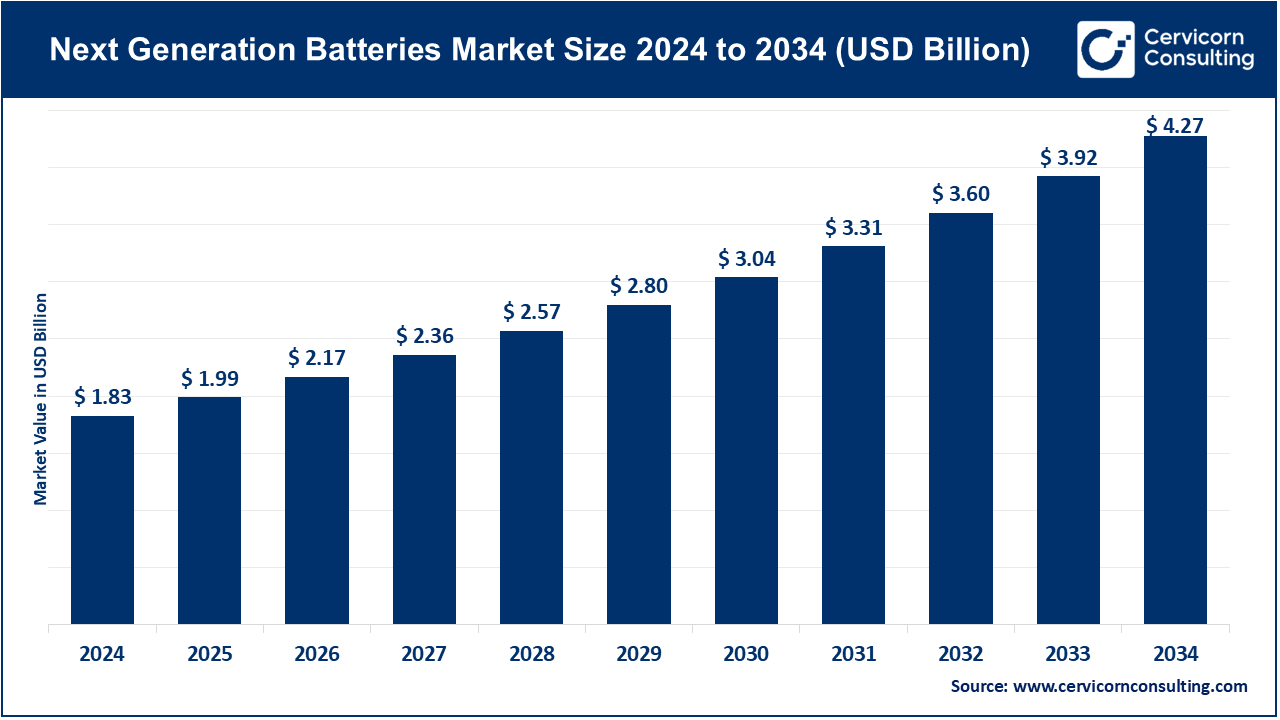

The global next generation batteries market size was valued at USD 1.83 billion in 2024 and is expected to reach around USD 4.27 billion by 2034, growing at a CAGR of 8.84% during the forecast period 2025 to 2034. Factors like an advancement in technology, an upsurge in demand for electric vehicles, and a growing need for energy-efficient storage solutions for renewable power are leading the next generation batteries market at a high pace. A lot of investments in various innovative battery technologies such as lithium-sulfur, sodium-ion, and solid-state batteries have resulted from a rapid shift toward environment-friendly and sustainable sources of energy. High government efforts to reduce the carbon footprint associated with carbon emissions, coupled with increasing consumer demand for longer-duration and faster-recharging batteries.

Next-generation batteries refer to advanced energy storage technologies designed to address the limitations of traditional batteries, such as lithium-ion. These innovative batteries aim to deliver superior performance in terms of energy density, charging speed, lifespan, safety, and environmental sustainability. Examples include solid-state batteries, lithium-sulfur batteries, sodium-ion batteries, and zinc-air batteries. They are being developed for diverse applications, including electric vehicles (EVs), renewable energy storage, portable electronics, and industrial equipment.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.99 Billion |

| Expected Market Size in 2034 | USD 4.27 Billion |

| Projected CAGR 2025 to 2034 | 8.84% |

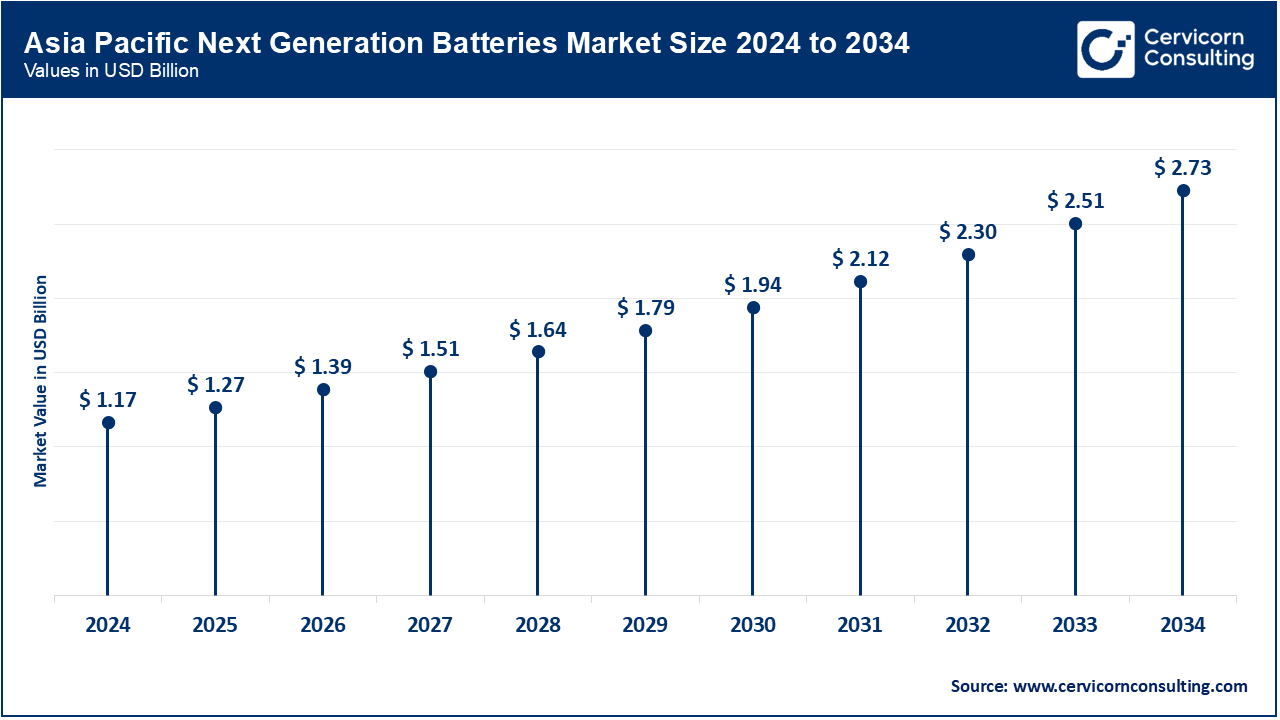

| Dominant Region | Asia-Pacific |

| Key Segments | Technology, Chemistry, Application, End Use, Region |

| Key Companies | Panasonic, Faraday Battery Challenge, EnerVenue, A123 Systems, Sakti3, QuantumScape, LG Energy Solution, Samsung SDI, Northvolt, Solid Power, Hitachi Zosen, Contemporary Amperex Technology Co Limited, StoreDot, BYD, Tesla |

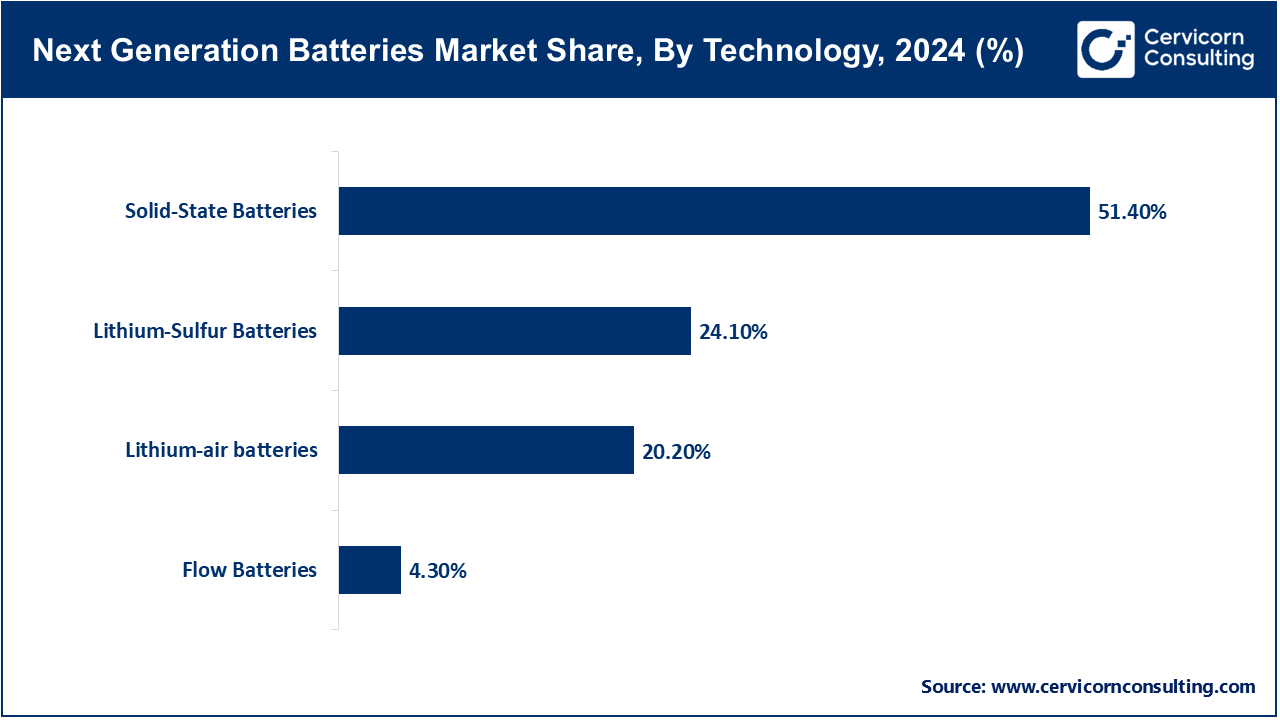

The next generation batteries market is segmented into technology, application, end use, chemistry and region. Based on technology, the market is classified into lithium-sulfur batteries, solid-state batteries, lithium-air batteries and flow batteries. Based on application, the market is classified into electric vehicles, consumer electronics, energy storage systems (ESS), aerospace and Defense. Based on end use, the market is classified into transportation, residential, commercial and utilities. Based on chemistry, the market is classified into lithium-ion, nickel-metal hydride, lead-acid and zinc-air.

Lithium-sulfur batteries: Lithium-sulfur batteries are presently gaining so much popularity lately because it has high energy density and their lightweight properties have made it particularly suitable for portable electronic apparatus and electric automobiles. The material used in a cathode is in this case sulfur, it is abundant also much cheaper in comparison to a cathode of a lithium battery. Some of these problems, however, like short cycle life and performance degradation on repeated usage, are under process through continuous R&D. They hold promise for high-performance energy storage.

Solid-State Batteries: The Solid-State Batteries segment dominated the market in 2024. This technology substitutes a solid instead of the liquid inside traditional batteries as an electrolyte. They provide greater safety, have higher energy density, and tend to live much longer than any other conventional batteries. This new generation is popularly taking off for electric cars because it supports faster chargeability and higher driving range. Moreover, their improved safety profile should replace the flammable liquid electrolyte makes them a very promising candidate for consumer electronics and aerospace applications to gain massive interest in the market.

Lithium-air Batteries: Lithium-air batteries are one of the recently developed new technologies used to develop highly energetic power from the use of oxygen in air as a reacting species. So light, they are revolutionizing electric vehicles and aerospace applications. Commercialization is currently limited because of technical barriers like low efficiency, short lifetimes, and moisture and CO2 contamination sensitivities.

Flow Batteries: Scalable flow batteries have the ability to store significant levels of energy. They are, therefore, suitable for grid-scale systems. They use liquid electrolytes that are stored in outside tanks. They last longer and scale more easily. Their usefulness can be witnessed more in the integration of renewable energy sources as they can store the intermittent supply that comes from solar and wind power, thus assisting in making the energy supply steadier and more reliable.

Electric Vehicles: The next generation of the battery market is already strongly driven by the electric vehicle sector. Demand for longer-range, faster-charging, and more environment-friendly EVs is increasing. So, there is adoption of advanced next-generation batteries, mainly solid-state and lithium-sulfur batteries, which can overcome the limitations of the commercialized lithium-ion battery, offering higher energy efficiency and supporting electrification of transport across the globe.

Consumer Electronics: There is significant demand for more energy density, longer life, lighter weight, and smaller size batteries for most portable consumer electronics products, including smartphones, laptops, and wearable devices. These new technologies such as solid-state and lithium-sulfur variants are well-positioned to answer the calls, with the added benefit of better safety. These new-generation batteries are opening doors for new, imaginative products and longer times that will enable extended usage and therefore improve user experience and drive market penetration in these segments.

Next Generation Batteries Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Electric Vehicles (EVs) | 58.30% |

| Consumer Electronics | 11.60% |

| Energy Storage Systems (ESS) | 26.40% |

| Aerospace and Defense | 3.70% |

ESS: Applications of ESS are highly crucial for grid stabilization, considering the increased focus on renewable sources like solar and wind energy. Flow batteries and solid-state batteries are slowly but surely penetrating this market segment due to the provision of large-scale, long-duration energy storage. These technologies balance energy supply and demand and reduce dependence on fossil fuels; they also enable energy resilience both in residential and commercial settings.

Aerospace and Defense: In the aerospace and defense industries, lightweight and high-performance batteries are required for UAVs, satellites, and military equipment. Lithium-air and solid-state batteries will be very appropriate in these industries due to their improved energy density and reliability in extreme conditions. They power critical systems and reduce payload weights, which is essential for developing aerospace and defense technologies.

The regional market for next generation batteries comprises North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). More analysis of all of these is shown below.

North America is an important market for next-generation batteries, led by high investments in renewable energy and electric vehicles (EVs). The U.S. leads the region because of government incentives for the adoption of EVs, vast R&D funding, and key battery manufacturers' presence. Solid-state and lithium-sulfur batteries are emerging innovations, and demand for ESS to stabilize the grid is pushing the market forward.

It is a world leader in sustainability programs and promotes next-generation battery development. The EU Green Deal and phaseout of fossil fuel use are driving EV adoption and renewable energy. Countries that are well ahead of others have sizeable investments in R&D on batteries and gigafactories like Germany and Norway. Solid-state and flow batteries are gaining momentum, mainly in ESS and automotive applications.

The Asia-Pacific next generation batteries market size was estimated at USD 1.17 billion in 2024 and is expected to hit around USD 2.73 billion by 2034. The Asia-Pacific region is far ahead of the rest of the world in next-generation batteries. Demand for EVs, large manufacturing capabilities, and a booming industry in countries like China, Japan, and South Korea have created this scenario. China is the market leader in terms of EV production and innovation of battery technology. Japan and South Korea are following the emergence of solid-state and lithium-air technologies. There is more focus on renewable energy, and the government offers subsidies to further boost the market.

It has growth opportunities with next-generation batteries that are mainly about energy storage with renewable power. Latin America, by focusing on projects involving renewable power, such as solar and wind, will attract flow and solid-state batteries. Demand is being seen in the Middle East, with growing interest in the stability of grid and EV. Africa is tapping into battery technology to improve remote energy access. Thus, an off-grid solution remains a potential future market.

Market Segmentation

By Technology

By Application

By End Use

By Chemistry

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Next Generation Batteries

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Chemistry Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Need for High-Speed Charging Batteries

4.1.1.2 Decarbonization Targets

4.1.1.3 Data Center Expansion

4.1.2 Market Restraints

4.1.2.1 High Upfront Costs

4.1.2.2 Raw Material Availability

4.1.2.3 Technological Complexity

4.1.3 Market Challenges

4.1.3.1 Lithium and cobalt availability are raw material dependent and quite scarce

4.1.3.2 Cost reduction

4.1.4 Market Opportunities

4.1.4.1 Consumer electronics innovation

4.1.4.2 Battery Recycling Market

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Next Generation Batteries Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Next Generation Batteries Market, By Technology

6.1 Global Next Generation Batteries Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Lithium-Sulfur Batteries

6.1.1.2 Solid-State Batteries

6.1.1.3 Lithium-air batteries

6.1.1.4 Flow Batteries

Chapter 7. Next Generation Batteries Market, By Chemistry

7.1 Global Next Generation Batteries Market Snapshot, By Chemistry

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Lithium-Ion

7.1.1.2 Nickel-Metal Hydride

7.1.1.3 Lead-Acid

7.1.1.4 Zinc-Air

Chapter 8. Next Generation Batteries Market, By Application

8.1 Global Next Generation Batteries Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Electric Vehicles (EVs)

8.1.1.2 Consumer Electronics

8.1.1.3 Energy Storage Systems (ESS)

8.1.1.4 Aerospace and Defense

Chapter 9. Next Generation Batteries Market, By End-User

9.1 Global Next Generation Batteries Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Transportation

9.1.1.2 Residential

9.1.1.3 Commercial

9.1.1.4 Utilities

Chapter 10. Next Generation Batteries Market, By Region

10.1 Overview

10.2 Next Generation Batteries Market Revenue Share, By Region 2024 (%)

10.3 Global Next Generation Batteries Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Next Generation Batteries Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Next Generation Batteries Market, By Country

10.5.4 UK

10.5.4.1 UK Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Next Generation Batteries Market, By Country

10.6.4 China

10.6.4.1 China Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Next Generation Batteries Market, By Country

10.7.4 GCC

10.7.4.1 GCC Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Next Generation Batteries Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Panasonic

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Faraday Battery Challenge

12.3 EnerVenue

12.4 A123 Systems

12.5 Sakti3

12.6 QuantumScape

12.7 LG Energy Solution

12.8 Samsung SDI

12.9 Northvolt

12.10 Solid Power

12.11 Hitachi Zosen

12.12 Contemporary Amperex Technology Co Limited

12.13 StoreDot

12.14 BYD

12.15 Tesla