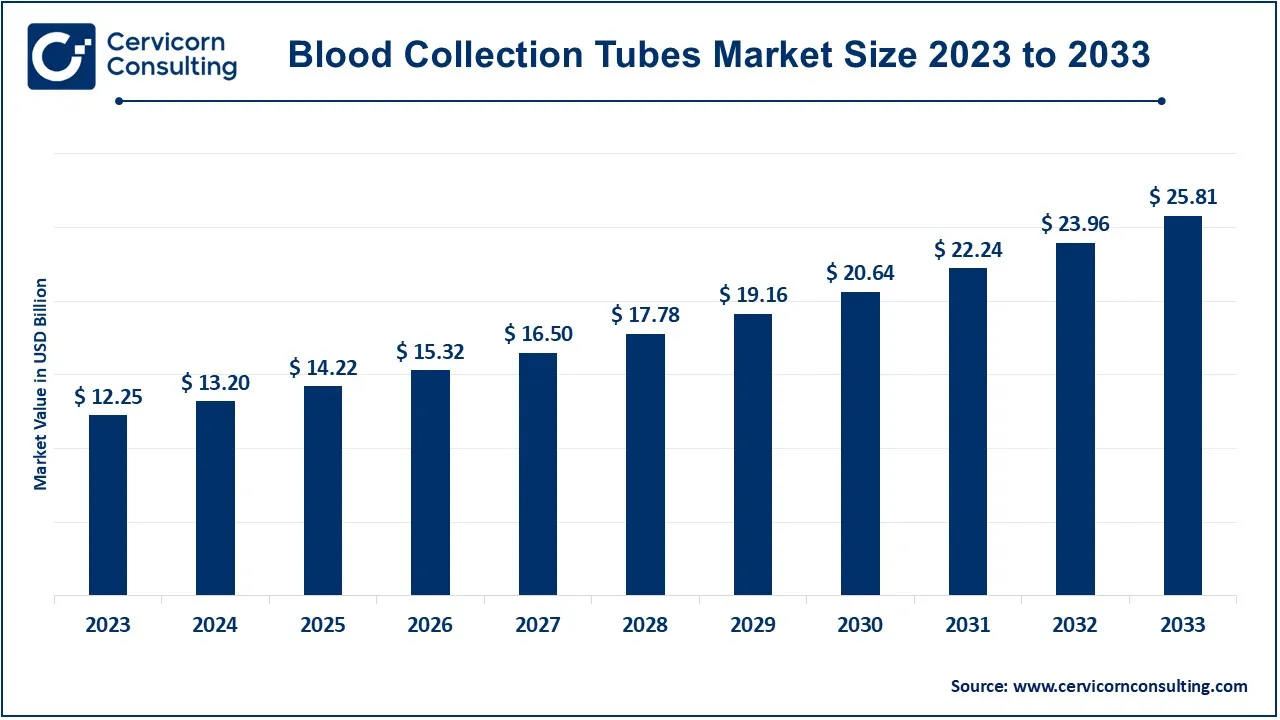

The global blood collection tube market size was valued at USD 12.25 billion in 2023 and is expected to be worth around USD 25.81 billion by 2033, growing at a compound annual growth rate (CAGR) of 7.73% from 2024 to 2033. U.S. blood collection tubes market size was valued at USD 4 billion in 2023.

In recent years, the global blood collection tubes market has shown significant growth due to the rising demand for diagnostic testing and laboratory procedures. Factors contributing to the expansion include the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions, which require regular monitoring. Additionally, technological advancements in diagnostic testing have made blood collection tubes more efficient and accurate in delivering precise results, thus enhancing their adoption in healthcare settings worldwide. The growing trend toward preventive healthcare has further propelled the market, as early detection is crucial for effective treatment. The blood collection tube market is also benefiting from an increase in medical procedures and a growing healthcare infrastructure, particularly in emerging economies. These regions are investing in healthcare to improve diagnostics, leading to higher demand for blood collection tubes. Between March 2023 and February 2024, the growth rate of blood collection tube imports stood at 78%, while exports grew by 47% during the same period.

A blood collection tube is a specialized container used in medical settings to collect and store blood samples for laboratory testing. These tubes are typically made of plastic or glass and come in various sizes, depending on the amount of blood required. Blood collection tubes are often pre-treated with chemicals that help preserve the sample for specific tests, such as clotting or preventing microbial growth. Some tubes contain anticoagulants (to prevent clotting) like EDTA, heparin, or sodium citrate, while others are without additives for tests that require serum. The tube is sealed with a colored cap, each color representing the type of additive inside. Blood collection tubes are used in various diagnostic tests, from simple blood counts to more complex tests like blood typing or pathogen detection.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 14.22 Billion |

| Estimated Market Size in 2033 | USD 25.81 Billion |

| Growth Rate 2024 to 2033 | 7.72% |

| High-impact Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Product, Material, End User, Region |

| Key Companies | Abacus ALS, Greiner AG, Nipro Medical Corporation, Abbott, Quest Diagnostics, Qiagen, Improve Medical, Medtronic, SARSTEDT AG & Co. KG, Chengdu Rich Science Industry Co., Ltd. |

The blood collection tube market is segmented into product, material, end-user and region. Based on product, the market is classified into serum separating tubes, EDTA tubes, plasma separation tubes, and serum tubes. Based on material, the market is classified into glass, and plastics. Based on end-user, the market is classified into diagnostic centers, healthcare centers, research and development centers.

Based on product, the market is segmented into serum separating tubes, EDTA tubes, plasma separation tubes, and serum tubes. The EDTA tubes segment has generated highest revenue share in 2023.

EDTA Tubes: EDTA tubes refer to preservative anticoagulants containing EDTA and preventing the coagulation of blood. They greatly help in test cases when the patient is diagnosed with hematological cases or cases under CBC and blood smear tests. The EDTA is used to preserve all cellular structures within the blood. Then it is a little easier to view those structures without the clot, which is formed by this process of coagulation and will interfere with such observation. These tubes prove very essential for research studies about blood cells and study morphology and count.

Serum Separating Tubes: Serum separating tubes SSTs are special collection tubes designed for the drawing and separation of serum from other components in the blood specimen. They have a semi-solid gel separating between the serum and the blood after centrifugation. Separation is therefore easy when the gel has been exposed to centrifugal force: serum separating tubes are generally applied in biochemical and immunoassays. SSTs are also used since they are easy to dispose of and reduce the risks of contamination, an element that is considered when using these for testing.

Plasma Separation Tubes: Plasma separation tubes are designed to collect blood samples and separate plasma from blood cells on centrifugation. They often contain additives that help release plasma. These tubes are thus best suited for tests that require plasma, such as coagulation studies and some biochemical analyses. Plasma separates clearly and allows the precise measurement of many substances present in plasma, thereby enhancing the reliability of diagnostic results.

Serum Tubes: Fastened serum tubes are designed to allow rapid serum collection and separation. The clotting is usually faster than normal such that serum is ready quite fast, and that matters in urgent medical practice conditions. They are indispensable and very useful in the Emergency Department or any POC testing since time impacts patient management greatly. Its quick turnaround makes the test a crucial tool for application in fast-paced clinical surroundings.

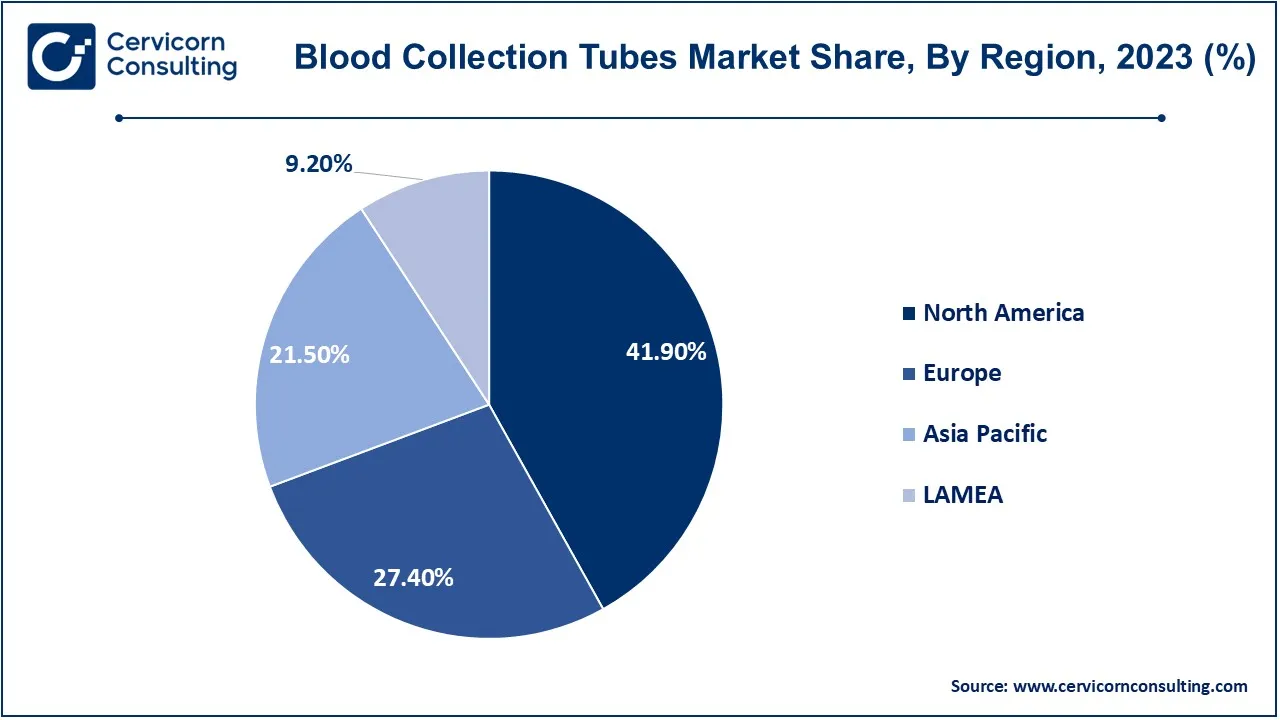

The blood collection tube marketis segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America has held dominant position in the market in 2023. The Asia-Pacific is expected to witness highest growth in the forecast period.

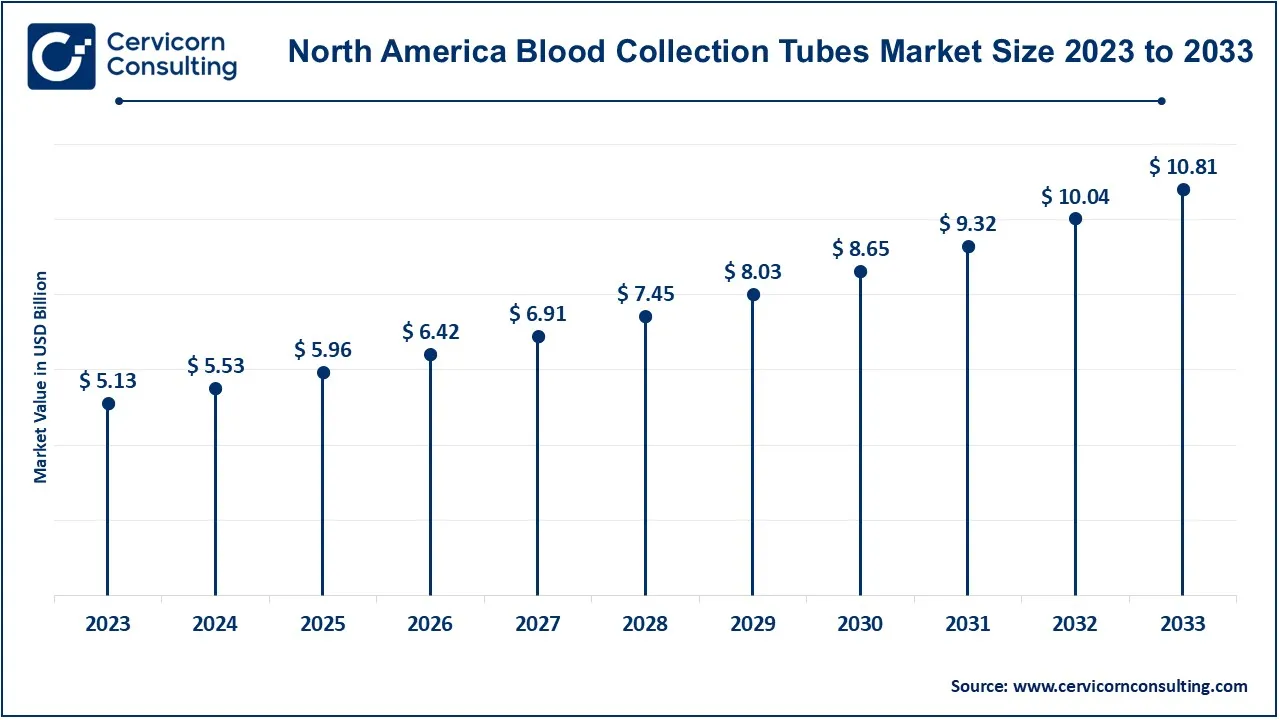

The North America blood collection tube market size was valued at USD 5.13 billion in 2023 and is expected to reach around USD 10.81 billion by 2033. North America, which mainly comprises the United States and Canada, accounts for the largest share of the blood collection tube market. The region has a well-developed healthcare infrastructure, a high prevalence of chronic diseases, and a high investment in research and development. The U.S. is one of the major medical innovation hubs, which ensures constant demand for high-quality blood collection products. The healthcare system of Canada also supports the adoption of modern blood collection technologies, thereby contributing to the growth of the market.

The Europe blood collection tube market size was estimated at USD 3.36 billion in 2023 and is projected to hit around USD 7.07 billion by 2033. The countries dominating the other continent, Europe, which also possesses a huge demand for these blood collection tubes are Germany, France, the UK, and Italy. It sets a well-structured frame and has its regulatory norms at very high levels that give more importance to patients' safety and efficiency levels of the laboratories. A much higher level of infectious disease occurrence in patients with respective appropriate practice in offering a donation of blood is needed which is in huge demand hence bringing more scopes into existence there.

The Asia-Pacific blood collection tube market size was accounted for USD 2.63 billion in 2023 and is predicted to surpass around USD 5.55 billion by 2033. The Asia-Pacific region includes countries like China, India, Japan, and Australia. In the blood collection tubes market, this region is growing at a high speed. It is driven by increasing healthcare expenditure, growth in population, and more awareness regarding health issues related to blood. Additionally, healthcare infrastructure in the region is also improving and has paved the way to allow modern technologies of blood collection.

The LAMEA blood collection tube market was valued at USD 1.13 billion in 2023 and is anticipated to reach around USD 2.37 billion by 2033. The LAMEA region comprises Latin America, the Middle East, and Africa, which is slowly becoming a developing market for blood collection tubes. Latin America's countries like Brazil and Mexico are improving their healthcare sectors, therefore generating higher demand for medical supplies. For instance, investments are made by the UAE and Saudi Arabia in the health development of the Middle East region. States in African regions highlighted improved health access and concerns about public health issues. Even though the market remains at its developing stage, immense growth opportunities are stated based on the growing level of awareness and healthcare investments.

The major players dominate the blood collection tube industry by quite a significant margin. They areAbacus ALS, Greiner AG, Nipro Medical Corporation, Abbott, and Quest Diagnostics, with strong product offerings and wide distribution networks. These companies are highly invested in R&D for making innovations and designing better tubes for the sake of safety in blood collection with maximum efficiency. Strategic collaborations with healthcare providers allow them to strengthen their standing in the market, open avenues to meet the emergent needs of high-quality diagnosis, and enhance their quality due to adherence to regulatory provisions and quality assurance.

CEO Statements

Saori Dubourg, CEO of Greiner AG

Akira Shimizu, CEO ofNipro Medical Corporation

Shayne Christensen, CEO of Abacus ALS

Recent innovations in the blood collection tube sector reflect a vibrant landscape of strategic collaborations from key players such as Abacus ALS, Greiner AG, Nipro Medical Corporation, Abbott, and Quest Diagnostics. These players are driving innovation in terms of tube design, material, and safety features to make samples more robust, minimizing the risk of contamination while making patients comfortable. Some of these innovations include special tubes for specific tests and automated systems to reduce the tedium of collecting blood. These inventions embody the spirit of competition to fill in the gaps in healthcare and to streamline laboratory practices.

The blood collection tubes industry is ready to take off. It has been observed that major companies such as Abacus ALS, Greiner AG, Nipro Medical Corporation, Abbott, and Quest Diagnostics are developing novel tube technologies, improving safety features, and enhancing the efficiency of blood collection. Investment in research and development along with their focus on filling the specific gaps in health care will enable them to extend their products and market standards. As they add high-technology materials and automation to their products, the market is going to see massive growth, thereby benefiting both the healthcare service providers and users.

Market Segmentation

By Product

By Material

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Blood Collection Tubes

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Material Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Blood Collection Tubes Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Technological Advancement

4.1.1.2 Increased Diagnostic Tests

4.1.1.3 Home Healthcare

4.1.2 Market Restraints

4.1.2.1 High Costs of Advanced Blood Collection Products

4.1.2.2 Risk of Contamination

4.1.2.3 Testing protocols variation

4.1.3 Market Challenges

4.1.3.1 Maintaining the Quality of Product

4.1.3.2 Adapting to Changes

4.1.3.3 Overcoming Resistance to Change

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Blood Collection Tubes Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Blood Collection Tubes Market, By Product

6.1 Global Blood Collection Tubes Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Serum Separating Tubes

6.1.1.2 EDTA Tubes

6.1.1.3 Plasma Separation Tubes

6.1.1.4 Serum Tubes

Chapter 7. Blood Collection Tubes Market, By Material

7.1 Global Blood Collection Tubes Market Snapshot, By Material

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Glass

7.1.1.2 Plastics

Chapter 8. Blood Collection Tubes Market, By End-User

8.1 Global Blood Collection Tubes Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Diagnostic Centers

8.1.1.2 Healthcare Centers

8.1.1.3 Research and Development Centers

Chapter 9. Blood Collection Tubes Market, By Region

9.1 Overview

9.2 Blood Collection Tubes Market Revenue Share, By Region 2023 (%)

9.3 Global Blood Collection Tubes Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Blood Collection Tubes Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Blood Collection Tubes Market, By Country

9.5.4 UK

9.5.4.1 UK Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Blood Collection Tubes Market, By Country

9.6.4 China

9.6.4.1 China Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Blood Collection Tubes Market, By Country

9.7.4 GCC

9.7.4.1 GCC Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Blood Collection Tubes Market Revenue, 2021-2033 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2021-2023

10.1.3 Competitive Analysis By Revenue, 2021-2023

10.2 Recent Developments by the Market Contributors (2023)

Chapter 11. Company Profiles

11.1 Abacus ALS

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Greiner AG

11.3 Nipro Medical Corporation

11.4 Abbott

11.5 Quest Diagnostics

11.6 Qiagen

11.7 Improve Medical

11.8 Medtronic

11.9 SARSTEDT AG & Co. KG

11.10 Chengdu Rich Science Industry Co., Ltd.