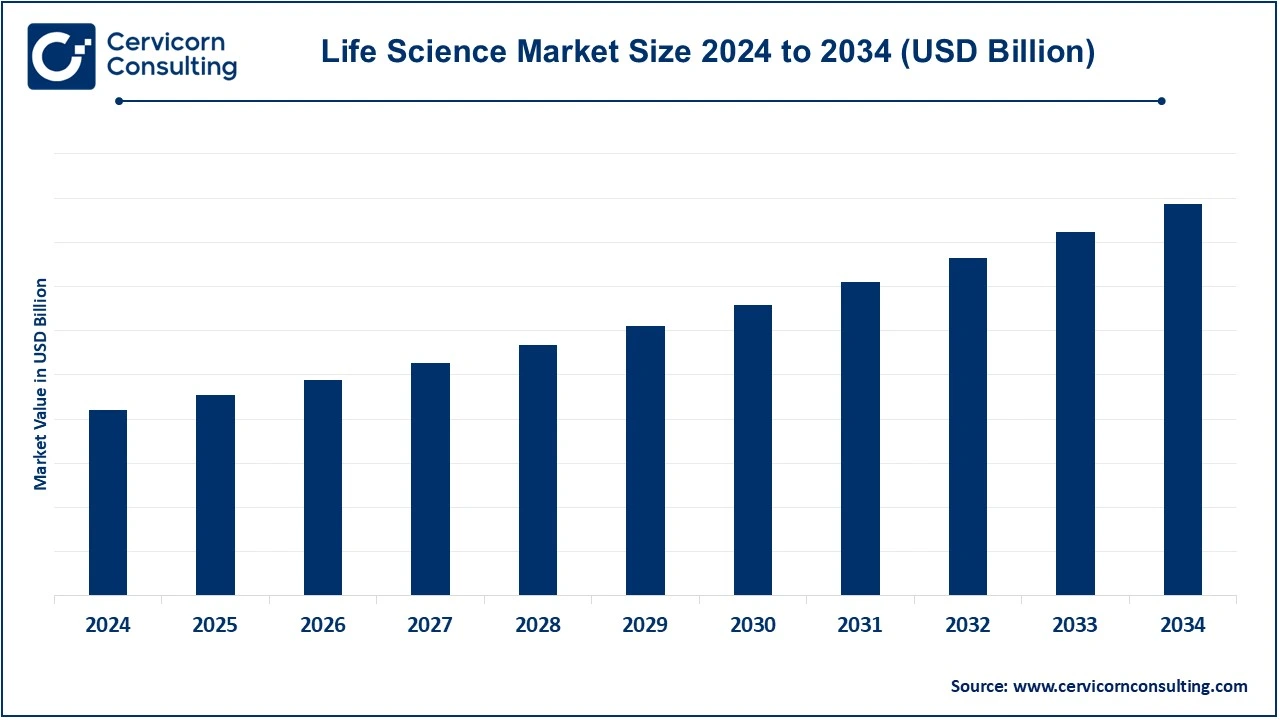

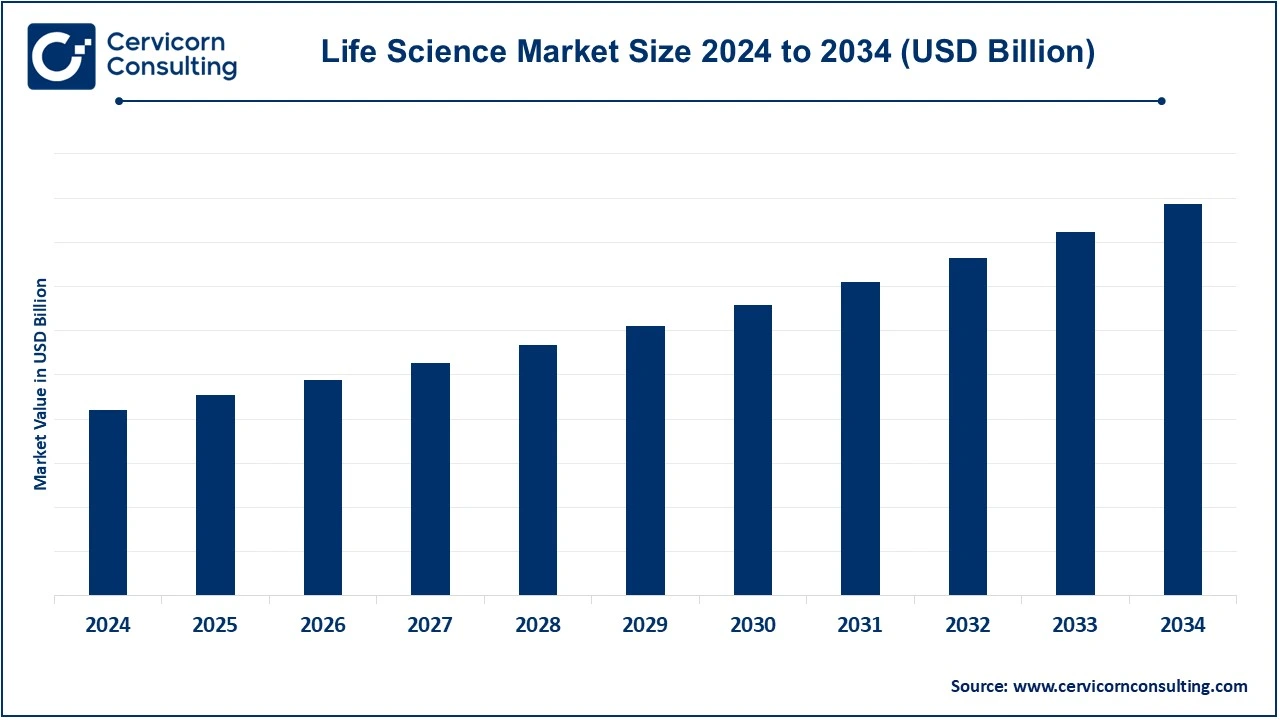

Life Science Market Size and Growth 2025 to 2034

The global life science market is expected to witness growth at a compound annual growth rate (CAGR) of 10.28% over the forecast period 2025 to 2034. Life science encompasses the scientific study of living organisms, including humans, animals, plants, and microorganisms. It involves disciplines such as biology, biotechnology, genetics, molecular biology, and pharmaceuticals, which focus on understanding the mechanisms of life and developing solutions to improve health and sustainability. Life sciences drive innovations in areas like drug discovery, gene therapy, precision medicine, agricultural biotechnology, and diagnostics. These advancements not only improve healthcare but also address global challenges such as food security and environmental sustainability.

The life sciences industry plays a pivotal role in shaping the future of healthcare and technology. With the rapid adoption of technologies like artificial intelligence (AI), CRISPR gene editing, and next-generation sequencing (NGS), the sector is advancing at an unprecedented pace. Post-pandemic, the focus on personalized medicine, early diagnostics, and preventive healthcare has surged, boosting the demand for life sciences applications globally.

The life sciences market is driven by several key factors, including advancements in biotechnology, the growing prevalence of chronic and infectious diseases, and the increasing demand for personalized medicine and biologics. The rise of innovative technologies, such as gene editing tools like CRISPR, next-generation sequencing, and artificial intelligence in drug discovery, is accelerating breakthroughs in research and development. Furthermore, increased government funding, private investments, and partnerships between academia and industry are fostering innovation, while the global aging population and the need for advanced healthcare solutions continue to propel growth in the sector.

Key insights beneficial for the life science market:

- Biotech Investments: Global biotech funding increased by 20% in the past five years.

- AI in Healthcare: AI-driven drug discovery reduced research costs by 30%.

- Personalized Medicine: Demand for precision medicine is expected to grow by 15% annually.

- Gene Therapy Market: Projected to expand at a CAGR of 25% in the coming years.

- Regenerative Medicine: Stem cell therapy saw a 40% rise in research funding.

Stats and Facts

Pipeline Innovation & Investments

- AION Labs in Israel is currently fostering AI-driven pharma drug discovery using deep learning and machine learning, backed by AstraZeneca, Merck, Teva and AWS.

- Wuxi International Life Sciences Innovation Park, based in China has targeted approximately $19 billion industrial output by 2025. This campus’ facilities are attracting 500+ biopharma and smart health enterprises.

- Roche committed $50 billion for over five years in order to expand manufacturing for gene therapy, obesity treatment and diagnostics. This plan aims to offer approximately 1,200 jobs.

- Novo Nordisk is investing approximately $2.5 billion to upgrade a production facility near Rome for weight-loss drugs by 2029.

Government Funding Programs & Initiatives

- United States: As of 2025, the United States has invested over $45 billion in National Nanotechnology Initiative. The state government also introduced National Biotechnology Initiative Act in the same yeat to streamline innovation and establish a national biotech strategy office.

- India: India launched Bio-RIDE initiative to boost R&D industrial biotech and bio-manufacturing. National Medical Device Policy by the government of India aims to step-up India to a global manufacturer of medical devices, with a targeted 12% market share in global industry.

- China: National strategy has already supported China’s biotech sector as it has conducted 7,100 clinical trials and license approval of around 37% of molecule by major pharmaceutical companies is expected in 2025.

- Australia: The Medical Research Future Fund aims to support cutting-edge biomedical research and tech commercialization which is seeded at AU $20 billion. Biotech and pharmaceutical firms in Australia benefit from Early-stage Innovation Company Scheme that offers tax incentives on R&D.

Key Innovations in Life Science Market: Case Study of Latest Trends

AI & Automation

The overall pharma sector has already invested millions of dollars in hyper-productivity in order to boost the innovation and optimize the development of sophisticated drugs. Currently, 65-85% of life science companies are deploying AI to support drug discovery and clinical research and development.

Number of biopharma companies across the globe are adopting digital twins to boost the production lines and to improve operator integration. On an average 85% of biopharma firms are seen implementing digital initiatives in 2025, whereas 78% of them have already leverage cloud computing solutions.

In 2025, a survey of 143 life sciences manufacturing executives was done by Rockwell Automation. The firm aimed to understand production efficiency, digital transformation of pharma sector and regulatory compliances. Following are the key findings from the survey report:

- 95% of life sciences firms are investing in smart manufacturing while considering automation systems, real-time monitoring and process control solutions as major services.

- Approximately 35% of surveyed executives stated that their organizations are implementing digital twin technology for more than one production lines and for process optimization.

- However, 26% of industry leaders say finding skilled workers is currently becoming a biggest barrier while adopting digital solutions.

Top Life Science Companies & Their Investments (2023-2025)

- Merck & Co. - Invested approximately $30.5 billion in R&D in 2023. The company has performed 330 late-stage clinical trials globally, involving 50+ countries.

- Johnson & Johnson - Achieved revenue of U.S. $ 88.8 billion in 2024 while invested $15 billion in research and development by making it one of the largest investments across the globe.

- Novartis - Invested approximately $11.37 billion in 2023 for R&D which is a Y-o-Y 24% growth.

- AstraZeneca - Increased its R&D spend in 2024 by 24% which represents a rough 25% share of its annual revenue.

- Pfizer - Considering the declining demand for COVID vaccine, the company aimed on its oncology pipeline with a $43 billion acquisition of Seagen.

Market Trends

The life science market is evolving rapidly, driven by a combination of technological innovations, shifting demographics, and increased demand for personalized healthcare solutions. Below are some key trends currently shaping the life science sector:

Technological Advancements and Digital Transformation

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are playing an increasingly pivotal role in life sciences, particularly in drug discovery, clinical trials, and genomics. AI tools are being used for drug repurposing, predicting protein structures, and analyzing vast datasets, which can significantly reduce research time and costs. AI is also enabling precision medicine, where treatments are tailored to individual genetic profiles.

- Big Data and Bioinformatics: The rise of big data in genomics, clinical research, and diagnostics has made bioinformatics a crucial aspect of life sciences. Tools that help manage, analyze, and interpret large datasets are accelerating the discovery of new therapeutic targets and biomarkers.

- Automation and Robotics: The use of automation and robotics in laboratories and manufacturing facilities is enhancing efficiency in drug development and production. Robotics are being used for high-throughput screening, sample preparation, and even robotic surgery, improving both accuracy and speed.

Personalized Medicine and Biotechnology

- Genomics and Gene Editing: With the rapid progress of genome sequencing technologies, life sciences are increasingly focused on personalized medicine. By sequencing individual genomes, scientists are identifying genetic variations that may influence disease risk and drug response. CRISPR and other gene-editing tools are enabling the precise modification of genes to treat genetic disorders and cancers.

- Cell and Gene Therapies: The development of therapies based on stem cells, gene editing, and gene therapies is gaining significant momentum. Cell-based therapies, such as CAR-T cell therapies in oncology, are already revolutionizing treatment options for various cancers, and gene therapies are being used to address rare genetic diseases.

- Biologics and Biosimilars: The biologics market is booming, driven by the increasing use of monoclonal antibodies, cell-based therapies, and other biologic drugs for complex diseases. As patents for blockbuster biologic drugs expire, the biosimilars market is also expanding rapidly, providing affordable alternatives to high-cost biologics.

Growth of Digital Health and Remote Monitoring

- Telemedicine and Telehealth: The COVID-19 pandemic has significantly accelerated the adoption of telemedicine and telehealth solutions, which are now widely used for consultations, monitoring chronic conditions, and managing patient care remotely. This trend is expected to continue as healthcare providers and patients embrace the convenience of virtual care.

- Wearable Devices: Devices like fitness trackers, smartwatches, and continuous glucose monitors are gaining popularity, allowing users to track their health metrics in real time. These devices are also becoming valuable tools for clinical trials, enabling the collection of patient data remotely.

- Digital Therapeutics: Digital therapeutics, software-driven interventions for the prevention, management, and treatment of diseases, are becoming an essential component of the healthcare landscape. These technologies are especially valuable for managing chronic conditions like diabetes, hypertension, and mental health disorders.

Expansion in Emerging Markets

- Asia-Pacific Growth: Emerging markets, particularly in Asia-Pacific, are expected to contribute significantly to the life science market growth. Countries like China and India are investing heavily in biotechnology, pharmaceuticals, and healthcare infrastructure. This expansion is driven by increasing healthcare access, rising healthcare expenditures, and a growing middle class that demands better healthcare solutions.

- Global Health Initiatives and Collaborations: Public-private partnerships, government initiatives, and global collaborations are helping to address healthcare challenges in developing regions, especially in Africa and Latin America. These efforts are focusing on improving disease prevention, diagnostics, and treatments for infectious diseases such as malaria, tuberculosis, and HIV.

Regulatory Developments and Investment Growth

- Increased Investment in Life Sciences: Venture capital investments in life sciences have surged, particularly in the biotech and pharma sectors. Investors are focusing on emerging technologies like gene therapies, AI, and next-generation sequencing, which are seen as having the potential to revolutionize healthcare. The global venture capital funding in life sciences reached over $47 billion in 2023, a sign of investor confidence in the market's potential.

- Regulatory Streamlining: Regulatory agencies, including the FDA and EMA, are streamlining approval processes for new drugs, biologics, and medical devices. This trend is helping accelerate innovation, particularly in areas such as rare diseases, personalized medicine, and immunotherapies.

Report Scope

| Area of Focus |

Details |

| Market CAGR 2025 to 2034 |

10.28% |

| Dominant Region |

North America |

| Fastest Growing Region |

Asia Pacific |

| Key Segments |

Type, Therapeutic Areas, Application, End User, Region |

| Key Companies |

Thermo Fisher Scientific Inc., Danaher Corporation, Roche Holding AG, Merck KGaA (MilliporeSigma), Pfizer Inc., Johnson & Johnson, Agilent Technologies Inc., Illumina, Inc., Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Inc., Abbott Laboratories, GE HealthCare |

Market Dynamics

Drivers

Technological Advancements

- AI and Machine Learning in Healthcare: Artificial intelligence (AI) and machine learning (ML) are revolutionizing the life sciences by accelerating drug discovery, clinical trials, and precision medicine. According to a Cervicorn Consulting study, 72% of healthcare executives believe AI will significantly improve healthcare services in the next 5 years. These technologies help in analyzing vast amounts of medical data to improve diagnosis, treatment plans, and patient outcomes.

Aging Global Population

- Increasing Elderly Population: As the global population ages, there is an increased demand for healthcare services and treatments for age-related diseases, such as Alzheimer's and cardiovascular disorders. According to the World Health Organization (WHO), the number of people aged 60 years or older is expected to reach 2.1 billion by 2050, doubling from 1 billion in 2020. This demographic shift is fueling demand for healthcare solutions, including pharmaceuticals, diagnostics, and therapies targeted at age-related conditions.

Growth in Chronic Diseases

- Rising Prevalence of Chronic Diseases: The growing prevalence of chronic diseases, including diabetes, cardiovascular diseases, and cancer, is driving the demand for life science innovations. The Centers for Disease Control and Prevention (CDC) reports that nearly 6 in 10 Americans live with at least one chronic disease, and 4 in 10 have two or more chronic diseases. This increasing burden on healthcare systems is accelerating the development of new treatments and technologies in life sciences.

Expansion of Personalized Medicine

- Gene Editing and Genomics: The shift toward personalized medicine, driven by advances in genomics and gene-editing technologies like CRISPR, is transforming healthcare. Personalized medicine allows for targeted treatments based on an individual's genetic makeup, which increases the effectiveness of therapies. According to the National Institutes of Health (NIH), the global personalized medicine market is projected to reach $3.2 trillion by 2025, reflecting the growing demand for tailored healthcare solutions.

Restraints

High R&D and Production Costs

- Costly Drug Development: Developing new drugs and therapies remains a significant financial burden. The cost of developing a new drug, from discovery to market approval, can exceed $2.6 billion, according to a Tufts Center for the Study of Drug Development report. This high cost, combined with the uncertain success rate of clinical trials, limits the capacity of smaller companies to innovate and delays the availability of new treatments.

Regulatory Challenges

- Regulatory Hurdles: Navigating the complex regulatory environment for new drugs and medical devices can be time-consuming and costly. The U.S. Food and Drug Administration (FDA) approval process, for instance, can take 10 to 15 years from drug development to market entry. Regulatory uncertainties in different regions also complicate global market access for life science companies, delaying the launch of critical new therapies.

Intellectual Property (IP) Issues

- Patent Expirations and Generic Competition: The expiration of patents for blockbuster drugs leads to the emergence of generic alternatives, reducing the revenue potential for pharmaceutical companies. According to the IQVIA Institute for Human Data Science, patent expirations for major drugs will result in a loss of $200 billion in sales by 2025, as generics capture market share. This increasing competition from biosimilars and generics can limit profitability for life science companies, particularly in the pharmaceutical sector.

Regional Analysis

The life science market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa).

Why is North America dominates the life science market?

North America, particularly the United States, dominates the global life science industry due to its advanced healthcare infrastructure, high levels of investment in biotechnology, and the presence of leading pharmaceutical and biotechnology companies. The U.S. is home to numerous research institutions, universities, and healthcare providers that contribute to the development of life science technologies and innovations. The increasing demand for healthcare services, especially in areas like oncology, cardiovascular diseases, and diabetes, has bolstered the market. Moreover, the U.S. government’s continuous investment in biomedical research, through organizations like the National Institutes of Health (NIH), supports innovation in the sector. Furthermore, the rising demand for personalized medicine, gene therapies, and cell-based therapies is driving growth in North America. The adoption of advanced technologies such as AI, machine learning, and precision medicine also plays a critical role in the region's leadership.

The presence of major pharmaceutical companies like Pfizer, Johnson & Johnson, and Merck, along with increasing venture capital funding in the biotechnology sector, has made North America a hub for life science research and product development. However, the region faces challenges like high healthcare costs, regulatory complexities, and the threat of generic drugs after patent expirations. Despite these challenges, the market's growth remains strong due to continuous innovation and the expanding healthcare needs of an aging population. In fact, the U.S. Food and Drug Administration (FDA) is expected to approve over 50 new drugs annually, further fueling market expansion.

What factors driving the Asia Pacific fastest growth in the life science market?

The Asia Pacific region is emerging as one of the fastest-growing markets in the life science sector. The region’s growth is driven by countries like China, India, Japan, and South Korea, which have large populations, expanding healthcare access, and growing middle-class demand for advanced healthcare services. The Asia Pacific life science market is projected to grow at a CAGR of 12-15% from 2024 to 2033. China's rapid advancements in biotechnology and its robust pharmaceutical industry, including companies like Sinovac and Shanghai Pharmaceuticals, have positioned it as a global leader in life science research and production.

India is also witnessing significant growth in the biotechnology and pharmaceutical sectors, supported by its large and young population, as well as its growing healthcare needs. India is known as the "pharmacy of the world," providing generic drugs to many parts of the globe. The Indian life sciences market is driven by increased investment in research and development. Japan and South Korea are also investing heavily in biotechnology, with Japan focusing on regenerative medicine and stem cell research. The region faces challenges such as varying healthcare standards, regulatory issues, and infrastructure disparities, but its potential for growth is substantial due to an increasingly affluent population and rising healthcare needs.

Life Science Companies Landscape

The life sciences market is highly competitive and innovation-driven, with companies focusing on advancing healthcare, diagnostics, and biotechnology. The landscape is characterized by intense research and development (R&D) efforts, strategic collaborations, and acquisitions to expand product portfolios and global reach. Major players invest heavily in genomics, proteomics, cell therapies, and artificial intelligence to address growing healthcare demands.

The adoption of personalized medicine, gene editing (like CRISPR), and advanced diagnostic tools has intensified competition. Emerging startups and established giants are driving progress in areas such as immunotherapy, vaccine development, and biomanufacturing. Companies are also focusing on automation and digitalization for lab processes, which enhance efficiency and accuracy.

Top Companies

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Roche Holding AG

- Merck KGaA (MilliporeSigma)

- Pfizer Inc.

- Johnson & Johnson

- Agilent Technologies Inc.

- Illumina, Inc.

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc.

- Abbott Laboratories

- GE HealthCare

Recent Developments

Thermo Fisher Scientific

- June 2023: Opened a new cell therapy manufacturing facility in Princeton, NJ, to accelerate clinical and commercial production.

- September 2023: Announced the acquisition of Olink Holding AB, enhancing its proteomics research capabilities.

Danaher Corporation

- August 2023: Completed the spin-off of its environmental and applied solutions segment into a new company, Veralto, focusing on life sciences and diagnostics.

- November 2023: Introduced new CRISPR/Cas9 genome editing tools through Cytiva for precision medicine.

Roche Holding AG

- March 2023: Launched the Elecsys Alzheimer’s Disease Plasma Panel, a blood-based diagnostic test.

- October 2023: Partnered with Moderna to explore mRNA-based personalized cancer vaccines.

Pfizer Inc.

- April 2023: Completed the acquisition of Seagen Inc. for $43 billion to strengthen its oncology pipeline.

- December 2023: Announced the development of an oral RSV (respiratory syncytial virus) treatment.

Illumina, Inc.

- May 2023: Released the NovaSeq X Series, enabling ultra-high-throughput DNA sequencing.

- November 2023: Partnered with Grail Inc. to scale liquid biopsy screening for early cancer detection.

Market Segmentation

By Type

- Biotechnology

- Genomics

- Proteomics

- Metabolomics

- Bioinformatics

- Pharmaceuticals

- Branded Drugs

- Generic Drugs

- Biosimilars

- Medical Devices

- Diagnostics

- Therapeutic Devices

- Wearables

- Life Science Tools

- Instruments

- Reagents & Consumables

- Analytical Tools

- Digital Health Solutions

- AI in Life Sciences

- Cloud-based Solutions

- Health Informatics

By Applications

- Drug Discovery and Development

- Diagnostics

- Therapeutics

- Clinical Trials

- Research & Development

By Therapeutic Areas

- Oncology

- Cardiology

- Neurology

- Immunology

- Rare Diseases

- Infectious Diseases

- Others

By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Academic & Research Institutions

- Hospitals & Clinics

- Others (Contract Research Organizations (CROs), and Government Organizations)

By Geography

- North America

- APAC

- Europe

- LAMEA