The global supercharger market size was valued at USD 7.42 billion in 2024 and is expected to be worth around USD 12.78 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.58% during the forecast period 2025 to 2034. The U.S. supercharger market size was estimated at USD 2.52 billion in 2024.

The superchargers market is growing due to the increasing need for high performance and fuel-efficient vehicles in many automotive sectors. Superchargers enhance engine performance by compressing air and introducing more oxygen for combustion. Therefore, they are most common in sports cars, motorcycles, and high-end cars. Since most vehicle components are already electrical and hybridized superchargers don’t have any exhaust gases, the demand for them has increased rapidly. Moreover, the increasing regulatory concern about the emissions of greenhouse gases, together with the consumer demand for more powerful vehicles, compels car makers to turn to new more ecological supercharging techniques. The market will also take advantage of the continued R&D funded to improve the efficiency of supercharger systems as well as the reduction of lag and maintenance costs of the vehicle so that superchargers become friendly to both the producers and the consumers.

CEO Statements

These CEO statements reflect a shared commitment to leveraging technology and personalized approaches in supercharger, aiming to enhance employee health and productivity. Through innovation and comprehensive solutions, these key players are driving significant improvements in workplace well-being and performance.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 7.42 Billion |

| Expected Market Size in 2034 | USD 12.78 Billion |

| CAGR 2025 to 2034 | 5.58% |

| Leading Region | North America |

| Accelerating Region | Asia-Pacific |

| Key Segments | Product, Type, Application, Voltage Range, Electrolyte Type, Capacitance, End User, Region |

| Key Companies | A&A Corvette Performance, Audi Sport GmbH, Chevrolet Performance (General Motors), Eaton Corporation, Edelbrock LLC, Ford Performance (Ford Motor Company), Harrop Engineering, Honeywell International Inc., IHI Corporation, Magnuson Superchargers, Ogura Clutch Co., Ltd., Paxton Automotive, ProCharger (Accessible Technologies, Inc.), Rotrex A/S, Roush Performance Products, Inc., Sprintex Ltd, TPS Motorsports, Vortech Engineering, Inc., Whipple Superchargers |

Economic Growth in the Emerging Markets

Enhanced Durability and Reliability of Modern Superchargers

High Initial Cost of Superchargers

Rising Popularity of Turbochargers

Increasing Consumer Awareness of Vehicle Performance

OEM and Aftermarket Partnerships

Limited Adoption in Electric Vehicles

High Maintenance and Potential Durability issues

The supercharger market is segmented into product, type, application, voltage range, electrolyte type, capacitance, end user and region. Based on product, the market is classified into roots and twin-screw superchargers and centrifugal superchargers. Based on type, the market is classified into electrostatic double-layer capacitors, pseudo-capacitors and hybrid capacitors. Based on application, the market is classified into aftermarket and OEM. Based on vehicle type, the market is classified into passenger vehicle, commercial vehicle and high-performance vehicle. Based on voltage range, the market is classified into low voltage (up to 2.7 V), medium voltage (2.8 to 5 V) and high voltage (Above 5 V). Based on electrolyte type, the market is classified into aqueous electrolytes, organic electrolytes and solid electrolytes. Based on capacitance, the market is classified into low (< 10 Farads), medium (10 to 100 Farads) and high (Above 100 Farads). Based on end user, the market is classified into automotive, consumer electronics, energy, grid stabilization, industrial, aerospace & defense, healthcare, telecommunications and others.

Roots and Twin-Screw Superchargers: The roots and twin-screw superchargers are known for providing a set volume of air for every engine cycle. Roots superchargers admit outside air pressure straight into the combustion chamber, therefore, the boost is available almost instantaneously from low engine speeds which is perfect for a torque demanding setup. However, this may not be the same case when the engine speeds are higher. More heat is generated instead. Twin-screw superchargers address this issue by forcing the air into the engine where it is compressed within the unit itself before it can be released into the engine, thus allowing for improved and cooler airflow which in turns increases the performance and the fuel efficiency.

Centrifugal Superchargers: Centrifugal superchargers operates like turbochargers however they are driven by the engine instead of collected exhaust gases. They use an impeller to compress the air in a radial fashion. In this design, boost is built up gradually with RPM, so the power output is concentrated at high speeds, which is perfect for applications that prioritize performance at the very end of the speed range. Because centrifugal superchargers employ a compact design, they are also more fuel efficient than other types because they do not produce as much power at low speeds.

Passenger Vehicle: Superchargers are installed in passenger cars with the aim of increasing power ratings without affecting fuel economy. The segment includes family-oriented cars such as saloon cars and SUVs among others where manufacturers are now using superchargers to increase performance and adhere to emission regulations. On the other hand, superchargers make the daily driving cars, providing faster speeds, thus making these vehicles suitable for both urban and highway driving.

Commercial Vehicle: The incorporation of superchargers in commercial vehicles such as trucks, vans, or buses enhances engine performance and efficiency during heavy load operations. This comes in handy especially for some vehicles that spend more time in low rpm ranges where superchargers deliver torque instantly thus enhancing acceleration and driving force. Superchargers also come in handy for allowing engine downsizing, which in turn helps in saving in fuel and engine emissions without losing the required power enhancing them for the delivery and logistics fleets which operate in green zones.

High-Performance Vehicles: The high-performance vehicles’ segment holds a rather considerable portion of the superchargers market, as such vehicles practically aim for power, speed, and rapid acceleration. Sports cars, muscle cars, and high-end performance vehicles tend to favour fitment of superchargers as they guarantee power on demand and provide excitement to operate. In most instances, car manufacturers provide these units as original equipment manufacturer (OEM) fitments to their models considered performance cars and sport cars appeal to car and motorsport fans.

Aftermarket: Superchargers, as well as other components, are distributed via aftermarket channels. Supercharger installation kits are tailored to automotive enthusiasts who wish to improve overall performance beyond what the stock vehicle offers. These kits can be fitted onto a range of vehicles so that customers can enhance the power ratings of their cars without the need to buy an expensive sports car. Aftermarket superchargers are mostly purchased by the owners of sports and muscle cars as well as modified cars who want to enjoy an instant boost in power and thrilling ride.

OEM: OEM refers to a supercharger system that comes installed in a car from the factory when the latter is being assembled. These systems are manufactured by third parties to specified performance standards. OEM superchargers come with the added benefit of fitting perfectly within the engine because they are designed with the right degree of strength and efficiency and have been subjected to many tests. Car manufacturers restrict the use of superchargers to certain high-end sporty or luxury models of cars in order to enhance customer satisfaction and power delivery from the cars straight from the dealership.

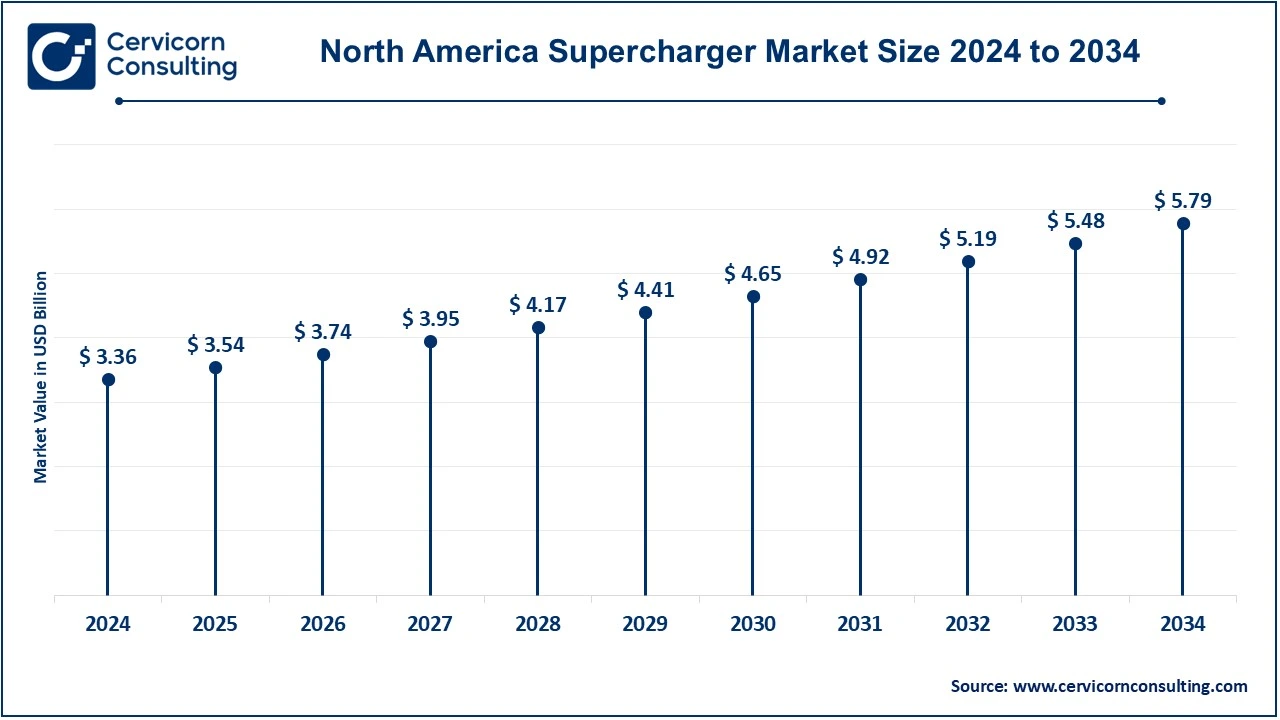

The supercharger market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. The North America has held leading position in 2024.

The North America supercharger market size was estimated at USD 3.36 billion in 2024 and is expected to reach around USD 5.79 billion by 2034. The growth for North America region is mostly affected by the increasing excitement for high-performance vehicles as well as healthy automotive among others industries especially in the US where a high number of car lovers particularly muscle and sports cars are found and thereby creating a bigger market for supercharger kits.

The Europe supercharger market size was accounted for USD 7.42 billion in 2024 and is projected to hit around USD 12.78 billion by 2034. Europe market is supported by a strong automotive industry, with leading automakers such as Mercedes-Benz, BMW, and Audi incorporating superchargers in performance models. Moreover, the market in Europe is heightened by the existing pollution control policies that compel companies to adopt superchargers to enhance efficiency without reducing the power output.

Rising disposable incomes, an expanding middle class, and increasing luxury car sales in China, Japan, and India, are all factors contributing to the rapid growth of the superchargers market in Asia Pacific. With the rise in automobile sales mostly in China, there is an increase in sales of performance enhancing components such as superchargers. The aftermarket segment of the region is also transforming at a tremendous pace, as vehicle owners who are passionate about cars are altering the cars for better performance.

The LAMEA market is still in its infancy stage as there is an increase in the demand for luxurious and swift automobiles. In the case of LAMEA, the rising trend of customized vehicles acts as the engine of growth for the Latin American market, while in the Middle East, the demand for luxury and high-performance vehicles provides strength for the original equipment manufacturers applications. Even though certain factors such as economic issues and challenges related to infrastructure are a limitation, the market is promising even more so for the inner cities where consumers have availed themselves to the trend of high-end vehicles.

The new entrants in the supercharger industry are employing technology to devise the most efficient and light-weight supercharging systems. These new market players tend to concentrate on the manufacturing of electric and hybrid compatible supercharging systems which help in cutting down emissions without compromising the power, hence targeting the green conscious consumers and car makers with tough emissions regulations. Most of them are also coming up with ready-to-install supercharger raw materials and accessories in order to tap into the present-day aftermarket craze. For example, Kenne Bell is firmly establishing its reputation with the help of proven advanced twin-screw superchargers whereas RIPP Superchargers installs very effective systems to the bolt-on areas of pick-up trucks and specific sport utilities. Others, such as Boosted Solutions, offer low-cost, flexible-based superchargers aimed at both racers and average users.

Recent strategic partnerships and investments in the EV charging infrastructure reflect a strong commitment to advancing sustainable transportation. Key collaborations across Europe and South America are set to enhance charging networks, integrate innovative technologies, and expand the availability of renewable energy-powered charging solutions.Some notable examples of key developments in the supercharger industry include:

Market Segmentation

By Product

By Type

By Vehicle Type

By Voltage Range

By Electrolyte Type

By Capacitance

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Supercharger

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Type Overview

2.2.3 By Vehicle Type Overview

2.2.4 By Voltage Range Overview

2.2.5 By Electrolyte Type Overview

2.2.6 By Capacitance Overview

2.2.7 By Application Overview

2.2.8 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Supercharger Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Economic Growth in the Emerging Markets

4.1.1.2 Enhanced Durability and Reliability of Modern Superchargers

4.1.2 Market Restraints

4.1.2.1 High Initial Cost of Superchargers

4.1.2.2 Rising Popularity of Turbochargers

4.1.3 Market Challenges

4.1.3.1 Limited Adoption in Electric Vehicles

4.1.3.2 High Maintenance and Potential Durability issues

4.1.4 Market Opportunities

4.1.4.1 Increasing Consumer Awareness of Vehicle Performance

4.1.4.2 OEM and Aftermarket Partnerships

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Supercharger Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Supercharger Market, By Product

6.1 Global Supercharger Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Roots and Twin-Screw Superchargers

6.1.1.2 Centrifugal Superchargers

Chapter 7. Supercharger Market, By Type

7.1 Global Supercharger Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Electrostatic double-layer capacitors

7.1.1.2 Pseudo-capacitors

7.1.1.3 Hybrid capacitors

Chapter 8. Supercharger Market, By Application

8.1 Global Supercharger Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Aftermarket

8.1.1.2 OEM

Chapter 9. Supercharger Market, By Vehicle Type

9.1 Global Supercharger Market Snapshot, By Vehicle Type

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Passenger Vehicle

9.1.1.2 Commercial Vehicle

9.1.1.3 High-Performance Vehicle

Chapter 10. Supercharger Market, By Voltage Range

10.1 Global Supercharger Market Snapshot, By Voltage Range

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Low Voltage (up to 2.7 V)

10.1.1.2 Medium Voltage (2.8 to 5 V)

10.1.1.3 High Voltage (Above 5 V)

Chapter 11. Supercharger Market, By Electrolyte Type

11.1 Global Supercharger Market Snapshot, By Electrolyte Type

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Aqueous Electrolytes

11.1.1.2 Organic Electrolytes

11.1.1.3 Solid Electrolytes

Chapter 12. Supercharger Market, By Capacitance

12.1 Global Supercharger Market Snapshot, By Capacitance

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Low (< 10 Farads)

12.1.1.2 Medium (10 to 100 Farads)

12.1.1.3 High (Above 100 Farads)

Chapter 13. Supercharger Market, By End User

13.1 Global Supercharger Market Snapshot, By End User

13.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

13.1.1.1 Automotive

13.1.1.2 Consumer Electronics

13.1.1.3 Energy

13.1.1.4 Grid Stabilization

13.1.1.5 Industrial

13.1.1.6 Aerospace & Defense

13.1.1.7 Healthcare

13.1.1.8 Telecommunications

13.1.1.9 Others

Chapter 14. Supercharger Market, By Region

14.1 Overview

14.2 Supercharger Market Revenue Share, By Region 2024 (%)

14.3 Global Supercharger Market, By Region

14.3.1 Market Size and Forecast

14.4 North America

14.4.1 North America Supercharger Market Revenue, 2022-2034 ($Billion)

14.4.2 Market Size and Forecast

14.4.3 North America Supercharger Market, By Country

14.4.4 U.S.

14.4.4.1 U.S. Supercharger Market Revenue, 2022-2034 ($Billion)

14.4.4.2 Market Size and Forecast

14.4.4.3 U.S. Market Segmental Analysis

14.4.5 Canada

14.4.5.1 Canada Supercharger Market Revenue, 2022-2034 ($Billion)

14.4.5.2 Market Size and Forecast

14.4.5.3 Canada Market Segmental Analysis

14.4.6 Mexico

14.4.6.1 Mexico Supercharger Market Revenue, 2022-2034 ($Billion)

14.4.6.2 Market Size and Forecast

14.4.6.3 Mexico Market Segmental Analysis

14.5 Europe

14.5.1 Europe Supercharger Market Revenue, 2022-2034 ($Billion)

14.5.2 Market Size and Forecast

14.5.3 Europe Supercharger Market, By Country

14.5.4 UK

14.5.4.1 UK Supercharger Market Revenue, 2022-2034 ($Billion)

14.5.4.2 Market Size and Forecast

14.5.4.3 UKMarket Segmental Analysis

14.5.5 France

14.5.5.1 France Supercharger Market Revenue, 2022-2034 ($Billion)

14.5.5.2 Market Size and Forecast

14.5.5.3 FranceMarket Segmental Analysis

14.5.6 Germany

14.5.6.1 Germany Supercharger Market Revenue, 2022-2034 ($Billion)

14.5.6.2 Market Size and Forecast

14.5.6.3 GermanyMarket Segmental Analysis

14.5.7 Rest of Europe

14.5.7.1 Rest of Europe Supercharger Market Revenue, 2022-2034 ($Billion)

14.5.7.2 Market Size and Forecast

14.5.7.3 Rest of EuropeMarket Segmental Analysis

14.6 Asia Pacific

14.6.1 Asia Pacific Supercharger Market Revenue, 2022-2034 ($Billion)

14.6.2 Market Size and Forecast

14.6.3 Asia Pacific Supercharger Market, By Country

14.6.4 China

14.6.4.1 China Supercharger Market Revenue, 2022-2034 ($Billion)

14.6.4.2 Market Size and Forecast

14.6.4.3 ChinaMarket Segmental Analysis

14.6.5 Japan

14.6.5.1 Japan Supercharger Market Revenue, 2022-2034 ($Billion)

14.6.5.2 Market Size and Forecast

14.6.5.3 JapanMarket Segmental Analysis

14.6.6 India

14.6.6.1 India Supercharger Market Revenue, 2022-2034 ($Billion)

14.6.6.2 Market Size and Forecast

14.6.6.3 IndiaMarket Segmental Analysis

14.6.7 Australia

14.6.7.1 Australia Supercharger Market Revenue, 2022-2034 ($Billion)

14.6.7.2 Market Size and Forecast

14.6.7.3 AustraliaMarket Segmental Analysis

14.6.8 Rest of Asia Pacific

14.6.8.1 Rest of Asia Pacific Supercharger Market Revenue, 2022-2034 ($Billion)

14.6.8.2 Market Size and Forecast

14.6.8.3 Rest of Asia PacificMarket Segmental Analysis

14.7 LAMEA

14.7.1 LAMEA Supercharger Market Revenue, 2022-2034 ($Billion)

14.7.2 Market Size and Forecast

14.7.3 LAMEA Supercharger Market, By Country

14.7.4 GCC

14.7.4.1 GCC Supercharger Market Revenue, 2022-2034 ($Billion)

14.7.4.2 Market Size and Forecast

14.7.4.3 GCCMarket Segmental Analysis

14.7.5 Africa

14.7.5.1 Africa Supercharger Market Revenue, 2022-2034 ($Billion)

14.7.5.2 Market Size and Forecast

14.7.5.3 AfricaMarket Segmental Analysis

14.7.6 Brazil

14.7.6.1 Brazil Supercharger Market Revenue, 2022-2034 ($Billion)

14.7.6.2 Market Size and Forecast

14.7.6.3 BrazilMarket Segmental Analysis

14.7.7 Rest of LAMEA

14.7.7.1 Rest of LAMEA Supercharger Market Revenue, 2022-2034 ($Billion)

14.7.7.2 Market Size and Forecast

14.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 15. Competitive Landscape

15.1 Competitor Strategic Analysis

15.1.1 Top Player Positioning/Market Share Analysis

15.1.2 Top Winning Strategies, By Company, 2022-2024

15.1.3 Competitive Analysis By Revenue, 2022-2024

15.2 Recent Developments by the Market Contributors (2024)

Chapter 16. Company Profiles

16.1 A&A Corvette Performance

16.1.1 Company Snapshot

16.1.2 Company and Business Overview

16.1.3 Financial KPIs

16.1.4 Product/Service Portfolio

16.1.5 Strategic Growth

16.1.6 Global Footprints

16.1.7 Recent Development

16.1.8 SWOT Analysis

16.2 Audi Sport GmbH

16.3 Chevrolet Performance (General Motors)

16.4 Eaton Corporation

16.5 Edelbrock LLC

16.6 Ford Performance (Ford Motor Company)

16.7 Harrop Engineering

16.8 Honeywell International Inc.

16.9 IHI Corporation

16.10 Magnuson Superchargers

16.11 Ogura Clutch Co., Ltd.

16.12 Paxton Automotive

16.13 ProCharger (Accessible Technologies, Inc.)

16.14 Rotrex A/S

16.15 Roush Performance Products, Inc.

16.16 Sprintex Ltd

16.17 TPS Motorsports

16.18 Vortech Engineering, Inc.

16.19 Whipple Superchargers