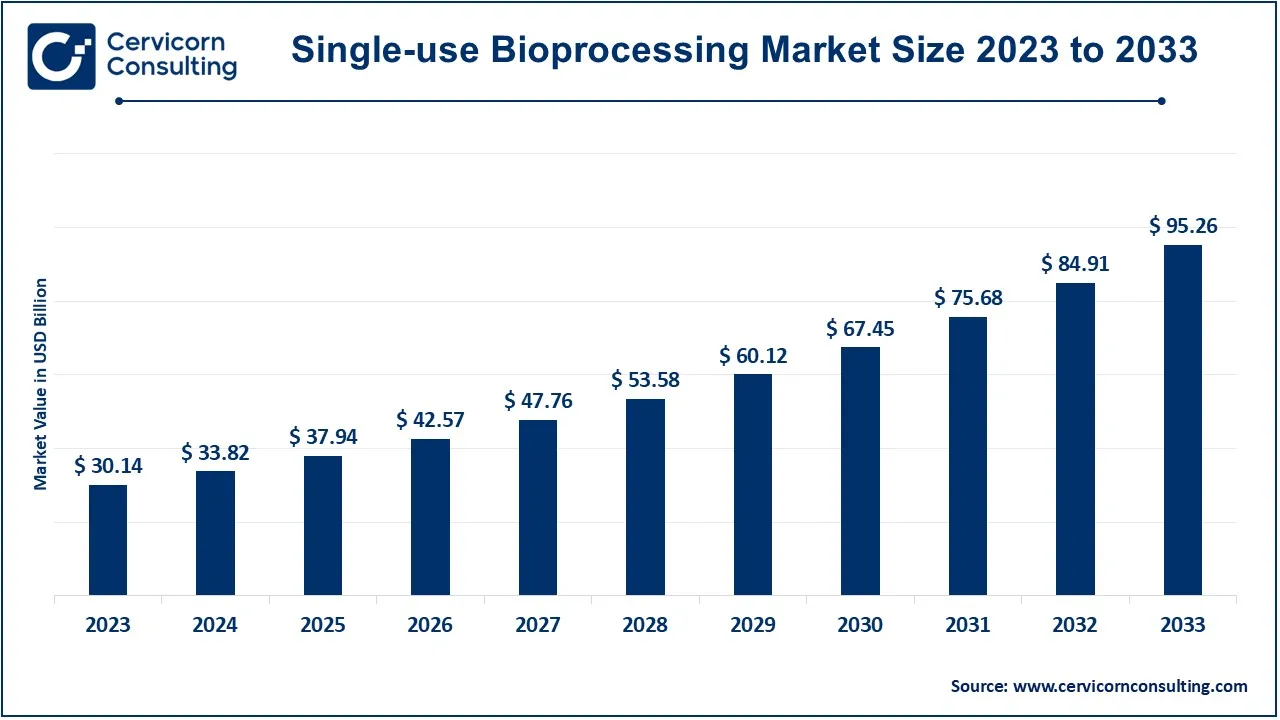

The global single-use bioprocessing market size was valued at USD 33.82 billion in 2024 and is expected to be worth around USD 95.26 billion by 2033, growing at a compound annual growth rate (CAGR) of 12.19% from 2024 to 2033.

The single-use bioprocessing market has been growing rapidly due to increasing demand for biologics and the cost efficiency of these systems. The healthcare industry's shift towards personalized medicine and biopharmaceutical production also contributes to the growth. The adoption of single-use systems is further propelled by the advantages of quicker turnaround times, reduced facility requirements, and the need for flexible production capabilities. As a result, many pharmaceutical companies are increasingly relying on single-use technology for both small-scale and large-scale production. The single-use bioprocessing market is projected to continue expanding, driven by innovations in biotechnology and the increasing global demand for biologics. The ability to scale production quickly and economically, without significant capital investment in infrastructure, has attracted many manufacturers to adopt single-use technology. In April 2023, Novo Holdings agreed to acquire a majority stake in Single Use Support, a provider of tools and services for drug substance production. Novo Holdings will acquire approximately 60% of Single Use Support, with the remaining shares held by the company's founders and Danaher Corporation.

Single-Use Bioprocessing is a method in biotechnology and pharmaceutical manufacturing where equipment like bioreactors, mixers, and filtration systems are used for one production cycle and then discarded. This approach contrasts with traditional bioprocessing, where equipment is reused after cleaning and sterilization. The primary advantage of single-use systems is their ability to minimize contamination risks, reduce cleaning and validation time, and lower operational costs. These systems are typically made of disposable plastics, making them lightweight and easy to handle. Single-use bioprocessing is commonly used in the production of biologics, such as vaccines, monoclonal antibodies, and gene therapies.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 37.94 Billion |

| Expected Market Size in 2033 | USD 95.26 Billion |

| Growth Rate 2024 to 2033 | 12.19% |

| Leading Region | North America |

| Highest Growth Region | Asia-Pacific |

| Key Segments | Product, Workflow, Molecule Type, Application, End User, Region |

| Key Companies | Thermo Fisher Scientific, Sartorius AG, Merck KGaA, Danaher Corporation, GE Healthcare (Cytiva), Pall Corporation, Eppendorf AG, Avantor, Inc., Corning Incorporated, Saint-Gobain Life Sciences, Lonza Group AG, Repligen Corporation, Meissner Filtration Products, Parker Hannifin Corporation |

Increased Adoption of Biologics and Personalized Medicine

Advances in Bioprocessing Technologies

Environmental Concerns Over Waste Disposal

Cost of Implementation in Large-Scale Production

Emerging Markets and Growing Demand for Biologics

Partnerships with Contract Development and Manufacturing Organizations (CDMOs)

Waste Management and Sustainability

Regulatory Compliance and Standardization

The single-use bioprocessing market is segmented into product, workflow, molecule type, application, end-users and region. Based on product, the market is classified into single-use bioreactors, filtration systems, mixing systems, tubing and connectors, and sampling systems. Based on workflow, the market is classified into upstream bioprocessing, fermentation, and downstream bioprocessing. Based on molecule type, the market is classified into monoclonal antibodies, vaccines, therapeutics proteins & peptides, cell & gene therapies. Based on application, the market is classified into biopharmaceutical manufacturing, vaccine production, monoclonal antibodies, gene and cell therapy, and biosimilars production. Based on end-users, the market is classified into pharmaceutical & biotechnology companies, contract development and manufacturing organizations (CDMOs), research and academic institutes, and clinical research organizations (CROs).

Based on product, the market is segmented into single-use bioreactors, filtration systems, tubing and connectors, mixing system, and sampling systems.

Single-Use Bioreactors: Single-use bioreactors are relatively simple and represent the basis of single-use bioprocessing since multiple products may be produced in the bioreactor without cross-contaminating the equipment. These bioreactors come in various sizes and are increasingly popular in vaccines production, mAb synthesis, and gene therapy to mention a few reasons in favour of versatility and affordability.

Filtration Systems: Plastic disposable filtration devices are important to filter biologics to high standards that will meet safety and quality requirements. Newer trends in disposable filter technology including the membrane and depth type filters are enabling the processing of the large number of biologic materials in a short time span with reduced time and costs for cleaning and sterilization of the equipment.

Mixing Systems: Temporary mixing systems are employed for the preparation of buffers, preparation of media and product mixing. These systems range from laboratory applications up to industrial process scale, which provide more flexibility and opportunity than convention mix tanks but also opportunity for cross contamination.

Tubing and Connectors: Disposable tubing and connectors are considered vital in pumping fluids from one stage to another of the bioprocess. Disposable tubing systems also reduce the chance of contamination in the transfer of media while at the same time being more efficient than holding tubes. These products are offered in numerous types; aseptic connectors and disconnector to meet various processing requirements in bioprocessing.

Sampling Systems: Disposable sampling systems are among the simplest and most effective sampling tools for use during and after the production process. These systems are used extensively in biopharmaceutical production to give on-line high quality and accurately control product homogeneity for the bioprocess panel without the necessity of cleaning and sterilisation which minimises ‘down-time’.

Based on application, the market is segmented into biopharmaceutical manufacturing, vaccine production, monoclonal antibodies (mAbs), gene and cell therapy, biosimilars production.

Biopharmaceutical Manufacturing: Single-use technologies have been on the increase in biopharmaceutical applications mostly because of their flexibility, scalability and reduced costs. These systems aid the manufacturers in an attempt to provide for the increasing demand for biologics such as monoclonal antibodies, vaccines and cell therapies. Single use systems reduce the chances of contamination and are designed to do away with time consuming sterilization procedures.

Vaccine Production: Single use in the context of this article is as a technology and the pandemic escalated the usage of such technology in vaccine manufacturing. Single-use bioprocessing systems affords the opportunity to upscale or downgrade production according to the need of the market most specifically in the wake of viral diseases. Some of these systems are in use to create different next-generation vaccines especially in the mRNAs and the viral vectors.

Monoclonal Antibodies (mAbs): Monoclonal antibody production is on the increase globally and in the biopharmaceutical industry, single-use systems provide the flexibility and cost benefits required. Single-use equipment such as bioreactors, filtration systems, and chromatography columns are a modern advancement in manufacturing methods replacing steel equipment used conventionally.

Gene and Cell Therapy: Single-use technologies are ideal with cell and gene therapies that required flexible and scalable manufacturing processes due to the increased use of gene and cell therapies. These therapies may needs small-scale, highly controlled production that single-use systems delivers, making it possible for manufactures to ramp up production while maintaining essential sterility.

Biosimilars Production: As patents for major biologics expire, the need for biosimilars is rising Because FDA Asus a key factor in the growth of biosimilar medicines accounting for more than half of all biologics approved by the FDA. In the biosimilars market, increasing preferences for single-use bioprocessing systems are facilitating affordable production of biologic drugs at a faster rate. These systems, in turn, present manufacturers with opportunities to reduce capital expenditure while addressing the needs of biosimilar production regulations.

Based on end user, the market is segmented into pharmaceutical & biotechnology companies, contract development and manufacturing organizations (CDMOs), research and academic institutes, clinical research organizations (CROs).

Pharmaceutical & Biotechnology Companies: Due to flexibility and cost benefit which are provided by the single-use technologies, pharmaceutical as well as biotechnology companies are the largest users of these systems. These firms are able to cut time-to-market and capital investments when employing disposable systems especially in manufactures of biologics/personalized medicine.

Contract Development and Manufacturing Organizations (CDMOs): Single-use bioprocessing systems are employed by CDMOs in a growing manner to provide agile and configurable production solutions to clients. Single-use systems also enable CDMOs to be able to cater for diverse production need for different biologics, from the small clinical trial batch to the full industrial scale.

Research and Academic Institutes: Single use technologies are employed in numerous academic and research laboratories as well as in pilot, development and proof of concept scale biosystems. These systems are more appropriate in research situations as they involve low capital appropriation, are simple to use, and flexible enough to accommodate much process improvement.

Clinical Research Organizations (CROs): CROs are already applying single use technology for clinical trial manufacturing especially for biologics and personalized medicine. Single use systems can be easily scaled up and down and keep the process aseptic during clinical production when a product needs to be manufactured in small lots for multiple studies.

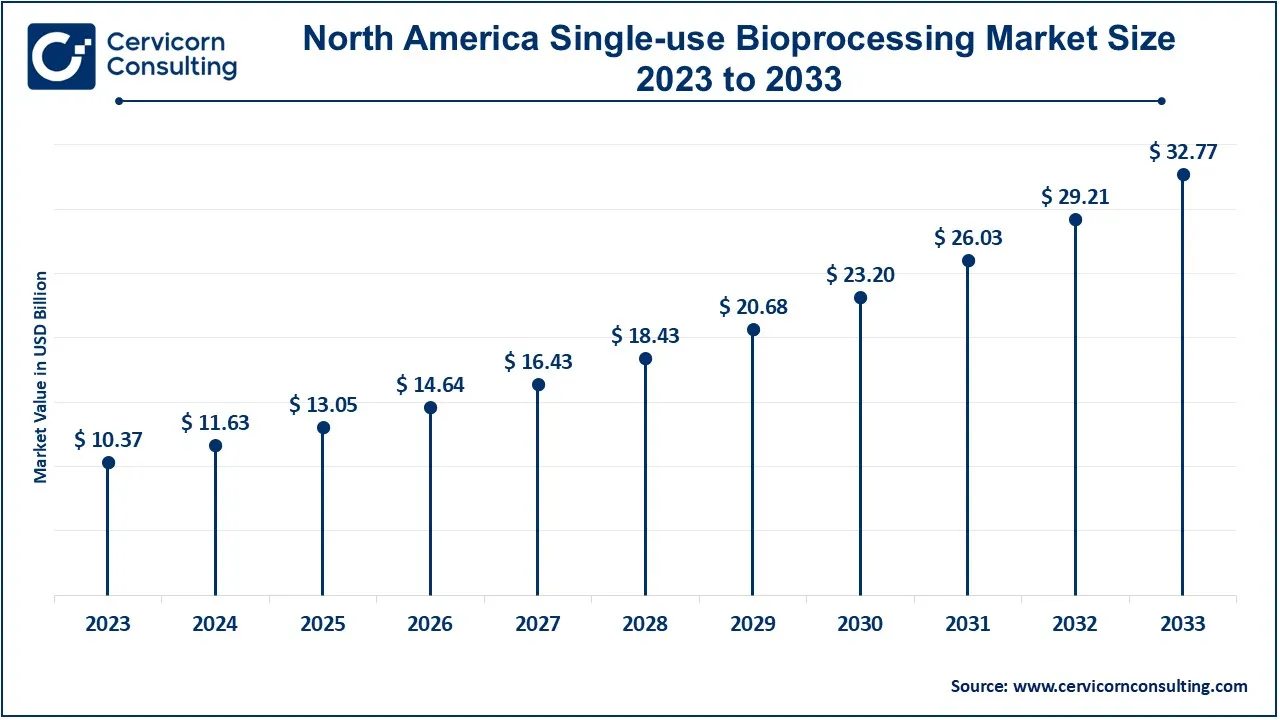

The global market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. In 2023, North America hit leading position in the market.

The North America single-use bioprocessing market size was estimated at USD 10.37 billion in 2023 and is expected to reach around USD 32.77 billion by 2033. North America has the largest market share in market because of the developed biopharmaceutical industry, high investment on biotech research and development and increasing adoption of biologics and personalized medicine. Currently, the United States is the most advanced in using single-use Technologies across its industries especially in monoclonal antibodies and vaccines manufacturing. Canada is also adopting these systems especially due to extending biopharma manufacturing capacity and flexibility options.

The Europe single-use bioprocessing market size was valued at USD 8.68 billion in 2023 and is projected to hit around USD 27.43 billion by 2033. There are major opportunities for the market in Europe proving by technology, regulation, and sustainable drive for biomanufacturing. Germany, the UK and Switzer and are some of the most influential nations in the set-up of single use systems for biologics production. Environmental responsibility in the region is directing firms towards disposable technologies that lower water and energy consumption and augment organizational performance.

The Asia-Pacific single-use bioprocessing market size was accounted for USD 7.29 billion in 2023 and is predicted to surpass around USD 23.05 billion by 2033. The Asia-Pacific region has been identified as having higher growth rates for single-use bioprocessing systems due to bio-tech investment, more manufacturing facilities of biologics and most countries that support biopharmaceutical industry development. China, India and South Korean companies are at the forefront of this growth, as domestic firms have quickly embraced the use of single use technologies to advance global demand for vaccines, biosimilars and gene therapies. Another factor is youths in the region and increasing use of innovative technology by the generational workforce, also growing healthcare is acting as a booster to the market.

The LAMEA single-use bioprocessing market was valued at USD 3.80 billion in 2023 and is anticipated to reach around USD 12 billion by 2033. The LAMEA region is gradually emerging with increased demand that the biopharmaceutical industries and research institutes are seeking more flexible and cost-effective solutions. Brazil and Mexico are two new-frontier countries in Latin American and Middle East especially the UAE and KSA is spending heavily on biotech ware facilities. Africa is gradually coming into the market driven by partnerships worldwide and growing demand for local production of biologics.

New entrants into the single-use bioprocessing industry are positioning themselves as solution providers to the growing and complex needs of the biopharmaceutical industry for flexible and scalable single-use solutions. The bioprocessing single-use market has been driven by innovative technologies such as disposable bioreactors, filtration facilities, and tubing being offered by startups to bio-manufacturing industries meeting the growing need of the bio-pharma market for biologics, vaccines, and customized therapies. These new entrants are enabling smaller biotech companies to improve their manufacturing processes since single-use systems offer a cheaper solution to traditional stainless-steel systems.

On the other hand, historical players such as Thermo Fisher Scientific and Merck KGaA remain entrenched with the consistent broadening of product lines and the addition of superior technologies to their single-use product offerings. Sartorius is another company which is positioning itself to supply sophisticated, multifaceted single-use system solutions to address the new requirements for producing contamination free products. These new entrants and industry leaders are therefore partnering together and radically changing the design of the future global biopharma manufacturing industry by making innovative single-use bioprocessing systems more available.

CEO statements

Here are some recent CEO statements from key players in the Single Use Bioprocessing Market

Dr. Joachim Kreuzburg, CEO of Sartorius AG

"The future of biopharmaceutical manufacturing lies in flexible and scalable solutions. Sartorius is at the forefront of this evolution, providing single-use technologies that reduce time-to-market while ensuring the highest standards of quality and safety. Our goal is to empower our partners in the biotech space to innovate and respond quickly to global health needs."

Stefan Oschmann, CEO of Merck KGaA

"At Merck, we recognize the critical role of single-use technologies in advancing the production of complex biologics and personalized therapies. Our mission is to support our biopharma partners by providing cutting-edge single-use systems that deliver both efficiency and sustainability, ensuring that patients around the world can access innovative treatments."

Leading stakeholders in the single-use bioprocessing industry are expending significantly on the future development of technologies that add efficacy and repetition to biopharmaceutical production. These are the leaders that are driving improvements in disposable bioreactors, filtration, and sensors that allow for easy, contamination-free biosimilar production. Prominent advancement in this market include:

These developments can be attributed to certain factors such as the expansion of the single-use bioprocessing sector from companies accomplished by way of acquisitions, and more pivotal collaborations, and hefty bet on emergent technologies. Many industry players are venturing to cover a larger area in the flow of bioprocessing from upstream to downstream with highly modularized systems, as well as enhancing user comfort via automated system and real-time monitoring tools. All of these reflect moves aimed at increasing the efficiency of manufacturing and processing biologics, minimizing contamination sources, and preparing for increased worldwide demand for vaccines and individualized treatments. Other drivers for even higher use include newer filtration technologies, single use sensors and greater process control.

Market Segmentation

By Product

By Workflow

By Molecule Type

By Application

By End-Users

By Regions