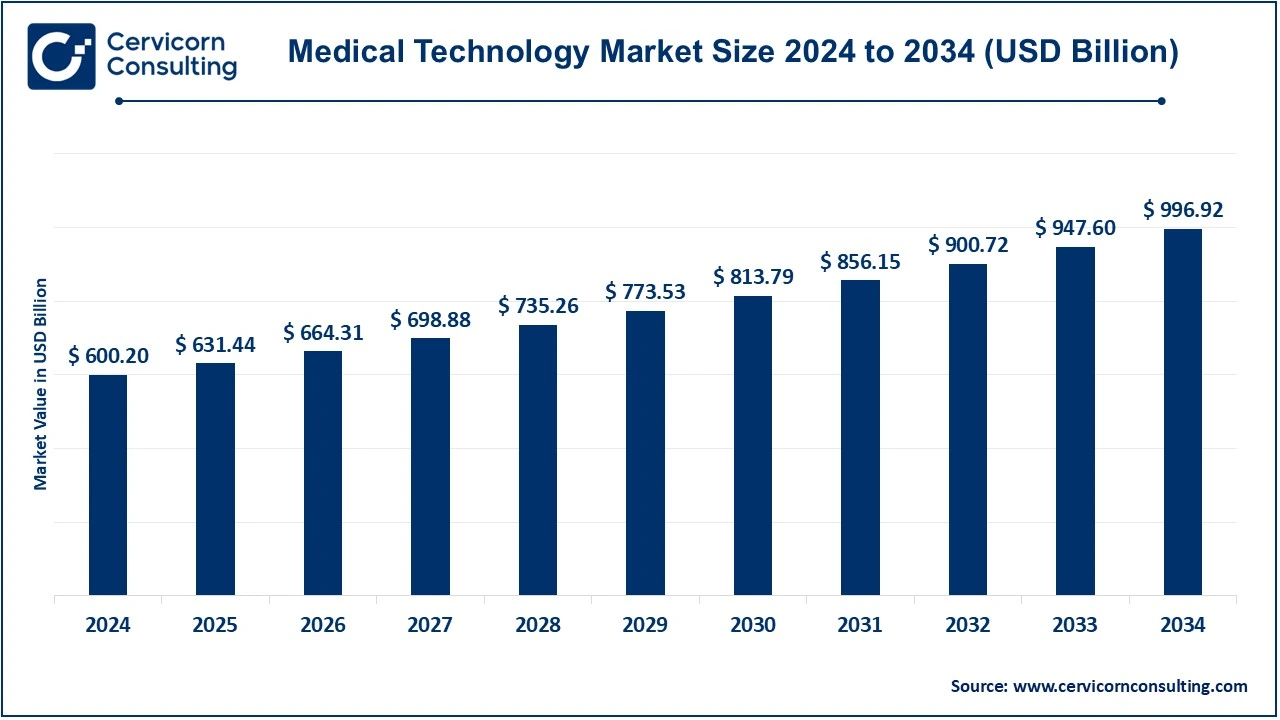

The global medical technology market size was valued at USD 600.20 billion in 2024 and is expected to be worth around USD 996.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.20% over the forecast period 2025 to 2034.

Growth in the medical technology market is facilitated by rapid expansion through the demand for individualized solutions, an aging population and associated growing needs, chronic diseases, and upgraded minimally invasive procedures. It's also the growth that is fueled by advances in digital health technologies, medical equipment, and diagnostic tools as healthcare systems worldwide work to reduce treatment costs, improve outcomes for patients, and increase operational efficiency. The acceleration that telemedicine and remote monitoring services have put into the industry has further propelled growth.

Medical technology refers to the application of scientific principles, methods, equipment, and gadgets for diagnosing, tracking, treating, and preventing medical diseases while advancing the development of better patient care. It would mean the advancement of equipment in devices such as pacemakers and prosthetics, and diagnostic tools in the form of MRIs, X-rays, and blood testing. This encompasses more advanced forms of biotechnology, robotics, and telemedicine technologies, and also includes even medical devices such as ventilators or dialysis machines. In several clinical settings, medical technology continues to be an essential element in improving the quality of life of patients, maximizing the use of processes, and maximally enhancing medical outcomes.

CEO Statements

Joaquin Duato, CEO of Johnson & Johnson: "At Johnson & Johnson, we are committed to advancing medical technology to improve patient outcomes and revolutionize the healthcare experience. Through innovation and collaboration, we are shaping the future of healthcare by developing transformative solutions that address the needs of patients and healthcare professionals around the world."

Dr. Bernd Montag, CEO of Siemens Healthineers: "Medical technology is transforming healthcare by making it more precise, personalized, and accessible. At Siemens Healthineers, we are committed to advancing this transformation through innovation, collaboration, and a relentless focus on improving patient outcomes globally."

Geoff Martha, CEO of Medtronic: "At Medtronic, we believe that medical technology can help solve the world’s most significant healthcare challenges. Our mission is to transform healthcare for the better by innovating with solutions that improve patient outcomes, reduce costs, and increase access to life-saving therapies around the world."

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 600.20 Billion |

| Estimated Market Size in 2034 | USD 996.92 Billion |

| Projected CAGR 2025 to 2034 | 5.20% |

| Dominant Region | North America |

| Region with the Quickest Growth | Asia-Pacific |

| Key Segments | Product, End User, Region |

| Key Companies | Johnson & Johnson, Medtronic, Siemens Healthineers, GE Healthcare, Stryker, Abbott Laboratories, Boston Scientific, BD, Olympus Corporation, Zimmer Biomet |

The medical technology market is segmented into product, end user, and region. Based on product, the market is classified into medical devices, medical equipment, in-vitro diagnostics (IVD), telemedicine platforms, and others. Based on end use, the market is classified into hospitals and clinics, ambulatory surgical centers, home healthcare, and diagnostic laboratories.

Medical Devices: Medical devices are instruments used for diagnosis, treatment, or monitoring of a patient. They range from rather simple instruments, such as stethoscopes, to complicated devices, like pacemakers and ventilators. These are important because they will enhance patient care, especially in chronic disease management and during surgery.

Medical Equipment: Medical equipment is the large machinery used in hospitals and clinics. MRI scanners, CT machines, and ventilators are all examples. They can bring precision in diagnostics, inpatient monitoring, and treatment. Improvements in this class enhance the capability of healthcare delivery and patient outcomes.

In-vitro Diagnostics (IVD): IVD tests are those that are conducted outside the human body, for example in the lab, to check or monitor a disease. They include blood tests and genetic screenings. In-vitro Diagnostics (IVD) assumes much significance in disease diagnosis as well as management since new technologies have taken the lead in faster yet more precise results.

Telemedicine Platforms: Video calls and online messaging service enables a patient to get his or her remote consultation. There has been increased access for patients, both in rural areas and routine follow-up of their mental health, by following up with telemedicine platforms.

Hospitals and Clinics: Medical technologies will vary greatly in various hospitals and clinics to ensure proper treatment for all patients. From diagnostic devices to equipment that can sustain lives, these setups enable emergency and scheduled healthcare services to be provided to patients. Some of the benefits of new technologies include better outcomes and efficiency in healthcare delivery procedures.

ASCs: ASCs provide immediate outpatient surgical care and increasingly embrace the use of new medical technologies to ensure more effective, less expensive interventions. These types of institutions employ techniques that involve the use of minimally invasive surgical instruments and imaging systems to ensure faster restoration and improved patient results.

Home Healthcare: Home health care provides medical care for patients in their homes, care that they get through portable medical devices, such as blood pressure monitors and telemedicine platforms. The demand for this market is growing because patients, especially the elderly and/or chronically ill, prefer to be cared for at home, thus reducing hospital visits and improving comfort.

Diagnostic Laboratories: Through tests like blood work and imaging, uses of diagnostic laboratories in the case of disease diagnosis take place. However, for all this to be possible, advanced diagnostic tools utilized in the laboratory, such as IVD products and automated analyzers, are used to deliver quick but correct results for a timely treatment decision and better care of patients.

The medical technology market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

North America is one of the largest and most developed markets for medical technology. It's dominated by the United States and Canada. It is due to a very high spending level on health care, an efficient infrastructure regarding health care, and thorough adoption of new medical technologies. For instance, in 2022, it invested USD 110 billion into healthcare technology. The rise in the activities of capital markets in the health sector of the USA is about 45% from the effect of the COVID-19 pandemic. Health tech innovators played a very important role during the response stage and in healing and rebuilding post the pandemic. Though much smaller, Canada remains one of the markets whose higher demand for more advanced medical devices and technologies is being driven by an aging population as well as improved healthcare outcomes.

Europe hit significant growth in the market. Germany represents 27% of the market. Sales by this country alone amount to almost USD 45 billion. The European MedTech market, which includes IVDs, was USD 170 billion in 2022; Germany accounted for approximately USD 40 billion of this total. The most important markets are the United Kingdom, France, Italy, and Spain. UK demand is very strong due to the comprehensive healthcare needs of the NHS. Orthopedic products and medical imaging are also regionally strong, but home healthcare equipment can be a challenging category in these countries. Strict regulations are good for quality but difficult for new market entrants.

The Asia-Pacific represents one of the high-growth areas in medical technology, being driven forward by economic development, large populations, and growing healthcare needs. China and India are identified as critical markets, with China being the largest, thanks to a rising middle class, urbanization, and the increase in health expenditure. In 2021, the healthcare market of China reached almost USD 1500 Billion and is supposed to reach about USD 2400 Billion by 2030 under the "Healthy China 2030" initiative. Demand for medical devices such as diagnostic equipment, prosthetics, and monitoring systems is increasing. Opportunities also are present in India, especially in affordable medical technologies. Meanwhile, Japan, South Korea, and Australia are developed countries in health care systems. In medical robotics and imaging technologies, Japan is number one, and in the healthcare system, South Korea is behind.

The LAMEA region is found to be a widely diversified healthcare market, also including Latin America, the Middle East, and Africa. It covers various levels of infrastructure as well as different adoptions of technologies. Tends for the countries in these regions to increase demands for medical devices in the diagnostics and treatment areas mainly due to a growing middle class and modernization of healthcare in Latin America. Middle East: Healthcare infrastructure in the region enjoys huge investment as demand remains high for highly sophisticated technologies such as diagnostics imaging and surgical robotics. But Africa is mixed. South Africa and Nigeria have increased healthcare investing, while challenges persist due to lessened infrastructure and low spending for growth. There remains a strong demand for affordable medical devices, diagnostics, and telemedicine - mainly in underserved rural areas.

The latest product launches and strategic partnerships undertaken by the companies operating in the medical technology industry bring about remarkable innovations in industry leaders such as Johnson & Johnson, Medtronic, Siemens Healthineers, GE Healthcare, Stryker, and Abbott Laboratories. This approach has further driven medical progress through such leading-edge technologies as artificial intelligence, robotics, minimally invasive procedures, and personalized healthcare solutions. They improve their capabilities in surgical robotics, diagnostic imaging, and patient monitoring by partnerships and acquisitions and enhance global presence while improving health care delivery. This is a wave of innovation changing not only clinical outcomes but also how patients are treated around the world as well as how healthcare systems work more efficiently.

Some notable examples of key developments in the medical technology industry include:

Market Segmentation

By Product Type

By End Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Medical Technology

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Medical Technology Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Innovation in Medical Devices

4.1.1.2 Regulatory Support

4.1.1.3 Technological Convergence

4.1.2 Market Restraints

4.1.2.1 Higher Development Costs

4.1.2.2 Security Risks

4.1.2.3 Fragmented Healthcare Systems

4.1.3 Market Challenges

4.1.3.1 Adoption Resistance

4.1.3.2 Increase in Preventive Healthcare

4.1.3.3 Health inequities

4.1.4 Market Opportunities

4.1.4.1 Minimally Invasive Surgery

4.1.4.2 Regenerative Medicine and Stem Cell Therapy

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Medical Technology Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Medical Technology Market, By Product

6.1 Global Medical Technology Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Medical Devices

6.1.1.2 Medical Equipment

6.1.1.3 In-vitro Diagnostics (IVD)

6.1.1.4 Telemedicine Platforms

6.1.1.5 Others

Chapter 7. Medical Technology Market, By End Use

7.1 Global Medical Technology Market Snapshot, By End Use

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Hospitals and Clinics

7.1.1.2 Ambulatory Surgical Centers

7.1.1.3 Home Healthcare

7.1.1.4 Diagnostic Laboratories

Chapter 8. Medical Technology Market, By Region

8.1 Overview

8.2 Medical Technology Market Revenue Share, By Region 2024 (%)

8.3 Global Medical Technology Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Medical Technology Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Medical Technology Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Medical Technology Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Medical Technology Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Medical Technology Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Medical Technology Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Medical Technology Market, By Country

8.5.4 UK

8.5.4.1 UK Medical Technology Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France Medical Technology Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Medical Technology Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Medical Technology Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Medical Technology Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Medical Technology Market, By Country

8.6.4 China

8.6.4.1 China Medical Technology Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Medical Technology Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India Medical Technology Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Medical Technology Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Medical Technology Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Medical Technology Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Medical Technology Market, By Country

8.7.4 GCC

8.7.4.1 GCC Medical Technology Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Medical Technology Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Medical Technology Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Medical Technology Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10. Company Profiles

10.1 Johnson & Johnson

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Medtronic

10.3 Siemens Healthineers

10.4 GE Healthcare

10.5 Stryker

10.6 Abbott Laboratories

10.7 Boston Scientific

10.8 BD

10.9 Olympus Corporation

10.10 Zimmer Biomet