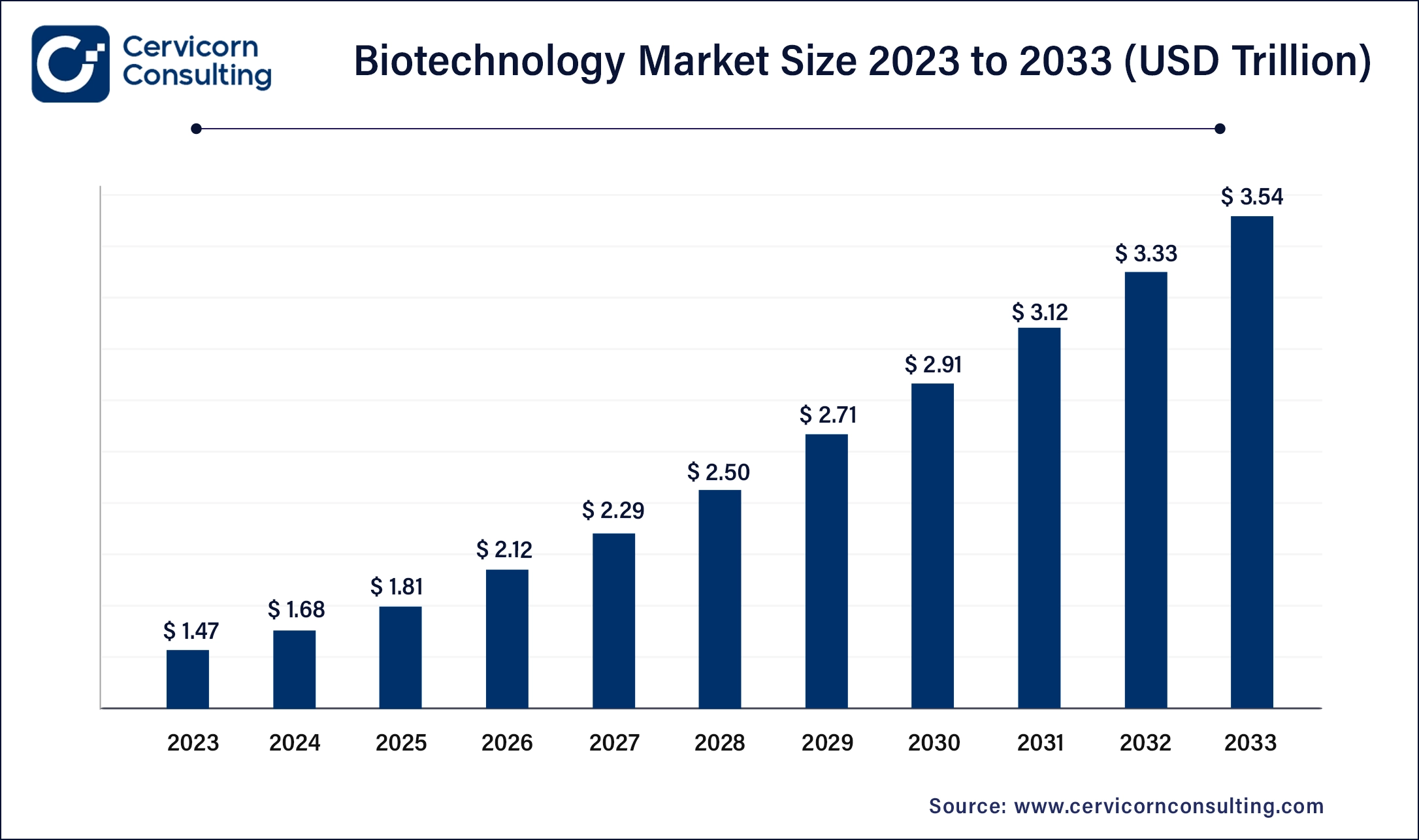

The global biotechnology market size was accounted for USD 1.68 trillion in 2024 and is projected to be worth around USD 3.75 trillion by 2034, expanding at a compound annual growth rate (CAGR) of 8.36% over the forecast period 2025 to 2034.

The biotechnology market is experiencing significant growth due to several key factors, including advancements in genetic research, the increasing demand for personalized medicine, and the rise in chronic diseases requiring innovative treatments. The development of cutting-edge technologies such as CRISPR gene editing, artificial intelligence in drug discovery, and stem cell research is driving innovation across various biotech sectors. Additionally, growing investments from both public and private sectors, along with favorable government regulations and funding for biotech startups, are fueling industry expansion. The aging global population and increasing healthcare awareness are further contributing to the market's growth, creating a need for more effective diagnostics, therapeutics, and biopharmaceutical products. Moreover, the rise of biologics and biosimilars, which offer more targeted treatments with fewer side effects, has led to an increased preference for biotech solutions over traditional pharmaceuticals. Countries in Asia-Pacific and Europe are expanding their biotechnology hubs, challenging North America's dominance and creating a competitive global market.

Biotechnology is a field of science that utilizes living organisms, cells, or biological systems to develop products or processes aimed at improving the quality of life. It plays a pivotal role in various industries, including healthcare, agriculture, environmental management, and food production. In the healthcare sector, biotechnology is used for drug development, genetic testing, and producing vaccines. In agriculture, biotechnology contributes to genetically modified crops that are resistant to pests, diseases, and environmental stresses. Additionally, biotechnology is employed in environmental processes, such as waste management and bio-remediation, where it helps in cleaning up pollutants or managing ecosystems effectively. The field combines biological sciences with engineering principles to create innovative solutions to some of the world’s most pressing challenges.

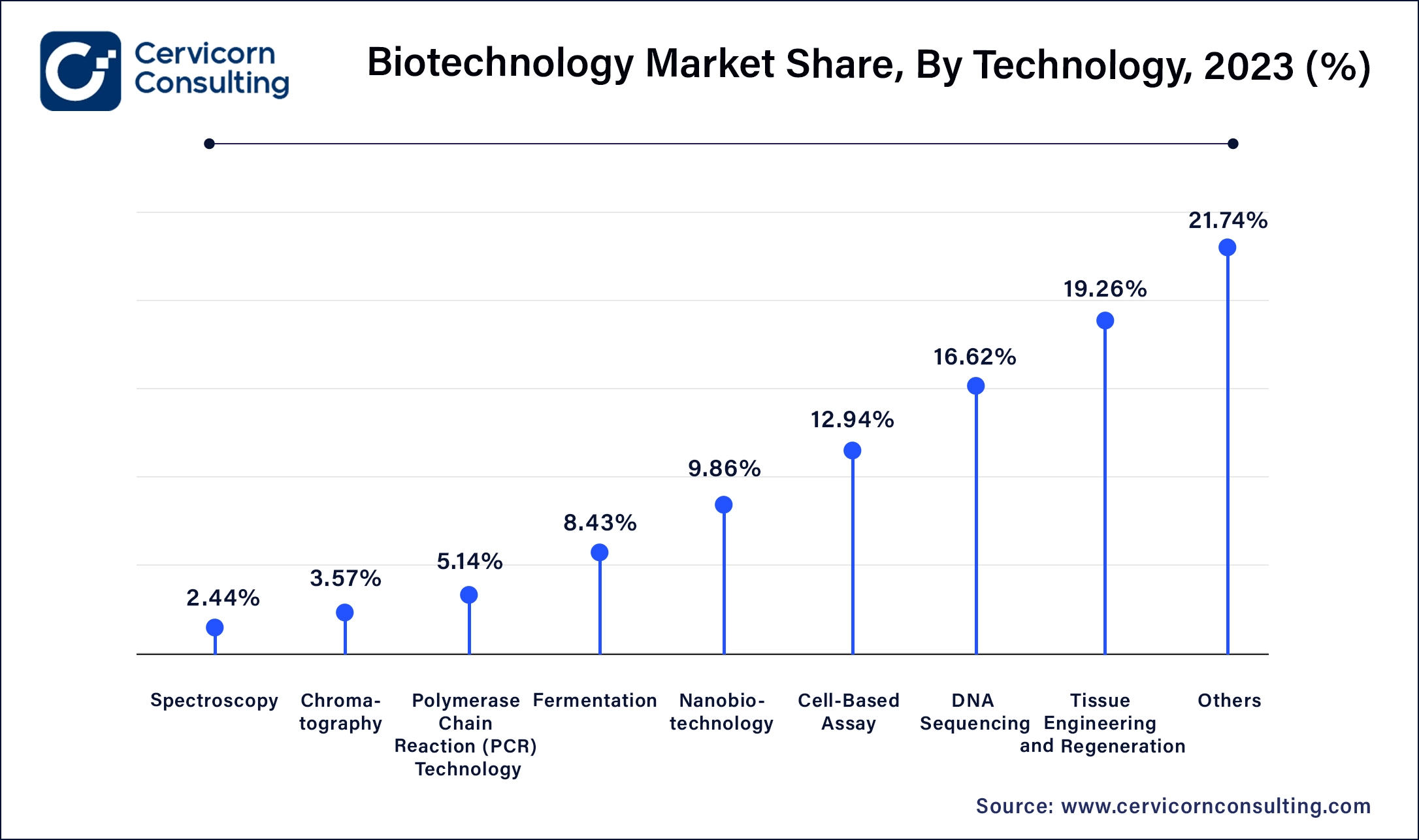

Key segments include healthcare (biopharmaceuticals, cell and gene therapies, diagnostics), agricultural (genetically modified crops, animal biotechnology), industrial (biofuels, bioplastics), and environmental biotechnology (bioremediation, waste management). It leverages advanced technologies like DNA sequencing, PCR, recombinant DNA, tissue engineering, fermentation, and nanobiotechnology. Major end users include pharmaceutical companies, research institutions, hospitals, and the agricultural and industrial sectors.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.81 Trillion |

| Projected Market Size in 2034 | USD 3.75 Trillion |

| Expected CAGR from 2025 to 2034 | 8.36% |

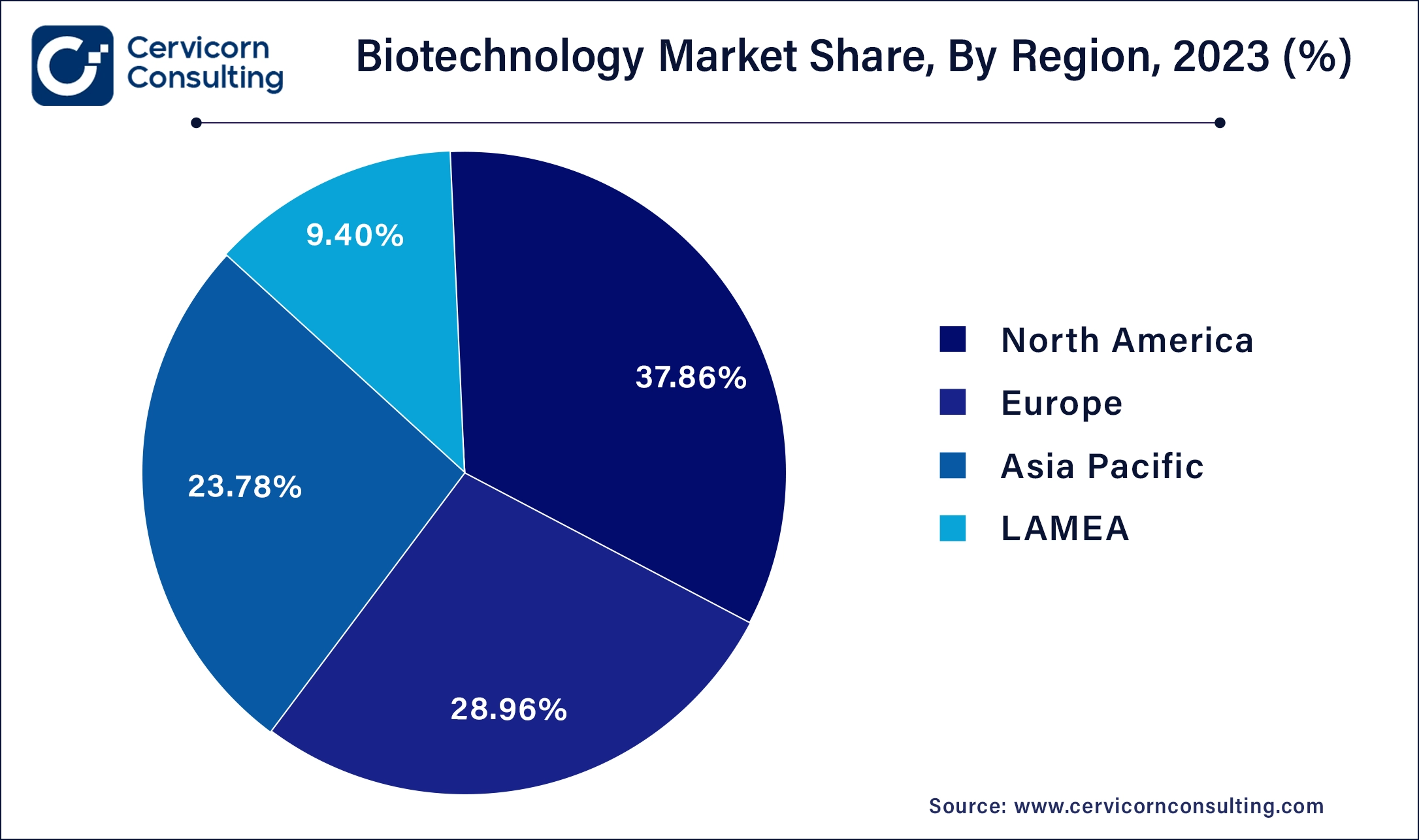

| Dominant Region | North America |

| High Growth Region | Asia-Pacific |

| Key Segments | Technology, Product Type, Application, Region |

| Key Companies | Amgen Inc., Gilead Sciences, Inc., Biogen Inc., Regeneron Pharmaceuticals, Inc., Vertex Pharmaceuticals Incorporated, AbbVie Inc., Novo Nordisk A/S, Alexion Pharmaceuticals, Inc. |

Regulatory and Ethical Hurdles:

High Research and Development Costs:

The biotechnology market is segmented into technology, product type, application and region. Based on technology , the market is classified into nanobiotechnology, tissue engineering and regeneration, DNA sequencing, cell-based assays, fermentation, PCR Ttechnology, chromatography, and others. Based on product type, the market is classified into instruments, reagents and kits, software & services, others. Based on application, the market is classified into health, food & agriculture, natural resources & environment, industrial processing, bioinformatics,and others.

Nanobiotechnology: Nanobiotechnology combines nanotechnology and biology to develop nanoscale tools, such as nanoparticles and nanodevices, for medical and industrial applications. Key trends include the development of targeted drug delivery systems, nanoscale biosensors for early disease detection, and nanomaterials for tissue engineering. The integration of AI in designing nanobiotech applications is also growing, enhancing precision and efficacy in diagnostics and treatment.

Tissue Engineering and Regeneration: Tissue engineering and regeneration involve creating biological tissues through the combination of cells, scaffolds, and biologically active molecules to restore or replace damaged tissues. Trends include advancements in 3D bioprinting of tissues and organs, development of biomaterials for better integration and function, and increasing focus on regenerative therapies for diseases like osteoarthritis and cardiovascular conditions. Collaboration between academia and industry is accelerating innovation.

DNA Sequencing: DNA sequencing determines the order of nucleotides in DNA, providing essential information for genetic research and diagnostics. Next-generation sequencing (NGS) technologies are making sequencing faster and more affordable, facilitating personalized medicine, cancer genomics, and infectious disease tracking. The integration of AI for data analysis and the development of portable sequencers are also key trends, expanding accessibility and application.

Cell-based Assays: Cell-based assays utilize live cells to measure cellular responses to stimuli, commonly used in drug discovery and toxicity testing. Increasing use of high-throughput screening and automation in cell-based assays is enhancing drug discovery efficiency. Advances in 3D cell culture models and organ-on-a-chip technologies are providing more physiologically relevant data, improving predictive accuracy for human responses.

Fermentation: Fermentation uses microorganisms to convert organic substrates into valuable products like biofuels, pharmaceuticals, and food ingredients. Innovations in synthetic biology and metabolic engineering are optimizing microbial strains for higher yields and productivity. The shift towards sustainable and renewable feedstocks is driving the development of bio-based products, and advances in bioreactor design are improving process scalability and efficiency.

PCR Technology: PCR (Polymerase Chain Reaction) amplifies specific DNA sequences, enabling detailed genetic analysis. Trends include the development of digital PCR for more precise quantification, rapid PCR technologies for faster results, and portable PCR devices for point-of-care testing. The application of PCR in detecting infectious diseases, including COVID-19, has significantly expanded its market presence.

Chromatography: Chromatography is a technique for separating mixtures into their individual components, essential in biopharmaceutical production and analytical labs. Advances in high-performance liquid chromatography (HPLC) and ultra-performance liquid chromatography (UPLC) are enhancing separation efficiency and speed. The integration of chromatography with mass spectrometry (LC-MS) is becoming more prevalent for detailed molecular analysis, and green chromatography methods are gaining attention for their environmental benefits.

Others: This category includes emerging biotechnologies like bioinformatics, biosensors, and bioprocessing technologies not covered in traditional segments. Bioinformatics is leveraging big data and AI to accelerate genetic research and drug discovery. Biosensors are being developed for rapid and sensitive diagnostics, and bioprocessing advancements are improving the scalability and cost-efficiency of producing biologics and other biotech products. The convergence of these technologies is driving interdisciplinary innovations.

Type Instruments: Instruments encompass tools used in biotechnological research and applications, such as DNA sequencers, mass spectrometers, and microscopes. Trends include advancements in automation, miniaturization for point-of-care testing, and integration with AI for data analysis, enhancing precision and efficiency in biological research.

Reagents and Kits: Reagents and kits are essential chemicals and pre-packaged sets used in biotech processes like PCR and DNA extraction. Trends focus on development of environmentally friendly reagents, multiplexed assays for simultaneous testing, and ready-to-use kits for rapid diagnostics, catering to demand for efficiency and reliability.

Software & Services: Software & services cover bioinformatics tools, data analysis software, and consulting services in biotechnology. Trends include AI-driven predictive analytics, cloud-based platforms for data storage and collaboration, and personalized medicine solutions integrating patient data, enhancing research capabilities and clinical outcomes.

Others: This category includes miscellaneous biotech products like disposables, lab consumables, and culture media. Trends involve sustainable and recyclable materials, bioengineered scaffolds for tissue engineering, and smart bioreactors for efficient bioprocessing, addressing environmental concerns and optimizing production processes.

Health: Biotechnology in health focuses on developing treatments, diagnostics, and therapies using biological systems. Trends include personalized medicine, gene therapy advancements, and precision diagnostics, leveraging genomics and biopharmaceuticals for targeted therapies.

Food & Agriculture: Biotechnology in food and agriculture enhances crop yield, pest resistance, and nutritional content through genetic modification. Trends include the development of GMOs, biopesticides, and sustainable farming practices to meet global food demand and promote environmental stewardship.

Natural Resources & Environment: Biotechnology in natural resources and environment focuses on bioremediation, waste management, and renewable energy production. Trends include biofuel development, biodegradable plastics, and microbial solutions for environmental cleanup, addressing sustainability challenges.

Industrial Processing: Biotechnology in industrial processing involves using biological systems for manufacturing chemicals, materials, and energy. Trends include bioprocessing innovations, fermentation technologies, and bio-based products to reduce environmental impact and improve efficiency.

Bioinformatics: Bioinformatics integrates biological data with computational tools for analyzing genetic sequences, drug discovery, and personalized medicine. Trends include AI-driven analytics, genomic data mining, and precision healthcare solutions, enhancing research and clinical outcomes.

Others: Other biotechnology applications span areas like veterinary medicine, nanobiotechnology, and synthetic biology. Trends include advancements in regenerative medicine, nanomedicine, and innovative biotech applications across diverse industries, driving interdisciplinary collaborations and breakthroughs.

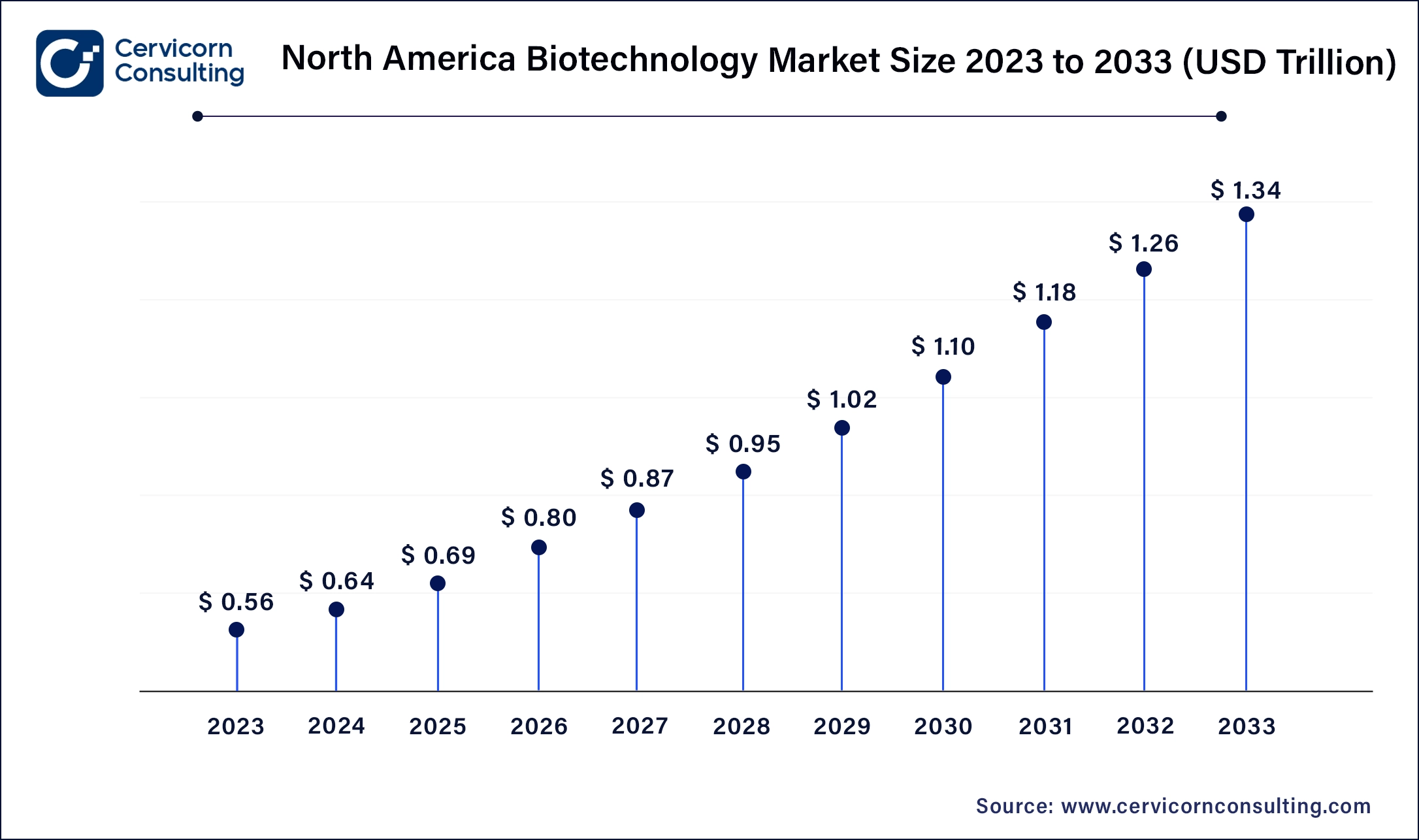

North America is expected to grow at a CAGR of 9.20% from 2025 to 2034. North America leads in biotechnology innovation and investment, with a focus on personalized medicine, genomic research, and biopharmaceutical development. Trends include strong regulatory support for biotech startups, AI integration in healthcare, and significant venture capital funding for biotech R&D. The U.S. market size is calculated at USD 473 billion in 2024 and is foreseen to reach around USD 1,054.69 billion by 2034.

Asia-Pacific is projected to grow at a highest CAGR of 9.27% in the forecast period. Asia-Pacific is rapidly growing in biotechnology, with a focus on biopharmaceutical manufacturing, genetic research, and agricultural biotech. Trends include the rise of biotech hubs in China and India, investment in CRISPR gene editing technologies, and government initiatives promoting biotech innovation.

Europe is anticipated to reach at a CAGR of 9.12% from 2025 to 2034. Europe emphasizes sustainable biotechnology solutions, including GMO regulations, biofuel development, and environmental bioremediation. Trends include advancements in synthetic biology, precision agriculture, and cross-border collaborations in biopharmaceutical research.

LAMEA region is anticipated to reach at a CAGR of 8.4% over the forecast period. LAMEA regions are expanding biotechnology capabilities, focusing on biodiversity, bioinformatics, and healthcare access. Trends include genetic diversity studies, bio-based products for sustainable development, and partnerships for biopharmaceutical production capacity building.

New players entering the biotechnology market often adopt innovative technologies like CRISPR gene editing, AI-driven drug discovery, and precision medicine approaches to carve out their niche. These companies leverage agile business models and strategic partnerships to accelerate their entry and growth. Key players dominating the market include established biopharmaceutical giants like Amgen, Gilead Sciences, and Biogen, known for their extensive R&D capabilities, robust product pipelines, and global market presence. They maintain leadership through continuous innovation, large-scale investments in research, strategic acquisitions, and strong regulatory compliance, securing significant market share and influencing industry standards and advancements.

Market Segmentation

By Technology

By Product Type

By Application

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Biotechnology

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Product Type Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Biotechnology Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Advancements in CRISPR and Gene Editing Technologies

4.1.1.2 Integration of Artificial Intelligence (AI) and Machine Learning (ML)

4.1.2 Market Restraints

4.1.2.1 Regulatory and Ethical Challenges

4.1.2.2 High Costs and Complex Development Processes

4.1.3 Market Opportunities

4.1.3.1 Precision Medicine and Personalized Therapies

4.1.3.2 Sustainable Agricultural Biotechnology

4.1.4 Market Challenges

4.1.4.1 Regulatory and Ethical Hurdles

4.1.4.2 High Research and Development Costs

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Biotechnology Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Biotechnology Market, By Technology

6.1 Global Biotechnology Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

6.1.1.1 NanoBiotechnology

6.1.1.2 Tissue Engineering and Regeneration

6.1.1.3 DNA Sequencing

6.1.1.4 Cell-based Assays

6.1.1.5 Fermentation

6.1.1.6 PCR Technology

6.1.1.7 Chromatography

6.1.1.8 Others

Chapter 7 Biotechnology Market, By Product Product Type

7.1 Global Biotechnology Market Snapshot, By Product Product Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

7.1.1.1 Instruments

7.1.1.2 Reagents and Kits

7.1.1.3 Software & Services

7.1.1.4 Others

Chapter 8 Biotechnology Market, By Application

8.1 Global Biotechnology Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

8.1.1.1 Health

8.1.1.2 Food & Agriculture

8.1.1.3 Natural Resources & Environment

8.1.1.4 Industrial Processing

8.1.1.5 Bioinformatics

8.1.1.6 Others

Chapter 9 Biotechnology Market, By Region

9.1 Overview

9.2 Biotechnology Market Revenue Share, By Region 2023 (%)

9.3 Global Biotechnology Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Biotechnology Market Revenue, 2021-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Biotechnology Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Biotechnology Market Revenue, 2021-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Biotechnology Market Revenue, 2021-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Biotechnology Market Revenue, 2021-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Biotechnology Market Revenue, 2021-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Biotechnology Market, By Country

9.5.4 UK

9.5.4.1 UK Biotechnology Market Revenue, 2021-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Biotechnology Market Revenue, 2021-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Biotechnology Market Revenue, 2021-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Biotechnology Market Revenue, 2021-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Biotechnology Market Revenue, 2021-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Biotechnology Market, By Country

9.6.4 China

9.6.4.1 China Biotechnology Market Revenue, 2021-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Biotechnology Market Revenue, 2021-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Biotechnology Market Revenue, 2021-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Biotechnology Market Revenue, 2021-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Biotechnology Market Revenue, 2021-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Biotechnology Market Revenue, 2021-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Biotechnology Market, By Country

9.7.4 GCC

9.7.4.1 GCC Biotechnology Market Revenue, 2021-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Biotechnology Market Revenue, 2021-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Biotechnology Market Revenue, 2021-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Biotechnology Market Revenue, 2021-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2021-2023

10.1.3 Competitive Analysis By Revenue, 2021-2023

10.2 Recent Developments by the Market Contributors (2023)

Chapter 11 Company Profiles

11.1 Amgen Inc.

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Gilead Sciences, Inc.

11.3 Biogen Inc.

11.4 Regeneron Pharmaceuticals, Inc.

11.5 Vertex Pharmaceuticals Incorporated

11.6 AbbVie Inc.

11.7 Novo Nordisk A/S

11.8 Alexion Pharmaceuticals, Inc.

11.9 Celgene Corporation (now part of Bristol-Myers Squibb)

11.10 Vertex Pharmaceuticals Inc.