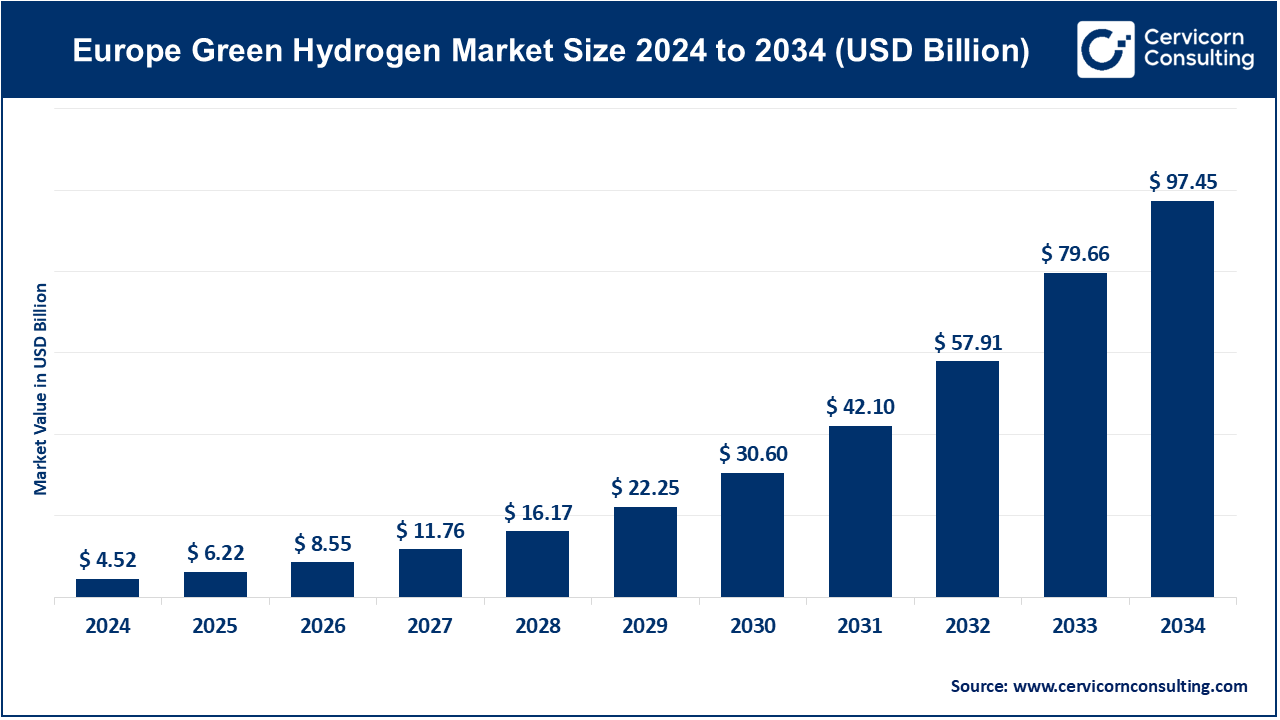

The Europe green hydrogen market size was valued at USD 4.52 billion in 2024 and is expected to be worth around USD 97.45 billion by 2034, growing at a compound annual growth rate (CAGR) of 40.72% over the forecast period 2025 to 2034. The European green hydrogen market is experiencing rapid growth, driven by substantial investments and supportive policies. Germany, for instance, has committed EUR 9 billion to develop 5 gigawatts of electrolyzer capacity by 2030, aiming to reduce dependence on fossil fuels and enhance energy security. Similarly, companies like Air Liquide and TotalEnergies are investing over EUR 1 billion in large-scale green hydrogen projects in the Netherlands, expected to significantly cut COâ‚‚ emissions in the region. These initiatives reflect Europe's strategic focus on green hydrogen as a cornerstone of its clean energy transition, with the market projected to expand significantly in the coming years.

Green hydrogen is a type of hydrogen fuel produced using renewable energy sources, such as wind, solar, or hydroelectric power. Unlike grey hydrogen, which is made using fossil fuels, green hydrogen is created through a process called electrolysis. This process splits water into hydrogen and oxygen using electricity from renewable sources, making it a clean and sustainable energy carrier. The main advantage of green hydrogen is that it does not emit carbon dioxide (COâ‚‚), reducing greenhouse gas emissions and supporting the global shift toward clean energy. It can be used in industries such as transportation, power generation, and manufacturing, providing an alternative to fossil fuels in sectors that are hard to decarbonize.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 4.52 Billion |

| Expected Market Size in 2034 | USD 97.45 Billion |

| CAGR (2025 to 2034) | 40.72% |

| Key Segments | Technology, Energy Source, Distribution Channel, End User |

| Key Companies | Air Products & Chemicals Inc, Cummins Inc, Engie SA, L’Air Liquide SA, Linde Plc, Nel ASA, Orsted AS, Siemens Energy AG, Toshiba Energy Systems & Solutions Corp, Uniper SE |

Europe green hydrogen market is segmented into technology, energy source, distribution channel and end user. Based on technology, market is segmented into alkaline electrolysis, PEM electrolyzer, and SOEC electrolyzer. Based on energy source, market is segmented into wind energy and solar energy. Based on distribution channel, market is segmented into pipeline and cargo. Based on end user, market is segmented into chemical, power, food and beverages, medical, petrochemicals, others

Alkaline electrolysis: Alkaline electrolysis is an old but still growing technique that encompasses the method of producing hydrogen with an alkaline solution to conduct electricity. This technique is touted to have good efficiencies and lower costs of operation. Because of their scalability, this method enjoys popularity in large-scale hydrogen production. However, they usually require a bigger infrastructure than that of most other applications. Alkaline electrolyzers are much preferred in Europe because it is considered that they provide reliability and robustness and greatly help green hydrogen initiatives in the region.

PEM Electrolysis: PEM Electrolysis is becoming more dominant due to its high efficiency and operational flexibility. In this type of technology, the conduction of protons is via a solid polymer membrane, which makes it suitable in applications requiring a fast response to variable energy applications. These are compact electrolyzers that can be used in any application, from small-scale installations to large plants. The ability to work efficiently with renewable energy sources adds to the attractiveness of PEM water electrolysis for building green hydrogen systems in Europe.

Wind Energy: Wind energy is a key renewable source for hydrogen production in Europe. Wind farms generate electricity, which can power electrolyzers for green hydrogen production. This method benefits from Europe’s substantial wind resources, particularly in coastal regions and offshore installations. Optimizing excess wind energy during peak generation periods will enhance the efficiency of hydrogen production, thereby closing the loop of energy. The use of wind energy for hydrogen generation is especially relevant in view of the emission reduction targets in the European region.

Solar Energy: Solar energy represents a critical aspect of the European green hydrogen landscape. Solar photovoltaic (PV) systems convert sunlight into electricity for electrolysis to produce hydrogen. Boosting its solar capacity is rather in line with the commitment in the region for sustainable energy solutions. Solar-based hydrogen production benefits from plentiful sunlight, particularly in Southern Europe, allowing for viable and cost-effective hydrogen generation for a number of applications.

Chemical: The chemical industry uses green hydrogen on a large scale due to its employment in ammonia production and refining processes. Chemically synthesized fertilizers-are produced for agriculture: hydrogen is indispensable. The decarbonization of industrial operations is bringing about greater demand for green hydrogen, driven by growing regulatory pressures and the sustainable vision of companies. The moving of green hydrogen into chemical processes results in not only the significant reduction of the amount of carbon emitted, but also in other respects supports the transition toward sustainable practices.

Power: In the power sector, green hydrogen is fast emerging as an effective energy carrier capable of both storing and distributing renewable energy. Its use in fuel cells offsets electricity generation and blends with natural gas in existing power plants. The ultimate addition of hydrogen means grid stability, energy security. Green hydrogen is expected to become much more important for power generation as Europe seeks to convert its energy mix into cleaner fuel.

Food and Beverages: the Food and Beverage sector has not emphasized hydrogenated oil, it stands out in food processing, which is predominant in hydrogenation. Healthier food with hydrogenated fats and oils therefore enhances their market value. Several such industries are thus being tilted toward using green hydrogen in the automobile sector to leave an environmental footprint and gain credentials for being environmentally conscious.

Medical: Generally, in the medical field, green hydrogen encompasses production in pharmaceuticals and hydrogen gas for different medical purposes, especially the hydrogen inhalation therapy. This drive for sustainability in health care has sparked an interest in green hydrogen due to its being a cleaner alternative. As hospitals and medical facilities embark on keeping carbon footprints low, the acceptance of green hydrogen in medical implementation is expected to rise toward broader environmental aspirations.

Petrochemical: The industry is currently putting efforts in place for exploring the use of green hydrogen feedstock; this route would allow cleaner fuels and chemicals to be produced. Hydrogen is key for processes in refining like hydrocracking and desulfurization. The regulatory framework and market demand for greener products see accelerating transition to sustainable feedstock. Petrochemical companies can lower their carbon emissions and thus enhance their sustainability profile through the integration of this approach in their operations.

Others: The category of "others" comprises a range of different sectors undertaking exploration of green hydrogen usage, such as transport, steelmaking and even energy storage. The transportation, steel, and energy storage sectors are beginning to explore different ways to use hydrogen for decarbonization. With technological advancements and evolving markets, green hydrogen is therefore expected to open up further opportunities across sectors and propel the European market forward as a whole.

CEO Statements

Pierre-Etienne Franc, CEO of FiveT Hydrogen

Market Segmentation

By Technology

By Energy Source

By Distribution Channel

By End User

By Geography

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Europe Green Hydrogen

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Energy Source Overview

2.2.3 By Distribution Channel Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Market Dynamics and Trends

3.1 Market Dynamics

3.1.1 Market Drivers

3.1.1.1 Mitigation of Climate Change

3.1.1.2 Energy Security

3.1.1.3 Industrial Demand

3.1.2 Market Restraints

3.1.2.1 High Production Costs

3.1.2.2 Infrastructure Challenges

3.1.2.3 Market Competition

3.1.3 Market Challenges

3.1.3.1 Investment Requirements

3.1.3.2 Public Perception

3.1.3.3 Supply Chain Issues

3.2 Market Trends

Chapter 4. Premium Insights and Analysis

4.1 Europe Green Hydrogen Market Dynamics, Impact Analysis

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of Substitute Products

4.2.4 Rivalry among Existing Firms

4.2.5 Threat of New Entrants

4.3 PESTEL Analysis

4.4 Value Chain Analysis

4.5 Product Pricing Analysis

4.6 Vendor Landscape

4.6.1 List of Buyers

4.6.2 List of Suppliers

Chapter 5. Green Hydrogen Market, By Technology

5.1 Europe Green Hydrogen Market Snapshot, By Technology

5.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

5.1.1.1 Alkaline electrolysis

5.1.1.2 Polymer Electrolyte Membrane (PEM) Electrolyzer

5.1.1.3 SOEC Electrolyzer

Chapter 6. Green Hydrogen Market, By Energy Source

6.1 Europe Green Hydrogen Market Snapshot, By Energy Source

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Wind Energy

6.1.1.2 Solar Energy

Chapter 7. Green Hydrogen Market, By Distribution Channel

7.1 Europe Green Hydrogen Market Snapshot, By Distribution Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Pipeline

7.1.1.2 Cargo

Chapter 8. Green Hydrogen Market, By End User

8.1 Europe Green Hydrogen Market Snapshot, By End User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Chemical

8.1.1.2 Solar

8.1.1.3 Food and beverages

8.1.1.4 Medical

8.1.1.5 Petrochemicals

8.1.1.6 Others

Chapter 9. Green Hydrogen Market, By Region

9.1 Overview

9.2 Europe

9.2.1 Europe Green Hydrogen Market Revenue, 2022-2034 ($Billion)

9.2.2 Market Size and Forecast

9.2.3 Europe Green Hydrogen Market, By Country

9.2.4 UK

9.2.4.1 UK Green Hydrogen Market Revenue, 2022-2034 ($Billion)

9.2.4.2 Market Size and Forecast

9.2.4.3 UK Market Segmental Analysis

9.2.5 France

9.2.5.1 France Green Hydrogen Market Revenue, 2022-2034 ($Billion)

9.2.5.2 Market Size and Forecast

9.2.5.3 France Market Segmental Analysis

9.2.6 Germany

9.2.6.1 Germany Green Hydrogen Market Revenue, 2022-2034 ($Billion)

9.2.6.2 Market Size and Forecast

9.2.6.3 Germany Market Segmental Analysis

9.2.7 Rest of Europe

9.2.7.1 Rest of Europe Green Hydrogen Market Revenue, 2022-2034 ($Billion)

9.2.7.2 Market Size and Forecast

9.2.7.3 Rest of Europe Market Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Air Products & Chemicals Inc

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Cummins Inc

11.3 Engie SA

11.4 L’Air Liquide SA

11.5 Linde Plc

11.6 Nel ASA

11.7 Orsted AS

11.8 Siemens Energy AG

11.9 Toshiba Energy Systems & Solutions Corp

11.10 Uniper SE