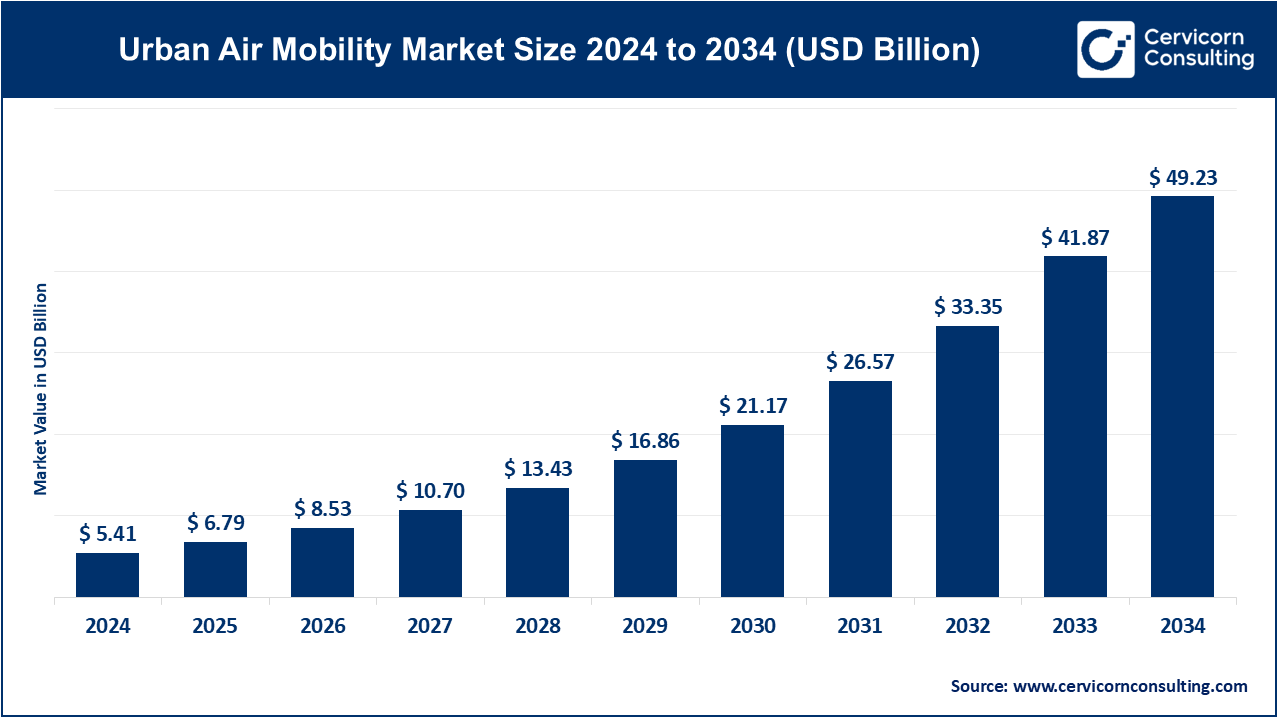

The global urban air mobility market size was reached at USD 5.41 billion in 2024 and is expected to be worth around USD 49.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 24.71% over the forecast period from 2025 to 2034.

Urban air mobility, aka eVTOL, is the market of airborne technologies and businesses that will transform the aerial transportation system of the city. This market covers electric vertical take-off and landing (eVTOL) aircraft, self-flying vehicles such as drones or autonomous aerial vehicles (AAV), as well as infrastructure, including vertiports and air traffic control systems.

Some important factors driving this market include the use of artificial intelligence for carrying out solo flights, the use of electrical power for enhancing the ability to reduce emissions, and the application of better concepts of air traffic management to deliver safety and efficiency in crowded urban airspace markets. Also, there is a focus on increasing the complexity through IoT, which allows for better ability of vehicles and their management.

Moreover, there are innovations in the field of UAM, which are also being applied in different areas such as passenger, services, and delivery. This is especially important in adopting integrated governmental policies and strategies that allow the development of a market for the integration of such solutions with existing urban structures.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 6.79 Billion |

| Projected Market Size (2034) | USD 49.23 Billion |

| Growth Rate (2025 to 2034) | 24.71% |

| Dominant Region | North America |

| Expanding Region | Asia-Pacific |

| Key Segments | Component, Product, Technology, Platform Architecture, Range, Type, Application, End User, Region |

| Key Players | Airbus, Boeing, Joby Aviation, Lilium, Volocopter, Bell Helicopter, EHang, Vertical Aerospace, Pipistrel, Archer Aviation, EmbraerX, Hyundai Motor Group (Supernal), Kitty Hawk, Terrafugia, Wisk Aero |

Increased Funding and Investment

Rising Consumer Demand for Faster, More Efficient Travel

Regulatory and Safety Concerns

High Initial Costs

Sustainable Urban Transport Solutions

Emerging Markets and Smart Cities

Infrastructure Development

Public Acceptance and Safety Concern

Passenger Transportation: Based on its basic concept, UAM provides a new approach toward urban mobility with greatly shortened traveling time, avoiding city traffic jams. This application therefore aims at individual travellers and urban business personnel who are in constant search for faster means of getting around cities. EVTOL aircraft is versatile and therefore can fly from one point directly to the next avoiding common traffic constrictions. Contrary to the current exclusivity of the technology, it could one-day form part of new-age public transport systems, especially in large metropolitan areas.

Cargo and Logistics: UAM has the potential to be the new force for last-mile delivery as it is capable of providing more optimized transport solutions, especially for items such as food and parcels in the contexts of e-commerce and other emergent applications. Nodes and self-sufficient delivery drones and cargo-relevant aerial vehicles reduce time, and complexity and increase supply chain management opportunities of logistics in concrete environments. This minimizes the reliance on ground transportation so that delivery may be made quicker and with more flexibility. This means that as the demand for delivery intensifies, UAM takes the mantle of responding to the needs throughout the whole world.

Emergency and Medical Services: UAM can facilitate lifesaving by ensuring quicker transportation of organs, and patients’ evacuations among others. UAM aircraft can avoid interfering with ground traffic and therefore provide quicker ways of accessing hospitals and medical facilities in urban centres. Furthermore, these aircraft can also bring in medical supplies during disasters or rescue stranded people in remote areas. These in the emergency response units can enhance response time.

Military and Defense: Yet, in the military sphere, UAM may be employed for personnel and material transportation, observation and scouting, and logistic purposes especially in or around the built environment or the area of difficult topographical conditions. Easier logistic support can be provided by using autonomous systems and eVTOLs require minimum airstrips hence the logistics can be quickly deployed. These capabilities give armed forces tactical values for maneuvering in the urban environment and supply chain management. This adaptability is beneficial in restricted spaces which ideally position UAM for utilization in defense systems.

eVTOL Aircraft: These electric vertical take-off and landing vehicles constitute the primary product that underpins UAM as people movers and cargo carriers that are efficient and environmentally friendly as compared to fuel-dependent aviation. Their design enables them to hover and transition into landing with ease hence suitable for use in areas congested with space. These aircraft are believed to play a crucial role in building future urban air mobility systems.

Autonomous Aerial Vehicles: These aircraft are built with no human driver present inside the cabin and are propelled by artificial intelligence, as well as intelligent autopilot systems. Largely employed for freight transport, self-driving cars will decrease human interference and enhance the safety of UAM. They also have possibilities for use in passenger transportation in the future, finally decreasing operating expenses. It is for this reason that more fully autonomous solutions for UAM are foreseen as technology continues to develop.

Hybrid Aircraft: Hybrid aircraft use electric and traditional fuels giving longer flight range than purely electric cars, and a huge versatility compared to electric vehicles. These are suitable for mid to long-distance inter and intra-urban travels and would expand the role of UAM beyond the first and last-mile connectivity. Hybrid systems also make it possible to drive in areas that have not been established with charging infrastructure. They therefore remain a transition technology until utilities scale up fully electric solutions to optimal levels.

Private Individuals: For private individuals, urban air mobility provides an opportunity to travel through congested city areas in a shorter time than otherwise possible. As with traditional uses of autonomous vehicles, it can be anticipated that the initial uptake of UAM services for personal transport will be primarily for high value, whereas widespread acceptance will only occur as costs reduce. All these services help those clients who seek luxury, and convenience as opposed to traditional ground ride hire business. However, in the long run, ride-sharing might unlock the market for UAM to the general public.

Commercial and Corporate: Businesses can employ UAM to provide fast movement of employees and clients between company locations or from central offices to branches in cities or regions. UAM if adopted by organizations to be used in the organization’s business travel would greatly help in saving a lot of time hence boosting productivity. UAM can also be employed in the delivery of goods and documents in cities in the shortest time making it competitively advantageous in such sectors as finance, real estate, and consultancy. They provide a new concept for managing corporate mobility requirements.

Government and Public Sector: UAM can be effectively used by governments for policing, city planning, as well as in incident management. First and foremost, the use of UAM vehicles would relieve traffic jams, because city officials and other services would travel in different transport. Moreover, such systems can also be used for security purposes and constantly monitor traffic or weather conditions, safety issues, etc. UAM will continue to be adopted in the public sector, especially as the regulatory structures mature.

Healthcare and Emergency Services: UAM can be used by healthcare facilities to transport medical commodities, organs or personnel swiftly across cities and thus enhance the rate of response to calamities. UAM has the function of traffic avoidance and thus, can save lives, as ability to get to the hospital or a site of a disaster faster. In sparsely populated and areas that are difficult to access, UAM can be a sort of a saviour since resources can be ferried to these areas quickly. However, with the development of medical drone technology in future, we are going to see a tremendous contribution of UAM in the health sector.

Autonomous Flight Systems: These systems employ artificial intelligence, machine learning, and various sensors to control the movement of aircraft with a lot of autonomy. These are crucial to allow the safe and compatible use of UAM vehicles in complex and highly populated environments like cities’ airspace. This enhances safety while also cutting costs within the operations hence, the UAM market becomes more open to the larger market. They would make it possible for the automation of passenger transport in the cities making it a game changer for transportation means.

Electric Propulsion Systems: Electric propulsion is beginning with the UAM initiative as a much cleaner and quieter way to power aircraft than the burning of fossil fuels. These systems lower the ecological footprint of transport systems in urban areas thus being friendly to the global environment. Electric-powered eVTOL can be cheaper to operate than a conventional aircraft and, more to the point, will generate vastly less noise pollution, making them well-suited to metropolitan environments. These systems are expected to grow with time with advancing battery technology thus increasing the range and efficiency of the systems.

Air Traffic Management Systems: The presence of UAM vehicles in urban airspace must be controlled, hence advancing air traffic control systems. These technologies help to prevent or eliminate risks of crashes and maintain the space and route of aircraft in dense traffic zones. Intensive international cooperation with governments and technology suppliers is required to create a centralized system of air traffic control to accommodate the large number of UAM flights. These systems will become increasingly essential because as the capabilities for urban air mobility grow, so does the use of technologies and structures such as these.

Battery and Energy Storage Solutions: The energy storage system is a critical element to manage in order to maintain the dynamic characteristics while enhancing the operational distance of electric UAM vehicles. The increasing battery density, performance and charging times are steering more capable UAM systems. Energy storage solutions also affect the behavior of vehicles and are also involved in the optimization of the general cost of operation of UAM services. Upgrade in battery technology will be constant over time and this is seen as the main driver towards the adoption of UAM.

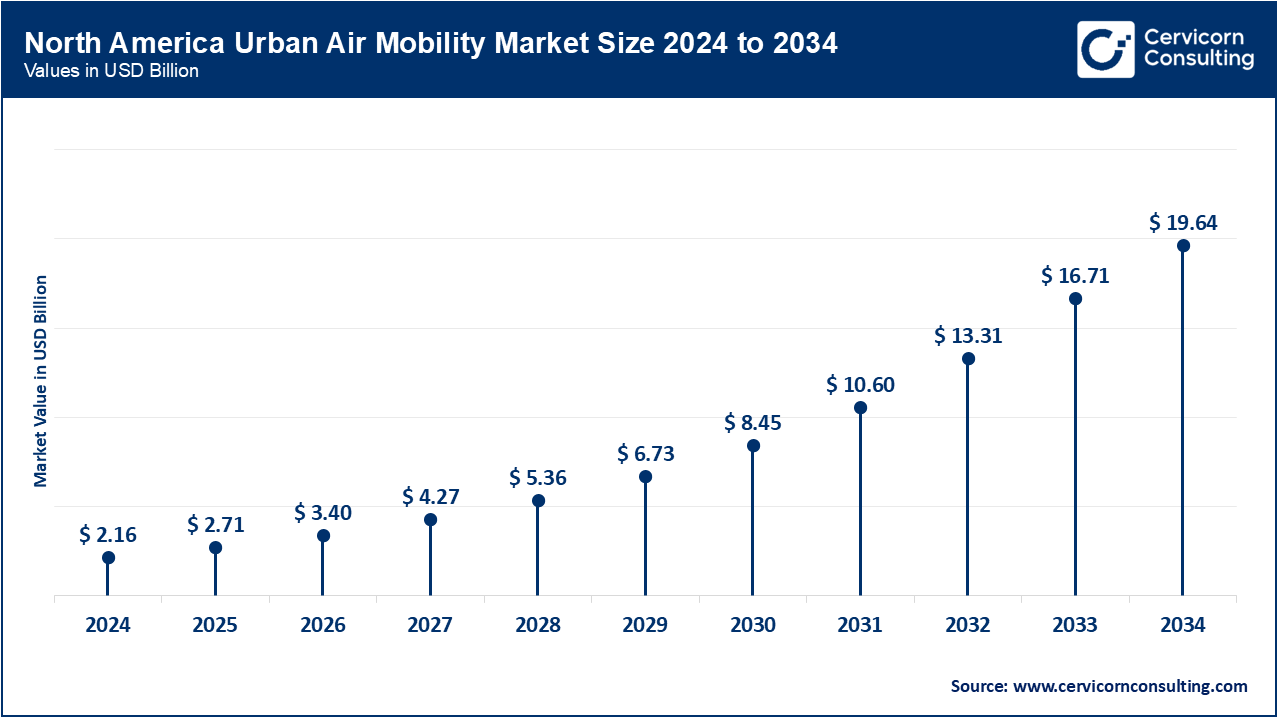

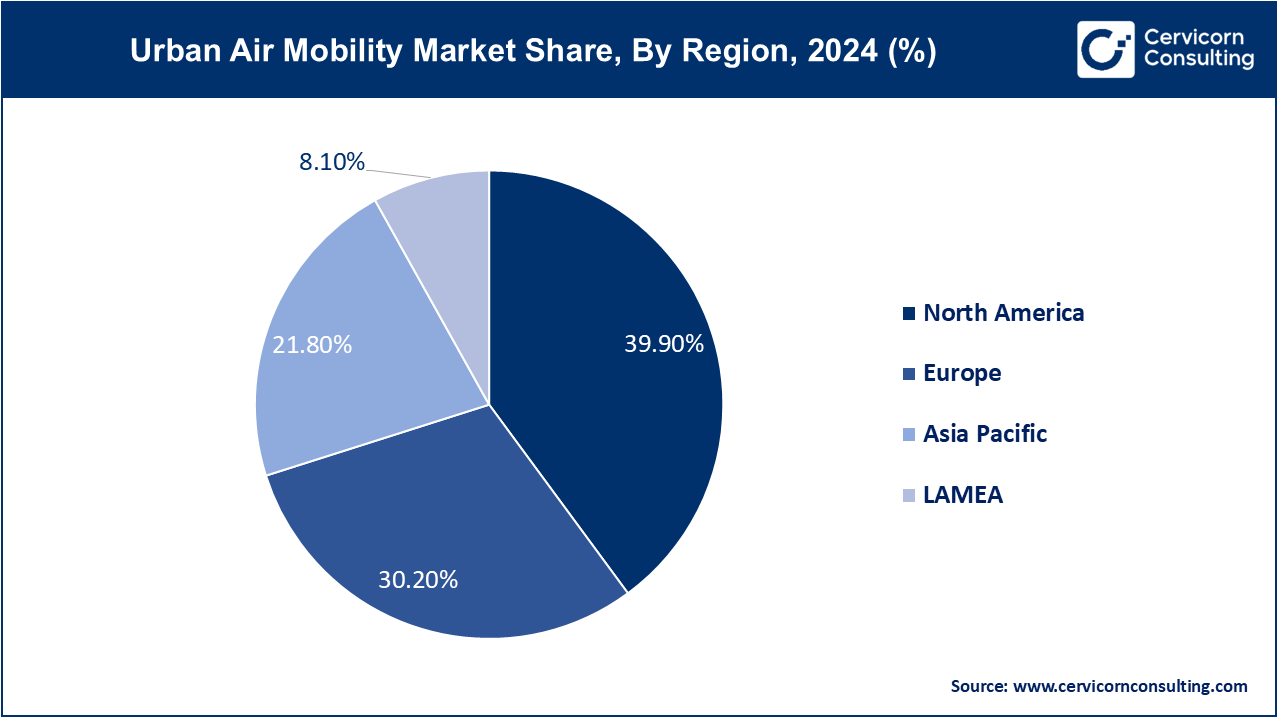

The North America urban air mobility market size was estimated at USD 2.16 billion in 2024 and is expected to reach around USD 19.64 billion by 2034. North America dominates the UAM market because of its sound aviation support systems, clear legal requirements, and research and development expenditure. The leaders are from the United States where technology giants and aerospace manufacturers are working to explore advanced technology in the eVTOL aircraft. The potential of the area is in sustainable transport and the requirement for faster transportation in congested urban settings is encouraging the use of UAM in passengers, freight and rescue operations. Canada is also beginning to take interest in UAM, especially in areas of regulation as well as testbed further stimulating the markets growth.

The Europe urban air mobility market size was estimated at USD 1.63 billion in 2024 and is projected to surpass around USD 14.87 billion by 2034. This results in a higher than global average growth of UAM market in Europe, due to the regulatory support, technology development, and mutually beneficial relations between the public and private sectors. Germany, France and the United Kingdom take the lead in adopting UAM through technological investment in green solutions in transport, and smart cities.

The European Union Interest in sustainability along with the promotion of the reduction of traffic congestion around cities and emissions makes it favorable for the future advancement of UAM. The relationship between EU citizens and advanced air mobility (UAM) will grow stronger as vertiport infrastructure is set in major European cities and governments develop the right legislation for autonomous and electric flight.

The Asia-Pacific urban air mobility market size was accounted for USD 1.18 billion in 2024 and is predicted to hit around USD 10.73 billion by 2034. The Asia-Pacific region specifically has perhaps the quickest-growing market for UAM due to enhanced urbanization, increasing disposable income per capita, and capital investment in smart networking systems. Currently, companies from China, Japan, and South Korea are pushing forward with solid governmental support and private investment in eVTOL and autonomous flight solutions.

China stands out as a leading market and investor in the development of UAM, with an interest in deploying air mobility for both people mover and freight applications. Both, Japan and South Korea are also applying UAM to alleviate traffic density and contribute efficient solutions for travelling between cites.

The LAMEA urban air mobility market was valued at USD 0.44 billion in 2024 and is anticipated to reach around USD 3.99 billion by 2034. The LAMEA UAM market is still in its infancy, but there is optimism in segments with high traffic density and increasing demands for transport development.

In the Latin American region, Brazil is keen on using UAM to overcome urban mobility hurdles, for example while the Middle East is betting on UAM technologies for passengers as well as delivery, especially with Dubai aspiring to become the center for future UAM operations. Africa has some issues of infrastructure and regulation but experiencing some improvements in pilot projects and collaborations aligned towards improving mobility in urban centres with aerial services especially in regions that have high population densities.

Out of the new entrants, Joby Aviation is currently sailing on the burgeoning e-VTOL technology that aims at providing air taxis for urban cities while reducing the use of fossil fuel. Lilium is notifying about its revolutionary business of Jet-Powered Electric Vertical Take-off and Landing (eVTOL) aircraft for exceeding more distance, hence, introducing a new concept in inter-city mobility. On the other hand, there are large incumbents notably Airbus, which has decades of experience in Aerospace, pushing UAM forward through programmes like the CityAirbus NextGen.

Boeing uses its international power in aviation with the intent of embedding UAM into larger air mobility systems, whereas Volocopter is employed in using urban passenger transport and delivery with electrical Vertical Take-off and Landing (e-VTOL) aircraft. Industry development was fueled by innovation and cooperation in new ideas at Joby with giant transportation service providers and Airbus in green mobility. These efforts underscore the extent of their control over the otherwise rapidly emerging UAM market.

Market Segmentation

By Component

By Technology

By Product

By Platform Architecture

By Range

By Maximum Take-off Weight

By Type

By Application

By End-Users

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Urban Air Mobility

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Technology Overview

2.2.3 By Product Overview

2.2.4 By Platform Architecture Overview

2.2.5 By Range Overview

2.2.6 By Maximum Take-off Weight Overview

2.2.7 By Type Overview

2.2.8 By Application Overview

2.2.9 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Urban Air Mobility Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Funding and Investment

4.1.1.2 Rising Consumer Demand for Faster, More Efficient Travel

4.1.2 Market Restraints

4.1.2.1 Regulatory and Safety Concerns

4.1.2.2 High Initial Costs

4.1.3 Market Opportunity

4.1.3.1 Sustainable Urban Transport Solutions

4.1.3.2 Emerging Markets and Smart Cities

4.1.4 Market Challenges

4.1.4.1 Infrastructure Development

4.1.4.2 Public Acceptance and Safety Concern

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Urban Air Mobility Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Urban Air Mobility Market, By Component

6.1 Global Urban Air Mobility Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hardware

6.1.1.2 Software

Chapter 7 Urban Air Mobility Market, By Technology

7.1 Global Urban Air Mobility Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Autonomous Flight Systems

7.1.1.2 Electric Propulsion Systems

7.1.1.3 Air Traffic Management Systems

7.1.1.4 Battery and Energy Storage Solutions

Chapter 8 Urban Air Mobility Market, By Product

8.1 Global Urban Air Mobility Market Snapshot, By Product

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 eVTOL Aircraft

8.1.1.2 Autonomous Aerial Vehicles

8.1.1.3 Hybrid Aircraft

8.1.1.4 Support Infrastructure

Chapter 9 Urban Air Mobility Market, By Platform Architecture

9.1 Global Urban Air Mobility Market Snapshot, By Platform Architecture

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Fixed Wing

9.1.1.2 Rotary Blade

9.1.1.3 Hybrid

Chapter 10 Urban Air Mobility Market, By Range

10.1 Global Urban Air Mobility Market Snapshot, By Range

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Intracity (Below 100 km)

10.1.1.2 Intercity (Above 100 km)

Chapter 11 Urban Air Mobility Market, By Maximum Take-off Weight

11.1 Global Urban Air Mobility Market Snapshot, By Maximum Take-off Weight

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 <100 Kg

11.1.1.2 100 – 300 Kg

11.1.1.3 >300 Kg

Chapter 12 Urban Air Mobility Market, By Type

12.1 Global Urban Air Mobility Market Snapshot, By Type

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Air Taxis

12.1.1.2 Air Metros & Air Shuttles

12.1.1.3 Personal Air Vehicles

12.1.1.4 Cargo Air Vehicles

12.1.1.5 Air Ambulances & Medical Emergency Vehicles

Chapter 13 Urban Air Mobility Market, By Application

13.1 Global Urban Air Mobility Market Snapshot, By Application

13.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

13.1.1.1 Passenger Transportation

13.1.1.2 Cargo and Logistics

13.1.1.3 Emergency and Medical Services

13.1.1.4 Military and Defense

Chapter 14 Urban Air Mobility Market, By End-Users

14.1 Global Urban Air Mobility Market Snapshot, By End-Users

14.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

14.1.1.1 Private Individuals

14.1.1.2 Commercial and Corporate

14.1.1.3 Government and Public Sector

14.1.1.4 Healthcare and Emergency Services

Chapter 15 Urban Air Mobility Market, By Region

15.1 Overview

15.2 Urban Air Mobility Market Revenue Share, By Region 2024 (%)

15.3 Global Urban Air Mobility Market, By Region

15.3.1 Market Size and Forecast

15.4 North America

15.4.1 North America Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.4.2 Market Size and Forecast

15.4.3 North America Urban Air Mobility Market, By Country

15.4.4 U.S.

15.4.4.1 U.S. Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.4.4.2 Market Size and Forecast

15.4.4.3 U.S. Market Segmental Analysis

15.4.5 Canada

15.4.5.1 Canada Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.4.5.2 Market Size and Forecast

15.4.5.3 Canada Market Segmental Analysis

15.4.6 Mexico

15.4.6.1 Mexico Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.4.6.2 Market Size and Forecast

15.4.6.3 Mexico Market Segmental Analysis

15.5 Europe

15.5.1 Europe Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.5.2 Market Size and Forecast

15.5.3 Europe Urban Air Mobility Market, By Country

15.5.4 UK

15.5.4.1 UK Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.5.4.2 Market Size and Forecast

15.5.4.3 UK Market Segmental Analysis

15.5.5 France

15.5.5.1 France Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.5.5.2 Market Size and Forecast

15.5.5.3 France Market Segmental Analysis

15.5.6 Germany

15.5.6.1 Germany Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.5.6.2 Market Size and Forecast

15.5.6.3 Germany Market Segmental Analysis

15.5.7 Rest of Europe

15.5.7.1 Rest of Europe Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.5.7.2 Market Size and Forecast

15.5.7.3 Rest of Europe Market Segmental Analysis

15.6 Asia Pacific

15.6.1 Asia Pacific Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.6.2 Market Size and Forecast

15.6.3 Asia Pacific Urban Air Mobility Market, By Country

15.6.4 China

15.6.4.1 China Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.6.4.2 Market Size and Forecast

15.6.4.3 China Market Segmental Analysis

15.6.5 Japan

15.6.5.1 Japan Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.6.5.2 Market Size and Forecast

15.6.5.3 Japan Market Segmental Analysis

15.6.6 India

15.6.6.1 India Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.6.6.2 Market Size and Forecast

15.6.6.3 India Market Segmental Analysis

15.6.7 Australia

15.6.7.1 Australia Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.6.7.2 Market Size and Forecast

15.6.7.3 Australia Market Segmental Analysis

15.6.8 Rest of Asia Pacific

15.6.8.1 Rest of Asia Pacific Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.6.8.2 Market Size and Forecast

15.6.8.3 Rest of Asia Pacific Market Segmental Analysis

15.7 LAMEA

15.7.1 LAMEA Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.7.2 Market Size and Forecast

15.7.3 LAMEA Urban Air Mobility Market, By Country

15.7.4 GCC

15.7.4.1 GCC Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.7.4.2 Market Size and Forecast

15.7.4.3 GCC Market Segmental Analysis

15.7.5 Africa

15.7.5.1 Africa Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.7.5.2 Market Size and Forecast

15.7.5.3 Africa Market Segmental Analysis

15.7.6 Brazil

15.7.6.1 Brazil Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.7.6.2 Market Size and Forecast

15.7.6.3 Brazil Market Segmental Analysis

15.7.7 Rest of LAMEA

15.7.7.1 Rest of LAMEA Urban Air Mobility Market Revenue, 2022-2034 ($Billion)

15.7.7.2 Market Size and Forecast

15.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 16 Competitive Landscape

16.1 Competitor Strategic Analysis

16.1.1 Top Player Positioning/Market Share Analysis

16.1.2 Top Winning Strategies, By Company, 2022-2024

16.1.3 Competitive Analysis By Revenue, 2022-2024

16.2 Recent Developments by the Market Contributors (2024)

Chapter 17 Company Profiles

17.1 Airbus

17.1.1 Company Snapshot

17.1.2 Company and Business Overview

17.1.3 Financial KPIs

17.1.4 Product/Service Portfolio

17.1.5 Strategic Growth

17.1.6 Global Footprints

17.1.7 Recent Development

17.1.8 SWOT Analysis

17.2 Boeing

17.3 Joby Aviation

17.4 Lilium

17.5 Volocopter

17.6 Bell Helicopter

17.7 EHang

17.8 Vertical Aerospace

17.9 Pipistrel

17.10 Archer Aviation