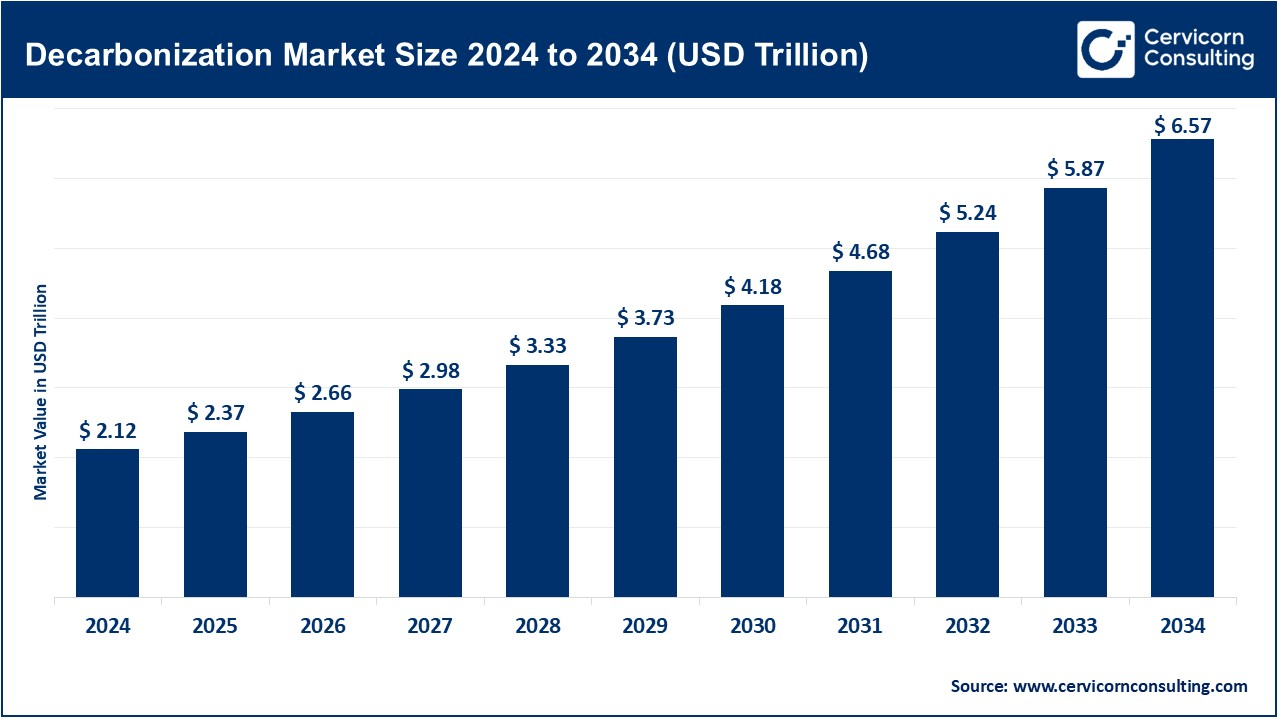

The global decarbonization market size was reached at USD 2.12 trillion in 2024 and is expected to be worth around USD 6.57 trillion by 2034, reflecting a compound annual growth rate (CAGR) of 11.97% over the forecast period from 2025 to 2034.

The decarbonization market is experiencing rapid growth due to stricter government regulations, corporate sustainability goals, and technological advancements in clean energy. Countries worldwide are implementing carbon pricing, emission reduction policies, and renewable energy incentives, driving investments in green solutions. Businesses are also adopting low-carbon strategies to meet consumer demand for sustainable products and reduce operational costs. This shift is accelerating the adoption of renewable energy, energy storage, and electric mobility.

Additionally, innovations in hydrogen fuel, battery technology, and AI-driven energy optimization are further boosting the market. The growing commitment to achieving net-zero emissions by 2050 is pushing companies across various sectors power, manufacturing, and transportation to invest in decarbonization solutions. Emerging economies are also joining this transition, supported by international funding and partnerships. As a result, the market is expected to expand significantly, transforming industries and paving the way for a cleaner, greener global economy.

What is Decarbonization?

Decarbonization refers to the process of reducing or eliminating carbon dioxide emissions from industries, transportation, energy production, and other sectors. The goal is to transition from fossil fuels (coal, oil, and gas) to cleaner, renewable energy sources like solar, wind, and hydropower. This shift is essential to combating climate change and achieving global net-zero emission targets.

The process involves multiple strategies, including improving energy efficiency, adopting electric vehicles (EVs), using carbon capture and storage (CCS) technologies, and promoting sustainable practices in industries like steel, cement, and agriculture. Governments, businesses, and organizations worldwide are implementing policies and investing in cleaner technologies to support decarbonization efforts. Additionally, carbon offset programs, such as reforestation and carbon credits, help balance unavoidable emissions.

Decarbonization is crucial for a sustainable future, reducing environmental damage, improving public health, and driving innovation in green technologies. Countries and businesses that adopt decarbonization strategies not only contribute to environmental protection but also gain economic benefits through energy cost savings, job creation, and long-term sustainability.

Surge in Renewable Energy Adoption

Expansion of Sustainable Transportation

Corporate Climate Commitments

Technological Innovations in Energy Efficiency

Strengthened Government Policies and Investments

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 2.37 Trillion |

| Expected Market Size in 2034 | USD 6.57 Trillion |

| Projected CAGR 2025 to 2034 | 11.97% |

| High-impact Region | North America |

| Leading Growth Region | Asia-Pacific |

| Key Segments | Service, Technology, Deployment, End User, Region |

| Key Companies | General Electric (GE), Siemens Energy, Schneider Electric, ABB Ltd., Honeywell International Inc., Tesla, Inc., Vestas Wind Systems A/S, Ørsted A/S, NextEra Energy, Inc., Shell Plc (Renewables & Energy Solutions), Mitsubishi Heavy Industries, Ltd., Carbon Clean Solutions Limited |

Government Regulations and Net-Zero Commitments

Rapid Growth in Renewable Energy Deployment

High Initial Investment Costs

Slow Adoption in Hard-to-Abate Industries

Growth in Carbon Pricing and Emission Trading Systems (ETS)

Rising Demand for Green Hydrogen

Grid Infrastructure and Energy Storage Limitations

Supply Chain Disruptions and Resource Constraints

The decarbonization market is segmented into service, technology, deployment, end-use and region. Based on service, the market is classified into carbon accounting and reporting services, waste reduction and circular economy services and sustainable transportation services. Based on technology, the market is classified into renewable energy technologies, electric vehicles (EVs), carbon removal technologies, energy efficiency solutions and carbon capture and storage (CCS). Based on deployment, the market is classified into on-premises and cloud. Based on end-use, the market is classified into oil & gas, agriculture, aerospace & defense, energy and utility, automotive & transportation, government and manufacturing.

Sustainable Transportation Services: The Sustainable Transportation Services segment has dominated the market in 2024. The push for greener mobility solutions is accelerating the adoption of sustainable transportation services. Electrification of public transport, fuel-efficient logistics, and investments in high-speed rail networks are key trends. Many cities are implementing low-emission zones and offering incentives for businesses to adopt sustainable fleet management solutions. The deployment of EV charging infrastructure, coupled with policy support, is further driving demand for sustainable transport services.

Carbon Accounting and Reporting Services: Organizations worldwide are increasingly adopting carbon accounting tools to track emissions and ensure compliance with environmental regulations. Governments and financial institutions are pushing for standardized carbon reporting frameworks, such as the Greenhouse Gas (GHG) Protocol and Science Based Targets initiative (SBTi). Companies like Microsoft and Salesforce have launched AI-powered carbon tracking solutions, making it easier for businesses to assess and reduce their carbon footprint. The demand for carbon reporting services is rising across industries, particularly in energy, manufacturing, and retail.

Waste Reduction and Circular Economy Services: Many corporations are shifting towards circular business models to minimize waste generation and promote resource efficiency. Companies like Adidas and IKEA are investing in sustainable materials, closed-loop recycling, and product take-back programs to minimize environmental impact. Governments are also introducing extended producer responsibility (EPR) laws to push businesses toward sustainable production practices. This segment is growing as industries seek to optimize resource use while reducing costs and waste disposal challenges.

Renewable Energy Technologies: The Renewable Energy Technologies segment was leader in 2024. Solar and wind energy continue to dominate the renewable energy landscape, with record capacity additions in many regions. Many corporations are signing power purchase agreements (PPAs) with renewable energy providers to meet their sustainability goals. Offshore wind energy projects are gaining traction, with new developments in Europe, the U.S., and China. Advancements in battery storage solutions are also enabling better integration of renewables into the grid.

Electric Vehicles (EVs): The electric vehicles segment is expected to register a significant CAGR during the forecast period. The EV market is witnessing a surge in demand due to falling battery costs, government incentives, and improved charging infrastructure. Automakers are expanding their EV production lines, and new models with extended range and faster charging capabilities are entering the market. Fleet electrification is also becoming a priority for logistics and transportation companies, reducing overall emissions in the sector. Governments worldwide are setting ambitious targets to phase out internal combustion engine (ICE) vehicles.

Carbon Removal Technologies: Technologies like Direct Air Capture (DAC) and enhanced weathering are emerging as critical tools for reducing atmospheric carbon dioxide. Major corporations are investing in carbon removal projects to offset their emissions. Biochar, which sequesters carbon in soil while improving agricultural productivity, is gaining attention as a scalable solution. Carbon offset markets are expanding as businesses seek verified carbon removal credits.

Energy Efficiency Solutions: Businesses and households are adopting energy efficiency measures such as smart thermostats, LED lighting, and advanced building insulation. Industrial sectors are implementing energy management systems to optimize consumption and reduce operational costs. AI-driven energy optimization is helping enterprises reduce energy wastage and improve grid stability. Green building certifications, such as LEED and BREEAM, are driving investments in energy-efficient infrastructure.

Carbon Capture and Storage (CCS): Oil and gas companies, power plants, and heavy industries are integrating CCS solutions to curb emissions. Governments are funding large-scale CCS projects to accelerate adoption. While CCS technology is still expensive, advancements in capture efficiency and storage techniques are improving its feasibility. Industrial hubs and clusters are exploring shared CCS infrastructure to reduce costs and enhance scalability.

On-premises: The on-premises segment led the market in 2024. Large enterprises in manufacturing, oil & gas, and heavy industries prefer on-premises decarbonization solutions due to security, customization, and regulatory compliance. Industrial facilities with high emissions rely on in-house carbon tracking and reduction solutions to meet their sustainability targets. In sectors where real-time monitoring of emissions is critical, on-premises solutions provide greater control and integration with operational workflows.

Cloud: Cloud-based decarbonization solutions are becoming increasingly popular among small and medium-sized enterprises (SMEs) and service-based industries. Cloud platforms provide scalability, real-time data access, and seamless integration with existing business systems. AI-powered cloud solutions help organizations analyze emissions data, generate insights, and automate sustainability reporting. Tech companies are leading the charge in developing cloud-based tools for carbon tracking, energy optimization, and ESG compliance.

End Use Analysis

The oil & gas segment generated the highest revenue in 2024 and is projected to grow at a CAGR of 13.8% during the forecast period.

Decarbonization Market Revenue Share, By End-use, 2024 (%)

| End Use | Revenue Share, 2024 (%) |

| Oil & Gas | 30.20% |

| Agriculture | 16.30% |

| Aerospace & Defense | 6.50% |

| Energy and Utility | 21.10% |

| Automotive & Transportation | 17.40% |

| Government | 5.10% |

| Manufacturing | 3.40% |

The decarbonization market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

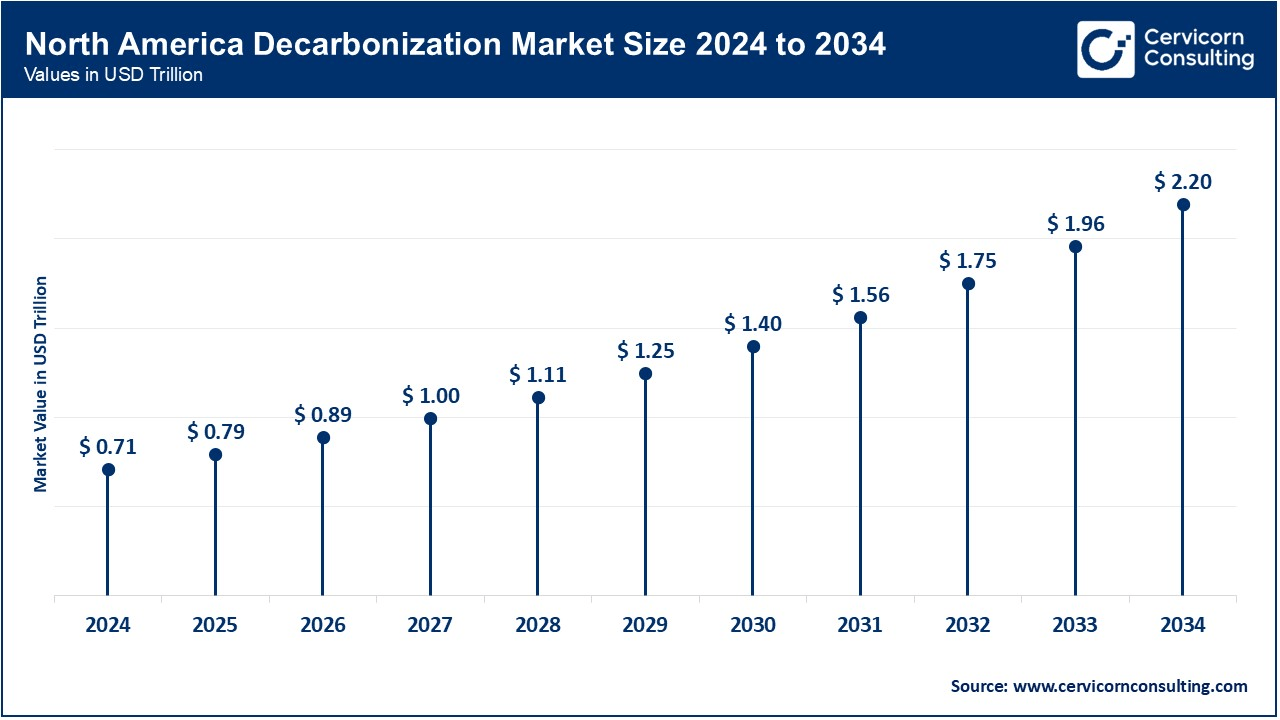

The North America decarbonization market size was valued at USD 0.71 trillion in 2024 and is expected to reach around USD 2.20 trillion by 2034. North America holding the highest market share in 2024. This dominance is driven by strong government policies, corporate sustainability commitments, and advanced technological innovations. The U.S. plays a pivotal role, with large-scale investments in renewable energy, carbon capture and storage (CCS), and electric vehicles (EVs). Federal initiatives such as the Inflation Reduction Act (IRA) and state-level net-zero targets accelerate market growth. The region's mature energy sector, increasing adoption of green hydrogen, and growing carbon offset programs further bolster decarbonization efforts. Canada also contributes significantly with its aggressive carbon pricing policies and clean energy transitions.

The Asia-Pacific decarbonization market size was estimated at USD 0.49 trillion in 2024 and is projected to reach around USD 1.51 trillion by 2034. Asia-Pacific (APAC) is the fastest-growing region, with rapid industrial transformation and ambitious government climate policies. Countries like China, India, Japan, and South Korea are leading the transition with massive investments in renewable energy, sustainable transportation, and carbon capture technologies. China remains the largest investor in solar and wind power, while Japan and South Korea focus on hydrogen energy and green infrastructure. India’s increasing focus on energy efficiency, green manufacturing, and carbon credit trading further propels market expansion. APAC's industrial decarbonization, growing EV adoption, and rising green finance initiatives make it a key driver in the global market.

The Europe decarbonization market size was accounted for USD 0.54 trillion in 2024 and is forecasted to surpass around USD 1.67 trillion by 2034. Europe holds a substantial share, backed by its strong regulatory framework and climate leadership. The European Union’s (EU) Green Deal, Fit for 55 package, and carbon border tax are key enablers of market growth. The region’s well-established renewable energy sector, commitment to circular economy models, and corporate net-zero targets ensure sustained growth. Germany, France, and the U.K. lead in offshore wind energy, hydrogen fuel initiatives, and CCS adoption. Europe’s advanced research and development (R&D) in carbon removal technologies and energy-efficient solutions solidify its position as a mature and stable market for decarbonization.

The LAMEA decarbonization market was estimated at USD 0.37 trillion in 2024 and is anticipated to reach around USD 1.13 trillion by 2034. The LAMEA region presents emerging growth opportunities. While its market share is smaller compared to other regions, increasing investments in renewable energy, sustainable agriculture, and carbon credit programs drive demand. Brazil and Mexico are expanding solar and wind energy projects, while the Middle East focuses on green hydrogen and carbon capture initiatives. African nations are adopting clean energy solutions and afforestation projects to counter carbon emissions. Government-led sustainability programs, rising foreign investments, and corporate ESG commitments are expected to accelerate decarbonization efforts in LAMEA, contributing to moderate but steady market growth.

The decarbonization industry is highly competitive, driven by a mix of established energy giants, technology innovators, and sustainability-focused companies. Leading firms such as General Electric, Siemens Energy, Schneider Electric, and ABB Ltd. are investing heavily in renewable energy solutions, carbon capture technologies, and smart grid infrastructure to support global net-zero targets. Companies like Tesla and Vestas Wind Systems are spearheading the transition to clean energy through electric vehicles (EVs) and wind power solutions. Ørsted and NextEra Energy are expanding their renewable portfolios, focusing on offshore wind and solar power. Meanwhile, major oil and gas players like Shell are diversifying into low-carbon technologies, including hydrogen and carbon capture, to stay competitive in the evolving energy landscape. Emerging players like Carbon Clean Solutions are revolutionizing carbon removal technologies, further accelerating market growth. The industry’s momentum is fueled by increasing government regulations, corporate sustainability goals, and financial incentives, positioning decarbonization as a key pillar of global economic transformation.

Market Segmentation

By Service

By Technology

By Deployment

By End-use

By Region