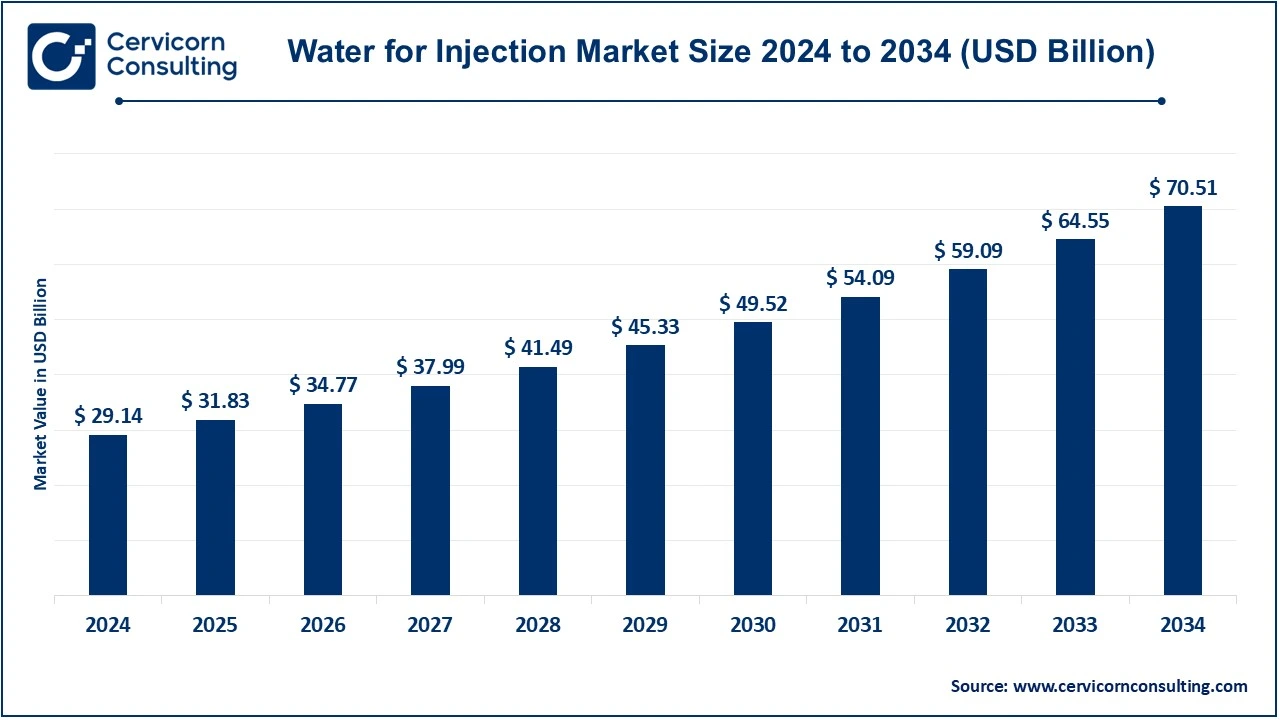

The global water for injection (WFI) market size was reached at USD 29.14 billion in 2024 and is expected to surpass around USD 70.51 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 9.24% over the forecast period 2025 to 2034.

The water for injection market is experiencing strong growth due to the increasing demand for injectable drugs, vaccines, and biopharmaceuticals. The rise in chronic diseases like diabetes and cancer has driven the need for sterile injectable treatments, boosting WFI demand. Additionally, the global pharmaceutical industry expansion, advancements in biologics, and the development of personalized medicines have contributed to market growth. The COVID-19 pandemic also led to a surge in vaccine production, increasing WFI consumption. The market is expected to grow steadily, with significant demand from North America, Europe, and Asia-Pacific.

What is Water for Injection (WFI)?

Water for Injection (WFI) is a highly purified form of water used in pharmaceutical and medical applications. It is free from contaminants, bacteria, and endotoxins, making it suitable for preparing injectable medicines, vaccines, and intravenous (IV) fluids. WFI is produced through processes like distillation or reverse osmosis to ensure it meets strict quality standards set by regulatory bodies like the United States Pharmacopeia (USP) and the European Pharmacopoeia (EP).

There are different types of WFI, including Sterile Water for Injection (used directly in injections), Purified WFI (used in non-sterile pharmaceutical preparations), and Distilled WFI (single or double-distilled for higher purity). It is commonly used in hospitals, biotech labs, and pharmaceutical manufacturing. The production of WFI requires special equipment and sterile conditions to prevent contamination. As the demand for injectable drugs, vaccines, and biopharmaceuticals grows, the need for high-quality WFI continues to rise globally.

Report Highlights

Rising Demand for Injectable Drugs and Biologics

Stringent Regulatory Standards and Compliance

Expansion of Pharmaceutical Manufacturing in Emerging Markets

Adoption of Membrane-Based Purification Technologies

Increasing Use of Single-Use Systems in Pharmaceutical Manufacturing

Rising Investments in Biopharmaceuticals and Vaccine Production

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 29.14 Billion |

| Expected Market Size in 2034 | USD 70.51 Billion |

| Projected CAGR (2025 to 2034) | 9.23% |

| Dominant Region | North America |

| High Growth Region | Asia Pacific |

| Key Segments | Type, Application, End User, Region |

| Key Companies | Merck Group, Fresenius Kabi AG, B. Braun Melsungen AG, Baxter International Inc., Pfizer Inc., Sandoz International GmbH, Lonza Group, Samsung Biologics, Boehringer Ingelheim, GSK (GlaxoSmithKline), Hospira (Now part of Pfizer), Apotex Inc., Aurobindo Pharma, Amgen Inc., Eli Lilly and Co. |

Increasing Prevalence of Chronic Diseases

The rising global burden of chronic diseases such as cancer, diabetes, and cardiovascular disorders is a major driver of the water for injection (WFI) market. According to the World Health Organization (WHO), chronic diseases account for 74% of all deaths globally. The increasing number of patients requiring injectable medications, biologics, and vaccines has significantly boosted the demand for WFI, as it is a critical component in drug formulation and intravenous therapies. Additionally, the global biologics market is projected to grow significant, further driving the need for high-quality WFI in pharmaceutical and biopharmaceutical applications.

Expansion of Biopharmaceuticals

The rapid growth of the biopharmaceutical sector is significantly contributing to the demand for WFI. Advances in biologics, including gene therapies and monoclonal antibodies, require ultra-pure water for manufacturing and formulation. As pharmaceutical companies focus more on developing biologic drugs, the need for high-quality WFI becomes more critical. Biopharmaceuticals often involve complex molecules that necessitate highly purified water during the production process to ensure sterility and prevent contamination. The continued expansion of the biopharmaceutical industry is expected to sustain and increase the demand for WFI in the future.

High Production Costs

Producing WFI involves complex purification processes such as distillation, reverse osmosis, and ultrafiltration, which require significant capital investment in advanced equipment and infrastructure. The high energy and operational costs associated with these processes make WFI an expensive pharmaceutical excipient. Additionally, manufacturers must adhere to strict regulatory requirements from agencies like the FDA (U.S.), EMA (Europe), and WHO, which further increases production costs. These financial constraints can limit market entry for small and mid-sized pharmaceutical companies, slowing down overall industry growth.

Regulatory Compliance Challenges

The WFI market is highly regulated, with stringent Good Manufacturing Practices (GMP) and compliance requirements across different regions. For example, the FDA mandates that WFI must meet USP (United States Pharmacopeia) standards, while the European Pharmacopoeia (Ph. Eur.) enforces different guidelines for sterile and non-sterile WFI production. Non-compliance with these regulations can lead to product recalls, legal penalties, and delays in drug approvals, creating significant challenges for manufacturers. Moreover, regulatory updates and evolving safety standards require continuous process optimization, adding to the industry's complexity.

Emerging Markets

Developing regions such as Asia-Pacific, Latin America, and the Middle East present significant growth opportunities for the WFI market due to expanding pharmaceutical industries, increasing healthcare investments, and rising demand for generic drugs. Countries like India and China, which are already global hubs for generic medicine production, are witnessing increased foreign direct investments (FDI) and government support for pharmaceutical infrastructure development.

Technological Advancements in Purification

The development of advanced membrane-based filtration technologies such as electrodeionization (EDI), reverse osmosis (RO), and ultrafiltration (UF) is transforming the WFI market. These energy-efficient and cost-effective purification methods are increasingly replacing traditional distillation techniques. Additionally, innovations in single-use systems and automation in pharmaceutical water production are improving process efficiency and reducing contamination risks. The adoption of these modern purification techniques is expected to enhance production capacity while maintaining compliance with stringent regulatory standards, creating lucrative opportunities for market players.

Risk of Contamination

One of the most critical challenges in WFI production is maintaining sterility and purity throughout the manufacturing, storage, and distribution processes. Even minimal contamination from bacteria, endotoxins, or organic matter can render WFI unsafe for use in pharmaceuticals and injectables, leading to potential health risks for patients. Pharmaceutical companies must invest in advanced filtration systems, continuous monitoring, and strict quality control measures to prevent contamination. The risk of microbial growth in storage and distribution systems also necessitates the use of high-end sterilization techniques, increasing production complexity.

Supply Chain Disruptions

The COVID-19 pandemic, geopolitical tensions, and raw material shortages have highlighted the vulnerability of global pharmaceutical supply chains. Disruptions in the availability of filtration equipment, sterilization components, and packaging materials can cause delays in WFI production, affecting pharmaceutical manufacturing. Additionally, logistics challenges, trade restrictions, and fluctuating raw material costs pose uncertainties for WFI producers. To mitigate these risks, companies are increasingly focusing on regional supply chain diversification and localizing production facilities to ensure a stable supply of pharmaceutical-grade water.

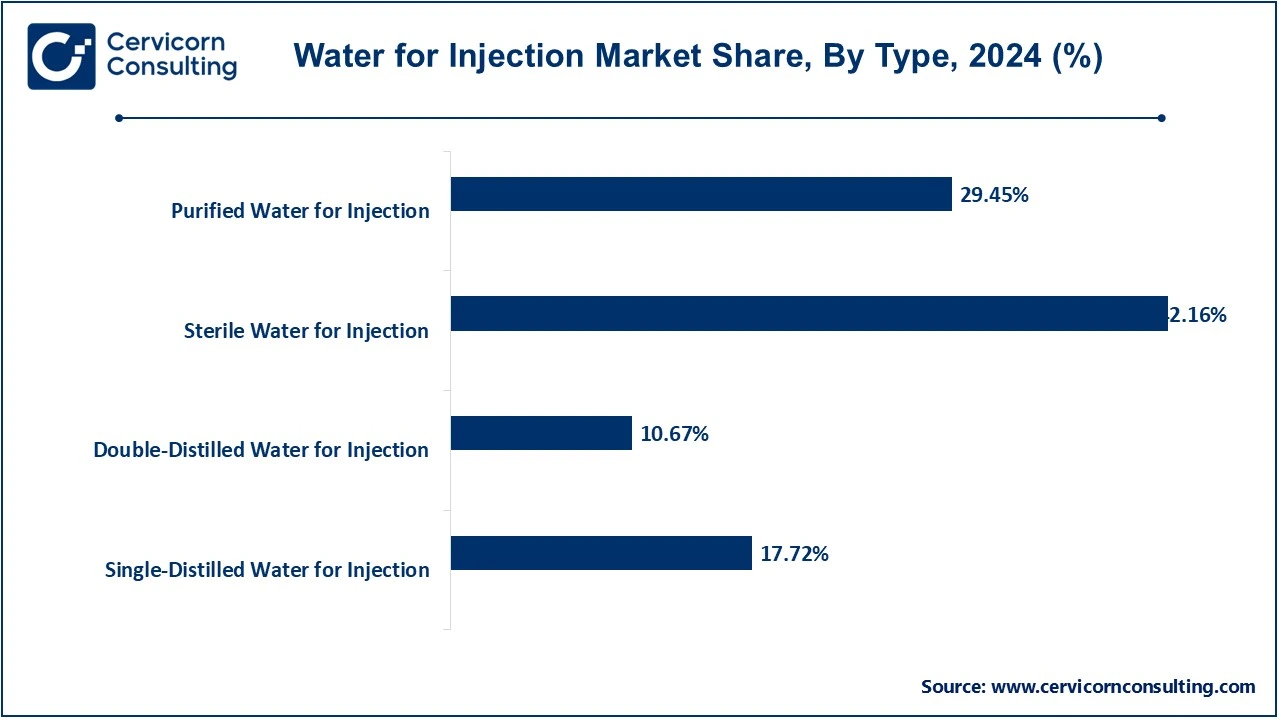

Single-Distilled Water for Injection: Single-distilled water for injection (WFI) is water that has undergone a distillation process once to meet the purity standards required for pharmaceutical and medical applications. This type of WFI is widely used in the formulation of injectable drugs, where the demand for water with a moderate level of purity is sufficient. Single-distilled WFI is typically less expensive compared to double-distilled WFI, making it a popular choice in manufacturing environments where cost-effectiveness is prioritized.

Double-Distilled Water for Injection: Double-distilled water for injection undergoes two rounds of distillation to achieve a higher level of purity. This type of WFI is generally preferred in the production of highly sensitive or complex injectable drugs and biologics that require a stricter standard of water purity. Double-distilled WFI is essential in processes that demand ultra-pure water to prevent any contamination that could affect the quality or efficacy of the final product. Its market share is expected to grow due to the increasing demand for high-precision pharmaceutical products.

Sterile Water for Injection: Sterile water for injection is WFI that has been sterilized to ensure it is free from microorganisms, making it safe for use in medical and pharmaceutical applications. It is commonly used for reconstituting drugs or as a solvent in injectable formulations. The segment has the largest market share, as it is essential for a wide range of medical and pharmaceutical applications, including vaccines and parenteral drug products. The increasing demand for injectable medications is driving growth in this segment.

Purified Water for Injection: Purified water for injection meets the required purity standards, but it may not be subjected to the same sterilization process as sterile WFI. While it is suitable for certain applications, it requires further sterilization before being used for injectable formulations. This type of WFI is typically used in the preparation of non-parenteral drug forms, laboratory applications, and manufacturing processes where high levels of purity are required, but sterilization is not necessary. The growing pharmaceutical and laboratory sectors are driving the demand for this segment.

Pharmaceuticals: The pharmaceuticals segment remains the dominant application for WFI, driven by the high demand for injectable drugs, vaccines, and biologics. Water for Injection is essential in the preparation, formulation, and dilution of parenteral drugs, ensuring their sterility and safety. The pharmaceutical industry’s continuous innovation and the rising number of new drug approvals are driving the need for WFI in drug development and manufacturing processes.

Biopharmaceuticals: The biopharmaceuticals segment has seen significant growth due to the increasing demand for biologic drugs, gene therapies, and monoclonal antibodies. WFI plays a critical role in the production of these complex biologics, which require ultra-pure water for formulation and manufacturing. The increasing adoption of biologic therapies is expected to continue to boost demand in this segment as the need for sterilization and high-purity water increases.

Laboratory and Research Applications: In laboratory and research applications, WFI is used in various experiments, testing, and formulation processes, where high-quality, purified water is required. Its usage is essential in ensuring the consistency of experimental results, especially in pharmaceutical research and clinical trials. The growth in research and development (R&D) activities, particularly in the pharmaceutical and biotechnology sectors, is driving the demand for WFI in this application.

Cosmetics and Personal Care: WFI is also used in the cosmetics and personal care industry, particularly in the production of skincare products, shampoos, and other formulations where water purity is critical. This application segment is expected to see moderate growth as consumer demand for high-quality, pure products increases. As the trend for natural and safe cosmetics rises, the need for WFI in product formulation continues to expand.

Medical Devices: Water for injection is used in the production and sterilization of medical devices, particularly those that come into contact with the human body, such as surgical instruments, IV sets, and implants. WFI ensures that these devices are free from microorganisms, thus preventing infections. With the growing demand for advanced medical devices, the need for WFI in sterilization processes is expected to rise.

Pharmaceutical Companies: Pharmaceutical companies are the largest end-users of WFI, as it is an essential ingredient in the formulation of injectable drugs, biologics, and vaccines. The demand for WFI in pharmaceutical companies is driven by the constant need for high-quality, sterile water in drug manufacturing and packaging. This segment holds a major share of the market, as WFI is a critical component in the production of parenteral medications and other pharmaceutical products.

Hospitals and Clinics: Hospitals and clinics are another key end-user of WFI, especially for preparing injectable drugs, intravenous fluids, and other medical solutions used for patient care. WFI is also used for reconstituting powdered drugs or diluting concentrated medications before they are administered to patients. The increasing number of healthcare facilities and growing patient populations worldwide are contributing to the rising demand for WFI in hospitals and clinics.

Others: The "Others" category includes various niche industries that require WFI for specific applications, such as veterinary medicine, laboratory testing, and certain industrial applications where high-purity water is needed. This segment is smaller compared to pharmaceuticals and healthcare, but it is expected to grow steadily as new applications for WFI emerge. The increasing recognition of the importance of water purity in a range of industries will contribute to the growth of this segment.

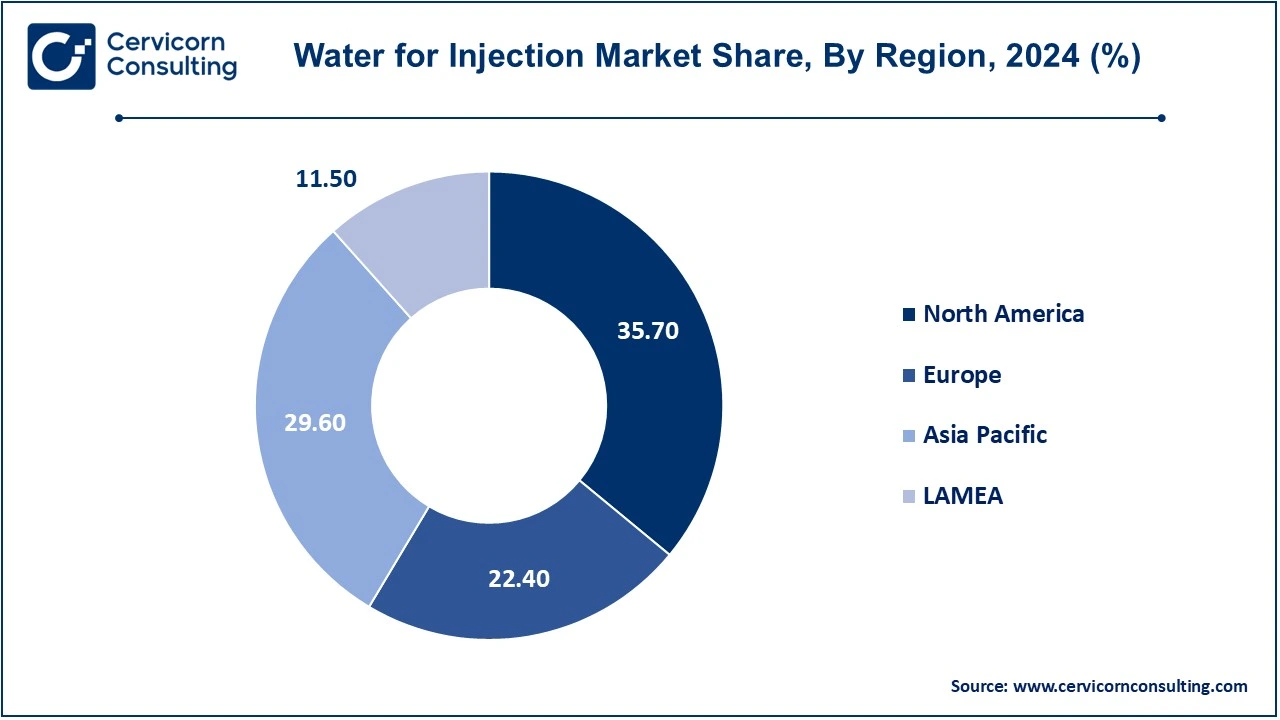

The water for injection market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

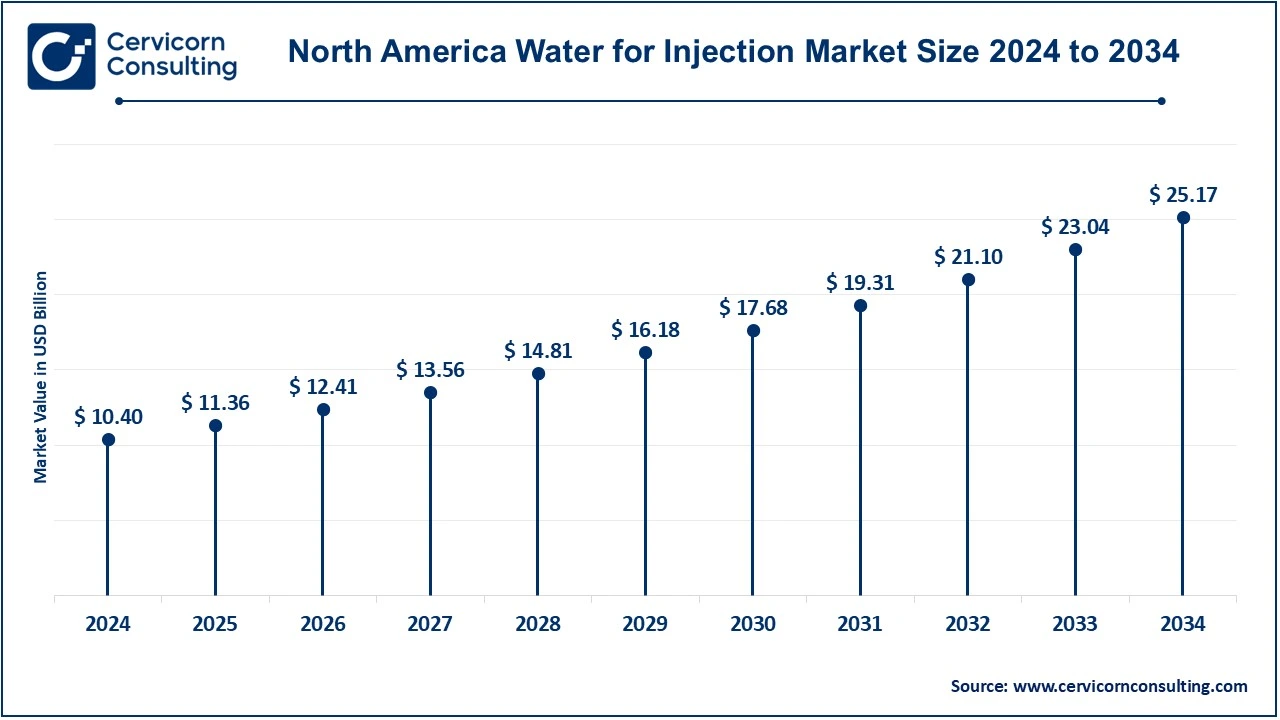

The North America water for injection market size was valued at USD 10.40 billion in 2024 and is expected to reach around USD 24.17 billion by 2034. North America leads the WFI market, accounting for highest market share in 2024. This dominance is driven by the U.S., which has a strong pharmaceutical and biopharmaceutical industry. The growing demand for injectable drugs and biologics, coupled with stringent regulatory standards that ensure the use of high-quality WFI, contributes to the region’s market leadership. The rise in chronic diseases, along with a robust healthcare infrastructure and a high number of new drug approvals, is expected to maintain the steady growth of the WFI market in North America. The increasing focus on biotechnology and vaccine production further bolsters the demand for sterile and purified water in this region.

The Asia-Pacific water for injection market size was estimated at USD 8.63 billion in 2024 and is expected to be worth around USD 20.87 billion by 2034. The Asia-Pacific (APAC) region is poised for the fastest growth, with an impressive CAGR of 10.47% from 2025 to 2034. The expanding pharmaceutical, biopharmaceutical, and healthcare sectors in countries like China, India, and Japan are key growth drivers. With a rising focus on R&D activities, clinical trials, and increasing healthcare spending, the demand for WFI is expected to surge. The region’s growing pharmaceutical manufacturing base and regulatory improvements further enhance the need for ultra-pure water in injectable drug production. APAC’s rapid industrialization, healthcare advancements, and pharmaceutical innovations make it a key growth driver for the global WFI market.

The Europe water for injection market size was accounted for USD 6.53 billion in 2024 and is projected to hit around USD 15.79 billion by 2034. Europe represents a significant portion, with well-established pharmaceutical giants, strong healthcare infrastructure, and rigorous regulations governing drug manufacturing, Europe continues to be a major contributor to the WFI market. The demand for WFI in injectable drug production is fueled by the growing prevalence of chronic diseases and an aging population, particularly in Western Europe. Furthermore, the continuous development of biologics and vaccines has led to an increasing need for sterile and purified water. Europe’s stable and mature market for Water for Injection is expected to remain a stronghold in the coming years, bolstered by consistent innovation and regulatory compliance.

The LAMEA water for injection market size was valued at USD 3.35 billion in 2024 and is anticipated to reach around USD 8.11 billion by 2034. The LAMEA (Latin America and Middle East & Africa) region represents a combined emerging market with steady growth potential for market. While its market share is smaller compared to other regions, countries like Brazil, Mexico, Saudi Arabia, and the UAE are experiencing growth driven by increasing investments in healthcare infrastructure and pharmaceutical production. The rising demand for injectable drugs, an aging population, and the growing prevalence of chronic diseases contribute to the WFI market’s expansion in this region. LAMEA’s demand for Water for Injection is expected to increase at a moderate pace as more healthcare facilities and pharmaceutical manufacturing plants are established. Governments' focus on improving healthcare access and regulatory standards further supports the region’s market potential.

The water for injection (WFI) industry is highly competitive, featuring a range of global companies that lead the way in the production and supply of highly purified water used in pharmaceuticals, biopharmaceuticals, and medical applications. Key players like Merck Group, Fresenius Kabi, B. Braun, and Baxter International are at the forefront, providing high-quality WFI for injectable drug formulations, vaccine production, and other critical healthcare applications. These companies leverage advanced technologies and comply with stringent regulatory standards to ensure the purity and sterility of their products. Additionally, large pharmaceutical corporations such as Pfizer, GSK, and Eli Lilly integrate WFI into their manufacturing processes, expanding its application in biologics and drug delivery systems. With continuous innovation, strategic partnerships, and expanding production capabilities, these market leaders are well-positioned to drive growth in the WFI market, addressing the increasing demand for sterile, safe, and efficient water solutions in healthcare and biopharmaceutical industries.

Market Segmentation

By Type

By Application

By End Use

By Region