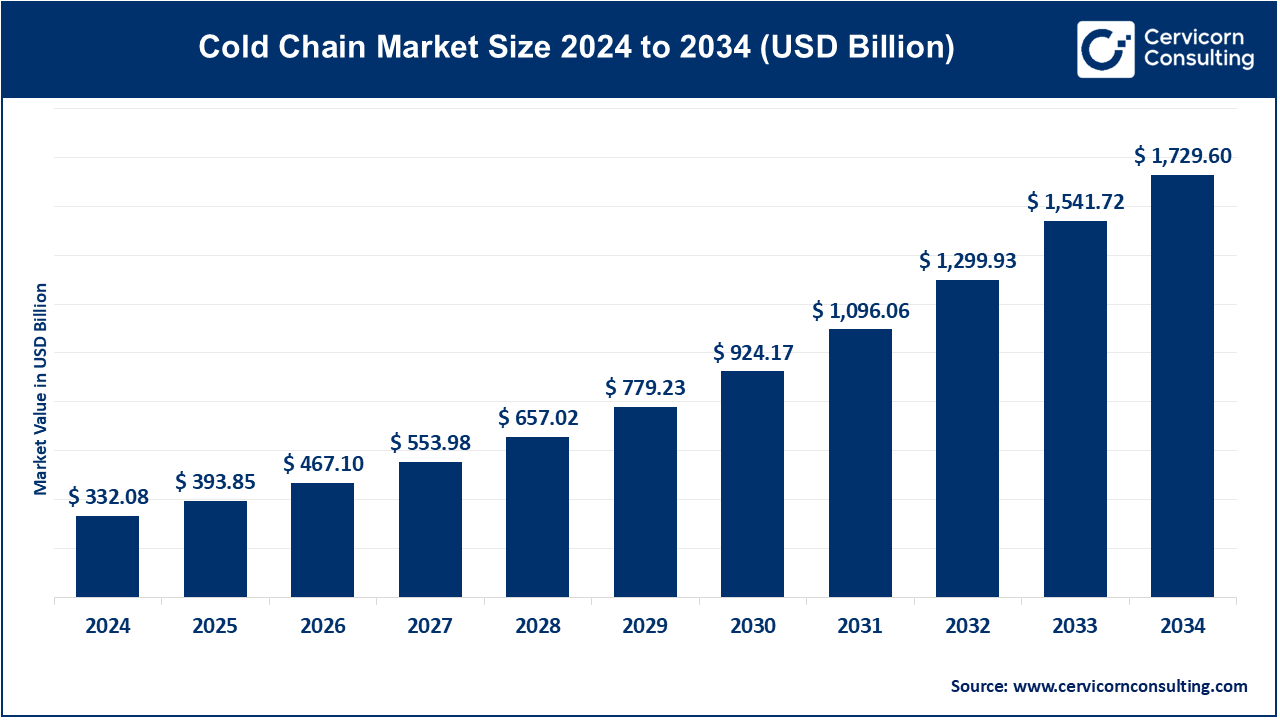

The global cold chain market size was valued at USD 332.08 billion in 2024 and is expected to reach around USD 1,729.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 18.06% over the forecast period 2025 to 2034.

The cold chain market is experiencing rapid expansion due to increasing globalization, urbanization, and the growing consumer demand for fresh, high-quality perishable products. The surge in online grocery shopping, especially for frozen and fresh food items, has significantly driven investments in cold storage and transportation infrastructure. The pharmaceutical industry is another major contributor to this growth, as temperature-sensitive drugs, vaccines, and biologics require specialized cold chain systems to ensure efficacy. Additionally, government regulations emphasizing food safety and pharmaceutical quality standards are pushing companies to adopt advanced cold chain solutions. Emerging technologies, such as IoT-enabled monitoring, AI-driven predictive analytics, and blockchain for traceability, are transforming the cold chain industry. These innovations are improving operational efficiency and minimizing losses due to temperature fluctuations. In regions like Asia-Pacific, the expansion of middle-class populations and rising disposable incomes are fueling demand for high-quality perishable products, further driving the need for enhanced cold chain logistics.

A cold chain is a temperature-controlled supply chain system used to store, transport, and distribute perishable goods, such as food, pharmaceuticals, and biologics, while maintaining their quality and safety. It relies on advanced refrigeration and monitoring technologies to ensure optimal temperature ranges throughout the supply chain. Key components of a cold chain include refrigerated storage facilities, temperature-controlled vehicles, and specialized packaging solutions. The cold chain can be classified into two main types, refrigerated storage, which includes warehouses and facilities that maintain goods at specific temperatures for extended periods, and refrigerated transportation, involving temperature-controlled trucks, containers, and cargo ships to transport goods across short or long distances. Another emerging type is cold chain monitoring, which uses IoT sensors and software to track and report real-time temperature data to ensure compliance with quality standards.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 393.85 Billion |

| Market Size in 2034 | USD 1,729.6 Billion |

| Market Growth Rate | CAGR of 18.06% from 2025 to 2034 |

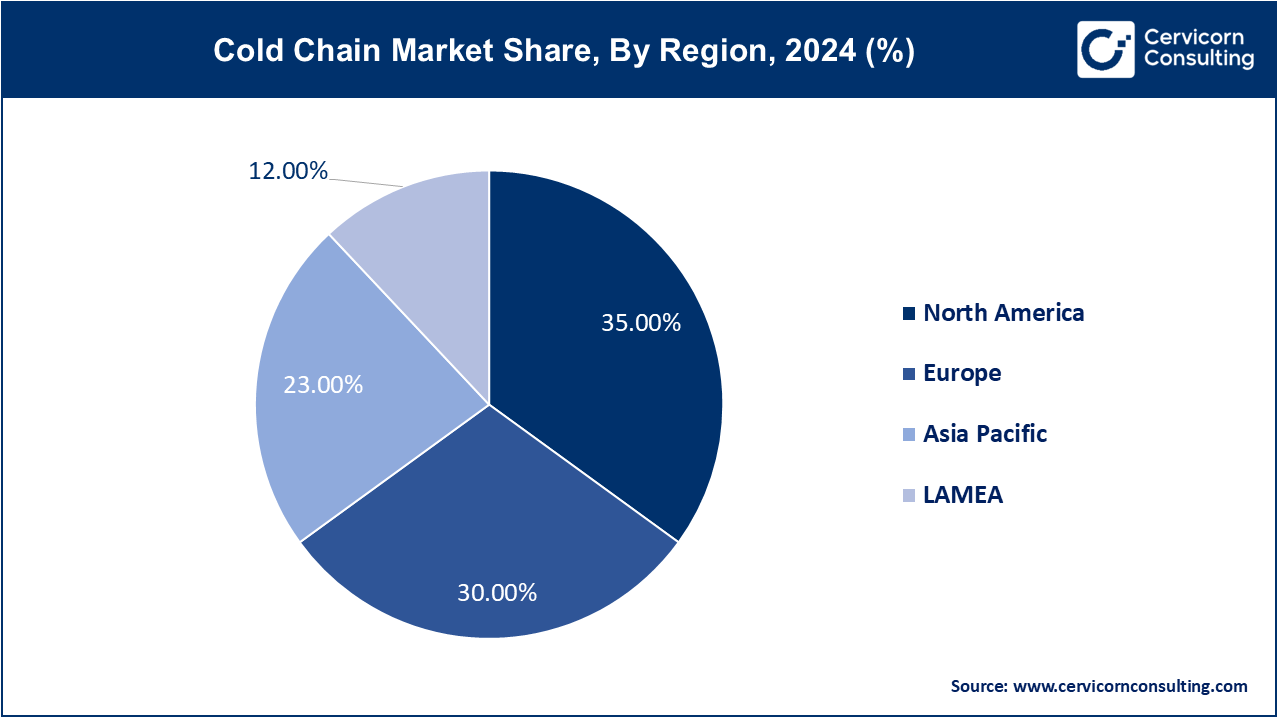

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segment Covered | By Type, Temperature Range, Application, Regions |

Government Investments and Initiatives

Increasing Global Food Trade

High Operational Costs

Infrastructure Challenges in Developing Regions

Adoption of Renewable Energy Solutions

Development of Smart Cold Chain Technologies

Complex Regulatory Compliance

Logistical and Infrastructure Limitations in Remote Areas

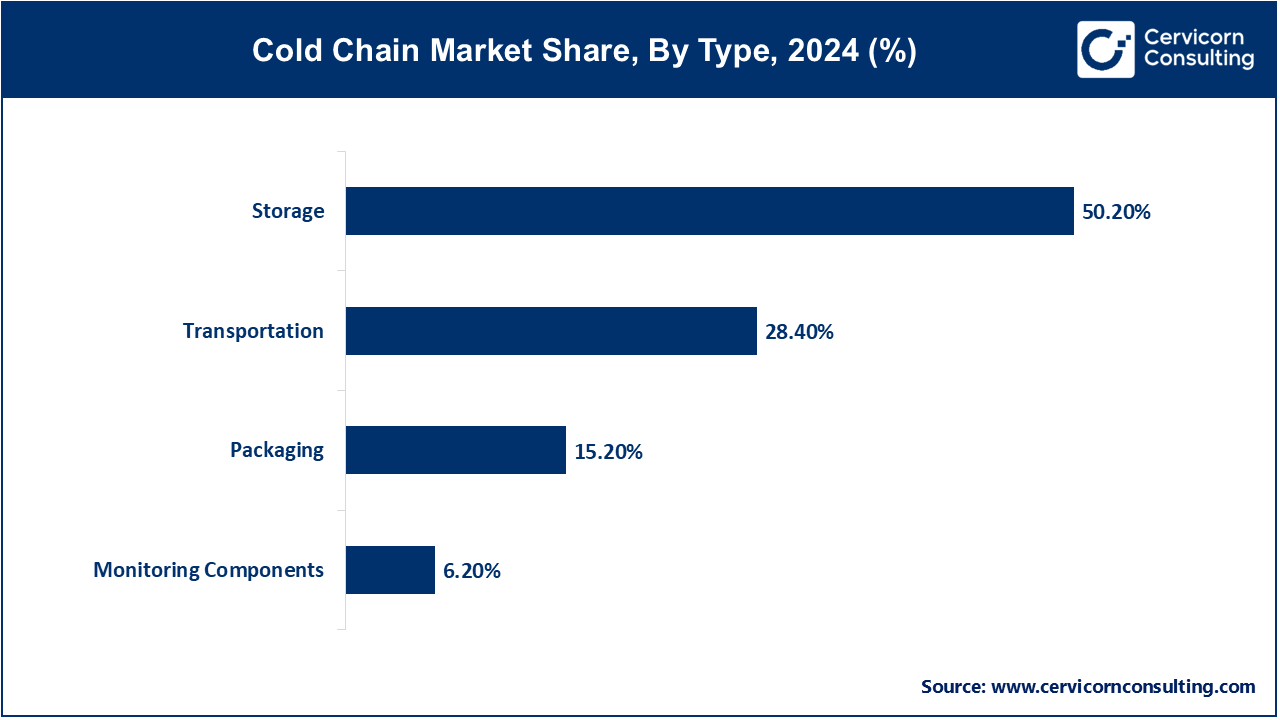

Refrigerated Storage: The refrigerated storage segment has dominated the market with share of 50.2% in 2024. Refrigerated storage involves facilities designed to maintain controlled temperatures for perishable goods, such as cold stores and bulk storage facilities. Trends include the adoption of energy-efficient refrigeration systems and automation technologies to enhance storage capacity and reduce operational costs. There is also increasing use of advanced monitoring systems to ensure precise temperature control and compliance with safety regulations.

Refrigerated Transportation: The refrigerated transportation segment has registered market share of 28.4% in 2024. refrigerated transportation refers to vehicles equipped to transport temperature-sensitive goods, including road, rail, air, and sea transport. Trends in this segment include the development of smart logistics solutions, such as IoT-enabled tracking systems and advanced insulation materials, which enhance route optimization and real-time monitoring. There is also a growing emphasis on sustainability, with companies investing in energy-efficient and eco-friendly transportation options.

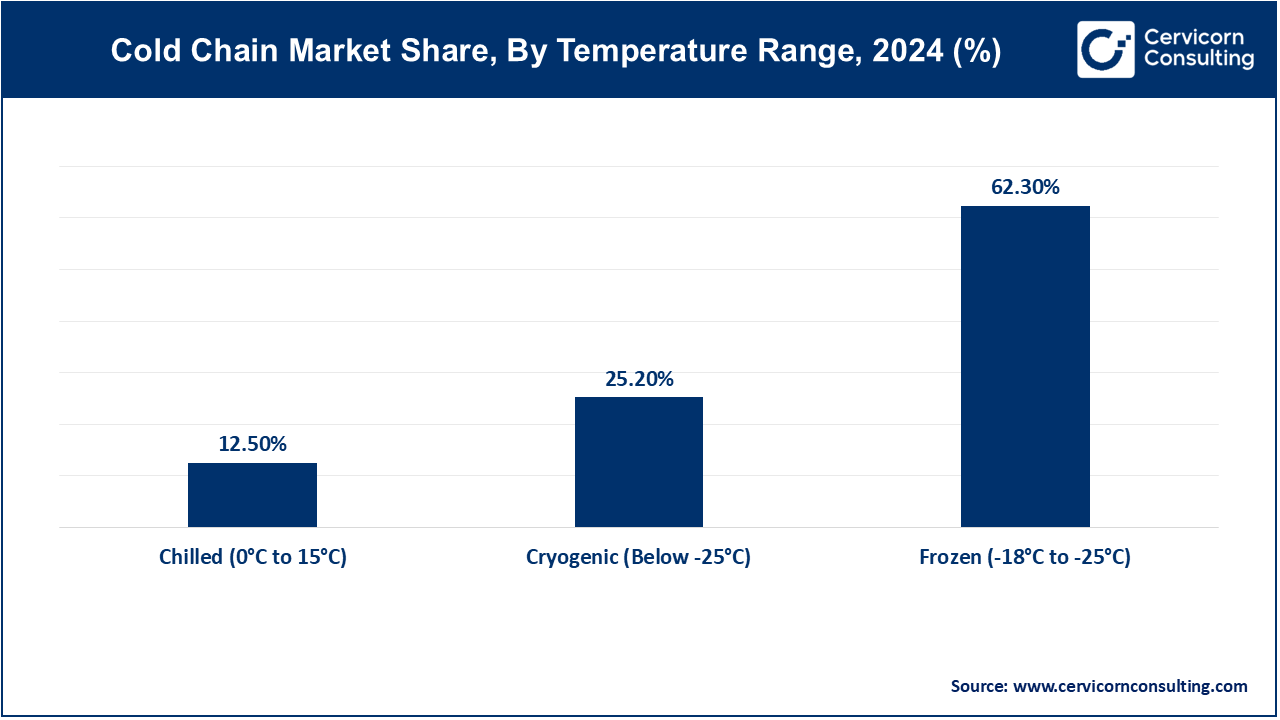

Chilled (Above Freezing): The chilled temperature segment has recorded market share of 12.5% in 2024. Chilled storage maintains temperatures above freezing, typically between 0°C to 8°C (32°F to 46°F), essential for preserving the freshness of perishable goods like dairy products, fruits, and vegetables. Growing consumer demand for fresh produce and convenience foods is driving advancements in chilled storage technology, including energy-efficient refrigeration systems and improved insulation materials to reduce energy consumption and extend shelf life.

Frozen (Below Freezing): The frozen segments has covered highest market share of 62.3% in 2024. Frozen storage involves maintaining temperatures below 0°C (32°F), crucial for preserving meat, seafood, and frozen foods. It prevents microbial growth and spoilage by keeping products solidified. The expansion of global frozen food markets and increased online grocery shopping are spurring investments in advanced freezing technologies, such as blast freezing and automated storage systems, to enhance efficiency and reduce waste.

Cryogenic (Ultra-low Temperature): The cryogenic segment has captured market share of 25.2% in 2024. Cryogenic storage involves extremely low temperatures, often below -150°C (-238°F), used for specialized applications like pharmaceuticals, vaccines, and scientific research. Rising demand for biologics and high-value pharmaceuticals is driving innovations in cryogenic storage, including advancements in cryogenic containers and monitoring systems to ensure precise temperature control and enhance the safety and effectiveness of sensitive products.

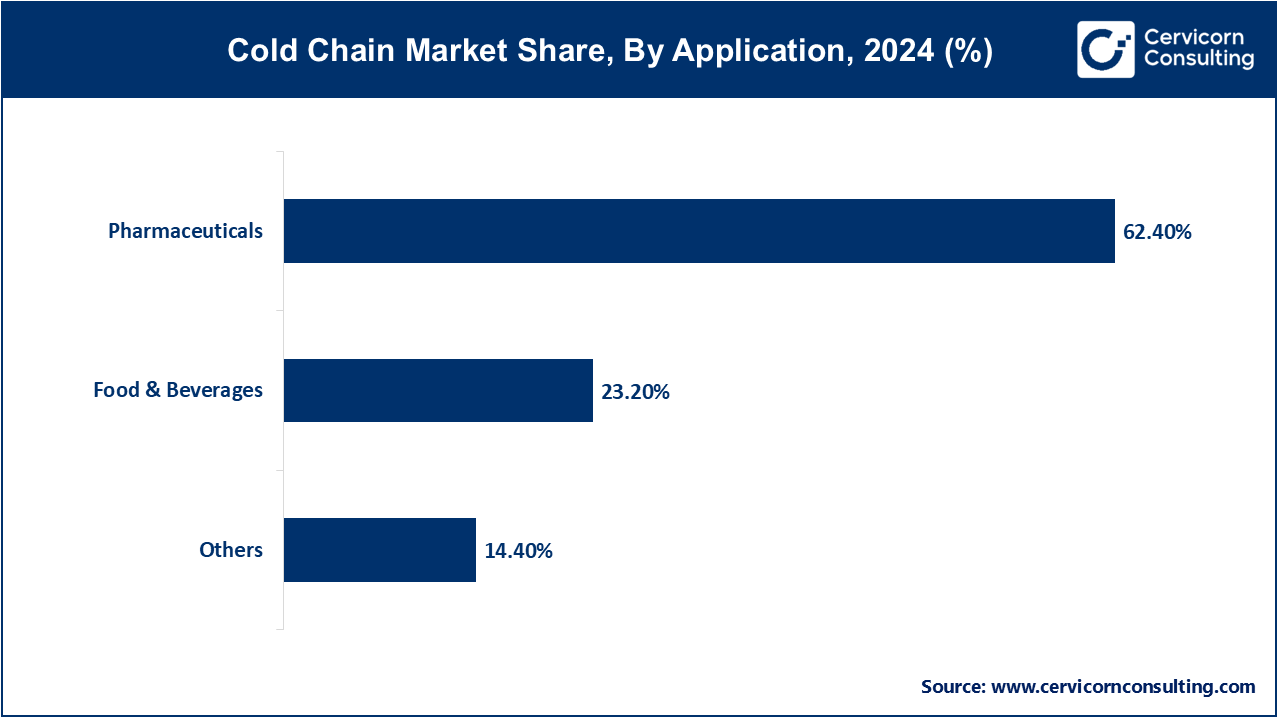

Food and Beverages: The food & beverages segment has measured market share of 23.2% in 2024. This segment includes the storage and transport of perishable items such as dairy products, fruits, vegetables, meat, seafood, and beverages, requiring controlled temperatures to maintain quality and safety. Growing consumer demand for fresh and organic products is driving innovation in cold storage solutions. Enhanced tracking technologies and energy-efficient systems are improving efficiency and reducing costs in this segment.

Pharmaceuticals and Healthcare: The pharmaceuticals and healthcare segment has generated dominating market share of 62.4% in 2024. This segment encompasses the cold chain logistics for temperature-sensitive pharmaceuticals, including vaccines, biopharmaceuticals, and clinical trial materials, which must be stored and transported within strict temperature ranges. The rise in global vaccination campaigns and the development of advanced biologics are driving growth. Increased use of IoT and blockchain technologies for real-time monitoring and traceability is enhancing the reliability and compliance of pharmaceutical cold chains.

Chemicals: The chemicals segment involves the transportation and storage of temperature-sensitive chemicals, including specialty and industrial chemicals, that require specific temperature conditions to maintain stability and safety. Increased demand for specialty chemicals and stringent safety regulations are boosting the need for advanced cold chain solutions. Innovations in temperature-controlled containers and monitoring systems are improving the efficiency and safety of chemical logistics.

Others: The others segment has accounted market share of 14.4% in 2024. This segment covers various other applications of cold chain logistics, including biotechnology products, cosmetics, and certain consumer goods requiring temperature control. The expansion of e-commerce and increased consumer awareness of product quality are driving demand. Companies are investing in flexible and scalable cold chain solutions to cater to diverse and emerging needs, incorporating advanced technologies for better efficiency and sustainability.

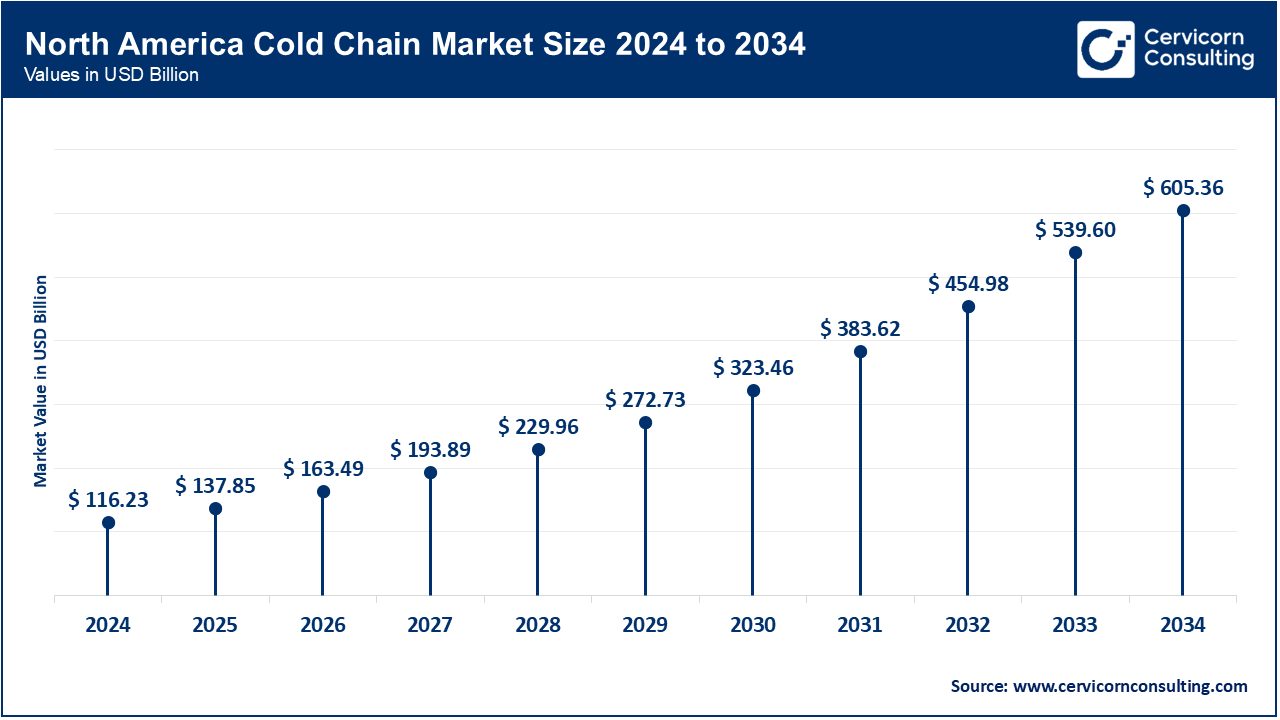

The North America market size is calculated at USD 116.23 billion in 2024 and is projected to grow around USD 605.36 billion by 2034. North America includes the U.S., Canada, and Mexico, where cold chain logistics support diverse industries, including food, pharmaceuticals, and chemicals. Increased focus on sustainability and energy efficiency is driving innovation. The adoption of advanced technologies, such as IoT and AI for real-time monitoring and automation, is enhancing operational efficiency. Moreover, there is a growing emphasis on expanding infrastructure to meet the demands of e-commerce and consumer expectations for fresh goods.

The Europe market size is predicted to hit around USD 518.89 billion by 2034 from USD 99.62 billion in 2024. Europe encompasses countries like Germany, the U.K., France, and others, with a strong emphasis on regulatory compliance and advanced cold chain practices. The European market is experiencing a rise in demand for traceability and transparency due to stringent regulations. The adoption of green technologies and renewable energy in cold chain operations is prominent, driven by the European Union’s sustainability goals and initiatives to reduce carbon emissions in logistics.

The Asia Pacific market size is expected to reach around USD 367.81 billion by 2034 increasing from USD 76.38 billion in 2024. Asia-Pacific includes countries such as China, India, Japan, and Australia, with a rapidly growing cold chain market due to economic expansion and rising consumer demand. The region is witnessing significant investment in infrastructure development and modernization of cold chain facilities. The rise of e-commerce and increasing consumption of perishable goods are driving the adoption of advanced cold chain technologies. Additionally, there is a focus on improving logistics efficiency to cater to the diverse and expanding market.

The LAMEA market size is estimated to reach around USD 207.55 billion by 2034 from USD 39.85 billion in 2024. LAMEA includes Latin America (e.g., Brazil, Argentina) and the Middle East & Africa (e.g., GCC countries, South Africa), where cold chain logistics support a range of industries, including agriculture and pharmaceuticals. The region is experiencing growth in cold chain infrastructure, driven by increasing urbanization and a demand for higher-quality goods. Investments in mobile refrigeration units and decentralized cold storage solutions are addressing challenges related to infrastructure and accessibility, enhancing supply chain efficiency in remote areas.

New players such as Zymergen Inc. and Temasek Holdings are leveraging innovations in biotechnology and sustainable practices to enter the cold chain market, focusing on advanced materials and eco-friendly solutions. Lineage Logistics and Americold Realty Trust dominate the market through their extensive global networks and cutting-edge technologies. They lead with innovations like IoT-enabled temperature monitoring, automated storage systems, and energy-efficient refrigeration. Their market dominance stems from large-scale infrastructure, strategic acquisitions, and a strong focus on operational efficiency and sustainability.

Market Segmentation

By Type

By Temperature Range

By Application

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Cold Chain

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Temperature Range Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Cold Chain Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Government Investments and Initiatives

4.1.1.2 Increasing Global Food Trade

4.1.2 Market Restraints

4.1.2.1 High Operational Costs

4.1.2.2 Infrastructure Challenges in Developing Regions

4.1.3 Market Opportunity

4.1.3.1 Adoption of Renewable Energy Solutions:

4.1.3.2 Development of Smart Cold Chain Technologies

4.1.4 Market Challenges

4.1.4.1 Complex Regulatory Compliance

4.1.4.2 Logistical and Infrastructure Limitations in Remote Areas

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Cold Chain Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Cold Chain Market, By Type

6.1 Global Cold Chain Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Refrigerated Storage

6.1.1.2 Refrigerated Transportation

6.1.1.3 Packaging

6.1.1.4 Monitoring Components

Chapter 7 Cold Chain Market, By Temperature Range

7.1 Global Cold Chain Market Snapshot, By Temperature Range

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Chilled (Above Freezing)

7.1.1.2 Frozen (Below Freezing)

7.1.1.3 Cryogenic (Ultra-low Temperature)

Chapter 8 Cold Chain Market, By Application

8.1 Global Cold Chain Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Food and Beverages

8.1.1.2 Pharmaceuticals and Healthcare

8.1.1.3 Chemicals

8.1.1.4 Others

Chapter 9 Cold Chain Market, By Region

9.1 Overview

9.2 Cold Chain Market Revenue Share, By Region 2024 (%)

9.3 Global Cold Chain Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Cold Chain Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Cold Chain Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Cold Chain Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Cold Chain Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Cold Chain Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Cold Chain Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Cold Chain Market, By Country

9.5.4 UK

9.5.4.1 UK Cold Chain Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Cold Chain Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Cold Chain Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Cold Chain Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Cold Chain Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Cold Chain Market, By Country

9.6.4 China

9.6.4.1 China Cold Chain Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Cold Chain Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Cold Chain Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Cold Chain Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Cold Chain Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Cold Chain Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Cold Chain Market, By Country

9.7.4 GCC

9.7.4.1 GCC Cold Chain Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Cold Chain Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Cold Chain Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Cold Chain Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 DHL Supply Chain

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Kuehne + Nagel International AG

11.3 C.H. Robinson Worldwide, Inc.

11.4 XPO Logistics, Inc.

11.5 DB Schenker

11.6 FedEx Corporation

11.7 UPS Supply Chain Solutions

11.8 J.B. Hunt Transport Services, Inc.

11.9 Agility Logistics

11.10 Schaeffler Group