Hydrogen Electrolyzer Market Size and Growth 2025 to 2034

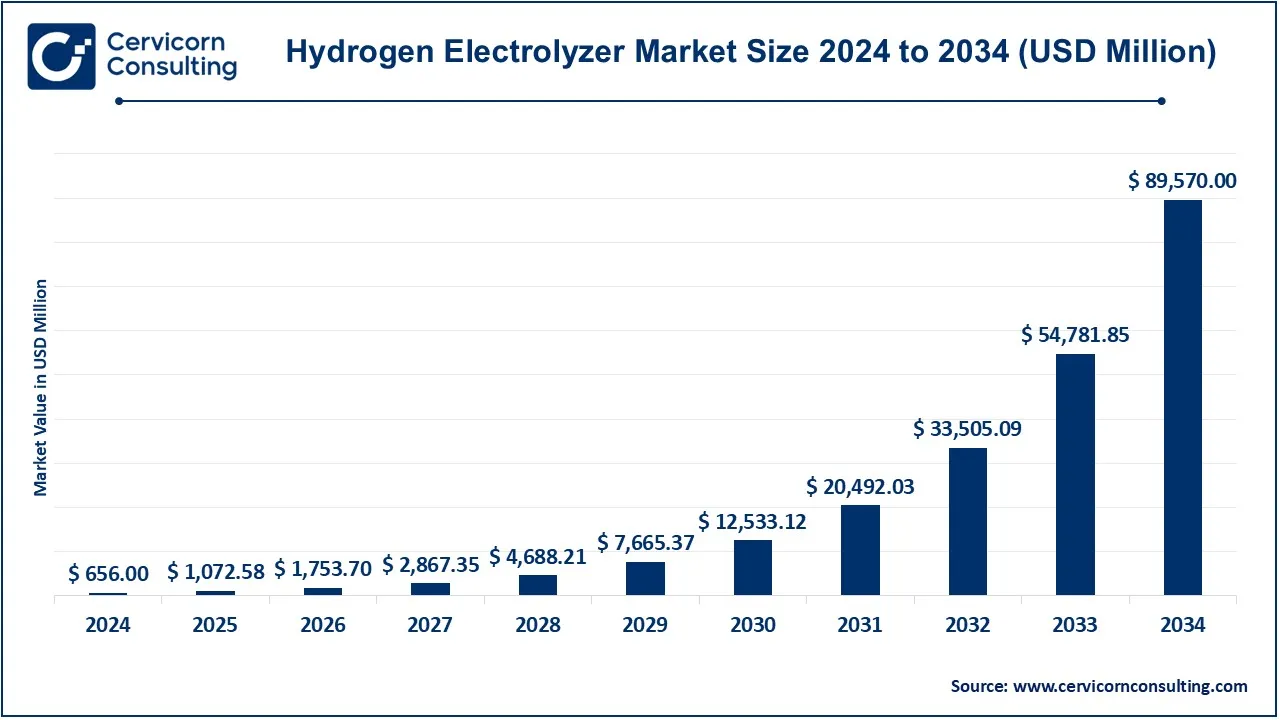

The global hydrogen electrolyzer market size was valued at USD 656 million in 2024 and is expected to be worth around USD 89,570 million by 2034, growing at a compound annual growth rate (CAGR) of 92.11% over the forecast period 2025 to 2034.

The hydrogen electrolyzer market is experiencing rapid growth due to increasing investments in green hydrogen and government initiatives supporting clean energy. Countries worldwide are setting net-zero emissions targets, pushing industries to shift from fossil fuels to hydrogen-based solutions. The demand for zero-emission fuels in industries such as transportation, steel, and chemical manufacturing is driving adoption. Additionally, advancements in electrolyzer efficiency and declining costs of renewable energy are making hydrogen production more viable. The market is also benefiting from increased adoption of hydrogen-powered fuel cells, particularly in the automotive and energy storage sectors. Countries like Germany, Japan, South Korea, and the U.S. are heavily investing in hydrogen infrastructure. Strategic collaborations between companies and government incentives are further accelerating growth.

Electrolyzers work through the process of electrolysis; that is, they split water into hydrogen and oxygen with the aid of electric current. This clean technology is the core for making green hydrogen when the input is from renewable energy sources, most often from solar or wind. The hydrogen thus made can then be put to use as an energy storage, as a source in fuel cells or in industrial processes. A variety of electrolyzers exist and include alkaline, polymer electrolyte membrane (PEM), and solid oxide, with distinctions in efficiency and operational condition. With the ever-increasing appeal for sustainable energy sources, hydrogen electrolyzer is receiving wider recognition as the 'go-to technology' of choice in carbon emission cuts across various sectors.

A hydrogen electrolyzer is a device that splits water into hydrogen and oxygen using electricity through a process called electrolysis. It consists of an anode, a cathode, and an electrolyte that facilitates the movement of ions. When electricity is applied, hydrogen gas is produced at the cathode, and oxygen gas is released at the anode. The hydrogen generated can be stored and used as a clean energy source for various applications, including power generation, industrial processes, and transportation.

There are four main types of hydrogen electrolyzers:

- Alkaline Electrolyzer (AEL): Uses a liquid electrolyte (potassium hydroxide) and is the most widely used type.

- Proton Exchange Membrane (PEM) Electrolyzer: Uses a solid polymer membrane, offering high efficiency and quick response times.

- Solid Oxide Electrolyzer (SOE): Operates at high temperatures, making it ideal for industrial applications.

- Anion Exchange Membrane (AEM) Electrolyzer: A newer technology that combines the benefits of AEL and PEM by using a solid electrolyte with alkaline chemistry, promising lower costs and improved efficiency.

Hydrogen Electrolyzer Market Report Highlights

- The U.S. hydrogen electrolyzer market size was valued at USD 87.71 million in 2024.

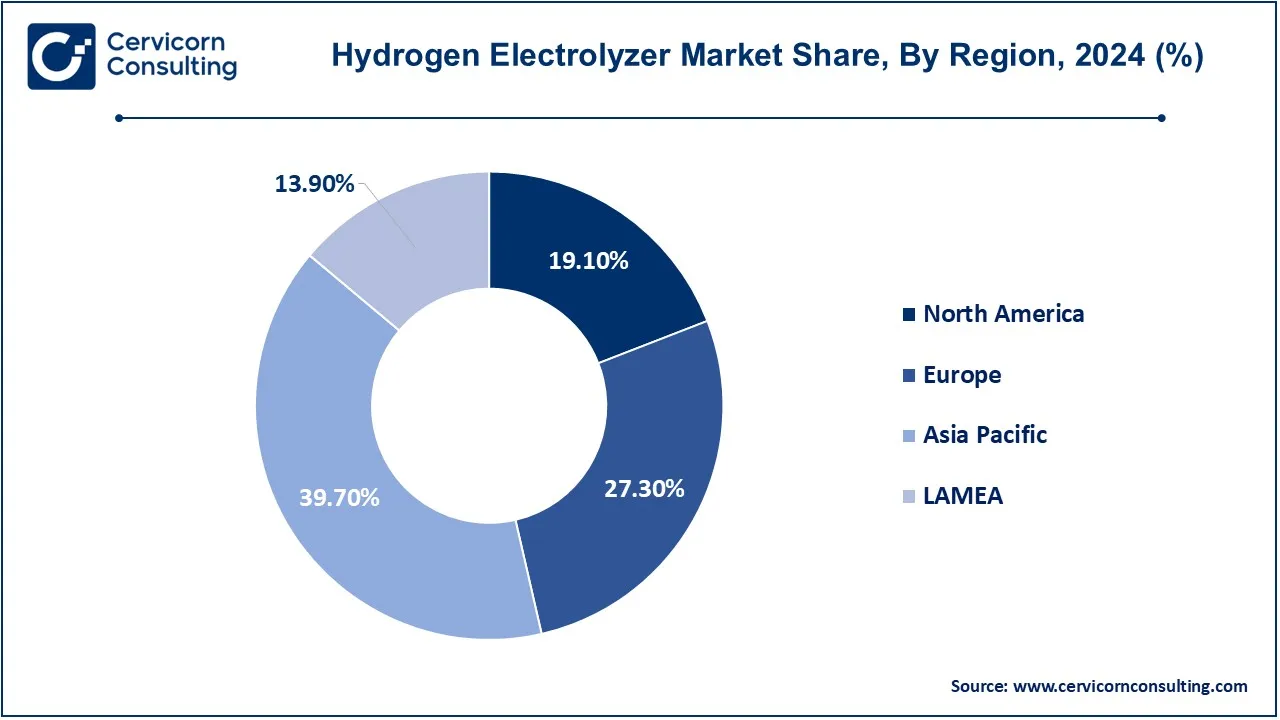

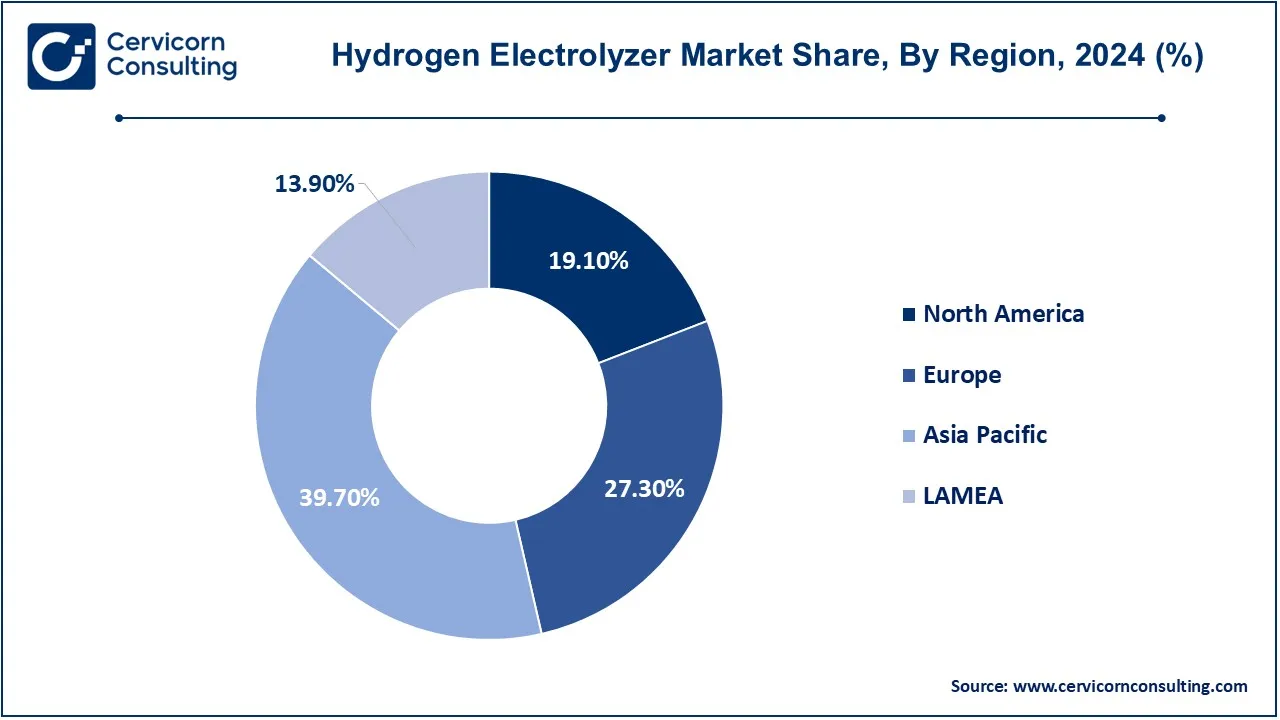

- Asia-Pacific region has accounted highest revenue share of 39.70% in 2024.

- Europe has accounted revenue share of 27.30% in 2024.

- By product, the PEM electolyzer segment has accounted revenue share of 48% in 2024.

- By capacity, the low (<500 kW) segment has recorded revenue share of 41% in 2024.

Hydrogen Electrolyzer Market Growth Factors

- Approaching Policy Enforcement for Decarbonization: Green hydrogen, produced through electrolyzers, is thus emerging as a vital path to the solution as governments and industries converge in realizing a zero-carbon economy. This hydrogen generation through electrolyzers with renewable energy also is allowing decarbonizing of sectors like transportation, industry, and generation.

- Rapid Deployment of Renewables: Turbine-generated electricity is good for electrolyzers. With the increased global renewable power capacity, particularly in Europe and North America, hydrogen electrolyzer operators have abundant cheap dispatchable renewable power to rely on for green hydrogen production.

- Hydrogen Demand from Industry: Industries such as steel, cement, and chemicals are increasingly relying on hydrogen for decarbonization. With electrolyzers, the industries can generate hydrogen on-site to provide a low-carbon alternative for less-efficient sectors.

- Electrolyzer Efficiency Will Change: Technical upgrades in various designs, among them PEM and alkaline electrolyzers, seek to lower operational costs while maximizing efficiency, thus making it popular for mass-scale hydrogen production.

- Surge in Demand for Fuel Cell Electric Vehicles: Transport has become one of the core sectors driving the rapid growth of market. Entry of most commercially viable fuel cell electric vehicles in regions such as Tokyo and California has caused a spike in demand for electrolyzer-produced hydrogen.

- Amplification of Hydrogen Refuelling Stations: This is further set in place by the growth in hydrogen fueling infrastructure that allows a wide base for the rollout of hydrogen vehicles. Hydrogen production in these refueling stations, much more in Germany and Japan, is done through electrolyzers, growing the collective market even further.

Hydrogen Electrolyzer Market Trends

- Transitions from Fossil-Fuel-Based Hydrogen to Green Hydrogen-a driven move away from fossil-fuel-based hydrogen towards one that recognizes green hydrogen as produced by renewable energy and electrolyzers-favors an acceleration of national commitments to decarbonization and sustainability.

- Hybrid Energy Systems: Hydrogen electrolyzers find application in hybrid energy systems-these include the integration of solar, wind, and hydrogen production for energy storage and grid stabilizing.The advantage of hybrid systems lies in their optimized use of renewable energy.

- Emerging Gigawatt-Scale Hydrogen Projects: Gigawatt-scale hydrogen projects, especially large electrolyzer plants, are already on uh course as part of national hydrogen strategies across regions such as Europe, Australia, and the Middle East. These projects are set up for an expanding demand crucially driven by industrial and transportation needs.

- Dauntless Private Sector Investment on the Rise: Venture capital firms and private corporations increasingly invest in promising technologies and startups that shape electrolyzers. Jobs and commercialization of innovations will accelerate the fleet and ensure that the next EU, US, and Clean Hydrogen value networks increasingly use electrolyzers with much more efficiency.

- Most recent is the focus on new hydrogen storage innovations: liquid hydrogen and metal hydride storage technologies to even out the logistics of safe hydrogen storage by the mere facilitation of effective transport and storage. Further, these also seek to foretell solutions to very restrictively low energy density problems concerning hydrogen.

Report Scope

| Area of Focus |

Details |

| Market Size in 2024 |

USD 656 Million |

| Expected Market Size in 2034 |

USD 89,570 Million |

| CAGR (2025 to 2034) |

91.11% |

| Dominant Region |

Asia-Pacific |

| Expanding Region |

North America |

| Key Segments |

Product, Capacity, Output Pressure, Application, Region |

| Key Companies |

Air Liquide, Ballard Power Systems, Beijing CEI Technology Co., Ltd., Enapter, Gaztransport &,Technigaz, Giner Inc., GreenHydrogen Systems, iGas Energy GmbH, ITM Power Plc, McPhy Energy, Nel Hydrogen, Next Hydrogen, Plug Power Inc., Siemens AG, Tianjin Mainland Hydrogen Equipment Co. Ltd |

Hydrogen Electrolyzer Market Dynamics

Drivers

- Green Hydrogen Production Growing by Leaps and Bounds: Rising in global clean energy demand fuels rapid growth in green hydrogen production with hydrogen electrolyzers as the vaulting benchmark technology converting renewable electricity to hydrogen at the heart of the green energy supply chain, further driving the process forward in uptake.

- Hydrogen Electrolyzers for Power Grid Stability: Hydrogen electrolyzers stabilize power grids with power generated through surplus or excess electricity from renewable projects. Surplus electrolyzers offer storage solutions and balance supply-demand challenges across renewable energy generation.

- Declining Cost of Renewable Energy: Getting cheaper renewable energy systems, including wind and solar power, is a significant driving cause underlying the growth of the hydrogen electrolyzer industry. As renewables are becoming cheaper and more accessible, providing very inexpensive electricity to electrolyzers is helping to make green hydrogen production economically feasible and competitive to hydrogen made from conventional fossil fuels.

- Expanding Demand for Green Hydrogen: The growing demand for green hydrogen worldwide as driven by decarbonization efforts in segments like transportation, industry, and energy is one of the key factors propelling the hydrogen electrolyzer market growth.bThe green hydrogen produced with renewable energy is expected to play a vital role in the transition toward net-zero emissions, boosting investments in the hydrogen electrolyzer sector as well as their installations.

- Fusion of Smart Technologies: The integration of some smart technologies like AI, IoT, and advanced analytics helps improve the efficiency and working of hydrogen electrolyzers. These technologies optimize energy use and performance monitoring by providing real-time system performance data, while they will also help to cut back on operating costs, thereby hastening the adoption of electrolyzers in various industries and driving market growth.

- Adoption of National Hydrogen Strategies: The countries of Japan, South Korea and the EU aim to formulate specific hydrogen roadmaps in order to pursue methane reduction targets and foster demand for electrolysis across numerous sectors.

Restraints

- High Initial Capital Cost of Electrolyzers: With advances in the technology, the cost of establishing electrolyzer plants is generally still perceived to be very high and could be a limiting factor for widespread adoption, especially by smaller companies or emerging economies lacking in the financial capacity to scale up hydrogen production.

- Lack of Hydrogen Infrastructure: Lack of existing hydrogen infrastructures, such as pipelines, storage facilities, and refueling stations remains a significant challenge in growing the hydrogen electrolyzer market, particularly in all those regions that have not yet committed any resources towards the hydrogen infrastructures.

- Hydrogen Transport: Transporting hydrogen over long distances presents technical and economic challenges primarily because of hydrogen’s low energy density and high compression requirement. This limits the geographical area over which hydrogen electrolyzers could be effective, as distribution is often prohibitively expensive.

- Technology Limitations of Large-Scale Projects: Scaling up hydrogen production to satisfy industrial and national energy requirements is challenging. Current generation technologies of the electrolyzer, particularly of the solid oxide and PEM types, almost invariably encounter hurdles when required to meet the levels of efficiency and scalability requisite for a very high-scale hydrogen production system.

Challenges

- High Operational Costs: the usage of electrolyzers involves much electricity consumption which translates to high operating costs especially in the areas where clean energy is not accessible or cheap. Consequently, the process of hydrogen generation is expensive relative to other processes that utilize energy sources.

- Unavailability of Cheap Renewable Energy: Hydrogen electrolyzers must be continuously fed with renewable energy at a low cost so as to be economical. In areas where green energy is not well developed, the cost associated with green hydrogen production is high hence leading to a slow growth rate of the market.

- Threat from Competing Modes: The green hydrogen made by electrolyzers has to compete even with the blue and gray hydrogens which are made of fossilized natural gas of any degree. The cost of production of blue and gray hydrogen is lower making it difficult for the market penetration of expensive green hydrogen.

- Deficiency of Trained Personnel: Skilled labor, particularly those that can operate, maintain, and develop the hydrogen electrolyzer systems, is in short supply in the hydrogen electrolyzermarket. This demand-supply imbalance is therefore a constraint in production expansion that is exacerbated by the rising hydrogen electrolyzer markets around the world.

Hydrogen Electrolyzer Market Segmental Analysis

The hydrogen electolyzer market is segmented into product, capacity, output pressure and application. Based on product, the market is segmented into PEM electrolyzer, alkaline water electrolyzer, solid oxide electrolyzer and anion exchange membrane. Based on capacity, the market is segmented into low (<500 kW), medium (500 kW to 2 MW) and high (Above 2 MW). Based on output pressure, the market is segmented into low (Upto 10 Bar), medium (10 Bar – 40 Bar) and high (More than 40 Bar). Based on application, the market is segmented into ammonia, methanol, refinery industry, electronics, energy, power to gas and other.

Product Analysis

Proton Electrolyte Membrane (PEM) Electrolyzer: In PEM electrolyzers, the electrochemical decomposition of water takes place with a solid polymer electrolyte. However, despite its small size, it possesses an impressive efficiency and good sustained levels of performance under rapid variations, which is highly advantageous for applications with varying charge such as solar and wind energies. PEM electrolyzer has a quick response time to load changes and is designed to be easily expandable which makes it perfect for the production of hydrogen in remote locations where individuals are dispersed.

Hydrogen Electrolyzer Market Revenue Share, By Product, 2024 (%)

| Product |

Revenue Share, 2024 (%) |

| Alkaline Electrolyzer (AE) |

36% |

| Proton Exchange Membrane (PEM) |

48% |

| Solid Oxide Electrolyzer (SOE) |

11% |

| Anion Exchange Membrane (AEM) |

5% |

Alkaline Water Electrolyzer: The technology used in alkaline electrolyzers is the most developed, mature, and, commercially, the most available. Alkaline electrolyzer technology employs liquid alkaline potassium hydroxide for facilitating the hydrogen production. Capable of withstanding harsh operating conditions and available at low costs, they are extensively used in hydrogen production plants, particularly those requiring continuous hydrogen output, owing to the size of their capacity.

Solid Oxide Electrolysers: Solid oxide electrolysers are high temperature hydrogen electrolyzers which comprises of a ceramic electrolyte. The performance in solid oxide electrolysis mostly stems from the use of waste heat from other industrial processes, but suffers from durability and material failure problems. It is mainly an academic tool or used in industries where a lot of waste heat is produced.

By Application

Ammonia: Hydrogen is a primary feedstock in the manufacture of ammonia, an important agricultural fertilizer. Most of the green hydrogen produced from electrolyzers is now being employed to bring about transformations in industries, specifically in the case of ammonia production which aids in meeting the prevailing environmental regulations and cutting down CO2 emissions from the conventional way of producing ammonia.

Methanol: In the designers of methanol, which is used in chemicals, fuels, and plastics, electrolyzers are important. Green hydrogen is a growing alternative to natural methane in the production of methanol for the industry, thereby improving environmental performance of methanol production.

Refinery Industry: Natural gas is required for several processes in oil refineries such as hydrocracking and desulfurizing. Electrolyzers are one means of providing green hydrogen for refineries to help them meet the growing issues posed by their reliance on natural gas based hydrogen.

Electronics: Hydrogen is incorporated in the production of certain gadgets such as semiconductors and screens within the electronics sector. And more importantly, the use of electrolyzers will assist in producing the ultrapure hydrogen required in such processes without relying on the dirty sources of hydrogen which are more available as the electronics market keeps widening.

Energy: The utilization of hydrogen is in deeper higher role as it is being integrated inside fuel cells and energy storage devices as storage media. It is also vital in to avoid system overloads for energy networks that include a high proportion of variable renewable energy sources.

Power to gas: The power-to-gas principle incorporates the use of electrolysers in excess power converted into hydrogen gas, which is either stored or injected into the gas grid. It helps to balance out intermittent renewable power, improves energy security n and thanks to hydrogen inside the natural gas mixture, it lowers greenhouse gas emissions as well.

Other: Other sectors in which hydrogen electrolysers are used include food processing, metallurgic production, glass making, and pharmaceuticals where hydrogen is required for some manufacturing processes. The electrolyser produced green hydrogen can replace their home used hydrogen for these industries without being a burden to the environment.

Hydrogen Electrolyzer Market Regional Analysis

The global market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific region has dominated the market in 2024.

What makes Asia-Pacific the dominant region in the hydrogen electrolyzer market?

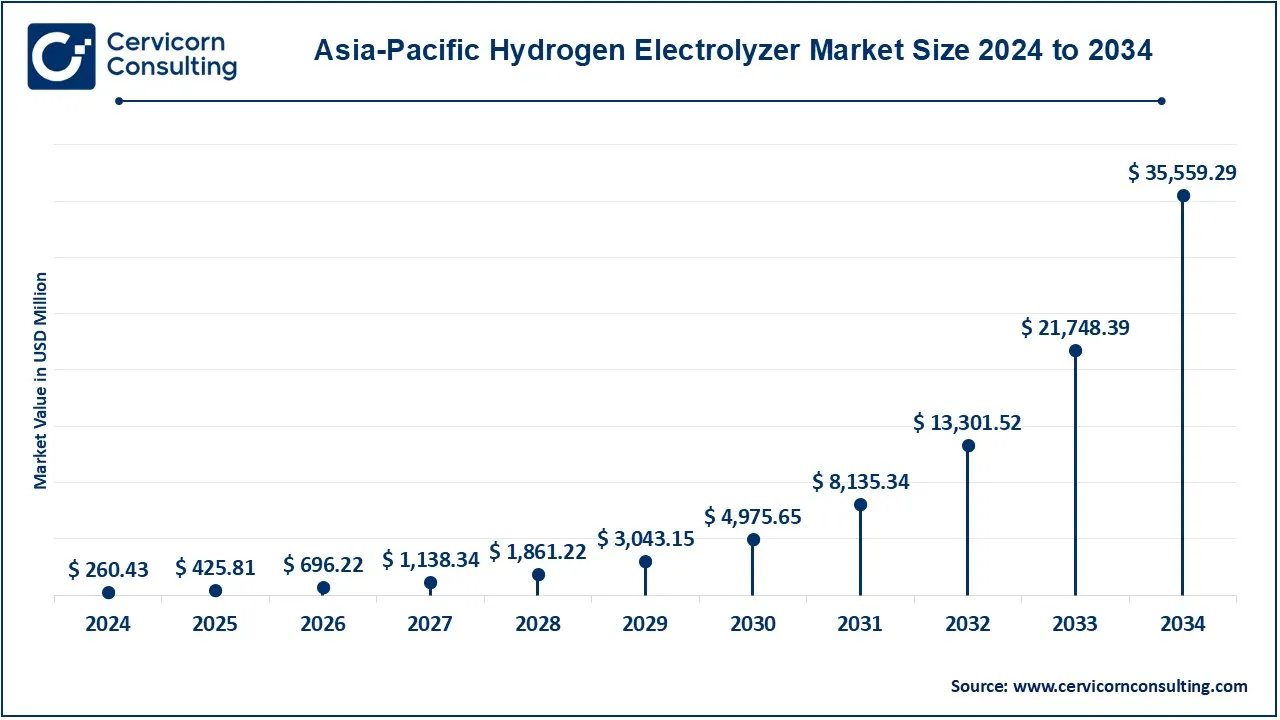

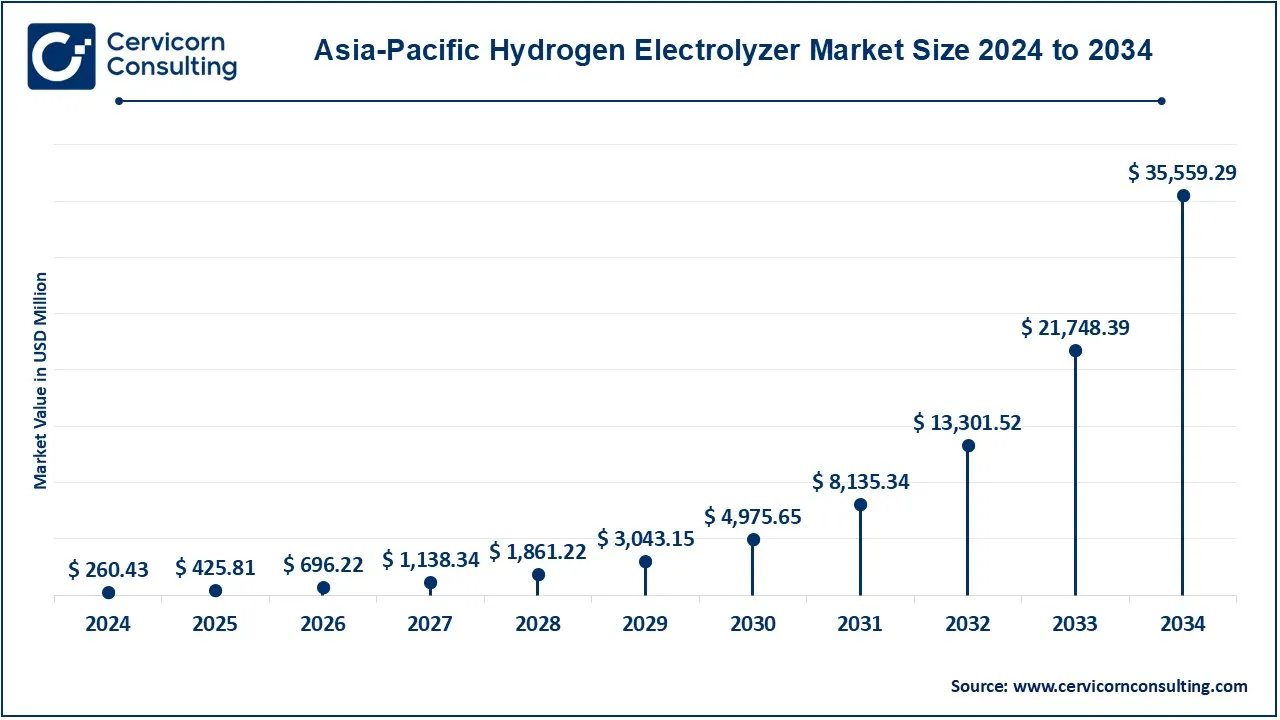

The Asia-Pacific hydrogen electrolyzer market size was valued at USD 260.43 million in 2024 and is expected to be worth around USD 35,559.29 million by 2034. Asia-Pacific is a rapidly growing market, driven by China, Japan, South Korea, and Australia. Japan and South Korea are leaders in hydrogen-powered transportation and fuel cell technologies. China is scaling up hydrogen electrolyzer production for use in the steel and chemical industries. Australia is emerging as a major player with several hydrogen export projects. Regional governments are investing in hydrogen to meet decarbonization goals and reduce dependency on coal and natural gas.

Why is North America hit notable growth in hydrogen electrolyzer market?

The North America hydrogen electrolyzer market size was valued at USD 125.30 million in 2024 and is expected to reach around USD 17,107.87 million by 2034. The North America is primarily supported by green hydrogen production technologies being developed in the U.S. and Canada. The U.S. government invests heavily in hydrogen technologies under the Infrastructure Investment ad Jobs Act. Canada’s Hydrogen Strategy has an ambitious target of 20 – 90% hydrogen supply across the country. Key applications for these energies are also storage and transport in these countries due to high renewable energy targets and decarbonization in other sectors. These plans are speeding up the hydrogen electrolyzer market growth in the region.

Why is Europe forecasted to witness considerable expansion in hydrogen electrolyzer market?

The Europe hydrogen electrolyzer market size was estimated at USD 179.09 million in 2024 and is expected to be worth around USD 24,452.61 million by 2034. Europe is first in the hydrogen electrolyzers market with countries like Germany, France, and the Netherlands taking the lead in green hydrogen projects. Germany’s National Hydrogen Strategy and the French hydrogen plan both work on the development of electrolyzer technology in order to achieve industrial decarbonization. Continuing with this, the Green Deal issued by the European Union empowers additional gender usage of hydrogen in the region. More specific, Germany is highly focused on developing hydrogen production for domestic energy and transport markets as well as for heavy industries to cut down on fossil fuel consumption.

LAMEA is seeing a growing interest in hydrogen electrolyzers

The LAMEA hydrogen electrolyzer market size was valued at USD 91.18 million in 2024 and is expected to be worth around USD 12,450.23 million by 2034. LAMEA is experiencing an increasing interest in hydrogen electrolyzers ranging from Brazil, Chile, Saudi Arabia, and South Africa. In this regard, Chile and Brazil are more concentrated on green hydrogen projects, as they have renewable energies that can be exploited. The Middle East has also brought into focus hydrogen with Saudi Arabia’s NEOM planning to build the world’s largest green hydrogen plant and in South Africa, hydrogen is being looked at as an energy diversification mechanism. The region has an abundance of natural resources that present immense opportunities for the production and export of hydrogen at a commercial scale.

Hydrogen Electrolyzer Market Top Companies

CEO Statements

Paul Barrett, CEO of Hysata

- "Our breakthrough technology has achieved 95% efficiency in green hydrogen production, significantly lowering energy consumption, thus allowing industries like steel and chemicals to decarbonize faster. This simplified approach will be critical to scaling up green hydrogen globally."

Stefan Höller, CEO of Hoeller Electrolyzer GmbH

- "The compact design of our Prometheus product line allows for easy integration into existing and new hydrogen production systems, including wind turbines. We believe hydrogen will be pivotal in the future energy infrastructure, particularly for renewable energy storage."

Mats Blacker, CEO of Hymeth

- "Our new Hyaeon™ electrolyzer offers up to 90% efficiency, aiming to replace conventional PEM systems with a more cost-effective alkaline alternative. We are targeting applications like steel production and fuel cell vehicles, providing industries with affordable green hydrogen solutions."

Recent Developments

- In January 2023, NewHydrogen, a company based in the U.S., unveiled its prototype for a green hydrogen generator. The prototype serves as a foundation for integrating further advancements in electrolyzer components in the future.

- In June 2022, Rolls-Royce announced its intention to produce MTU hydrogen electrolyzers, marking its entry into the hydrogen electrolyzer industry by acquiring a 54% majority stake in Hoeller Electrolyzer, a specialist in electrolysis stack technology.

Market Segmentation

By Product

- Proton Electrolyte Membrane (PEM) Electrolyzer

- Alkaline Water Electrolyzer

- Solid Oxide Electrolyzer

- Anion Exchange Membrane

By Capacity

- Low (<500 kW)

- Medium (500 kW to 2 MW)

- High (Above 2 MW)

By Output Pressure

- Low (Upto 10 Bar)

- Medium (10 Bar – 40 Bar)

- High (More than 40 Bar)

By Application

- Ammonia

- Methanol

- Refinery Industry

- Electronics

- Energy

- Power to Gas

- Other

By Regions

- North America

- APAC

- Europe

- LAMEA

...

...