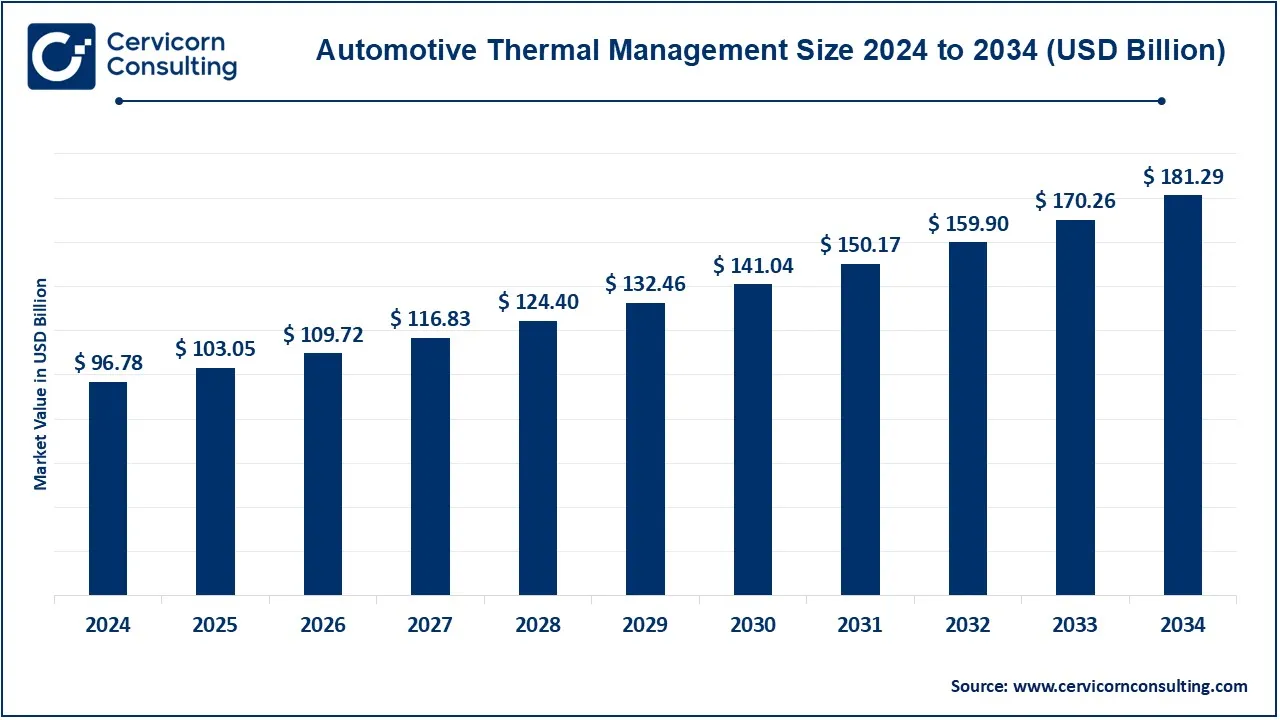

The global automotive thermal management market size was valued at USD 96.78 billion in 2024 and is expected to be worth around USD 181.29 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.47% from 2025 to 2034.

Thermal management is important for several reasons, including ride quality, heat insulation and dissipation, and environmental standards. Automotive thermal management has become a critical focus area in vehicle design and development. With the advent of electric vehicles (EVs), hybrid models, and high-performance cars, controlling heat within the vehicle has become essential to ensure efficiency, safety, and longevity. Temperature regulation is a crucial component of vehicle engineering as it affects a variety of parts, including infotainment systems, motors, and batteries. Optimized thermal management improves performance while promoting energy efficiency.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 96.78 Billion |

| Expected Market Size in 2034 | USD 181.29 Billion |

| Projected CAGR (2025 to 2034) | 6.47% |

| Most Prominent Region | North America |

| Hot Growth Market | Asia-Pacific |

| Key Segments | Vehicle Type, Application, Region |

| Key Companies | Denso Corporation, MAHLE GmbH, Gentherm Incorporated, Hanon Systems, Valeo, Robert Bosch GmbH, Modine Manufacturing Company, Marelli Holdings Co., Ltd., Schaeffler Group AG & Co. KG., Continental AG, BorgWarner Inc., Aptiv Inc., DuPont, Renesas Electronics Corporation, Dana Limited, NORMA Group, VOSS Automotive GmbH, Kendrion NV, Visteon Corporation, ZF Friedrichshafen AG, Keihin Corporation |

Increased Demand for Luxury Vehicles

Increasing implementation of stringent regulations

High vehicle costs

Maintenance and raw material limitations

Thermal Management and Autonomous Vehicles

Growing Number of Components in Vehicles

Battery Thermal Management in Electric Vehicles

Lack of Standardization

The automotive thermal management market is segmented into vehicle, application and region. Based on vehicle, the market is classified into commercial and passenger. Based on application, the market is classified into engine, cabin, transmission, waste heat recovery/exhaust gas recirculation, battery, motor and power electronics.

Commercial: The commercial vehicle segment includes both light and heavy commercial vehicles, including vans, pickup trucks, heavy trucks, and buses. Commercial vehicles equipped with electronic traction control, electronic stability programs, anti-lock braking systems (ABS), and adaptive cruise control systems are likely to gain popularity during the forecast period as consumer awareness about safety features increases. Global demand for commercial vehicle sales and emerging logistics and e-commerce sectors are driving up the price of automotive thermal management systems. Increasing urbanization may further support market expansion in developing countries, which is expected to increase the demand for light, medium, and heavy commercial vehicles.

Automotive Thermal Management Market Revenue Share, By Vehicle Type, 2024 (%)

| Vehicle | Revenue Share, 2024 (%) |

| Commercial | 64% |

| Passenger | 36% |

Passenger: Personal transportation remains the primary mode of transportation for most consumers. Even as shared mobility increases, advancing urbanization and rising incomes in developing countries will sustain private car ownership in the long term. Manufacturers are emphasizing thermal efficiency and reliability in passenger vehicles to improve customer satisfaction and brand perception. Tight engine compartments require sophisticated compact cooling modules, while cabin comfort requires efficient HVAC systems. Premium brands also place additional emphasis on thermal aesthetics to convey a sense of quality. In addition, in recent years, demand for SUVs in the passenger car segment has increased from Asia Pacific, North America and Europe (especially in China). Car electrification is expected to continue to advance due to planned models from manufacturers around the world. As passenger cars are expected to continue to be the volume driver of the automotive industry worldwide, their need for thermal management will also increase, leading to market growth in the foreseeable future.

Engine: The engine segment has dominated the market with highest revenue share in 2024. Automotive engine thermal management is used for cooling, which is driven by the increasing number of vehicles with internal combustion engines. Vehicle powertrains use internal combustion engines to convert chemical energy into heat and mechanical energy. This heat must be removed from the system for the engine to function properly. Several parts are used to keep the engine at the right temperature, including the radiator and the coolant pump.

Cabin: In the vehicle cabin thermal management system, complete heating, ventilation, and air conditioning (HVAC) systems are used to control the interior temperature of the vehicle. The number of vehicles sold worldwide will drive the market during the study period as the occupants of both internal combustion engines and electric vehicles need to be comfortable. Both internal combustion engines and electric vehicles have unique cabin thermal management systems. So, as investments in electric vehicles increase, the development of the cabin thermal management system is also increasing.

Transmission: A transmission cooler works like a heat exchanger mounted next to the vehicle's radiator. Hot transmission fluid flows through the unit and comes in contact with a series of fins or plates. The resulting heat dissipation cools the fluid as it flows back into the transmission. The radiator for the automatic transmissions is housed inside the radiator. The reason for this is that the antifreeze provides the perfect environment. It warms up the transmission with its coldness and prevents it from getting too hot in extreme heat.

Waste Heat Recovery/Exhaust Gas Recirculation: Factors such as increased sales of commercial vehicles and introduction of exhaust gas recirculation (EGR) and turbochargers as standard equipment and due to increased emission norms, waste heat recovery technology is being implemented in petrol vehicles. These are some of the major factors driving the growth of the market.

Battery: Energy storage in the form of batteries plays a key role in the operation of electric vehicles and power systems. When storing batteries, it is extremely important to maintain a defined temperature range. Moreover, overheated batteries pose an increased risk of fires and explosions. The battery cooling system in electric vehicles regulates the temperature of the battery pack. Battery thermal management in electric vehicles uses cooling circuits containing liquid coolants such as ethylene glycol. An electric pump circulates the coolant through the batteries.

Motor and Power Electronics: As electric drive systems become more complex and increasingly rely on temperature-sensitive components, efficient and effective cooling is essential to avoid the risk of costly overheating, performance degradation and shutdown. By keeping the engine in its ideal temperature range, these cooling systems improve the efficiency and reliability of the vehicle. There are many ways to cool engines and power electronics, including heat pipes, liquid cooling plates, air cooling, forced air cooling, gas cooling and phase transition cooling. Engine and power electronics cooling systems are the modules used by leading OEMs in the bus and coach, off-road, commercial and specialty vehicle sectors.

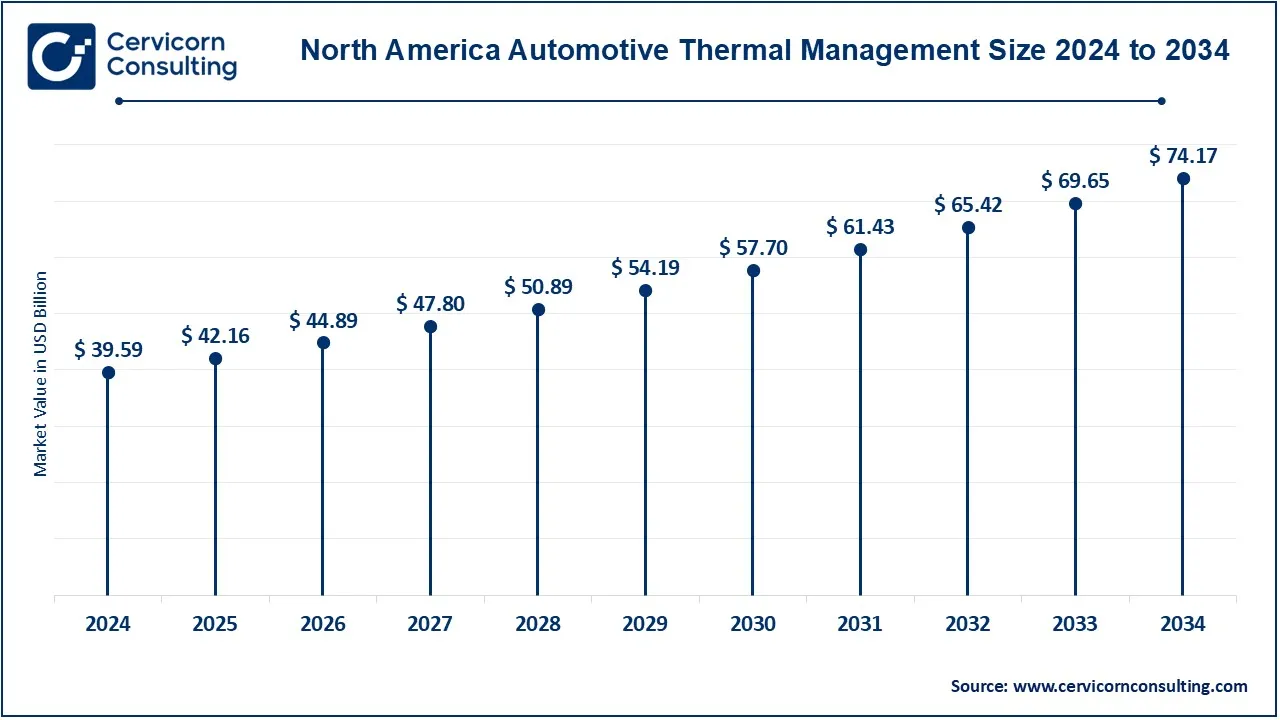

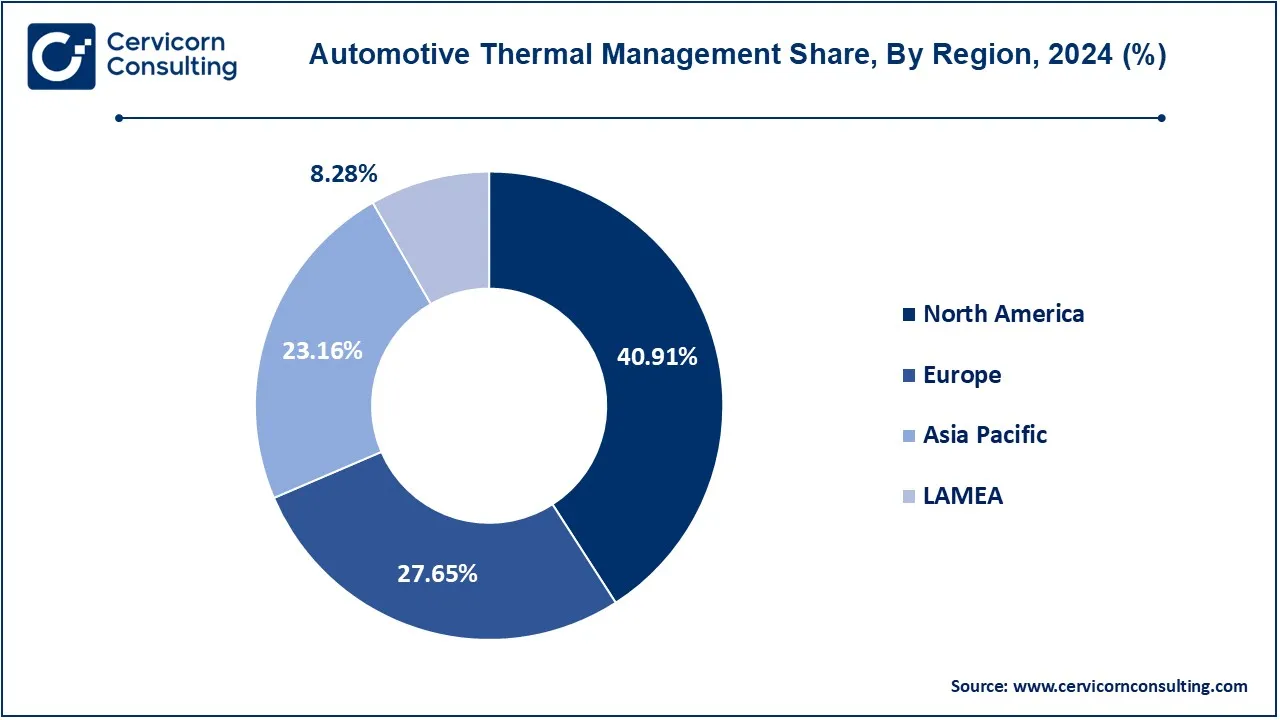

The automotive thermal management market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. The North America region ahs dominated the market in 2024.

The North America automotive thermal management market size was valued at USD 39.59 billion in 2024 and is expected to reach around USD 74.17 billion by 2034. The presence of automotive giants such as General Motors, Ford, and Fiat-Chrysler has made the U.S. the largest automobile manufacturer in the world. With a focus on research and development of innovative thermal management technologies, these companies have established supply chains around North America. Several major automotive suppliers have also set up shop in the region to meet the requirements of original equipment manufacturers. This has resulted in North America having the most advanced thermal management systems integrated in a wide range of vehicles. With increasing consumer demand for larger and more powerful engines in trucks and SUVs, thermal management remains a crucial factor in North American auto designs.

The Europe automotive thermal management market size was estimated at USD 26.76 billion in 2024 and is projected to hit around USD 50.13 billion by 2034. In Europe, increasing technological breakthroughs and increasing spending on innovations in the automotive industry are expected to drive the demand for the market. The expansion of the automotive thermal management sector is also expected to be moderately impacted by government policies such as a ban on the use of diesel vehicles as this is likely to encourage the adoption of electric vehicles. Leading automakers are evaluating innovative HVAC and thermal management systems developed by German vehicle manufacturing companies. In addition, battery thermal management has been improved, enabling more efficient driving and longer range, especially in cold weather.

The Asia-Pacific automotive thermal management market size was accounted for USD 22.41 billion in 2024 and is predicted to surpass around USD 41.99 billion by 2034. The market is expected to be driven by the expanding automotive industry in Asia Pacific, where centers for producing auto parts for Western auto giants are emerging in China and India. The market growth forecast is expected to be positive during the forecast period due to increasing government regulations to encourage the adoption of electric vehicles and aggressive expansion strategies by regional OEMs and suppliers to meet the increasing demand of the Chinese automotive industry. However, the thermal management requirements of vehicles in the hot and humid Asian climate pose unique challenges. To gain market share and reduce costs, local manufacturers are collaborating with international component suppliers to deploy advanced thermal technologies.

The LAMEA automotive thermal management market was valued at USD 8.01 billion in 2024 and is anticipated to reach around USD 15.01 billion by 2034. The major factors driving the LAMEA region are growth of the automotive industry, rising demand for high-tech features in cars, and increasing development of interior comfort features by the automakers. The region is facing challenges related to rising raw material prices as well as dependence on North America and China for electronics, components, and other raw material imports, which further restricts the growth prospects in the automotive thermal management market. The Latin America region is facing challenges related to rising raw material prices as well as dependence on electronics, components, and other raw material imports, which further restricts the growth prospects in the automotive thermal management market. Halla Visteon Climate Control Corp. recently opened a new manufacturing facility in the Brazilian state of Sao Paulo, Atibaia, to facilitate localization and improve customer service. Governments are taking initiatives to promote electric vehicles and providing tax incentives and rebates. The rise in the electric vehicle market is due to the rapid advancement of technology, due to which the demand for electric vehicle thermal management systems is increasing in the market. The electric vehicle thermal management system market in the Middle East and Africa is growing rapidly due to the increasing demand for electric vehicles.

Some of the key players in the automotive thermal management industry include DENSO Corporation, Gentherm Incorporated, Hanon Climate Systems India Pvt. Ltd., and BorgWarner Inc. Automotive thermal management systems are growing at an accelerated rate as a result of major corporations investing in a variety of R&D initiatives to broaden their product offerings. Companies are also taking strategic steps to expand their presence globally by launching new products, increasing investments, collaborating and announcing partnerships with other market players and contractual agreements. In January 2023, Grayson Thermal Systems launched a vehicle thermal management system to optimize the range of electric buses, off-highway applications, and commercial vehicles. To further solidify their leading positions in thermal management, Valeo and FUCHS announced in December 2023 that they would be working together to develop thermal management solutions for battery energy storage.

CEO Statements

Arnd Franz, CEO of MAHLE Group

Ravi Chidambar, CEO of Tata Toyo Radiator Ltd

These improvements represent a significant increase in the automotive thermal management industry, fuelled by smart acquisitions and creative initiatives aimed at enhancing sustainability, improving construction efficiency, and extending product offerings to fulfil different building demands. These advancements mark a notable expansion in the automotive thermal management market, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Vehicle

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Automotive Thermal Management

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Vehicle Type Overview

2.2.2 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Automotive Thermal Management Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Demand for Luxury Vehicles

4.1.1.2 Increasing implementation of stringent regulations

4.1.2 Market Restraints

4.1.2.1 High Vehicle Costs

4.1.2.2 Maintenance and raw material limitations

4.1.3 Market Challenges

4.1.3.1 Battery Thermal Management in Electric Vehicles

4.1.3.2 Lack of Standardization

4.1.4 Market Opportunities

4.1.4.1 Thermal Management and Autonomous Vehicles

4.1.4.2 Growing Number of Components in Vehicles

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Automotive Thermal Management Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Automotive Thermal Management Market, By Vehicle Type

6.1 Global Automotive Thermal Management Market Snapshot, By Vehicle Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Commercial

6.1.1.2 Passenger

Chapter 7. Automotive Thermal Management Market, By Application

7.1 Global Automotive Thermal Management Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Engine

7.1.1.2 Cabin

7.1.1.3 Transmission

7.1.1.4 Waste Heat Recovery/Exhaust Gas Recirculation

7.1.1.5 Battery

7.1.1.6 Motor and Power Electronics

Chapter 8. Automotive Thermal Management Market, By Region

8.1 Overview

8.2 Automotive Thermal Management Market Revenue Share, By Region 2024 (%)

8.3 Global Automotive Thermal Management Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Automotive Thermal Management Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Automotive Thermal Management Market, By Country

8.5.4 UK

8.5.4.1 UK Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Automotive Thermal Management Market, By Country

8.6.4 China

8.6.4.1 China Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Automotive Thermal Management Market, By Country

8.7.4 GCC

8.7.4.1 GCC Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Automotive Thermal Management Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10. Company Profiles

10.1 Denso Corporation

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 MAHLE GmbH

10.3 Gentherm Incorporated

10.4 Hanon Systems

10.5 Valeo

10.6 Robert Bosch GmbH

10.7 Modine Manufacturing Company

10.8 Marelli Holdings Co., Ltd.

10.9 Schaeffler Group AG & Co. KG.

10.10 Continental AG

10.11 BorgWarner Inc.

10.12 Aptiv Inc.

10.13 DuPont

10.14 Renesas Electronics Corporation

10.15 Dana Limited

10.16 NORMA Group

10.17 VOSS Automotive GmbH

10.18 Eberspächer

10.19 Kendrion NV

10.20 Visteon Corporation

10.21 ZF Friedrichshafen AG

10.22 Keihin Corporation