Surge Arrester Market Size and Growth 2025 to 2034

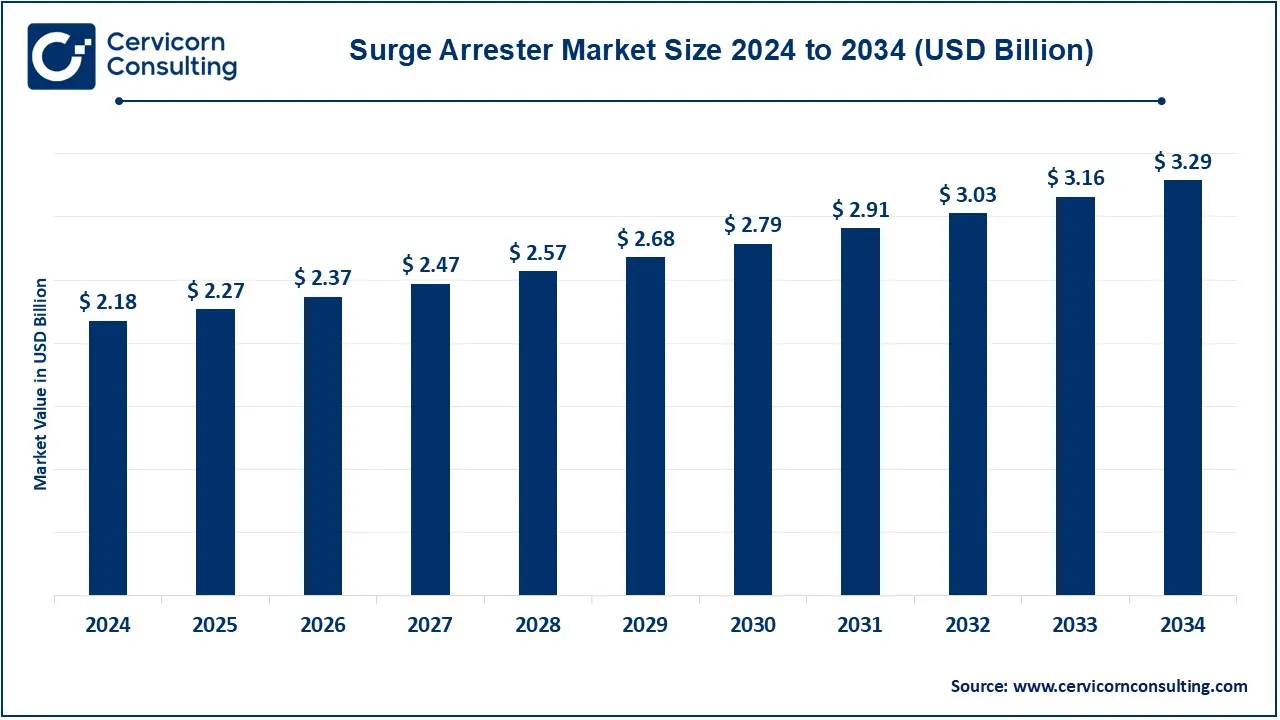

The global surge arrester market size was valued at USD 2.18 billion in 2024 and is expected to be worth around USD 3.29 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.20% from 2025 to 2034.

The demand for surge arresters is growing due to increasing power infrastructure development and rising electricity consumption. The expansion of renewable energy sources, such as solar and wind power, has further driven the need for effective surge protection. Governments worldwide are also investing in grid modernization, which boosts the adoption of advanced surge protection devices. The industrial sector, especially in automation and manufacturing, is another major contributor to market growth. With urbanization and digital transformation, the need for stable and uninterrupted power is crucial. Smart grid technology and IoT-based electrical networks require reliable protection against voltage surges, fueling the demand for surge arresters. The growing concerns over electrical safety and the increasing number of electronic devices in homes and industries also contribute to this market expansion.

A surge arrester is a device used to protect electrical equipment from sudden voltage spikes, also known as power surges. These surges can be caused by lightning strikes, switching operations, or faults in the power system. The arrester works by diverting excessive voltage safely to the ground, preventing damage to sensitive equipment like transformers, circuit breakers, and power lines.

Surge arresters are commonly used in power transmission and distribution systems, industrial facilities, and residential areas to enhance electrical system reliability. They come in different types, such as metal-oxide varistor (MOV) arresters, which are the most widely used due to their fast response time and efficiency. By preventing electrical damage, surge arresters help in reducing maintenance costs and ensuring uninterrupted power supply.

Key Insights beneficial for the Surge arresters Market:

- Renewable Energy Boom: Increased use of solar and wind energy has driven a 15-20% annual rise in surge arrester adoption.

- Urbanization & Smart Grids: Over 30% growth in smart grid projects worldwide has enhanced the need for surge protection.

- Industrial Automation: Rising industrial automation has led to a 10-15% increase in surge arrester installations in manufacturing plants.

- Electrical Safety Awareness: Governments and industries enforcing stricter electrical safety regulations have boosted demand by 25% in recent years.

- IoT & Digitalization: The adoption of IoT in power systems has resulted in a steady 12-18% growth in surge arrester deployment.

Surge Arrester Market Report Highlights

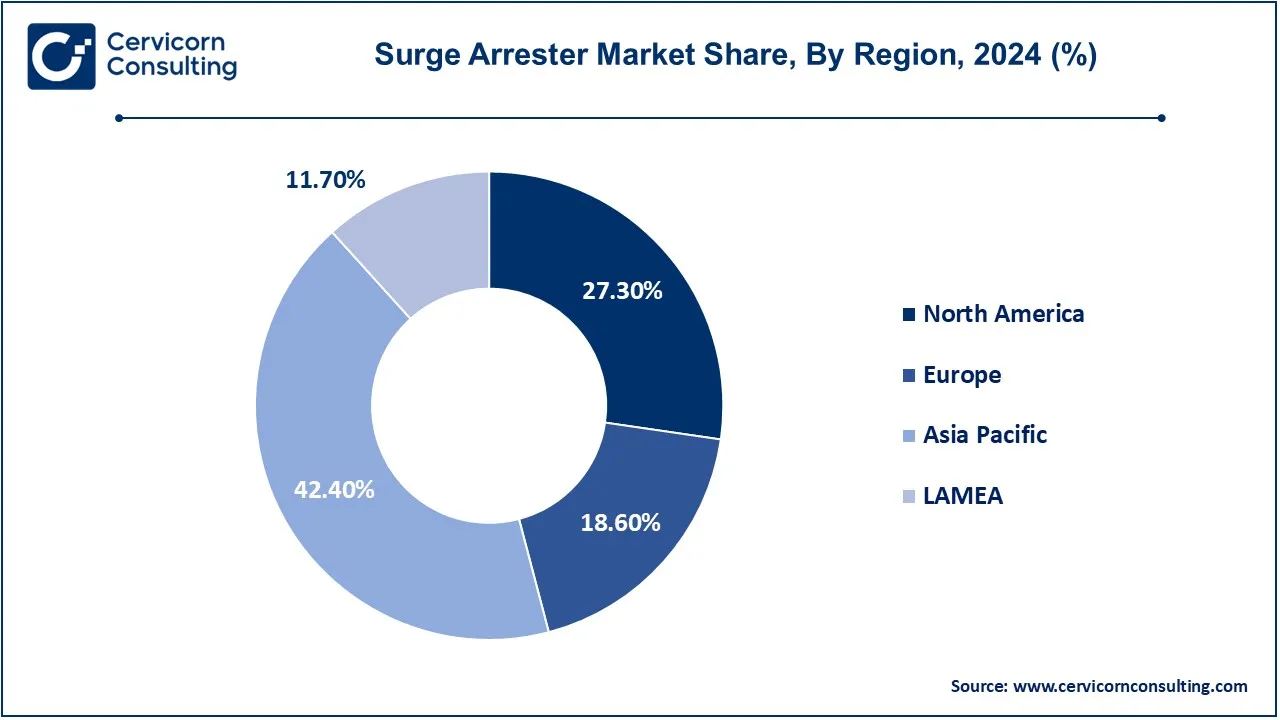

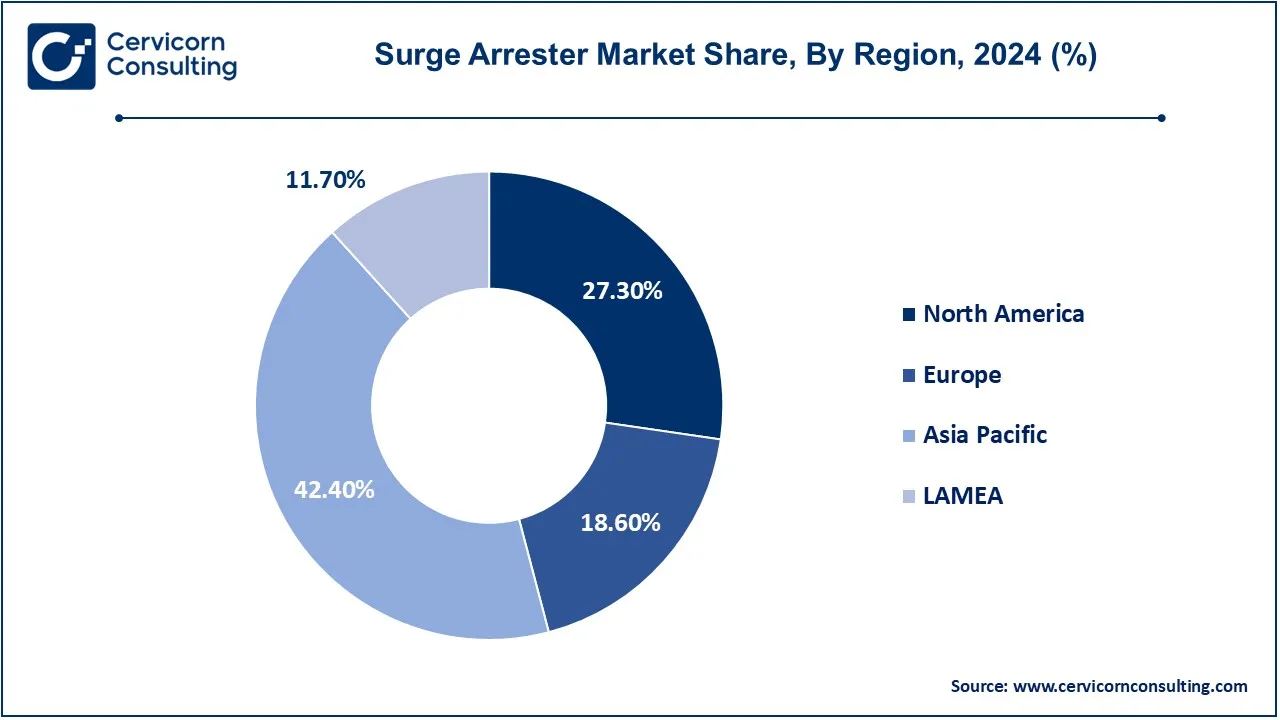

- The Asia-Pacific region has accounted for 42.40% of the total revenue share in 2024.

- The North America has generated revenue share of 27.30% in 2024.

- By type, the polymeric segment has held revenue share of 71% in 2024.

- By voltage, the medium voltage segment has captured revenue share of 54.20% in 2024.

- By end user, the utilities segment has recorded revenue share of 56% in 2024.

Surge Arrester Market Growth Factors

- Increasing Demand for Electricity: Large-scale consumption of power at the global level due to population increase and industrialization demands opening up opportunities for better power transmission systems. The surge arresters are important in voltage fluctuation protection to ensure reliable power supply and minimal downtimes.

- Infrastructure Development: Backed by investments in infrastructure projects, built mostly in the developing world, the process of urbanization is fed through the establishment of modern and reliable electrical networks. Surge arresters are very important in protecting these construction electrical grids from voltage spikes that will welcome the construction of the electrical grids.

- Adoption of Smart Grid: As smart grids keep developing in a way to improve the distribution and efficiency of energy, surge arresters are supporting efficient and smooth power flow while protecting sensitive equipment from sudden disruptions-a non-negotiable component for smart grid reliability.

- Industrial Automation: Where there is increased reliance on complex processes and electronics, it means an increased vulnerability of the electrical and electronic systems and networking to damage-to electric surges. As a result, surge arresters must be used to keep this equipment safe from electrical surges so that manufacturing, oil and gas, and transportation industries can operate smoothly and uninterruptedly.

- Electric Vehicle Charging Infrastructure: With the increasing adoption of electric vehicles being shown, there is a consequent need for EV charging infrastructure. Surge arresters are required to protect EV charging stations from voltage surges so that their safe and profitably long use is ensured even under high demand.

Surge Arrester Market Trends

- Shift from Porcelain to Polymer Surge Arresters: Polymer surge arresters are gradually replacing traditional porcelain. The reason is simple; polymers garner more excellent insulation, have lighter weight and provide better resistance against adverse atmospheric conditions, hence their suitability for modern electrical systems.

- Integration of IoT in Surge Arresters for Real-Time Monitoring: Survey gadgets envisioned IoT-enabled surges, and the suppliers' optimum choice of action suggested real-time monitoring and diagnostics arose from this integrated option for utility companies, which, while expediting detection and clarification of outbreaks, would enhance operational reliability in power distribution systems overall.

- Development of Compact and Lightweight Surge Arresters: At this point, the manufacturers have to strive hard to manufacture compact and lightweight surge arresters aimed at installations requiring limited physical space. It permits surge protection in an efficient manner, while given the best advantages during installation operationally.

- Increased Use within the Renewable Power Grids: Surge arresters are being used to protect over-voltage conditions created by natural events or switching operations in wind farms, solar farms, and other renewable energy systems.

- Rising Deployed Surge Arresters in Data Centres: Surge arresters are being employed in data centres being constructed the world over for cloud computing and storage needs; hence, the requirement grows for protective systems countering surges. Surge arresters secure critical servers and electrical systems; hence operation continuity is established.

- Use of Surge Arresters in Electric Vehicle Charging Stations: With the demand for electric vehicles on the rise, the charging stations are being equipped with surge arresters for fence protection from electrical surges in order to ensure continuous service and avoid damage to such expensive charging infrastructure.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 2.27 Billion |

| Projected Market Size in 2034 |

USD 3.29 Billion |

| Estimated CAGR (2025 to 2034) |

4.20% |

| Leading Region |

Asia-Pacific |

| Key Segments |

Type, Voltage, Application, Class, End User, Region |

| Key Companies |

Hitachi ABB, Siemens, Schneider Electric, General Electric, Eaton, Mitsubishi Electric, Toshiba, Hubbell, Legrand, CG Power, Meidensha, Tripp Lite |

Surge Arrester Market Dynamics

Drivers

- Increased Investment in Power Transmission and Distribution: The governments and private sectors have stepped up the game by investing in power grid and distribution upgrades primarily in emerging markets due to necessity. These demand installation of surge arresters to secure and stabilize the transmission of power.

- Growth of Renewable Energy Projects: The global shift to renewables such as solar and wind energy, calls for the installation of surge protection systems. Generally, surge arresters are used to prevent surges in voltage generated from external sources such as lightning or internal sources such as switching, from damaging renewable energy systems.

- Rapid Growth in Smart Cities Projects: The establishment of a smart city wears heavily on improved energy infrastructure that surge arresters avoid fluctuation of voltage from reaching the smart grid system; they thereby avoid failures or outages in smart applications and services.

- Technological Developments in Surge Arresters: Surge arresters with innovative configurations-above all, polymer-based designs-are providing better performance to the systems due to improved insulation and semicond-uctors. Increased performance, long life cycle, and reduced cost of surge arresters now are driving the growing adoption in the power system of a renewably-generating grid and smart networks.

- Secure and Maintainable Energy Usage: The increased consumption of energy in homes and businesses is increasingly calling for surge protection systems against electrical system hazards, especially in the densely populated urban centers of the world.

- World-Focused Energy Efficiency and Sustainability: Global focus by governments and agencies is placed on ensuring energy-efficient systems capable of reducing carbon footprints. Surge arresters play key in protecting these advanced-efficient systems from electrical surges that promote the custodians of sustainable energy.

Restraints

- High initial costs of modern surge arresters: A surge arrester, especially of polymer make, is immensely costly when it comes to installation, but this also acts as a deterrent for small ventilation companies and industrial consumers from doing so.

- Complex installation and maintenance: Surge arresters for high-voltage systems require precise and regular maintenance, which adds to operational costs and inhibits organizations with limited technical resources or expertise.

- Limited use in smaller industries: Smaller industries are often less inclined to invest in surge arresters due to cost-related inhibitions, perceived low risk, or ignorance. This limits the ability for market development, especially where threes or smaller industries predominate.

Opportunity

- Growing Infrastructure Development: The demand for surge arresters has been growing with the increasing surge coming into infrastructure projects all over the world, especially across the developing economies. Surge arresters are an integral part of the designs safeguarding electrical systems and equipment from voltage surges that may stem from lightning strikes, switching operations, and/or other transient pressuresUrbanization and industrialization are gathering pace, and with it the entrance of surge arresters to protect the rapidly-expanding power networks and communication systems provides a significant opportunity for surge arrester manufacturers.

- Increase in Demand for Renewables: Surge arresters will remain in high demand in the renewable energy market due to rising power generated from renewable sources such as wind and solar, and will conform to the unpredictable voltage spikes in the power systems. With expanding renewable energy infrastructure comes the demand for that protection, keeping these systems functional and stable. This renewable energy transition brings many opportunities for manufacturing the protective equipment that the surge arrester market will devote towards stabilizing our changing energy horizons.

- Technological Developments in Surge Arresters: Surge arrester manufacturers continue to develop designs that increase the efficiency and reliability of electrical devices. New technologies, namely metal-oxide varistor surge arresters (MOAs) and hybrid surge arresters, expect better performance from the protecting electrical systems against high voltage surges. The increased demand for reliable power infrastructure allowed surge arresters to supply high-performance and inexpensive surge protection solutions for telecommunication, utility, and transport sectors.

Challenges

- Variability in Standards in Various Regions: The surge arresters market is an amalgam of global market fragmentation, technical standards, and certifications. This lack of standardization is proving to be a problem for manufacturers who wish to provide products across multiple regions.

- Constant High Performance Under Difficult Environmental Conditions: Surge arresters must perform reliably under extreme conditions like high humidity, salt-laden atmospheres, or freezing temperatures. This is a real challenge in ensuring development of arresters, which do not fail too frequently where such environments are concerned.

- Interfacing Surge Arresters to Complex Grid Infrastructures: Providing interfacing between surge arresters and a complicated grid system has been noted as a challenge, as the generation of power must be done through such smart grid-tied generation.

- Managing Increasing Power Demand for Effective Surge Protection: Due to increasingly energy demanding societies, surge protection systems must be deployed in such a manner that will allow rise in loads efficiently, without sacrificing performance, efficiency, or substantiating costly upgrade activities. This is proving to be a real challenge for manufacturers and utilities.

Surge Arrester Market Segmental Analysis

The surge arrester market is segmented into type, voltage, application, class, end user and region. Based on type, the market is classified into polymeric and porcelain. Based on voltage, the market is classified into medium voltage, high voltage and extra high voltage. Based on application, the market is classified into AIS and GIS. Based on class, the market is classified into distribution class, intermediate class and station class. Based on end user, the market is classified into utilities, industries and transportation.

Type Analysis

Polymeric: The polymeric segment has dominated the market in 2024. Polymeric surge arresters have gained immense popularity due to their lightweight and better insulations as compared to porcelain devices, while the arresters serve excellently in eastern environmental conditions. They are therefore acceptable for modern synergetic installations that invest more weight and performance. Polymer-based models operate longer and resist damage from even changing extreme conditions of weather, pollution, and UV radiation. Suddenly rise tall; its flexible design allows very compact installations in extremely narrow locations. Owing to the force behind renewable energy and smart grids, polymeric surge arresters have now found an increased acceptance in utility power systems.

Surge Arrester Market Revenue Share, By Type, 2024 (%)

| Type |

Revenue Share, 2024 (%) |

| Polymeric |

71% |

| Porcelain |

29% |

Porcelain: Surge arresters constituted by porcelain are old devices used for surge protection of electrical systems. They find a place due to mechanical strength and resistance to high temperature; thus, they are commonly used in heavy-duty applications. Its weight and susceptibility to certain game-changing extreme weather conditions such as cracking at freezing point prevent their use in modern-day space-craved environments. Nevertheless, porcelain surge arresters are still a preferable choice in areas subjected to extreme mechanical stresses or where robust construction is demanded.

End User Analysis

Utilities: The utilities segment has dominated the market in 2024. Surge arresters are critical to protect the power transmission and distribution network from overvoltage incidents. With the rising investments in grid modernization and renewable energy projects, utilities are one of the fore-running consumers of surge arresters. They are crucial in protecting equipment, such as transformers, substations, and transmission lines, from lightning surges or switching operations that can lead to power outages and shorten electrical device lifetime.

Industries: Industries depend on surge arresters to protect sensitive machinery and deliver operational reliability. Surge protection is integral to industries, namely manufacturing, oil and gas, and mining, for without it, a little downtime can eventually lead to production loss and financial loss. Place into backdrop the increasing application of industrial automation; yet it calls for more dependable surge protection solutions to appreciate uninterrupted operations even in environments that expose electrical equipment to varying voltage swings.

Surge Arrester Market Revenue Share, By End User, 2024 (%)

| End User |

Revenue Share, 2024 (%) |

| Utilities |

56% |

| Industries |

29% |

| Transportation |

15% |

Transportation-specific: Surge arresters in transportation are fast gaining load-shedding applications in electrified railway systems, metro stations, and electric vehicle infrastructure. Surge protection is poised to gain paramount importance because of the electric mobility drive propelled by global efforts in sustainable transportation and land flow—paving their developments for individual station trustworthiness, control systems, and electrified tracks. This sector is poised for massive growth as the transportation sector embraces electric and automated systems across the world.

Voltage Analysis

Medium Voltage: The medium voltage segment has dominated the market in 2024. Medium voltage surge arresters are defined by voltages of typically 1-69 kV, providing protection to distribution, transmission, and industrial networks. Different from that function, they could also provide, in this case, protection against overvoltage to transformers, circuit breakers, and electric motors. Smart grid and distributed energy resources, most notably urban infrastructure and renewable energy plants such as wind and solar power plants, are driving a rise in demand for surge arresters.

High Voltage: High voltage surge arresters are designed to protect a power system power transmission networks that operate between 69 and 230 kV. They facilitate protection against lightning strokes and switching over-voltages for installations like power generation plants, substations, and transmission lines. The growth of expenditure into grid modernization and integration of renewables is increasing the demand for high voltage surge arresters, especially in areas extending the grids and energy infrastructure.

Surge Arrester Market Revenue Share, By Voltage, 2024 (%)

| Voltage |

Revenue Share, 2024 (%) |

| Medium Voltage |

54.20% |

| High Voltage |

36.60% |

| Extra High Voltage |

9.20% |

Extra High Voltage: Extra high voltage (EHV) surge arresters work in ultra-high voltage transmission networks where voltage levels exceed 230 kV. Such systems play a prominent role in long-distance power transmission, especially in nations with a huge area. The increasingly vulnerable infrastructures, such as large power substations and interregional power grids, are protected more thoroughly by EHV surge arresters from very high surge voltages. The broadening footprint of renewable energy and cross-border electricity trading is driving the surge protection against EHV exposure.

Surge Arrester Market Regional Analysis

The surge arrester market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-pacific region has dominated the market in 2024.

What makes Asia-Pacific the leader in the surge arrester market?

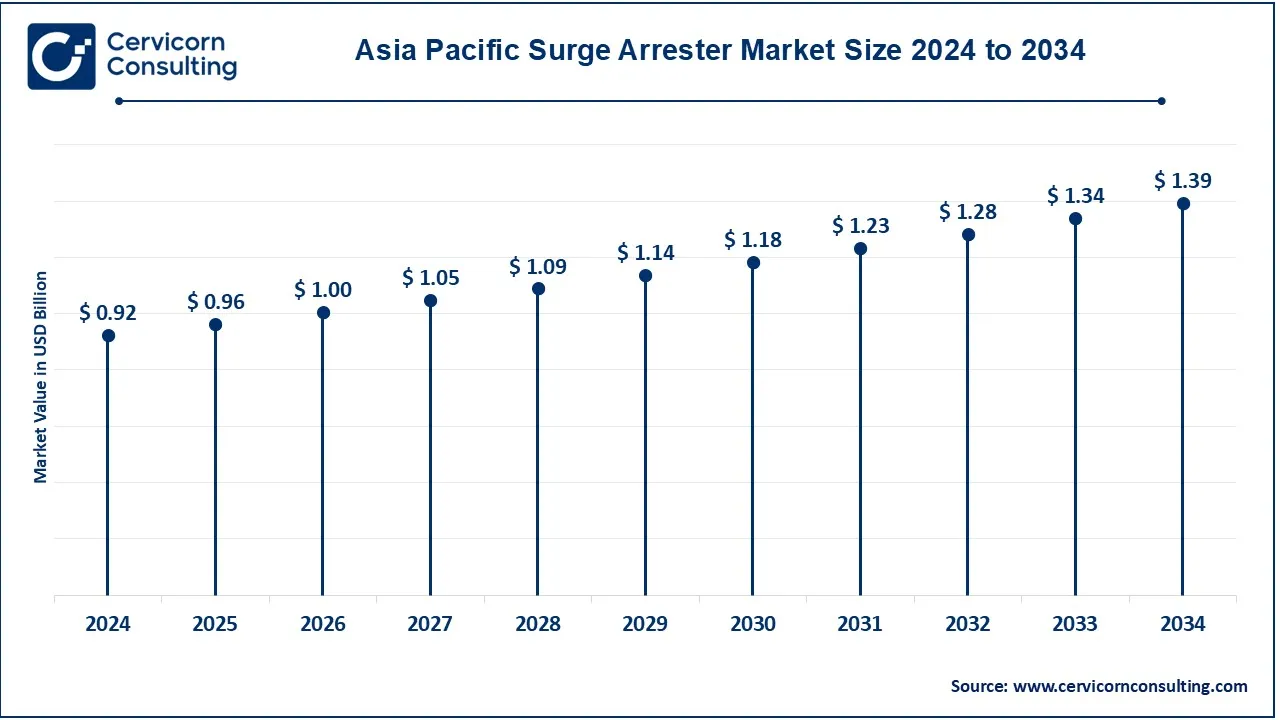

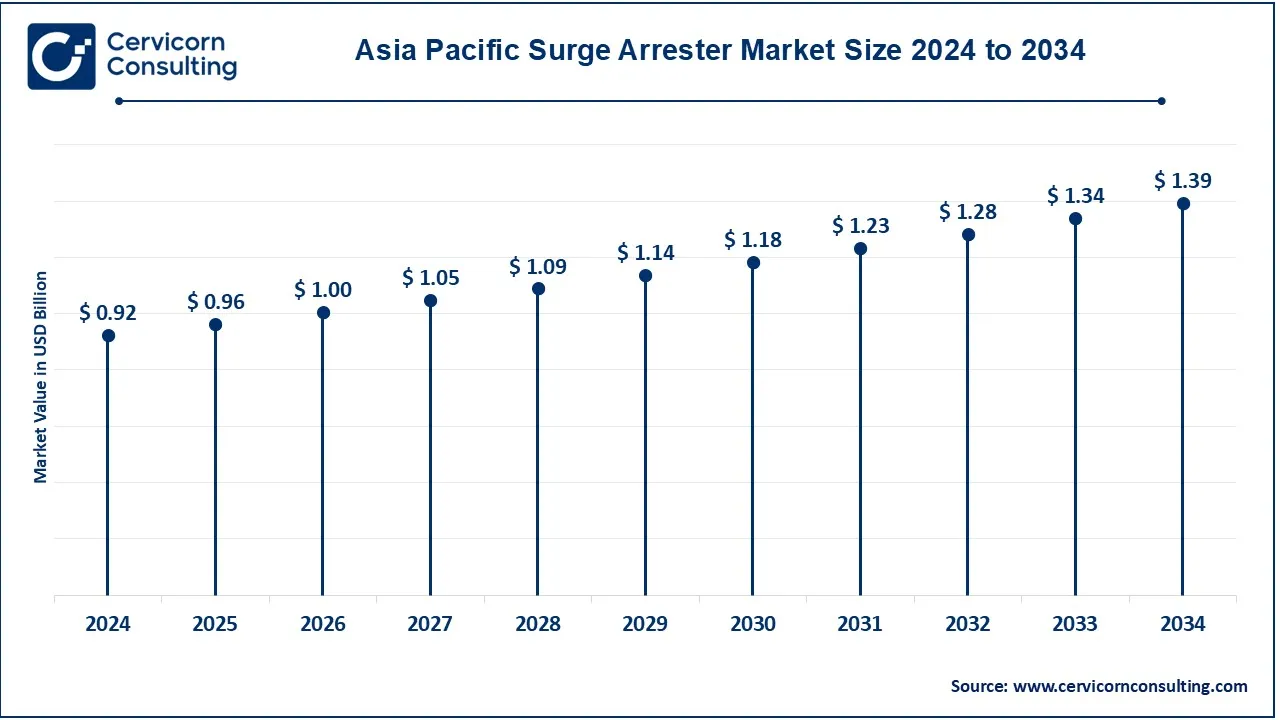

The Asia-Pacific surge arrester market size was accounted for USD 0.92 billion in 2024 and is predicted surpass around USD 1.39 billion by 2034. As the fastest growing region, demand for surge arresters in Asia-Pacific has stunned everyone, owing to its rapid industrialization combined with gigantic urbanization and increasing energy demand. Such markets are China, India, Japan, and South Korea, with the major investments concerning upgrading power infrastructure, especially transmission and distribution networks. The increased renewable energy projects in China and India have also stimulated demand for surge protection. In addition, the smart grid initiatives taken by governments in Southeast Asia are further propelling the demand for surge arresters in the region.

What are the driving factors of North America surge arrester market?

The North America surge arrester market size was valued at USD 0.60 billion in 2024 and is expected to reach around USD 0.90 billion by 2034. The modernization of power grids and the expansion of renewable energy, as well as upgrading infrastructure, are expected to be inevitable growth drivers for the North American surge arresters market. Surge arresters in this case are an application that is growing, led by the United States and Canada, where big bucks are spent on smart grid projects and future power transmission networks. Coupled with a solid focus on increasing engagements with the grid, following vast energy consumption increases and the adoption of electric vehicles, some further momentum for increased demand for surge arresters protecting critical electrical systems will be seen based on more accommodating government policies regarding renewable energy projects.

Why is Europe experiencing significant growth in the surge arrester market?

The Europe surge arrester market size was estimated at USD 0.41 billion in 2024 and is projected to hit around USD 0.61 billion by 2034. The market for electric surge protectors is expected to record significant growth in Europe due to the stringent measures put in place about power safety, switch over to clean sources of energy and the refurbishment of aging grid systems. Key nations include Germany, the UK, and France as well as Spain, all of which are investing heavily in projects of renewable energy generation, which include wind and solar power, that require advanced grade surge protection systems. EU continues with its unprecedented demand in Europe giving special impetus to green energy and smart city development. Thus, we find significant growth in the applications of surge arresters aimed at grid reliability and sustainability.

LAMEA surge arrester market growth

The LAMEA surge arrester market size was valued at USD 0.26 billion in 2024 and is expected to be worth around USD 0.38 billion by 2034. Surging forward with growth in LAMEA, mainly owing to rampant investments in electricity and energy transmission systems. In Latin America, key national/global markets are Brazil, Mexico, and Argentina, while in the Middle East and Africa, these are Saudi Arabia, the UAE, and South Africa. The demand for surge arresters in the region is strongly driven by rural electrification, smart grids, and the integration of renewable energy; in these cases, governments are focusing more on making the power grids across these nations reliable and sustainable.

Surge Arrester Market Top Companies

CEO Statements

Natarajan Chandrasekaran, CEO of Hitachi ABB Power Grids

- "Our commitment to sustainability drives us to innovate in surge protection solutions. The new factory in Xiamen will enable us to meet growing demand in renewable energy sectors effectively."

Roland Busch, CEO of Siemens

- "As we enhance our portfolio, our focus remains on providing comprehensive surge protection solutions that align with the industry's shift towards digitalization and sustainability."

Craig Arnold, CEO of Eaton

- "We are excited about our latest series of surge arresters, which are designed for extreme environments, supporting our goal to provide reliable solutions for critical infrastructure.”

Recent Developments

- In April 2024, President Ferdinand R. Marcos Jr. inaugurated the Mobile Energy System (MES) and the Energy Sector Emergency Operations Center (ESEOC) to bolster the resilience of energy systems and ensure a stable power supply across the Philippines. This initiative aims to enhance emergency preparedness and improve energy management capabilities.

- In April 2024, Safran Electrical & Power launched the GENeUSCONNECT, a high-power electrical harness designed to complete its comprehensive range of electrical systems for hybrid and electric aircraft. This development underscores Safran's commitment to advancing sustainable aviation technology.

- In April 2024, Ideal Power Inc. reported a purchase order for its patented bidirectional semiconductor power switch, B-TRAN™, from a leading global company in power electronics and semiconductor solutions. This marks a significant step in Ideal Power's efforts to commercialize this innovative technology.

Market Segmentation

By Type

By Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

By Application

By Class

- Distribution Class

- Intermediate Class

- Station Class

By End User

- Utilities

- Industries

- Transportation

By Region

- North America

- APAC

- Europe

- LAMEA

...

...