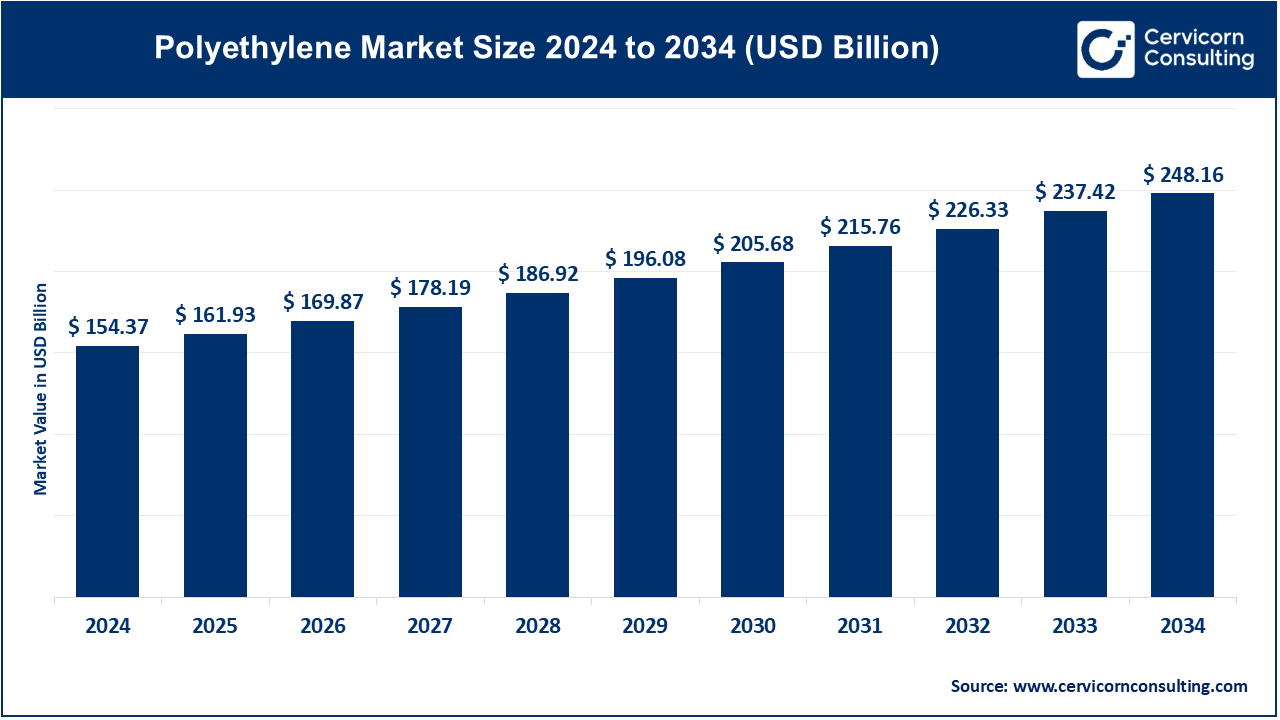

The global polyethylene market size was reached at USD 154.37 billion in 2024 and is expected to exceed around USD 248.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.86% from 2025 to 2034.

The polyethylene market has experienced steady growth over the years, and it is expected to continue expanding due to increasing demand in packaging and consumer goods. The rise in global population and urbanization has led to greater demand for polyethylene-based products, particularly in packaging applications such as flexible films, bottles, and containers. Packaging is the largest sector, driven by e-commerce, food, and beverage industries, where polyethylene's lightweight and protective properties are highly valued. In addition, polyethylene's recyclability has spurred growth in eco-friendly packaging solutions, further fueling market demand. Emerging markets, especially in Asia-Pacific, are becoming key contributors to the market due to the rapid industrialization and urban development. Moreover, the adoption of polyethylene in the automotive industry for making fuel tanks and bumpers, as well as its use in agricultural films for crop protection, are significant drivers of market growth. India plans to invest $87 billion in its petrochemical sector over the next decade to meet the growing demand for polyethylene and other petrochemical products. This investment aims to increase production from 29.62 million tons to 46 million tons by 2030.

Polyethylene (PE) is one of the most commonly used plastics in the world. It is a lightweight, durable, and flexible synthetic polymer made from the polymerization of ethylene, a type of hydrocarbon. Polyethylene is produced in various forms, including low-density polyethylene (LDPE), high-density polyethylene (HDPE), and linear low-density polyethylene (LLDPE), each with different properties. LDPE is soft and flexible, HDPE is more rigid and strong, and LLDPE has enhanced toughness and flexibility. Polyethylene is widely used for packaging materials such as plastic bags, bottles, containers, and plastic films. It is also used in medical devices, piping, and insulation.

Polyethylene is the most widely used thermoplastic in the world, essential to sectors such as packaging, construction, automotive, electrical, and agriculture. It is valued for its lightweight versatility, chemical resistance, and recyclability. As the world moves towards sustainable circular economies, both conventional and renewable polyethylene are experiencing significant evolution driven by environmental goals, trade dynamics, and industrial innovation.

Key Trends Transforming the Polyethylene Sector

Global Production & Trade Snapshot of Polyethylene Market (2024–2025)

| Region | Key Insights |

| Asia-Pacific | Accounts for approximately 54% of HDPE consumption; China alone accounted for around 31% of global resin output in 2020. |

| North America (USA) | Received significant investments of USD 200 billion since 2010 in petrochemical capacity. |

| Europe | Polyethylene production fell by 8.3% in 2023, and recycling also declined, highlighting ongoing challenges. |

| Latin America | Braskem leads with 16 Mt of resin output and operates a Green PE plant. |

| Trade Policies | Malaysia imposes duties ranging from 6.33% to 37.44% on PET. U.S. imports of bio-resins are subject to tariffs. |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 161.93 Billion |

| Projected Market Size in 2034 | USD 248.16 Billion |

| Growth Rate 2025 to 2034 | 4.86% |

| Leading Region | Asia-Pacific |

| Key Segments | Type, End User, Application, Region |

| Key Players | BASF SE, Borealis AG, Braskem, Dow, Exxon Mobil Corporation, Formosa Plastics, INEOS Group, LG Chem, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, MOL Group, SABIC, China Petrochemical Corporation (Sinopec) |

The polyethylene market is segmented into type, end user, application and region. Based on type, the market is classified into Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Medium-Density Polyethylene (MDPE), and Linear Low-Density Polyethylene (LLDPE). Based on end user, the market is classified into packaging, construction, automotive, agriculture, and consumer goods. Based on application, the market is classified into bottles & containers, films & sheets, bags & sacks, pipes & fittings, other.

Based on type, the global market is segmented into low-density polyethylene (LDPE), high-density polyethylene (HDPE) and medium-density polyethylene (MDPE). The high-density polyethylene (HDPE) segment has held dominant possition in market in 2024.

High-Density Polyethylene (HDPE): The HDPE segment has accounted revenue share of 49.20% in 2024. HDPE is a tough, formal plastic, displaying high tensile strength and rigidity. It is often used for the production of containers, bottles, and piping systems. The driver of HDPE is its ruggedness, making it suitable for applications requiring strength and resistance to chemicals. Moreover, the fact that HDPE can be recycled supports sustainability initiatives in packaging and construction.

Medium-Density Polyethylene (MDPE): MDPE is an intermediate compound between flexible and rigid plastics; this makes it suitable for lots of different applications; from gas pipes to wrapping materials. The main driver of MDPE is overcoming stress imposed during environmental use and providing good impact strength and low-temperature properties. That is the reason why this polymer has a big advantage in those sectors that require durable materials: utilities and packaging.

Low-Density Polyethylene (LDPE): LDPE is a soft and lightweight plastic with an excellent resilience to an impact and moisture. Generally, it is used in packaging plastic bags, wraps, and films. The major advantage of using LDPE is its versatility and low cost and hence is suitable for many consumer and industrial applications. The fact that it can be recycled and re-used increases its appeal with the environmentally-conscious market.

Based on application, the global market is segmented into bottles and containers, films and sheets, bags and sacks, pipes and fittings and others. The bottles and containers segment has held leading position in the market in 2024.

Bottles & Containers: The bottles and containers segment has accounted revenue share of 39.60% in 2024. This application of polyethylene focuses on producing bottles and containers for beverages, household products, and industrial chemicals. The driving factor for this segment is the growing demand for lightweight, durable, and shatter-resistant packaging solutions. Additionally, the shift toward recyclable and sustainable packaging is propelling innovations in polyethylene bottle designs.

Films & Sheets: Polyethylene films and sheets are used for packaging, agricultural, and construction applications. The driving factor for this segment is the increasing demand for flexible and protective packaging solutions that are lightweight yet strong. The versatility of polyethylene films in various applications, including food packaging and construction membranes, continues to drive growth in this category.

Bags & Sacks: This application includes the production of various bags and sacks for retail, agricultural, and industrial use. The driving factor for the bags and sacks segment is the ongoing demand for convenient and cost-effective packaging solutions. Innovations in bag design, including the use of recycled materials and biodegradable options, are further stimulating market growth.

Pipes & Fittings: Polyethylene is widely used in manufacturing pipes and fittings for water, gas, and sewage applications. The driving factor for this segment is the growing need for durable, corrosion-resistant, and lightweight piping systems. The increasing investment in infrastructure development and the transition to efficient water management systems further enhance the demand for polyethylene pipes.

Others: This category encompasses various niche applications, including medical devices, toys, and automotive parts. The driving factor for these applications is the adaptability and versatility of polyethylene in meeting diverse industry requirements. Continuous innovation in processing techniques allows for the development of specialized products that cater to unique market needs.

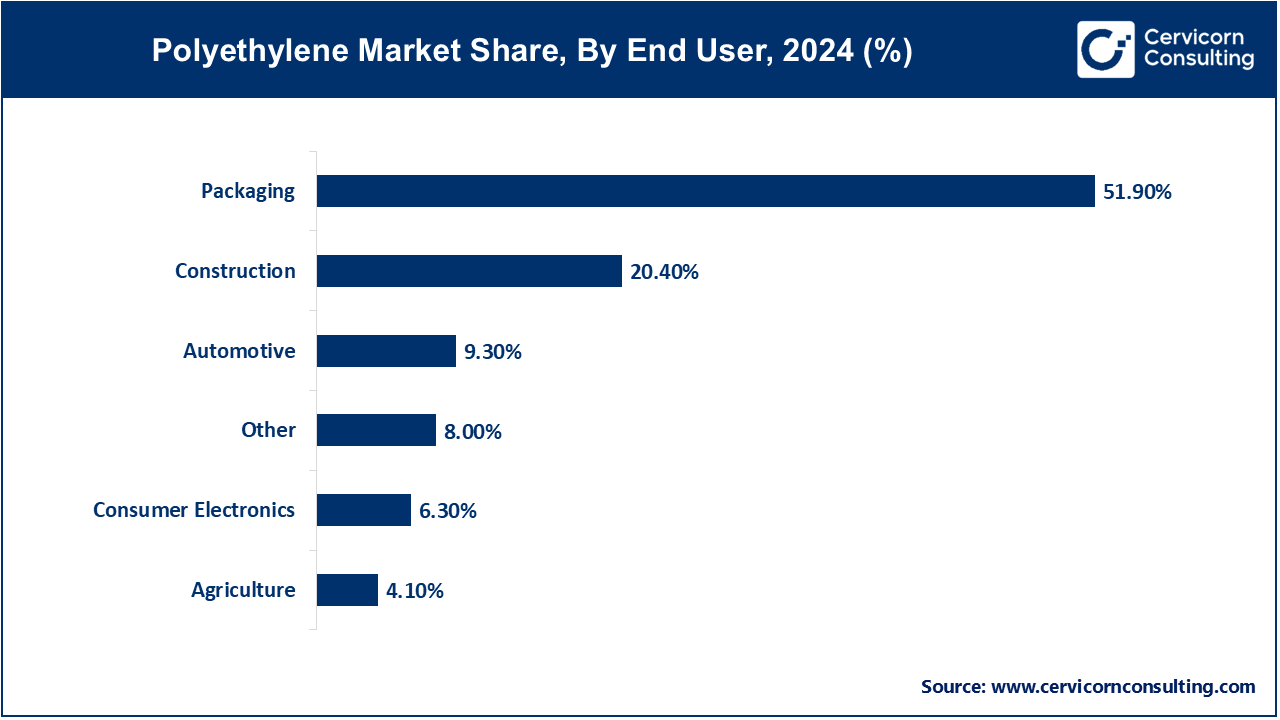

Based on end user, the global market is segmented into packaging, construction, automotive, agriculture, consumer goods and others. The packaging segment has held leading position in market in 2024.

Packaging: The packaging segment has accounted revenue share of 51.90% in 2024. The packaging industry is the largest consumer of polyethylene, utilizing it for films, bags, and containers. The primary driving factor is the increasing demand for packaged food and beverages, which require durable and lightweight materials to maintain product integrity and extend shelf life. Additionally, innovations in sustainable packaging solutions are fostering growth in this segment.

Construction: The construction segment has accounted revenue share of 20.40% in 2024. In the construction sector, polyethylene is used for pipes, insulation, and geomembranes. Its growth is driven by the rising construction activities globally and the need for durable, weather-resistant materials. The push for infrastructure development and the adoption of HDPE in plumbing applications further enhance demand.

Automotive: The automotive segment has accounted revenue share of 9.30% in 2024. Polyethylene is increasingly utilized in automotive applications for parts, fuel tanks, and interior components due to its lightweight and durable properties. The growing emphasis on fuel efficiency and reduced emissions in vehicles is a key driver, as manufacturers seek to incorporate lighter materials to enhance performance.

Agriculture: The agriculture segment has accounted revenue share of 4.10% in 2024. In agriculture, polyethylene is used for films, mulch, and drip irrigation systems. The segment is driven by the need for efficient water management and the rising adoption of advanced farming techniques. The use of polyethylene in greenhouse applications is also increasing, providing a controlled environment for crop production.

Consumer Goods: The consumer goods segment uses polyethylene in a variety of applications, including toys, containers, and household items. The driving factor is the growing consumer preference for lightweight, durable, and cost-effective products. The trend towards e-commerce has also increased demand for polyethylene packaging solutions in shipping consumer goods.

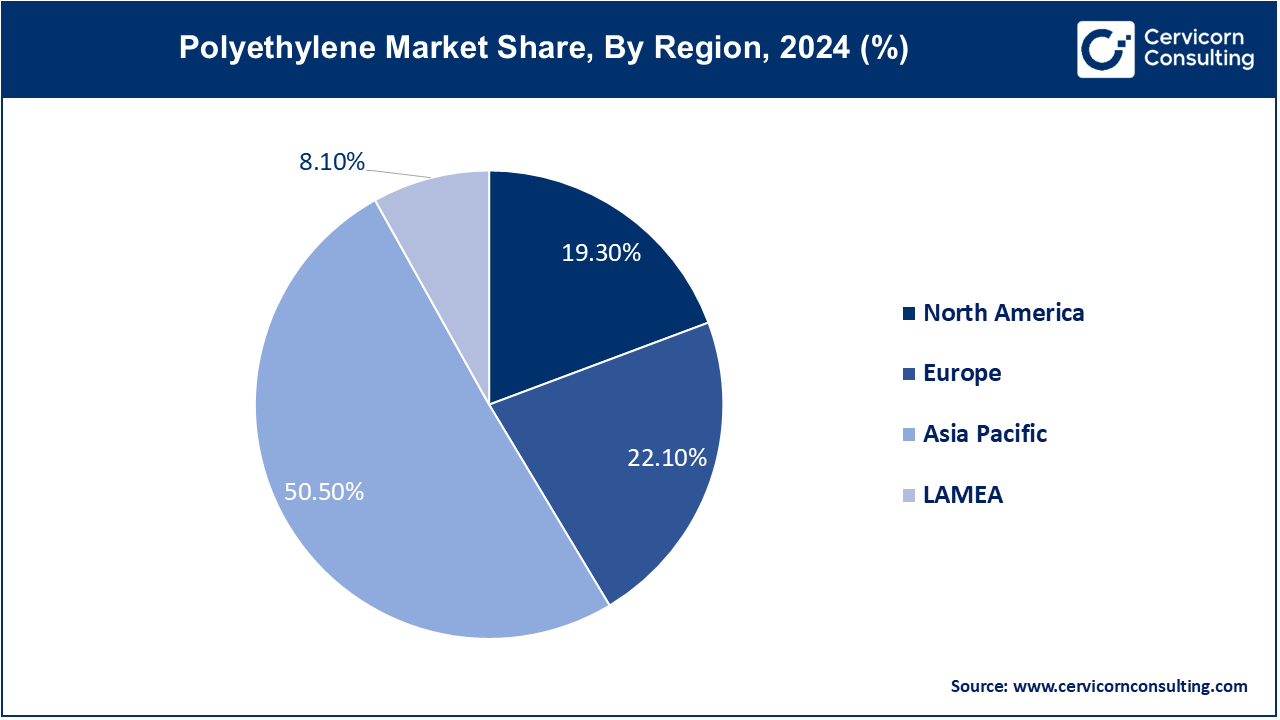

The polyethylene market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific is the largest and fastest-growing region in this market. Here’s an in-depth look at each region.

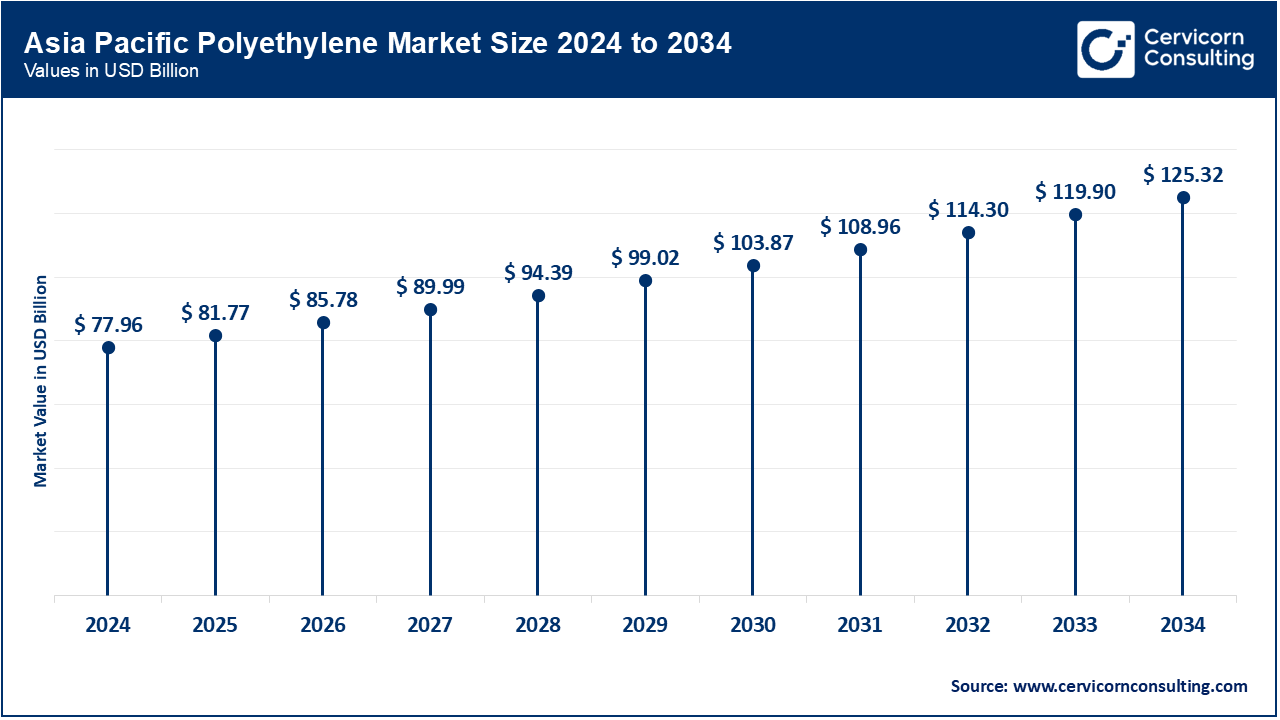

The Asia-Pacific polyethylene market size was valued at USD 77.96 billion in 2024 and is expected to reach around USD 125.32 billion by 2034. The Asia-Pacific region is the largest and fastest-growing market for polyethylene, primarily driven by China and India. China, as the world's largest consumer of polyethylene, has a robust manufacturing base, particularly in packaging and construction applications. India is witnessing significant growth due to urbanization and rising disposable incomes, leading to increased demand for consumer goods and packaging solutions. Southeast Asian countries, such as Indonesia and Vietnam, are also emerging markets, supported by their expanding economies and growing industrial sectors, which contribute to the polyethylene demand.

The North America polyethylene market size was estimated at USD 29.79 billion in 2024 and is predicted to hit around USD 47.90 billion by 2034. The North America is primarily driven by the United States and Canada, with a growing demand for packaging materials and consumer goods. The U.S. is a major producer and consumer, benefiting from abundant shale gas, which serves as a key feedstock for polyethylene production. Mexico is also emerging as a significant player, bolstered by its manufacturing sector and increased demand for polyethylene in packaging and automotive applications. Regulatory frameworks in these countries are also focusing on sustainability, prompting shifts toward recyclable polyethylene solutions.

The Europe polyethylene market size was valued at USD 34.12 billion in 2024 and is projected to hit around USD 54.84 billion by 2034. The Europe market is characterized by high consumption rates in countries such as Germany, France, and the United Kingdom. The region faces stringent environmental regulations, pushing manufacturers toward sustainable production practices and biodegradable alternatives. Germany leads in technological advancements and recycling initiatives, while France emphasizes circular economy strategies. Additionally, Eastern European countries like Poland and Hungary are experiencing increased polyethylene demand due to rising industrial activities and consumer spending, contributing to overall market growth in the region.

The LAMEA polyethylene market was valued at USD 12.50 billion in 2024 and is anticipated to reach around USD 20.10 billion by 2034. The LAMEA region, comprising Latin America, the Middle East, and Africa, is experiencing steady growth in the polyethylene industry. In Latin America, Brazil and Argentina are the key players, with growing demand in packaging and construction sectors. The Middle East, particularly Saudi Arabia and the UAE, benefits from abundant petrochemical resources, making it a significant producer of polyethylene. In Africa, countries like South Africa and Nigeria are witnessing increasing demand driven by infrastructure development and urbanization. However, the region faces challenges such as political instability and fluctuating oil prices, which can impact market growth.

The polyethylene market is dominated by a few central players, including BASF SE, Borealis AG, Braskem, Dow, among others. The polyethylene market is primarily driven by major players such as BASF SE, Borealis AG, Braskem, and Dow. These companies are recognized for their innovative solutions and significant investments aimed at enhancing production capacity and sustainability. For instance, Dow’s recent $6.5 billion investment in the Fort Saskatchewan Path2Zero project underscores their commitment to achieving carbon neutrality by 2050 while expanding polyethylene capacity by 2 million metric tons annually. These organizations not only lead in production but also emphasize sustainability and circular economy initiatives, further solidifying their positions in the polyethylene market.

CEO Statements

Peter Vanacker, CEO of LyondellBasell

“Peter Vanacker, CEO of LyondellBasell, recently addressed the current state of the polyethylene market during a quarterly earnings call. He noted that "demand for nondurables has been consistent," indicating a stable market for packaging applications. Vanacker also mentioned that destocking across the packaging value chain seems to be complete, which could lead to potential restocking in the near future.”

Jim Fitterling, CEO of Dow Inc.

“Jim Fitterling, CEO of Dow Inc., discussed the company's recent initiatives in sustainable packaging during a conference. He emphasized that Dow is committed to developing eco-friendly polyethylene products, such as a sustainable yogurt pouch launched in partnership with Mengniu in China. This move aligns with growing consumer preferences for environmentally friendly packaging solutions and highlights Dow's focus on innovation within the polyethylene sector.”

Strategic investments and partnerships are driving the dynamic evolution of the polyethylene industry, with industry leaders prioritizing enhanced production capabilities and sustainability initiatives. Major companies are focusing on various aspects of polyethylene, including the development of new manufacturing facilities and the expansion of existing production capacities, as exemplified by Dow's $6.5 billion investment in the Fort Saskatchewan Path2Zero project, aimed at achieving carbon neutrality by 2050. Additionally, collaborations such as the Borealis AG and TotalEnergies SE joint venture to build the Borstar PE unit highlight the push for increased production efficiency.

Companies are also uniting to promote sustainability, as demonstrated by Dow's partnership with Mengniu to launch recyclable PE yogurt pouches in China. These collective efforts not only bolster production but also aim to create comprehensive platforms that enhance access to diverse tools and insights, ultimately improving productivity and resource management across the industry. Some notable examples of key developments in the polyethylene industry include:

Market Segmentation

By Type

By End User

By Application

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Polyethylene

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By End User Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Polyethylene Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased applications in agriculture

4.1.1.2 Construction activity expansion

4.1.1.3 A carousel of technological advancements

4.1.1.4 The growing move towards bio-based products

4.1.2 Market Restraints

4.1.2.1 The Green Initiative

4.1.2.2 Circular Recycling Infrastructure

4.1.2.3 Alien Materials

4.1.3 Market Opportunity

4.1.3.1 Growing circular economy initiatives

4.1.3.2 Innovation of Biodegradable Polyethylene

4.1.3.3 Emerging markets expansion

4.1.3.4 Increased focus on light weighting in automobiles

4.1.4 Market Challenges

4.1.4.1 Environmental regulations

4.1.4.2 Plastic pollution

4.1.4.3 Raw Material Price Fluctuations

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Polyethylene Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Polyethylene Market, By Type

6.1 Global Polyethylene Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Low-Density Polyethylene (LDPE)

6.1.1.2 High-Density Polyethylene (HDPE)

6.1.1.3 Medium-Density Polyethylene (MDPE)

6.1.1.4 Linear Low-Density Polyethylene (LLDPE)

Chapter 7 Polyethylene Market, By End User

7.1 Global Polyethylene Market Snapshot, By End User

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Packaging

7.1.1.2 Construction

7.1.1.3 Automotive

7.1.1.4 Agriculture

7.1.1.5 Consumer Goods

Chapter 8 Polyethylene Market, By Application

8.1 Global Polyethylene Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Bottles & Containers

8.1.1.2 Films & Sheets

8.1.1.3 Bags & Sacks

8.1.1.4 Pipes & Fittings

8.1.1.5 Other

Chapter 9 Polyethylene Market, By Region

9.1 Overview

9.2 Polyethylene Market Revenue Share, By Region 2024 (%)

9.3 Global Polyethylene Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Polyethylene Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Polyethylene Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Polyethylene Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Polyethylene Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Polyethylene Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Polyethylene Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Polyethylene Market, By Country

9.5.4 UK

9.5.4.1 UK Polyethylene Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Polyethylene Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Polyethylene Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Polyethylene Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Polyethylene Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Polyethylene Market, By Country

9.6.4 China

9.6.4.1 China Polyethylene Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Polyethylene Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Polyethylene Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Polyethylene Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Polyethylene Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Polyethylene Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Polyethylene Market, By Country

9.7.4 GCC

9.7.4.1 GCC Polyethylene Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Polyethylene Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Polyethylene Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Polyethylene Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 BASF SE

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Borealis AG

11.3 Braskem

11.4 Dow

11.5 Exxon Mobil Corporation

11.6 Formosa Plastics

11.7 INEOS Group

11.8 LG Chem

11.9 LyondellBasell Industries Holdings B.V.

11.10 Mitsubishi Chemical Corporation