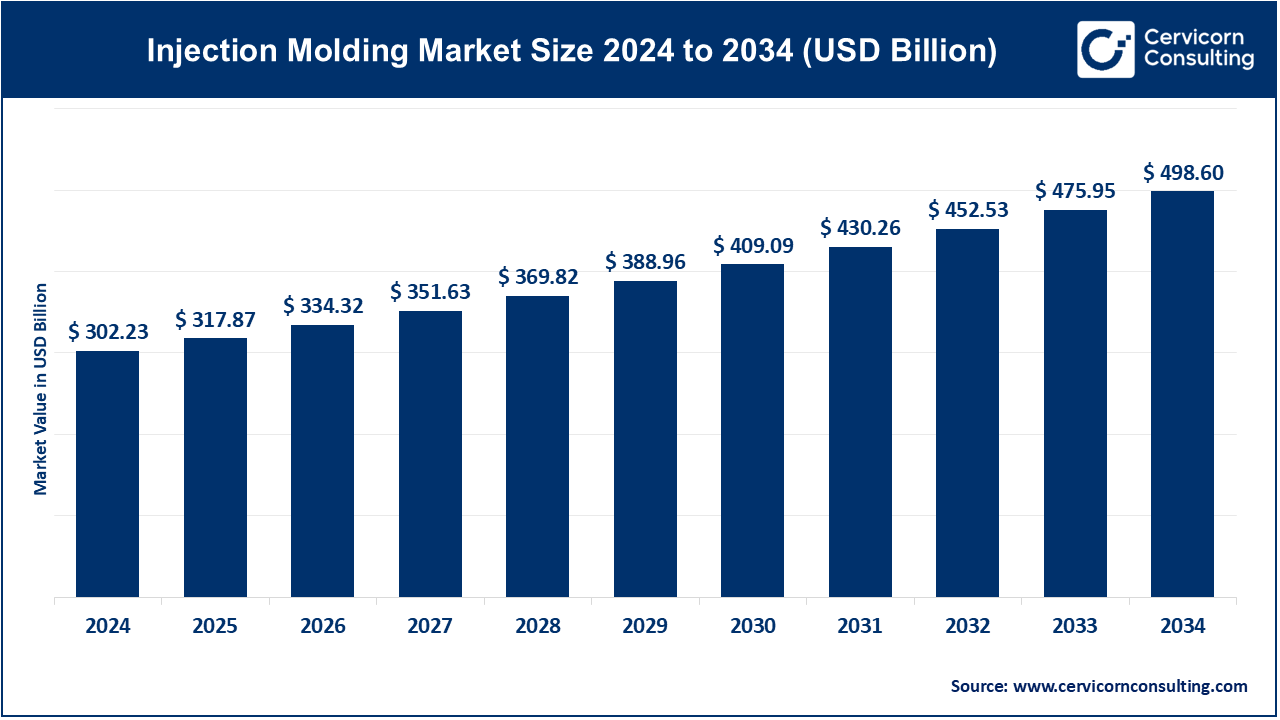

The global injection molding market size was accounted for USD 302.23 billion in 2024 and is expected to surpass around USD 498.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.17% from 2025 to 2034.

The global injection molding market is experiencing significant growth due to increasing demand for lightweight and durable components in various industries. The automotive sector, in particular, is adopting injection molding for producing precision parts such as dashboards, bumpers, and other components. Technological advancements in automation and robotics are improving the efficiency and precision of injection molding, making it more cost-effective and appealing to manufacturers. Additionally, the growing emphasis on sustainability has led to the development of biodegradable and recyclable materials used in injection molding, further boosting its market growth. The increasing trend of lightweight and compact designs in electronics is expected to further drive the demand for injection molding. In 2022, injection-molding machines for rubber or plastic ranked as the world's 595th most traded product, with a total trade value of USD 6.5 billion. As global industries continue to focus on innovation and efficiency, the injection molding market is poised for steady expansion in the coming years.

Injection molding is a manufacturing process used to create parts by injecting molten material into a mold. The process begins by heating the material (such as plastic, metal, or rubber) until it melts. This molten material is then injected under high pressure into a mold cavity, where it cools and solidifies to form the desired shape. Injection molding is highly efficient and allows for mass production of complex shapes and detailed designs, making it widely used in industries such as automotive, electronics, and packaging.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 317.87 Billion |

| Projected Market Size (2034) | USD 498.60 Billion |

| Growth Rate (2025 to 2034) | 5.17% |

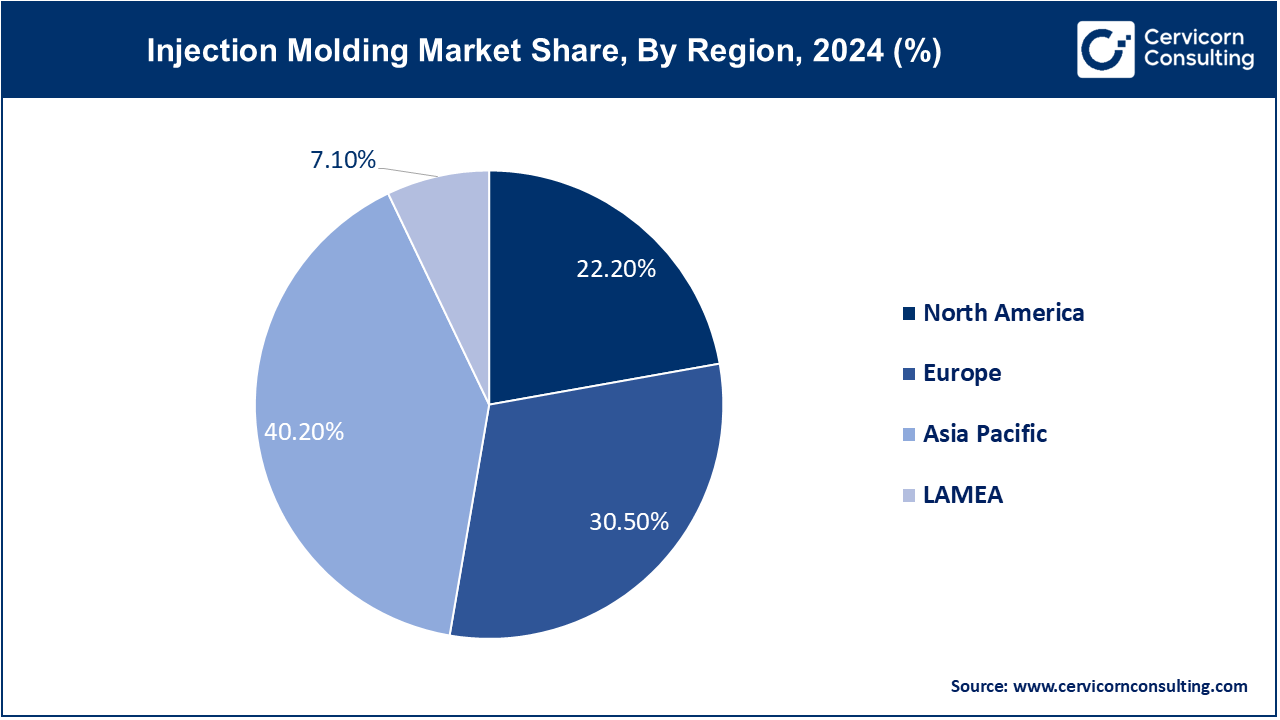

| Largest Revenue Holder Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Segments Covered | Material, Application, Region |

| Key Companies | Arburg GmbH + Co KG, Milacron Holdings Corp, Husky Injection Molding Systems Ltd., KraussMaffei Group GmbH, Engel Austria GmbH, Milacron Holdings Corp., Sumitomo (SHI) Demag Plastics Machinery GmbH, Injection Molding Machine Co., Ltd. (JSW), Nissei Plastic Industrial Co., Ltd., Chen Hsong Holdings Limited, Toyobo Co., Ltd., Battenfeld-Cincinnati GmbH, Haitian International Holdings Limited Sodick Co., Ltd., Beckhoff Automation GmbH, Toshiba Machine Co., Ltd., BASF SE, DuPoint |

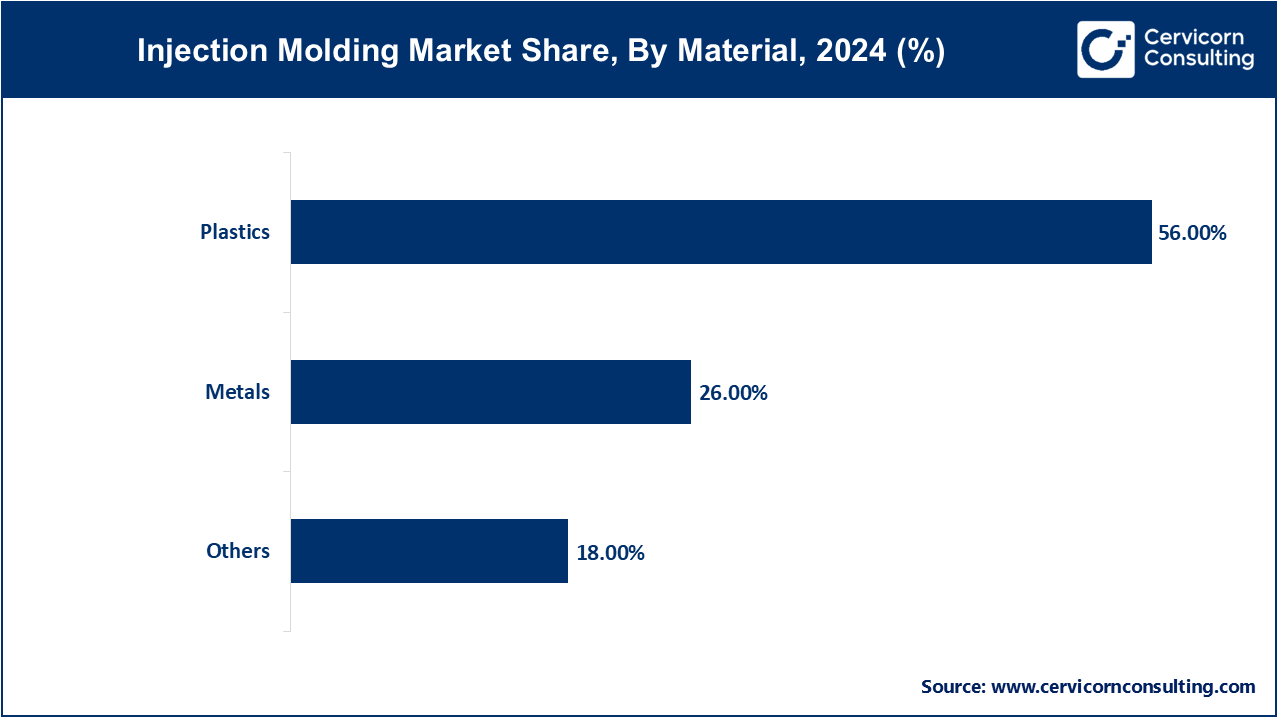

The injection molding market is segmented into product, material, application and region. Based on product, the market is classified into injection molded parts, and injection molded packaging. Based on material, the market is classified into plastics, metals, and others. Based on application, the market is classified into packaging, consumables & electronics, automotive & transportation, building & construction, medical, and others.

Injection Molded Parts: Injection molded parts are components produced through the injection molding process, where molten material is injected into a mold to create small, complex shapes. This method allows for high precision and repeatability, making it ideal for producing a wide range of components used in various applications. These parts can be manufactured in different sizes and geometries, catering to industries such as automotive, consumer goods, and electronics. The ability to incorporate intricate details and features in injection molded parts enhances their functionality and performance in end products, driving demand across multiple sectors.

Injection Molded Packaging: Injection molded packaging solutions include various products such as containers, bottles, lids, and other packaging materials created using injection molding techniques. This approach provides manufacturers with the capability to produce lightweight, durable, and cost-effective packaging solutions that meet specific design and performance requirements. Injection molded packaging is commonly used in industries like food and beverage, cosmetics, and pharmaceuticals, where product protection and shelf appeal are crucial. The versatility of injection molding allows for the creation of unique shapes and closures, contributing to innovative packaging designs that attract consumers.

Thermoplastics: Thermoplastics are widely used materials in injection molding due to their ability to be reheated and reshaped multiple times without undergoing any significant chemical change. Common thermoplastics used in injection molding include polyethylene (PE), polypropylene (PP), and polystyrene (PS). These materials offer excellent flexibility, impact resistance, and ease of processing, making them suitable for a variety of applications. In the automotive sector, thermoplastics are often used for interior components and exterior trim, while in consumer goods, they are found in everyday items like containers and toys. The adaptability and recyclability of thermoplastics further enhance their appeal in a sustainability-focused market.

Thermosetting Plastics: Thermosetting plastics are materials that, once molded and cured, cannot be remolded or reshaped. These materials are known for their high strength, heat resistance, and durability, making them ideal for applications that require structural integrity and performance under extreme conditions. Common examples of thermosetting plastics include epoxy resins, phenolic resins, and polyurethanes. In injection molding, thermosetting plastics are used for applications in automotive parts, electrical components, and industrial equipment where robustness and stability are essential. The unique properties of thermosetting plastics enable manufacturers to produce high-performance components that meet stringent quality standards.

Elastomers: Elastomers are flexible materials used in injection molding to produce parts that require rubber-like properties, such as elasticity and resilience. These materials can undergo significant deformation and return to their original shape, making them ideal for applications such as seals, gaskets, and cushioning components. Common elastomers used in injection molding include thermoplastic elastomers (TPEs) and silicone rubber. The versatility of elastomers allows them to be tailored for specific applications, providing solutions in industries like automotive, healthcare, and consumer products. The growing demand for lightweight and flexible components drives the adoption of elastomers in various injection-molded products.

Automotive: The automotive industry is a significant application area for injection molding, where components such as dashboards, bumpers, and interior trim parts are produced. Injection molding enables the manufacturing of lightweight and complex shapes that contribute to improved fuel efficiency and performance in vehicles. The process allows for the integration of multiple functions into a single part, reducing assembly time and costs. With the industry's ongoing shift towards electric and hybrid vehicles, the demand for innovative injection-molded components continues to grow, as manufacturers seek to enhance the design and functionality of automotive parts.

Consumer Goods: Injection molding plays a crucial role in the production of consumer goods, encompassing a wide range of household items, toys, and appliances. The ability to produce high volumes of consistent and durable products makes injection molding an attractive choice for manufacturers in this sector. Common products include containers, kitchen utensils, and personal care items, which benefit from the customization options and design flexibility offered by injection molding. As consumer preferences shift towards sustainable and innovative products, manufacturers increasingly leverage injection molding technology to create eco-friendly solutions and enhance product aesthetics.

Medical Devices: The medical devices sector relies heavily on injection molding to produce precision parts used in various medical equipment and devices. Components such as syringes, casings, and connectors are manufactured with high accuracy to ensure safety and reliability in healthcare applications. Injection molding allows for the creation of complex geometries and intricate features essential for medical devices, facilitating ease of assembly and functionality. With stringent regulatory requirements in the healthcare industry, the demand for high-quality injection-molded components continues to rise, driving innovation and advancements in manufacturing processes.

Electronics: The electronics industry utilizes injection molding for the production of housings, enclosures, and components for various electronic devices. The ability to create lightweight, durable, and intricate designs makes injection molding an ideal choice for manufacturers looking to enhance the performance and aesthetics of their products. Common applications include smartphone casings, computer parts, and consumer electronics. As the electronics sector evolves with the emergence of smart devices and Internet of Things (IoT) applications, the demand for innovative and high-quality injection-molded components is expected to increase, driving further advancements in the industry.

The injection molding market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s a detailed overview of each region:

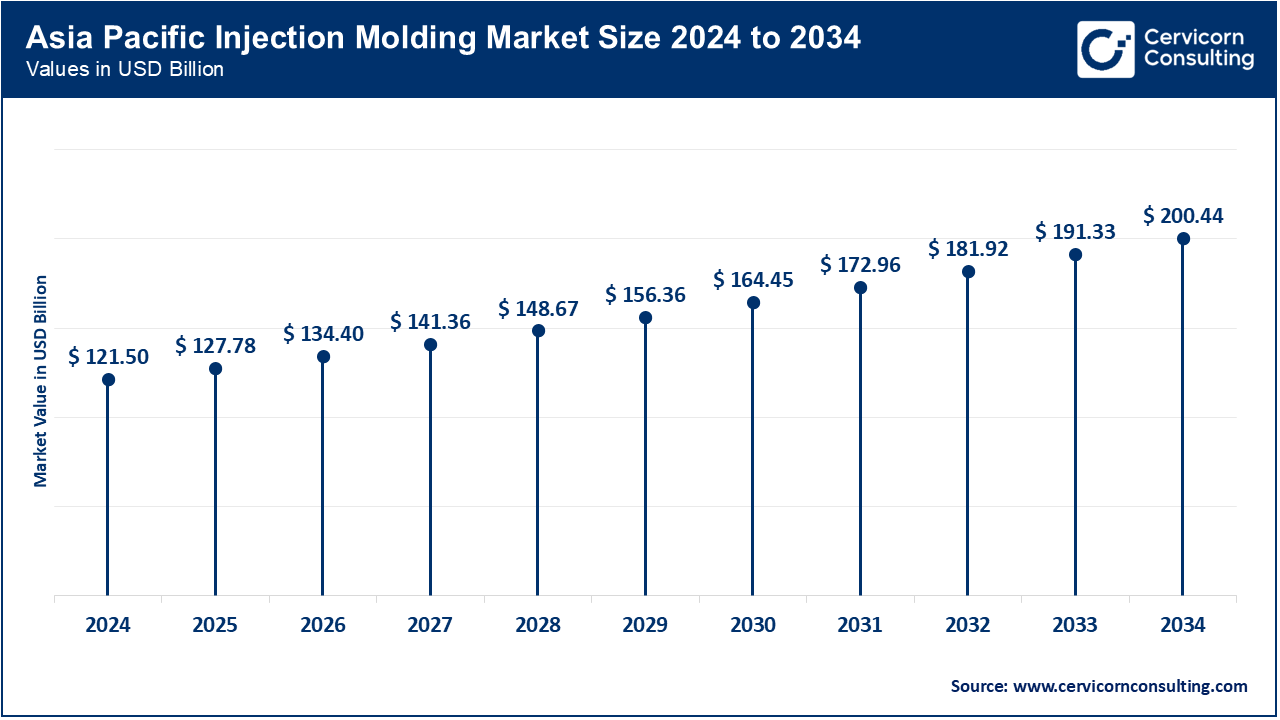

The Asia-Pacific injection molding market size was valued at USD 121.50 billion in 2024 and is expected to surpass around USD 200.44 billion by 2034. The Asia-Pacific region is witnessing rapid growth in the injection molding market, fuelled by escalating industrialization and expanding consumer bases. China and India are major contributors, with significant demand arising from the automotive, electronics, and consumer goods sectors. Japan and South Korea also play vital roles, particularly in high-tech and precision applications. The region's growth is supported by substantial investments in manufacturing infrastructure, advancements in technology, and a growing emphasis on efficient production processes. This rapid development is driving innovation and increasing the adoption of advanced injection molding solutions.

The North America injection molding market size was estimated at USD 67.10 billion in 2024 and is expected to reach around USD 110.69 billion by 2034. The North America is witnessing rapid growth, driven by strong demand across automotive, consumer goods, and medical device industries. The United States leads the market with advanced manufacturing technologies and a high demand for precision components. Canada contributes notably, especially in the healthcare and consumer products sectors. The region’s market dynamics are shaped by continuous innovation in molding technologies, a focus on high-quality standards, and a robust industrial base that supports diverse applications. Regulatory standards and technological advancements further enhance the efficiency and safety of injection molding processes in this region

The Europe injection molding market size was accounted for USD 92.18 billion in 2024 and is projected to hit around USD 152.07 billion by 2034. Europe is a significant player in the market, with demand driven by automotive, consumer electronics, and medical applications. Countries like Germany and France are prominent due to their strong industrial bases and emphasis on high-precision manufacturing. The European market is characterized by stringent regulatory frameworks that ensure product quality and environmental sustainability. Innovations in molding technologies and a focus on reducing environmental impact align with Europe’s goals of advancing manufacturing practices and promoting sustainable development.

The LAMEA injection molding market size was accounted for USD 21.16 billion in 2024 and is forecasted to surpass around USD 34.9 billion by 2034. LAMEA region is growing, driven by industrial expansion and increasing demand in various sectors. Brazil and South Africa are key markets, benefiting from their developing manufacturing sectors and rising consumer demand. The Middle East’s expanding construction and automotive industries also contribute to the market’s growth. Despite challenges such as economic fluctuations and infrastructure limitations, the region’s potential for development is significant. Rich natural resources and increasing industrial activities offer opportunities for further market expansion and technological advancements in injection molding.

The injection molding market features several prominent players, including companies like BASF SE, DuPont, and Milacron Holdings Corp, known for their advanced materials and innovative technologies. BASF SE is a global leader in chemical production, providing high-performance thermoplastics that enhance the functionality and durability of molded parts. DuPont specializes in specialty polymers and has a strong presence in the medical and electronics sectors, offering tailored solutions for specific applications.

Milacron Holdings Corp, a leader in manufacturing injection molding machinery, provides cutting-edge equipment that enhances production efficiency and quality. These companies, along with numerous regional players, are continuously investing in research and development to improve their product offerings and maintain a competitive edge in the evolving injection molding landscape.

CEO Statements

Here are some recent CEO statements from key players in the injection molding sector:

Arburg GmbH + Co KG: “Arburg's focus is on continuously developing and optimizing our injection molding technology to meet the evolving demands of our customers. We are committed to advancing automation and digitalization to drive efficiency and sustainability in manufacturing."

Husky Injection Molding Systems Ltd: “At Husky, we are dedicated to pushing the boundaries of injection molding technology. Our goal is to deliver solutions that enhance productivity, quality, and sustainability for our global customers”

KraussMaffei Group GmbH: " KraussMaffei is committed to leading the industry through innovation and advanced technology. We focus on providing state-of-the-art injection molding solutions that address the challenges of today’s manufacturing landscape”

These developments underscore significant strides in advancing infrastructure and technology, reflecting growing collaborations and strategic investments aimed at expanding the global injection molding industry.

Strategic partnerships and Launches highlight the rapid advancements and collaborative efforts in the Injection Molding market. Industry players are involved in various aspects of Injection Molding, including production, technologies, and Material, and play a significant role in advancing the market. Some notable examples of key developments in the injection molding industry include:

These developments underscore significant strides in advancing hydrogen infrastructure and technology, reflecting growing collaborations and strategic investments aimed at expanding the global market.

Market Segmentation

By Product

By Material

By Application

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Injection Molding

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Material Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Injection Molding Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Demand from Key Industries

4.1.1.2 Technological Innovation

4.1.2 Market Restraints

4.1.2.1 High Initial Investment

4.1.2.2 Material Limitations

4.1.3 Market Opportunity

4.1.3.1 Expansion into Emerging Markets

4.1.3.2 Advancements in Material Science

4.1.4 Market Challenges

4.1.4.1 Regulatory Compliance

4.1.4.2 Technological Adaptation

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Injection Molding Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Injection Molding Market, By Product

6.1 Global Injection Molding Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Injection Molded Parts

6.1.1.2 Injection Molded Packaging

Chapter 7 Injection Molding Market, By Material

7.1 Global Injection Molding Market Snapshot, By Material

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Plastics

7.1.1.2 Metals

7.1.1.3 Others

Chapter 8 Injection Molding Market, By Application

8.1 Global Injection Molding Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Packaging

8.1.1.2 Consumables & Electronics

8.1.1.3 Automotive & Transportation

8.1.1.4 Building & Construction

8.1.1.5 Medical

8.1.1.6 Others

Chapter 9 Injection Molding Market, By Region

9.1 Overview

9.2 Injection Molding Market Revenue Share, By Region 2024 (%)

9.3 Global Injection Molding Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Injection Molding Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Injection Molding Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Injection Molding Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Injection Molding Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Injection Molding Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Injection Molding Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Injection Molding Market, By Country

9.5.4 UK

9.5.4.1 UK Injection Molding Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Injection Molding Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Injection Molding Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Injection Molding Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Injection Molding Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Injection Molding Market, By Country

9.6.4 China

9.6.4.1 China Injection Molding Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Injection Molding Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Injection Molding Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Injection Molding Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Injection Molding Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Injection Molding Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Injection Molding Market, By Country

9.7.4 GCC

9.7.4.1 GCC Injection Molding Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Injection Molding Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Injection Molding Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Injection Molding Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Arburg GmbH + Co KG

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Milacron Holdings Corp

11.3 Husky Injection Molding Systems Ltd.

11.4 KraussMaffei Group GmbH

11.5 Engel Austria GmbH

11.6 Milacron Holdings Corp.

11.7 Sumitomo (SHI) Demag Plastics Machinery GmbH

11.8 Injection Molding Machine Co., Ltd. (JSW)

11.9 Nissei Plastic Industrial Co., Ltd.

11.10 Chen Hsong Holdings Limited