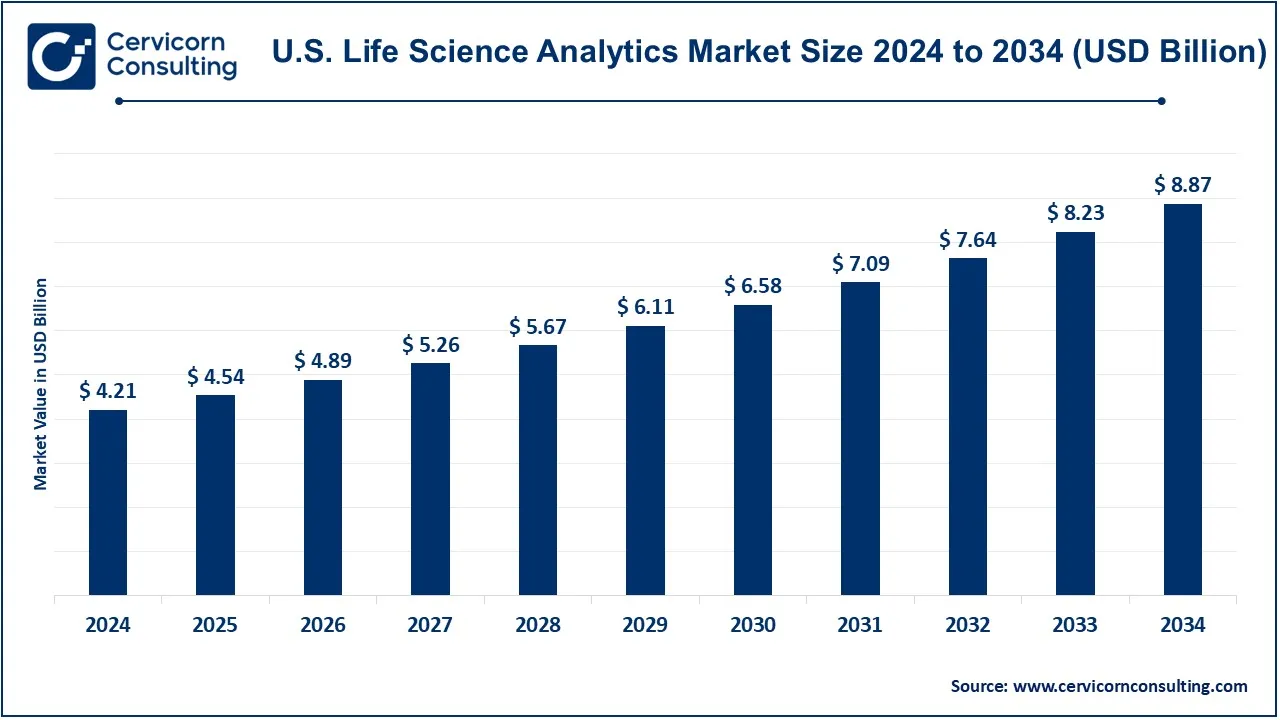

The U.S. life science analytics market size was valued at USD 4.21 billion in 2024 and is expected to be worth around USD 8.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.40% over the forecast period 2025 to 2034.

The life science analytics market is currently dominated by a strong growth factor caused primarily by the growing demand for decision-making and decision-making tools that depend on data in the pharmaceuticals and health sciences sectors. Advances in artificial intelligence, machine learning, and big data analytics allow organizations to tease out actionable insights from huge volumes of clinical, operational, and patient data. All this fuels the demand for advanced analytics solutions since customers get to be mainly focused on personalized medicine, regulatory compliance, and the urge to improve upon developing drugs. The increased adoption of cloud-based platforms with improved incorporation of real-time data accelerates the market. It makes it possible for stakeholders to make improvements in clinical outcomes, identify business strategies, and support developments within healthcare systems.

Life science analytics is a life science analytics process of applying data analysis techniques to understand the insights that could be generated from complex biological, clinical, and healthcare data. In this process, advanced analytics, statistical models, and machine learning are used to process and interpret data from pharmaceuticals, biotechnology, healthcare, and medical devices. The goal should be to enhance decision-making, optimize drug development, improve patient outcomes, promote personalized medicine, and enhance operational efficiency in research and clinical practice. Such analytics for large data changes the lives of most people by moving closer to excellence as facts lead to innovation and health improvement.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 4.21 Billion |

| Expected Market Size in 2034 | USD 8.87 Billion |

| CAGR | 8.40% |

| Key Segments | Component, Type, Delivery, Application, End User |

| Key Companies | IQVIA, Medidata Solutions, Veristat, ZS Associates, Clarivate, Oracle, Optum, Decision Resources Group, Bio-Optronics, HealthVerity |

The U.S. life science analytics market is segmented into component, type, delivery, application, end user. Based on component, the market is classified into software and services. Based on delivery, the market is classified into on-premise and on-demand. Based on type, the market is classified into reporting, descriptive, predictive, and prescriptive. Based on application, the market is classified into commercial analytics, personalized therapy, clinical research analytics, and supply chain analytics. Based on end users, the market is classified into medical device companies, pharma & biotech companies and contract research organizations.

Software & Services: This portfolio consists of digital platforms, software programs, and digital solutions mainly in data gathering, processing, and displaying life science-related complex data. It often covers an extensive range of tasks such as a clinical trial, patient tracking, drug discovery, and regulatory compliance. This allows pharmaceutical companies and makers of medical devices to make more data-driven decisions; operate more efficiently; and innovate faster. Some examples include bioinformatics platforms, clinical trial analytics software, and tools for predictive analytics in drug development.

Services: It is an expert-driven nature of life science analytics services for third-party organizations, thus helping them make the best possible utilization of the data that lies within their reach. Consulting, advanced analytics, data management, and also custom reporting solutions form a part of these services. Some of the services include analytics-based statistics analysis, real-world evidence generation, regulatory consulting, and technology implementation. Supports to the business unit include aspects such as decision-making and the optimization of business processes within an organization for compliance with changing regulations.But through analytics service outsourcing, technical expertise is now available to organizations without having to house massive in-house capability.

Commercial Analytics: Commercial analytics provides analysis for market data, customer behavior, sales performance, and marketing strategies in the life sciences industry. This is all the more essential for pharmaceutical, biotech, and medical device firms, which can shape product strategies, optimize sales efforts, and maximize profitability. Commercial analytics solutions enable an organization to track physicians' prescribing behaviors, identify market opportunities, and predict product demands. This makes better strategic decisions and adopts more effective go-to-market strategies.

Customized Therapy: Personalized analytics can help increase the utilization of huge amounts of data from a patient's genetic profile, medical history, and treatment response to other drugs for tailoring treatment. The field relies on precision medicine approaches that integrate genomics, clinical data, and patient-reported outcomes in use for life science companies. It helps them develop therapies to improve effectiveness, reduce adverse drug reactions, and enhance patient outcomes. Personalized therapy analytics is becoming a significant requirement in oncology, rare diseases, and many other therapeutic areas where individualized therapy should be used for maximum effectiveness.

Clinical Research Analytics: Clinical research analytics is the processing of data that often arises from sources like clinical trial registries, patient data, and results from laboratories to support a clinical trial or study. Analytics tools enable researchers to identify patterns and determine outcomes for patients, thus optimizing the design of the trials for further accuracy and efficiency. This will help cut down time and cost related to the process of bringing new drugs and treatments to market. This is in addition to tracking trial integrity, ensuring compliance, and providing real-time insights regarding ongoing trials with clinical research analytics.

Supply Chain Analytics: Supply chain analytics for life sciences is the effective management of pharmaceuticals, medical devices, and all related products in production and distribution. Analytics tools will help an organization forecast demand, manage inventory, optimize manufacturing processes, and improve the overall supply chain strategy. In this often global and complex industry, real-time analytics helps organizations track shipment, mitigate supply disruptions, and guarantee that critical products reach the right places at the right time. Supply chain analytics is crucial in managing global shortages, cold chain logistics for sensitive products, and keeping abreast of regulatory requirements.

Medical device companies: Companies in the medical devices sector use life science analytics to enhance design and manufacture and, subsequently, sales and distribution of products. Analytics support various functions, for example, product development, quality control, regulatory compliance, and post-market surveillance. In this regard, firms may analyze clinical data to ensure that their devices are safe to release or use commercial analytics to ascertain trends and the evolution of competition. With the increase in complexity of medical devices and demand for personalized solutions, analytics is now of great importance for improving the efficacy of the device, ensuring the safety of the patient, and adhering to regulations worldwide.

Pharma & Biotech Companies: One of the biggest consumers of life science analytics are pharmaceutical and biotech companies. Pharmaceutical companies, based on data-driven insights, can better advance the entire process of drug discovery and streamline clinical trials in getting new treatments in the market faster. Analytics becomes even more important for pharma companies to determine the drugs' efficiency, predict patient reaction, and create real-world evidence after marketing. Biotechnology companies are likely to focus on genomics and personalized medicines where analytics serves as a means of identification of new biomarkers, affirmation of drug targets, and facilitation of their clinical development strategy.

Contract research organizations (CROs): Contract research organizations (CROs) provide external research services to firms in the pharmaceutical, biotechnology, and medical devices industries. Crucial in the design of clinical trials, drug development, and submissions to regulatory agencies, analytics will enable a CRO to make better decisions in designing trials on how to monitor the safety of patients more effectively, ensure quality data, and optimize timelines for clinical development. Analytics can also help its CRO clients better manage large datasets from multi-center clinical trials, identify early-on potential risks and issues, and ensure compliance with regulatory standards.

CEO Statements

Ari Bousbib, CEO of IQVIA

"At IQVIA, we believe that data-driven insights are the key to unlocking the future of healthcare. By combining deep domain expertise with advanced analytics, we help life sciences companies navigate an increasingly complex landscape and drive better outcomes for patients."

Tarek Sherif, CEO of Medidata Solutions

“We believe that data and analytics are the key to unlocking innovations in life sciences. By leveraging the power of technology, we can accelerate drug development, improve patient outcomes, and ultimately transform the healthcare ecosystem.”

Patrick Flanagan, CEO of Veristat

"At Veristat, we understand that the key to accelerating the development of life-saving therapies lies in harnessing the power of advanced analytics. By leveraging cutting-edge data solutions, we help our clients make informed decisions, streamline their clinical trials, and ultimately bring novel treatments to market faster."

Recent products released for the U.S. life science analytics market reflect innovations as well as strategic collaborations of major players within the industry, including IQVIA, Medidata Solutions, Veristat, ZS Associates, Clarivate, and Oracle. They enhance their solutions, based on data, for an increasing demand for advanced analytics in clinical research, drug development, and regulatory compliance. They use cutting-edge technologies such as artificial intelligence, machine learning, and big data analytics to help make clinical trials more efficient in supporting better-informed decisions, faster time-to-market, and higher operational performance in a life sciences ecosystem. These are just part of a broader pattern into more individualized, data-driven approaches to health care, with huge stakes going for patient outcomes and process streamlining for big pharmacy and biotech companies.

Market Segmentation

By Component

By Delivery

By Type

By Application

By End User

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Life Science Analytics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Type Overview

2.2.3 By Delivery Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Life Science Analytics Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Adoption of Precision Medicine

4.1.1.2 New and Evolving Markets and Global Expansion

4.1.1.3 Increasing collaboration between pharmaceutical companies, biotech firms, and academic institutions

4.1.2 Market Restraints

4.1.2.1 Data Privacy and Security Concerns

4.1.2.2 Lack of Skilled Workforce

4.1.2.3 Low Adoption in Small and Medium Enterprises

4.1.3 Market Challenges

4.1.3.1 Integration of Heterogeneous Data Sources

4.1.3.2 Technology Adaptation and Integration

4.1.4 Market Opportunities

4.1.4.1 Regulatory Compliance and Risk Management

4.1.4.2 Outsourcing and Cloud-Based Solutions

4.1.4.3 Biotech and Genomics Data Analytics

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 U.S. Life Science Analytics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Life Science Analytics Market, By Component

6.1 U.S. Life Science Analytics Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Software & Solutions

6.1.1.2 Services

Chapter 7. Life Science Analytics Market, By Type

7.1 U.S. Life Science Analytics Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Reporting

7.1.1.2 Descriptive

7.1.1.3 Predictive

7.1.1.4 Prescriptive

Chapter 8. Life Science Analytics Market, By Delivery

8.1 U.S. Life Science Analytics Market Snapshot, By Delivery

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 On-premise

8.1.1.2 On-demand

Chapter 9. Life Science Analytics Market, By Application

9.1 U.S. Life Science Analytics Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Commercial Analytics

9.1.1.2 Personalized Therapy

9.1.1.3 Clinical Research Analytics

9.1.1.4 Supply Chain Analytics

Chapter 10. Life Science Analytics Market, By End User

10.1 U.S. Life Science Analytics Market Snapshot, By End User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Medical Device Companies

10.1.1.2 Pharma & Biotech Companies

10.1.1.3 Contract Research Organizations

Chapter 11. Life Science Analytics Market, By Region

11.1 Overview

11.2 U.S. Life Science Analytics Market Revenue, 2022-2034 ($Billion)

11.3 Market Size and Forecast

11.4 U.S. Market Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 IQVIA

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Medidata Solutions

13.3 Veristat

13.4 ZS Associates

13.5 Clarivate

13.6 Oracle

13.7 Optum

13.8 Decision Resources Group

13.9 Bio-Optronics

13.10 HealthVerity