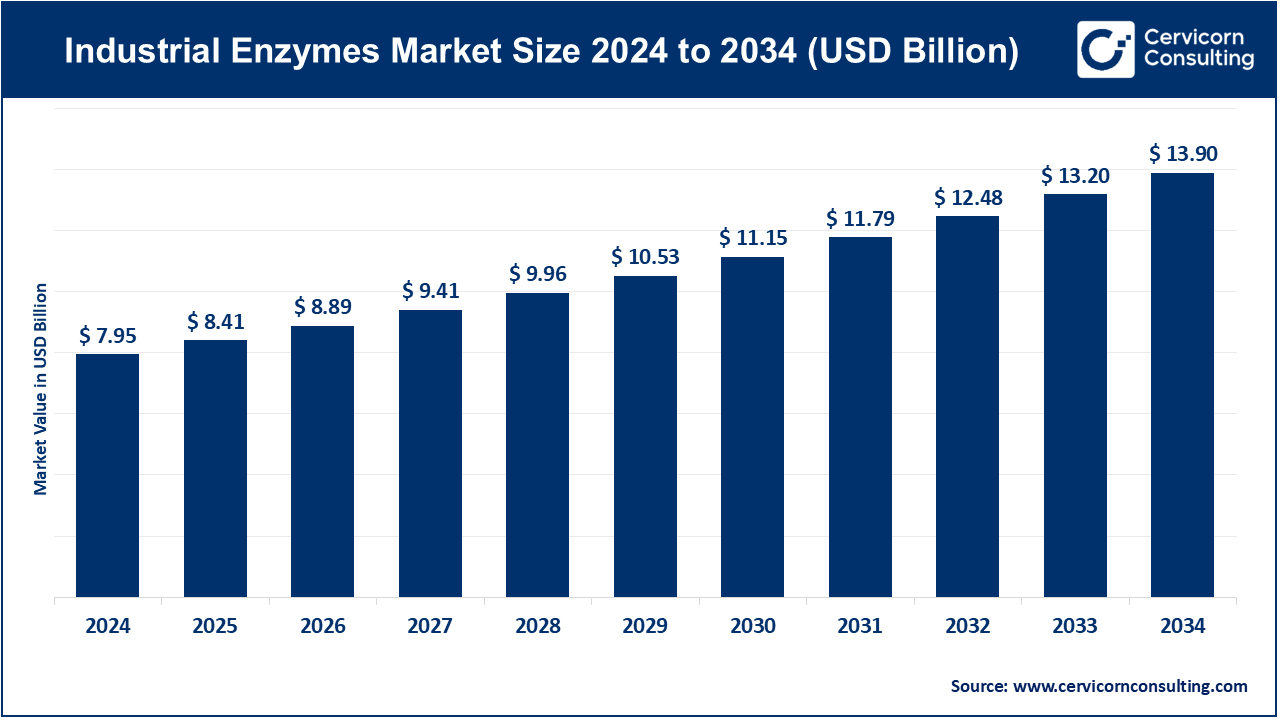

The global industrial enzymes market size was registered USD 7.95 billion in 2024 and is estimated to reach around USD 13.90 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.75% from 2025 to 2034.

The industrial enzyme market is experiencing robust expansion driven by the increasing adoption of enzymes across various sectors. Food and beverages, textiles, and detergents are some of the largest end-users, with enzymes being crucial for enhancing product quality and operational efficiency. The demand for biofuels is also growing, as enzymes are used in the production of ethanol and biodiesel, offering more efficient and environmentally friendly alternatives to traditional methods. Furthermore, as consumer preferences shift toward natural and sustainable products, industries are increasingly incorporating enzymes to meet these demands, particularly in areas like organic food production and green manufacturing processes. Market drivers such as growing environmental concerns, the need for cleaner energy solutions, and the push for waste reduction in industrial processes are contributing to the overall market growth.

Industrial enzymes are biological catalysts that accelerate chemical reactions in industrial processes. They are used in a wide variety of sectors, including food and beverages, textiles, detergents, biofuels, and pharmaceuticals. These enzymes play a vital role in improving production efficiency, reducing energy consumption, and promoting environmentally friendly processes. They are typically derived from microorganisms like bacteria, fungi, and yeast, which are cultivated to produce specific enzymes. Enzymes such as amylases, proteases, lipases, and cellulases are commonly used in industrial applications due to their specificity, effectiveness, and ability to work under mild conditions. By substituting traditional chemical processes, enzymes contribute to sustainable manufacturing and lower environmental impact.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 8.41 Billion |

| Market Growth Rate | CAGR of 5.75% from 2025 to 2034 |

| Market Size by 2034 | USD 13.90 Billion |

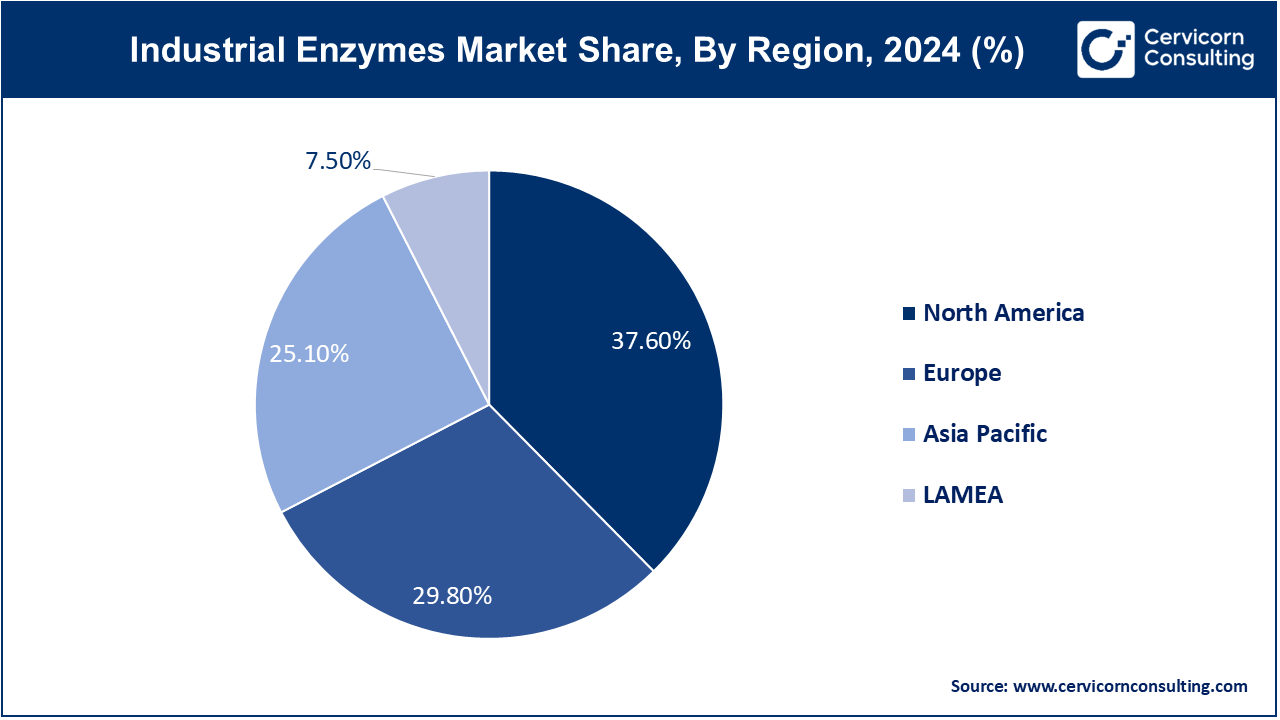

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Product, Source, Application and Regions |

Increasing Demand for Efficient Waste Management:

Growth in Textile Industry:

High Production Costs:

Limited Stability and Shelf Life:

Expansion in Emerging Economies:

Advancements in Enzyme Engineering:

Regulatory Compliance and Approval:

Enzyme Performance Variability:

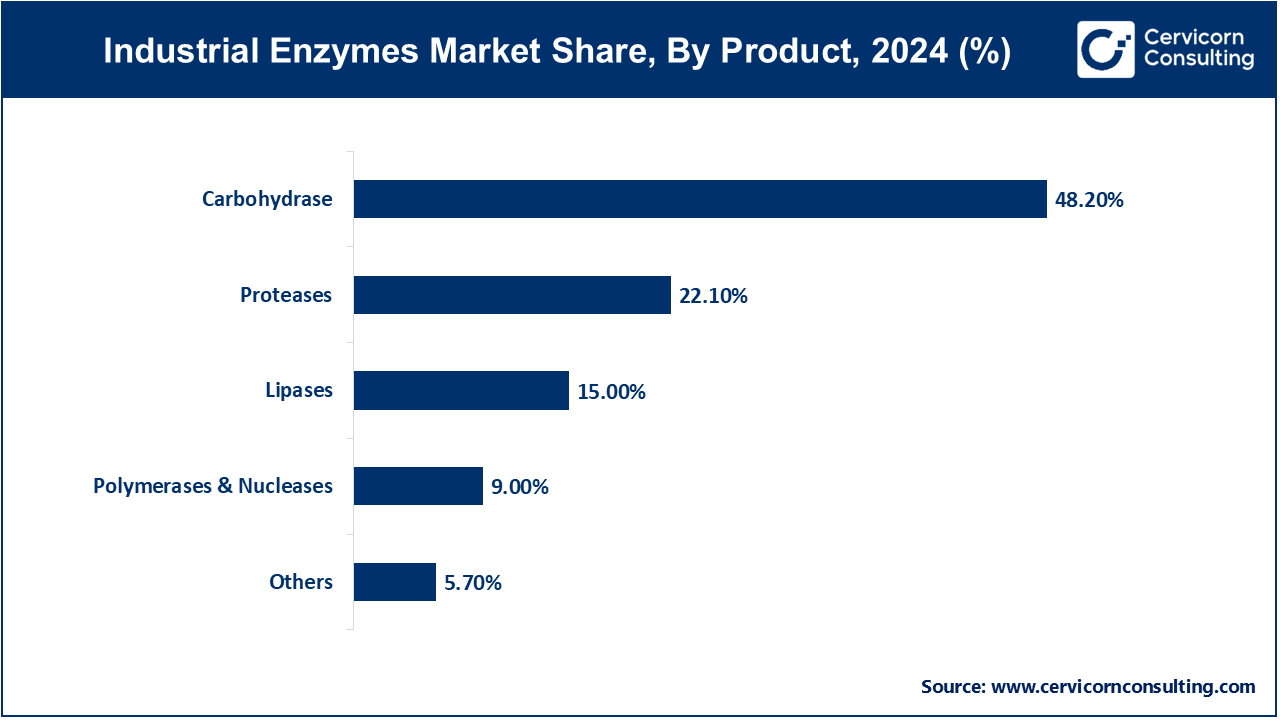

Carbohydrase: In 2024, carbohydrases segment has measured market share of 48.20%. Carbohydrases are enzymes that break down carbohydrates into simpler sugars. They are widely used in food and beverage industries for processes such as starch conversion, brewing, and baking. Trends include increasing demand for carbohydrases to enhance product texture, flavor, and nutritional content, driven by consumer preferences for processed foods and beverages.

Proteases: The proteases segment has confimed market share of 22.10% in 2024. Proteases are enzymes that degrade proteins into peptides and amino acids. They find applications in detergents, pharmaceuticals, and food processing. Current trends include growing use in protein-based therapeutic products and biotechnology, along with innovations in enzyme formulations to improve stability and efficiency in various industrial processes.

Lipases: Lipases segment has captured 15% of market share in 2024. Lipases are enzymes that catalyze the hydrolysis of lipids into fatty acids and glycerol. They are crucial in the food and beverage industry, biodiesel production, and dairy processing. Trends include expanding use in sustainable biofuel production and the development of high-performance lipases for specialized applications, reflecting the increasing focus on renewable energy and environmental sustainability.

Polymerases & Nucleases: In 2024, polymerases and nucleases segment has calculated market share of 9%. Polymerases and nucleases are enzymes involved in DNA and RNA manipulation, essential for molecular biology, genetic research, and diagnostics. Trends include rising demand due to advancements in genomics and personalized medicine, with increased focus on developing high-fidelity enzymes for precise genetic engineering and research applications.

Others: The others segment has covered market share of 5.70% in 2024. This category includes various specialized enzymes such as oxidases, reductases, and transferases used in niche applications. Trends in this segment involve growing innovation to develop enzymes for emerging industries like environmental biotechnology and advanced material processing, addressing specific needs in areas such as waste treatment, renewable energy, and high-tech manufacturing.

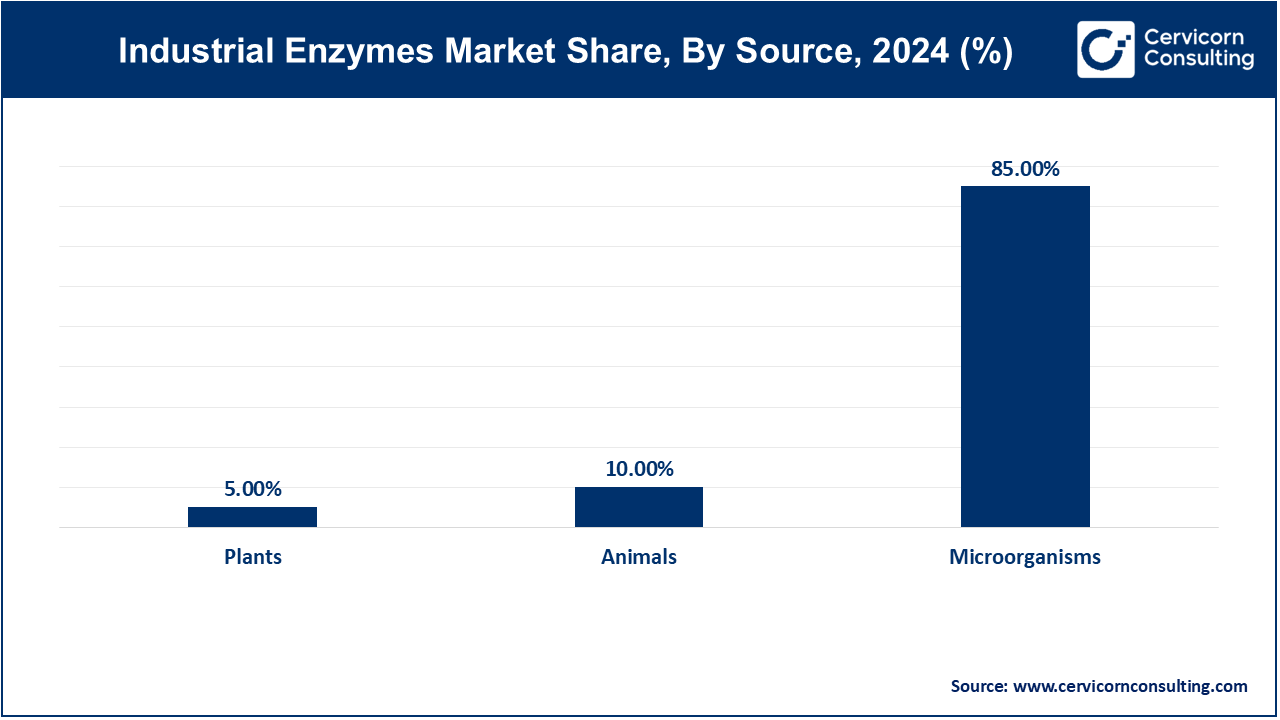

Plants: The plants segment has registered market share of 5% in 2024. Enzymes derived from plants are used in various industrial applications, including food processing and textile manufacturing. They are valued for their natural origin and specific functionalities. Trends include increasing research into plant-based enzymes for sustainable processes and the development of novel enzymes for specialized applications, such as plant-based meat alternatives.

Animals: Animals segment has covered market share of 10% in 2024. Animal-derived enzymes, such as those from pancreas or stomach tissues, are utilized in pharmaceuticals, detergents, and food industries. Trends focus on optimizing enzyme extraction methods and addressing ethical and sustainability concerns by exploring alternatives and improving enzyme stability and performance for industrial use.

Microorganisms: The microorganisms segment has acquired dominating share of 85% in 2024. Microorganism-derived enzymes, produced by bacteria, fungi, and yeast, dominate the industrial enzymes market due to their high efficiency and versatility. Trends include the use of genetic engineering to enhance enzyme performance, development of microbial strains for specific industrial applications, and increased adoption in biotechnology and environmental management due to their adaptability and cost-effectiveness.

Food & Beverages: In 2024, food & beverages segment has recorded market share of 21%. Enzymes in food and beverages enhance processes like brewing, baking, and dairy production. Trends include the increasing use of enzymes for improving product texture, flavor, and shelf life. Innovations focus on enzyme formulations tailored to specific food processing needs and cleaner label requirements.

Detergents: In detergents, enzymes such as proteases, lipases, and amylases break down stains and enhance cleaning efficiency. Trends include the development of more effective and environmentally friendly enzyme formulations that work at lower temperatures, supporting the growing demand for sustainable and energy-efficient laundry and cleaning products.

Animal Feed: Enzymes are added to animal feed to improve digestibility, nutrient absorption, and overall feed efficiency. Trends include the use of phytase and other enzymes to enhance the nutritional value of feed and reduce the environmental impact of livestock farming by improving feed conversion rates.

Biofuels: Enzymes play a crucial role in biofuel production by breaking down biomass into fermentable sugars. Trends focus on the development of enzymes that enhance the efficiency of second-generation biofuels from non-food feedstocks, supporting the shift towards more sustainable and renewable energy sources.

Textiles: In textiles, enzymes are used for processes such as bio-polishing, desizing, and dyeing. Trends include the increasing adoption of enzymes to reduce the use of harsh chemicals and water in textile processing, as well as innovations in enzyme applications that improve fabric quality and environmental sustainability.

Pulp & Paper: Enzymes in the pulp and paper industry help in fiber degradation, bleaching, and deinking. Trends include the development of enzymes that enhance the efficiency of pulp processing and paper recycling, reduce chemical usage, and improve the overall quality of paper products.

Nutraceutical: Enzymes in nutraceuticals aid in the digestion and absorption of nutrients, as well as the production of health supplements. Trends include the growing use of enzymes to create customized dietary supplements and functional foods that address specific health needs, reflecting the rising consumer interest in personalized nutrition.

Personal Care & Cosmetics: Enzymes in personal care and cosmetics enhance the efficacy of products like exfoliants and skin care formulations. Trends include the incorporation of natural and bio-based enzymes to improve product safety and effectiveness, catering to the increasing consumer preference for clean and sustainable beauty products.

Wastewater: Enzymes are used in wastewater treatment to break down organic pollutants and improve water quality. Trends focus on the development of enzymes that enhance the degradation of complex contaminants, support the treatment of diverse wastewater streams, and contribute to more sustainable and efficient wastewater management solutions.

Agriculture: In agriculture, enzymes improve soil health, enhance nutrient availability, and support the degradation of crop residues. Trends include the use of enzymes to optimize fertilizer use, promote soil fertility, and boost crop yields, addressing the growing need for sustainable agricultural practices and increased food production.

Others: This segment encompasses various niche applications of industrial enzymes, including their use in pharmaceuticals, diagnostics, and specialty chemicals. Trends involve the exploration of new enzyme applications and innovations to address emerging industrial needs and specific process challenges across diverse sectors.

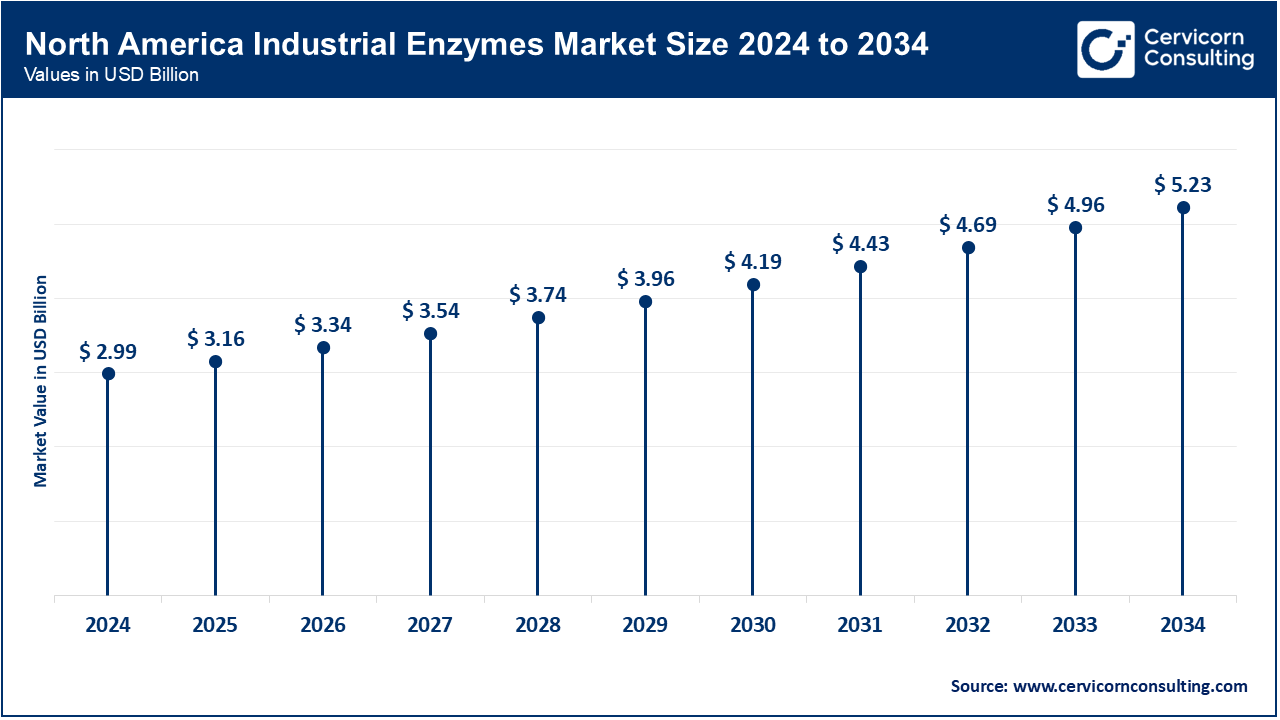

In North America, there is a strong emphasis on technological innovation and advancements in enzyme production. The region sees significant investment in R&D to develop high-performance enzymes for applications in food and beverages, biofuels, and detergents. North America market size is expected to reach around USD 5.23 billion by 2034 increasing from USD 2.99 billion in 2024. Additionally, there is a growing focus on sustainable practices and environmentally friendly enzyme solutions driven by regulatory standards and consumer demand.

Europe is experiencing a trend towards the adoption of green chemistry and sustainable industrial practices. Europe market size is measured at USD 2.37 billion in 2024 and is expected to grow around USD 4.14 billion by 2034. The region is a leader in the development and use of eco-friendly enzymes in various applications, including textiles, agriculture, and waste management. Regulatory pressures and consumer preferences for sustainable and biodegradable products are driving innovation and growth in enzyme technologies.

The Asia-Pacific region is seeing rapid growth in industrial enzyme applications due to expanding manufacturing sectors and increased demand for processed foods, biofuels, and animal feed. Asia Pacific market size is calculated at USD 2.00 billion in 2024 and is projected to grow around USD 3.49 billion by 2034. Trends include significant investments in enzyme production facilities and collaborations with international companies to meet the rising local demand. Additionally, there is a focus on improving agricultural practices and wastewater treatment through advanced enzyme technologies.

In LAMEA(Latin America, Middle East, and Africa), the growth trend is driven by increasing industrialization and development in the agriculture and food processing sectors. LAMEA market size is forecasted to reach around USD 1.04 billion by 2034 from USD 0.60 billion in 2024. The region is witnessing a rising adoption of enzyme solutions to improve agricultural productivity, enhance food processing efficiency, and address wastewater management challenges. Investment in infrastructure and technological advancements are key to expanding enzyme applications and meeting local industry needs.

New players such as Enzyme Development Corporation and Genomatica, Inc. are entering the industrial enzymes market by focusing on cutting-edge enzyme engineering and bioengineering solutions. They are leveraging innovations in enzyme specificity and sustainability to address niche applications and emerging industry needs. Key market leaders like Novozymes A/S and DSM Nutritional Products Ltd. dominate through extensive R&D investments, broad application portfolios, and robust global distribution networks. Their leadership is reinforced by their ability to provide advanced, scalable enzyme solutions that cater to diverse industrial processes, ensuring consistent quality and performance.

Market Segmentation

By Product

By Source

By Application

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Industrial Enzymes

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Source Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Industrial Enzymes Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Demand for Efficient Waste Management

4.1.1.2 Growth in Textile Industry

4.1.2 Market Restraints

4.1.2.1 High Production Costs

4.1.2.2 Limited Stability and Shelf Life

4.1.3 Market Opportunity

4.1.3.1 Expansion in Emerging Economies

4.1.3.2 Advancements in Enzyme Engineering

4.1.4 Market Challenges

4.1.4.1 Regulatory Compliance and Approval

4.1.4.2 Enzyme Performance Variability

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Industrial Enzymes Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Industrial Enzymes Market, By Product

6.1 Global Industrial Enzymes Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Carbohydrase

6.1.1.2 Proteases

6.1.1.3 Lipases

6.1.1.4 Polymerases & Nucleases

6.1.1.5 Others

Chapter 7 Industrial Enzymes Market, By Source

7.1 Global Industrial Enzymes Market Snapshot, By Source

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Plants

7.1.1.2 Animals

7.1.1.3 Microorganisms

Chapter 8 Industrial Enzymes Market, By Application

8.1 Global Industrial Enzymes Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Food & Beverages

8.1.1.2 Detergents

8.1.1.3 Animal Feed

8.1.1.4 Biofuels

8.1.1.5 Textiles

8.1.1.6 Pulp & Paper

8.1.1.7 Nutraceutical

8.1.1.8 Personal Care & Cosmetics

8.1.1.9 Wastewater

8.1.1.10 Agriculture

8.1.1.11 Others

Chapter 9 Industrial Enzymes Market, By Region

9.1 Overview

9.2 Industrial Enzymes Market Revenue Share, By Region 2024 (%)

9.3 Global Industrial Enzymes Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Industrial Enzymes Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Industrial Enzymes Market, By Country

9.5.4 UK

9.5.4.1 UK Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Industrial Enzymes Market, By Country

9.6.4 China

9.6.4.1 China Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Industrial Enzymes Market, By Country

9.7.4 GCC

9.7.4.1 GCC Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Industrial Enzymes Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Novozymes A/S

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 DSM Nutritional Products Ltd.

11.3 BASF SE

11.4 DuPont de Nemours, Inc.

11.5 AB Enzymes GmbH

11.6 Kerry Group plc

11.7 Tate & Lyle PLC

11.8 Syngenta AG

11.9 Enzyme Development Corporation

11.10 Amano Enzyme Inc.