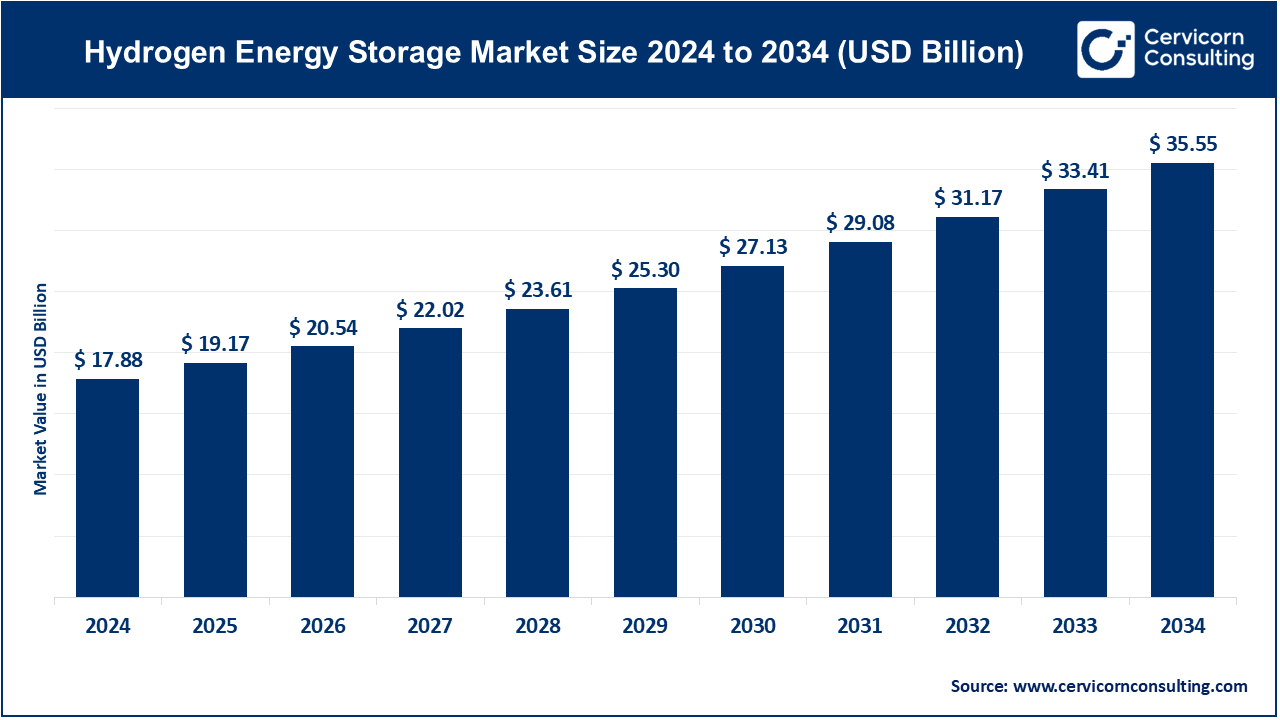

The global hydrogen energy storage market size was accounted for USD 17.88 billion in 2024 and is projected to surpass around USD 35.55 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.19% over the forecast period 2025 to 2034.

The hydrogen energy storage market is experiencing significant growth due to increasing global focus on renewable energy adoption and the need for efficient energy storage systems. Hydrogen offers a promising solution to address the intermittent nature of renewable energy sources like wind and solar, providing a way to store surplus energy generated during peak production times. Key players in the industry, including energy providers and governments, are investing heavily in hydrogen infrastructure and technologies to tap into its potential for clean energy transition. Additionally, hydrogen's role in decarbonizing hard-to-abate sectors, such as transportation and industrial applications, is driving further market expansion. Regions like Europe, Asia-Pacific, and North America are emerging as key hubs for hydrogen energy development, with initiatives like the European Union's Hydrogen Strategy and various national hydrogen roadmaps accelerating the pace of adoption.

Hydrogen energy storage is a method of storing surplus energy in the form of hydrogen gas, which can be later converted back into electricity when needed. It involves using surplus renewable energy, such as from wind or solar, to produce hydrogen through a process called electrolysis, where water is split into hydrogen and oxygen. The hydrogen gas can then be stored in various forms, including compressed gas, liquid hydrogen, or in chemical compounds such as ammonia. When energy demand rises, the stored hydrogen can be used in fuel cells to produce electricity or heat, thus offering a clean and efficient energy storage solution.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 19.17 Billion |

| Market Growth Rate | CAGR of 7.19% from 2025 to 2034 |

| Market Size by 2034 | USD 35.55 Billion |

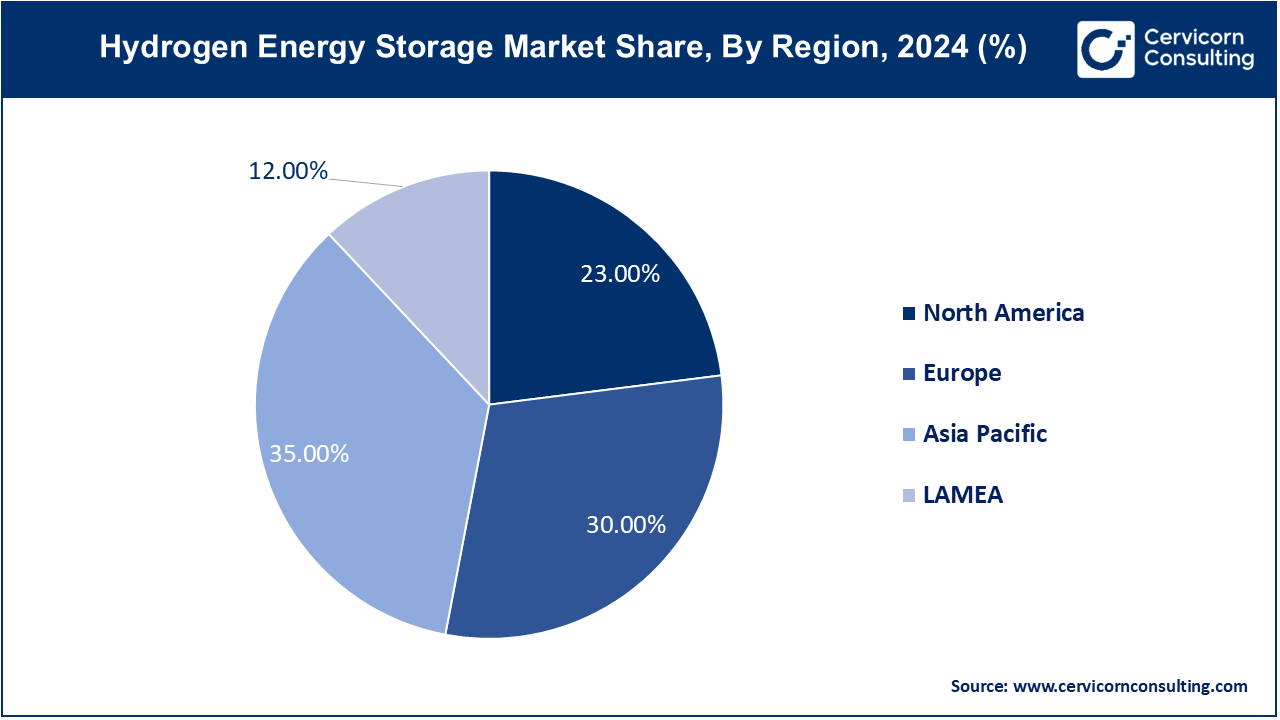

| North America Market Share | 23% in 2024 |

| APAC Market Share | 35% in 2024 |

| Segments Covered | Technology, Physical State , Application and Regions |

Grid Modernization and Stability

Industrial Demand for Hydrogen

High Production Costs:

Infrastructure Limitations:

Integration with Renewable Energy Projects

Government and Private Sector Investments

Technological Maturity and Scalability

Regulatory and Policy Uncertainty

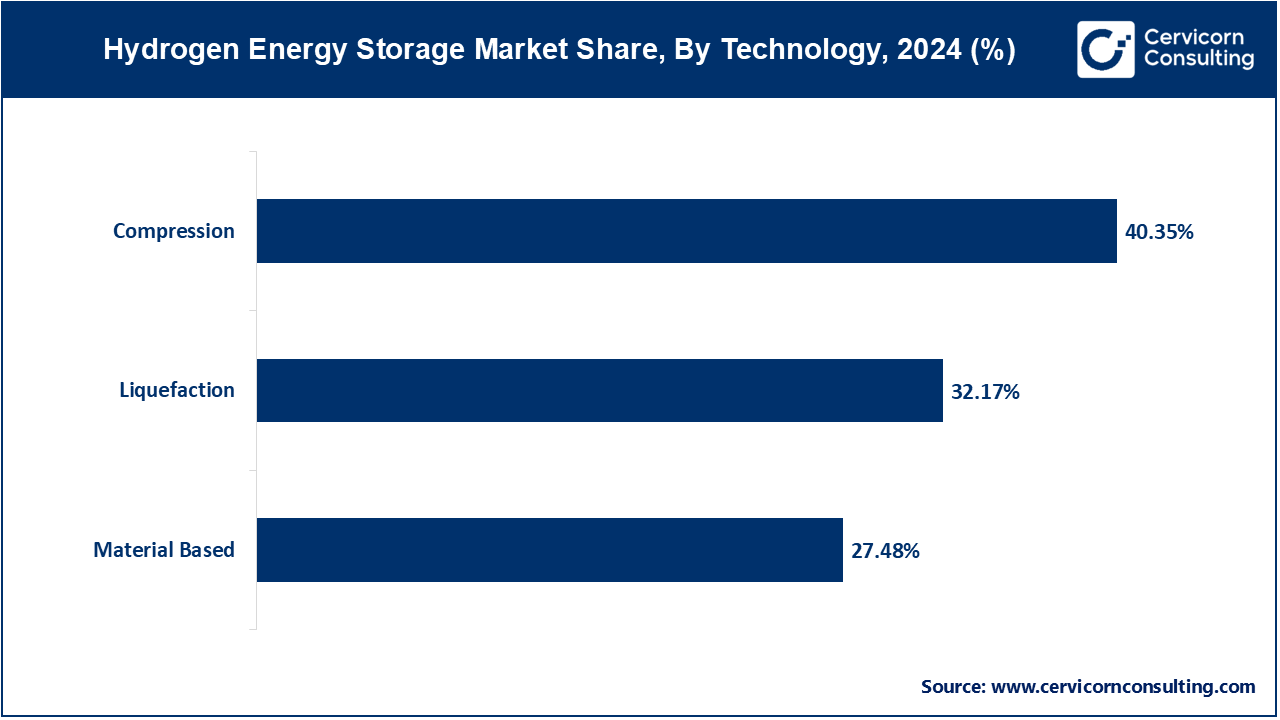

Compression: Compression technology in hydrogen energy storage involves compressing hydrogen gas to high pressures for storage in tanks. This segment has registered dominating market share of 40.35% in 2024. Key trends include advancements in high-pressure tank materials and designs, improving storage efficiency and safety. Drivers include the need for compact, efficient storage solutions for transportation applications and the growing adoption of hydrogen-powered vehicles, which rely on compressed hydrogen fuel.

Liquefaction: Liquefaction technology involves cooling hydrogen to extremely low temperatures to convert it into a liquid state. The liquefaction segment has covered market share of 32.17% in 2024. Trends focus on improving cryogenic storage methods and reducing energy consumption during liquefaction. Drivers include the demand for large-scale, long-term hydrogen storage solutions and the transportation of hydrogen over long distances, as liquid hydrogen is denser and more cost-effective to transport than gaseous hydrogen.

Material Based: The material-based segment has recorded market share of 27.48% in 2024. Material-based hydrogen storage utilizes materials like metal hydrides or chemical compounds to store hydrogen. Trends include research into advanced materials with higher storage capacities and faster hydrogen release rates. Drivers are the need for safer, more efficient storage methods for stationary applications and portable devices, and the potential for integrating these materials into existing energy systems, enhancing overall storage efficiency.

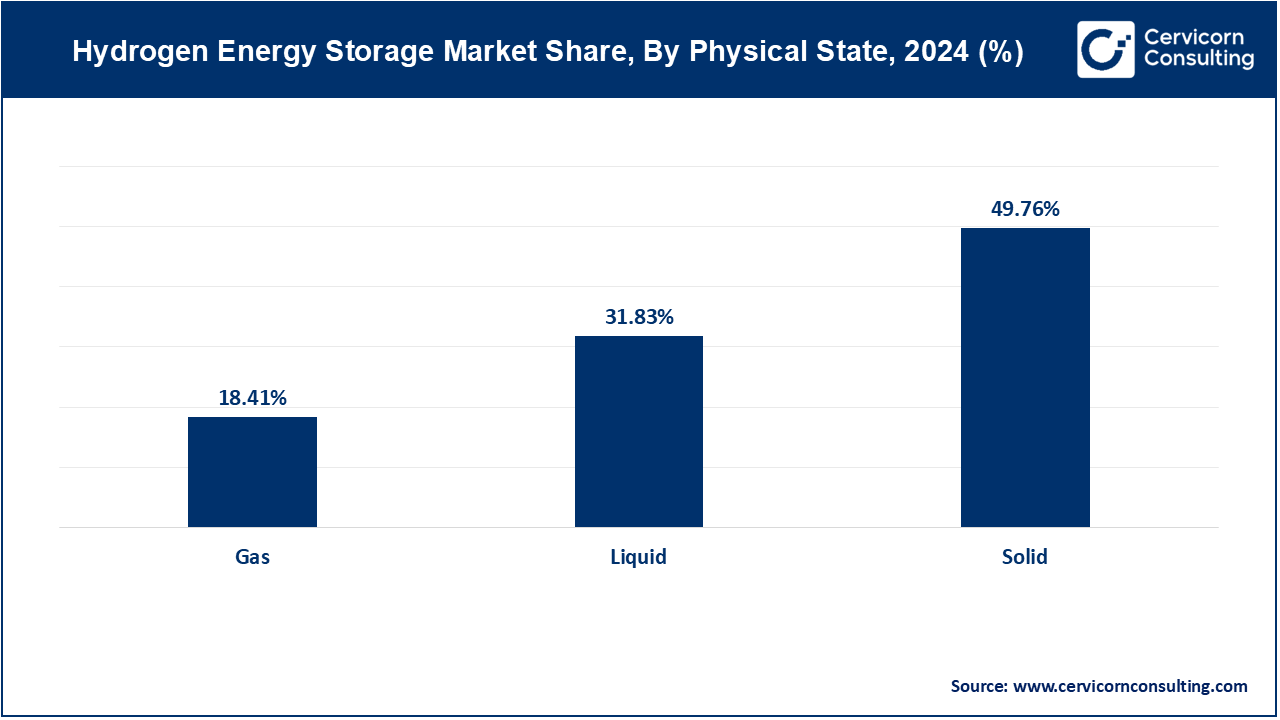

Solid: The solid segment has dominated the market with share of 49.76% in 2024. Solid hydrogen storage involves using materials such as metal hydrides and chemical compounds to absorb and release hydrogen. Key trends include advancements in material science to enhance storage capacity and efficiency. Drivers are the need for safer, more compact storage solutions for portable and stationary applications, and the potential for integrating solid-state storage into existing infrastructure.

Liquid: The liquid segment has generated second highest market share of 31.83% in 2024. Liquid hydrogen storage entails cooling hydrogen to cryogenic temperatures to convert it into a liquid form. Trends focus on improving cryogenic technologies and reducing the energy required for liquefaction. Drivers include the demand for high-density storage solutions for long-distance transportation and large-scale energy applications, as liquid hydrogen is more efficient for bulk storage and transport.

Gas: This segment has captured market share of 18.41% in 2024. Gaseous hydrogen storage involves compressing hydrogen gas to high pressures for containment in tanks. Trends include innovations in high-pressure tank design and materials to increase storage capacity and safety. Drivers are the growing adoption of hydrogen fuel cell vehicles and the need for efficient, scalable storage solutions for renewable energy integration and grid stabilization.

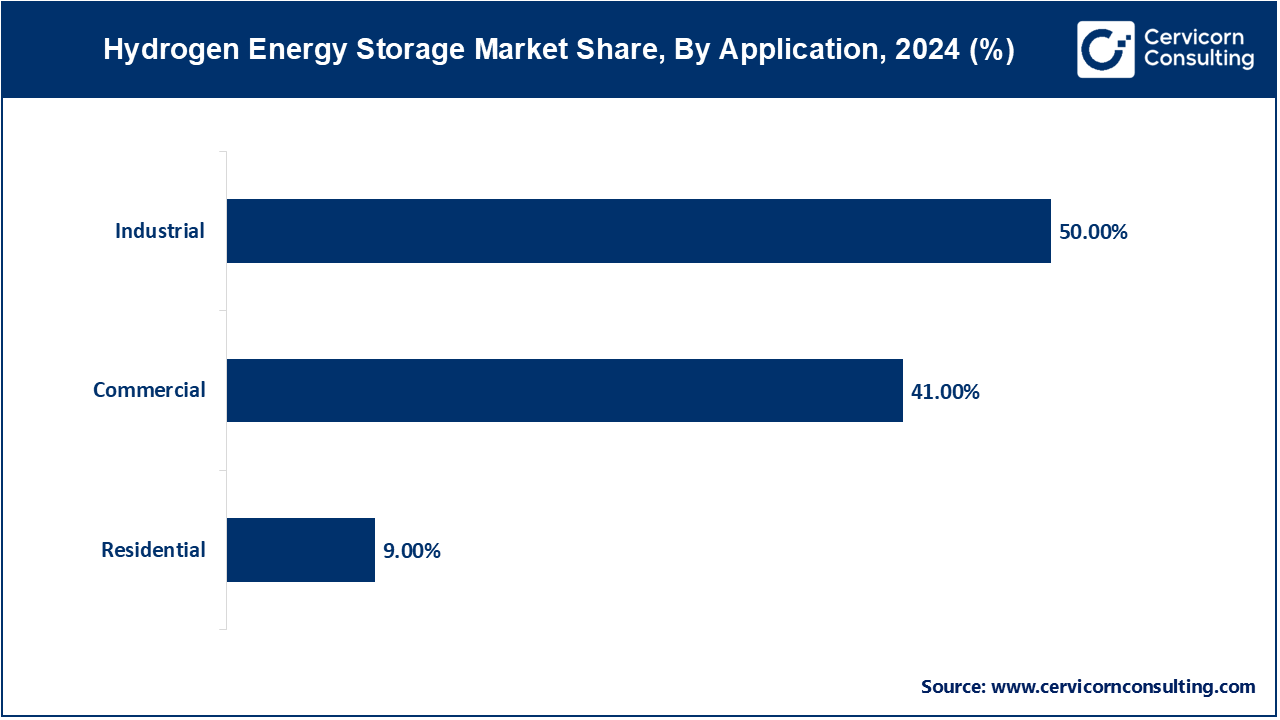

Residential: In the residential segment, hydrogen energy storage trends include the development of home-scale fuel cells and backup power systems. The residential segment has held market share of 9% in 2024. Drivers include increasing consumer interest in clean energy solutions and the desire for reliable, off-grid power sources. Advances in compact and affordable storage technologies are making residential hydrogen systems more accessible and practical for homeowners.

Commercial: The commercial segment has accounted market share of 41% in 2024. For commercial applications, hydrogen energy storage is trending towards integration with renewable energy systems and backup power solutions for businesses. Drivers include the need for reliable energy storage to support operations and reduce energy costs. Innovations in scalable storage solutions and the growing emphasis on sustainability are encouraging businesses to adopt hydrogen storage technologies.

Industrial: In the industrial segment, hydrogen energy storage trends focus on large-scale storage solutions for heavy-duty applications and energy-intensive processes. This segment has achieved highest market share of 50% in 2024. Drivers include the push for decarbonization and the need for reliable, high-capacity storage to manage energy supply fluctuations. Technological advancements and regulatory support for reducing industrial carbon footprints are key factors driving adoption in this segment.

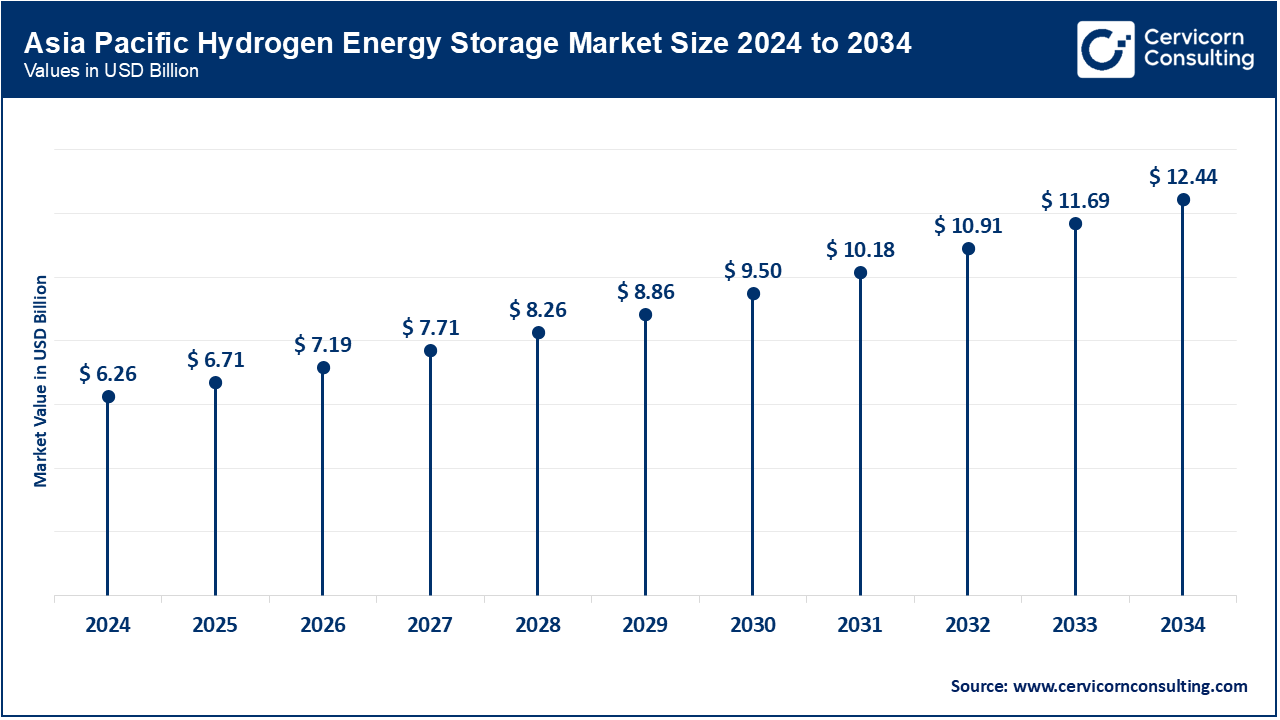

Asia Pacific market size is expected to reach around USD 12.44 billion by 2034 increasing from USD 6.26 billion in 2024. The Asia-Pacific region is experiencing rapid growth in the Hydrogen Energy Storage market, driven by large-scale investments from countries such as Japan, China, and South Korea. These nations are focusing on hydrogen as a key component of their energy transition strategies. Trends include significant development in hydrogen production, storage technologies, and fuel cell applications. The region is also investing heavily in hydrogen infrastructure to support its growing energy needs and reduce carbon emissions.

North America market size is calculated at USD 4.11 billion in 2024 and is projected to grow around USD 8.18 billion by 2034. In North America, the Hydrogen Energy Storage market is robust, driven by significant investments in clean energy and infrastructure development. The U.S. and Canada are leading in hydrogen technology advancements, supported by federal and state-level incentives. Trends include increasing deployment of hydrogen fuel cell vehicles and large-scale storage projects. Key players are focusing on both technological innovation and policy-driven growth to establish a strong hydrogen infrastructure and integrate hydrogen into the energy mix.

Europe market size is measured at USD 5.36 billion in 2024 and is expected to grow around USD 10.67 billion by 2034. Europe is a major player in the Hydrogen Energy Storage market, with substantial government backing and a strategic focus on achieving climate goals. The European Union has set ambitious targets for green hydrogen as part of its Green Deal. Trends include the development of hydrogen hubs and cross-border projects to enhance regional energy integration. Countries like Germany and the Netherlands are spearheading advancements in hydrogen technology and infrastructure, supported by comprehensive policies and funding.

LAMEA market size is forecasted to reach around USD 4.27 billion by 2034 from USD 2.15 billion in 2024. In the LAMEA region, the Hydrogen Energy Storage market is emerging, with a growing focus on energy diversification and sustainability. Countries are beginning to explore hydrogen solutions to address energy access and environmental concerns. Trends include initial investments in hydrogen infrastructure and pilot projects. The region's vast renewable energy resources offer potential for hydrogen production, although growth is tempered by economic and infrastructural challenges.

New players such as Hydrogen Pro and PowerCell Sweden AB are leveraging advancements in high-efficiency electrolyzer technology for green hydrogen production, focuses on innovative fuel cell systems. While dominating players like Air Liquide and Linde plc stand out due to their extensive global hydrogen infrastructure and industry expertise. Air Liquide excels with its expansive hydrogen networks and advanced storage solutions, while Linde plc drives innovation through its strategic partnerships and R&D efforts. Both established and emerging players are crucial in advancing hydrogen storage technologies and integrating them into broader energy systems.

Air Liquide, Benoît Potier, CEO

"Air Liquide is committed to advancing hydrogen technologies as a cornerstone of the energy transition. Our extensive global infrastructure and innovation in hydrogen production and storage are pivotal in supporting a sustainable and low-carbon future."

Linde plc, Steve Angel, CEO

"Linde is at the forefront of hydrogen energy solutions, leveraging our expertise to develop cutting-edge technologies and infrastructure. Our focus is on enhancing the efficiency and scalability of hydrogen storage systems to accelerate the transition to cleaner energy."

Nel ASA, Jon André Løkke, CEO

"At Nel ASA, we are dedicated to driving the hydrogen economy forward. Our innovations in electrolyzer and hydrogen storage technologies are designed to make green hydrogen a viable and competitive solution for global energy needs."

ITM Power, Dr. Graham Cooley, CEO

"ITM Power is advancing the hydrogen revolution with our state-of-the-art electrolyzers. By increasing the efficiency and reducing the costs of hydrogen production, we are supporting the widespread adoption of hydrogen as a sustainable energy source."

Plug Power Inc., Andrew Marsh, CEO

"Plug Power is leading the charge in hydrogen fuel cell technology and storage solutions. Our mission is to deliver reliable, cost-effective hydrogen systems that meet the demands of various industries and contribute to a cleaner energy future."

Ballard Power Systems, Randy MacEwen, CEO

"Ballard Power Systems is dedicated to revolutionizing hydrogen energy with our advanced fuel cell technologies. Our focus is on enhancing performance and reducing costs to drive the adoption of hydrogen solutions in transportation and industrial applications."

These statements reflect the commitment of key industry players to advancing hydrogen energy storage technologies and supporting the global transition to sustainable energy solutions.

Market Segmentation

By Technology

By Physical State

By Application

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Hydrogen Energy Storage

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Physical State Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Hydrogen Energy Storage Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Grid Modernization and Stability

4.1.1.2 Industrial Demand for Hydrogen

4.1.2 Market Restraints

4.1.2.1 High Production Costs

4.1.2.2 Infrastructure Limitations

4.1.3 Market Opportunity

4.1.3.1 Integration with Renewable Energy Projects

4.1.3.2 Government and Private Sector Investments

4.1.4 Market Challenges

4.1.4.1 Technological Maturity and Scalability

4.1.4.2 Regulatory and Policy Uncertainty

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Hydrogen Energy Storage Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Hydrogen Energy Storage Market, By Technology

6.1 Global Hydrogen Energy Storage Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Compression

6.1.1.2 Liquefaction

6.1.1.3 Material Based

Chapter 7 Hydrogen Energy Storage Market, By Physical State

7.1 Global Hydrogen Energy Storage Market Snapshot, By Physical State

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Solid

7.1.1.2 Liquid

7.1.1.3 Gas

Chapter 8 Hydrogen Energy Storage Market, By Application

8.1 Global Hydrogen Energy Storage Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Residential

8.1.1.2 Commercial

8.1.1.3 Industrial

Chapter 9 Hydrogen Energy Storage Market, By Region

9.1 Overview

9.2 Hydrogen Energy Storage Market Revenue Share, By Region 2024 (%)

9.3 Global Hydrogen Energy Storage Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Hydrogen Energy Storage Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Hydrogen Energy Storage Market, By Country

9.5.4 UK

9.5.4.1 UK Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Hydrogen Energy Storage Market, By Country

9.6.4 China

9.6.4.1 China Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Hydrogen Energy Storage Market, By Country

9.7.4 GCC

9.7.4.1 GCC Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Hydrogen Energy Storage Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Air Liquide

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Linde plc

11.3 Nel ASA

11.4 ITM Power

11.5 Cummins Inc.

11.6 Ballard Power Systems

11.7 Hydrogenics (a part of Cummins Inc.)

11.8 Plug Power Inc.

11.9 Bloom Energy

11.10 Hydrogen Pro