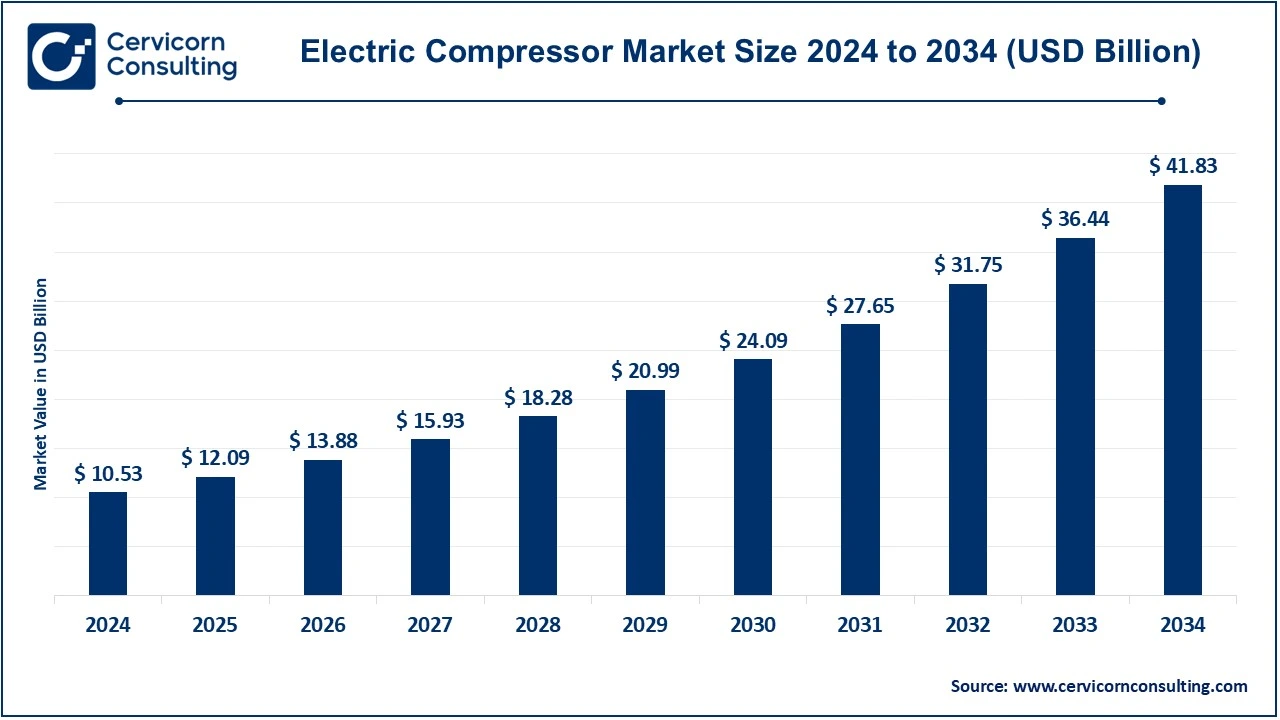

The global electric compressor market size was valued at USD 10.53 billion in 2024 and is expected to be worth around USD 41.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.79% over the forecast period 2025 to 2034.

The electric compressor market is experiencing significant growth driven by the increasing demand for energy-efficient and environmentally friendly solutions across various industries. The shift towards sustainability, along with advancements in electric vehicle (EV) technologies, is pushing the adoption of electric compressors, particularly in sectors such as automotive, industrial manufacturing, construction, and renewable energy. Additionally, innovations like variable-speed drive technology, which helps reduce energy consumption, are enhancing the market's expansion. As industries focus on reducing operational costs and carbon footprints, the demand for electric compressors is projected to continue growing, with substantial investments in energy-efficient technologies and the increasing use of electric systems across global markets.

What is an electric compressor?

An electric compressor is a device that uses electric power to compress air or gases. It works by drawing in air or gas through an intake valve, compressing it using mechanical components like pistons, screws, or rotors, and then storing the compressed air in a tank or delivering it to a system for various applications. Electric compressors are typically more energy-efficient and environmentally friendly compared to their traditional fuel-powered counterparts, as they do not produce exhaust emissions. They are commonly used in industries such as automotive, manufacturing, construction, mining, healthcare, and energy, and are popular in applications such as air conditioning systems, pneumatic tools, industrial processes, and more.

Key Statistics

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 12.09 Billion |

| Expected Market Size in 2034 | USD 41.83 Billion |

| Projected CAGR | 14.79% |

| Dominant Area | North America |

| Leading Growth Region | Asia-Pacific |

| Key Segments | Type, Power Range, Application, Region |

| Key Companies | Atlas Copco, Ingersoll Rand, Kaeser Compressors, Siemens, Gardner Denver, Boge Compressors, Sullair (A subsidiary of Hitachi), Elgi Compressors, Mitsubishi Electric, Schneider Electric, Hyundai Heavy Industries, Howden |

Increasing Industrial Automation

Growing Demand for Clean and Oil-Free Air

High Initial Investment Costs

Limited Availability in Emerging Markets

Increasing Adoption of IoT-Enabled Compressors

Expansion of Renewable Energy Infrastructure

Technical Complexity and Maintenance

Intense Market Competition

The electric compressor market is segmented into type, power range, application and region. Based on type, the market is classified into scroll compressors, screw compressors, rotary compressors, centrifugal compressors and reciprocating compressors. Based on power range, the market is classified into low power compressors (Below 20 kW), medium power compressors (20–100 kW) and high power compressors (Above 100 kW). Based on application, the market is classified into automotive, construction, manufacturing, mining, healthcare, energy and power.

Screw compressors hold the largest market share, accounting for approximately 40%. Their dominance can be attributed to their widespread use in industrial applications due to their ability to deliver continuous airflow with high efficiency. Screw compressors are highly reliable, have a long operational life, and require minimal maintenance, making them a preferred choice in manufacturing, construction, and mining sectors.

Scroll compressors are experiencing rapid growth due to their compact size, low noise levels, and energy-efficient operation. They are widely used in industries such as healthcare and electronics, where clean and contaminant-free air is crucial. The increasing adoption of scroll compressors in HVAC systems and their suitability for small-scale industrial applications contribute to their accelerated growth.

Medium power compressors hold the largest market share, contributing approximately 45%. These compressors strike a balance between power output and energy efficiency, making them suitable for a wide range of applications, including manufacturing, construction, and automotive. Their versatility and efficiency drive their extensive usage in industries with moderate air demand.

High power compressors are the fastest growing segment, driven by increasing demand in energy-intensive industries such as mining, energy, and large-scale manufacturing. These compressors provide high-capacity air supply, making them essential for heavy-duty applications. The expansion of renewable energy projects and large industrial facilities is boosting the demand for this segment.

The manufacturing sector dominates the market, holding a share of approximately 35%. This is due to the extensive use of electric compressors in assembly lines, pneumatic tools, and process automation. The demand for reliable compressed air in production processes and the shift toward smart manufacturing systems are key drivers of growth in this segment.

The automotive sector is the fastest growing segment, primarily fueled by the rising production of electric vehicles (EVs). Electric compressors are essential for EV air conditioning systems and thermal management. The global shift toward sustainable mobility and the growing demand for EVs drive the rapid growth of this application segment.

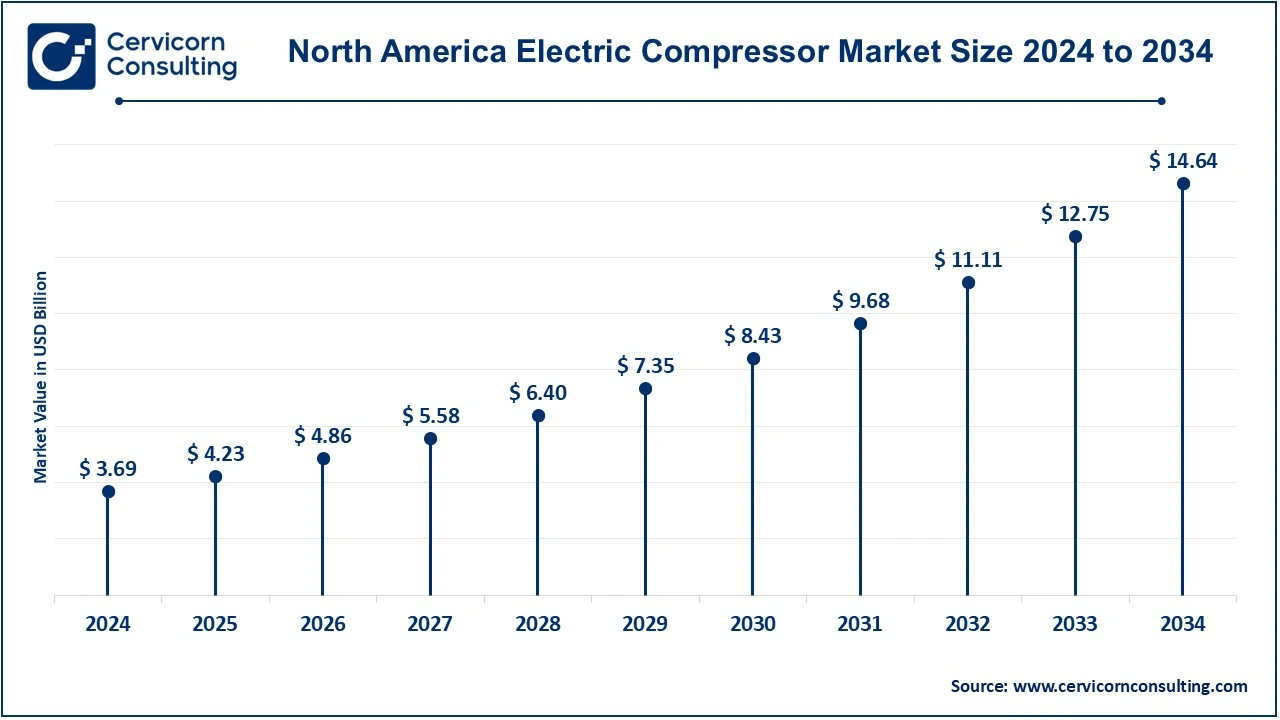

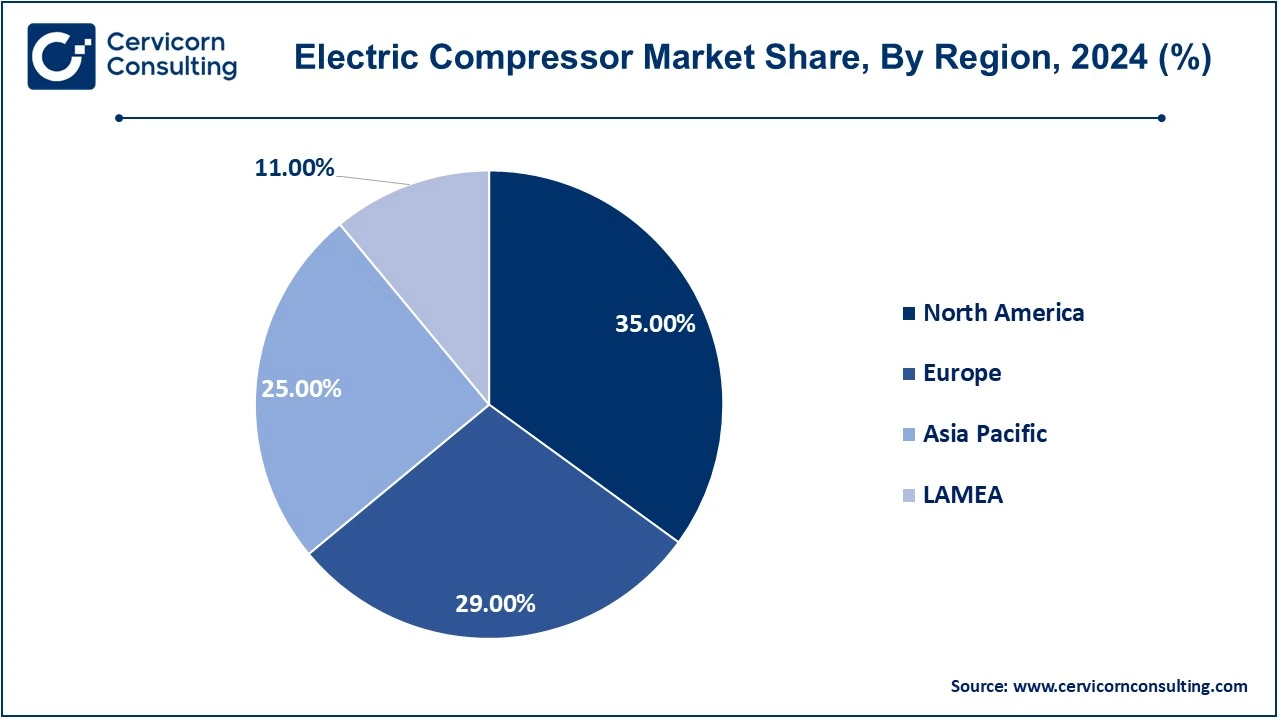

North America holds the largest market share, contributing approximately 35%. The global electric compressor market size was valued at USD 10.53 billion in 2024 and is expected to be worth around USD 41.83 billion by 2034. This dominance can be attributed to the region's advanced industrial infrastructure and high adoption of energy-efficient technologies. The United States and Canada are leading markets, driven by significant investments in the automotive, manufacturing, and construction sectors. Additionally, strict environmental regulations promoting sustainable and energy-saving solutions further propel the adoption of electric compressors in this region.

The APAC region is the fastest-growing market. The rapid industrialization in countries like China, India, Japan, and South Korea is fueling the demand for electric compressors. The expansion of the manufacturing and automotive industries, coupled with government initiatives to promote green energy and infrastructure development, is driving substantial growth. Additionally, the increasing adoption of electric vehicles in this region further boosts demand for electric compressors.

Europe is driven by its focus on sustainability and energy efficiency. The region is witnessing high demand for electric compressors in sectors like automotive, healthcare, and energy. Countries like Germany, France, and the UK lead the market due to their well-established automotive and manufacturing industries. Additionally, stringent EU regulations to reduce carbon emissions and promote eco-friendly technologies have accelerated the adoption of advanced electric compressors.

The LAMEA region is still developing compared to other regions, but growing industrial activities in Latin America and the Middle East are driving demand. The mining and energy sectors in countries like Brazil, South Africa, and Saudi Arabia are increasingly utilizing electric compressors for efficient and sustainable operations. However, limited infrastructure and lower adoption of advanced technologies in some parts of this region pose challenges to growth.

The electric compressors industry is highly competitive and comprises key players that are driving innovation and technological advancements to meet the growing demand for energy-efficient and sustainable solutions. These companies cater to a wide range of industries, including automotive, construction, manufacturing, and healthcare, while maintaining a strong focus on R&D to stay ahead in the market.

These companies are expanding their global footprint through strategic collaborations, partnerships, and acquisitions. They are also focusing on emerging markets in Asia-Pacific and LAMEA to capitalize on rapid industrialization and infrastructure development in these regions. This competitive landscape reflects a robust market, with companies striving to address evolving customer needs, enhance energy efficiency, and support industries transitioning toward greener solutions.

Market Segmentation

By Type

By Power Range

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Electric Compressor

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Power Range Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Industrial Automation

4.1.1.2 Growing Demand for Clean and Oil-Free Air

4.1.2 Market Restraints

4.1.2.1 High Initial Investment Costs

4.1.2.2 Limited Availability in Emerging Markets

4.1.3 Market Challenges

4.1.3.1 Technical Complexity and Maintenance

4.1.3.2 Intense Market Competition

4.1.4 Market Opportunities

4.1.4.1 Increasing Adoption of IoT-Enabled Compressors

4.1.4.2 Expansion of Renewable Energy Infrastructure

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Electric Compressor Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Electric Compressor Market, By Type

6.1 Global Electric Compressor Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Scroll Compressors

6.1.1.2 Screw Compressors

6.1.1.3 Rotary Compressors

6.1.1.4 Centrifugal Compressors

6.1.1.5 Reciprocating Compressors

Chapter 7. Electric Compressor Market, By Power Range

7.1 Global Electric Compressor Market Snapshot, By Power Range

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Low Power Compressors (Below 20 kW)

7.1.1.2 Medium Power Compressors (20–100 kW)

7.1.1.3 High Power Compressors (Above 100 kW)

Chapter 8. Electric Compressor Market, By Application

8.1 Global Electric Compressor Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Automotive

8.1.1.2 Construction

8.1.1.3 Manufacturing

8.1.1.4 Mining

8.1.1.5 Healthcare

8.1.1.6 Energy and Power

Chapter 9. Electric Compressor Market, By Region

9.1 Overview

9.2 Electric Compressor Market Revenue Share, By Region 2024 (%)

9.3 Global Electric Compressor Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Electric Compressor Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Electric Compressor Market, By Country

9.5.4 UK

9.5.4.1 UK Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Electric Compressor Market, By Country

9.6.4 China

9.6.4.1 China Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Electric Compressor Market, By Country

9.7.4 GCC

9.7.4.1 GCC Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Electric Compressor Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Atlas Copco

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Ingersoll Rand

11.3 Kaeser Compressors

11.4 Siemens

11.5 Gardner Denver

11.6 Boge Compressors

11.7 Sullair (A subsidiary of Hitachi)

11.8 Elgi Compressors

11.9 Mitsubishi Electric

11.10 Schneider Electric

11.11 Hyundai Heavy Industries

11.12 Howden