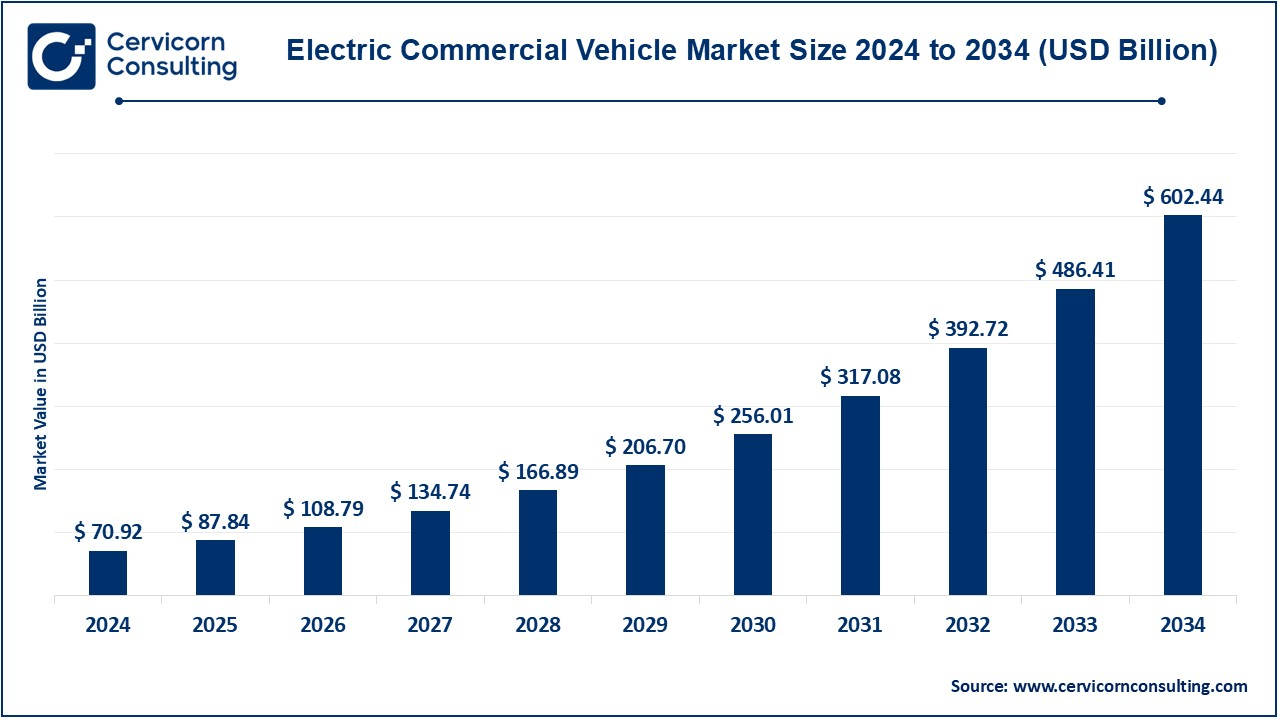

The global electric commercial vehicle market size was estimated at USD 70.92 billion in 2024 and is expected to hit around USD 602.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 23.85% over the forecast period 2025 to 2034.

Report Highlights

With the escalating environmental regulations worldwide for sustainability, the electric commercial vehicle market will keep on picking up. Strict emission standards on governments' agendas minimize pollution levels and combat climatic changes by reducing fossil fuels. Regulations push firms into opting for clean technologies, in which electric commercial vehicles (EVs) are some means that are helpful for corporations in achieving environment-related goals in the directions governments lead towards. Another addition is the low-emission zones implemented in many cities, which encourage using electric commercial vehicles. Businesses, especially in urban and regional transportation, are changing their ways to electric vehicles to protect against fines by abiding by the new regulation.

Electric commercial vehicles, on the other hand, is a commercial vehicle that runs not on fossil but on electricity, which includes commercial buses, vans, trucks, and other services used for either transporting goods or providing services to the public. ECVs are important, as they enable sustainable transportation methods, reducing gas emissions and at the same time reducing operational expenses compared to conventional engines. The ECV market is always increasing and is an overt move toward more environmentally friendly transport. Data from the U.S. Energy Information Administration, EIA, reveals that the electricity consumption by light-duty electric vehicles has risen smoothly since 2018 to the date. For instance, the amount of electricity that the BEVs and PHEVs used increased from 1,581,706 MWh in 2018 to 7,595,513 MWh in 2023, meaning that use is growing. This is propelled by a trend such as better battery technology, greater developments of charging points, and governmental stipulations to improve carbon emissions. The future for the ECV market seems promising as growth will continue to rise because of advancements in battery technologies, greater availability of charging stations, and investments by both the public and private sectors. As the regulatory framework for emissions gets tougher and stricter, this would push the shift for an increasing number of electric commercial vehicles. Thus, by the end of the decade, the ECV market would have gained substantial market valuations, wherein electric vehicles were one of the popular solutions in sustainable transportation solutions.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 87.84 Billion |

| Estimated Market Size in 2034 | USD 602.44 Billion |

| Projected CAGR 2025 to 2034 | 23.85% |

| Dominant Region | Asia-Pacific |

| Key Segments | Vehicle Type, Range, Propulsion, Battery Type, Battery Capacity, Power Output, Body Construction, Component, Application, Region |

| Key Companies | Volvo Group, Daimler AG, Traton Group, BYD, Nikola Motor, Tesla, DAF Trucks, Rivian, Ford Motor Group, General Motors, Tata Motors, Mahindra Electric, Ashok Leyland, Ather Energy, Ola Electric Mobility |

Technological Advancements

Government policies and laws

High Initial Investment Costs

Limited charging infrastructure

Growing Demand for Sustainable Transportation

Expansion of charging infrastructure

High Initial Costs

The electric commercial vehicle market is segmented into vehicle type, range, propulsion, battery type, battery capacity, power output, body construction, component, application, region. Based on vehicle type, the market is classified into electric trucks, electric vans, electric buses and electric light commercial vehicles. Based on range, the market is classified into short-range electric vehicles, medium-range electric vehicles and long-range electric vehicles. Based on propulsion, the market is classified into BEVS and FCEVS. Based on battery type, the market is classified into NMC batteries, LFP batteries, solid-state battery and others. Based on battery capacity, the market is classified into less Than 60KWH, 60-120 KWH, 121-200 KWH, 201-300 KWH, 301-500 KWH and 501-1000 KWH. Based on power output, the market is classified into less than 100 KW, 100-250 KW, and above 250 KW. Based on body construction, the market is classified into integrated, semi-integrated and full-sized. Based on component, the market is classified into battery pack, onboard charger, electric motors, inverters and fuel cell stacks. Based on application, the market is classified into logistics and freight, public transport, construction and mining and last-mile delivery.

Electric Trucks: Electric trucks are increasingly being used these days for the transportation of goods over varying distances. Light-duty trucks are used for short, urban delivery routes, and medium to heavy-duty trucks are used for a larger distance and heavier payload. Even big logistics players like UPS and FedEx have now started embracing electric trucks in a big way as a means of reducing emissions. The trend of producing electric trucks revolves around increasing the size of the batteries to have heavy payloads and overlong routes. As this technology advances, it can replace diesel trucking for freight movement between towns and cities for a majority of sustainability objectives.

Electric Vans: Electric vans are being popularized for urban delivery last mile needs because of their small size and low emissions, with cheaper operating costs. They are ideal for city-based logistics companies like Amazon, FedEx, and DHL that experience congested roads. Low maintenance requirements, government incentives, and the growing e-commerce sector accelerate the fast-paced adoption of electric vans. Additionally, developments in battery technology increase range and charge options for logistics needs and drive the electric van market.

Electric Buses: Electric buses are used globally because they eliminate pollution in cities, save money on their maintenance, and consume less energy. They are deployed in city public transportation, intercity, and school routes. Cities like London, Paris, and Los Angeles have promised to convert to electric buses as part of their overall efforts toward sustainability. Government funding also makes electric buses affordable for municipal transit authorities to adopt. Operationally, electric buses also help reduce noise pollution and reduce lifetime maintenance costs.

Electric Light Commercial Vehicles: These include the small delivery vans, electric pickup trucks, and others of their ilk that are vital for the movement of goods within an urban setup. The business saves fuel in these and are smaller, low-emitting vehicles, which are ideal for city roads. LCVs are being more and more used by small and medium-sized businesses for local deliveries. The demand for electric LCVs is expected to grow as more businesses seek efficient solutions for their fleets while aligning with sustainability goals. Some manufacturers such as Rivian and Ford invest in these types of vehicles and thus make them available and even cheaper.

Short-Range Electric Vehicles: These electric vehicles are developed for short-range operations within an urban setting or smaller-scale application. It ranges below 150 miles. These can be used in short local trips or commutations around the city or last-mile delivery operations. Since they are relatively small in terms of battery size, their cost is cheaper compared to long-range vehicles, hence suitable for small businesses and delivery services. Electric short-range vehicles have more demand in heavily trafficked cities with shorter distances between delivery points. Their ranges are also shorter which makes their recharging faster hence suitable for frequent stops and fast turnaround times.

Medium-Range Electric Vehicles: They will be able to range between 150 and 300 miles per charge, ideal for regional transportation requirements. They then become popular among logistics companies, regional delivery services, and businesses with moderate-distance travel requirements. They have bigger batteries so that they can drive on their daily routes comfortably while maintaining an inexpensive status relative to long-range vehicles. The range therefore makes feasible the trade-off between operational costs, efficiency, and sustainability. Electric trucks and vans from medium ranges therefore offer a way through which fleet owners can reduce their emissions considerably without losing out on their freight performance.

Long-Range Electric Vehicles: Over 300 miles on a single charge, the electric vehicles serve the requirement of long-distance haul distance freight movement. Ultra-long-range electric vehicles cater to the needs of companies that move state-to-state lines to implement cross-country deliveries and transportation interstate. The long-range feature reduces stops to charge further helps improve operational efficiency and saves time. Long-range electric vehicles cost more because more capacity is needed in the batteries. Companies adopting this type of vehicle will have to invest in infrastructure, but the overall benefits, like fuel cost and emission reduction, make it worthwhile to spend the amount on the purchase of the long-haul electric vehicle.

Logistics and Freight: The top big area is Logistics and Freight with the major of adopting electric commercial vehicles. Such fleets help logistic companies save fuel, achieve emission targets, and lessen noise pollution due to electric trucks and vans. Companies like DHL and UPS are testing or adding electric vehicles on their diesel lines, especially at the last leg of delivery through towns or cities. In the case of electric vehicles, several models may fit cargo transportation, especially short-distance urban operations or more regional routes. Logistics companies have taken sustainability into great focus, and are finding solutions that help optimize the supply chain efficiency as well as reduce the impact on the environment.

Public Transport: The use of electric buses is a major component of shifting towards cleaner public transport. Cities are implementing electric buses slowly to achieve set air quality targets as well as low operating costs. The top countries of electric public transport are China, the U.K., and India. Electric buses produce less noise and fewer greenhouse gases as well as need less maintenance compared to traditional diesel buses. Not only city buses but electric buses are also being employed for intercity and even school transport. Governments offer financial benefits for using such vehicles. These vehicles are connected to long-term savings and align with climate change mitigation.

Construction and Mining: Electric commercial vehicles are being gradually replaced with diesel-powered equipment in the construction and mining industries. Electric bulldozers, excavators, and haul trucks emit lower carbon content and are more efficient, thus fitting perfectly for workspaces that value workers' safety and sound reduction. Though adoption is slower in these industries than in urban transport, companies are increasingly drawn to the long-term environmental and economic benefits. Industry players are focusing on improving the capabilities of these machines, such as longer battery life and higher performance, for more demanding tasks in remote or construction sites, with growing interest in electric solutions.

Last-Mile Delivery: Last-mile delivery is one of the fastest-growing segments. e-Commerce boom is the reason behind it. Electric vans and small trucks are suitable vehicles for delivering products to consumers living in cities. Electric propulsion systems have reduced environmental impacts in delivering frequently. Cars are more diminutive, agile, and less pricey, so they appeal to various clients. In addition, most last-mile delivery activities involve short routes, and electric cars are ideal for such operations. Therefore, e-commerce increases, customers demand faster deliveries, and companies begin to scale up electric vehicles to meet their sustainability commitments and realize delivery savings.

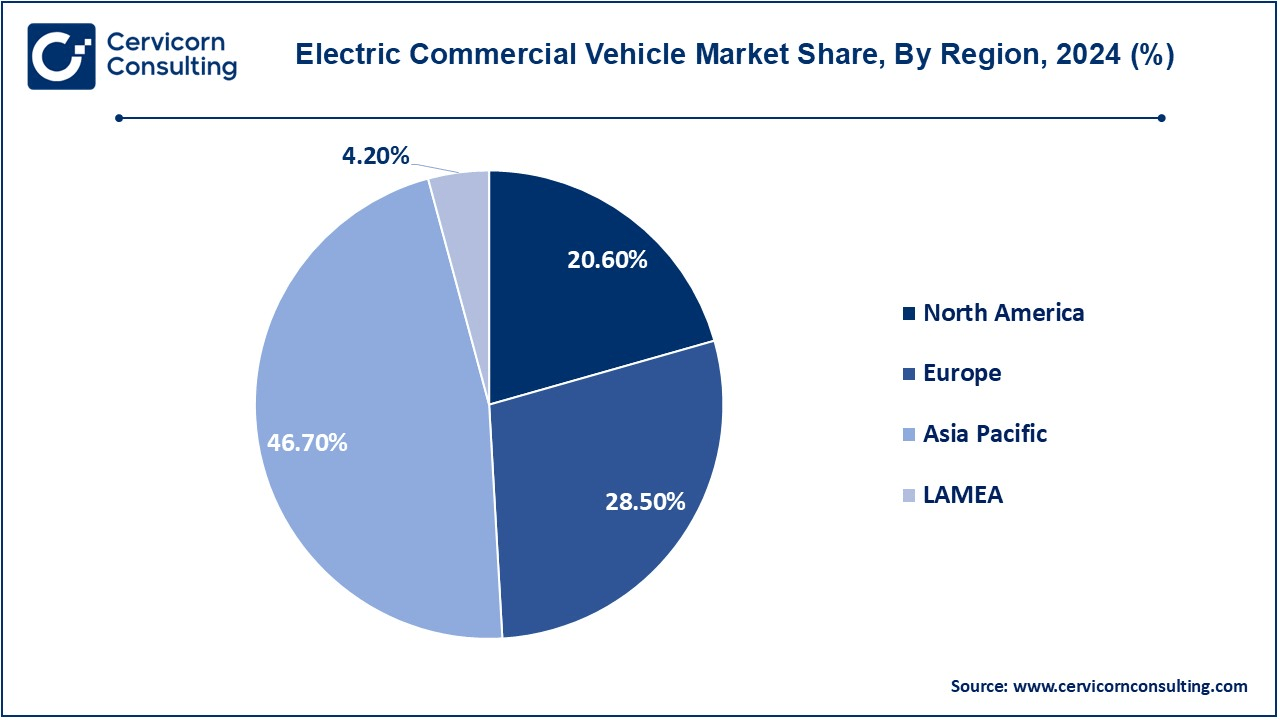

The electric commercial market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

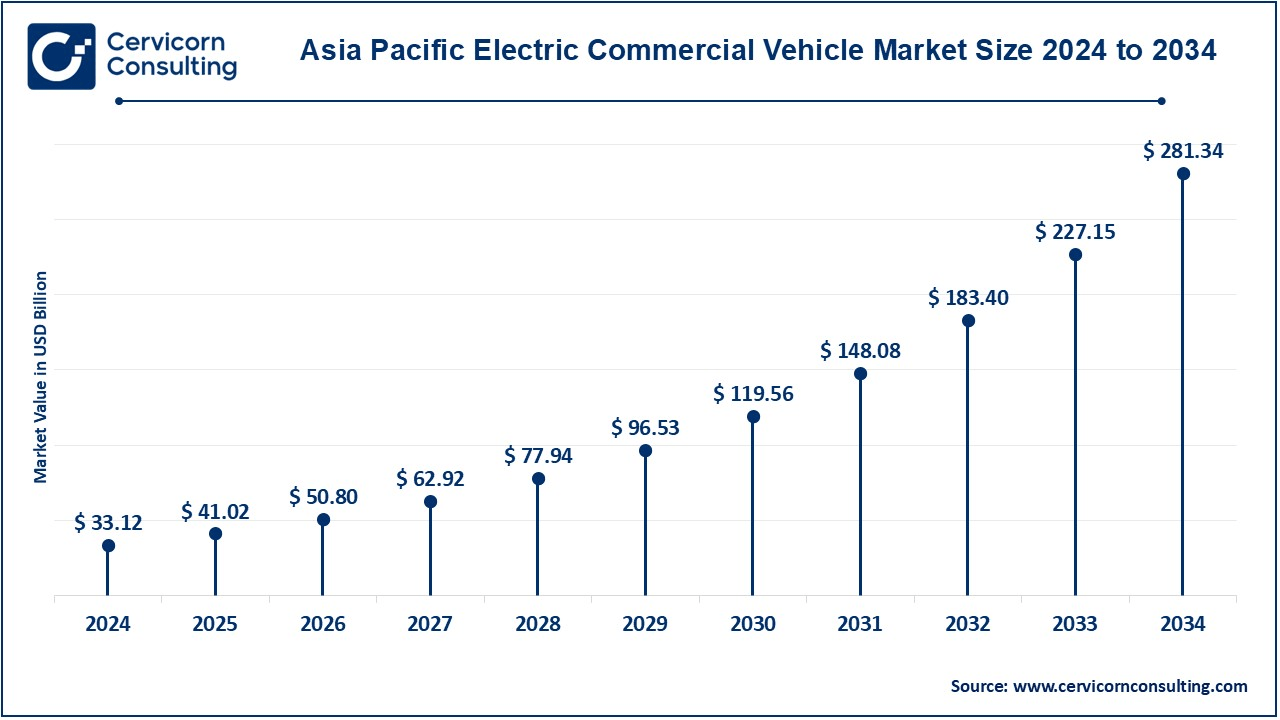

The Asia-Pacific electric commercial vehicle market size was accounted for USD 33.12 billion in 2024 and is predicted to surpass around USD 281.34 billion by 2034. The Asia Pacific region, yet again led by China, is the market with the biggest demand for e-commercial vehicles. China is at the top in the adoption and production of electric trucks, buses, and vans with great government support in incentives and infrastructural settings. The adoption of electric commercial vehicles is increasing in countries committed to clean energy and emissions reduction. Other countries including Japan and India have gradually been embracing electric vehicles. India is targeting bus electrification, and Japan is developing electric freight solutions to meet sustainability objectives.

The North America electric commercial vehicle market size was reached at USD 14.61 billion in 2024 and is forecasted to grow around USD 124.10 billion by 2034. In North America, the U.S. and Canada are on the advanced side of electric commercial vehicle implementation, mainly because of positive government policies, incentives, and infrastructure development. The increasing trend towards zero-emission transportation solutions and carbon emissions regulations push fleet operators to place electric trucks and vans in service. Cities such as Los Angeles and New York are now found to be at the forefront of adopting electric buses and last-mile delivery vehicles. More so, US-based companies like Tesla and Rivian are also experiencing massive success in the market. Electric buses and vans are being taken up by Canada in urban cities through government grants and clean energy.

The Europe electric commercial vehicle market size was valued at USD 20.21 billion in 2024 and is projected to hit around USD 171.70 billion by 2034. Europe has been the forerunner in electric commercial vehicles as the emission rules are quite stringent, and most governments encourage that kind of usage through incentives. Norway, the Netherlands, and the UK have led. Ambitious targets have been set by the companies in adopting electric vehicles. The companies target cities, especially for adaptation to electric vehicles. In Europe, urban centers are among the growing markets where cities have adopted renewable transport through electric buses. Companies such as Volvo and Daimler have invested quite seriously in the manufacturing of electric trucks. More recently, the European Union's Green Deal and more are accelerating e-vehicle migration on the continent; hence making Europe a key growth centre for electric commercial vehicles.

The LAMEA electric commercial vehicle market was valued at USD 2.98 billion in 2024 and is anticipated to reach around USD 25.30 billion by 2034. The adoption rate is slower in regions such as Latin America, Africa, and the Middle East but is increasing gradually. For instance, Brazil and Mexico are investing in electric vehicle infrastructure, and the government offers subsidies to encourage adoption. However, disadvantages are still seen in the insufficient charging infrastructure and the higher price of vehicles. Electric buses are being introduced in some African cities to curb air pollution. The Middle East is promising electric commercial vehicles in the UAE and Saudi Arabia to reduce dependence on traditional energy sources and lessen emissions.

CEO Statements

Thierry Dombreval, CEO of Renault Trucks

Ola Källenius, CEO of Mercedes-Benz Group AG

Market Segmentation

By Vehicle Type

By Range

By Propulsion

By Battery Type

By Battery Capacity

By Power Output

By Body Construction

By Component

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Electric Commercial Vehicle

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Vehicle Type Overview

2.2.2 By Power Output Overview

2.2.3 By Battery Capacity Overview

2.2.4 By Battery Type Overview

2.2.5 By Propulsion Overview

2.2.6 By Range Overview

2.2.7 By Body Construction Overview

2.2.8 By Application Overview

2.2.9 By Component Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Technological Advancements

4.1.1.2 Government policies and laws

4.1.2 Market Restraints

4.1.2.1 High Initial Investment Costs

4.1.2.2 Limited charging infrastructure

4.1.3 Market Challenges

4.1.3.1 High Initial Costs

4.1.3.2 Limits of Charging Infrastructure

4.1.4 Market Opportunities

4.1.4.1 Growing Demand for Sustainable Transportation

4.1.4.2 Expansion of charging infrastructure

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Electric Commercial Vehicle Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Electric Commercial Vehicle Market, By Vehicle Type

6.1 Global Electric Commercial Vehicle Market Snapshot, By Vehicle Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Electric Trucks

6.1.1.2 Electric Vans

6.1.1.3 Electric Buses

6.1.1.4 Electric Light Commercial Vehicles (LCVs)

Chapter 7. Electric Commercial Vehicle Market, By Power Output

7.1 Global Electric Commercial Vehicle Market Snapshot, By Power Output

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Less Than 100 KW

7.1.1.2 100-250 KW

7.1.1.3 Above 250 KW

Chapter 8. Electric Commercial Vehicle Market, By Range

8.1 Global Electric Commercial Vehicle Market Snapshot, By Range

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Short-range Electric Vehicles

8.1.1.2 Medium-range Electric Vehicles

8.1.1.3 Long-range Electric Vehicles

Chapter 9. Electric Commercial Vehicle Market, By Propulsion

9.1 Global Electric Commercial Vehicle Market Snapshot, By Propulsion

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 BEVS

9.1.1.2 FCEVS

Chapter 10. Electric Commercial Vehicle Market, By Battery Type

10.1 Global Electric Commercial Vehicle Market Snapshot, By Battery Type

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 NMC Batteries

10.1.1.2 LFP Batteries

10.1.1.3 Solid-State Battery

10.1.1.4 Others

Chapter 11. Electric Commercial Vehicle Market, By Battery Capacity

11.1 Global Electric Commercial Vehicle Market Snapshot, By Battery Capacity

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Less Than 60KWH

11.1.1.2 60-120 KWH

11.1.1.3 121-200 KWH

11.1.1.4 201-300 KWH

11.1.1.5 301-500 KWH

11.1.1.6 501-1000 KWH

Chapter 12. Electric Commercial Vehicle Market, By Body Construction

12.1 Global Electric Commercial Vehicle Market Snapshot, By Body Construction

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Integrated

12.1.1.2 Semi-Integrated

12.1.1.3 Full-Sized

Chapter 13. Electric Commercial Vehicle Market, By Application

13.1 Global Electric Commercial Vehicle Market Snapshot, By Application

13.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

13.1.1.1 Logistics and Freight

13.1.1.2 Public Transport

13.1.1.3 Construction and Mining

13.1.1.4 Last-Mile Delivery

Chapter 14. Electric Commercial Vehicle Market, By Component

14.1 Global Electric Commercial Vehicle Market Snapshot, By End-User

14.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

14.1.1.1 Battery Pack

14.1.1.2 Onboard Charger

14.1.1.3 Electric Motors

14.1.1.4 Inverters

14.1.1.5 Fuel Cell Stacks

Chapter 15. Electric Commercial Vehicle Market, By Region

15.1 Overview

15.2 Electric Commercial Vehicle Market Revenue Share, By Region 2024 (%)

15.3 Global Electric Commercial Vehicle Market, By Region

15.3.1 Market Size and Forecast

15.4 North America

15.4.1 North America Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.4.2 Market Size and Forecast

15.4.3 North America Electric Commercial Vehicle Market, By Country

15.4.4 U.S.

15.4.4.1 U.S. Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.4.4.2 Market Size and Forecast

15.4.4.3 U.S. Market Segmental Analysis

15.4.5 Canada

15.4.5.1 Canada Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.4.5.2 Market Size and Forecast

15.4.5.3 Canada Market Segmental Analysis

15.4.6 Mexico

15.4.6.1 Mexico Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.4.6.2 Market Size and Forecast

15.4.6.3 Mexico Market Segmental Analysis

15.5 Europe

15.5.1 Europe Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.5.2 Market Size and Forecast

15.5.3 Europe Electric Commercial Vehicle Market, By Country

15.5.4 UK

15.5.4.1 UK Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.5.4.2 Market Size and Forecast

15.5.4.3 UKMarket Segmental Analysis

15.5.5 France

15.5.5.1 France Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.5.5.2 Market Size and Forecast

15.5.5.3 FranceMarket Segmental Analysis

15.5.6 Germany

15.5.6.1 Germany Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.5.6.2 Market Size and Forecast

15.5.6.3 GermanyMarket Segmental Analysis

15.5.7 Rest of Europe

15.5.7.1 Rest of Europe Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.5.7.2 Market Size and Forecast

15.5.7.3 Rest of EuropeMarket Segmental Analysis

15.6 Asia Pacific

15.6.1 Asia Pacific Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.6.2 Market Size and Forecast

15.6.3 Asia Pacific Electric Commercial Vehicle Market, By Country

15.6.4 China

15.6.4.1 China Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.6.4.2 Market Size and Forecast

15.6.4.3 ChinaMarket Segmental Analysis

15.6.5 Japan

15.6.5.1 Japan Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.6.5.2 Market Size and Forecast

15.6.5.3 JapanMarket Segmental Analysis

15.6.6 India

15.6.6.1 India Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.6.6.2 Market Size and Forecast

15.6.6.3 IndiaMarket Segmental Analysis

15.6.7 Australia

15.6.7.1 Australia Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.6.7.2 Market Size and Forecast

15.6.7.3 AustraliaMarket Segmental Analysis

15.6.8 Rest of Asia Pacific

15.6.8.1 Rest of Asia Pacific Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.6.8.2 Market Size and Forecast

15.6.8.3 Rest of Asia PacificMarket Segmental Analysis

15.7 LAMEA

15.7.1 LAMEA Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.7.2 Market Size and Forecast

15.7.3 LAMEA Electric Commercial Vehicle Market, By Country

15.7.4 GCC

15.7.4.1 GCC Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.7.4.2 Market Size and Forecast

15.7.4.3 GCCMarket Segmental Analysis

15.7.5 Africa

15.7.5.1 Africa Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.7.5.2 Market Size and Forecast

15.7.5.3 AfricaMarket Segmental Analysis

15.7.6 Brazil

15.7.6.1 Brazil Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.7.6.2 Market Size and Forecast

15.7.6.3 BrazilMarket Segmental Analysis

15.7.7 Rest of LAMEA

15.7.7.1 Rest of LAMEA Electric Commercial Vehicle Market Revenue, 2022-2034 ($Billion)

15.7.7.2 Market Size and Forecast

15.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 16. Competitive Landscape

16.1 Competitor Strategic Analysis

16.1.1 Top Player Positioning/Market Share Analysis

16.1.2 Top Winning Strategies, By Company, 2022-2024

16.1.3 Competitive Analysis By Revenue, 2022-2024

16.2 Recent Developments by the Market Contributors (2024)

Chapter 17. Company Profiles

17.1 Volvo Group

17.1.1 Company Snapshot

17.1.2 Company and Business Overview

17.1.3 Financial KPIs

17.1.4 Product/Service Portfolio

17.1.5 Strategic Growth

17.1.6 Global Footprints

17.1.7 Recent Development

17.1.8 SWOT Analysis

17.2 Daimler AG

17.3 Traton Group

17.4 BYD

17.5 Nikola Motor

17.6 Tesla

17.7 DAF Trucks

17.8 Rivian

17.9 Ford Motor Group

17.10 General Motors

17.11 Tata Motors

17.12 Mahindra Electric

17.13 Ashok Leyland

17.14 Ather Energy

17.15 Ola Electric Mobility