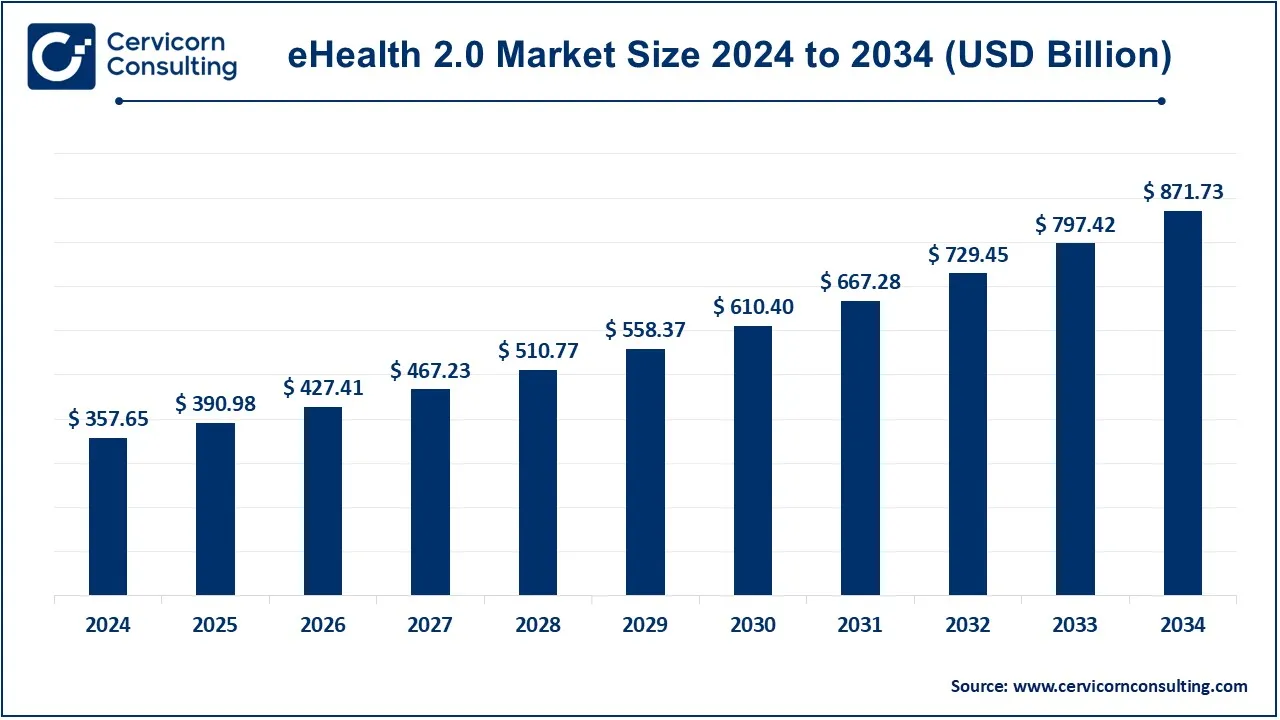

The global eHealth 2.0 market size was valued at USD 357.65 billion in 2024 and is expected to be worth around USD 871.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.1% from 2024 to 2033. The eHealth 2.0 market is growing rapidly due to increasing demand for remote healthcare services, digital health records, and AI-based medical solutions. Government initiatives promoting digital healthcare, along with rising healthcare costs, are driving adoption. The widespread use of mobile devices and internet access has further accelerated the shift toward digital healthcare platforms. Emerging technologies such as AI, IoT, and cloud computing are expected to fuel further innovation in this space. Additionally, the COVID-19 pandemic significantly boosted the adoption of telemedicine and remote monitoring, increasing investments in digital healthcare solutions. With growing concerns over chronic diseases and aging populations, eHealth 2.0 is expected to play a crucial role in improving healthcare accessibility and efficiency. As healthcare providers, insurers, and pharmaceutical companies embrace digital transformation, the eHealth 2.0 market is poised for sustained long-term growth.

Healthcare systems worldwide clearly recognize the potential of digital health and have invested heavily in national eHealth programs over the past decade. However, most of these programs have only achieved a modest return as measured by higher quality of care, greater efficiency, or better patient outcomes. eHealth software and ICT (information and communication technology) are being extensively used in the healthcare sector to improve the quality of healthcare, a key driver of the global eHealth 2.0 market. There is also an increasing need to manage regulatory compliance through the use of eHealth solutions and secure and appropriate storage of data, which contributes to the market growth. The long-term growth of the global eHealth 2.0 market is greatly impacted by the ability to eliminate the need for costly and time-consuming primary research and data collection. Additionally, eHealth solutions also enhance patient safety and outcomes and facilitate collaboration among various healthcare providers. Additional administrative costs can be avoided by reducing the need for redundant examinations and the time spent maintaining the currently fragmented IT and infrastructure systems.

What is eHealth 2.0?

eHealth 2.0 refers to the next generation of digital healthcare solutions that leverage advanced technologies like artificial intelligence (AI), big data, cloud computing, and the Internet of Things (IoT) to enhance healthcare delivery. It builds on traditional eHealth by integrating smart systems, real-time data analysis, and automation to improve patient outcomes, streamline workflows, and enhance accessibility. Key components include telemedicine, wearable health devices, electronic health records (EHRs), and mobile health apps. One of the main goals of eHealth 2.0 is to provide personalized and data-driven healthcare services. AI-powered diagnostics, remote patient monitoring, and blockchain-secured patient records are some innovations shaping this field. By connecting patients, doctors, and healthcare providers through digital platforms, eHealth 2.0 enables faster, more efficient, and cost-effective healthcare services. As global healthcare demands increase, digital transformation in this sector is becoming essential for improving service quality and patient experiences.

Key benefits of eHealth 2.0

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 390.98 Billion |

| Projected Market Size in 2034 | USD 871.73 Billion |

| CAGR 2025 to 2034 | 10.10% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segmentation Covered | Type, Service, End User, Region |

| Key Companies | Boston Scientific Corporation, Veradigm LLC, Oracle Cerner, CVS Health, Athenahealth Inc., American Well, iCliniq, Medtronic, Epocrates, Medisafe |

Rise in Non-Communicable Diseases

Increased demand for E-Health Services

Reluctanceto Adopt Among Medical Professionals

Privacy Concerns and Security Issues

Emerging IoT-Powered Virtual Hospitals and Telemedicine 2.0

Growing Technological Advancements

Reimbursement Procedure

Lack of Qualified Personnel

Based on type, the market is segmented into telemedicine, electronic health records, e-prescriptions, remote patient monitoring, mHealth, health information exchange and others.

Telemedicine: Telemedicine and e-health are the two main e-environments in healthcare where the risks of inequality could be described. Telemedicine refers to the delivery of healthcare in situations where the healthcare professional and the patient are not in the same physical location; in clinical diagnostic and therapeutic evaluation, it is a clinical pathway in which remote digital interactive communication is established. The current use of telemedicine and e-health has further highlighted the need to better understand how to promote equity and prevent marginalization.

Electronic Health Records: EHR improves the quality of healthcare and provides convenience to healthcare providers in the form of quick access to patient records, improved decision support, clinical alerts, and real-time quality reporting. These benefits have led to the rise in the adoption of electronic health records worldwide.

e-prescriptions: The increasing adoption of e-prescriptions for controlled substances (EPSC) and supporting government regulations have driven segmental growth. Further, in October 2018, Congress passed the support for Patients and Communities Act, which mandates e-prescriptions for controlled substances under Medicare Part D starting January 1, 2021. Moreover, increased awareness about patient safety is expected to further drive the market growth.

Remote Patient Monitoring: Remote patient monitoring (RPM) enables patients and providers to manage acute and chronic conditions by collecting and sharing health information. The benefits include continuous monitoring of the patient's health status, patient-provider data sharing, and patient engagement. RPM uses digital devices to collect and send patient data and clinical information. The healthcare provider reviews the patient's health data. This information is used to manage health conditions, detect health risks, and educate patients.

mHealth: Increasing penetration of smartphones and internet connectivity and increasing use of mHealth technologies by physicians and patients are factors driving the segment's growth. According to Uswitch Limited's calculations, there were about 71.8 million mobile phone subscriptions in the UK at the beginning of 2022, which was 4.2 million more than the country's population. This represents a 3.8% increase from 2021, which represents about 2.6 million new mobile phone subscriptions. The increasing trend of preventive healthcare and rising funding for mHealth startups are other factors driving the market.

Health Information Exchange (HIE): Health Information Exchange (HIE) is the electronic mobilization of health information between organizations within a region, community, or hospital system. The goal of HIE is to facilitate access and retrieval of clinical data to assist health authorities in analyzing the health status of the population. In a centralized HIE model, there is a central (or master) database that contains a copy of all records of each patient.

Others: Theothers segment includes clinical decision support, consumer health information, and health information systems. By providing physicians with evidence-based recommendations at the point of care, clinical decision support systems (CDSSs) are being incorporated into healthcare settings to improve clinical efficiency, reduce medical errors, and improve treatment outcomes. In recent decades, clinical decision support systems, or CDSSs, have significantly advanced, giving doctors the essential tools they need to make well-informed decisions about patient care. With a variety of tools, including applications, social media, portals, and medical devices, consumer e-health empowers people to efficiently manage and impact their health and well-being. It improves cooperation with caregivers and makes healthcare services more accessible. A system created specifically for the management of medical data is known as a health information system (HIS). This includes systems that help with hospital operations management, collection, storage, management, and transmission of a patient's electronic medical record (EMR), and health decision support. Systems that handle data related to the operations of healthcare organizations and providers are included in health information systems.

Based on service, the market is segmented into monitoring, diagnosis and treatment.

Monitoring: The increasing demand for self-monitoring devices that automatically monitor various physical activities and vital signs and create a database is expected to drive the growth of this segment. Based on services, the market has been segmented into monitoring, diagnostics, health empowerment, and other services. The monitoring segment includes vital signs, specialization, adherence monitoring, and accessories.

Diagnosis: Diagnostic services provide instant connectivity to patients, which helps in diagnosing diseases and other health issues. This factor is expected to drive the demand for these services and provide a boost to the market during the forecast period.

Treatment: eHealth enables the secure exchange of medical information between healthcare professionals. This is crucial for effective and comprehensive treatment, especially for treatment that requires an interdisciplinary approach. The use of eHealth tools is critical for healthcare systems and has increased significantly following the COVID-19 pandemic, which aggravated mental health issues.

Based on end user, the market is segmented into healthcare providers and insureres. The healthcare providers dominated the market in 2024.

Healthcare providers: eHealth 2.0 offers a lot of convenience to healthcare professionals in terms of patient workflows and data management. The rapid rise of eHealth 2.0 and other digital technologies in hospitals and clinics across the world. The increasing government initiatives to digitize the healthcare sector to improve the operational efficiency of healthcare facilities have boosted the growth of this segment.

Insurers: eHealth 2.0 synchronizes all healthcare data, thereby reducing the time spent on paperwork. It also helps in faster claim settlement. The increasing adoption of eHealth 2.0 by insurers to keep track of their customers' health status and prepare insurance policies is driving the growth of this segment.

The eHealth 2.0 marketis segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The market growth in North America is attributed to the highly developed healthcare industry, significant R&D investments in e-health 2.0 solutions, increasing product approval rates, and many e-health companies in the region. Athenahealth has introduced a brand-new telemedicine tool that is integrated with electronic health records (HER). This tool helps doctors conduct virtual visits without downloading additional software or using a third-party-developed app. Furthermore, a rise in healthcare costs is contributing to the expansion of the market. The market expansion in North America is mainly driven by the numerous investments made by e-health service providers and government programs and services in the healthcare industry related to e-health 2.0.

Europe has a significant and well-established e-health 2.0 market. The UK, France, and Germany are among the countries in Europe that hold a significant market share. The market growth is attributed to the rise in the cost of medical care, the development of e-health-related products such as telemedicine and medical apps, and the modernization of healthcare facilities. Moreover, according to the European Commission, electronic health records (EHR) are currently available in all EU countries and are used by nearly 96 percent of general practitioners. An increasing emphasis from governments is driving the overall expansion of the e-health market in Europe, with a focus on reducing healthcare costs and improving safety and data accuracy by implementing interoperable healthcare systems.

Increasing government investments and reforms to modernize healthcare systems, an increase in the number of product launches, an increase in the number of people traveling for medical care, implementation of e-health programs, and an increase in per capita income means that Asia Pacific is expected to witness the highest growth rate throughout the forecast period. For example, J.D. Health, based in China and the healthcare division of Chinese e-commerce giant JD.com, recently launched a “family doctor” service based on a model that combines the Internet and healthcare. In addition, the proportion of older adults in the population is increasing faster than in any other region in the world.

The key factors driving the overall growth of the eHealth 2.0 market are an increase in the number of health problems, a shortage of healthcare professionals, and a lack of medical facilities. In addition, the proportion of older people in the population is growing exponentially, which has led to an increase in chronic diseases. Due to the slow processes in the healthcare system, many patients are unable to receive the appropriate medical care. Due to improved real-time communication between patients and their doctors, simplified access to health-related information, and accelerated disease diagnosis, information technology in medical practice is growing rapidly. Therefore, factors such as the rising number of chronic diseases such as cancer and diabetes are expected to drive the expansion of the market.

Most of the companies are actively pursuing research and development. These market players strive to gain a higher market share through strategies such as investments, partnerships, and acquisitions & mergers. The companies also invest in developing improved products. Moreover, they focus on maintaining competitive pricing. In October 2023, NextGen Healthcare launched NextGen Ambient Assist, an ambient hearing solution that interprets patient-doctor conversations in real time to enable efficient appointment summaries and care plan documentation. In May 2021, MediTelecare launched a direct-to-consumer mobile technology called MediTely, specifically designed for the geriatric population. Hence, such major players are showing leadership and influencing the dynamic eHealth 2.0 market through their strategic initiatives and creative thinking. In May 2021, Lytus Technologies Holdings PTV. Ltd launched Lytus Telemedicine, which is a telemedicine/telehealth services platform that is actively serving the US and Indian markets. This launch is intended to help the company increase the adoption of e-health services.

Market Segmentation

By Type

By Service

By End User

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of EHealth 2.0

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Service Overview

2.2.2 By Type Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on EHealth 2.0 Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rise in Non-Communicable Diseases

4.1.1.2 Increased demand for E-Health Services

4.1.2 Market Restraints

4.1.2.1 Reluctanceto Adopt Among Medical Professionals

4.1.2.2 Privacy Concerns and Security Issues

4.1.3 Market Challenges

4.1.3.1 Reimbursement Procedure

4.1.3.2 Lack of Qualified Personnel

4.1.4 Market Opportunities

4.1.4.1 Emerging IoT-Powered Virtual Hospitals and Telemedicine 2.0

4.1.4.2 Growing Technological Advancements

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global EHealth 2.0 Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 EHealth 2.0 Market, By Service

6.1 Global EHealth 2.0 Market Snapshot, By Service

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Monitoring

6.1.1.2 Diagnostic

6.1.1.3 Treatment

Chapter 7 EHealth 2.0 Market, By Type

7.1 Global EHealth 2.0 Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Telemedicine

7.1.1.2 Electronic Health Records (EHRS)

7.1.1.3 E-Prescription

7.1.1.4 Remote Patient Monitoring

7.1.1.5 mHealth

7.1.1.6 Health Information Exchange (HIE)

7.1.1.7 Others

Chapter 8 EHealth 2.0 Market, By End User

8.1 Global EHealth 2.0 Market Snapshot, By End User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Healthcare Providers

8.1.1.2 Insurers

8.1.1.3 Others

Chapter 9 EHealth 2.0 Market, By Region

9.1 Overview

9.2 EHealth 2.0 Market Revenue Share, By Region 2023 (%)

9.3 Global EHealth 2.0 Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America EHealth 2.0 Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe EHealth 2.0 Market, By Country

9.5.4 UK

9.5.4.1 UK EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific EHealth 2.0 Market, By Country

9.6.4 China

9.6.4.1 China EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA EHealth 2.0 Market, By Country

9.7.4 GCC

9.7.4.1 GCC EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA EHealth 2.0 Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2023)

Chapter 11 Company Profiles

11.1 Boston Scientific Corporation

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Veradigm LLC

11.3 Oracle Cerner

11.4 CVS Health

11.5 Athenahealth Inc.

11.6 American Well

11.7 iCliniq

11.8 Medtronic

11.9 Epocrates

11.10 Medisafe