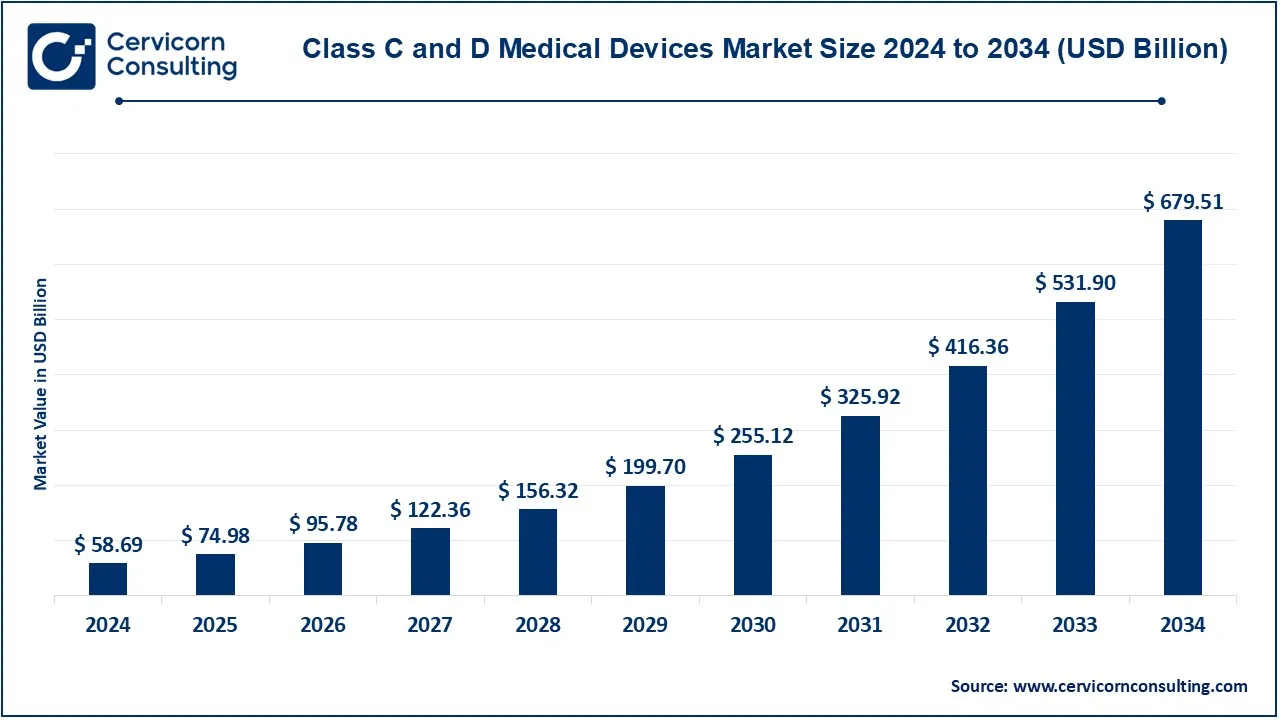

The global class C and D medical devices market size was valued at USD 58.69 billion in 2024 and is expected to be worth around USD 679.51 billion by 2034, growing at a compound annual growth rate (CAGR) of 27.75% from 2025 to 2034. The global market for Class C and Class D medical devices is expanding rapidly due to technological advancements, aging populations, and the rising prevalence of chronic diseases. The demand for innovative solutions in diagnostics, treatment, and patient monitoring is pushing manufacturers to develop safer, more efficient devices. Government regulations and increasing healthcare investments further contribute to market expansion. Additionally, the integration of AI, IoT, and robotic-assisted surgeries has enhanced the capabilities of these devices, making them more precise and efficient. Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing significant growth due to improved healthcare infrastructure and increased medical expenditures.

The global class C and D medical devices market consists of high-end medical devices that are crucial in diagnosing, treating and managing various complicated medical conditions. High risk medical devices such as class C devices (infusion pumps and ventilators) and class D devices (implantable defibrillators, pacemakers, etc.) are strictly controlled due to their influence on health. The market has been facilitated by the increasing prevalence of chronic diseases, the usage of advanced medical treatment tools, and the rise in healthcare spending around the world. Leaders of the key players are focusing on innovation as well as implementation of the strategic alliances and geographic expansion to be on the lead. The growth has picked trend owing to an increase in the population and need for effective and less invasive medical techniques. Nonetheless, factors such as strict regulation guidelines and expensive research and development costs are likely to limit the expansion of the market.

What are the Class C and Class D Medical Devices?

Class C and Class D medical devices are high-risk medical products that require stringent regulatory approval due to their potential impact on human health.

Both classes must meet international safety and efficacy standards, such as FDA (U.S.), MDR (EU), and ISO 13485 certification. Due to technological advancements, demand for these devices is rising, particularly in aging populations and increasing chronic disease cases.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 58.69 Billion |

| Expected Market Size in 2034 | USD 679.51 Billion |

| Projected CAGR 2025 to 2034 | 27.75% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Device Type, Application, End User, Region |

| Key Companies | Medtronic plc, Johnson & Johnson, Siemens Healthineers AG, Philips Healthcare, GE HealthCare Technologies Inc., Stryker Corporation, Abbott Laboratories, Boston Scientific Corporation, Becton, Dickinson and Company (BD), Zimmer Biomet Holdings, Inc., Intuitive Surgical, Inc., Smith & Nephew plc, Edwards Lifesciences Corporation, Roche Diagnostics, Thermo Fisher Scientific Inc. |

Rising Prevalence of Lifestyle Diseases

Government Support and Subsidies

Stringent Regulatory Requirements

High Development and Manufacturing Costs

Integration of AI and IoT in Medical Devices

Growing Incidence of Infectious Diseases

Limited Accessibility in Emerging Markets

Lack of Skilled Professionals

The class C and D medical devices market is segmented into device type, application, end user and region. Based on device type, the market is classified into therapeutic devices, diagnostic devices and monitoring devices. Based on application, the market is classified into cardiology, neurology and oncology. Based on end user, the market is classified into hospitals & clinics and home healthcare.

Therapeutic Devices: Therapeutic devices encompass life-supporting equipment such as o pacemaker, infusion pump, ventilator or even a surgical robot which are a must in severe medical treatment. Pacemakers and implantable cardioverter defibrillator treat cardiac arrhythmia whereas in case of ventilators, these are used whenever there is a problem associated with breathing. The use of surgical robots is on the rise because of their ability to do accurate surgeries and shorter time taken during recovery. The rise in the adoption of therapeutic devices can be attributed to the increase in chronic diseases such as heart failure and respiratory diseases and the increasing effectiveness of minimally invasive treatments.

Diagnostic Devices: Diagnostic devices include imaging equipment that includes MRI, CT scanners, and laboratory systems, which are instrumental in early detection of diseases. These devices are crucial in diagnosing cancer, disorders of the circulation system and even conditions affecting the nervous system. This particular segment is expanding owing to the increasing focus on preventive healthcare as well as the improvements in imaging systems. Incorporation of AI into these systems has results in incredibly high accuracy levels in lesions diagnosis, as well as a short time needed for the readings.

Monitoring Devices: Monitoring devices such ICU monitoring systems, wearables and implantable monitors are important since they provide real time health data of the patients. These devices greatly help in the control of chronic ailments by providing alert on any risks and minimizing hospitalization. With the invention of IoT and wireless technologies, Patients are now cared for at home by providing them with monitoring capabilities.

Cardiology: This section includes all the devices including implantable defibrillators, cardiac monitors, and stents which target cardiovascular diseases that contribute to high mortality rates globally. There is a high demand for these devices due to the increased cases of heart-related illnesses, the rise of older adults in the population, and unhealthy lifestyle practices like lack of physical exercise. In addition to these factors, some technology innovations, for example, AI cardiac monitoring devices, and cardiac diseases intervention techniques, help customers in utilizing these devices more.

Neurology: Neurology devices that comprise neurostimulators, EEG systems, as well as advanced brain imaging devices are paramount in treating neurological anomalies such as epilepsy, Parkinson’s disease, and injuries to the brain. There is growing demand in this sub-segment owing to the expanding geriatric populations which have been associated with increasing neurological diseases and improvement in imaging of the brain.

Oncology: Devices in the category of oncology include chemotherapy infusion pumps, radiation oncology devices, and diagnostic imaging systems. The increasing rate of cancer incidences across the globe is the key factor for the growth of this particular sub-segment. There has been a growing trend where devices that do targeted therapies, for instance, linear accelerators, are superior than standard machines since they are accurate and have minimal side effects. Also, the increasing demand of targeted treatment and improvements in diagnostics also assist in propelling this market.

Hospitals and Clinics: As these institutions are capable of carrying out intricate medical processes, Class C and D medical equipment is in great demand within these facilities. These facilities spend considerable amounts on high-risk medical instruments such as ventilators and complex imaging systems as well as surgical robots in order to provide advanced treatment. In the hospitals, such devices are in increasing demand due to rise in chronic ailments and complicated surgical procedures that are performed.

Home Healthcare: Equipment such as home healthcare devices that provide convenience such as portable ventilators, dialysis machines, and glucose monitors are on the rise thanks to their efficiency and lower costs. Such devices help patients with long lasting illnesses to avoid going to hospitals often enabling them to take care of their health by themselves. There was a radical rise in the provision of home care focused on health care equipment, especially in the extreme period of the COVID-19 pandemic where such equipment proved to be very useful in the mitigation of the health burden posed on the systems. There have been advances in these kinds of devices due to software advancement in their use and incorporation of wireless technology.

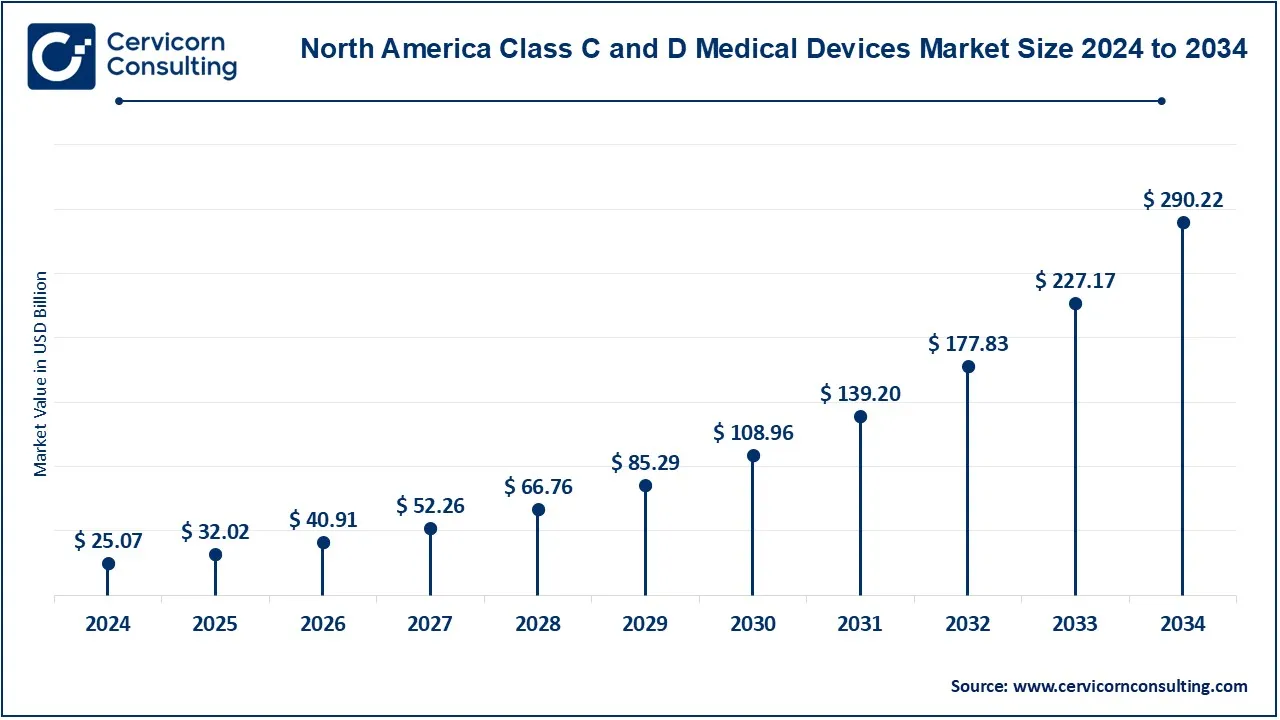

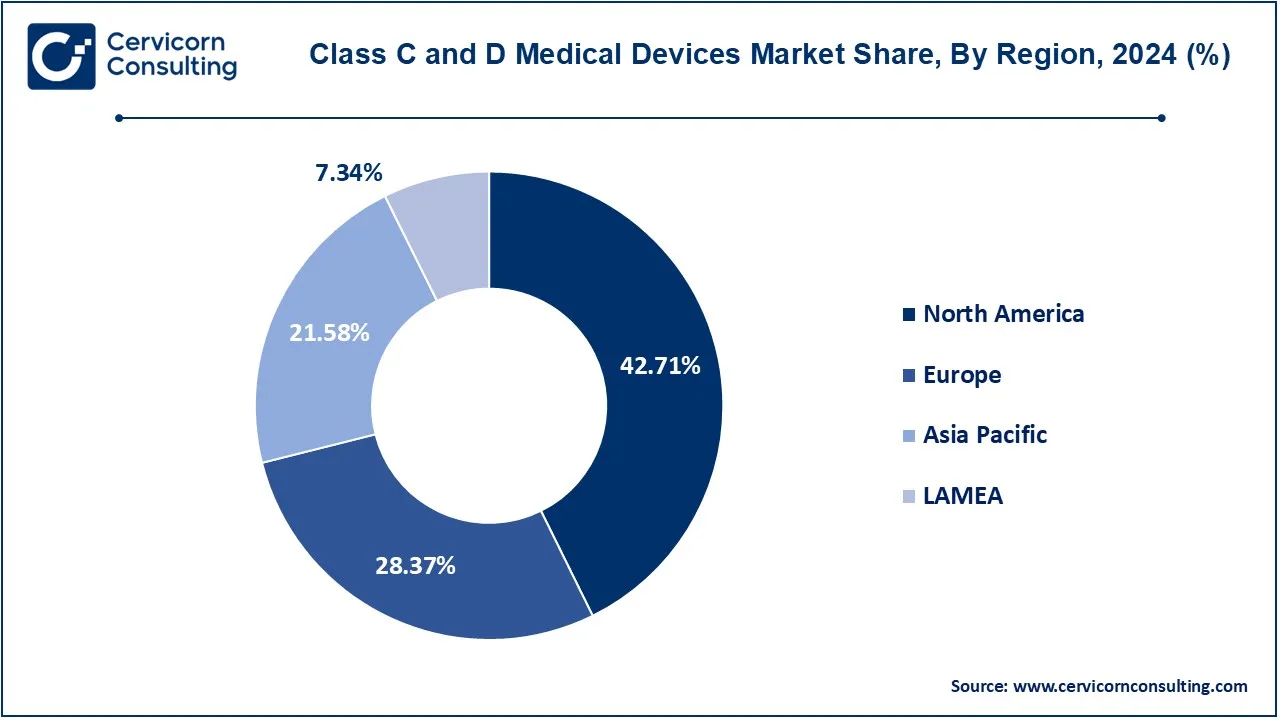

The class C and D medical devices market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. The North America region has dominated the market in 2024.

The North America class C and D medical devices market size was valued at USD 25.07 billion in 2024 and is expected to be worth around USD 290.22 billion by 2034. North America is expected to remain the largest market, due to the availability of sophisticated healthcare facilities, high health care expenditure, and emphasis on technology innovation. With the presence of prominent players in the market alongside extensive R&D activities, the region ensures the constant availability of advanced devices treasure. Furthermore, regions such as the North America market is growing owing to innovation friendly policies such as the fast-track approval of breakthrough device by the FDA.

The Europe class C and D medical devices market size was estimated at USD 16.65 billion in 2024 and is predicted to surpass around USD 192.78 billion by 2034. Europe also accounts for a notable portion, owing to the growing elderly population and a developed healthcare system. The adoption of the EU Medical Device Regulation (MDR) has improved safety and quality of products leading to confidence in high end medical devices. Further geographies include Germany, the UK and France which have high spending on healthcare and prioritize research and development activities.

The Asia-Pacific class C and D medical devices market size was accounted for USD 12.67 billion in 2024 and is projected to hit around USD 146.64 billion by 2034. Asia-Pacific is the most lucrative region, due to factors such as increasing urbanization, better healthcare settings, and the rising income levels. Countries such as China, India, and Japan are showing the high demand due to increasing healthcare spending and a large patient population. Moreover, opportunities brought by government policies encouraging access to healthcare and insurance, expansion of the medical tourism industry, assist in market growth.

The LAMEA class C and D medical devices market was valued at USD 4.31 billion in 2024 and is anticipated to reach around USD 49.88 billion by 2034. The LAMEA region is experiencing moderate growth on account of higher healthcare spending and increasing burden of chronic diseases. The Latin America region is spearheaded by Brazil and Mexico and is focused on high-end medical devices to enhance the level of care in this region. Middle East and Africa have seen an increase in demand due to efforts aimed at modernizing the health care systems as well as promoting medical tourism. Nevertheless, there are drawbacks to the wider availability of medical devices such as limited infrastructure and cost-effective strategies.

The medical devices market of Class C and D is now witnessing the entrance of a number of new players who are successfully innovating in their respective niches. This is accomplished through the application of new technologies and the unmet demands of the health care sector. These companies tend to focus on creating high-tech solutions such as AI-based diagnostics systems and other products less invasive to the body, as well as health monitors which a person can wear. They also improve the devices and the results of patients by adding ICTs such as the IoT, telemetry, and big data analytics. Emerging players, on the other hand, are also venturing into offering products in value markets by creating cheaper but better-quality imitations of high-end products offered by existing players. Many of those companies engage in partnerships with research institutions, healthcare providers, as well as other larger firms for faster product development and gaining market share.

Market Segmentation

By Device Type

By Application

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Class C and D Medical Devices

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Device Type Overview

2.2.2 By Application Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Class C and D Medical Devices Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Prevalence of Lifestyle Diseases

4.1.1.2 Government Support and Subsidies

4.1.2 Market Restraints

4.1.2.1 Stringent Regulatory Requirements

4.1.2.2 High Development and Manufacturing Costs

4.1.3 Market Challenges

4.1.3.1 Limited Accessibility in Emerging Markets

4.1.3.2 Lack of Skilled Professionals

4.1.4 Opportunities

4.1.4.1 Integration of AI and IoT in Medical Devices

4.1.4.2 Growing Incidence of Infectious Diseases

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Class C and D Medical Devices Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Class C and D Medical Devices Market, By Device Type

6.1 Global Class C and D Medical Devices Market Snapshot, By Device Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Therapeutic Devices

6.1.1.2 Diagnostic Devices

6.1.1.3 Monitoring Devices

Chapter 7. Class C and D Medical Devices Market, By Application

7.1 Global Class C and D Medical Devices Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Cardiology

7.1.1.2 Neurology

7.1.1.3 Oncology

Chapter 8. Class C and D Medical Devices Market, By End User

8.1 Global Class C and D Medical Devices Market Snapshot, By End User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Hospitals and Clinics

8.1.1.2 Home Healthcare

Chapter 9. Class C and D Medical Devices Market, By Region

9.1 Overview

9.2 Class C and D Medical Devices Market Revenue Share, By Region 2024 (%)

9.3 Global Class C and D Medical Devices Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Class C and D Medical Devices Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Class C and D Medical Devices Market, By Country

9.5.4 UK

9.5.4.1 UK Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Class C and D Medical Devices Market, By Country

9.6.4 China

9.6.4.1 China Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Class C and D Medical Devices Market, By Country

9.7.4 GCC

9.7.4.1 GCC Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Class C and D Medical Devices Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Medtronic plc

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Johnson & Johnson (including DePuy Synthes and Ethicon)

11.3 Siemens Healthineers AG

11.4 Philips Healthcare

11.5 GE HealthCare Technologies Inc.

11.6 Stryker Corporation

11.7 Abbott Laboratories

11.8 Boston Scientific Corporation

11.9 Becton, Dickinson and Company (BD)

11.10 Zimmer Biomet Holdings, Inc.

11.11 Intuitive Surgical, Inc.

11.12 Smith & Nephew plc

11.13 Edwards Lifesciences Corporation

11.14 Roche Diagnostics

11.15 Thermo Fisher Scientific Inc.