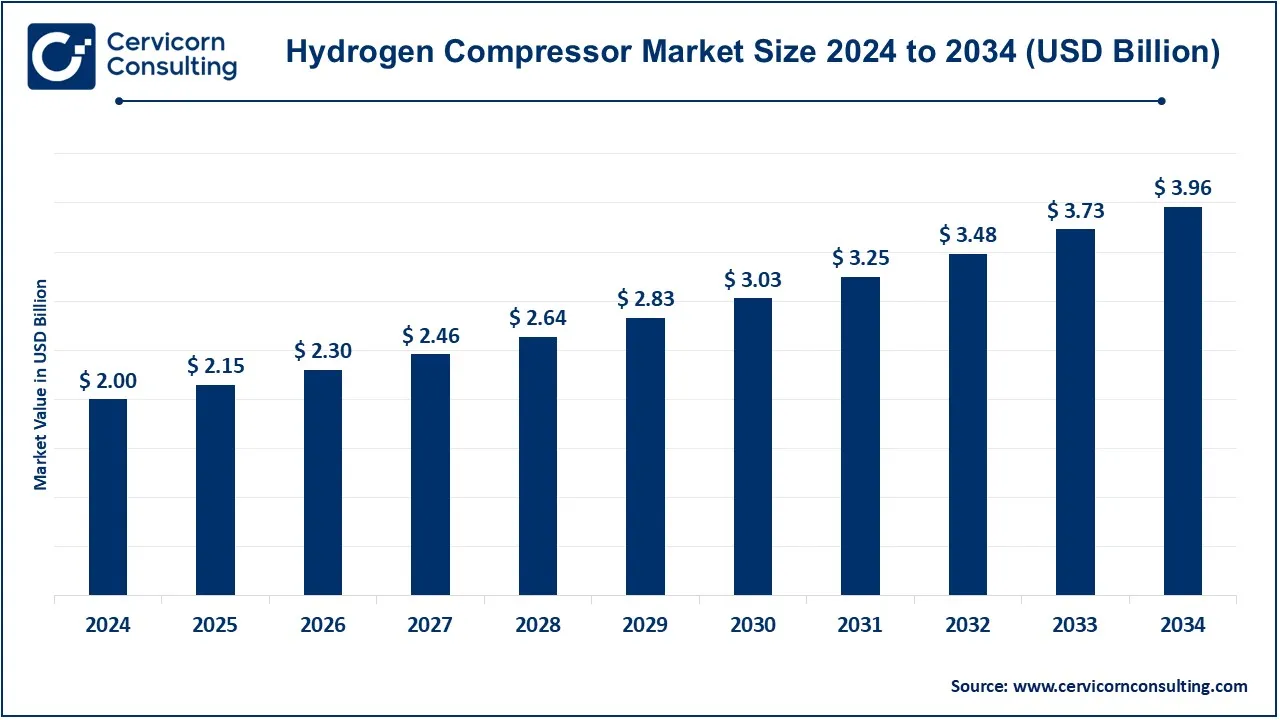

The global hydrogen compressor market size was valued at USD 2 billion in 2024 and is expected to be worth around USD 3.96 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.14% over the forecast period 2025 to 2034.

The hydrogen compressor market is witnessing significant growth due to the rising adoption of hydrogen fuel cells, increased investments in hydrogen infrastructure, and the push for clean energy solutions. Governments worldwide are implementing policies to reduce carbon emissions, driving demand for hydrogen storage and distribution. The expansion of hydrogen refueling stations and industrial hydrogen applications is further boosting market opportunities. Technological advancements in compression efficiency and the development of cost-effective, high-pressure solutions are enhancing market prospects. Additionally, the integration of renewable hydrogen production with storage infrastructure is fostering long-term demand for hydrogen compressors in various sectors, including transportation, power generation, and industrial manufacturing.

A hydrogen compressor is a mechanical device that increases the pressure of hydrogen gas for storage, transportation, or industrial applications. It works by reducing the volume of hydrogen while maintaining its energy content, making it suitable for high-pressure applications such as hydrogen fuel cells, refueling stations, and industrial processes. There are different types of hydrogen compressors, including piston compressors, diaphragm compressors, and scroll compressors, each designed for specific applications based on efficiency, pressure requirements, and operational costs. Industries such as energy, chemical processing, and mobility rely on these compressors to handle and transport hydrogen effectively. With the growing adoption of green hydrogen for clean energy solutions, the demand for efficient hydrogen compression technology is rising.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 2 Billion |

| Predicted Market Size in 2034 | USD 3.96 Billion |

| CAGR (2025 to 2034) | 7.14% |

| High-impact Region | Asia Pacific |

| Booming Region | North America |

| Key Segments | Technology, Lubrication, Design, Region |

| Key Companies | Hitachi Ltd., Burckhardt Compression Holding AG, IDEX CORPORATION, HAUG SAUER KOMPRESSOREN AG, Chart Industries, Inc. (Howden Group), Fluitron Inc., ARIEL CORPORATION, ATLAS COPCO AB, NEL ASA, Ingersoll Rand Inc. |

The hydrogen compressor market is segmented into technology, lubrication, design and end user. Based on technology, the market is segmented into mechanical compressors and non-mechanical compressors. Based on lubrication type, the market is segmented into oil-based and oil-free. Based on design, the market is segmented into single-stage, and multi-stage. Based on end user, the market is segmented into hydrogen infrastructure and industrial application.

Mechanical Compressors: Mechanical compressors are a group of machines that use mechanical means, like pistons, or diaphragms or rotary components, to compress hydrogen gas. Mechanical compressors are great in volume applications. They are thus dependable and cost-effective while meeting high pressure needs, which is the reason for their widespread use amidst a myriad of applications globally. They are usually seen at hydrogen refueling stations and industrial gas applications where the production of high volumes of hydrogen sets it up for compression storage or transport.

Hydrogen Compressor Market Revenue Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Mechanical Compressors | 62% |

| Non-Mechanical Compressors | 38% |

Non-Mechanical Compressors: Non-Mechanical compressors such as electrochemical or adsorption-based compressors use chemical or physical processes to compress hydrogen. These compressors are generally more energy efficient and have simpler designs with fewer moving parts, therefore being offered lower maintenance rhythms. They are getting more and more popular in applications based on green hydrogen where energy efficiency and environmental considerations are very important. Non-mechanical compressors are being more actively sought in small-scale and renewable hydrogen production systems.

Oil-based: Oil-based compressors-utilize lubricants to reduce mechanical friction and wear during compression. This type of compressor finds wide use in industry, where higher pressure and ruggedness with heavy workload permit its deployment. Oil-based compressors, however, require intensive maintenance to prevent hydrogen contamination with lubricants that can affect the purity of the gas.

Hydrogen Compressor Market Revenue Share, By Lubrication, 2024 (%)

| Lubrication | Revenue Share, 2024 (%) |

| Oil-based | 67.40% |

| Oil-free | 32.60% |

Oil-free: Oil-free compressors are such that they do not utilize any lubricants. Therefore, these are more suited for all applications where purity is key for hydrogen, such as in fuel cells and chemical processes. These compressors mitigate the risk of contamination and tend to be friendlier to the environment. While oil-free compressors are gaining popularity within industries wherein gas purity is of paramount importance, they may require greater investment in terms of development cost.

Oil and gas: The oil-and-gas industry sometimes uses hydrogen compressors in refining and petrochemical processing. Hydrogen compression is needed in some stages of hydrogen production and refining for hydrogen transportation into hydrocracking and desulfurization processes. This growing focus on hydrogen as a cleaner fuel alternative also drives demand for hydrogen compressors in this sector.

Chemical: The chemical realm employs H2 compressors for ammonia production, methanol synthesis, and hydrogen-based reactions. Hydrogen, a feedstock for several chemical processes, exerts a heavy work on the compressors, which are maintained at high pressures. As the industries are taking clean methods of production, demand for hydrogen and compressors will keep increasing.

Hydrogen Compressor Market Revenue Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Hydrogen Infrastructure | 41% |

| Industrial Application | 59% |

Automotive: Hydrogen compressors are mainly used in the automotive industry by fuel cell equipment manufacturers, notably at this current time with the fuel cell electric vehicles making an entrance into the market. The compressors are utilized at hydrogen refueling stations for dispensing the hydrogen at suitable pressures that match the requirements of refuelling the vehicles. The increase in the demand for hydrogen compressors in the automotive sector, comes as no surprise, since a good proportion of the world is advocating for clean means of transport.

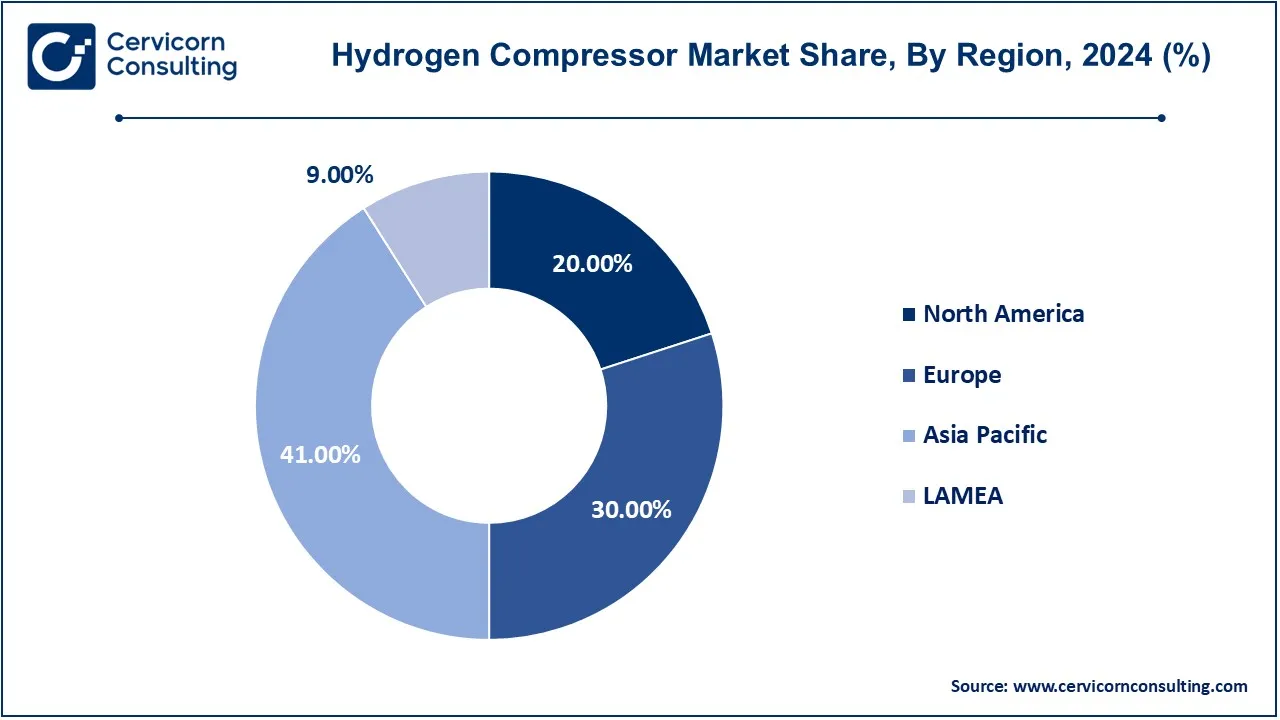

The Asia-Pacific hydrogen compressor market size was accounted for USD 0.82 billion in 2024 and is predicted to surpass around USD 1.62 billion by 2034. Asia-Pacific is seen as another region having the utmost appearance of no growth in the procurement of hydrogen compressors, particularly by virtue of China's, Korea's, and others' immense contributions. Toyota is already a world leader in hydrogen technology, having invested heavily in hydrogen infrastructure and the introduction of FCEVs. At the same time, China is rapidly ramping up hydrogen production because of hydrogen's various applications in industries and transport. Korea is also pushing hydrogen as a part of its main energy strategy, in addition to major hydrogen fuel cell projects.

The North America hydrogen compressor market size was valued at USD 0.40 billion in 2024 and is expected to reach around USD 0.79 billion by 2034. North America market is growing, owing to the extensive hydrogen technology adoption across U.S. and Canada. U.S. is leading the way for the hydrogen infrastructure that includes refueling stations and production plants, which is particularly seen in California. In addendum, with green hydrogen projects coming under the focus of Canada, various governmental support schemes like grant programs for clean energy clean, have been fostering the growth of the market across the region. Such other factors combined with the rising investments in hydrogen fuel cell vehicles and industrial hydrogen utilization drive the demand for compressors in North America.

The Europe hydrogen compressor market size was estimated at USD 0.60 billion in 2024 and is projected to hit around USD 1.19 billion by 2034. Europe is very important for hydrogen compressors and Europe is one of those areas where the strict energy policies are laid down to encourage investments in hydrogen infrastructures. With respect to green hydrogen, Germany, France, and the Netherlands command the hand because of their strong objectives toward carbon emission reduction. Germany has positioned itself at the forefront of the promotion of hydrogen with the implementation of its National Hydrogen Strategy. The market is cherishing the presence of FCEVs and is transforming into hydrogen since there is a rise in the refueling stations across the region.

The LAMEA hydrogen compressor market was valued at USD 0.18 billion in 2024 and is anticipated to reach around USD 0.36 billion by 2034. The Latin America, Middle East, and Africa region, according to estimates, provides a favorable market for hydrogen compressors; Brazil, Saudi Arabia, and the UAE have dedicated expressways for bold investment in producing the earliest hydrogen in the market. Saudi Arabia and the UAE are working to invest in some sort of green hydrogen projects to diversify their energy portfolios, while Brazil is formally committing to hydrogen within the realm of clean energy initiatives. With an abundance of renewable energy in the Middle East, the growing use of green hydrogen as a second-tier energy substitute is favorable, while Africa is looking for hydrogen for industrial and energy purposes.

CEO Statements

Craig Balis, Chief Technology Officer of Garrett Motion Inc

Mats Rahmström, CEO of Atlas Copco

Christian Bruch, CEO of Siemens Energy

Recent product launches in the hydrogen compressor industry highlight a significant trend toward innovation and strategic partnerships among major industry players. Companies such as Hitachi Ltd., Burckhardt Compression Holding AG, and IDEX Corporation are focusing on developing cutting-edge technologies to enhance efficiency and reliability in hydrogen applications. These innovations not only address the increasing demand for green hydrogen solutions but also reflect a commitment to sustainability and reducing carbon emissions. Partnerships are integral, enabling shared expertise and resources to accelerate advancements in hydrogen compression technology, crucial for the energy transition. Some notable examples of key developments in the hydrogen compressor sector include:

Market Segmentation

By Technology Type

By Lubrication Type

By Design

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Hydrogen Compressor

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Lubrication Overview

2.2.3 By Design Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Hydrogen Compressor Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising adoption of hydrogen as an alternative fuel in energy and transportation sectors

4.1.1.2 Growing focus on reducing greenhouse gas emissions through clean energy solutions

4.1.1.3 Government incentives and subsidies for hydrogen production and infrastructure

4.1.2 Market Restraints

4.1.2.1 High capital costs are associated with hydrogen compressor systems

4.1.2.2 Limited hydrogen infrastructure in many regions inhibits widespread adoption

4.1.2.3 Energy-intensive compression processes increase operational inefficiencies

4.1.3 Market Challenges

4.1.3.1 Complication of the compressors sustained at high pressures

4.1.3.2 Managing hydrogen embrittlement which affects compressor durability

4.1.3.3 Adapting to regulatory changes that may affect hydrogen handling processes

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Hydrogen Compressor Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Hydrogen Compressor Market, By Technology Type

6.1 Global Hydrogen Compressor Market Snapshot, By Technology Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Mechanical Compressors

6.1.1.2 Non-Mechanical Compressors

Chapter 7. Hydrogen Compressor Market, By Lubrication

7.1 Global Hydrogen Compressor Market Snapshot, By Lubrication

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Oil-based

7.1.1.2 Oil-free

Chapter 8. Hydrogen Compressor Market, By Design

8.1 Global Hydrogen Compressor Market Snapshot, By Design

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Single-stage

8.1.1.2 Multi-stage

Chapter 9. Hydrogen Compressor Market, By End User

9.1 Global Hydrogen Compressor Market Snapshot, By End User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Hydrogen Infrastructure

9.1.1.2 Industrial Application

Chapter 10. Hydrogen Compressor Market, By Region

10.1 Overview

10.2 Hydrogen Compressor Market Revenue Share, By Region 2024 (%)

10.3 Global Hydrogen Compressor Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Hydrogen Compressor Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Hydrogen Compressor Market, By Country

10.5.4 UK

10.5.4.1 UK Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Hydrogen Compressor Market, By Country

10.6.4 China

10.6.4.1 China Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Hydrogen Compressor Market, By Country

10.7.4 GCC

10.7.4.1 GCC Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Hydrogen Compressor Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Hitachi Ltd.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Burckhardt Compression Holding AG

12.3 IDEX CORPORATION

12.4 HAUG SAUER KOMPRESSOREN AG

12.5 Chart Industries, Inc. (Howden Group)

12.6 Fluitron Inc.

12.7 ARIEL CORPORATION

12.8 ATLAS COPCO AB

12.9 NEL ASA

12.10 Ingersoll Rand Inc.