The global green logistics market size was valued at USD 1.55 trillion in 2024 and is expected to be worth around USD 3.69 trillion by 2034, growing at a compound annual growth rate (CAGR) of 9.06% over the forecast period 2025 to 2034.

The green logistics market is expanding rapidly due to rising environmental concerns, government regulations, and advancements in sustainable technology. Many logistics companies are investing in electric vehicles, smart warehouses, and digital solutions to reduce emissions and improve efficiency. E-commerce growth has also fueled demand for sustainable supply chain solutions, encouraging companies to adopt green logistics practices. Additionally, global corporations are committing to carbon neutrality, which further boosts investments in sustainable logistics. The rise of ESG (Environmental, Social, and Governance) policies in business strategies is pushing companies to adopt green logistics solutions. Innovations such as hydrogen-powered trucks, blockchain for transparent supply chains, and carbon footprint tracking tools are expected to drive further growth in the industry.

Future supply chains will be built around robust, AI-powered, cloud-based logistics solutions that help businesses automate shipping and tracking, optimize routes, figure out when and where to charge batteries, compute ETAs, keep an eye on vehicle maintenance, and much more. Data modeling and simulation routes and fleet capacities can be tested, and integrated technologies can assist in integrating and analyzing supply chain and delivery data throughout the whole value chain. Any step towards smoother and faster transportation and delivery of goods is a win-win situation that makes customers happier and more engaged and helps companies improve their sustainability profiles and profits.

The increasing adoption of electric vehicles (EVs) in the logistics sector and the rise in CSR-related initiatives by logistics companies are the driving factors of the green logistics market. However, the heavy dependence of the transportation sector on fossil fuels could prevent the market from growing. On the contrary, the increasing environmental awareness in end-use industries is likely to provide lucrative opportunities for green logistics industry players.

What is a Green Logistics?

Green logistics refers to environmentally friendly practices in the transportation, storage, and distribution of goods. It focuses on reducing carbon emissions, optimizing energy consumption, and minimizing waste in supply chain operations. Companies adopt green logistics by using fuel-efficient vehicles, alternative energy sources, eco-friendly packaging, and digital tools to optimize delivery routes. The goal is to achieve sustainable transportation while balancing economic and environmental benefits. Stricter environmental regulations, corporate sustainability goals, and increasing consumer demand for eco-friendly practices drive the shift toward green logistics. Businesses implementing green logistics not only reduce their carbon footprint but also benefit from cost savings, improved brand reputation, and compliance with global sustainability standards.

Key Insights Beneficial to the Green Logistics Market:

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.69 Trillion |

| Projected Market Size (2034) | USD 3.69 Trillion |

| Growth Rate (2025 to 2034) | 9.06% |

| Dominant Region | Europe |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Type, Mode, Business Type, Application, End User, Region |

| Key Companies | Agility Public Warehousing Company K.S.C.P., ARK India, AI Futtaim Logistics, Bollor SE, DHL International GmbH, Mahindra Logistics Ltd, CEVA Logistics, Deutsche Post DHL Group, DSV, FedEx Corporation, GEODIS, Go Green Logistics, Gosselin Logistics, Bowling Green Logistics, Green Logistics LLC, United Parcel Service, States Logistics Services, Inc, The Green Group, United Parcel Service of America, Inc., Westerman Multimodal Logistics, XPO Logistics, Inc., Yusen Logistics Co., Ltd |

Increased Demand for Green Warehouses

Growing Concerns Regarding Environmental Pollution

High Capital Expenditures

Implementation Complexities

Rise of E-Commerce

Advancements in Technology

Building Partnerships

Lack of Infrastructure

Transportation: When choosing sustainability initiatives, transportation should be closely monitored as it is one of the primary causes of pollution and carbon emissions. Market participants are forced to adopt more ecologically friendly transportation practices by the increasingly stringent emission standards and environmental regulations that are enforced by numerous governments and regulators worldwide.

Inbound Logistics: Inbound logistics refers to the transportation, storage, and receipt of goods in a company. It refers to the procurement of goods for office use or the manufacturing unit. In a manufacturing company, the manufacturing unit purchases raw materials or components from its suppliers for the manufacture of other goods.

Outbound Logistics: Outbound logistics is the demand side of the focus of the supply-demand relationship. The procedure comprises the storage and delivery of the products to the client or final user. Packaging, shipping, order fulfillment, delivery, and delivery-related customer support are among the steps.

Waste disposal and reverse logistics: The powerful e-commerce sector has led to a high demand for reverse logistics. Moreover, the transportation sector is expected to have access to profitable new growth opportunities because of the intense competition among logistics service providers in emerging markets.

Warehousing and material handling: There has been a gradual shift towards a more environmentally friendly way of storage and transport solutions are the trend. Automation and robots in warehousing not only reduce energy consumption but also increase productivity for distribution and logistics. Companies can equip the warehouses with solar and wind energy, energy-efficient lighting, and energy-efficient HVAC systems. Innovative reusable products, waste-reducing packaging strategies, and biodegradable materials are to be considered when it comes to material handling.

Packaging insulation: The term "green packaging," refers to packaging that utilizes as little energy as possible and is eco-friendly. Insulation packaging is a creative approach to environmentally friendly packaging. Utilizing available resources to package electronics can cut down on waste and the environmental effects of a business. Because the creative packaging is entirely composed of paper, fewer environmentally hazardous plastic materials are used.

Consumer Goods Retail: Using sustainable practices to reduce the logistics network's environmental impact is known as "green logistics." Since they make up more than 50% of the logistics sector, retail supply chains are the biggest emitters in the sector. This is not unexpected, particularly in light of COVID-19. As e-commerce took off, packaging volumes rose sharply and exceeded the capacity of many logistics’ providers. The industry had to drastically opt for new measures to meet the growing demands of both corporate sustainability goals and consumers for environmentally friendly products leading to boosting demand for green logistics.

Semiconductors and Electronics: The semiconductor industry plays an important role in the global economy. The semiconductor industry provides various necessary technologies such as IoT, AI, advanced manufacturing technologies, etc. to various industries including automotive, electronics and communications, healthcare, construction, aerospace, etc. At a time when environmental awareness is shifting paradigms across industries, the electronics sector faces a particularly urgent call. "Green electronics" are those that are produced with minimal impact on the environment. They account for both carbon emissions and energy use. Recycled materials are used for creating green electronics, which helps in lowering the consumption of essential natural resources.

Chemicals and materials: Reusable or biodegradable packaging and materials are used in green logistics. Long-term cost savings for businesses can be achieved by using recyclable materials, despite their initial cost being higher than that of disposable materials and components. These include using cardboard pallets rather than wooden ones, reusing plastic wrap, and so on. Global commitments to sustainability combined with growing environmental awareness have created an urgent need for change.

Automotive: Commercial vehicles are severely restricted on public roads as they contribute significantly to pollution. As a result of this factor encouraging global logistics companies to adopt green environmental policies including the use of electric cars for their transportation fleet, the size of the global green logistics market is growing.

Energy and utilities: With the continued growth of global trade and associated parcel delivery volumes, there is a growing need for eco-friendly and neighborhood-friendly last-mile delivery solutions in cities and logistics operations. This development, coupled with an increasing shift towards renewable or “green” energy sources (solar, wind, etc.), is driving the development of electromobility and building solutions for logistics, helping the industry go green. With the right supply chain management, green practices essentially create more efficient logistics processes that reduce energy consumption.

Other: The “Other” segment includes banking and financial services, and healthcare. Green banking is a term used for practices and policies that make banks economically, environmentally, and socially sustainable. The goal is to make banking processes and the use of IT and physical infrastructure as efficient and effective as possible, with zero or minimal impact on the environment. Green healthcare – the incorporation of environmentally friendly practices into healthcare – is attractive to healthcare professionals and institutions for many reasons. Eliminating unnecessary healthcare waste in hospitals and providing better quality healthcare are the core themes of green supply chain management (GSCM). Green logistics in the pharmaceutical industry encompasses a set of practices aimed at minimizing the environmental impact of the supply chain.

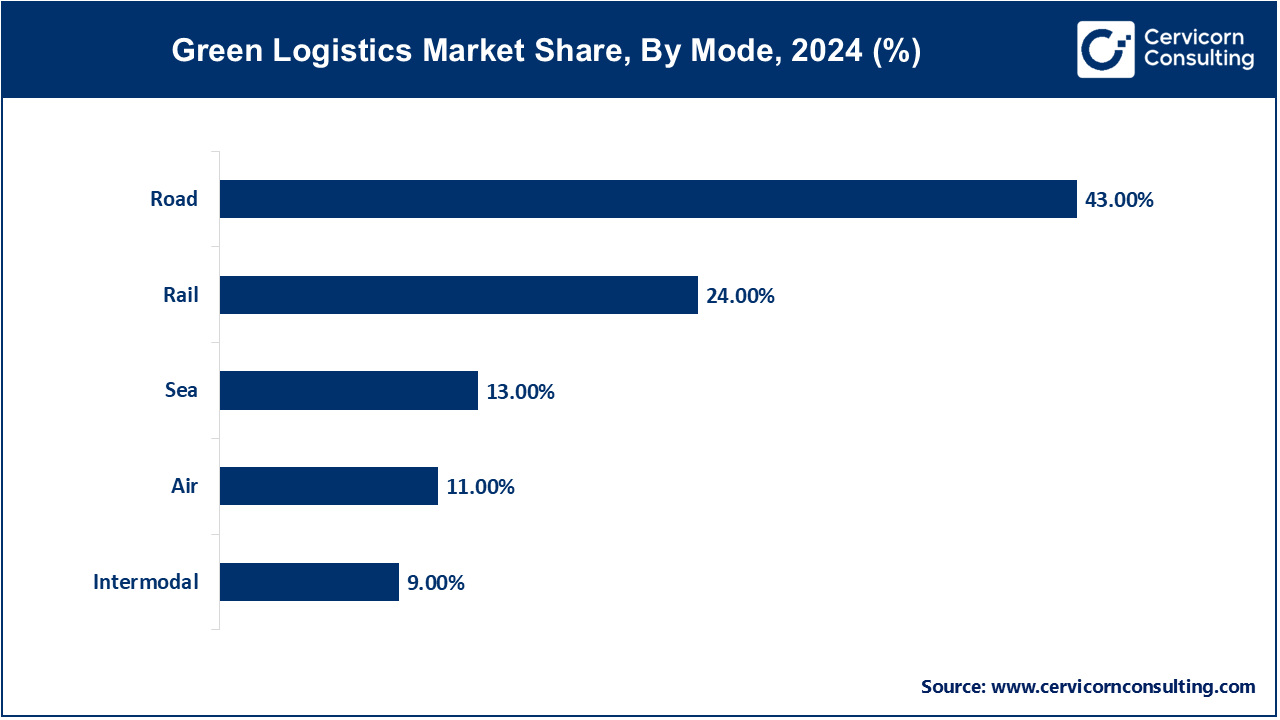

Road: The roads segments has dominates the market and accounted revenue share of 43% in 2024. Roads play an important role in last-mile delivery and flexibility. Despite having an impact on the environment, owing to the green technology advancements road transportation is changing. By use of alternative fuels, electric, and hybrid vehiclesCO2 emissions are being greatly reduced. Road transportation effectively connects various supply chain components and is becoming more environmentally friendly owing to ongoing innovations. Road transportation helps in providing direct and adaptable delivery choices, which are necessary for satisfying clients and controlling inventory. By fuel-saving technologies and proper route optimization, the impact on the environment can be further reduced.

Rail: The rail segment has generated revenue share of around 24% in 2024. Rail transportation is considered to be safe, quick, stable, and environmentally friendly. Rail is usually consideredthe best option for long-distance transportation. It has several positive environmental effects, such as increased fuel economy, decreased carbon dioxide emissions, and less traffic. Rail transportation is a crucial component of green logistics.

Sea: The Sea segment has captured revenue share of around 13% in 2024. Sea freight is one of the economical and energy-efficient modes of transportation and most of the international trades are carried out by sea freight. Many large ships that are used for ocean freight, have the potential to produce significant amounts of greenhouse gases and thus worsen air pollution. Despite the benefits of sea freights, the environment and nearby communities tend to suffer because of oil spills and any other environmental mishaps related to shipping.

Air: The air segment has accounted revenue share of 11% in 2024. Although air freight is the fastest mode of transportation, it also adds a substantial amount to air pollution and greenhouse gas emissions. One of the main reasons for climate change and global warming is the emissions generated from airplane engines. However, by employing fuel-efficient aircraft technologies and lighter materials for packaging, air freight also prioritizes sustainability.

Intermodal: The intermodal segment has reported revenue share of 9% in 2024. When moving freight from the origin to the destination, intermodal transport refers to the use of two or more modes of transportation. Costs can be cut, productivity can rise, and customer service can be enhanced. When you use the most efficient mode of transportation for each leg of the journey, intermodal transport can help you save energy and lessen your carbon footprint.

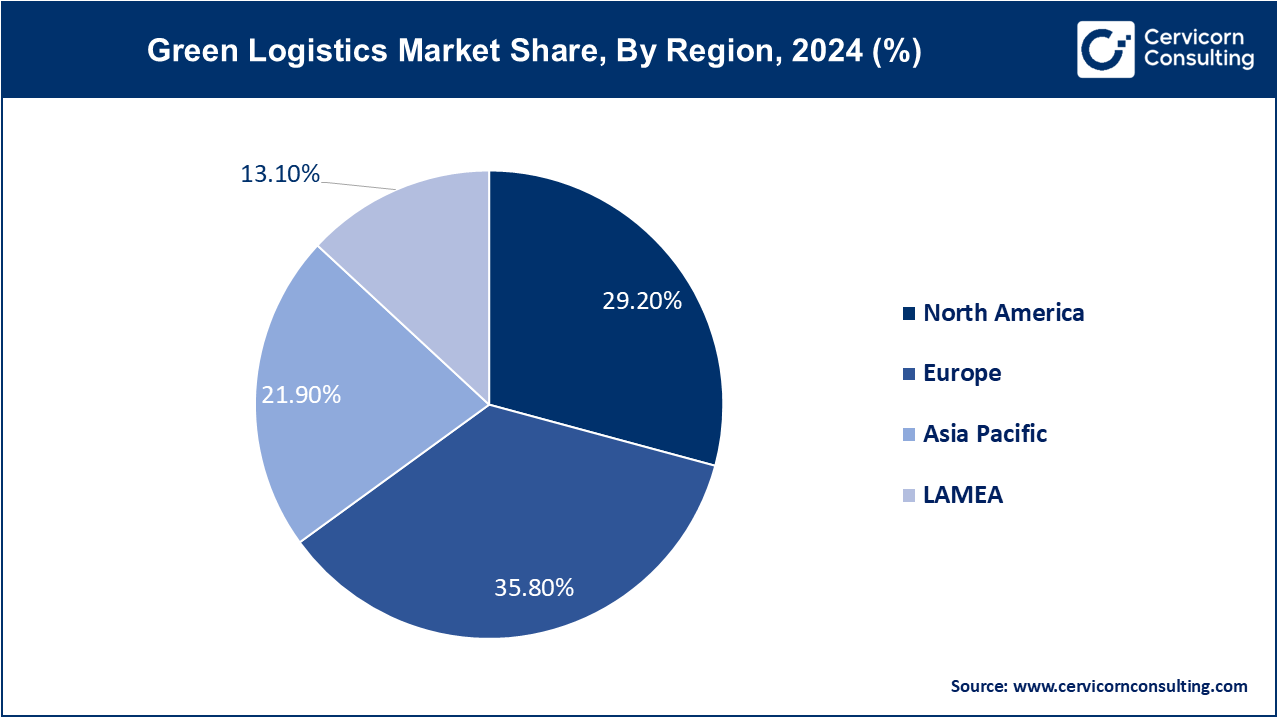

The North America green logistics market size was accounted for USD 0.45 trillion in 2024 and is expected to reach around USD 1.08 trillion by 20343. Corporate sustainability commitments and stringent environmental regulations are the factors driving the market. Market players are progressively implementing eco-friendly strategies to satisfy legal requirements and customer demands that are more environmentally friendly, such as electric cars, sustainable packaging, and route planning that maximizes efficiency. As a result of these developments and initiatives, green logistics is expanding which emphasizes lowering carbon footprints and enhancing the effectiveness of the supply chain across a wide range of sectors. In addition, to these, the expansion of the market in the region is being driven by the growing need to comply with regulations and demand from customers for environmentally friendly practices.

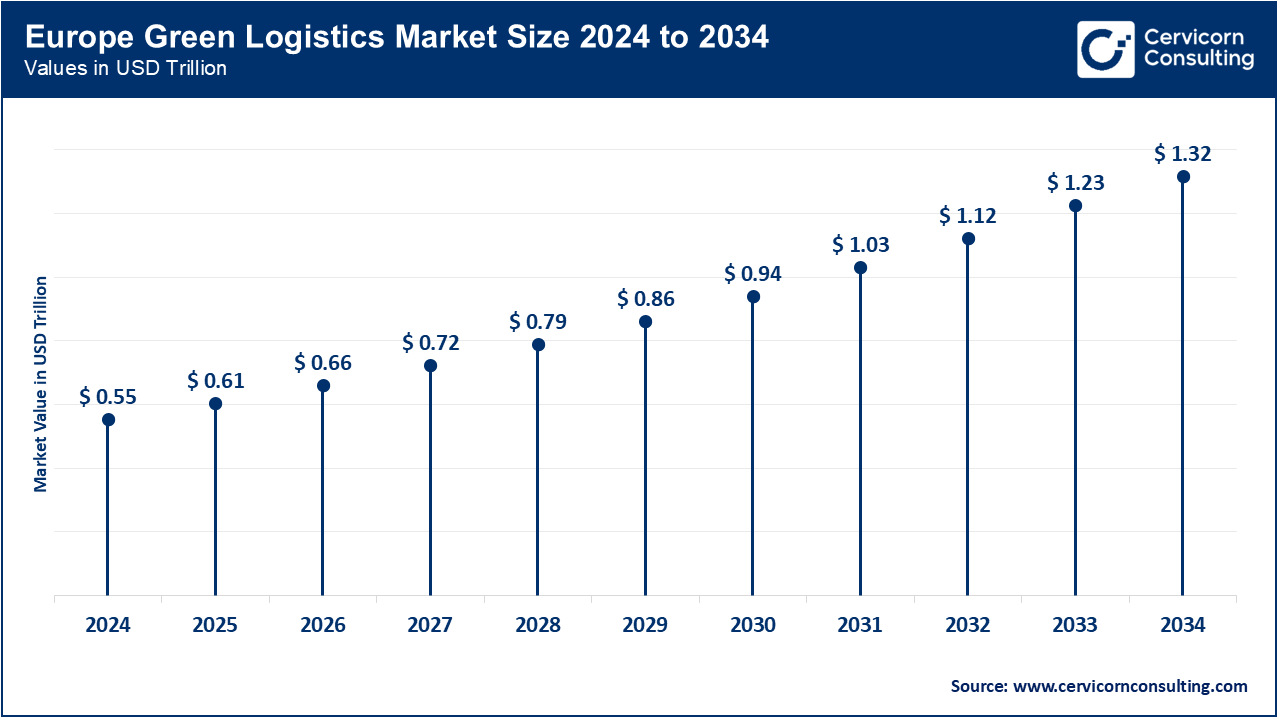

The Europe green logistics market size was estimated at USD 0.55 trillion in 2024 and is projected to surpass around USD 1.32 trillion by 2034. Europe has strict environmental regulations and standards. Market players are implementing sustainable logistics practices, such as utilizing electric vehicles and installing energy-efficient systems because of the stringent green mandates and climate policies of the European Union. This regulatory mandate along with a strong corporate commitment towards sustainability accelerates the development and adoption of environmentally friendly logistics solutions in the region. It is projected that increased focus on reducing carbon emissions and encouraging the development of green technologies will fuel market growth in Europe. In addition, the expansion is being driven by the need to comply with regulations and the growing demand from customers for environmentally friendly practices.

The Asia-Pacific green logistics market size was estimated at USD 0.34 trillion in 2024 and is projected to hit around USD 0.81 trillion by 2034. In recent years, the Asia-Pacific region has made great progress in the field of sustainable development, with many countries dedicated to green and sustainable growth. To guarantee the region's sustainability, more work is to be done by reducing the emission of greenhouse gases, and slowing down climate change requires the usage of renewable energy. The government in the region encourages investment in renewable energy by providing incentives for companies and individuals to use clean technologies and invest in renewable energy infrastructure.

The LAMEA green logistics market was valued at USD 0.20 trillion in 2024 and is anticipated to reach around USD 0.48 trillion by 2034. The LAMEA green logistics market is growing due to increased awareness of energy efficiency and advances in building infrastructure. Demand in the LATAM region is being driven by sustainability and modern construction, while in the Middle East, there is substantial investment in large-scale projects and cutting-edge technologies that are driving market growth. Africa may have limited resources, but owing to several international collaborations and funding, access to cutting-edge tools is expanding throughout the continent.

The majority of the market share for green logistics is held by businesses like Deutsche Post DHL Group, FedEx Corporation, and UPS (United Parcel Service). These companies help in encouraging sustainable practices by utilizing their extensive global networks. With a reputation for setting high standards for the environment, DHL has invested heavily in green technologies like electric cars and eco-friendly packaging.

UPS has established a strong position through its extensive fleet optimization and commitment to renewable energy. FedEx Corporation also plays a pivotal role by advancing green logistics solutions and incorporating innovative technologies. FedEx’s efforts include the deployment of electric delivery vehicles, the use of sustainable fuels, and significant investments in energy-efficient infrastructure. These key players, with their innovative approaches and strategic initiatives, underscore their leadership and influence in the evolving green logistics market.

CEO Statements

Stefan Paul, CEO of Kuehne+Nagel:

Vincent Clerc, CEO of A.P. Moller - Maersk:

These advancements mark a notable expansion in the green logistics market, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Type

By Business Type

By Mode

By Application

By End Use

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Green Logistics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Business Type Overview

2.2.3 By Mode Overview

2.2.4 By Application Overview

2.2.5 By End Use Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Green Logistics Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Demand for Green Warehouses

4.1.1.2 Growing Concerns Regarding Environmental Pollution

4.1.2 Market Restraints

4.1.2.1 High Capital Expenditures

4.1.2.2 Implementation Complexities

4.1.3 Market Opportunity

4.1.3.1 Rise of E-Commerce

4.1.3.2 Advancements in Technology

4.1.4 Market Challenges

4.1.4.1 Building Partnerships

4.1.4.2 Lack of Infrastructure

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Green Logistics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Green Logistics Market, By Type

6.1 Global Green Logistics Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Transportation

6.1.1.2 Inbound Logistics

6.1.1.3 Outbound Logistics

6.1.1.4 Disposal and Reverse Logistics

6.1.1.5 Warehousing and Material Handling

6.1.1.6 Packaging

Chapter 7 Green Logistics Market, By Business Type

7.1 Global Green Logistics Market Snapshot, By Business Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Warehousing

7.1.1.2 Distribution

7.1.1.3 Value added services

Chapter 8 Green Logistics Market, By Mode

8.1 Global Green Logistics Market Snapshot, By Mode

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Road

8.1.1.2 Rail

8.1.1.3 Sea

8.1.1.4 Air

8.1.1.5 Intermodal

Chapter 9 Green Logistics Market, By Application

9.1 Global Green Logistics Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Retail Consumer Goods

9.1.1.2 Semiconductor and Electronics

9.1.1.3 Chemical and Material

9.1.1.4 Automotive

9.1.1.5 Energy and Utilities

9.1.1.6 Others

Chapter 10 Green Logistics Market, By End Use

10.1 Global Green Logistics Market Snapshot, By End Use

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Healthcare

10.1.1.2 Manufacturing

10.1.1.3 Automotive

10.1.1.4 Banking and financial services

10.1.1.5 Retail and E-Commerce

10.1.1.6 Others

Chapter 11 Green Logistics Market, By Region

11.1 Overview

11.2 Green Logistics Market Revenue Share, By Region 2024 (%)

11.3 Global Green Logistics Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Green Logistics Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Green Logistics Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Green Logistics Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Green Logistics Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Green Logistics Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Green Logistics Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Green Logistics Market, By Country

11.5.4 UK

11.5.4.1 UK Green Logistics Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Green Logistics Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Green Logistics Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Green Logistics Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Green Logistics Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Green Logistics Market, By Country

11.6.4 China

11.6.4.1 China Green Logistics Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Green Logistics Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Green Logistics Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Green Logistics Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Green Logistics Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Green Logistics Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Green Logistics Market, By Country

11.7.4 GCC

11.7.4.1 GCC Green Logistics Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Green Logistics Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Green Logistics Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Green Logistics Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 Agility Public Warehousing Company K.S.C.P.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 ARK India

13.3 AI Futtaim Logistics

13.4 Bollor SE

13.5 DHL International GmbH

13.6 Mahindra Logistics Ltd

13.7 CEVA Logistics

13.8 Deutsche Post DHL Group

13.9 DSV

13.10 FedEx Corporation