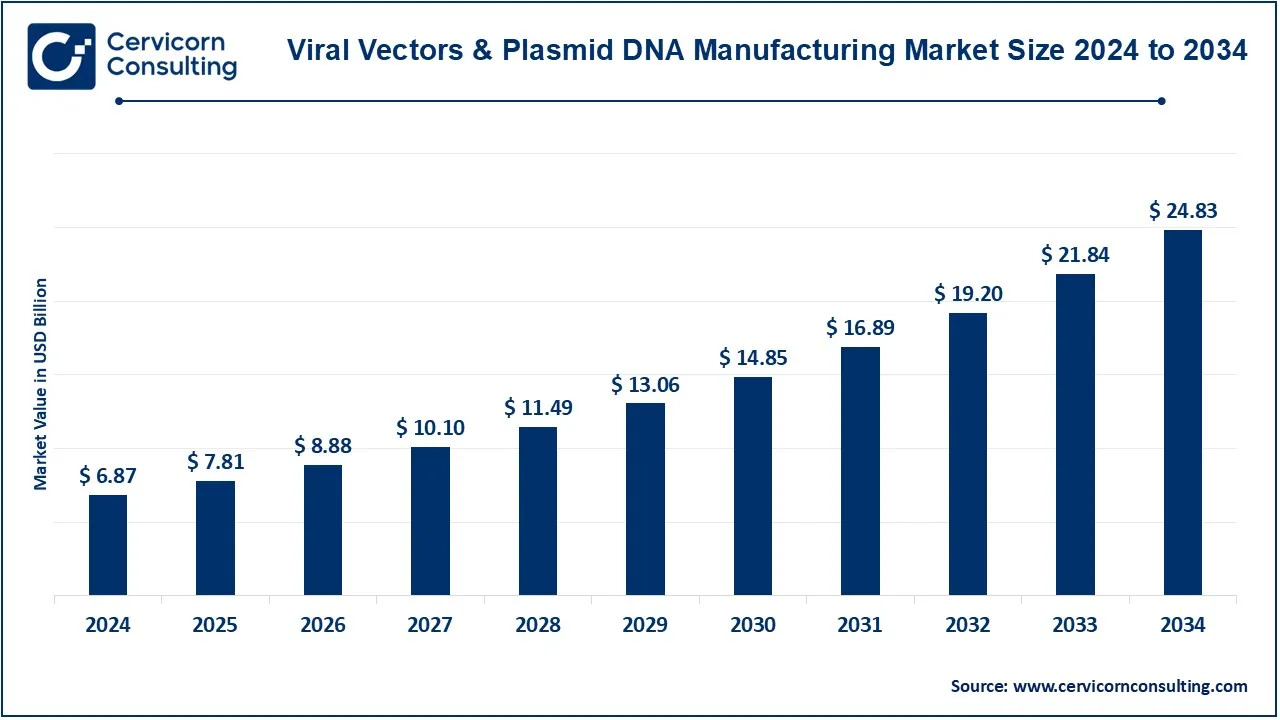

The global viral vectors & plasmid DNA manufacturing market size was accounted for USD 6.87 billion in 2024 and is expected to be worth around USD 24.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 20.16% from 2025 to 2034. The demand for viral vectors and plasmid DNA manufacturing is rising due to advancements in gene therapy, personalized medicine, and mRNA-based vaccines. Pharmaceutical and biotech companies are investing heavily in manufacturing capabilities to meet growing clinical and commercial demands. Additionally, government funding and partnerships are accelerating research and production expansion. The FDA and EMA approvals for gene therapy treatments further boost market potential. The market is expected to grow significantly due to the increasing number of clinical trials in cell and gene therapy, expansion of biopharmaceutical production, and the need for high-yield viral vector manufacturing technologies. Emerging trends include AI-driven bioprocessing, automation in gene therapy production, and improved vector design for higher efficiency and lower costs.

What are Viral Vectors and Plasmid DNA?

Viral vectors and plasmid DNA are essential tools in gene therapy, vaccine development, and cell therapy. Viral vectors are engineered viruses used to deliver genetic material into cells, helping treat genetic disorders and cancer. Common types include adenoviral, lentiviral, and adeno-associated viral (AAV) vectors. Plasmid DNA, on the other hand, is a circular piece of DNA used as a template for producing therapeutic proteins or delivering genes. It plays a key role in vaccine production, such as mRNA vaccines, and in gene therapy research. Manufacturing these biological materials involves complex processes, including cell culture, fermentation, purification, and quality control to ensure safety and effectiveness. With increasing demand for gene therapies and advanced vaccines, companies are focusing on scalable production, automation, and compliance with regulatory standards. Innovations in bioprocessing, single-use systems, and cell-line engineering are driving efficiency in production.

Key insights beneficial to the viral vectors and plasmid DNA manufacturing market:

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 6.87 Billion |

| Expected Market Size 2034 | USD 24.83 Billion |

| Projected CAGR 2025 to 2034 | 20.16% |

| High-impact Region | North America |

| Booming Region | Asia-Pacific |

| Key Segments | Vector Type, Application, Workflow, End User, Disease, Region |

| Key Companies | Merck KGaA, Lonza, FUJIFILM Diosynth Biotechnologies, Thermo Fisher Scientific, Cobra Biologics, Catalent Inc., Wuxi Biologics, Takara Bio Inc., Waisman Biomanufacturing, Genezen laboratories, Batavia Biosciences, Miltenyi Biotec GmbH, SIRION Biotech GmbH, Virovek Incorporation, BioNTech IMFS GmbH, Audentes Therapeutics, BioMarin Pharmaceutical, RegenxBio, Inc. |

Opportunity

The viral vectors and plasmid DNA manufacturing market is segmented into vector type, application, workflow, end user, disease and region. Based on vector type, the market is classified into adenovirus, retrovirus, adeno-associated virus (AAV), lentivirus, plasmids, others; Based on application, the market is classified into antisense & RNAi therapy, gene therapy, cell therapy, vaccinology, and research applications; Based on disease, the market is classified into cancer, genetic disorders, infectious diseases and others; Based on end-use, the market is classified into pharmaceutical and biopharmaceutical companies and research institutes. Based on workflow, the market is classified into upstream manufacturing, downstream manufacturing.

Adeno-Associated Virus: The Adeno-Associated Virus segment has dominated the market in 2024. There are quite a few applications with this vector in gene therapy applications involving conditions where prolonged gene expression is essential. These vectors have good safety histories with minimal immunogenicity; hence they have found application in a number of clinical trials and approved gene therapies. Its demand has sharply risen because of its high efficiency in targeting particular tissue, especially in neurobiology and ophthalmology.

Adenoviruses: Adenovirus are rapidly becoming a vector of choice for gene therapy because of the ease with which they can be transduced and the delivery of genetic material into non-replicating cells. They are strong inducers of immune responses, so they are good candidates for the development of vaccines. Their application in cancer therapies is on the rise, delivering therapeutic genes directly into tumor cells.

Retrovirus: Retroviruses have made a lot of progress and are now among the sylvatic vertebrates the least invasive and the most suitable for the introduction of therapeutic genes into the genome of the host organism. It is this feature that makes such vectors perfect for the treatment of hereditary illnesses. However, the risk of insertional mutagenesis has restricted the use of these vectors in some cases.

Lentivirus: Lentivirus are retroviruses capable of transducing both dividing and quiescent cells and therefore highlight a wide spectrum of further therapeutic applications, including CAR-T. They enable stable integration into host cells for long-term gene expression, being of paramount importance in research and novel cell therapy trials.

Plasmids: Plasmid DNA is considered critical for any viral vector production, and therefore a very important vector for gene and cell therapy. It is the most critical starting point for vaccine developments of any sort, including COVID-19. High-quality plasmids are so important in this respect for both the large number of applications in producing therapeutic viral vectors and also as standalone tools for nonviral gene therapies.

Others: Includes minor viral vectors such as baculovirus and herpes simplex virus (HSV), which cater for specialized therapeutic applications. The baculovirus, for instance, has been proposed for application in protein production and gene therapy research, while vector studies of HSV are under way for potential neurological applications on their ability to deliver transgenes to the nervous system.

Vaccinology: The vaccinology segment has dominated the market in 2024. Passionately pursued, these vectors serve as a basic delivery system for providing antigens directly and evoking formidable immune responses so that vaccines could rapidly be deployed. The use of adenoviruses in developing vaccines is strongly sought as they have repeatedly exhibited potentiality in inducing immune responses.

Antisense and RNAi: Antisense oligonucleotides and RNA interference-based therapies utilize specific sequences of genes to silence those genes responsible for disease. This application is gaining importance as RNA-based therapies become more popular for treating such diseases as neurodegenerative conditions and cancers.

Gene Therapy: In fact, gene therapies are the primary propellant for the viral vectors market: these sequences employ vectors that deliver therapeutic genes aimed at correcting defective ones or replace them. This category spans disorders in the Genetic, metabolic, and rare Disease spectrum; within therapy research it opens its nose wide for complex designs amid cancer and cardiovascular medicine.

Cell Therapy: Cell therapy utilizes viral vectors for the engineering of cells for therapeutic purposes. Besides many other applications, the engineering of patient-derived T-cells into CAR-T cell therapy now stands as a modern revolution in the cancer treatment landscape that backs the advancements and climbs the demand that lentiviral vectors are experiencing.

Research Applications: The research application of different viral vectors or plasmids is the basis that permits studies related to gene function, disease modeling, and drug discovery. It covers a wide range of scientific investigations and preclinical studies that impact efforts to explore novel therapeutic possibilities, vector efficiencies, and clinical safety matters.

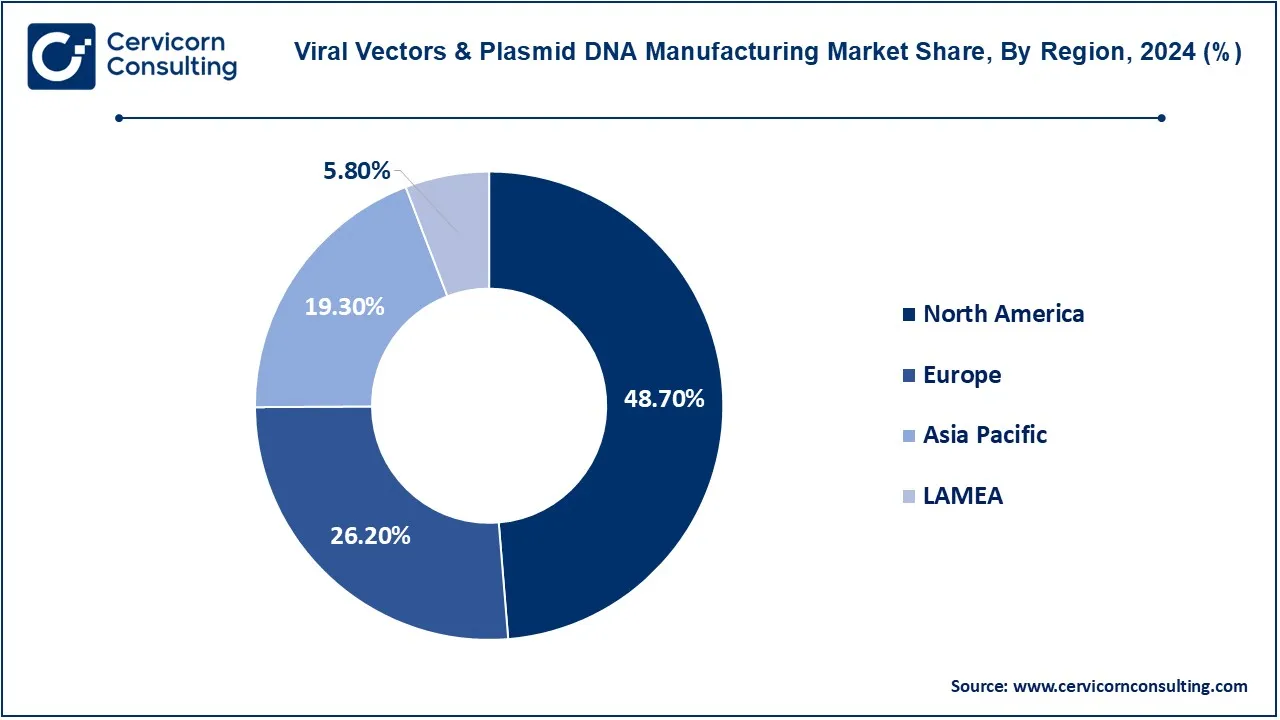

The viral vectors & plasmid DNA manufacturing market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America region has dominated the market in 2024.

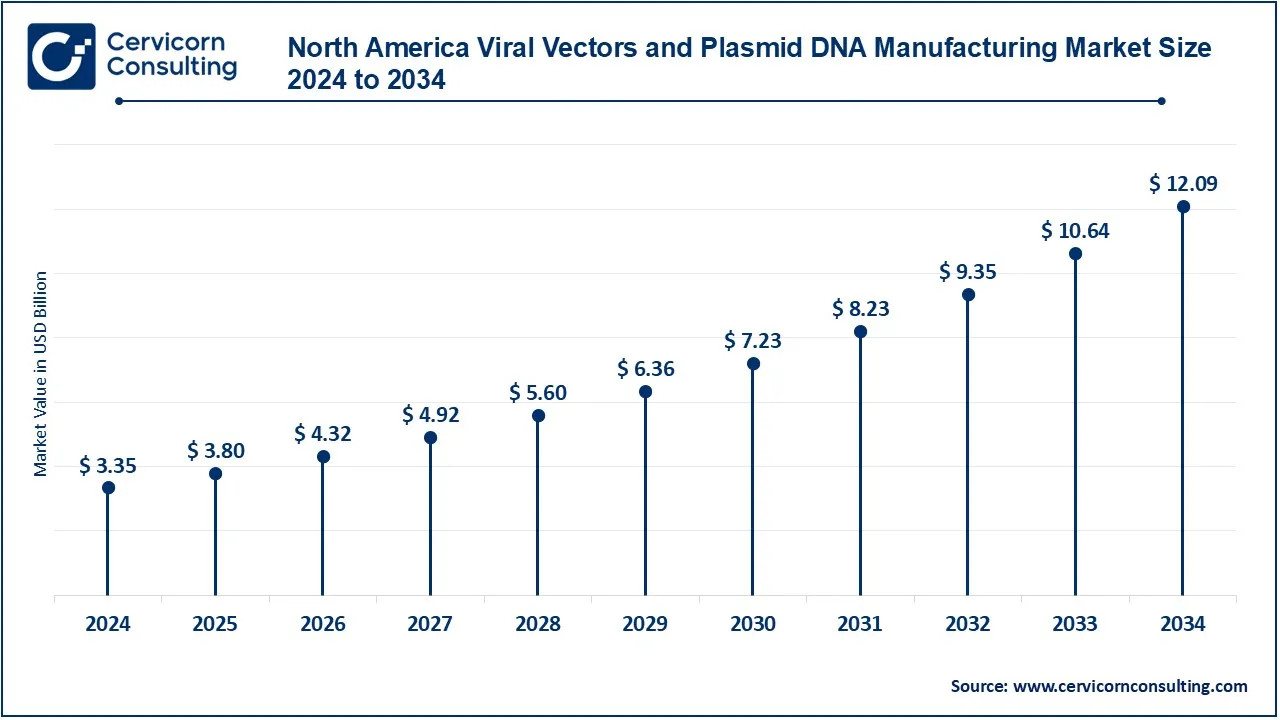

The North America viral vectors & plasmid DNA manufacturing market size was valued at USD 3.35 billion in 2024 and is expected to reach around USD 12.09 billion by 2034. North America continues to retain a premier position in the market due to its top-notch biotechnology research and well-structured infrastructure. The United States, attributed to leading biotechnology companies, solid investments in gene-based therapies included with a tough regulatory protocol, is at the forefront. In Canada, however, there is the hunger for an increase in research initiatives and collaborations within the biotech sector. It possesses a fully developed healthcare system and a lot of funding for research and development, which acts to its advantage in this industry.

The Europe viral vectors & plasmid DNA manufacturing market size was estimated at USD 1.33 billion in 2024 and is projected to hit around USD 4.79 billion by 2034. With one of the major market shares, Germany, the United Kingdom, and France are mainly in the charge of biopharmaceutical research and development. The European Union has given rise to some initiatives featuring innovation in gene therapy and vaccine development-a clear guiding hand in creating awareness in the market. In Germany, a great number of biotech companies deal with viral vector technology, while regulated advancements and funding for clinical trials go primarily from the United Kingdom. The relaxing mood on collaboration in this region goes a long way with respect of outcome on the plasmid DNA manufacture-and gene delivery systems.

The Asia-Pacific viral vectors & plasmid DNA manufacturing market size was accounted for USD 1.80 billion in 2024 and is predicted to surpass around USD 6.51 billion by 2034. The Asia-Pacific region is swiftly rising to be a significant player in the market, mainly on the heels of dipping investments in biotechnology and the pharmaceutical sector. Significant advancements into gene therapy research, along with government initiatives and increased healthcare spending, are seen in China and Japan. The growing biotechnology environment in India, along with the expertise in the plasmid DNA manufacturing part, contributes to the growth of the region. The growth of collaborations and innovations in the Asia-Pacific is fueled by an ever-increasing need for advanced and effective therapeutic solutions.

The LAMEA viral vectors & plasmid DNA manufacturing market was valued at USD 0.40 billion in 2024 and is anticipated to reach around USD 1.44 billion by 2034. The LAMEA region, which consists of Latin America, the Middle East, and Africa, is starting to experience, albeit slowly compared to other regions. In these regions, major strides in biotechnology are undertaken by Brazil and Mexico, aided by emerging healthcare markets within the Middle East, especially in Israel, and the advancement toward innovations in biopharmaceuticals and gene therapy. Africa is slowly building up its prowess in biotechnology in local research and development to address health challenges in the region. However, challenges remain on infrastructure and funding.

CEO Statements

Lynn Brubaker, CEO of Aldevron

Marc de Garidel, CEO of Eurogentec

Darius Adamczyk, CEO of Honeywell International

Market Segmentation

By Vector Type

By Application

By Disease

By Workflow

By End-Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Viral Vectors And Plasmid DNA Manufacturing

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Vector Type Overview

2.2.2 By Application Overview

2.2.3 By Disease Overview

2.2.4 By Workflow Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Viral Vectors And Plasmid DNA Manufacturing Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Prevalence of Chronic Diseases

4.1.1.2 Rising Investments in Biotech

4.1.1.3 Focus on Immunotherapy

4.1.2 Market Restraints

4.1.2.1 High Production Costs

4.1.2.2 Technical Hurdles for Production

4.1.2.3 Quality Concerns

4.1.3 Market Challenges

4.1.3.1 Quality and Compliance Issues

4.1.3.2 Integrating Innovation Practices

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Viral Vectors And Plasmid DNA Manufacturing Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Viral Vectors And Plasmid DNA Manufacturing Market, By Vector Type

6.1 Global Viral Vectors And Plasmid DNA Manufacturing Market Snapshot, By Vector Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Adenovirus

6.1.1.2 Retrovirus

6.1.1.3 Adeno-Associated Virus (AAV)

6.1.1.4 Lentivirus

6.1.1.5 Plasmids

6.1.1.6 Others

Chapter 7. Viral Vectors And Plasmid DNA Manufacturing Market, By Application

7.1 Global Viral Vectors And Plasmid DNA Manufacturing Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Antisense & RNAi Therapy

7.1.1.2 Gene Therapy

7.1.1.3 Cell Therapy

7.1.1.4 Vaccinology

7.1.1.5 Research Applications

Chapter 8. Viral Vectors And Plasmid DNA Manufacturing Market, By Disease

8.1 Global Viral Vectors And Plasmid DNA Manufacturing Market Snapshot, By Disease

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Cancer

8.1.1.2 Genetic Disorders

8.1.1.3 Infectious Diseases

8.1.1.4 Others

Chapter 9. Viral Vectors And Plasmid DNA Manufacturing Market, By Workflow

9.1 Global Viral Vectors And Plasmid DNA Manufacturing Market Snapshot, By Workflow

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Upstream Manufacturing

9.1.1.2 Downstream Manufacturing

Chapter 10. Viral Vectors And Plasmid DNA Manufacturing Market, By End-Use

10.1 Global Viral Vectors And Plasmid DNA Manufacturing Market Snapshot, By End-Use

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Pharmaceutical and Biopharmaceutical Companies

10.1.1.2 Research Institutes

Chapter 11. Viral Vectors And Plasmid DNA Manufacturing Market, By Region

11.1 Overview

11.2 Viral Vectors And Plasmid DNA Manufacturing Market Revenue Share, By Region 2024 (%)

11.3 Global Viral Vectors And Plasmid DNA Manufacturing Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Viral Vectors And Plasmid DNA Manufacturing Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Viral Vectors And Plasmid DNA Manufacturing Market, By Country

11.5.4 UK

11.5.4.1 UK Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Viral Vectors And Plasmid DNA Manufacturing Market, By Country

11.6.4 China

11.6.4.1 China Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Viral Vectors And Plasmid DNA Manufacturing Market, By Country

11.7.4 GCC

11.7.4.1 GCC Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Viral Vectors And Plasmid DNA Manufacturing Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Merck KGaA

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Lonza

13.3 FUJIFILM Diosynth Biotechnologies

13.4 Thermo Fisher Scientific

13.5 Cobra Biologics

13.6 Catalent Inc.

13.7 Wuxi Biologics

13.8 Takara Bio Inc.

13.9 Waisman Biomanufacturing

13.10 Genezen laboratories

13.11 Batavia Biosciences

13.12 Miltenyi Biotec GmbH

13.13 SIRION Biotech GmbH

13.14 Virovek Incorporation

13.15 BioNTech IMFS GmbH

13.16 Audentes Therapeutics

13.17 BioMarin Pharmaceutical

13.18 RegenxBio, Inc.