The green methanol market is growing at high rates due to the increased demand for clean sources of fuel, improved carbon emission regulations, and increased investment in alternative fuels. Governments worldwide are promoting low-carbon fuels to achieve climate objectives, thereby increasing the use of green methanol in the transportation, shipping, and industrial sectors. The maritime sector is particularly leading demand with the move towards carbon-free shipping solutions.

In addition, the development of carbon capture technology and hydrogen-based production of methanol is propelling green methanol as a promising substitute for fossil fuels. Growth of market is further being strengthened by the increasing bio-based production of methanol from waste and biomass feedstocks. For instance, in 2022, global methanol production was estimated to have exceeded 111 million metric tons, growing by nearly four percent from the previous year.

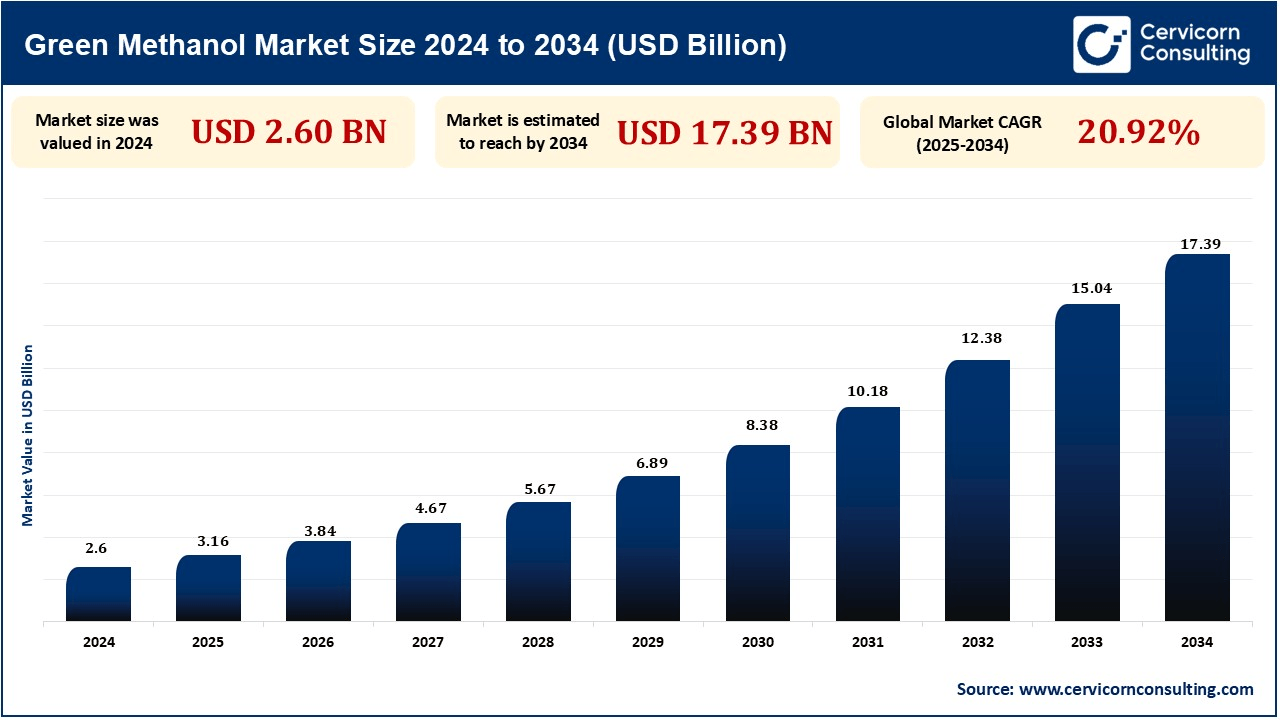

The global green methanol market size is expected to surge around USD 17.39 billion by 2034 from USD 2.60 billion in 2024 and is exhibiting a CAGR of 20.92% during the forecast period 2025 to 2034.

The shipping industry is increasingly using green methanol as a low-carbon alternative to traditional fossil fuels, with a push coming from the International Maritime Organization's (IMO) tight emissions limits. Green methanol contains lower levels of sulfur, has reduced greenhouse gas emissions, and higher energy efficiency and is therefore a viable option for maritime shipping decarbonization. Leading shipping companies are investing in ships powered by methanol, with industry leaders such as Maersk launching green methanol-fueled ships. Furthermore, advances in dual-fuel engine technology are boosting uptake, allowing the sector to transition towards cleaner fuel options. For instance, in 2023, Maersk launched the world’s first container vessel powered by green methanol, aiming to decarbonize shipping.

Green hydrogen is an essential raw material for sustainable methanol manufacturing, and rising production capacity is fueling the growth of the market. Governments across the globe, such as in Germany, China, and the U.S., are funding electrolyzer technology, renewable energy-based hydrogen manufacturing, and gigascale hydrogen initiatives. The cost reduction of electrolysis and renewable sources is bringing down the cost of green hydrogen, resulting in lower green methanol production costs. With increasing scale-up of green hydrogen production, it is anticipated to drive the expansion of the green methanol market through enhanced supply chains and lower dependence on fossil-based methanol production. For example, Siemens Energy and Masdar partnered to develop large-scale green hydrogen production, supporting methanol synthesis.

Though the environment is a beneficiary, green methanol is still costlier under the present scenario compared to traditional methanol because of the extremely high cost of renewable power, carbon capture, and electrolysis technologies. Green hydrogen, being a critical feedstock, is not cheap enough, hence discouraging e-methanol and bio-methanol production in price contrast markets. Furthermore, the lack of huge production facilities and inefficiency in supply chains incur costs. Although technology advances and economies of scale will reduce the cost in the long run, affordability remains the biggest hindrance to mass adoption.

Green methanol manufacturing is dependent on green hydrogen, and the growth of hydrogen production plants at a rapid pace is a significant growth opportunity. Governments and private players are investing in hydrogen electrolysis, storage, and transportation infrastructure, which is making renewable hydrogen more affordable and accessible. Initiatives such as Europe's Green Hydrogen Strategy and China's Hydrogen City initiatives are paving the way for green methanol uptake at scale. With costs going down and economies of scale being the norm, green methanol might be a preferred sustainable fuel choice, fueling its take-up in most industrial uses.

| Attributes | Details |

| Green Methanol Market Size in 2025 | USD 3.16 Billion |

| Green Methanol Market CAGR | 20.92% in 2025 to 2034 |

| Key Players |

|

| By Feedstack |

|

| By Production Technology |

|

| By Application |

|

| By End-Use |

|

| By Region |

|

North America is a prominent market for green methanol because of the availability of stringent environmental regulations, increasing adoption of renewable fuels, and heavy investments in carbon capture technologies. The United States and Canada are leading the low-carbon methanol transition, with prominent industries utilizing green methanol as a clean fuel in chemicals, energy, and transportation sectors. Availability of prominent players, government support for biofuels, and growing hydrogen economy are also driving market expansion. Besides that, the maritime and automotive industries are also considering methanol-based fuels to comply with emission regulations, while continuing innovations in waste-to-methanol projects are establishing the region's market dominance.

Asia-Pacific is witnessing rapid market growth for green methanol fueled by increasing industrialization, government-led sustainability, and increasing demand for low-carbon fuels. China, India, and Japan are some of the major drivers, with substantial investments in bio-methanol and carbon recycling technologies. The region's maritime sector is seriously considering methanol as a cleaner alternative for fuel, especially in China's large shipping fleet. Moreover, increasing chemical and energy industries are incorporating green methanol in production. The fact that there are giant methanol manufacturers, increased renewable energy facilities, and welcome government measures is turning Asia-Pacific into a global leader in the manufacture of green methanol.

Green methanol made from COâ‚‚ emissions utilizes captured carbon from industrial sources, power plants, or direct air capture technology. The process reduces greenhouse gas emissions significantly by converting COâ‚‚ into a valuable chemical feedstock and fuel. Carbon utilization is being promoted by governments and industries to promote circular economies and become carbon neutral. Technological progress in carbon capture and utilization (CCU) is improving efficiency and scalability, and COâ‚‚-based methanol is becoming a leading driver of sustainable fuel and chemical production. Large corporations are investing in integrated plants that blend carbon capture with renewable hydrogen to make low-emission methanol.

Bio-methanol is produced from biomass-derived feedstocks including agricultural residues, forest residues, and municipal solid waste. Renewable methanol in this form finds extensive application as a drop-in fuel for gasoline blending and as a green chemical feedstock. Bio-methanol lowers greenhouse gas emissions by a large extent and promotes the circular economy by recycling wastes. Bio-methanol is being increasingly adopted in industries such as automotive, power generation, and chemical production. European nations and North America are investing in bio-refineries to manufacture sustainable methanol. With government aid policies and growing need for low-carbon fuels, bio-methanol is set for robust growth in the market.

Green methanol is being used increasingly as a low-carbon fuel in maritime transportation, automotive, and power. The International Maritime Organization (IMO) regulations are promoting the use of methanol as a green fuel to mitigate sulfur and carbon emissions in transport. Automotive industry players are researching methanol fuel cells as a means of cleaner transportation. Methanol-to-hydrogen conversion is also being researched for hydrogen fuel cell purposes. Methanol-based fuels are being encouraged by governments everywhere to help decrease reliance on traditional fossil fuels. Investment in methanol refueling stations and hybrid engine technology infrastructure will drive the growth of this segment.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2315

Ask here for more details@ sales@cervicornconsulting.com