and EV applications. With growing commercialization and research, solid-state batteries will drive BESS growth through enhanced performance, improved charging times, and reduced maintenance costs.

| Attributes | Details |

| BESS Market Size in 2025 | USD 39.84 Billion |

| BESS Market CAGR | 5.68% from 2025 to 2034 |

| Key Players |

|

| By Technology |

|

| By Storage System |

|

| By Connection Type |

|

| By Ownership |

|

| By Energy Capacity |

|

| By Application |

|

| By Region |

|

The market for battery energy storage system is aided by the high level of the region's focus on renewable energy integration, especially that of the United States and Canada, resulting in growing investments in residential and grid-scale storage solutions. The Inflation Reduction Act (IRA) in the US is an example of government initiatives granting tax incentives and credits for energy storage projects to drive market growth. Also, growth in the adoption of electric vehicles (EVs), increased microgrid deployments, and advancements in lithium-ion and solid-state battery technologies contribute to the supremacy of North America in the market.

The Asia-Pacific BESS market is induced by the rising development of renewable energy projects, especially in China, India, Japan, and South Korea. Rising investments in solar and wind energy as well as government policies supporting grid stability as well as energy security are fueling demand for the market. The reducing price of lithium-ion batteries, increasing adoption of electric vehicles (EVs), and growth of smart grids and microgrids also drive growth. Industrialization, urbanization, and growing electricity demand are also forcing businesses and utilities to implement BESS for peak load management, backup power, and cost optimization of energy.

The battery segment dominated the largest market share in 2024. Energy storage battery systems have shapen the global energy storage market because of their versatility, scalability, and diminishing costs. Those systems implement different technologies, including lithium-ion, lead-acid, and flow batteries, to store and discharge electricity more smartly. Batteries are crucial in supporting the transition to sustainable energy and improving grid stability in areas like renewable energy integration, load balancing, and backup power.

The industrial segment dominated the Battery Energy Storage System market in 2024. Energy storage systems are essential for utilizing energy efficiently in the industrial sector, which, in turn, enhances operational efficiency by balancing the peak loads of demand and supply. The high energy demand from several industries can have energy storage systems that work as reliable buffers, alleviating high costs during peak demand. Energy storage integrated with an on-site renewable generation makes that much more enabling in support of the corporations' sustainable development and energy independence. Focusing on honorable carbon footprint, the European industry is proportionately increasing the demand for energy storage solutions.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2313

Ask here for more details@ sales@cervicornconsulting.com