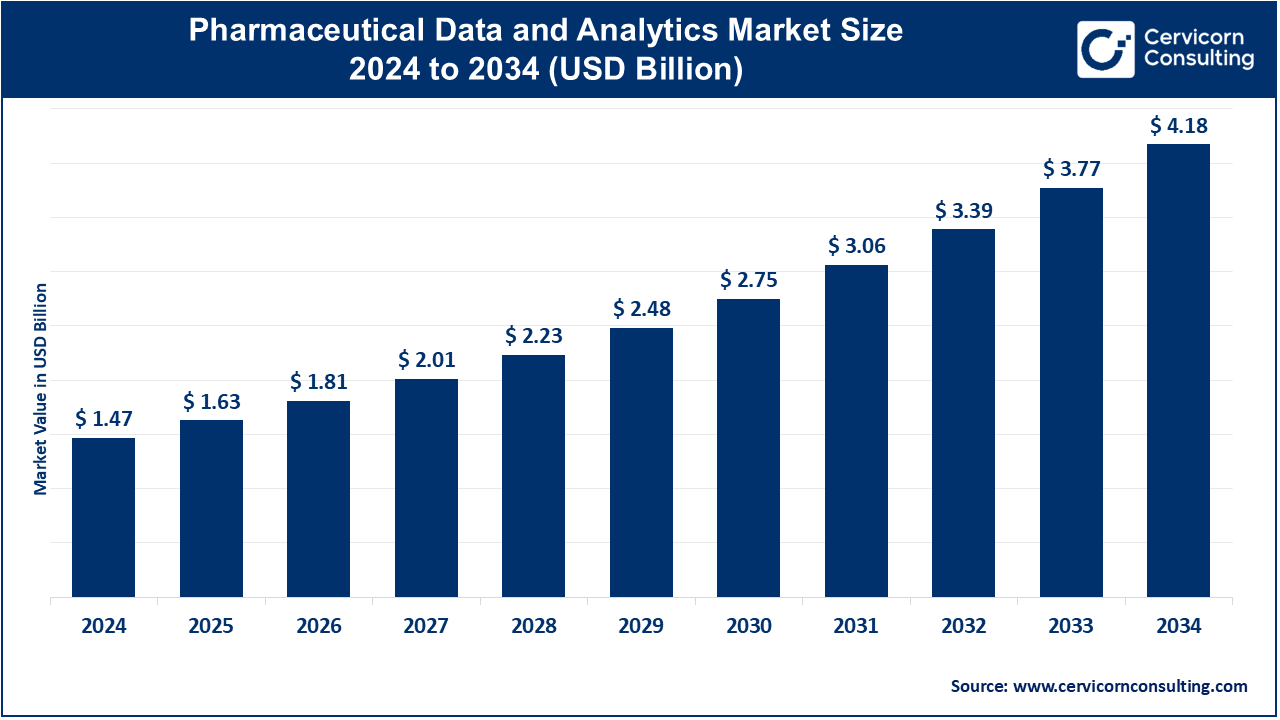

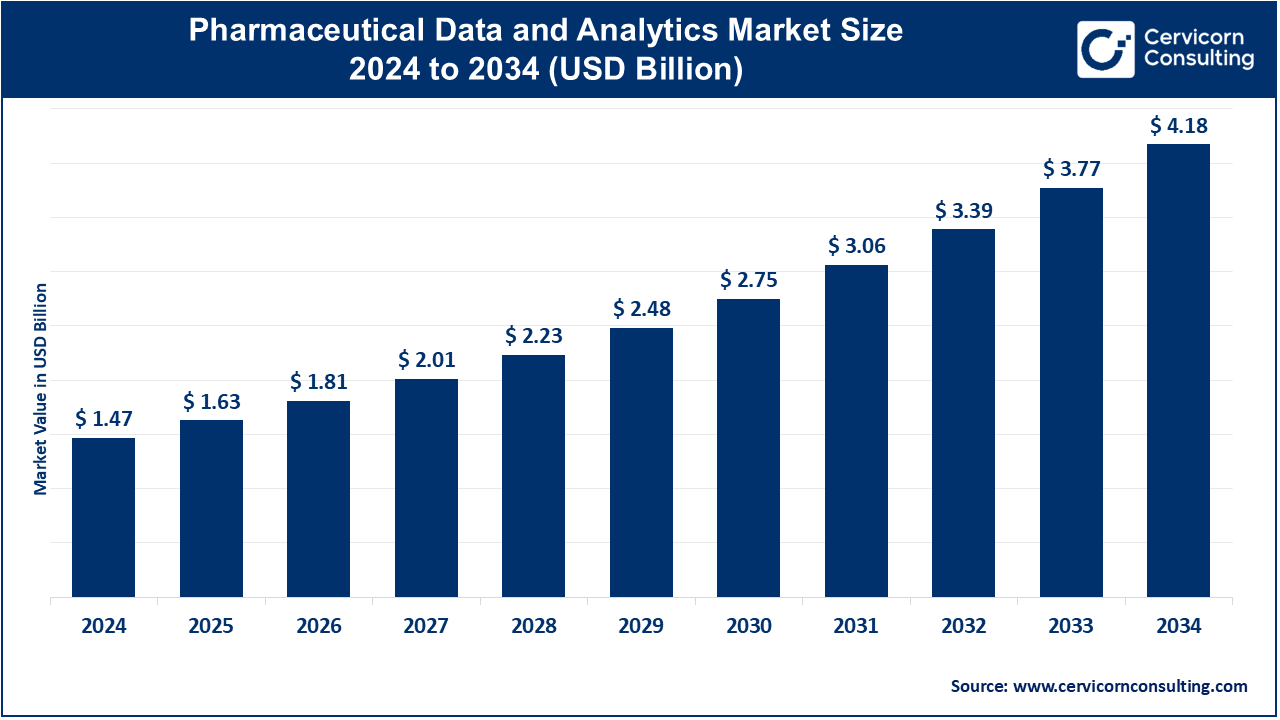

Pharmaceutical Data and Analytics Market Size and Growth 2025 to 2034

The global pharmaceutical data and analytics market size was valued at USD 1.47 billion in 2024 and is estimated to reach around USD 4.18 billion by 2034, growing at a CAGR of 11.01% during the forecast period 2025 to 2034. The pharmaceutical data and analytics market is expected to witness substantial growth owing to increasing usage of the analytical technologies for streamlining the business processes. It also has an important role in the improvement of drug discovery, optimization of clinical trials, and improving patient outcomes with the help of data-driven insights.

The pharmaceutical data and analytics market is expected to grow owing to rising demand for the data-driven decision making for development of drugs along with clinical trials and market access strategies. In the pharmaceutical sector, from widespread digital teratology testing, companies are more substantial increases in Data Mining and the advance of Artificial Intelligence (AI) and Machine Learning (ML). This has led to genuinely transformative changes in the pharmaceutical sector in terms of knowing about the strain, personalized curing, and being able to predict adverse-event likelihood while work is in progress in a trial. For instance, in the next ten years, the R&D pipeline involved serving patients, ensuring greater satisfaction, and improving disaster recovery using customized medications from a small set of cladistic similarities within commercial data sets. The surge in electronic medical records (EMRs), demand for data transparency as part of regulatory requirements, and the use of the best cloud technology have created a very satisfactory market as part of the digitization process. However, the best sales for this market are found in North America, which is because great pharmaceutical companies are sitting with strong investment in R&D and sophisticated healthcare IT facilities.

Report Highlights

- North America registered high revenue share in 2024.

- Asia-Pacific is expected to grow at a fastest pace over the forecast period.

- By end user, pharmaceutical and biopharmaceutical companies segment dominated the market in 2024.

- By deployment model, the hybrid segment will lead the market.

- By component, the software segment dominated the market in 2024.

Growth Factors

- AI and Machine Learning Adoption: The application of artificial intelligence (AI) and machine learning (ML) for pharmaceutical data analytics is changing drug discovery and development. These technologies allow performing predictive modeling, automating complex data analysis and finding potential drugs with better and quicker accuracy. Through the analysis of big data, AIs and MAs can be used to improve clinical trial designs, improve failure rates, and predict patient outcomes due to treatments. Their latent pattern discovery capabilities fuel innovation and advance decision-making and as such they are crucial for a competitive pharmaceutical environment.

- Personalized Medicine Demand: Personalized medicine aims at individualization of treatments according to patients' characteristics (genetics, lifestyle, health status). Pharmaceutical data analytics is an important one achieved by allowing massive genomic, clinical, and real-world data analysis. This can facilitate the identification of biomarkers, prognosis and the development of targeted therapies. As patient demand for better and more customized treatments grows, analytics is the information needed to bring a personalized solution to them, ultimately improving patient outcomes and reducing trial-and-error processes in medication prescriptions.

- Real-World Evidence Utilization: Real-world evidence (RWE) refers to the study of information from informal healthcare environments such as patient registries, claims records, and wearables, to help decision-making based on these data. Pharmaceutical companies use RWE to augment clinical trial results, characterize treatment efficacy, and carefully monitor drug safety in the "real world. This methodology limits the need for a "trial" and improves "post-market" surveillance. As regulatory bodies push the use of RWE for approval, pharmaceutical companies are beginning to use analytics tools to pull out actionable insights from real-world data, leading to market expansion.

- Electronic Health Records Proliferation: With the general rollout of electronic health records (EHRs), there is a wealth of healthcare data available. Pharmaceutical companies use analytic tools to mine EHRs for information on disease patterns, patient behaviors, and treatment outcomes. This data is crucial for designing effective clinical trials, identifying unmet medical needs, and optimizing drug development pipelines. The global expansion of healthcare digitalization has increased the availability of EHRs and transformed them into an important engine of data and analytics development in the pharmaceutical industry.

- Regulatory Requirements: Regulatory bodies around the globe are pushing for increased transparency and data reporting in drug development, clinical trials, and pharmacovigilance. Analytics tools assist pharmaceutical companies in complying with these regulations by automating the process of data collection, analysis, and reporting. Advanced analytics ensure accurate and timely submission of data, reducing compliance risks and fostering trust with regulators. Considering that the pharmaceutical industry works in a highly regulated landscape, the demand for strong data analytics solutions for addressing these rigorous needs is a major area of growth.

Market Trends

- Biopharmaceutical R&D Investments: Biopharmaceutical research and development (R&D) has already received significant funding, and activities are continuing to spread throughout the pharmaceutical sector to tackle challenging issues, e.g., cancer or rare autosomal dominant disorders). Data analytics has also been applied to large dimensional data sets for modelling biological phenomena and for accelerating drug discovery. In addition, it may contribute to the discovery of novel drugs and the development of clinical trials to a more efficient design, which of the two approaches has the potential to shorten the time and cost of R&D. While the future generations of therapeutics are the target of companies, the data analytics market to improve the R&D efficiency has been constantly growing.

- Cloud Computing Advancements: Cloud computing has changed the landscape of drug, data storage and analysis by providing scalable, economic, and secure computing infrastructure (ICCI). In cloud computing, both applications are employed by the pharmaceutical sector and by both, processing either expanding or large-scale databases of data in real-time and then making decisions in real-time, far from the future. Such systems can enhance the productivity of drug discovery and clinical trials via remote work cooperation and data sharing. Flexibility and scalability are two of the main perceived motivators behind adopting cloud solutions and subsequently, advanced data analytics in the pharma industry.

- Chronic Disease Prevalence: Considering the increase of chronic diseases (diabetes mellitus, cardiovascular disease, cancer) on a worldwide scale, new therapeutic breakthroughs are required. Drug companies are poised to use data analytics to better understand disease patterns, to characterize individuals who might be at high risk, and to characterize the way treatments work. Through making inferences about the needs of patients and therapeutic and prognosis data, analytics can contribute to the design of clinically relevant interventions and the enhancement of disease management. As chronic diseases evolve, the demand for strong data analysis offers a promising growth engine.

- Blockchain Technology Adoption: While technology blockchain is expected to gain much relevance in pharma, it may serve data confidentiality, transparency and traceability. By integrating blockchain and analytics, businesses can provide guarantees concerning patient data trustworthiness, streamline clinical trials, and provide trialability concerning supply chains. Blockchain also offers solutions to the problem of how to establish the validity of information (which is of particular interest to the pharmaceutical field). As the overarching goals of trust and effectiveness are consolidated, market momentum is being driven through the application of blockchain and data analytics enhanced with cryptography.

- Cost Reduction and Efficiency Focus: Mitigating cost and improving operational efficiencies within pharmaceutical companies is a continuous work in progress. Not only by, for example, data analytics, data can furnish insights to take actions and predictive analytics that can help to streamline, processes, e.g., pharmaceutical research and development, clinical trials, production. Furthermore, if the inefficiencies are detected and the resource/allocation use grows, analytics have impacts on time-to-market and its cost. Competitive pressure in the cost reduction and operational efficiency space drives the implementation of advanced analytics solutions.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 1.47 Billion |

| Projected Market Size in 2034 |

USD 4.18 Billion |

| Expected CAGR from 2025 to 2034 |

11.01% |

| Dominant Area |

North America |

| Leading Growth Region |

Asia-Pacific |

| Key Segments |

Component, Deployment Model, End User, Region |

| Key Companies |

TRINITY PHARMA SOLUTIONS, CitiusTech Inc., IBM, International Business Machines Corporation, Northwest Analytics Inc., ORACLE, SCIO HEALTH ANALYTICS, Statistical Analysis System, TAKE Solutions Ltd., Wipro |

Market Dynamics

Market Drivers

IoMT Devices

- Some connected devices focused on patient real-time data collection, such as wearables or remote monitoring systems, comprise the actual fabric that makes up the Internet of Medical Things (IoMT). There could be such devices, the data generated by them becoming compose terribly vast text upon which pharmaceutical companies would pounce, provided it helps illustrate and understand patient behaviors. It monitors adherence to treatment and controls the drug's performance or efficiency. Regarding the analytics enabled by IoMT, they even advance and potentiate the detection of any adverse event, plus they even come up with better designs for clinical trials.

Emerging Markets Growth

- Emerging markets, mostly in Asia Pacific, are undergoing a rapid health digital transformation, with each government's funding also responding towards healthcare infrastructure creation, EHR application, and data-driven decision-making. These regions are a hotbed of pharma companies. They are targeting the over differentiating growing patient population there, mostly unrequited in medical requirements. The analytics tools adoption rate has increased in these markets as much as the supporting reforms and technology advances.

Market Restraints

Data Privacy and Security Concerns

- As per Pharma World pharma companies manage a vast amount of sensitive data including patient information and clinical trial results. One cannot ignore the stringent ness of the law, viz. GDPR and HIPAA, in the dealings that one makes handling pharmaceutical data privacy. There are fines as well as consequences for misuse or breach of data, and even the reputation of the company gets entwined in the mix. Meanwhile, these analytics still have a lot of reliance on integrating very extensive data networks, which makes safety all the more important.

High Implementation Costs

- Adoption and implementation of advanced data analytics tools demands heavy investment over infrastructure, software, and skilled employees. Whatever the size of the company, no one has that kind of financial resource lying presumptuously idle just waiting for investment, especially if one belongs to the ever-tight budget confines. It is Obvious; however, that generating enough financial return bows its head for commercial industry before the critical mass of required generation becomes capable. High maintenance and upgrade cost of such analytic system is still keeping several companies against its adoption. Despite the significant returns on investment afterwards still, the inconveniences are an enormous first one-time inconvenience in sensitive cost regions and organizations.

Market Opportunities

Integrated Analytics Platforms

- Such a situation of integrated analytics platforms gives the pharmaceutical industry a very significant opportunity, providing a consolidated, combinative-across clinical research data, real-world data, and genetic information in one place. They promote smooth data access between different stakeholders such as researchers, healthcare providers, and regulatory authorities. They also integrate advanced data visualization and predictive modeling at the referred time from Drug Development Committee's side, thereby reducing the number of decisions required between project gates.

Expansion in Emerging Markets

- Emerging markets of Asia Pacific, Latin America, and Africa offer huge data and analytics market potential for the pharma industry. Healthcare digitization is gaining ground through government investments in the form of digital disease registries, electronic health records (EHRs), tele-medicine, and so on. Moreover, in these countries, where the middle class is growing and the prevalence of chronic disease is increasing, there is a substantial unmet need for innovative health care solutions. Pharmaceuticals would find much use of such data and analytics possibilities in finding unmet medical needs of people, getting a better market entry, and ensuring better patient outcomes.

Market Challenges

Lack of Standardization

- The absence of any standardized manner of data formatting sat a typical problem in pharmaceutical analytics. Typically, data is collected in many cases stored in a number of diverse formats, and drawn from a number of sources. This often culminates in interoperability and discrepancy factors that pose problems with data integration, analysis, and sharing. In the end, they also mar the decision-making process. Nevertheless, it is critical, in today's world, that in many decisions as opposed to the past, data management standards must be aligned within entire industries. This is feasible and can be very useful, as the gain in standardization always brings great advantages.

Resistance to Technology Adoption

- Organizational inertia, gaps in skills, and fear often lead to resistance to the adoption of new technologies by pharmaceutical companies. Lacking training in the usage of such high-end analytical tools, many of the work forces within an organization concurrently feel the organization is too typical to divert from the established to the new data-driven methods. It is a fear set off by a kind of opposition between the idea of damaging current approaches, protest theories involving the implementation process, and various ideologies of doing things. With significant training packages, successful change management initiatives, and ways to tangibly demonstrate the value analytics brings, adoptions come very slowly.

Segmental Analysis

The pharmaceutical data and analytics market is segmented into component, deployment model, end user, region. Based on component, the market is classified into software, services and hardware. Based on deployment model, the market is classified into on-premises, cloud-based and hybrid. Based on end user, the market is classified into pharmaceutical and biopharmaceutical companies, contract research organizations (CROs), healthcare providers and regulatory bodies.

Component Analysis

Software: The software segment dominated the market in 2024. Software constitutes the nucleus of advanced pharmaceutical statistics and analytics markets and encompasses such things as data assimilation tools, predictive modelling, visualization, and many others. These platforms make it possible for pharmaceutical organizations to manage huge datasets effectively to uncover the latest trends in drugs as they relate to clinical trials or regulatory compliance. Increasing popularity is being observed about advanced analytics software such as AI-powered platforms and machine learning algorithms. They are helping professionals make more informed decisions and streamline R&D pipelines by providing superior scope comfort and customization to meet growing requirements related to data handling.

Services: Services play a crucial role in the new realm of pharmaceutical data and analytics by facilitating the deployment, integration, and maintenance of analytics solutions. Such services would include consultancy, which would be useful in framing the data strategy, and a program to train up the staff along with technical support that is to be given to ensure smooth operations. Increasingly fast traction is being garnered by new services, allowing companies to have data analysis tasks outsourced while they concentrate on what they do more pointedly.

Hardware: It is this hardware that is mainly responsible for powering the necessary computing and storage capacity of pharmaceutical data and analytics systems. That is, the aggregate ensemble of servers, a high-performance computer, and data servers used to process and managing large volumes of data in pharmaceuticals. It is an architectural problem, resulting in everything from big data-or at least cloud-based computation today. A robust bonding hardware solution is very important in getting more fluent integration and reliable performance of analytics software that will provide facilities with more uninterrupted operations.

Deployment Model Analysis

On-Premises: On-premise deployments require building data analytics solutions locally in an organization's server setup furnished by an organization. It gives more control over the most sensitive of pharmaceutical data and ensures compliance with many security and rigorous regulatory requirements. It tends to be employed by the large pharmaceutical organizations having a sufficient IT resource to manage and maintain the infrastructure. Nonetheless, in terms of on-premise solutions, there are significant initial investments and continued maintenance alongside them, which can make them less suitable for small organizations.

Cloud-Based: Cloud-enabled deployment is now very much preferred in pharmaceutical data and analytics due to its scalability, price, and ease of use. It enables organizations to store and analyze their data with the data located on remote servers, which lines up real-time coordination among people across a company so they can make decisions faster. Another reason that this one is particularly nice is that such solutions, as they keep minimizing the need for setting up larger IT network infrastructure, are generally best-suited for small and medium-sized enterprises (SMEs). Advances in cloud security have allayed apprehensions about data protection and spawned more adoption.

Hybrid: Hybrid deployments join the strengths of on-premise and cloud into a better approach for managing data. Data that is more sensitive may be kept on panels, but cloud platforms can be used for scalability and advanced capabilities of analytics available from the latest models. The flexible nature of this model enables cost optimization even as it upholds security and also compliance while meeting data needs that different kinds of pharmaceutical companies may have due to the varying regulatory environments that they have to navigate.

End User Analysis

Pharmaceutical and Biopharmaceutical Companies: The Pharmaceutical and Biopharmaceutical Companies segment dominated the market in 2024. The analysis of data is the main area of application for pharma and biopharma companies that implement these solutions to develop drug discovery, clinical development and manufacturing. Analytics can be leveraged for accelerating R&D, shortening time-to-market and enabling smarter decision making through predictive modelling and real-world evidence. Data analytics is also utilised by such firms in the marketing function, as well as for applications on patient care. With an exponential increase of competition in the industry, the solution based on data plays a crucial role in innovation, regulatory compliance, and efficiency.

Contract Research Organizations (CROs): Contract Research Organizations (CROs) rely to a significant measure on pharma data analytics for the monitoring of clinical trials, patient protection and regulatory compliance. Analytics tools provide the tools for CRC's to conveniently adjust trial designs, increase accrual, and analyze results appropriately. Through the use of advanced analytics, CROs can lower clients' costs both in terms of time and money as well as achieve top quality research results. With increasing outsourcing of R&D functions by the pharma industry, there continues to be a demand for CROs that serve the analytics vendors.

Healthcare Providers: Pharmaceutical data analytics is used by clinical practitioners to improve patient care and to enhance patient outcomes. Based on the analysis of patient file, treatment information and efficacy reports of drugs, clinicians are situated to provide personalized medicine and therefore lead to better treatment decision making. Analytics can track adverse drug reactions and, consequently, can have a preventive role in medication safety. With digital tool use in healthcare systems, providers are now among the key market participants in the field of pharmaceutical analytics and use data-driven insights to further strengthen the pharma-industry collaboration.

Regulatory Bodies: Pharmacovigilance data analytics are used by regulatory agencies to assess the safety, effectiveness, and adherence to the law of pharmaceuticals. In the field of clinical trials, advanced analytics help us guideline the regulator's decision on CT (clinical trial) data, adverse drug reaction monitoring and drug approval transparency. With the help of analytics, these authorities can fine-tune the process of decision-making and better monitor the drug- and medical-device-post-market surveillance. With regulatory environments rapidly data-driven, analytics solutions are crucial for determining how to perform effective and accurate assessments of pharmaceutical products.

Regional Analysis

The pharmaceutical data and analytics market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

Why North America region dominated the pharmaceutical data and analytics market?

The North America region dominated the market in 2024, due to the highly sophisticated nature of healthcare coalitions, wide adoption of digital technologies and significant R&D investments in the pharmaceutical market. Market growth is also behind the trend that there are large scale participants in the market, increased adoption of real-world evidence and regulatory endorsement of data-driven approaches in drug development. In particular, the United States is leading the development of AI-based analytics cloud-based solutions. Continuous high demand for personalized medicine and for efficient clinical trials is driving the application of analysis tools in the area.

Europe Pharmaceutical Data and Analytics Market Trends

European Union (EU) is one of the major markets for pharmaceutical data and analytics, regulatory interest as well as with an emphasis on innovation. There are countries on the globe, including Germany, Great Britain, and Switzerland, who have already started to apply advanced analyses to support drug discovery and clinical trials. In this area, it also benefits from implementation of initiatives to promote the digitisation of healthcare and the use of real-world evidence in regulatory decision-making. The need to reduce the cost of health care delivery and improve patient outcomes has led to the increased use of data analytics across the pharmaceutical and biopharmaceutical industries.

Why Asia-Pacific region growing at a fast pace in the pharmaceutical data and analytics market?

Asia-Pacific market is growing at a fast pace, thanks to the growth in the healthcare digitization, growing pharmaceutical R&D investments and adoption of analytics solutions. Developing countries such as China and India play a significant role, supported by government actions and the increasing number of pharmaceutical manufacturing sites. Supporting the large base of patient populace and high-burden chronic diseases in the area are unique opportunities for data-driven drug development and clinical trials. Due to a rise in demand of cost-effective strategies, clouds-based analytics tools and AI-powered platforms are rapidly expanding.

LAMEA Pharmaceutical Data and Analytics Market Trends

The LAMEA region is a slowly growing market driven by healthcare transformation and the growing acceptance of data-driven methodologies. In Latin America, both Brazil and Mexico are at present applying analytics to enhance clinical trials as well as regulatory compliance. Public sector health service transformation and productivity spending drive market growth in the Middle East and Africa. Nevertheless, some challenges including IT resource constraints and regulatory difficulties remain. Although, the region represents uncontested potential for analytics companies as healthcare networks evolve.

Pharmaceutical Data and Analytics Market Top Companies

Recent Developments

- In 2022 ZS which is US-based had been acquired by the Danish company Intomics which has a specialization in the systems bioinformatics and biology. Intomics improved the development and discovery of drugs by offering in-depth analysis of the biomedical data.

Market Segmentation

By Component

- Software

- Services

- Hardware

By Deployment Model

- On-Premises

- Cloud-Based

- Hybrid

By End User

- Pharmaceutical and Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Healthcare Providers

- Regulatory Bodies

By Region

- North America

- APAC

- Europe

- LAMEA