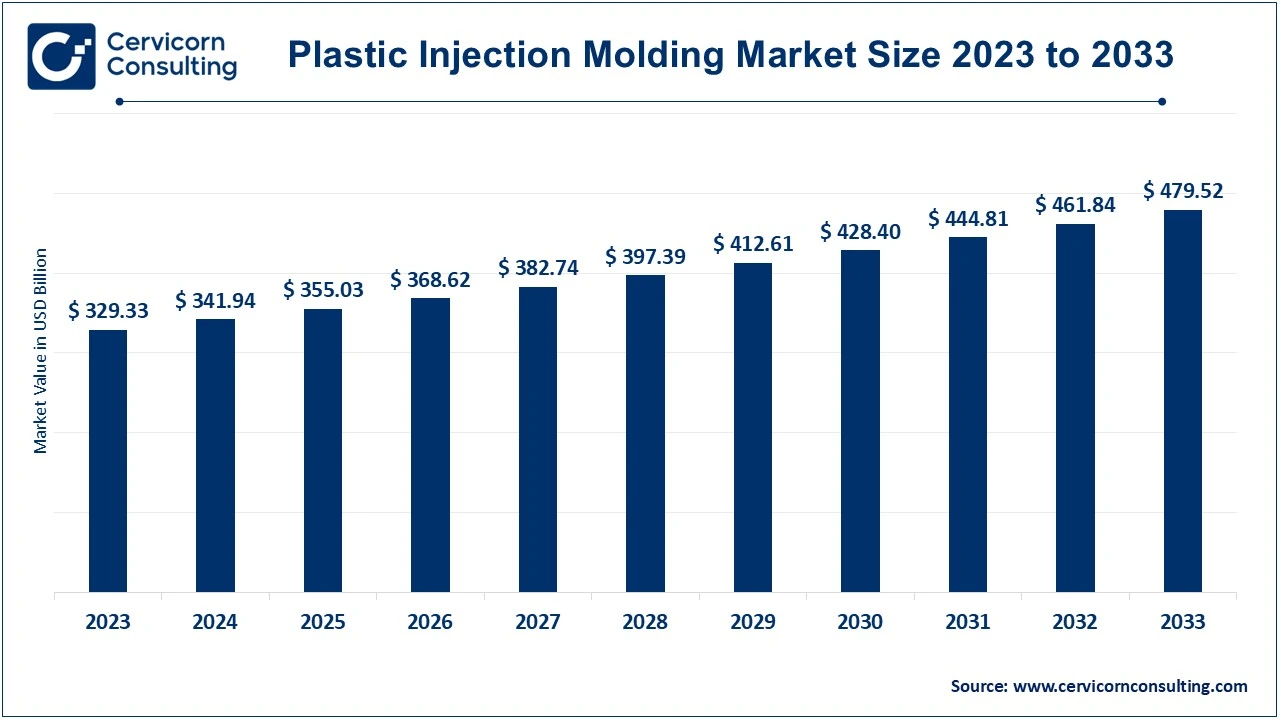

The global plastic injection molding market size was estimated at USD 341.94 billion in 2024 and is expected to be worth around USD 479.52 billion by 2033, growing at a compound annual growth rate (CAGR) of 4.15% from 2024 to 2033.

The plastic injection molding market is evolving rapidly, driven by the increasing demand for lightweight, durable, and cost-effective products across various sectors. The automotive industry, in particular, is one of the largest contributors to market growth, as manufacturers increasingly rely on injection molding to create complex components with high precision. Moreover, the growing adoption of electric vehicles (EVs) has amplified the need for efficient production of parts such as battery housings, charging components, and interior features, further driving demand for plastic injection molding. The medical and healthcare sectors are also playing a crucial role in the expansion of the market. With the rise of advanced medical devices, diagnostic equipment, and packaging for pharmaceuticals, there is a heightened need for custom-designed, high-quality plastic components that can meet stringent regulatory standards. In 2021, the United States significantly increased its imports of injection-molding machines, with purchases amounting to USD 822 million from January to October—a 43% rise compared to the same period in the previous year. The total imports for 2021 were estimated to surpass USD 1 billion.

Plastic injection molding is a manufacturing process used to produce parts by injecting molten plastic into a mold. The plastic is first heated until it melts, then injected under high pressure into a mold cavity where it cools and solidifies into the desired shape. This process is widely used to create a variety of products, from small components like bottle caps to larger items like automotive parts. The key advantage of injection molding is that it can produce high volumes of parts with consistent quality and precision, making it an essential process for industries like automotive, electronics, and consumer goods.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 355.03 Billion |

| Expected Market Size in 2033 | USD 479.52 Billion |

| Growth Rate 2024 to 2033 | 4.15% |

| Leading Region | Asia-Pacific |

| Key Segments | Raw Material, Application, Region |

| Key Companies | ExxonMobil Corporation, BASF SE, DuPont de Nemours, Inc., Dow, Inc., Huntsman International LLC., Magna International, Inc., IAC Group, Kreate, Eastman Chemical Company, INEOS Group, LyondellBasell Industries Holdings B.V., SABIC |

Increased Government Support and Incentives

Growing Demand in Houseware Market

High Initial Costs

Stringent Regulations

Manufacturing Lightweight and Electrified Vehicles

Growing Demand from the Healthcare Sector

Presence of Alternative Technologies

Environmental Concerns

The plastic injection molding market is segmented into raw material, application, and region. Based on raw material, the market is classified into Polypropylene (PP), Acrylonitrile butadiene styrene (ABS), High-density polyethylene (HDPE), Polystyrene (PS), Polyethylene, Polyvinyl Chloride (PVC), Polycarbonate, Polyamide, and Others. Based on application, the market is classified into automotive, packaging, building & construction, electrical & electronics, medical, and others.

Based on raw material, the plastic injection molding market is segmented into polypropylene (PP), acrylonitrile butadiene styrene (ABS), high-density polyethylene (HDPE), polystyrene (PS), polyethylene, polyvinyl chloride (PVC), polycarbonate, polyamide, and others.

Polypropylene (PP): Polypropylene is the preferred resin for the automotive and construction industries because it is lightweight and impact-resistant, which are important properties in terms of safety. It is one of the lowest-density plastics and is safe for food containers because it does not leach chemicals into food products. Polypropylene plastic injection molding is used to manufacture various parts and products of all shapes and sizes. Some of the major reasons for the widespread use of polypropylene in injection molding are moisture resistance, high moldability, food-grade availability, excellent food grade, chemical resistance, and low cost.

Acrylonitrile butadiene styrene (ABS): Acrylonitrile butadiene styrene (ABS) has high strength, good toughness, and is easily moldable. ABS is used in numerous applications in automotive parts, packaging, consumer products, industrial parts, and others. It is mainly used for these materials because it has high impact resistance, toughness, and scratch resistance and offers excellent dimensional stability.

High-density polyethylene (HDPE): Typically found in pellet form, high-density polyethylene (HDPE) is a resin that is designed for injection molding applications. It can withstand high impact resistance, stress cracking resistance, and exceptional durability. HDPE is an efficient thermoplastic with strong impact resistance and good tensile strength. This standard plastic is also very moisture-resistant and relatively easy to manufacture using the injection molding process. HDPE is used in many applications but has a high thermal expansion rate.

Polystyrene (PS): Polystyrene (PS) is a standard thermoplastic with an amorphous structure. It has excellent resistance to gamma rays and therefore supports sterilization by radiation. Polystyrene plastics can be either transparent or opaque, and unmodified polystyrene is clear, rigid, brittle, and moderately strong. Additionally, polystyrene is low-cost and supports injection molding. Polystyrene has several advantages that make it an ideal material for applications ranging from injection-molded automotive parts to medical products.

Others: The others include low-density polyethylene (LDPE), polyethylene terephthalate (PET), and polyvinyl chloride (PVC). Low-density polyethylene (LDPE) has good strength in relative to its density and is flexible even at low temperatures. LDPE is odorless, sterile, and waterproof, and can withstand considerable stretching before breaking. LDPE also maintains its structural integrity and has low water absorption. Applications of injection-molded LDPE include hose connections for water supplies. Polyethylene terephthalate (PET/PETP) is a thermoplastic, semi-crystalline polymer with very high dimensional stability, excellent wear resistance, and low coefficient of sliding friction. PET has good chemical resistance and low moisture absorption. PET plastic is well suited for injection-molded parts with high requirements for dimensional accuracy and surface quality. Injection molding of thin-walled and dimensionally stable PET parts such as rings, sliding elements, washers, or bushings improves the durability and running conditions of applications. PVC injection molding is a manufacturing process used to create parts from polyvinyl chloride (PVC), one of the most widely used plastics in the world. PVC does not absorb moisture and has good chemical resistance. Although it is not recommended for high-temperature applications, PVC is considered flame retardant because it is self-extinguishing. Injection molded PVC is used in the healthcare, construction, and consumer goods industries.

Based on application, the plastic injection molding market is segmented into automotive, medical, packaging, building & construction, electrical & electronics and others.

Automotive: Weight reduction in vehicles is one of the top priorities for automakers to increase fuel economy. Automotive injection molding is a manufacturing process that helps in creating a wide range of automotive parts, including body panels, engine parts, and interior components, through injecting plastic under high pressure. It is one of the most popular processes for mass producing plastic parts because it can quickly and effectively produce large quantities. Some of the frequently used plastics to make injection molded automotive parts are nylon, polypropylene, ABS, and other specialty polymers. The increasing use of plastics as a replacement for metals and alloys in automotive components is expected to drive product demand in the automotive end-use segment and provide tremendous opportunities for injection molded plastics to enter the market.

Packaging: The segment is driven by applications in food and beverage, pharmaceuticals, and retail. The demand for plastic closures and caps is driven by the secular shift in consumer packaging as people have switched from glass and metal to plastic due to the excellent properties of plastic packaging. Many injection molding companies work closely with food and beverage, pharmaceutical, and other manufacturers as these companies contend with government regulations and legal obligations. The packaging segment is also driven by the demand from various other industries such as personal care and beauty, biomedical, and others.

Building & Construction: Purchasing premium building materials, such as injection-molded plastic assemblies and products, is one of the secrets to undertaking successful construction projects. These materials comprise of a range of sturdy polymers, each of which has some unique qualities and that allows it to be used in a variety of construction settings. Injection molded plastics are also used for many purposes throughout the construction industry. Plastics can be frequently used, as building materials for piping, walls, windows, flooring, roofing, and insulation. Additionally, they are molded into assemblies and parts for a range of construction tools, including heavy machinery and portable power tools.

Electrical & Electronics: Electronic components are primarily made by plastic injection molding, these are used for the process because of their flexibility, inert qualities, conductive and non-conductive qualities, and inexpensive assembly. Electronic components are made from raw plastic that are in the form of pellets or granules at first, and are then converted using injection molding. The plastic is melted and then injected into a pre-made shape using an injection molding machine. The plastic part is removed from the mold for direct use or any form of additional finishing after it has cooled. Injection molded plastics are lightweight, durable and inexpensive and are used in countless applications such as coffee makers, irons, blenders, hair dryers and electric shavers.

Medical: Injection molding is used in the medical industry to manufacture small and complex items such as dental implants, prosthetic replacements, endoscopic instruments, implantable components, orthopedic products, and drug delivery devices. Increasing demand for disposable medical items, technological developments, and increasing plastic consumption in healthcare applications are driving industry growth in medical injection molding.

Others: The others segment includes food & beverage, consumer goods, and aerospace. Equipment used in the processing of food and beverages must adhere to safety regulations for its parts and components. GMA compliance and FDA certification are two examples of these. To meet the regulatory standards, plastic injection molded parts for these industries are made from food-grade materials, which are generally non-toxic and BPA-free. There are numerous applications for plastic in the consumer goods section. For most plastic consumer goods, injection molding has long been the go-to manufacturing process because of its speedy and affordable mass production. Certain requirements must be met by aerospace components. They need to be strong, resilient, and light to survive drastic temperature fluctuations. Panels, housings, and chassis parts are the most often injection-molded parts used in aerospace.

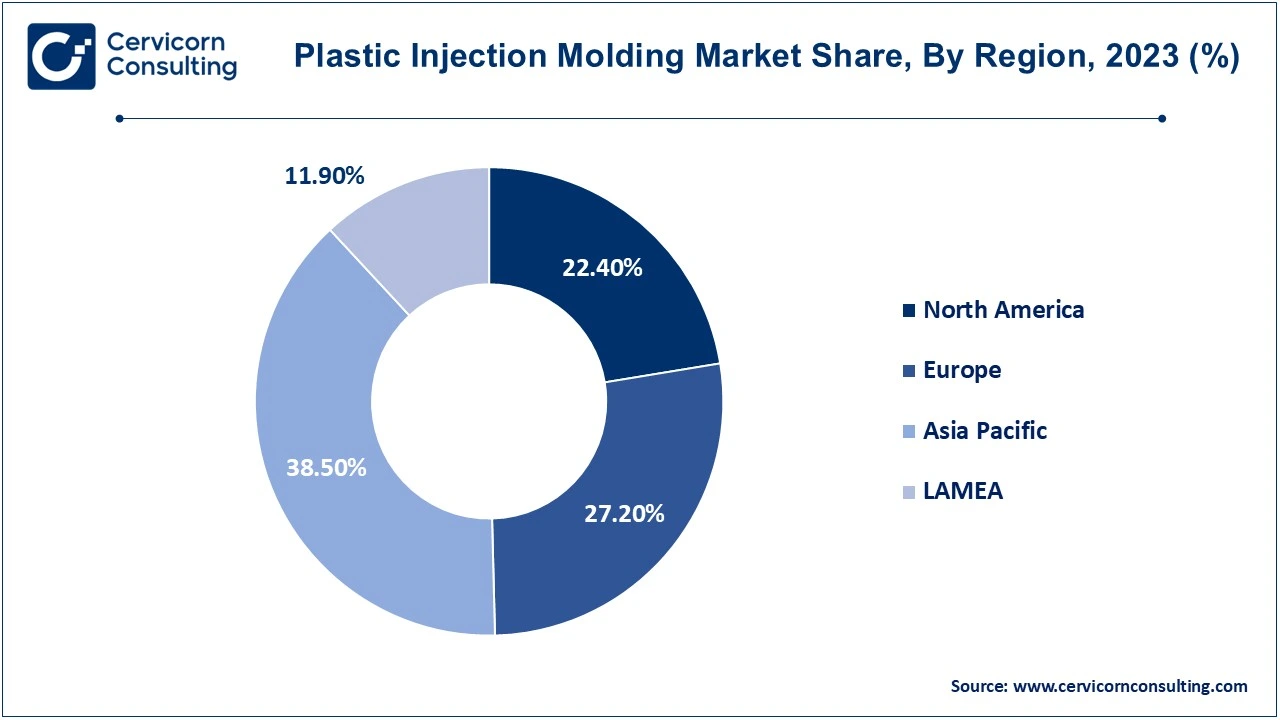

The plastic injection molding market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific has lead the market in 2023 and will also witness strong growth in upcoming years. Here is a brief overview of each region:

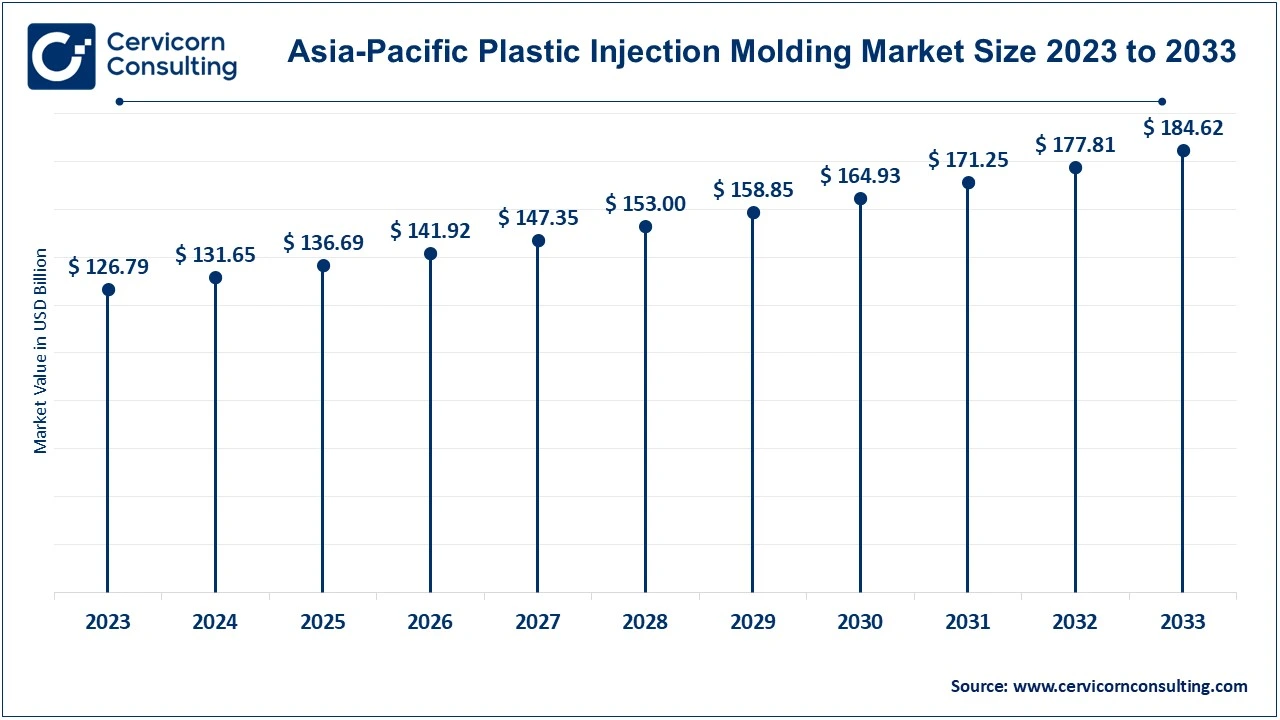

The Asia-Pacific plastic injection molding market size was estimated at USD 126.79 billion in 2023 and is projected to hit around USD 184.62 billion by 2033. Increasing demand for injection molded plastics from packaging and automotive industries is the major driver of the Asia Pacific plastic injection molding market. China is a major consumer due to growing population and rapid urbanization and hence will have a significant impact on the growth of the regional market. Moreover, increasing economic growth in Asia Pacific and consumer inclination towards efficient and smart buildings have led manufacturers to develop high performance products in construction. The region is expected to witness the highest growth globally in this market. China, India and Japan are major countries contributing to this market growth due to demand for healthy food with proper packaging and rising construction activities in these countries.

The North America plastic injection molding market size was valued at USD 73.77 billion in 2023 and is expected to reach around USD 107.41 billion by 2033. The North America is driven by exponentially increasing demand from the packaging and electronics industries of this region. For example, the US still manufactures sophisticated computer chips that are used in various fields such as medical devices, military equipment, communication technologies, and others. There is also a large manufacturer base in this region, and hence the market is expected to exhibit healthy growth in the near future.

The Europe plastic injection molding market size was estimated at USD 89.58 billion in 2023 and is predicted to surpass around USD 130.43 billion by 2033. The increasing demand for convenient packaging for food and beverages has broadened the vision of packaging product manufacturers. Companies such as Berry Global and Mondi Group are investing a large number of resources in developing innovative packaging products including bottles with novel shapes, easy-to-pour and sturdy caps and closures, and durable containers. These products are mainly manufactured using injection molding plastics, and hence the demand across the European region is expected to grow steadily during the forecast period. Moreover, the use of molded plastics for electronic goods is the other key factor driving the market growth in Europe.

The LAMEA plastic injection molding market size was accounted for USD 39.19 billion in 2023 and is anticipated to reach around USD 57.06 billion by 2033. The construction industry in Latin America is growing due to growing population and improved living conditions. Moreover, the demand for molded plastic furniture is gaining traction in the region as it is more affordable as compared to metal and wood alternatives, leading to slow but steady growth of the market. However, the lack of manufacturing infrastructure in the region is a key hindrance to the growth of the market. The demand for molded plastic products such as furniture, consumer goods, and electronic components is growing rapidly in the Middle East, primarily because they are cheaper and have similar physical properties to conventional metal products. Therefore, the Middle East market is expected to witness golden times during the forecast period.

Among the emerging players, BASF SE, HTI Plastics, DuPont, and others have developed strong regional presence, product offerings and distribution channels. In August 2023, BASF announced the development of a new bio-based nylon resin called PA 6.10 CF, it is made from renewable resources and is reinforced with carbon fiber for getting the added strength and stiffness. The new resin is expected to be used in a variety of applications, including auto parts, sporting goods and electronics. In May 2023, the company Biomerics completed a merger with Precision Concepts' medical business. This transaction included the acquisition of both Precision Concepts International's ("PCI") medical business and Precision Concepts Group ("PCG"). With 13 locations and more than 1.2 million square feet of manufacturing space, the merged company is said to operate under Biomerics. With their creative solutions and calculated moves, these major players are consolidating their position as leaders and exerting more influence in the rapidly expanding plastic injection molding industry.

CEO Statements

Boo-Keun Yoon, President and CEO of Samsung Electronics

"The IoT is bringing a significant change to our business. It is already shaping a new ecosystem within and outside of the tech industry, bringing infinite new opportunities. The convergence of technologies will accelerate, and collaborations will multiply to fill the needs of consumers."

Jim Fitterling, Chairman and CEO of Dow

"Plastics are essential to our modern world. They protect our health in medical products, prevent foods from spoiling too quickly, make wind turbines more efficient, and are critical in enabling electric vehicles."

Key players in the plastic injection molding industry are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies. Some notable developments in the plastic injection molding sector include:

These advancements mark a notable expansion in the plastic injection molding market, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Raw Material

By Application

By Regions

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Plastic Injection Molding

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Raw Material Overview

2.2.2 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Plastic Injection Molding Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Government Support and Incentives

4.1.1.2 Growing Demand in Houseware Market

4.1.2 Market Restraints

4.1.2.1 High Initial Costs

4.1.2.2 Stringent Regulations

4.1.3 Market Opportunity

4.1.3.1 Manufacturing Lightweight and Electrified Vehicles

4.1.3.2 Growing Demand from the Healthcare Sector

4.1.4 Market Challenges

4.1.4.1 Presence of Alternative Technologies

4.1.4.2 Environmental Concerns

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Plastic Injection Molding Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Plastic Injection Molding Market, By Raw Material

6.1 Global Plastic Injection Molding Market Snapshot, By Raw Material

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Polypropylene (PP)

6.1.1.2 Acrylonitrile butadiene styrene (ABS)

6.1.1.3 High-density polyethylene (HDPE)

6.1.1.4 Polystyrene (PS)

6.1.1.5 Polyethylene

6.1.1.6 Polyvinyl Chloride (PVC)

6.1.1.7 Polycarbonate

6.1.1.8 Polyamide

6.1.1.9 Others

Chapter 7 Plastic Injection Molding Market, By Application

7.1 Global Plastic Injection Molding Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Automotive

7.1.1.2 Packaging

7.1.1.3 Building & Construction

7.1.1.4 Electrical& Electronics

7.1.1.5 Medical

7.1.1.6 Others

Chapter 8 Plastic Injection Molding Market, By Region

8.1 Overview

8.2 Plastic Injection Molding Market Revenue Share, By Region 2023 (%)

8.3 Global Plastic Injection Molding Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Plastic Injection Molding Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Plastic Injection Molding Market, By Country

8.5.4 UK

8.5.4.1 UK Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Plastic Injection Molding Market, By Country

8.6.4 China

8.6.4.1 China Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Plastic Injection Molding Market, By Country

8.7.4 GCC

8.7.4.1 GCC Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Plastic Injection Molding Market Revenue, 2021-2033 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9 Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2021-2023

9.1.3 Competitive Analysis By Revenue, 2021-2023

9.2 Recent Developments by the Market Contributors (2023)

Chapter 10. Company Profiles

10.1 ExxonMobil Corporation

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 BASF SE

10.3 DuPont de Nemours, Inc.

10.4 Dow, Inc.

10.5 Huntsman International LLC.

10.6 Magna International, Inc.

10.7 IAC Group

10.8 Kreate

10.9 Eastman Chemical Company

10.10 INEOS Group

10.11 LyondellBasell Industries Holdings B.V.

10.12 SABIC