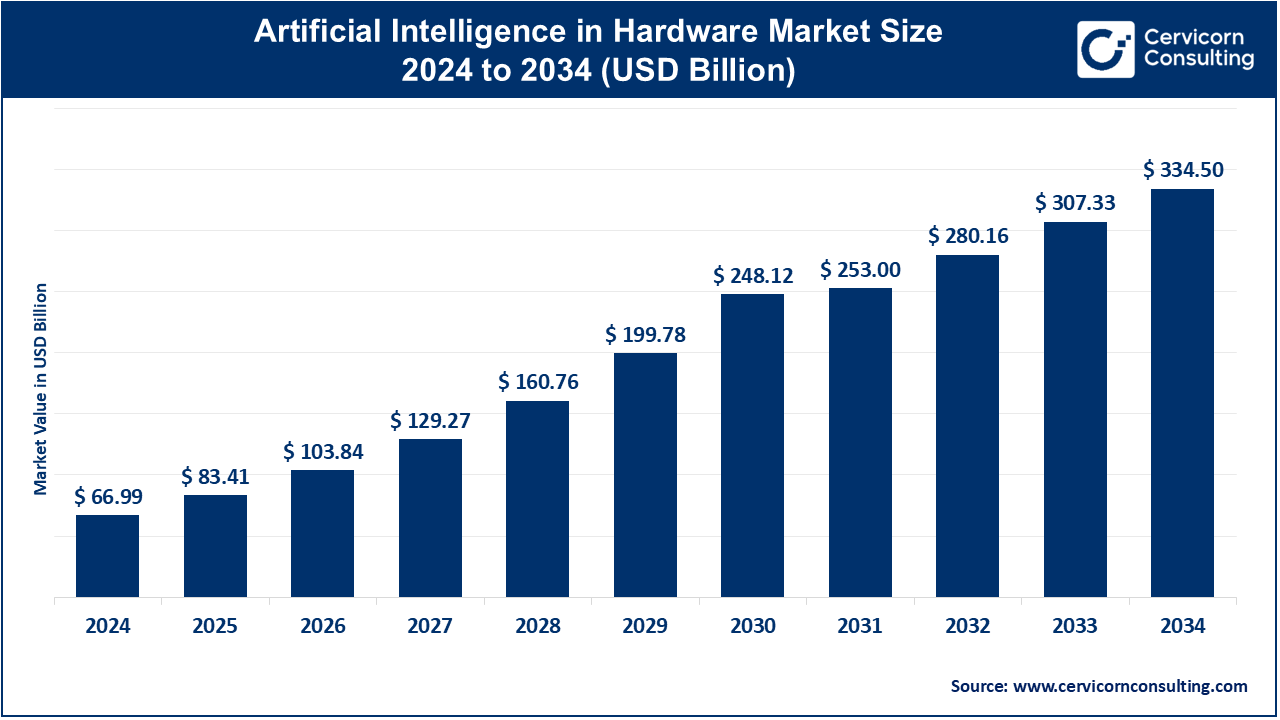

The global artificial intelligence (AI) in hardware market size was valued at USD 66.99 billion in 2024 and is expected to reach around USD 334.50 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.44% over the forecast period 2025 to 2034.

The Artificial Intelligence (AI) in hardware market is undergoing rapid transformation, fueled by the increasing adoption of AI across a wide range of industries. Companies are shifting toward specialized hardware solutions to meet the computational demands of AI applications. Traditional processors are being supplemented with purpose-built AI chips, such as GPUs, TPUs, and FPGAs, which are optimized for tasks like deep learning, data analytics, and real-time decision-making. This shift is particularly noticeable in industries like automotive, healthcare, and manufacturing, where AI is integral to innovations such as self-driving vehicles, predictive maintenance, and medical diagnostics. Companies like NVIDIA, Intel, and AMD are leading the charge by releasing next-generation hardware that supports faster data processing and energy-efficient AI model deployment. The growing demand for AI hardware is also being driven by the increasing need for edge computing.

Artificial Intelligence (AI) in hardware refers to the integration of AI technologies with physical computing systems, such as processors, chips, and specialized circuits. These AI-powered hardware devices are designed to accelerate machine learning tasks, enabling faster data processing, and improving the efficiency of AI algorithms. Key components of AI hardware include Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), and Field-Programmable Gate Arrays (FPGAs). GPUs, for instance, are widely used in training and inference tasks, particularly for deep learning models. TPUs are custom-built by Google to enhance neural network processing, while FPGAs allow for hardware customization, providing a balance between performance and flexibility. These devices help offload tasks from traditional processors, improving the speed and scalability of AI applications in fields such as autonomous driving, robotics, healthcare, and more.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 83.41 Billion |

| Market Size by 2034 | USD 334.50 Billion |

| Market Growth Rate | CAGR of 17.44% from 2025 to 2034 |

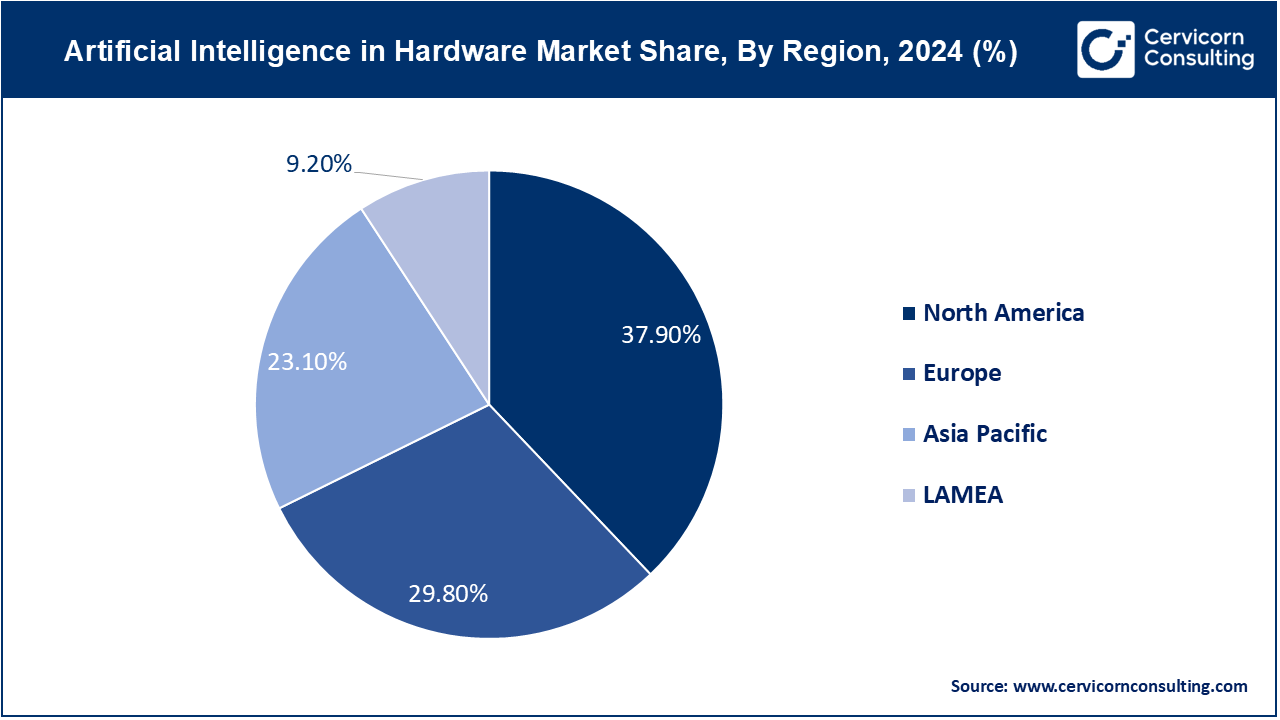

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Type, Application, Deployment, Technology, End User and Regions |

Collaboration and Partnerships

Regulatory Support and Incentives

High Development Costs

Complexity and Technical Challenges

Expansion into Emerging Markets

Development of Custom AI Solutions

Rapid Technological Obsolescence

Supply Chain Disruptions

The AI in hardware market is segmented into type, application, deployment, technology, end user, and region. Based on type, the market is classified into processor, memory, network, and storage. Based on application, the market is classified into training & simulation, driver monitoring systems, surveillance & security, imaging & diagnosis, robotic surgery, disaster management, visual inspection, and others. Based on deployment, the market is classified into cloud-based and on-premise. Based on technology, the market is classified into machine learning, computer vision and others. Based on end user, the market is classified into telecommunication and IT industry, banking and finance sectors, education, e-commerce, navigation, robotics, agriculture, healthcare, automotive, retail and others.

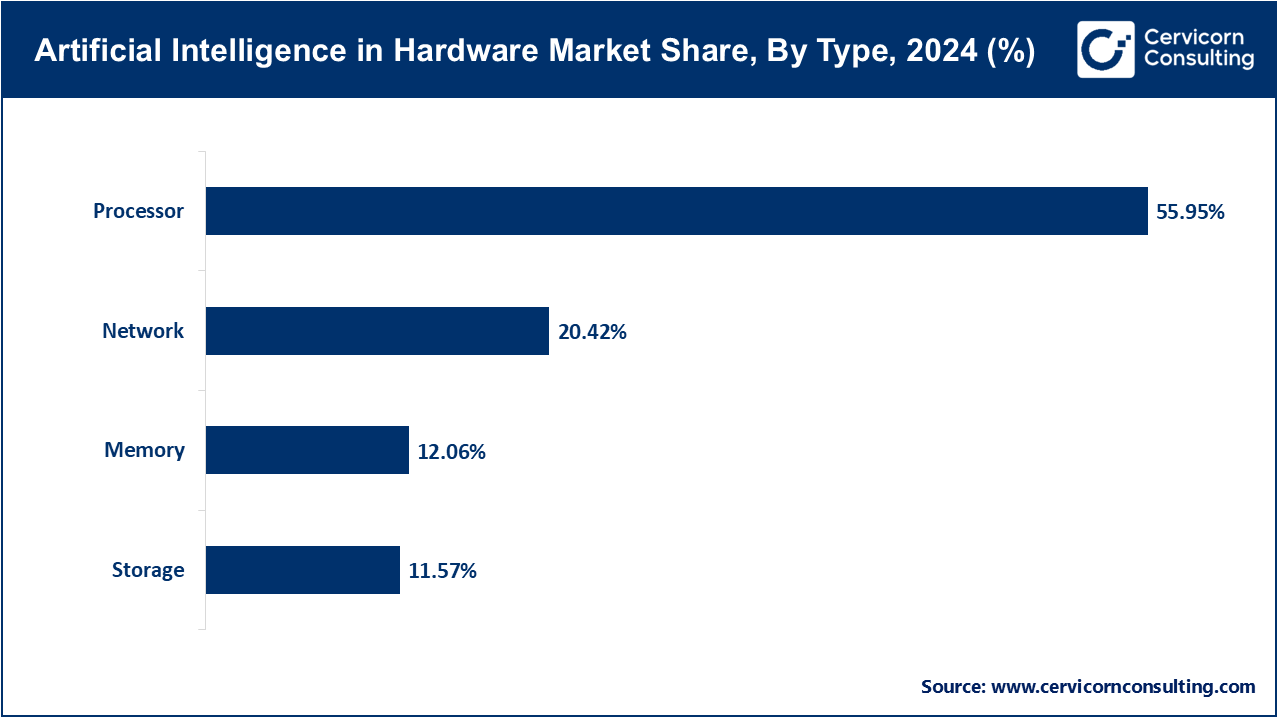

Processor: This segment has covered largest market share of 55.95% in the year of 2024. The processor segment in the AI hardware market is driven by the increasing demand for powerful computing capabilities to handle complex AI algorithms and data processing tasks. Trends include the development of specialized AI processors like GPUs, TPUs, and custom ASICs, which are optimized for high-speed parallel processing, essential for machine learning and deep learning applications.

Memory: This segment has captured market share of 12.06% in 2024. In the memory segment, the market is propelled by the need for high-speed, high-capacity memory solutions that can support the vast amounts of data processed by AI systems. Trends involve the adoption of advanced memory technologies like HBM (High Bandwidth Memory) and persistent memory to enhance data throughput and storage efficiency, critical for AI workloads.

Network: In 2024 network segment has confirmed market share of 20.42%. The network segment focuses on the infrastructure required for seamless data transfer and communication between AI hardware components. Market drivers include the growing necessity for low-latency, high-bandwidth networking solutions to support real-time AI applications. Trends highlight the implementation of advanced networking technologies like 5G and InfiniBand to improve connectivity and data exchange rates.

Storage: This segment has reported 11.57% market share in 2024. The storage segment is driven by the exponential increase in data generation and the need for efficient data management solutions. Trends in this segment include the development of high-capacity, fast-access storage systems like NVMe (Non-Volatile Memory Express) SSDs and AI-optimized storage architectures, which facilitate quick retrieval and analysis of large datasets essential for AI operations.

Training & Simulation: This segment is driven by the need for sophisticated AI models that require extensive computational power for training and simulation. Trends include the adoption of powerful AI hardware such as GPUs and TPUs to accelerate the training process and the use of simulation environments to develop and test AI algorithms efficiently.

Driver Monitoring Systems: AI hardware in driver monitoring systems is driven by the automotive industry's focus on enhancing vehicle safety and autonomous driving features. Trends involve integrating AI chips and sensors to monitor driver behavior in real-time, improving response times, and reducing accidents through advanced driver assistance systems (ADAS).

Surveillance & Security: The surveillance and security segment benefits from AI hardware advancements that enable real-time data processing and analytics for threat detection and monitoring. Trends include the use of AI-optimized processors and edge computing devices to enhance video analytics, facial recognition, and anomaly detection in various security applications.

Imaging & Diagnosis: In the imaging and diagnosis segment, AI hardware is driven by the healthcare industry's need for accurate and fast diagnostic tools. Trends focus on the integration of AI accelerators and high-performance computing systems to support medical imaging technologies, such as MRI and CT scans, enhancing diagnostic accuracy and efficiency.

Robotic Surgery: AI hardware in robotic surgery is propelled by the demand for precision and minimally invasive procedures. Trends include the use of advanced AI processors and real-time data processing units to enhance the capabilities of surgical robots, providing better control, precision, and outcomes in complex surgeries.

Disaster Management: The disaster management segment relies on AI hardware to improve response times and decision-making during emergencies. Trends highlight the deployment of AI-enabled drones and sensors for real-time data collection and analysis, improving disaster prediction, monitoring, and response strategies through enhanced computational power.

Visual Inspection: AI hardware in visual inspection is driven by the need for automated quality control and defect detection in manufacturing. Trends involve using AI accelerators and high-resolution cameras to enhance visual inspection systems' accuracy and speed, reducing human error and increasing production efficiency.

Others: This segment includes diverse applications such as natural language processing, financial modeling, and customer service automation. Trends indicate the widespread adoption of AI hardware across these varied fields, driven by the need for efficient data processing, real-time analytics, and improved decision-making capabilities, supported by specialized AI chips and advanced computing architectures.

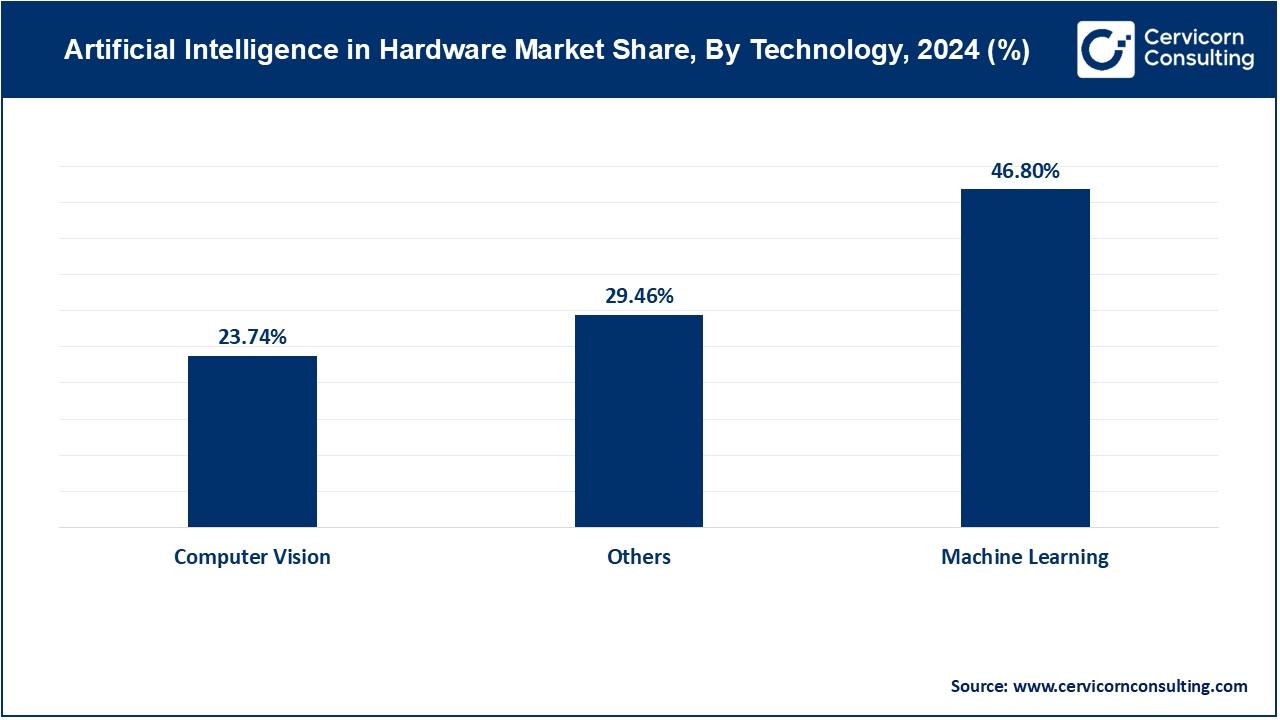

Based on technology the market is segmented into machine learning, computer vision and others: The machine learning segment market has reported highest market share of 46.8% in the year of 2024. The computer vision and others segment has accounted combined market share of 53.20% in 2024.

Telecommunication and IT Industry: This segment has accounted market share of 21.45% in th year of 2024. The AI hardware market in telecommunications and IT is driven by the need for enhanced network performance and data management. Trends include the deployment of AI-optimized processors for network optimization, predictive maintenance, and customer service automation, improving operational efficiency and service quality.

Banking and Finance Sectors: The banking and finance sectors has calculated share of 17.54% in 2024. In banking and finance, AI hardware is driven by the demand for high-speed data processing for fraud detection, algorithmic trading, and customer analytics. Trends involve the integration of AI accelerators to enhance real-time data analysis, risk management, and personalized financial services, boosting security and customer satisfaction.

Education: The education sector leverages AI hardware to enhance personalized learning, administrative efficiency, and research capabilities. Trends include using AI processors in educational tools and platforms for adaptive learning, real-time feedback, and data-driven decision-making, improving learning outcomes and operational efficiency.

Ecommerce: AI hardware in ecommerce is driven by the need for personalized shopping experiences and efficient logistics. Trends involve deploying AI-optimized systems for recommendation engines, customer service chatbots, and inventory management, enhancing customer engagement and operational efficiency.

Navigation: The navigation segment relies on AI hardware for accurate and real-time data processing. Trends include using AI accelerators in GPS systems, autonomous vehicles, and mapping applications to improve route planning, traffic management, and situational awareness, ensuring safety and efficiency.

Robotics: AI hardware in robotics is driven by the demand for advanced automation and precision in various applications. Trends involve integrating high-performance AI chips to enhance robots' capabilities in manufacturing, healthcare, and service industries, improving productivity and accuracy.

Agriculture: In agriculture, AI hardware is driven by the need for precision farming and resource optimization. Trends include using AI-enabled sensors and processors for real-time monitoring, predictive analytics, and automation of farming activities, improving crop yields and sustainability.

Healthcare: The healthcare sector's demand for AI hardware is driven by the need for improved diagnostics, treatment planning, and patient care. Trends involve integrating AI accelerators in medical devices and imaging systems, enabling real-time data processing and analysis, enhancing healthcare outcomes and efficiency. 12.57% market share has reported for healthcare segment in 2024.

Others: The others segment has generated highest market share of 29.21% in 2024. Others includes various sectors like entertainment, logistics, and energy. Trends indicate the widespread adoption of AI hardware to enhance data processing, predictive analytics, and automation across these fields, driven by the need for efficiency, accuracy, and improved decision-making capabilities.

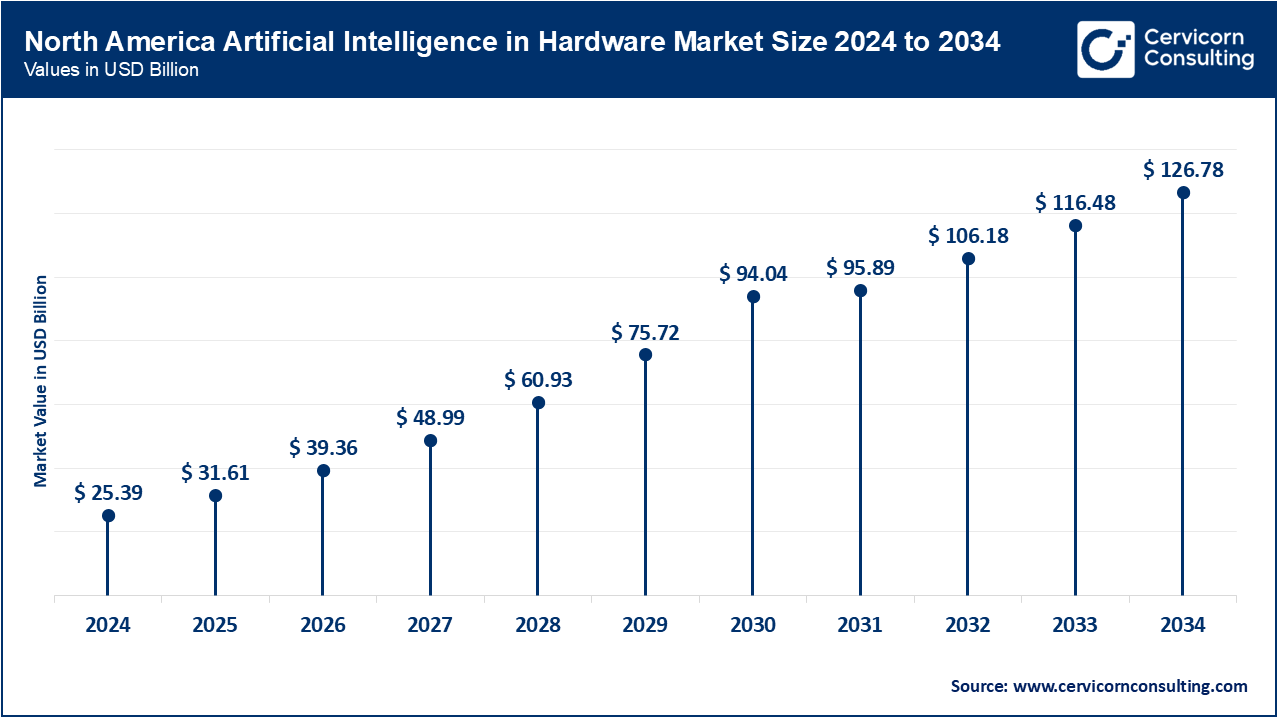

The North America market size is expected to reach around USD 126.78 billion by 2034 increasing from USD 25.39 billion in 2024 with a CAGR of 19.02%. North America leads the AI in Hardware market due to its robust technological infrastructure, significant R&D investments, and strong presence of key market players such as NVIDIA and Intel. The region's emphasis on innovation, supported by government initiatives and substantial funding, drives advancements in AI hardware. The widespread adoption of AI across industries like healthcare, automotive, and finance further boosts market growth. Additionally, North America's advanced network infrastructure and early adoption of cutting-edge technologies position it as a pivotal player in the global AI hardware landscape.

The Asia Pacific market size is calculated at USD 15.47 billion in 2024 and is projected to grow around USD 77.27 billion by 2034 with a CAGR of 19.36%. Asia-Pacific is experiencing rapid growth in the AI in Hardware market, fueled by significant investments from countries like China, Japan, and South Korea. The region's strong manufacturing base and advancements in semiconductor technologies contribute to its leadership in AI hardware development. Government initiatives and strategic partnerships drive innovation, while the increasing adoption of AI across sectors such as telecommunications, automotive, and consumer electronics propels market expansion. Asia-Pacific's focus on smart cities, 5G deployment, and digital transformation further accelerates the demand for advanced AI hardware solutions.

The Europe market size is measured at USD 19.96 billion in 2024 and is expected to grow around USD 99.68 billion by 2034 with a CAGR of 19.15%. Europe exhibits substantial growth in the AI in Hardware market, driven by strong government support, strategic investments, and collaborations between tech companies and research institutions. The region prioritizes ethical AI development and regulatory frameworks that foster innovation. Key industries, including automotive, manufacturing, and healthcare, are increasingly integrating AI hardware to enhance efficiency and competitiveness. Germany, the UK, and France are notable contributors, with initiatives like the European Commission's AI strategy promoting research and development, positioning Europe as a significant player in AI hardware advancements.

The LAMEA market size is forecasted to reach around USD 28.46 billion by 2034 from USD 6.20 billion in 2024 with a CAGR of 18.70%. The LAMEA region is emerging as a promising market for AI in Hardware, driven by increasing digitalization efforts and investments in AI infrastructure. Countries like Brazil and the UAE are spearheading AI initiatives, focusing on sectors such as healthcare, agriculture, and finance. Challenges such as infrastructure limitations and skill gaps are being addressed through strategic partnerships and government support. The region's growing interest in leveraging AI for economic growth and addressing societal challenges highlights its potential for significant contributions to the AI hardware market.

Among the new players, Graphcore Limited and Baidu, Inc. are notable. Graphcore leverages its Intelligence Processing Unit (IPU) for efficient AI workloads, while Baidu's Kunlun AI chips drive advancements in autonomous driving and cloud services. Dominating players like NVIDIA Corporation and Intel Corporation lead through robust GPUs and AI accelerators. NVIDIA's collaborations, such as with Mercedes-Benz for autonomous vehicles, and Intel's innovations in AI chips and partnerships with Mobileye for advanced driver-assistance systems (ADAS), underscore their dominance. These companies continually innovate and collaborate, driving market growth and technological advancements in AI hardware.

Jensen Huang, CEO of NVIDIA Corporation

Pat Gelsinger, CEO of Intel Corporation

Lisa Su, CEO of Advanced Micro Devices (AMD)

Sundar Pichai, CEO of Google LLC

Arvind Krishna, CEO of IBM Corporation

Andrew Feldman, CEO of Cerebras Systems (an emerging player)

Market Segmentation

By Type

By Application

By Deployment

By Technology

By End User

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Artificial Intelligence (AI) in Hardware

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Application Overview

2.2.3 By Deployment Overview

2.2.4 By Technology Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Artificial Intelligence (AI) in Hardware Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Collaboration and Partnerships

4.1.1.2 Regulatory Support and Incentives

4.1.1.3 High Development Costs

4.1.1.4 Complexity and Technical Challenges

4.1.2 Market Opportunity

4.1.2.1 Expansion into Emerging Markets

4.1.2.2 Development of Custom AI Solutions

4.1.3 Market Challenges

4.1.3.1 Rapid Technological Obsolescence

4.1.3.2 Supply Chain Disruptions

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Artificial Intelligence (AI) in Hardware Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Artificial Intelligence (AI) in Hardware Market, By Type

6.1 Global Artificial Intelligence (AI) in Hardware Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Processor

6.1.1.2 Memory

6.1.1.3 Network

6.1.1.4 Storage

Chapter 7 Artificial Intelligence (AI) in Hardware Market, By Application

7.1 Global Artificial Intelligence (AI) in Hardware Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Training & Simulation

7.1.1.2 Driver Monitoring Systems

7.1.1.3 Surveillance & Security

7.1.1.4 Imaging & Diagnosis

7.1.1.5 Robotic Surgery

7.1.1.6 Disaster Management

7.1.1.7 Visual Inspection

7.1.1.8 Others

Chapter 8 Artificial Intelligence (AI) in Hardware Market, By Deployment

8.1 Global Artificial Intelligence (AI) in Hardware Market Snapshot, By Deployment

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Cloud-Based

8.1.1.2 On-Premise

Chapter 9 Artificial Intelligence (AI) in Hardware Market, By Technology

9.1 Global Artificial Intelligence (AI) in Hardware Market Snapshot, By Technology

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Machine Learning

9.1.1.2 Computer Vision

9.1.1.3 Others

Chapter 10 Artificial Intelligence (AI) in Hardware Market, By End User

10.1 Global Artificial Intelligence (AI) in Hardware Market Snapshot, By End User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Telecommunication and IT industry

10.1.1.2 banking and finance sectors

10.1.1.3 Education

10.1.1.4 Ecommerce

10.1.1.5 Navigation

10.1.1.6 Robotics

10.1.1.7 Agriculture

10.1.1.8 Health care

10.1.1.9 Others

10.1.1.10 Automotive

10.1.1.11 Retail

Chapter 11 Artificial Intelligence (AI) in Hardware Market, By Region

11.1 Overview

11.2 Artificial Intelligence (AI) in Hardware Market Revenue Share, By Region 2024 (%)

11.3 Global Artificial Intelligence (AI) in Hardware Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Artificial Intelligence (AI) in Hardware Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Artificial Intelligence (AI) in Hardware Market, By Country

11.5.4 UK

11.5.4.1 UK Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Artificial Intelligence (AI) in Hardware Market, By Country

11.6.4 China

11.6.4.1 China Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Artificial Intelligence (AI) in Hardware Market, By Country

11.7.4 GCC

11.7.4.1 GCC Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Artificial Intelligence (AI) in Hardware Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 NVIDIA Corporation

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Intel Corporation

13.3 Advanced Micro Devices (AMD)

13.4 Google LLC

13.5 IBM Corporation

13.6 Qualcomm Incorporated

13.7 Apple Inc.

13.8 Samsung Electronics Co., Ltd.

13.9 Huawei Technologies Co., Ltd.

13.10 Microsoft Corporation