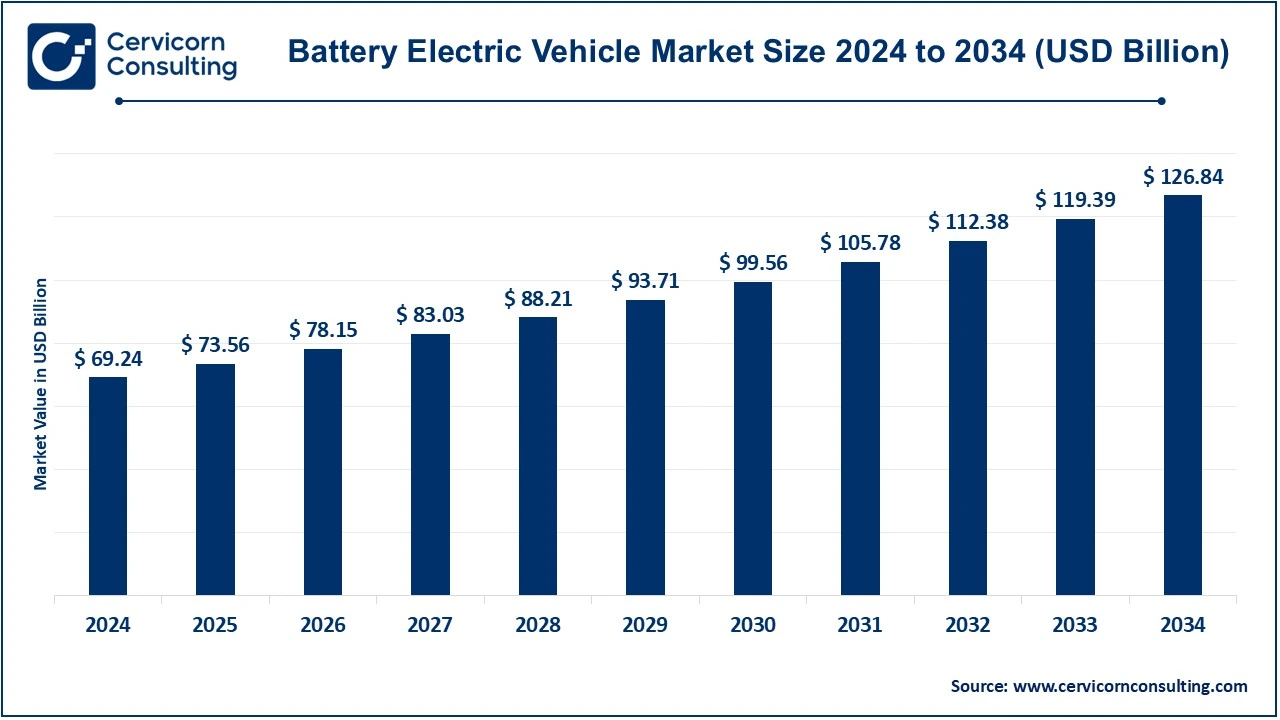

The global battery electric vehicle market size was valued at USD 69.24 billion in 2024 and is expected to be worth around USD 126.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.24% over the forecast period 2025 to 2034.

The battery electric vehicles (BEVs) market is growing very fast due to the vast demand for energy-efficient, eco-friendly transportation solutions across various industries, including automotive, logistics, and manufacturing. The surge in urbanization and infrastructure development is driving the presence of BEVs in both commercial and residential sectors. Stricter environmental regulations and government incentives promoting zero-emission vehicles have contributed to the growing adoption of BEVs. Technological developments such as advanced battery systems and electric drivetrains will improve BEV efficiency, reduce costs, and extend vehicle range. Ongoing R&D investments are boosting BEV performance, affordability, and consumer appeal. As these innovations align with global sustainability goals, the market is set for robust growth driven by a demand for cleaner, cost-effective, and efficient transportation solutions.

CEO Statements

Report Highlights

Rising Demand for Zero-Emission Vehicles:

Battery Cost Decline:

Technological Improvement Among Battery Systems:

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 69.24 Billion |

| Expected Market Size in 2034 | USD 126.84 Billion |

| Projected CAGR 2025 to 2034 | 6.24% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Segments | Battery Type, Vehicle Type, Region |

| Key Companies | Ampere Vehicles, Benling India Energy and Technology Pvt Ltd, BMW AG, BYD Company Limited, Chevrolet Motor Company, Daimler AG, Energica Motor Company S.p.A., Ford Motor Company, General Motors, Hero Electric, Hyundai Motor Company, Karma Automotive, Kia Corporation, Lucid Group, Inc., Mahindra Electric Mobility Limited, Nissan Motors Co., Ltd., Okinawa Autotech Pvt. Ltd., Rivain, Tata Motors, Tesla Inc. |

The battery electric vehicle market is segmented into battery type, vehicle type and region. Based on battery type, the market is classified into lead acid battery, nickel metal hydride battery, and lithium-ion battery. Based on vehicle type, the market is classified into passenger car, commercial vehicle, and two-wheeler.

Lithium-ion Battery: Lithium-ion batteries are dominant and prioritized in the BEV market because they have high energy density, very high efficiencies, and long life cycles. Such batteries incorporated longer driving ranges and faster charging. Tesla and BYD lead in large-scale lithium-ion battery applications, bringing BEVs materially forward.

Lead Acid Battery: Lead acid batteries are low-cost and offer a relatively long life cycle, and are mainly used in low-speed electric vehicles and backup power systems. Their low energy density, however, and short life cycle, do not allow them to be used in high-performance BEV applications. Businesses like Exide Industries are engaged in the manufacture of cost-effective lead-acid batteries for basic BEV applications.

Battery Electric Vehicle Market Share, By Battery Type, 2024 (%)

| Battery Type | Revenue Share, 2024 (%) |

| Lead Acid Battery | 26.90% |

| Nickel Metal Hydride Battery | 14.70% |

| Lithium-ion Battery | 58.40% |

Nickel Metal Hydride Battery: Nickel metal hydride batteries tear down the features of lead-acid batteries with more energy density and longevity, enabling them to be rolled out in hybrid vehicles. However, high cost and sensitivity to heat have prevented their extensive use in such BEVs. They were used in some of the earlier Prius models by Toyota-the very factor that demonstrated their feasibility.

Passenger Cars: Passenger cars being the highest seller among all BEVs owe their massive market by virtue of rising awareness among consumers toward zero emission and incentives from their respective governments. In this segment, major manufacturers like Tesla and Nissan invest their capabilities to the production of models such as Tesla Model 3 and Nissan Leaf.

Commercial Vehicle: BEVs are increasingly finding acceptance in commercial vehicles such as buses, trucks, and delivery vans based on cost savings from running and the stringent emission policies. Companies like Rivian and BYD are developing electric trucks and buses that would help in speeding up its adoption into global markets.

Two-Wheeler: The BEV segment for two-wheelers has picked up momentum in the Asia-Pacific region, where two-wheeler electric scooters and bikes are popular for urban mobility. It is supported by innovators such as Ather Energy and Hero Electric with their efficient and fairly priced models.

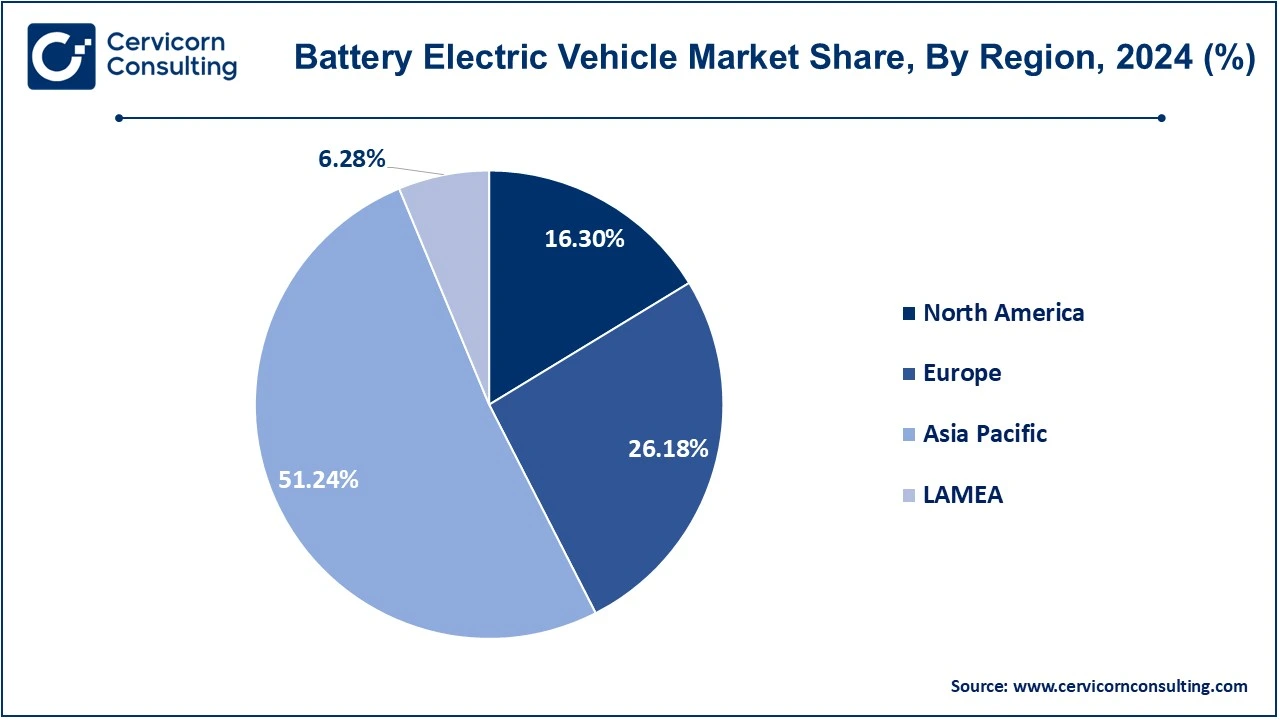

The battery electric vehicle market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

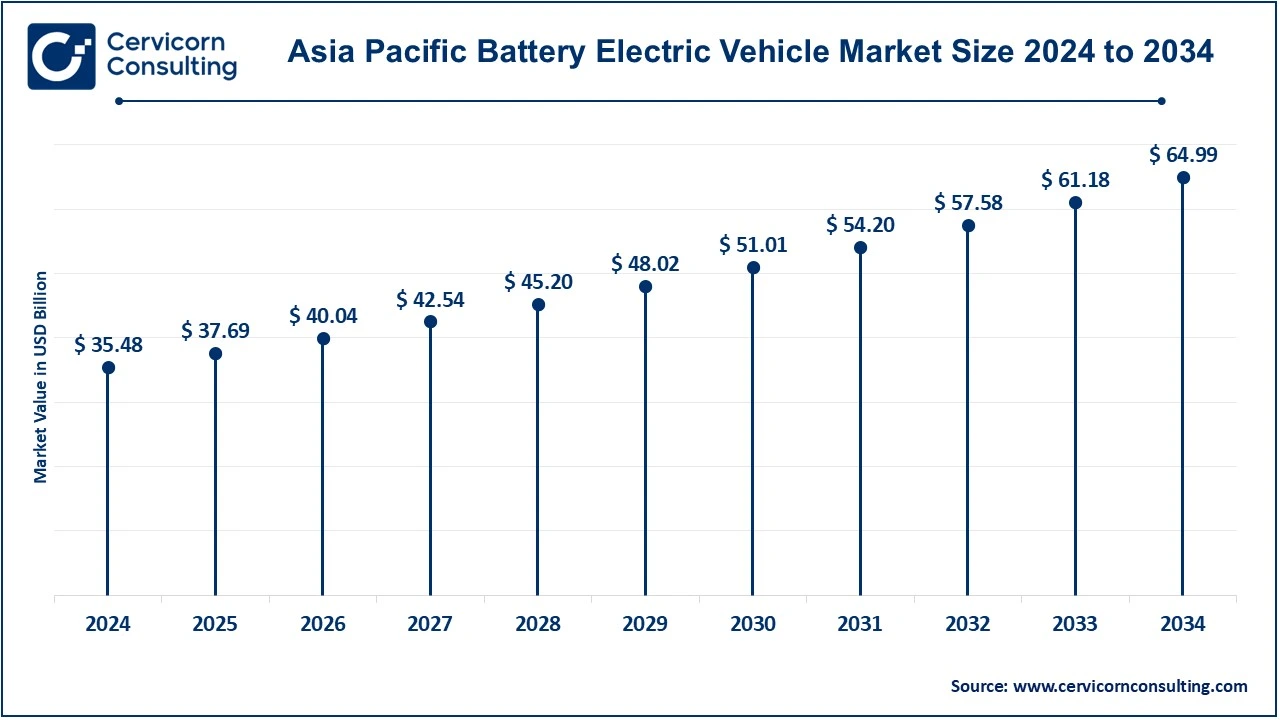

The Asia-Pacific battery electric vehicle market size was accounted for USD 35.48 billion in 2024 and is predicted to surpass around USD 64.99 billion by 2034. Asia-Pacific is the largest market for BEVs, with China as the biggest manufacturer and consumer in actual hardware construction and enjoyed strong government support policies such as subsidies and the establishment of infrastructure for charging. Above average advanced battery technologies were leveraged in Japan and South Korea where companies like BYD, LG Chem, and Panasonic are investing heavily. The fact that it has strong industrial bases, increasing urbanization, and cheaper BEV models has contributed to its spectacular growth, making it the fastest-growing BEV market in the region.

The North America battery electric vehicle market size was valued at USD 11.29 billion in 2024 and is expected to reach around USD 20.67 billion by 2034. In the North American region, government incentives, stringent emissions regulations, and the establishment of a robust charging infrastructure drive the development of the BEV market. The U.S. continues to maintain its upper hand in the adoption of BEVs with other leading players being Tesla and Rivian. Other key market drivers are consumer awareness of green mobility and advancements in battery technology. There has been steady growth in Canada and Mexico fueled by cross-border trade policies and regional electrification initiatives.

The Europe battery electric vehicle market size was estimated at USD 18.13 billion in 2024 and is projected to hit around USD 33.21 billion by 2034. A strengthening BEV market exists in Europe due to a strong regulation framework, as good as the European Green Deal itself, with incentives for adoption. Electric mobility is being pushed forth with prevailing costs in Norway, Germany, and the UK, which have very strict emission standards and extensive charging networks. Volkswagen and BMW are said to be increasing their investments in BEV production and R&D. The European market is also being developed as the battery manufacturing hub, bringing the supply chain close to BEVs.

The LAMEA battery electric vehicle market size was valued at USD 4.35 billion in 2024 and is anticipated to reach around USD 7.97 billion by 2034. In LAMEA, strong consciousness of environmental concerns and investments in sustainable mobility have led to a slow pace of adoption of BEVs. Governments in the Latin American region like Brazil and Argentina are contemplating initiatives to push the introduction of BEVs in line with government initiatives and multinational partnerships. Whereas in the Middle East, greening is in the form of BEVs in synergie with smart city projects, in Africa this phenomenon is overly embraced by the obstruction of meager infrastructure. Firms including Nissan and BYD venture to be able to push the BEV market into this kind of region by exploiting opportunities from emerging markets.

Recent strategic partnerships and joint ventures in the BEV market reflect a strong commitment to accelerating the transition to sustainable mobility. Collaborations among automakers, battery manufacturers, and technology companies aim to innovate energy storage solutions, expand charging infrastructure, and reduce production costs. These alliances, such as the Hyundai-SK Innovation joint venture and CATL-Sinopec partnership, highlight industry-wide efforts to scale up BEV adoption, meet rising consumer demand, and achieve global decarbonization goals.

Market Segmentation

By Battery Type

By Vehicle Type

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Battery Electric Vehicle

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Battery Type Overview

2.2.2 By Vehicle Type Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Battery Electric Vehicle Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Zero Emission Benefits

4.1.1.2 Battery Cost Reduction

4.1.1.3 Fuel Efficiency

4.1.2 Market Restraints

4.1.2.1 High Purchase Price at Initial

4.1.2.2 Lack of Charging Infrastructure

4.1.2.3 Issues of Battery Disposal

4.1.3 Market Challenges

4.1.3.1 Supply Chain Challenges of Battery Production

4.1.3.2 Consumer Perception and Awareness

4.1.3.3 High Charging Infrastructure Cost

4.1.4 Market Opportunities

4.1.4.1 Advances in Battery Technology

4.1.4.2 Electric Commercial Vehicles

4.1.4.3 Battery Leasing Models

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Battery Electric Vehicle Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Battery Electric Vehicle Market, By Battery Type

6.1 Global Battery Electric Vehicle Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Lead Acid Battery

6.1.1.2 Nickel Metal Hydride Battery

6.1.1.3 Lithium-ion Battery

Chapter 7. Battery Electric Vehicle Market, By Vehicle Type

7.1 Global Battery Electric Vehicle Market Snapshot, By Vehicle Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Passenger Car

7.1.1.2 Commercial Vehicle

7.1.1.3 Two-Wheeler

Chapter 8. Battery Electric Vehicle Market, By Region

8.1 Overview

8.2 Battery Electric Vehicle Market Revenue Share, By Region 2024 (%)

8.3 Global Battery Electric Vehicle Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Battery Electric Vehicle Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Battery Electric Vehicle Market, By Country

8.5.4 UK

8.5.4.1 UK Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Battery Electric Vehicle Market, By Country

8.6.4 China

8.6.4.1 China Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Battery Electric Vehicle Market, By Country

8.7.4 GCC

8.7.4.1 GCC Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Battery Electric Vehicle Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10. Company Profiles

10.1 Ampere Vehicles

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Benling India Energy and Technology Pvt Ltd

10.3 BMW AG

10.4 BYD Company Limited

10.5 Chevrolet Motor Company

10.6 Daimler AG

10.7 Energica Motor Company S.p.A.

10.8 Ford Motor Company

10.9 General Motors

10.10 Hero Electric

10.11 Hyundai Motor Company

10.12 Karma Automotive

10.13 Kia Corporation

10.14 Lucid Group, Inc.

10.15 Mahindra Electric Mobility Limited

10.16 Nissan Motors Co., Ltd.

10.17 Okinawa Autotech Pvt. Ltd.

10.18 Rivain

10.19 Tata Motors

10.20 Tesla Inc.