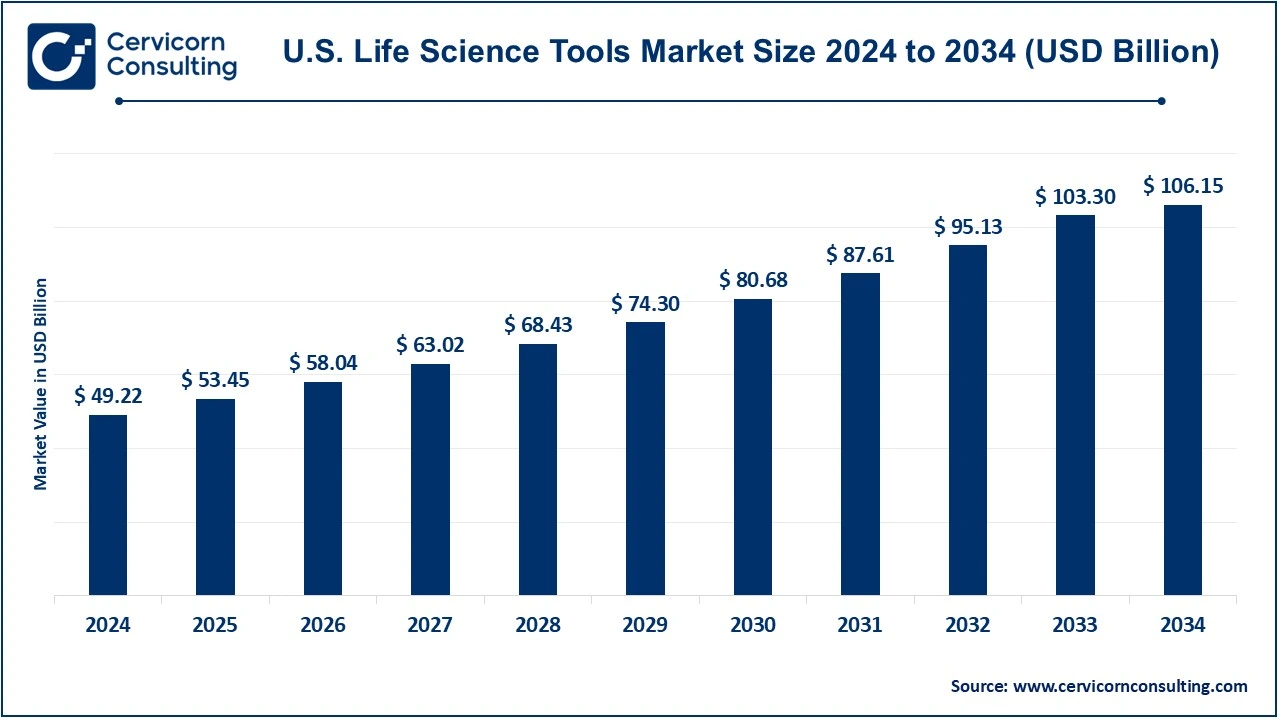

The U.S. life science tools market size was valued at USD 49.22 billion in 2024 and is projected to surge around USD 106.15 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.98% over the forecast period 2025 to 2034.

Improvement of biotechnology and genomics, higher demand for personalized medicine, and increased necessity for research in drug discovery and drug development are the primary growth drivers of the life science tools market. High-throughput screening, CRISPR gene editing, and next-generation sequencing are examples of technologies that increase research capacity and accelerate scientific discoveries. The trend is expected to be further accelerated by growing attention to molecular diagnostics, increased investments in health care, and an overall increase in the interest in preventive health care. Therefore, prospects are high for further growth of the Life Science Tools market, with both scientific discovery and the increasing global need for health care.

Life science tools are the overall range of tools, equipment, and materials used in biological and medical research to gain deeper insights into living things, cells, and molecular processes. These tools enable researchers to conduct investigations, analyze biological specimens, and determine knowledge about several complex systems such as drug development, cell biology, proteomics, and genomics. Life sciences tools in the lab include flow cytometers, PCR machines, microscopes, sequencing technologies, reagents, and data analysis software. Besides better health and new treatments, they are needed to advance our understanding of biology.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 53.45 Billion |

| Expected Market Size in 2034 | USD 106.15 Billion |

| Projected CAGR 2025 to 2034 | 7.98% |

| Key Segments | Product, Technology, Application, End User |

| Key Companies | Illumina, Thermo Fisher Scientific, Agilent Technologies, Bio-Rad Laboratories, PerkinElmer, Waters Corporation, Hologic, Charles River Laboratories |

Instruments: It includes the sophisticated devices to be used in genomics, proteomics, and cell research. The development of such instrumentation will enable researchers as well as diagnostic professionals to conduct highly accurate experiments and diagnostics. Examples include PCR machines, sequencers, and mass spectrometers. More emphasis on personalized medicine and the high-throughput generation of data requires more sophisticated instruments.

Consumables: These are the reagents, laboratory kits, and disposables that have been known to apply to scientific testing. This is mainly the product for the maintenance of laboratory workflows and is geared to result in obtaining accurate and reproducible results from experiments. The consumable market is growing through the increasing dependency of research and diagnostics on the continuous supply of quality material in molecular biology, diagnostics, and other laboratory processes.

Services: Services fall under categories like maintenance of the instrument, training, and technical support. Life science tool companies offer additional services such as maintenance, training, and technical support to provide maximum operation and uptime for this equipment. Value-added services such as these are being requested by the U.S. market on account of the increased complexity level of the research process along with regulatory requirements.

PCR: PCR technology is used for the amplification of DNA and RNA sequences throughout research, diagnostics, and forensic applications. The U.S. life science tools market experiences tremendous demand for PCR technologies on account of their critical value in genetics, disease discovery, and therapeutic designing, most critically in infectious diseases, as in the case of COVID-19.

Sanger Sequencing: Sanger sequencing is one of the methods used in the determination of an exact sequence of DNA molecules. While next-generation sequencing is very much a substitute in high throughput analysis, Sanger sequencing still enjoys a high value both in clinical diagnostics and genetic research, as well as in small-scale sequencing projects simply due to the reasons of its accuracy and reliability.

Separation Technologies: In this respect, chromatography and electrophoresis-based separation procedures are employed for the separation of components of a mixture containing proteins, nucleic acids, or metabolites. Demand accelerates in proportion to the importance attached to separation technologies, forming the core of life science research and diagnostics in proteomics, genomics, and biomarker discovery.

Flow Cytometry: Flow cytometry is the measurement of the physical and chemical properties of cells or particles. It has crucial applications in cell analysis, immunology, and cancer research. The U.S. market is growing because of a demand for increased research in the topics of immuno-oncology, drug development, and disease diagnosis using flow cytometry.

Nucleic Acid Microarray: Nucleic acid microarrays are designed for identifying and quantifying gene expression. Applicative ranges range from genetic research to diagnostics. Still, the need for high-throughput analysis in genomics, cancer research, and personalized medicine does benefit the U.S. market.

Research Laboratories: Research laboratories are the biggest end-user segment. These laboratories use many different life science tools and technologies for basic research, drug discovery, and disease studies. The growing demand for genetics research, personalized medicine, and biotechnology innovations has driven the need for life science tools in both academic and commercial research laboratories.

Diagnostic Laboratories: Life science instruments are used in the diagnostic laboratories for medical testing and diagnosis of diseases. In this respect, the market as such has vast potential expansion, coupled with technological development in personalized medicine, along with an increased need for accurate and timely diagnostic results. Technologies such as PCR, Sanger sequencing, and mass spectrometry are specifically critical in molecular diagnostics and disease detection in a clinical setting.

The U.S. life science tools industry is dominated by leading firms in the biotechnology research and innovation sector: PerkinElmer, Agilent Technologies, Thermo Fisher Scientific, Illumina, and Bio-Rad Laboratories. Their business focuses on developing and inventing technology for laboratory research, genomics, molecular biology, and diagnostics to provide contemporary tools for the advancement of health and acceleration of scientific discovery. They have, with time, consolidated their positions as leaders in the global market through high investments in research and development work undertaken, which has led to the introduction of new tools, platforms, and technologies that heighten precision, efficiency, and scalability in life sciences applications.

CEO Statements

Dirk Bontridder, CEO of PerkinElmer

Padraig McDonnell, CEO of Agilent Technologies

Marc N. Casper, CEO of Thermo Fisher Scientific

Market Segmentation

By Product

By Technology

By Application

By End User

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Life Science Tools

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Technology Overview

2.2.3 By Application Overview

2.2.4 By End Use Overview

2.3 Competitive Overview

Chapter 3. U.S. Impact Analysis

3.1 Russia-Ukraine Conflict: U.S. Market Implications

3.2 Regulatory and Policy Changes Impacting U.S. Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Technological Innovation in Genomic and Proteomic Analysis

4.1.1.2 Strength in Research Infrastructure

4.1.1.3 Emerging Markets in Cell and Gene Therapy

4.1.2 Market Restraints

4.1.2.1 High Initial Investment Costs

4.1.2.2 Regulatory Approvals

4.1.2.3 The remoteness of Healthcare Resources in the Rural Areas

4.1.3 Market Opportunities

4.1.3.1 Growing Demand for Personalized Medicines

4.1.3.2 Automation and high-throughput screening

4.1.3.3 Growing Research on Cancer

4.1.4 Market Challenges

4.1.4.1 Debates over intellectual property rights and patents

4.1.4.2 Data Privacy and Security Issues

4.1.4.3 Supply Chain Disruptions

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 U.S. Life Science Tools Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Life Science Tools Market, By Product

6.1 U.S. Life Science Tools Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Instruments

6.1.1.2 Consumables

6.1.1.3 Services

Chapter 7. Life Science Tools Market, By Technology

7.1 U.S. Life Science Tools Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 PCR

7.1.1.2 Cell Culture Systems & 3D Cell Culture

7.1.1.3 Next Generation Sequencing

7.1.1.4 Sanger Sequencing

7.1.1.5 Separation Technologies

7.1.1.6 Flow Cytometry

7.1.1.7 Nucleic Acid Microarray

7.1.1.8 Nucleic Acid Preparation

7.1.1.9 Transfection Devices & Gene Delivery Technologies

7.1.1.10 NMR

7.1.1.11 Mass Spectrometry

7.1.1.12 Other Separation Technologies

7.1.1.13 Other Products & Services

Chapter 8. Life Science Tools Market, By Application

8.1 U.S. Life Science Tools Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Proteomics Technology

8.1.1.2 Genomic Technology

8.1.1.3 Cell Biology Technology

8.1.1.4 Lab Supplies & Technologies

8.1.1.5 Others

Chapter 9. Life Science Tools Market, By End Use

9.1 U.S. Life Science Tools Market Snapshot, By End Use

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Research Laboratories

9.1.1.2 Diagnostic Laboratories

Chapter 10. Life Science Tools Market, By U.S.

10.1 Overview

10.2 U.S. Life Science Tools Market Revenue Share, By Region 2024 (%)

10.3 U.S. Life Science Tools Market Size and Forecast

10.4 U.S. Market Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Illumina

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 U.S. Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Thermo Fisher Scientific

12.3 Agilent Technologies

12.4 Bio-Rad Laboratories

12.5 PerkinElmer

12.6 Waters Corporation

12.7 Hologic

12.8 Charles River Laboratories