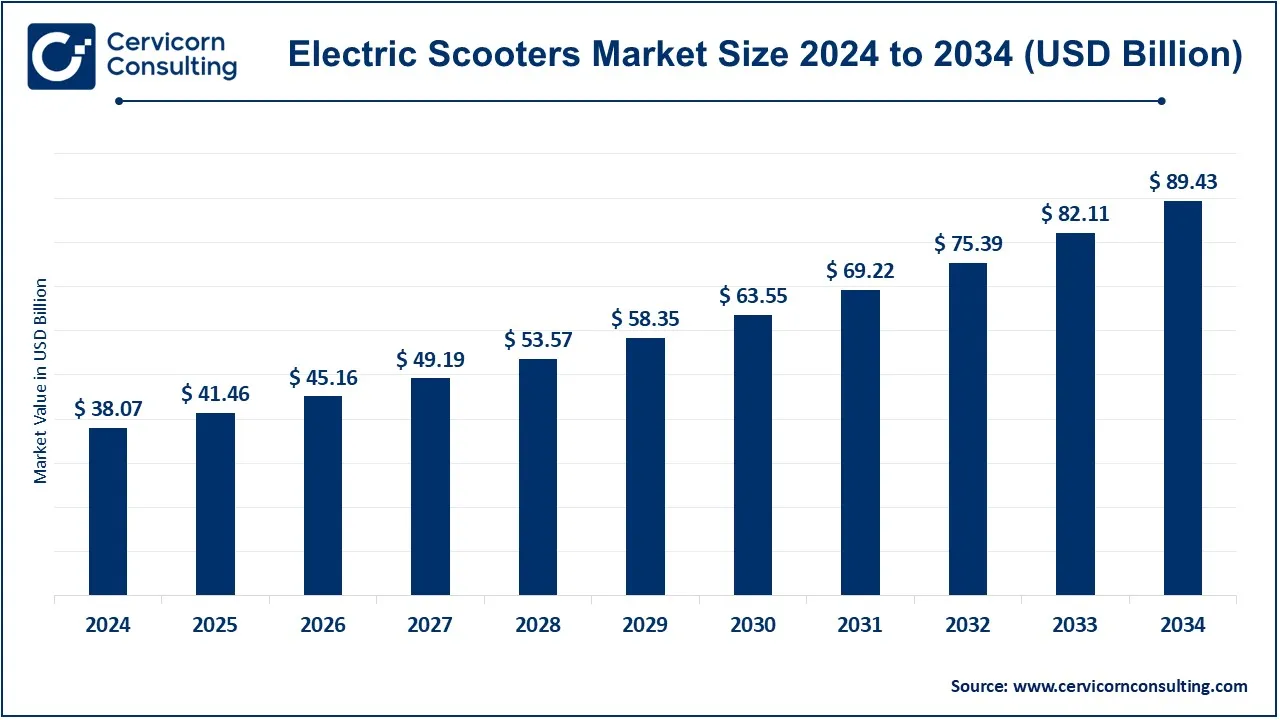

The global electric scooters market size was reached at USD 38.07 billion in 2024 and is expected to be worth around USD 89.43 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.7% over the forecast period 2025 to 2034. The electric scooter market has grown significantly due to increasing environmental awareness, rising fuel costs, and urban congestion. Governments worldwide are encouraging green mobility solutions by offering subsidies and infrastructure improvements like dedicated e-scooter lanes and charging stations. Technological advancements, including longer battery life, lightweight designs, and improved safety features, have also boosted consumer adoption. Companies like Bird, Lime, Xiaomi, and Segway are leading the industry, with investments in research and development. The market is expected to grow further as more cities adopt micro-mobility solutions to reduce traffic congestion and pollution. Additionally, increasing adoption by delivery and ride-sharing services is driving further expansion.

E-scooters have evolved from a new technology to a mainstay of city transportation. These days, they are as ubiquitous as cabs. It should come as no surprise that individuals are purchasing e-scooters in addition to the abundance of applications and services for sharing them. These devices are perfect for today's hectic city life since they combine sustainability, efficiency, and ease. They improve cities rather than merely transporting people from one location to another. Low-cost commuting reduced pollution, and less traffic are no little accomplishments. Electric scooters are rapidly emerging as the preferred answer for a wide range of urban issues; they are not merely a fad. Rapid technological advancements in safety features and battery power are integrating e-scooters into the transportation landscape.

Electric scooters come equipped with charging stations and GPS navigation for modern consumers. The bundle of features improves the accessibility of these machines and makes it easy to track them at will. This industry is booming thanks to government incentives, rising fuel prices, and the scarcity of fossil fuels. Although the future of the industry is uncertain, it is obvious that innovation will determine the market leaders. Lithium-ion batteries are still a subject of research. As their capabilities become clearer, the quality of e-scooters is bound to improve.

An electric scooter (e-scooter) is a two-wheeled vehicle powered by an electric motor and battery, designed for personal transportation. Unlike traditional scooters, e-scooters do not require fuel and operate silently with zero emissions. They are lightweight, easy to use, and often foldable, making them ideal for short-distance travel, urban commuting, and eco-friendly transportation. E-scooters come with a rechargeable lithium-ion battery that typically offers a range of 15–50 km per charge, depending on the model and riding conditions. They feature LED displays, speed controls, and regenerative braking for efficiency. Many cities now have e-scooter-sharing services, allowing users to rent them via mobile apps. The rising demand for sustainable and cost-effective transport solutions has fueled the popularity of e-scooters.

Key Insights of Electric Scooter

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 41.46 Billion |

| Expected Market Size in 2034 | USD 89.43 Billion |

| CAGR (2025 to 2034) | 9.70% |

| Leading Region | Asia Pacific |

| Key Segments | Battery, Voltage Type, Drive, Technology, Product, Battery Fitting, End Use, Region |

| Key Companies | Gogoro Inc., AllCell Technologies LLC, Lime, Spin, BMW Motorrad International, BOXX Corp., Greenwit Technologies Inc., Jiangsu Xinri E-Vehicle Co., Ltd., Mahindra GenZe, KTM AG, Peugeot Scooters, Green Energy Motors Corp., Honda Motor Co. Ltd., Vmoto Limited, Yamaha Motor Company Limited, Yadea Technology Group Co. Ltd., Xiaomi, Terra Motors Corporation, Suzuki Motor Corporation, Bird, Ninebot Limited |

Rising Fuel Prices

Increasing Traffic Congestion

Standardized Charging Infrastructure

Battery Management

Growing Concept of Micro-Mobility

Integration With Public Transport

Consumer Perception of Early Adopters

Increase in Range Anxiety

Based on battery, the market is segmented into lead acid battery and lithium-ion battery. The lithium-ion battery segment has dominated the market in 2024.

Lead Acid Battery: Factors like lower abuse tolerance, larger size, and fast discharge even without heavy loads are reducing the use of lead acid batteries in the coming years. However, the use of SLA batteries is expected to decline in the coming years as they are large and discharge quickly even when not carrying a significant load.

Electric Scooters Market Revenue Share, By Battery, 2023 (%)

| By Battery | Revenue Share, 2024 (%) |

| Lead Acid | 16% |

| Lithium-ion | 74% |

| Other | 10% |

Lithium-ion Battery: The price of lithium-ion batteries is expected to decrease in the coming years and fall by more than 70 percent by 2030. This is also expected to reduce the cost of electric scooters. More environmentally friendly batteries and the growing demand for high-performance batteries such as lithium-ion and NiMH batteries are driving the need for battery-powered e-scooters. Some of the advantages of these batteries are high charge/discharge efficiency, high charge density, and lightweight.

Based on voltage type, the market is segmented into 48 – 59V, 60 – 72V, 73 – 96V, Above 97V. The 48 – 59V segment has dominated the market in 2024.

48 – 59V: These batteries are well-compatible with e-scooters and have higher power, which is expected to drive market expansion. These scooters are generally preferred for short-distance rides.

60 – 72V: The 60 – 72V battery is used to avoid the hassle of charging the battery regularly; consumers prefer scooters with a long battery range.

Electric Scooters Market Revenue Share, By Voltage Type, 2023 (%)

| By Voltage Type | Revenue Share, 2024 (%) |

| 48-59 V | 40.70% |

| 60-72 V | 24.20% |

| 73-96V | 21.80% |

| Above 96V | 13.30% |

73 – 96V: Consumer preference for high-voltage e-scooters for long-distance travel and avoiding frequent battery charging will fuel the growth of this segment.

Above 97V: These target niche markets where power is paramount, enabling longer ranges and faster acceleration. The batteries above 97V represent cutting-edge electric motorcycle technology, often with advanced battery systems and innovative designs aimed at tech-savvy consumers willing to invest in premium options.

Based on end user, the market is segmented into personal and commercial. The personal segment has dominated the market in 2024.

Personal: Since electric scooters are more convenient, economical, lightweight, easy to maintain, and environmentally friendly than any other electric vehicle, they are revolutionizing the personal vehicle market. Furthermore, electric scooters are becoming more and more popular among low- and middle-class individuals as well as millennials owing to the benefits offered by the vehicle. Moreover, electric scooter manufacturers' focus on developing private charging stations or designated places to charge electric scooters is expected to increase consumer adoption of e-scooters.

Electric Scooters Market Revenue Share, By End User, 2023 (%)

| By End User | Revenue Share, 2024 (%) |

| Commercial | 19% |

| Personal | 81% |

Commercial: Electric scooters are an economical and viable option for last-mile delivery for commercial applications in places such as factories, universities, warehouses, and industrial facilities with large land areas. E-scooters can be an option for efficient and fast transportation. As the shared mobility trend gains momentum, many rental companies are increasingly offering e-scooters that can be used per mix or in time bundles for long-distance rides.

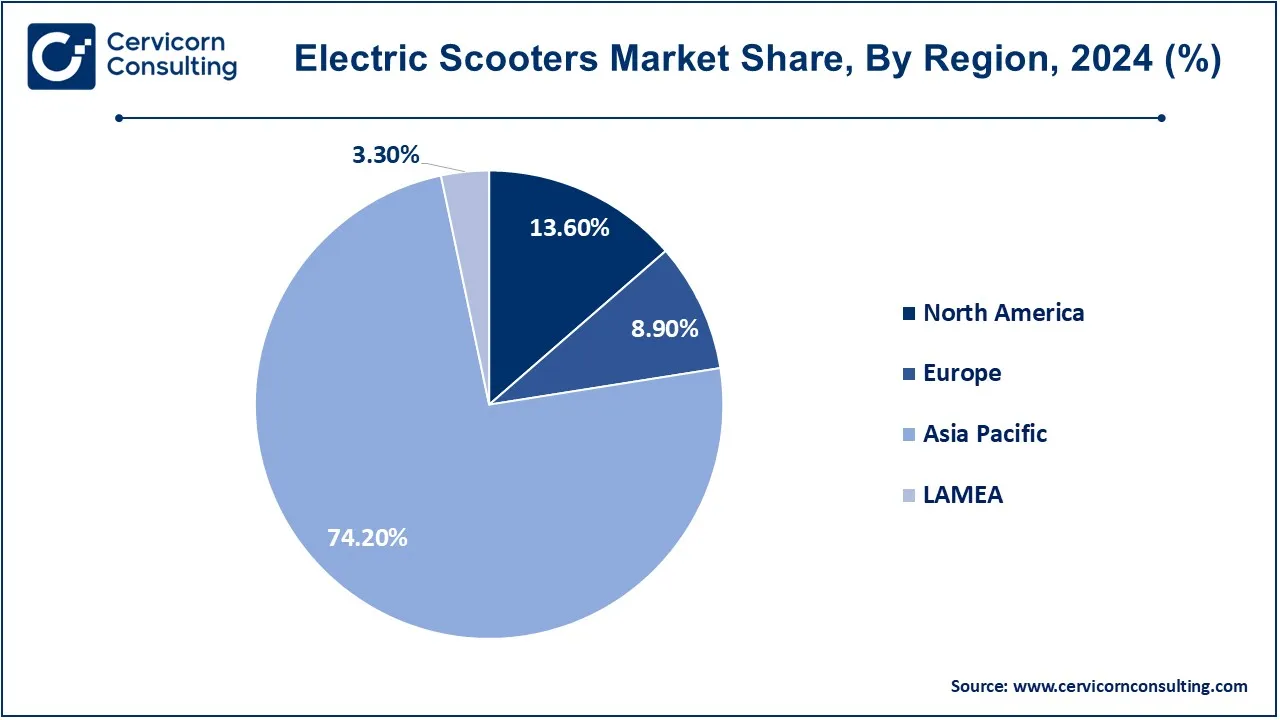

The electric scooters market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region led the market in 2024.

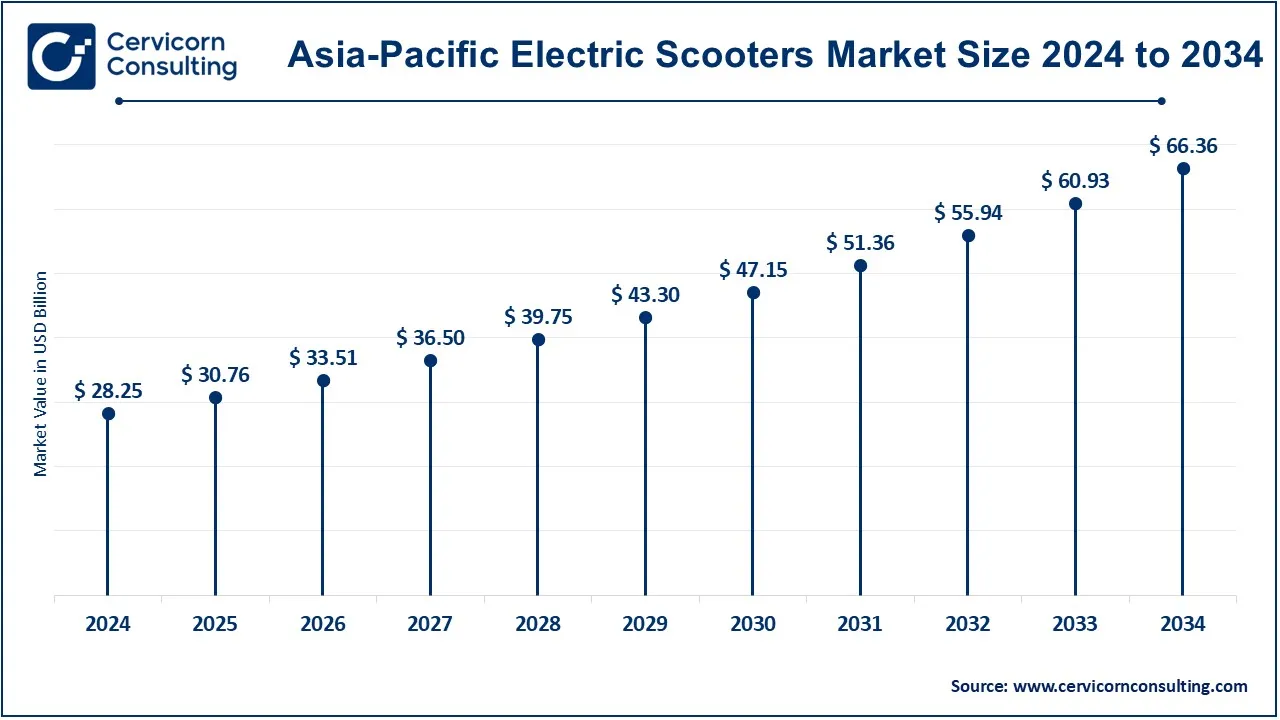

The Asia-Pacific electric scooters market size was estimated at USD 28.25 billion in 2024 and is expected to reach around USD 66.36 billion by 2034. Rising demand for fuel-efficient e-scooters for short-distance travel and government initiatives to promote this type of scooter are expected to drive the APAC market during the forecast period. The country's rapidly growing economy is driving the expansion of advanced technologies to improve electrification in China. In addition, the regional market is being fueled by growing consumer awareness of clean energy transportation to reduce vehicle emissions, rapid urbanization, and increasing affordability of e-scooters. Moreover, research and development activities will continue to give a significant boost to this market over the next decade. Notable Japanese companies such as Honda, Yamaha, Suzuki, and Kawasaki have launched their variants of electric scooters, further increasing competition in the Asian market. The Indian government has been promoting electric two-wheelers through programs such as FAME-II, which provides incentives and tax benefits to customers.

The North America electric scooters market size was valued at USD 5.18 billion in 2024 and is projected to hit around USD 12.06 billion by 2034. Increasing initiatives by government and private market players to expand the regional charging station network for electric two-wheelers. Furthermore, the promotion of research and development activities to develop high-density batteries is expected to boost the regional market growth in the next few years.

The Europe electric scooters market size was valued at USD 3.39 billion in 2024 and is expected to be worth around USD 7.96 billion by 2034. The Europe is expected to grow owing to consumer adoption of electric vehicles and autonomous vehicles; shared mobility is likely to drive the market expansion. Growing investments in electric vehicle charging infrastructure and research support for innovative high-density batteries are expected to contribute to the overall regional growth. Furthermore, given the strong growth of international electric scooter manufacturers, vendors operating in Europe are focusing on launching multiple variants of electric scooters to appeal to the young population. Such strategies adopted by the companies operating in the region are expected to boost the overall growth of the European market.

The LAMEA electric scooters market size was valued at USD 1.26 billion in 2024 and is expected to be worth around USD 2.95 billion by 2034. LAMEA is growing due to high urbanization and growing interest in sustainable transportation. Several companies have invested in developing electric scooters and launched new products to gain a competitive edge. Yamaha Motor Co., Ltd.'s 2.5 kW class NEO electric scooter with a removable battery. will launch in Latin America. In the MEA region, where traffic congestion and the demand for effective, environmentally friendly transportation solutions are becoming major issues, foldable electric scooters can be particularly well suited to urban environments. Additionally, their portability makes foldable electric scooters attractive. Foldable scooters are a practical option in urban areas where last-mile connectivity and public transit are critical. The future of e-scooters is particularly bright in the United Arab Emirates (UAE), which has positioned itself as a regional leader in shaping the future of mobility. In some locations in the UAE and Qatar, Fenix, a leading e-mobility platform in the Middle East, has launched on-demand shared electric bikes for locals and tourists.

The major players in the market include Gogoro, Inc., BOXX Corp, and AllCell Technologies LLC. Gogoro, Inc. designs and manufactures battery-swapping stations and electric scooters. GenZe by Mahindra is a division of the Mahindra Group of India that designs and manufactures e-bikes and e-scooters. The company offers a range of e-scooters including the 2.0s Scooter, 2.0e Scooter, and 2.0f Scooter. The major market players focus on R&D efforts and product-level strategies. For example, Gogoro's e-scooter bike with a removable battery has revolutionized the market in Taiwan. Many Asian vendors are collaborating with the company to incorporate the removable battery technology in their models. These types of scooters by major Japanese companies such as Honda, Yamaha, Suzuki, and Kawasaki have been launched, which has increased competition in the Asian market.

CEO Statements

Oscar Morgan, CEO and co-founderof Bo Mobility

Tarun Mehta, Founder and CEO of Ather Energy

Key players in the electric scooters industry are pivotal in delivering various innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies. Some notable developments in the market include:

These advancements mark a notable expansion in the electric scooters sector, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Battery Type

By Voltage Type

By Drive

By Technology

By Product

By Battery Fitting

By End Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Electric Scooters

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Battery Overview

2.2.2 By Voltage Type Overview

2.2.3 By Drive Overview

2.2.4 By Technology Overview

2.2.5 By Product Overview

2.2.6 By Battery Fitting Overview

2.2.7 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Electric Scooters Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Fuel Prices

4.1.1.2 Increasing Traffic Congestion

4.1.2 Market Restraints

4.1.2.1 Standardized Charging Infrastructure

4.1.2.2 Battery Management

4.1.3 Market Challenges

4.1.3.1 Consumer Perception of Early Adopters

4.1.3.2 Increase in Range Anxiety

4.1.4 Market Opportunities

4.1.4.1 Growing Concept of Micro-Mobility

4.1.4.2 Integration With Public Transport

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Electric Scooters Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Electric Scooters Market, By Battery Type

6.1 Global Electric Scooters Market Snapshot, By Battery Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Lead Acid Batteries

6.1.1.2 Li-ion Batteries

6.1.1.3 Others

Chapter 7. Electric Scooters Market, By Voltage Type

7.1 Global Electric Scooters Market Snapshot, By Voltage Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 48-59 V

7.1.1.2 60-72 V

7.1.1.3 73-96V

7.1.1.4 Above 96V

Chapter 8. Electric Scooters Market, By End User

8.1 Global Electric Scooters Market Snapshot, By End User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Personal

8.1.1.2 Commercial

Chapter 9. Electric Scooters Market, By Product

9.1 Global Electric Scooters Market Snapshot, By Product

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Standard

9.1.1.2 Folding

9.1.1.3 Self-Balancing

9.1.1.4 Maxi

9.1.1.5 Three wheeled

Chapter 10. Electric Scooters Market, By Battery Fitting

10.1 Global Electric Scooters Market Snapshot, By Battery Fitting

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Detachable

10.1.1.2 Fixed

Chapter 11. Electric Scooters Market, By Technology

11.1 Global Electric Scooters Market Snapshot, By Technology

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Plug-In

11.1.1.2 Battery

Chapter 12. Electric Scooters Market, By Drive

12.1 Global Electric Scooters Market Snapshot, By Drive

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Belt Drive

12.1.1.2 Chain Drive

12.1.1.3 Hub Motors

Chapter 13. Electric Scooters Market, By Region

13.1 Overview

13.2 Electric Scooters Market Revenue Share, By Region 2024 (%)

13.3 Global Electric Scooters Market, By Region

13.3.1 Market Size and Forecast

13.4 North America

13.4.1 North America Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.4.2 Market Size and Forecast

13.4.3 North America Electric Scooters Market, By Country

13.4.4 U.S.

13.4.4.1 U.S. Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.4.4.2 Market Size and Forecast

13.4.4.3 U.S. Market Segmental Analysis

13.4.5 Canada

13.4.5.1 Canada Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.4.5.2 Market Size and Forecast

13.4.5.3 Canada Market Segmental Analysis

13.4.6 Mexico

13.4.6.1 Mexico Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.4.6.2 Market Size and Forecast

13.4.6.3 Mexico Market Segmental Analysis

13.5 Europe

13.5.1 Europe Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.5.2 Market Size and Forecast

13.5.3 Europe Electric Scooters Market, By Country

13.5.4 UK

13.5.4.1 UK Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.5.4.2 Market Size and Forecast

13.5.4.3 UKMarket Segmental Analysis

13.5.5 France

13.5.5.1 France Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.5.5.2 Market Size and Forecast

13.5.5.3 FranceMarket Segmental Analysis

13.5.6 Germany

13.5.6.1 Germany Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.5.6.2 Market Size and Forecast

13.5.6.3 GermanyMarket Segmental Analysis

13.5.7 Rest of Europe

13.5.7.1 Rest of Europe Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.5.7.2 Market Size and Forecast

13.5.7.3 Rest of EuropeMarket Segmental Analysis

13.6 Asia Pacific

13.6.1 Asia Pacific Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.6.2 Market Size and Forecast

13.6.3 Asia Pacific Electric Scooters Market, By Country

13.6.4 China

13.6.4.1 China Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.6.4.2 Market Size and Forecast

13.6.4.3 ChinaMarket Segmental Analysis

13.6.5 Japan

13.6.5.1 Japan Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.6.5.2 Market Size and Forecast

13.6.5.3 JapanMarket Segmental Analysis

13.6.6 India

13.6.6.1 India Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.6.6.2 Market Size and Forecast

13.6.6.3 IndiaMarket Segmental Analysis

13.6.7 Australia

13.6.7.1 Australia Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.6.7.2 Market Size and Forecast

13.6.7.3 AustraliaMarket Segmental Analysis

13.6.8 Rest of Asia Pacific

13.6.8.1 Rest of Asia Pacific Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.6.8.2 Market Size and Forecast

13.6.8.3 Rest of Asia PacificMarket Segmental Analysis

13.7 LAMEA

13.7.1 LAMEA Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.7.2 Market Size and Forecast

13.7.3 LAMEA Electric Scooters Market, By Country

13.7.4 GCC

13.7.4.1 GCC Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.7.4.2 Market Size and Forecast

13.7.4.3 GCCMarket Segmental Analysis

13.7.5 Africa

13.7.5.1 Africa Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.7.5.2 Market Size and Forecast

13.7.5.3 AfricaMarket Segmental Analysis

13.7.6 Brazil

13.7.6.1 Brazil Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.7.6.2 Market Size and Forecast

13.7.6.3 BrazilMarket Segmental Analysis

13.7.7 Rest of LAMEA

13.7.7.1 Rest of LAMEA Electric Scooters Market Revenue, 2022-2034 ($Billion)

13.7.7.2 Market Size and Forecast

13.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 14. Competitive Landscape

14.1 Competitor Strategic Analysis

14.1.1 Top Player Positioning/Market Share Analysis

14.1.2 Top Winning Strategies, By Company, 2022-2024

14.1.3 Competitive Analysis By Revenue, 2022-2024

14.2 Recent Developments by the Market Contributors (2024)

Chapter 15. Company Profiles

15.1 Gogoro Inc.

15.1.1 Company Snapshot

15.1.2 Company and Business Overview

15.1.3 Financial KPIs

15.1.4 Product/Service Portfolio

15.1.5 Strategic Growth

15.1.6 Global Footprints

15.1.7 Recent Development

15.1.8 SWOT Analysis

15.2 AllCell Technologies LLC

15.3 Lime

15.4 Spin

15.5 BMW Motorrad International

15.6 BOXX Corp.

15.7 Greenwit Technologies Inc.

15.8 Jiangsu Xinri E-Vehicle Co., Ltd.

15.9 Mahindra GenZe

15.10 KTM AG

15.11 Peugeot Scooters

15.12 Green Energy Motors Corp.

15.13 Honda Motor Co. Ltd.

15.14 Vmoto Limited

15.15 Yamaha Motor Company Limited

15.16 Yadea Technology Group Co. Ltd.

15.17 Xiaomi

15.18 Terra Motors Corporation

15.19 Suzuki Motor Corporation

15.20 Bird

15.21 Ninebot Limited